SUMMARY

- US Completions Update

- Physical Crude Market and Russian Flows

- Saudi Arabia Pushes OSPs to Record

- Global Pressures Rising

- US Crude Demand Waning

- Supply Chain Slowdowns and Diesel

- US Completions Update

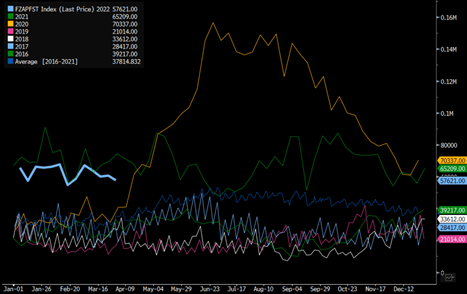

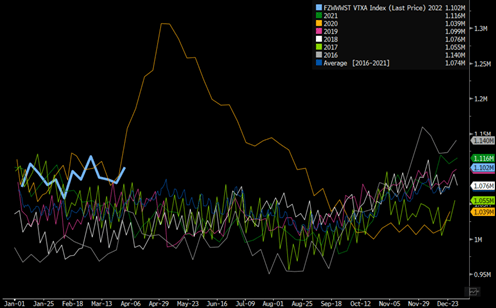

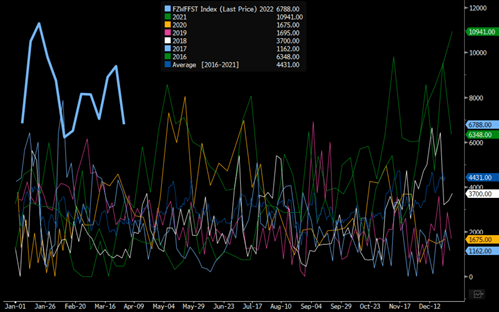

As we described two weeks ago, frac spread activity was going to start increasing last week, and we expect this to continue over the next few weeks. We will reach about 290 by the middle of next month- but the move to 300 will be closer to a June event. There are many issues that continue to hit the oil patch across labor, proppant, casing, and more importantly- pipe. The activity in the Permian will be able to hit about 157, but to get past that in the near term will be difficult given the labor and logistical struggle. We expect to see some of the smaller basins pick up 1-2 spreads over the next month, which will help us push higher to about 290 as we approach month end. East Texas and Louisiana will also remain robust and shake off some of the seasonal slowdowns as liquids and natural gas pricing/demand supports activity. We can already see that the TX-LA-SALT is well above ’19 levels and right in like with ’18. The Western Gulf has flatlined at around 25 spreads and have matched up almost perfectly to rigs where DUCs are not being added or declining. We expect that to remain the case with steady activity between 25-30 spreads in the region. The Williston will push back to about 20-21 but hold firm at those levels. Anadarko will work its way back to about 20 spreads as well, and there is some spare capacity in the area with some additional crews shifting from Appalachia to the region.

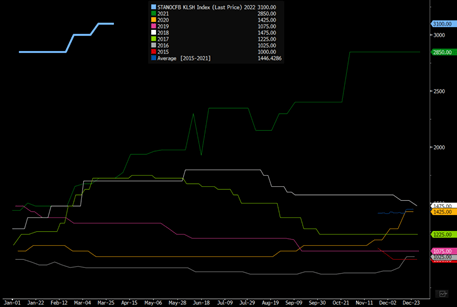

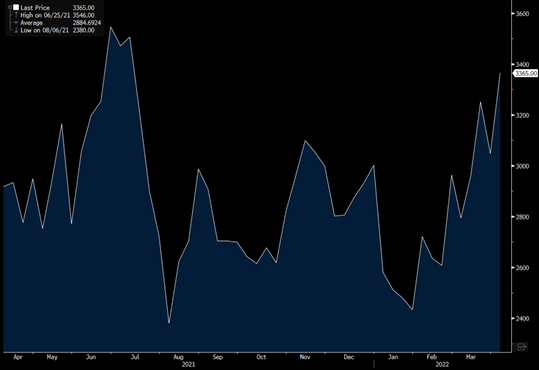

Steel and underlying pipe prices remain a huge overhang when we look at cost and the speed in which companies can operate. The below pricing chart shows North American OCTG Steel Pipe 5.5 Diameter spot FOB. It just gives you an idea of how costly it is to do anything in the oil patch across all pieces of the supply chain. The pressure points keep growing with little in the way to help alleviate the pain points in the near term.

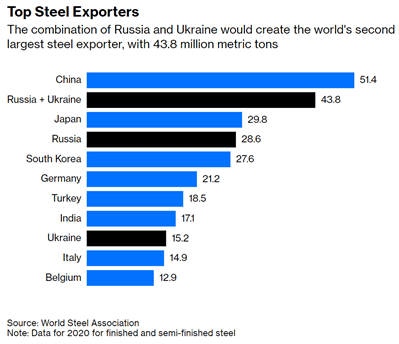

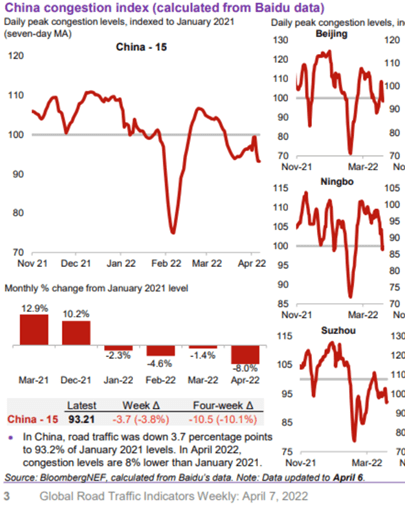

The underlying cost of operation will keep pressure on margins and OFS prices elevated as many things (labor/ diesel) are pass through costs. Russia and Ukraine account for about 43.8M metric tons of steel, which is a huge problem when we consider the shortages in the market. We have discussed at length the shortfalls created by the war, but this is just another layer of the complications created by the Russian invasion. China is also struggling with the COVID outbreak that has resulted in a huge drop in activity internally. We expect some of their steel to remain “in-country”, and will keep the underlying market tight without a way to increase capacity. Not only did Russia/Ukraine export the finished steel- they also exported iron ore and coal that was used in key areas- including Germany.

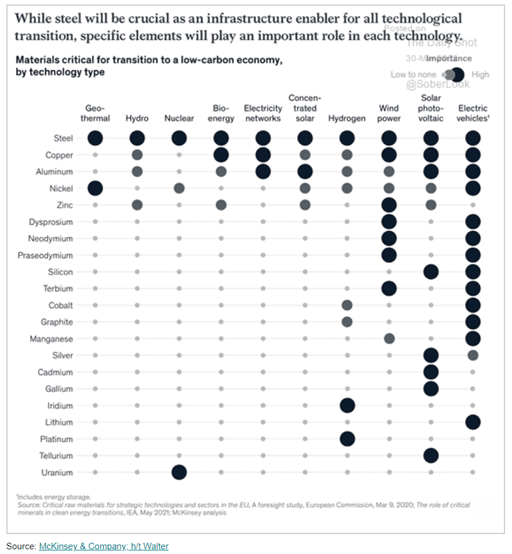

Steel is obviously a key component in the production and transportation of oil and natural gas, but it also has important ramifications on the ESG solutions. It is often ignored how important steel is for EVERY part of the ESG process- so when we hear that we need to “get away from Russia”- it becomes very difficult. If we move away from Russia that just increases our reliance on China, who doesn’t have the best Human Rights record. This is why local/regional solutions are so important when we look at onshoring manufacturing and underlying capacity. I am not just picking on ESG because this also clearly impacts energy and all forms of manufacturing- my point is that ESG doesn’t provide a catch all solution away from Russia. We need to have honest conversations about how we approach energy, transportation, and general economic growth going forward. The below chart helps to breakdown just how important everything from steel to zinc is to the green economy.

- Physical Crude Market and Russian Flows

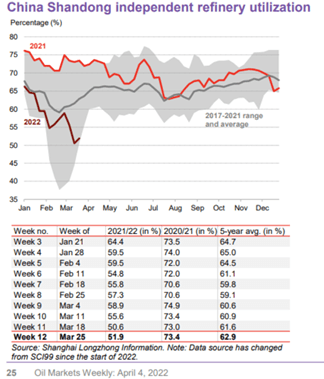

There is a growing focus on Russian crude as Urals print $34.80 below dated brent, and Russian companies are offering Chinese buyers ESPO cargoes without LOCs (lines of credit). They are also offering the cargoes in Yuan in order to entice their continued purchases. “A seller of Russian crude gave Chinese buyers the flexibility to pay in yuan, as the energy giant attempts to keep its few remaining export channels flowing smoothly. Geneva-based Paramount Energy & Commodities SA offered to let some Chinese customers make payments in yuan for May-loading ESPO crude shipped from Russia’s Far East, according to traders with knowledge of the matter.” Some of the biggest buyers of Russian crude has been Chinese Teapot refiners, and their purchases have been muted given the glut of crude offshore and the rampant lockdowns striking the country. We are starting to see more talk around increasing exports of gasoline/diesel to help alleviate some of the storage pressure onshore and capture the strong diesel margin in the market. We saw teapots actually reselling cargoes as lockdowns were starting in Mid-March, and they have yet to show up in any real size. Their buying has remained muted- especially for West African (WAF) crudes. There are expectations in the market that they are waiting for ESPO prices to fall further (which is likely) before they start picking up some of the excess. The problem is margins in China, which have gotten hit hard forcing the big drop in underlying utilization rates.

“Independent oil refiners in China’s Shandong province were making an integrated refining loss of 75.86 yuan ($11.94) a ton in the week to March 31, according to data from local consultant OilChem.

- Margins are down ~180 yuan a ton from a week earlier and ~282 yuan a ton lower y/y”

The pressure on margins, falling demand, and difficulty getting people to the facility are some reasons we are seeing utilization rates come under pressure. We will be setting a new record low in Chinese activity as the lockdowns are expected to worsen, and the reopening process will happen in phases. This will keep demand capped, and keep utilization rates sub-60 for at least another month (until early May at the earlies).

SPOT MARKET:

- Demand from China’s teapots for medium-heavy grades from Angola or such as Djeno was muted this week as margins for the independent plants went negative, according to traders

- Additionally, teapots are focusing on securing discounted ESPO flows, the people said; Brazilian grades are also more competitive than some West African barrels for sales in China, they added

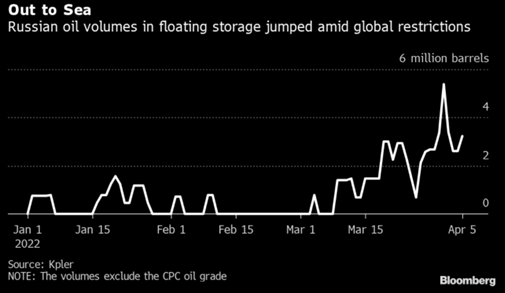

Russia is running into a very difficult spot because they have very limited storage capacity (we discussed that several weeks ago), and now it is filling up very quickly. Russia is trying to avoid shutting in production because there is a concern, they about bringing it back online. A lot of the equipment (top drives/ technology) is derived from Western nations that now have bans on exports to Russia. They were already running low on inventory, so Russian companies will want to keep things running as long as possible. We expect this desire to remain operational will result in steeper discounts for crude on the water because Russia needs to manage storage. The early estimates are that storage will be full in 50 days with Russia pushing some additional barrels (about 200M) into pipes and ships. But- we know that pipe storage is hard and ships are expensive- so I expect to see more discounts ahead. “Spare capacity at storage reservoirs operated by Russian oil producers dropped nearly 27% between March 1 and April 1, according to data from the Energy Ministry’s CDU-TEK unit that was seen by Bloomberg. At the start of this month, only 20.2 million barrels of space remained, which could be filled up within 50 days if the trend seen from March 25 to April 1 continues, Bloomberg calculations show. “

The volume at sea is going to keep pushing higher, and as it rises- the panic will grow that will result in more steep discounts vs Dated Brent. Saudi Arabia put their OSPs at record prices, which will push more people into Russian/ LatAm/ WAF/ US crudes over the next month or so.

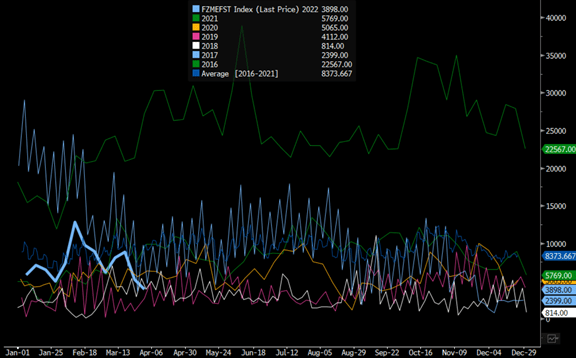

China has a growing amount of Venezuela, Iran, and Russian crude offshore with 22M barrels sitting there at the moment and more behind it. The problem remains bringing it onshore as the lockdowns not only persist but expand. This is limiting the ability to onshore crude and resulting in a build in storage onshore as the offshore will keep growing. We expect to see more gasoline/diesel exports over the next few weeks as the companies try to manage their storage on the product front. Refiners were already reselling floating crudes (mostly from WAF), and now it will push more refined products into the market. But given the current pricing in diesel globally- they are well positioned to make some extra cash flow by capitalizing on the rich pricing. The delays will put more crude on the water in general as the amount of supertankers signaling China remains elevated. We could get some of these cargoes resold- but so far- they are heading into the Asian direction.

This is why we expect Asian crude floating storage to move higher and get back to 2021 levels. The comps get a bit easier, but we believe that as the lockdowns persist floating storage will move back to over 70M barrels in the near term.

The problems in the market on physical crude remain with more crude on being put on the water (between in-transit and floating storage). The market is currently well above “normal”, but obviously well off of the 2020 shift higher in crude levels. We believe that the levels will continue to set records (outside of 2020) as the amount of floating storage remains elevated and countries keep reducing their differentials to compete in the market. The differentials will also have to fall into some key areas to compete against steeply discounted Ural/ ESPO/ Sokol cargoes, especially as Russia waives the need for LOCs and is willing to transact in local currencies (Yuan so far).

The pressure is showing up the most in West Africa (I know-shocker) as the region struggles to clear cargoes. Nigeria is sitting on over 30 cargoes in April and Angola over 5- both of which is insanely high for this point in the sales cycle. WAF floating storage still remains at record levels with some additional cargoes flowing into Europe, but right now- we don’t see a whole lot of buying out of Asia. Between lockdowns, economic pressure, and cheap Russian/Iranian barrels- the flows have been severely hampered.

Unipec sold Forties at the lowest price in 23 months on the Platts window. Petroineos kept a Forties cargo from chains. Ithaca Energy sees an opportunity to revive the U.K.’s controversial Cambo oil project.

PLATTS:

- Unipec sold Forties for April 24-26 to Totsa at Dated -70c/bbl, FOB: trader monitoring Platts window

- Traded price was the lowest since May 2020

- Unipec also offered Forties for April 28-30 at Dated -15c, FOB

Europe has been seeing a big decline in spreads as they sell crude at the lowest price in 23 months.

The shift in the physical market- Russia dumping crude- mixed with economic data slowing is pushing differentials lower: here is a sample of recent pricing. The prices have been dropping like a stone.

Exxon Mobil reduced its offer price for Angola’s Pazflor on the Platts window. TotalEnergies offered Nigeria’s Usan lower. Nigeria plans to increase combined exports of 15 key crudes to 1.43m b/d in May from 1.32m b/d of the same grades in April.

PLATTS:

- Exxon offered 950k bbl of Pazflor for April 25-26 loading at $1.55/bbl less than Dated Brent: trader monitoring window

- That’s the weakest observed offer level for Pazflor since Aug. 2; drops from -80c/bbl on April 1

- TotalEnergies offered 1m bbl of Usan for May 5-6 loading at 5c/bbl more than Dated Brent

- Drops from +70c/bbl on March 31

- Vitol offered 1m bbl of Usan for April 15-25 arrival on CFR Rotterdam/Augusta basis at $2.50/bbl more than Dated Brent; vessel is Ridgebury Mary Selena

- NOTE: Vitol offered a similar cargo for April 15-20 arrival at +$1.95/bbl on March 30

- Demand from China’s teapots for medium-heavy grades from Angola or such as Djeno was muted this week as margins for the independent plants went negative, according to traders

SONANGOL SPOT OFFER:

- Sonangol cut its offer prices for three cargoes of May-loading crude

- 950k bbl of Dalia crude for May 7-8 loading offered at $1.20/bbl more than Dated Brent

- Drops from $1.60/bbl on March 29

- 1m bbl of Girassol for May 25-26 loading offered at Dated +$3.20/bbl

- Drops from $3.50/bbl on March 29

- 950k bbl of Pazflor for May 7-8 loading offered at Dated +$1.20/bbl

- Drops from $1.60/bbl on March 29

- Trafigura offered Urals for northwest Europe delivery at a new record discount on the Platts window. Caspian CPC crude loadings have been revised lower to 5.126m tons for April. Saudi Arabia raised oil prices for customers in all regions. PLATTS:Trafigura offered Urals for April 20-24 delivery to northwest Europe at $34.80/bbl less than Dated Brent: trader monitoring Platts window

- That’s the lowest since at least September 2010 when Bloomberg started monitoring the data; previous low was – $31.35 on March 22

PLATTS:

- Vitol offered to sell 1m bbl of Nigeria’s Usan for April 15-25 arrival on CFR Rotterdam/Augusta basis at $2.30/bbl more than Dated Brent; vessel is Ridgebury Mary Selena: person monitoring window

- Drops from +$2.50/bbl on April 4

SONANGOL SPOT OFFER:

- 950k bbl of Dalia for May 7-8 loading offered at 50c/bbl more than Dated Brent

- Drops from $1.20/bbl on April 1, $1.60/bbl on March 29

- 1m bbl of Girassol for May 25-26 loading offered at Dated +$2.50/bbl

- Drops from $3.20/bbl on April 1, $3.50/bbl on March 29

- 950k bbl of Pazflor for May 7-8 loading offered at Dated 50c/bbl

- Drops from $1.20/bbl on April 1, $1.60/bbl on March 29

At least 540k tons of Urals crude lifted from Russia’s three western ports in the period April 1-8 are en route to India, according to port agent reports and ship-tracking data compiled by Bloomberg.

- The volume is equivalent to about 495k b/d; compares with 1.14m tons, or 270k b/d to India in the whole of March

This will continue, but insurance is becoming very hard to come by and really afford. “The cost of insuring merchant ships sailing to ports in the Black Sea has spiraled out of control, becoming a huge potential impediment to the movement of Russian cargoes from the region. Underwriters are charging as much as 10% of the value of a ship’s hull — basically the vessel’s worth as an asset — for what is called additional war-risk premium, according to four people involved in the market. Some are simply quoting to cover at prices that they know will be refused. There was almost zero cost prior to the war.” The cost of insuring merchant ships sailing to ports in the Black Sea has spiraled out of control, becoming a huge potential impediment to the movement of Russian cargoes from the region. Underwriters are charging as much as 10% of the value of a ship’s hull — basically the vessel’s worth as an asset — for what is called additional war-risk premium, according to four people involved in the market. Some are simply quoting to cover at prices that they know will be refused. There was almost zero cost prior to the war.

There are some ways to offset the cost with Central Banks stepping in to cover the cost (IE RBI and PBoC), but they are facing their own issues within the countries. Managing inflation and underlying slowdowns is a huge focus, and trying to facility cheap commodities from Russia is front and center. I expect to see them get more creative to ensure insurance is available for the shipments.

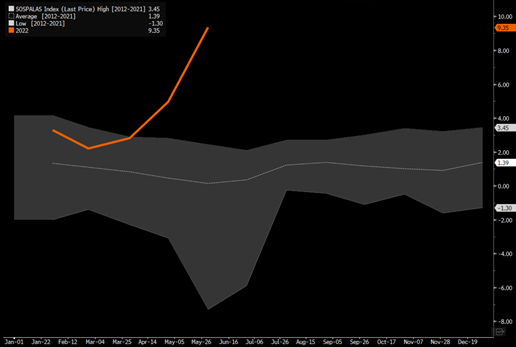

- Saudi Arabia Pushes OSPs to Record

On the flip side, Saudi Arabia sent their OSPs (Official Selling Prices) to the moon with a huge spread of $9.35 ABOVE Oman/Dubai for Arab Light flowing into Asia. They are setting records on pricing, and I am not sure if they expected dated brent to remain elevated or if they are trying to increase storage ahead of summer burn. Either way- this is going to severely reduce the amount of crude they can sell into the market. The floating storage was drawn down as Europe/Asia pulled a bit harder from the region, but as KSA pushes OSPs to records/ Russia discounts expand/ economic pressure mounts- we expect to see sales slow considerably. Floating storage dipped back to 2018/2019 levels, which also gave them the confidence to raise rates and to help refill some storage ahead of summer burn. The region has been increasing their consumption of natural gas for power generation, but they still have some fuel oil needs that will be filled up quickly given the surge in pricing.

The below chart just helps to put the surge in pricing in context.

KSA also raised their price of propane and butane to the highest level since 2014:

Saudi Aramco raised its April term contract prices for propane and butane to the highest since 2014, according to a company official who asked not to be named because of internal policy.

- April propane at $940/ton, up from $895/ton a month earlier

- April butane at $960/ton, up from $920/ton a month earlier

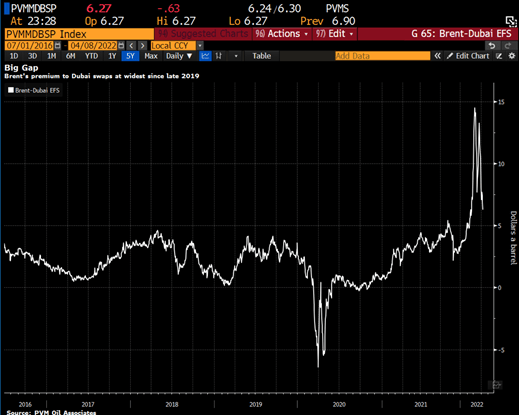

This will also hit emerging markets hard (especially India) that has seen a big increase in imports over the last several years. Asian markets have increased their consumption of LPG- and prices keep shifting higher around the world (just like everything else.) The spread between Brent and Oman/Dubai reached about $14.25, but has quickly dropped to about $6.27 over a very short period of time. So when you consider that KSA is charging over $9 to go to Asia- the price benefits fade very quickly. This is also happening right as floating storage in Europe has increased and onshore storage has spiked back up and closer to normal levels. This shift has put more pressure on European grades, and will also reduce the amount of crude purchased from the Middle East regions. We don’t expect to see the spreads get worse or better between Brent-Dubai, which will be an overhang for KSA. The market is still waiting for the OSPs from UAE/ Iraq/ Kuwait, and there is a change they raise prices but not to the extreme of KSA. This would help them undercut KSA, but they are also facing similar economic overhangs.

These shifts will also support additional exports from the U.S. market, and we have raised out U.S. crude exports to 3.3M barrels a day due to the economic pivots. Before the KSA spike, we saw a lot of support around 3M-3.1M barrels a day of U.S. exports, but as the market has shifted- we need to adjust our views as well and there is now more support at 3.3M barrels a day heading into the global market. It will be lumpy just given our waterways and infrastructure, but we use the 4-week rolling average to smooth out some of the noise.

- Global Pressures Rising

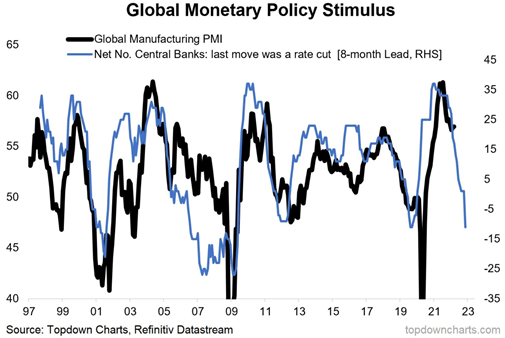

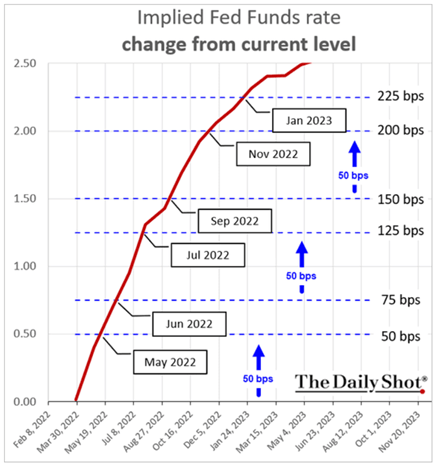

Crude has been pushing lower for several reasons, but one of the key ones is underlying positioning. Many investors/people were/are long crude on geopolitical risk and inflation, so it makes sense to see some adjustments as demand comes under pressure and the Fed “talks tough” on inflation. Global stimulus is quickly reversing lower as more central banks raise rates, and now the Fed is making comments that rates have to be as high as 4% to counter the surge in inflation. The U.S. is at 3.6% unemployment when “natural” unemployment is closer to 4.3%, which just means that the employment market is running hot. There are many parts of the economy (including housing) that is running well ahead of where it should all pointing to a quick increase in rates.

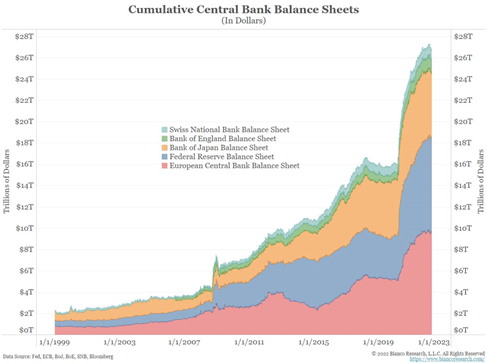

The problem remains the massive expansion of central bank balance sheets around the world.

The Fed is talking about rate rises that could hit over 4%, but in the near term- there is a growing likelihood that we get several .50% rises to help get in front of the ramping inflation. The problem is- many countries are deploying the same strategy into a slowing market. The U.S. 10-year treasury is the benchmark that sets a lot of the Emerging Market debt rates, and as it pushes closer to 3% (and in my opinion rises above it) the cost of borrowing is going to become a huge hinderance.

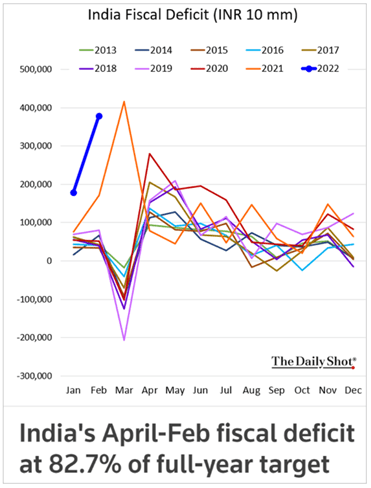

India is going to be under a significant amount of pressure as their inflation pushes towards 7% over the next 2 months and the fiscal deficit kicks off the year at a new record. Their borrowing needs are only going to expand as the cost of borrowing is going to limit the amount of subsidizes, they can provide to their people. Emerging markets will come under more pressure as they have to decide- cut subsidizes on fuel or food. I believe they will be forced to “mark to market” fuel to a degree as they try desperately to hold on to food subs.

Peru is a perfect example of what happens when food subsidizes are lifted and people can no longer feed themselves. There have been rampant riots and looting food stores as people struggle to deal with the shifts in the global food shortages. The food situation is hitting everyone hard, and China is no different with the world’s largest population.

The next few weeks will be crucial for China’s spring planting season.

That’s why Vice Premier Hu Chunhua convened a teleconference on corn and rice production on Friday, bringing together national regulators and officials from key provinces.

Hu said spring planting must go ahead without any hitches, and told officials to (Gov.cn):

- Ensure COVID-19 control measures don’t disrupt agricultural production

- Guarantee that farmers can get the fertilizers and pesticides they need at a reasonable price

ICYMI: Northeastern Jilin province is in the grip of a major COVID-19 outbreak, and pandemic control measures have made it hard for farmers to get supplies and plant their crops.

Get this: Jilin is a major corn producer, accounting for some 10% of the national crop.

Although 60% of corn goes into animal feed, an increasing chunk is processed for non-food uses. The government wants feed to take priority and Hu told attendees (Gov.cn):

- “It is necessary to strengthen regulation of demand from corn deep processing… and strictly control the use of corn for fuel.”

Some context: Beijing directed the expansion of the industrial corn starch, sugar, and ethanol processing sector to clear the glut of corn in state reserves between 2015-2018.

- It worked. Those excess reserves are gone – but the processing industry is still here, and it’s accounting for a rising share of corn demand.

Get smart: China’s experiment with ethanol fuel is nearing its inevitable end.

The bottom line: Food security is non-negotiable. Top leaders will do whatever it takes to guarantee that corn remains available at stable prices – including throttling the corn processing sector.

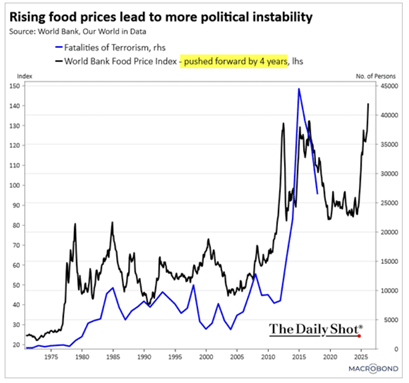

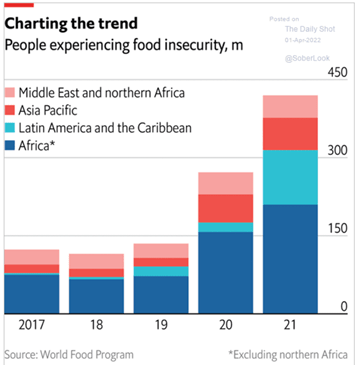

The issues keep compounding as China continues to pulldown as much fertilizer, seed, and crops to keep their silos full. By them being so aggressive in the market, they are driving up prices and reducing volumes available for other countries around the world. They are very aware of the dangers from food shortages that the below chart helps drive home:

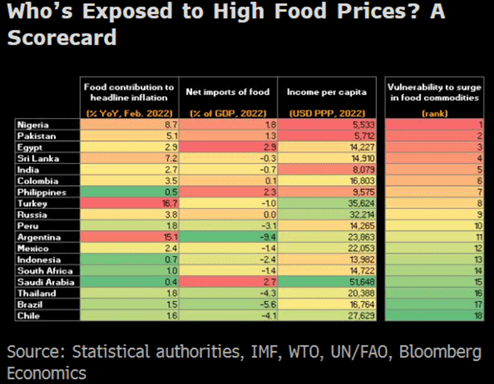

The CCP will do everything in its power to limit pressure out home no matter the cost. Even countries, such as Nigeria, that are sellers of crude are big buyers of refined products. The surge in pricing is also hitting their budget, and will directly impact their ability to purchase food. “The so-called Petroleum Motor Spirit subsidy is expected to cost 4 trillion naira ($9.6 billion) this year, compared with a previously projected 443 billion naira, President Muhammadu Buhari said in an April 6 letter to lawmakers seen by Bloomberg. Higher prices hurt Africa’s biggest oil producer because the state energy company swaps unrefined crude for imported gasoline, which it sells on at an increasingly steep loss to keep the pump price at 162.5 naira a liter ($.39). Budget revenue will also be hit by “significantly” lower crude output because of “massive theft” by criminals who tap into oil pipelines, Buhari said. The national police force also requires additional funding to “boost their morale as they grapple with heightened security challenges in the country,” the president said.” These are just a few examples of a global problem, but you can see that Nigeria hits the top of the list with India coming in very high… again more issues.

The below chart helps drive home where the issues are the most prolific, and it also indicates that these issues were starting to creep higher in 2019. This is NOT just because of COVID or the Russia Invasion- but it is a compounding problem that takes years to develop and years to fix.

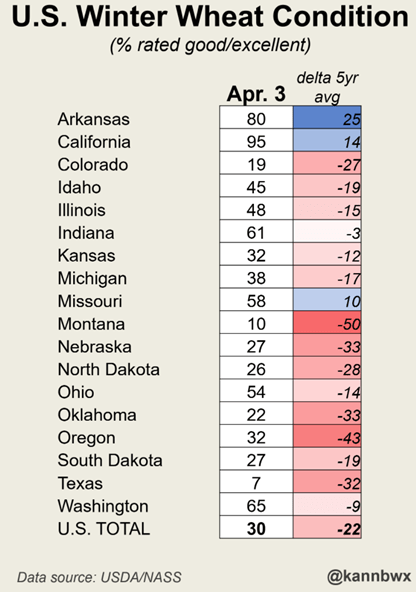

The issues are compounded with the U.S. posting the worst winter wheat condition in recorded history. The below numbers help to highlight the struggles that remain in the world as some of the biggest producers are either experiencing falling yield or unable to plant in general- IE Ukraine.

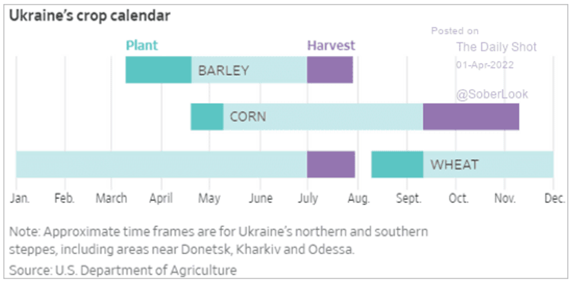

Here is a breakdown of the Ukrainian growing schedule. You can see that we have clearly missed key planting periods with little to no ability to close that gap even as Russia retreats back into Russia/Belarus from around Kyiv. “USDA LOWERS UKRAINE CORN EXPORTS BY 4.5M TONS TO 23M IN 2021-22.”

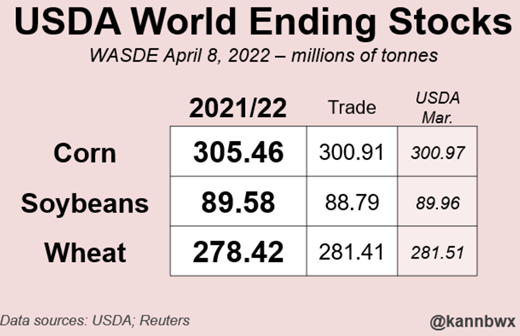

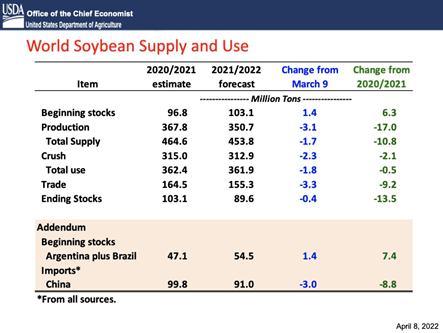

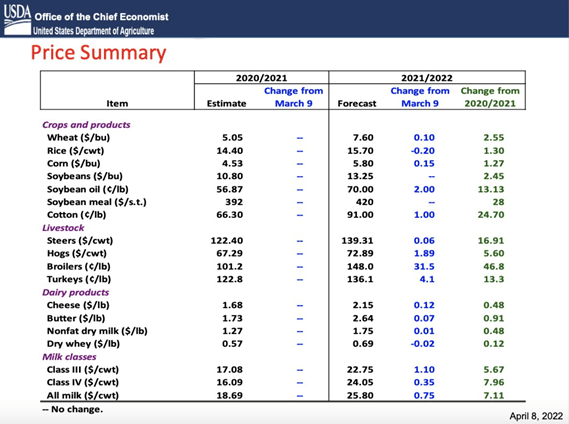

The WASDE data came out today with a fairly inline number for Soybeans with Corn at the high side, but Wheat continues to be a problem. We don’t see that adjusting in a meaningful way as expectations on yield continue to shift lower.

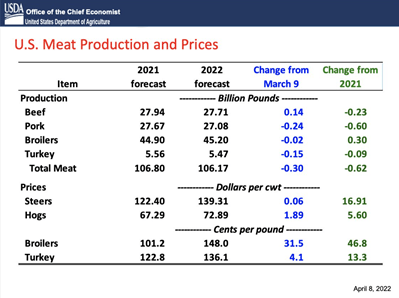

The issues start at food (obviously) but shift down into meat as well keeping prices elevated. We don’t see this adjusting or improving in the slightest, but worsening as we move into the summer months.

The underlying expectations have only worsened across all types of food stuffs:

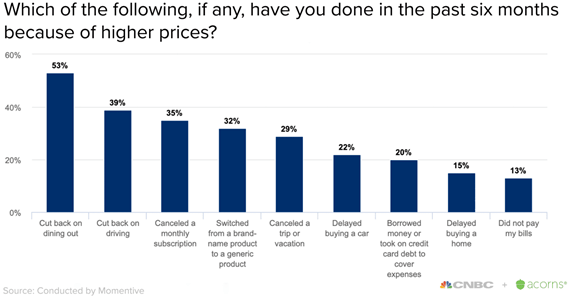

- US Crude Demand Waning

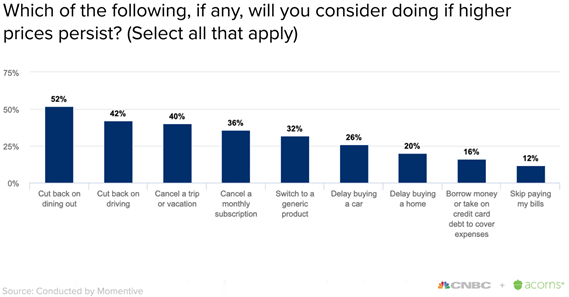

The U.S. is not going to avoid the pain and demand “deferral” is increasing- I say this because there are some out there that don’t like the language of “demand destruction.” People in the U.S. have already started to adjust the way they spend money over the last six months and will keep adjusting their spending patterns as the pain continues to grow. The easiest one (especially when you consider food prices) is eating out, but the one we keep seeing crop up is the decline in driving. We have been seeing this become a common theme in the U.S., Europe, China, and the Emerging Markets. There was a nice spike in some regions as Ramadan kicked off and people traveled to see family. In the U.S., the one to watch for summer demand is: “canceled a trip or vacation.” The U.S. doesn’t have demand destruction in the way people normally think- we don’t go from consuming 8.5M barrels a day of gasoline to 7.5M. Instead, we don’t have the normal increase in seasonal demand. We expect demand to fall flat, and not have the same seasonal bump that occurs as we progress into the summer months.

If the current price increases and lacking wage growth persists (our base case), it will lead to more cuts in trips and reduced activity. The below chart shows what happens IF this all persists.

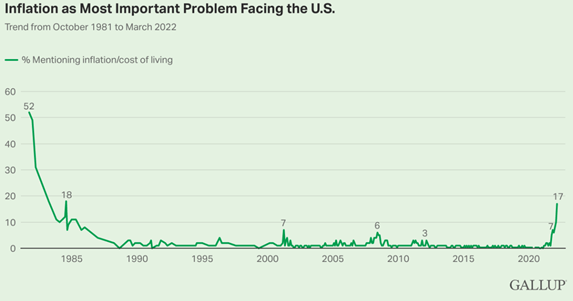

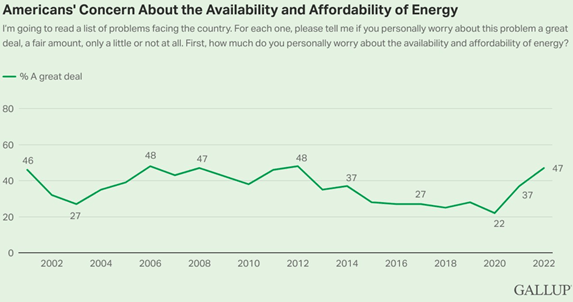

The fact that inflation is moving back to the top of people’s minds (most since the early 1980’s)- I expect that the reduction in travel will accelerate. The survey also showed that 47% of respondents are worried about the availability and affordability of energy.

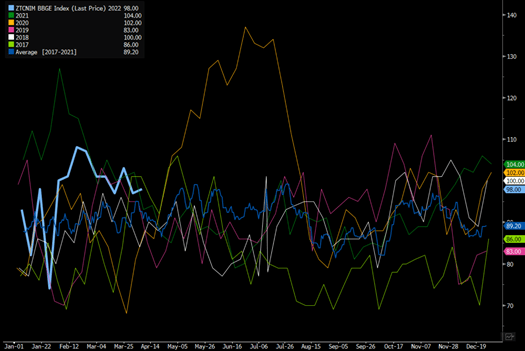

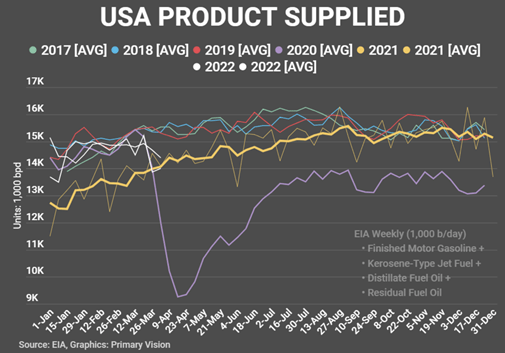

It is already showing up in the underlying U.S. demand numbers as we track well below the “normal years” of 2017-2019 and actually track much closer to 2021.

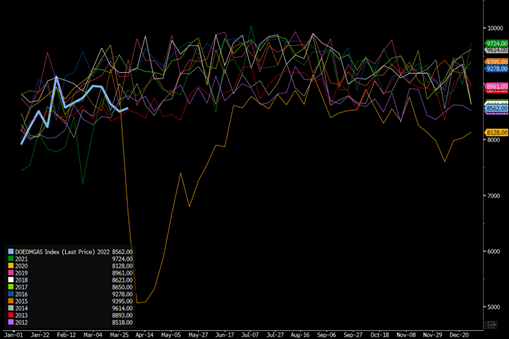

When we look at gasoline specifically, demand right now is tracking along the 2013 levels:

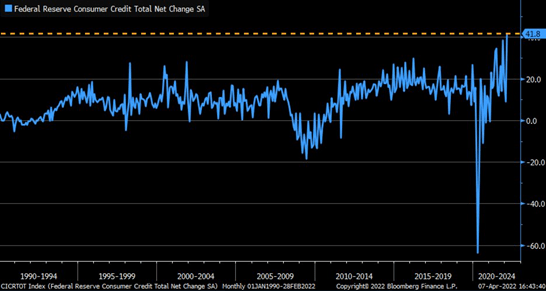

We expect to see a recovery in some of these numbers, but we don’t see a move back to “normal” spring/summer driving data. The cost of gasoline and underlying living expenses are draining discreationary income from people and limiting underlying spending. The surge in pricing, decline in government transfers, and lagging wage growth has resulted in a big surge in consumer borrowing. Consumer borrowing surged in February by most on record, +$41.8 billion vs. $+18.1 billion est. & +$8.9 billion in prior month (rev up from +$6.8 billion) … revolving credit (which includes credit cards) rose $18 billion (largest on record).

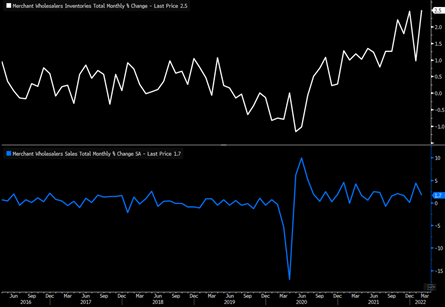

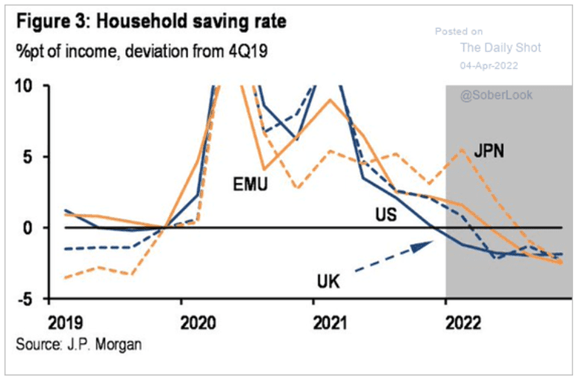

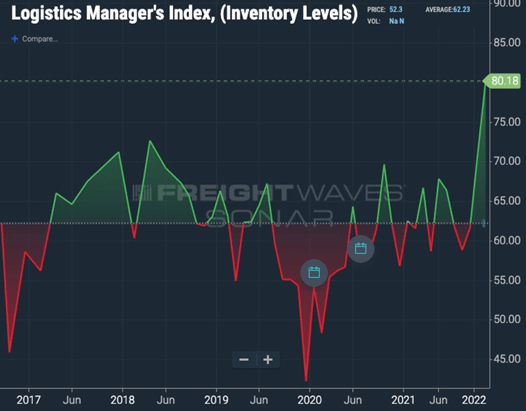

The shift in spending has resulted in some big increases in inventory levels with shifts higher at all levels of the supply chain. Prices rising have caused people to reduce their underlying spending while also cutting the savings rate in the market.

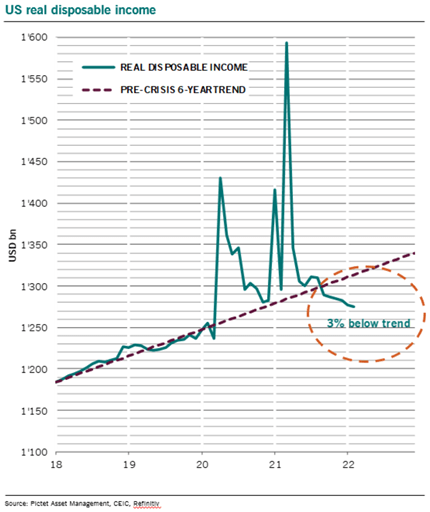

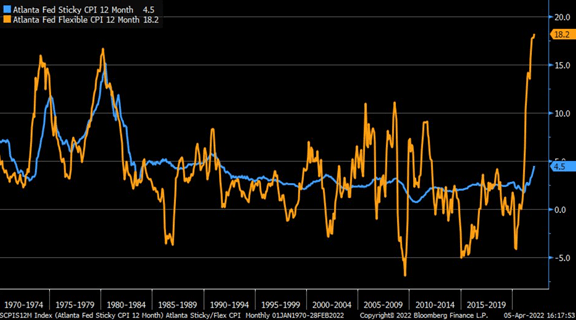

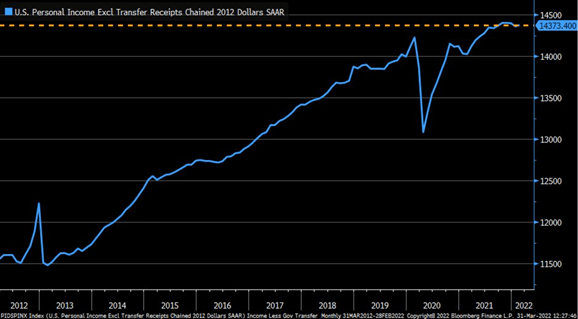

All of this is caused by a decline in real dispoable income:

These shifts are also happening when sticky inflation is still in the early innings of rising to highs as “flexible” inflation remains at record levels. It is also leading to a big decline in real disposable income (as you can see from above) . This is weighing on retail sales as they keep sinking when adjusted for inflation.

The trend is rolling over- but as wages stagnate and inflation keeps shifting higher- we expect the below chart to roll over a bit faster.

None of this happens all at once- rather it is slowly at first but it picks up steam as it accelerates. It will lead to more inventory builds and declines in spending as people cut back.

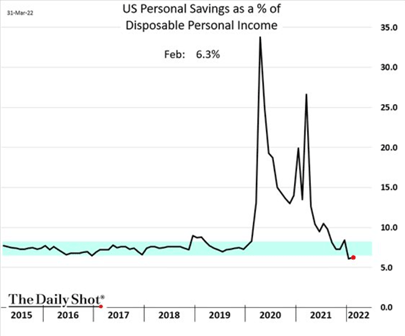

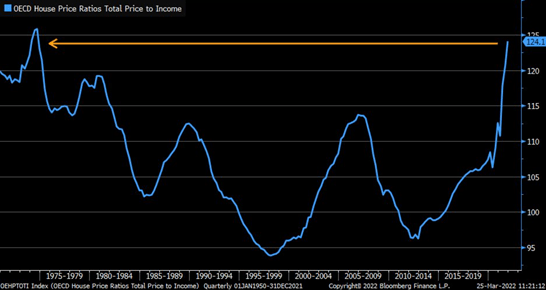

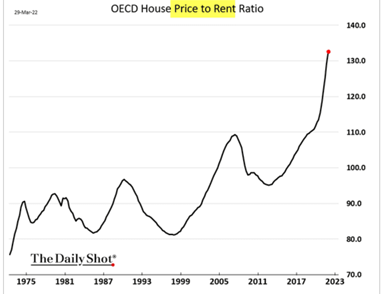

The issues we saw starting in September and accelerated in Nov/Dec are getting worse. It starts with people reducing savings- individuals turn to credit- reduction in real disposable income- rapid deceleration in spending. The issues are compounding as we hit records in the housing/rent markets BUT it isn’t just happening in the U.S. Across the whole OECD, we are seeing record levels of housing/rent costs that directly impacts the dispoable income and savings rates.

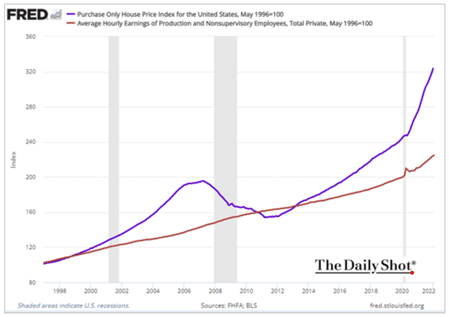

We are just following the obvious trend as real estate prices keep shifting higher with wages SEVERELY lacking any real growth. They are obviously rising- but at a very muted pace when you compare it to inflation.

Consumer spending +0.2% in Feb but fell 0.4% in real terms.

Disposable income +0.4%

Inflation-adj -0.2%

Savings +0.2pt to 6.3%: near 2013 low

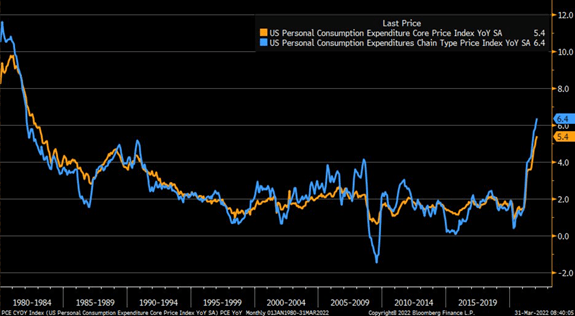

PCE prices +0.6% Inflation 6.4% (+0.4pt) high since ‘82

Core prices +0.4%

Core inflation 5.4% (+0.2pt) high since ’82

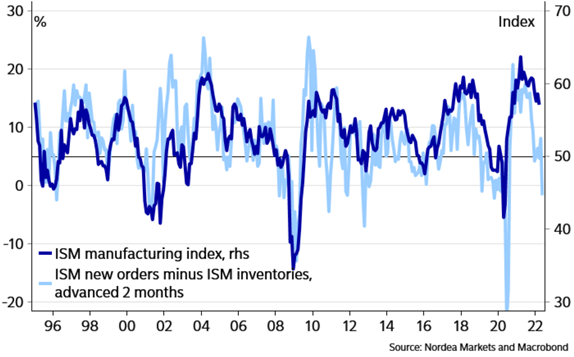

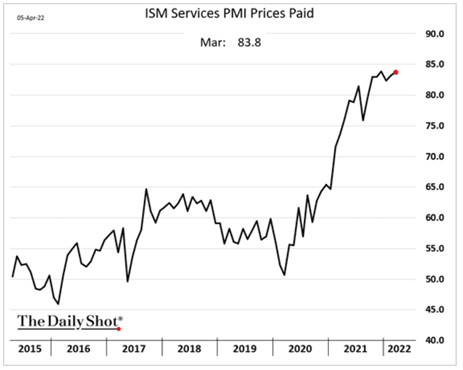

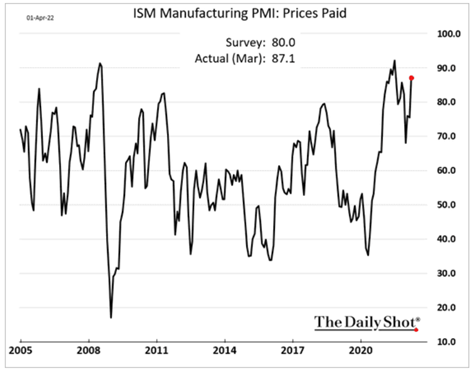

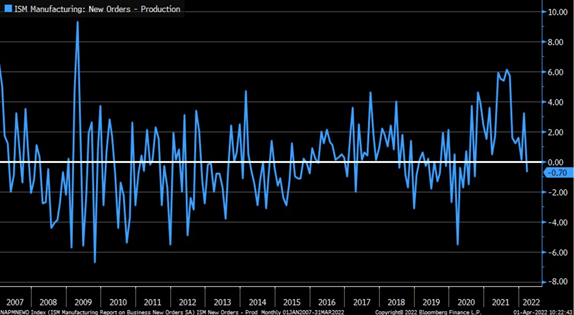

All of these slowdowns are showing up in the leading indicators across the board when you evaluate new orders and inventory vs the current data sets. The pressure remains to the downside with new orders getting hit hard and prices paid/received either near highs or setting new records.

Some examples:

Spread between new orders and production components within March ISM Manufacturing Index has collapsed and is at lowest level since late-2020

- Quick Summary of China Data

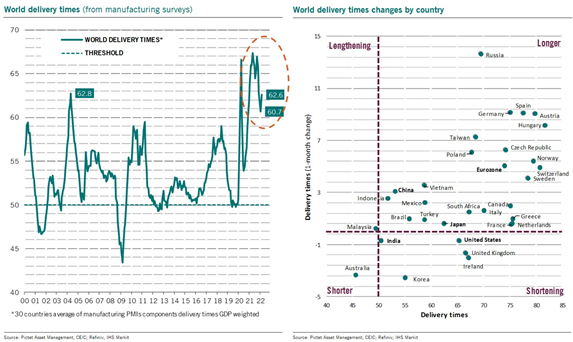

Delivery times did improve but now with China locking back down and Russia- we are seeing a new rise in shipping. The problem in particular is in Europe that is seeing an expansion of delays, which will hit their economy even harder.

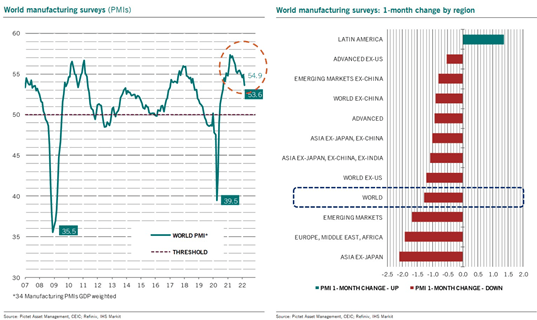

The issues are also global with a broad slowdown hitting global activity and worsening when you factor in new orders and other leading indicators.

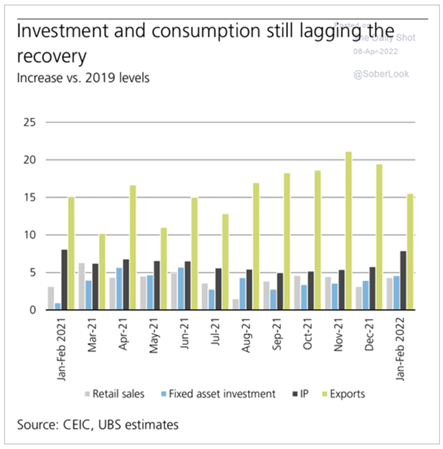

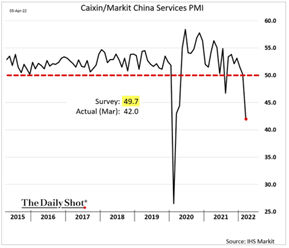

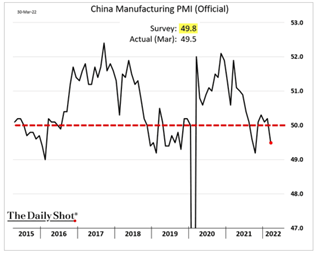

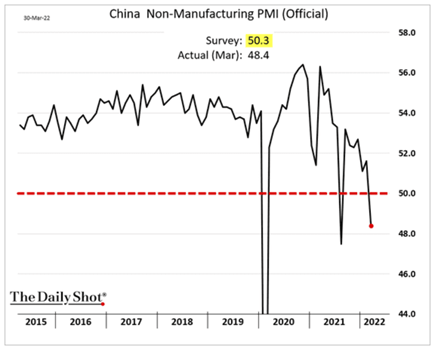

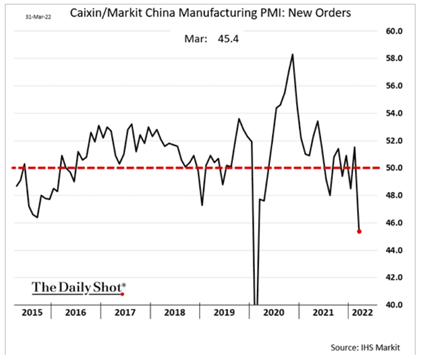

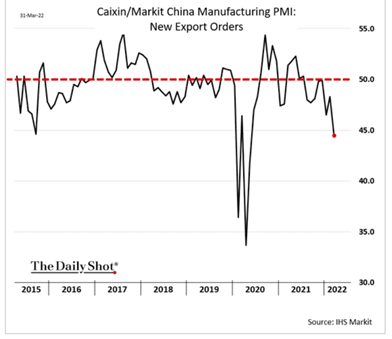

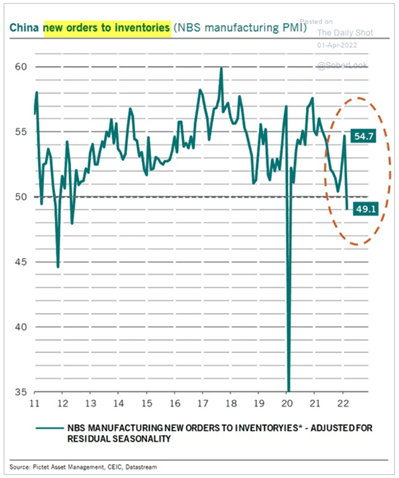

When we shift to China- the problems remain on the consumption level, and based on the new data that has come out- the problems will persit.

The whole country is experiencing a broad slowdown driven by a COVID outbreak, but the issues were already there prior to the recent outbreak. The data was already rolling over or just barely in expansion territory.

The new orders tell a better story on how the problems were already there with contracting activity.

Chinese activity is already at a standstill and don’t expect much recovery over the next several weeks.

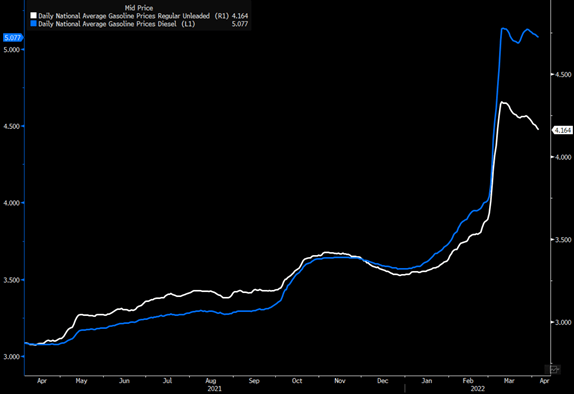

- Supply Chain Slowdowns and Diesel

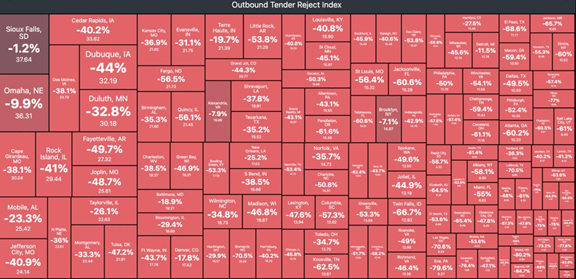

The diesel market remains very tight, which is leading to shortages and big price increases. As inventories have built at the retail and wholesale level resulting in canceled tenders. We have some demand declining and tenders being rejected as companies try to manage cost given the rise in labor/diesel prices.

Even as gasoline prices have slowed a bit, diesel prices remain at/near record levels that have kept prices elevated across the supply chain.

Global pressures are only mounting… we are in for a bumpy ride!