SUMMARY

- U.S Completions Update

- Russia Crude and Natural Gas Flows and Physical Market Impacts

- OPEC Shifts on Production and Demand

- More Downside for Crude Demand

- China Economic Slowdown and Impacts to Demand

- Global Inflation and Food Prices Pressing Higher

- U.S Completions Update

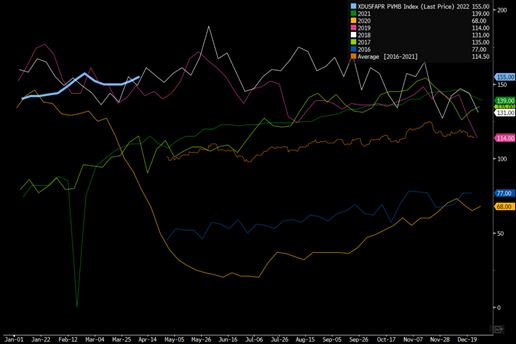

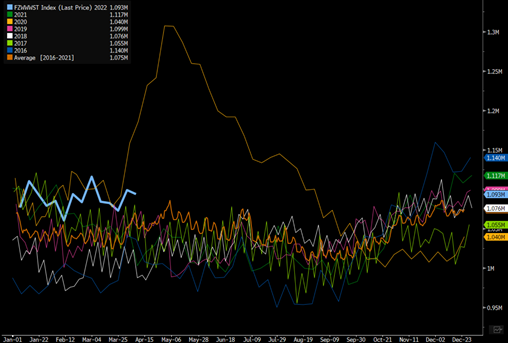

The U.S. completions market moved a bit higher again last week, and we expect to see another shift up over the next few weeks. We should end April at around 285-290 spreads with another 10 being added in May as we approach the summer push. Ahead of the summer- rigs are increasing activity with a big push in the Permian (I know SHOCKER!) as DUCs are added to support more activity in the region. The Permian is already at record activity levels, and we expect another 3-5 spreads to be deployed in the region over the next few weeks. The region is running very tight on horsepower- so the ability to see a big uptick is very difficult without new spreads. There is some opportunity to move spreads from other regions (unlikely), and the delivery of new spreads is well off in the future. It is also worth noting that almost 20% of these spreads are utilizing dualfrac/simulfrac and are more efficient vs ever before. This will keep production moving, but is also resulting in a severely strained logistics market. We don’t see that improving anytime soon over the coming few months as the market remains very tight across all levels.

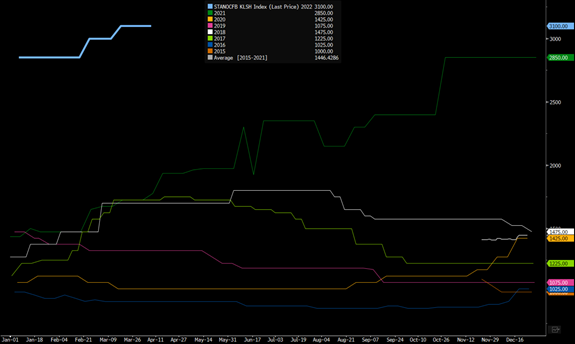

Rigs in the Permian are tracking 2017 almost perfectly, and we will see more rigs deployed to the region over the next few weeks as DUCs are added to keep activity rolling. Rigs are also way more efficient, but they still need to come to market in order to see a meaningful addition of DUCs. E&Ps will be comfortable (at the moment) with things running fairly even, which just means we need to see the drilled but uncompleted well count STOP falling. They will need to level off the drop to ensure there is enough running room into the summer.

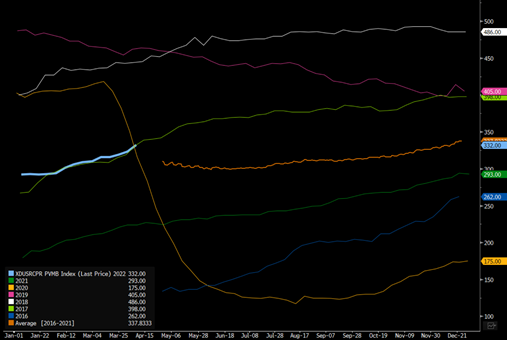

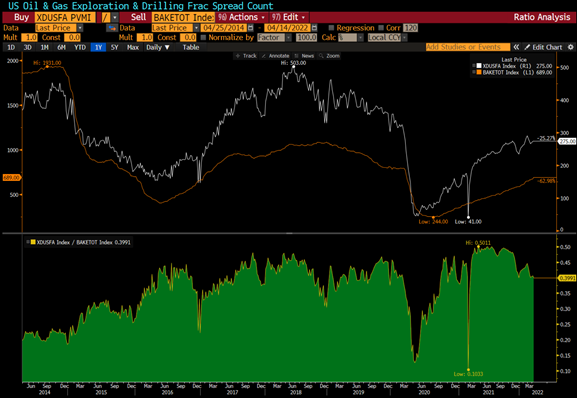

On a national level, we are seeing a big jump in rig counts versus frac spreads. This will start to adjust at this point and move closer to .43/.45 on a spread basis when we compare rigs and frac spreads. The running room remains for rigs in the near term as spreads will move about 15 over the next few weeks. The rig count (as we saw last week) can hit that number in a week as E&Ps get more aggressive on the drilling front and keep completions steady. The U.S. is currently producing about 11.87M barrels a day, and we are still on track to hit 12.2M barrels a day by the end of the year. The process will remain slow going as the supply chain stays challenged with limited to no way to improve things.

A key one to watch is the OCTG pipe side, which keeps moving higher. There is little reprieve in the near to medium term- especially as the Russian/Ukraine war is ongoing. We don’t see pipe prices moving any lower- so companies are dealing not only with price but also the lack of availability. Even if companies wanted to move faster- they physically cant- which won’t be adjusting any time soon.

- Russia Crude and Natural Gas Flows and Physical Market Impacts

Russia remains a key focal point given the shifts in the market on the crude front. I am sure many have seen confirmation regarding the RFN cruiser Moskva. It was hit by two Ukrainian Neptune missiles setting ammo on fire and causing her to sink to the bottom of the Black Sea. There is a lot to be said about that as Turkey has shut the Straits to Russian military vessels, which means no new reinforcements are coming into the region. This is a big blow to the Russian push on the Black Sea from a military perspective, and we expect to see a large response to such a vital asset being destroyed. The Moskva had several schedules upgrades delayed, which could have led to her sinking- but regardless- it is a huge win for the Ukrainian military.

- Why was she so close to shore?

- It was the flagship of the Black Sea fleet with 64 S-300s on board

- The Moskva could scan 1/3 of the Black Sea, and now without her- the skies are back open for Ukraine.

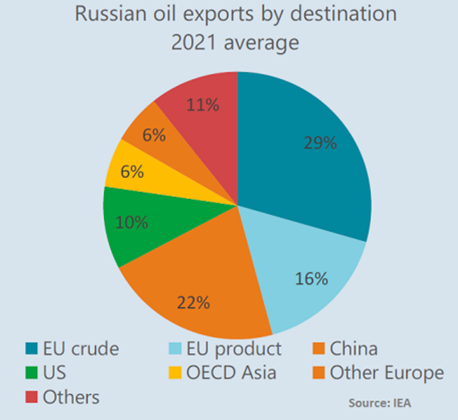

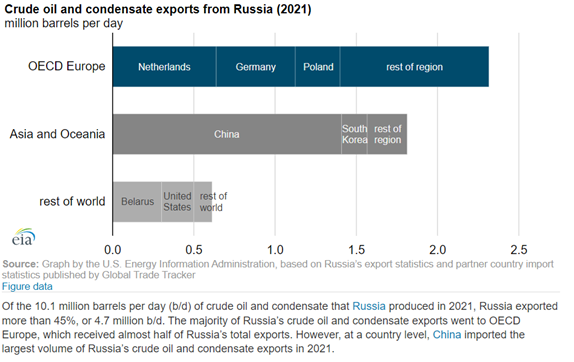

Europe is under pressure to reduce their consumption of Russian energy with the most recent deadline to for Russian crude purchases rapidly approaching. “Oil traders are set to cut Russian crude and fuel purchases beginning as soon as May 15, Reuters reports, citing sources. -Trading houses are cutting purchases from Rosneft to comply with current European Union sanctions on Russia.” In the U.S., the end of our purchases is supposed to be April 22nd, but we don’t account for a huge amount of their crude. The bigger fact becomes- how does Europe replace the current barrels?

Typically, Europe imports about 10.5M-11M barrels a day with about 2.2M of crude and 1.2M barrels per day of products originating from Russia

Largest:

Germany- 1.67M barrels per day

France- 736k barrels per day

Italy- 1.318M barrels per day

Netherlands: 1.266M

Poland: 619k

Spain: 1.22M

Belgium 590k barrels a day Europe could in theory replace all these barrels, but at what cost? We are looking at a huge increase in miles per ton, and the complexity of getting enough crude by water. On the flip side, Russia can’t afford to not sell their crude into the market, which is why we have seen a big spike in crude being pushed in the water.

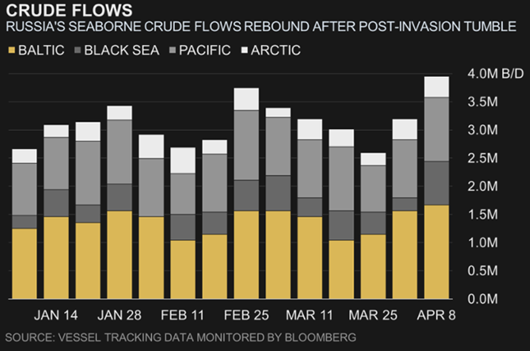

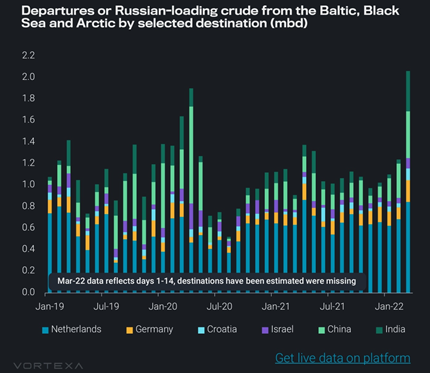

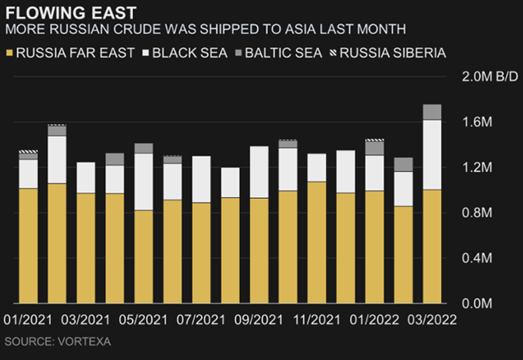

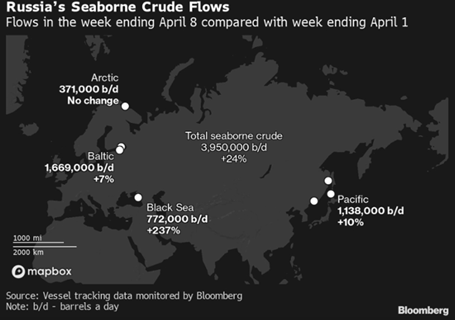

We have highlighted how Russia only has 8 days of storage and is rapidly closing in on shortages: at the current rate, it is estimated that Russia will be out of storage in 50 days. Russia is trying to offset that by putting as much crude as possible on the water with a large contingent of it heading into Asia. Seaborne crude has approached about 4M barrels a day with more being marketed.

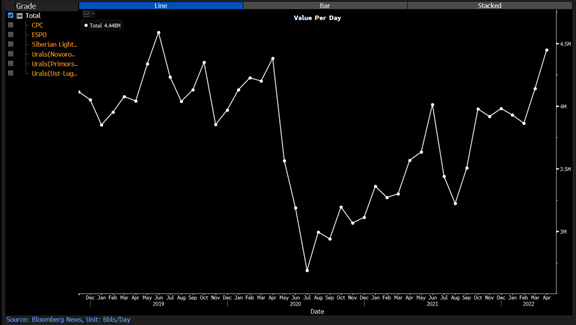

It won’t surprise you that a large part of that flow is heading directly to Asia and more specifically China/India. The buying has picked up for those two countries but will not be able to replace all of the EU flow. This will result in steeper drops in pricing across Urals, ESPO, and Sokol. Russia has taken the next steps of cutting prices:

Russia is set to lower export duty for crude in May to $49.6/ton amid lower average price of Urals crude over the March 15-April 14 monitoring period, the Finance Ministry says on Friday.

- Current duty is $61.20/ton

- NOTE: Average Urals price used by the ministry to calculate the duties was $79.81/bbl or $582.6/ton for the monitoring period

- Gasoline export duty will decrease to $14.8/ton from $18.3/ton

They will keep taking steps to reduce underlying prices and incentivize the move of crude/products into the floating market. The physical limitations on export capacity (by boat) is about 4.5M barrels a day and could be pushed to about 4.7M barrels per day. This is the natural stopping ground for flows, but that is also assuming you can get enough ships to the dock. It isn’t surprising to see Novak making the below comments:

- “There is hardly any reasonable alternative to Russian energy now”

- Renewable-energy resources are unreliable; Europe cannot hike its LNG imports quickly due to lack of infrastructure

- LNG cargoes are less reliable as they may be redirected

- Coal imports from South America and South Africa may be more expensive due to logistics

- Conditions for buyers of Russian gas are “as comfortable as possible” even amid Russia’s demand to receive only ruble payments for its gas

- “Several buyers have agreed to switch to the ruble transactions, we are awaiting the decision of other importers”

- Russia’s energy exports under the earlier signed contracts are stable

All of these options have very specific infrastructure limits that won’t be able to be overcome in any near-term capacity.

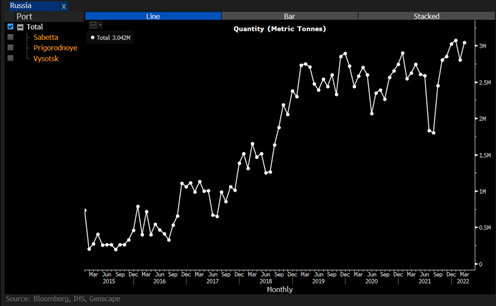

Russian LNG remains at peak export levels as Europe absorbs more from the market- Asia is pulling down additional Russian cargoes. As the market shifts in that direction, we will keep seeing the flows shift as Russia maintains current flows.

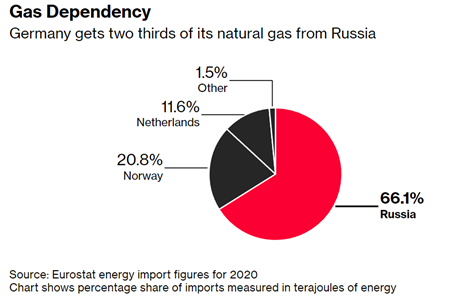

Germany is also one of the most dependent on Russian natural gas, and due to infrastructure limitation- it will be years before they can reduce these flows in a meaningful way. Back in ’18- I was at Bloomberg trying to convince anyone who would listen the importance of building more regasification capacity in Europe. My view was- natural gas IS NOT just a bridge fuel but rather a key fuel for the future. Russia has a stranglehold on the continent so it would be smart to diversify as LNG was becoming more readily available. I don’t claim to be prophetic, but when you look at the renewable options- they are intermittent at best. So you were ALWAYS going to need short-cycle natural gas turbines to be your backstop when the wind wasn’t blowing and the sun wasn’t shining.

Germany has now started the process of evaluating a regasification site, but the time it will take is measured in years and not weeks/months. Supply chains and steel shortages will obviously hit this timeline as it has crushed many other parts of the global economy… this will be no different.

Russia would love to send more through the Far East and less into the Black Sea, but as flow through pipelines slow- it will inevitable push more into the water as well. This will keep tankers busy at the port… as long as they can actually move the product into the water.

The amount of seaborn crude has started to pick up with more to go as the marketed crude is sitting at over 4.4M barrels per day while the actual flow is below 4M. Russia is going to need to close that gap, and it can only come from steeper discounts as long as ships can get to port. There is always a price for something- so it will have to cover insurance, day rates, and other ancillaries when it comes to underlying volume.

Europe continues to buy natural gas from Russia as well through the main pipelines that remain operational.

The orders/nominations have dropped, but still remain over 90 mcm/d flowing into Europe by way of Russian pipes- both through Ukraine and around. Europe remains a big buyer of LNG in order to ensure there is enough natural gas for summer and hopefully winter. This has essentially eliminated the “shoulder season” from the market as Europe purchases anything that is available- while also continuing their imports from Russia. The interesting fact about all of this- Europe pays Russia for the gas and Russia pays Ukraine for the transit. So Europe finances the Russian military and the Russian companies turn around and finances the Ukrainian military. The interlocking nature of all of this is just insane but that is the current world we live in.

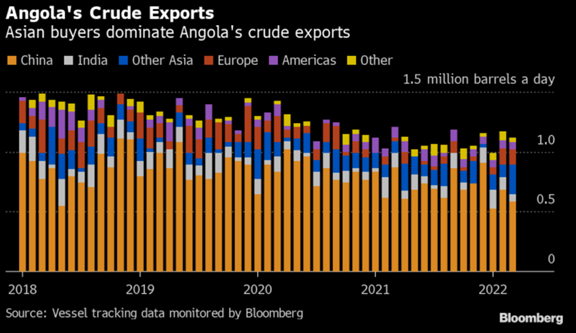

The amount of Russian crude being pushed into the market is resulting in steeper discounts out of West Africa as they compete to move volume into the market. The ability for Asia (India and China) to buy a mixture of Iranian, Venezuelan, and Russian crude at steep discounts is leaving a lot of WAF in the water. They are struggling to sell even the low end of their marketed crude and given how aggressive Russia is getting on price/other discounts- it is unlikely we see any more movement of WAF into the market. Europe/US could pick up more barrels, but I think they are also waiting for broader discounts before they get more aggressive in the market.

SONANGOL SPOT OFFER:

- 950k bbl of Dalia for May 7-8 loading offered at 50c/bbl less than Dated Brent

- Drops from +50c/bbl on April 6, +$1.20/bbl on April 1, +$1.60/bbl on March 29

- 1m bbl of Girassol for May 25-26 loading offered at Dated +$1.50/bbl

- Drops from +$2.50/bbl on April 6, +$3.20/bbl on April 1, +$3.50/bbl on March 29

- 950k bbl of Pazflor for May 7-8 loading offered at Dated -50c/bbl

- Drops from +50c/bbl on April 6, +$1.20/bbl on April 1, +$1.60/bbl on March 29

Vitol reduced its offer price for Nigeria’s Usan for April arrival to Europe on the Platts window. Glencore offered Chad’s Doba for May arrival to Europe. India’s MRPL tendered for crude supply including West African grades for May loading.

PLATTS:

- Vitol offered 500k bbl of Usan for April 15-30 arrival on CFR Rotterdam/Augusta basis at $2/bbl more than Dated Brent; vessel is Ridgebury Mary Selena: trader monitoring window

- Drops from +$2.35/bbl on Monday

- Glencore offered 950k bbl of Doba crude for May 8-15 arrival on CFR Rotterdam/Augusta basis at $3.30/bbl more than Dated Brent

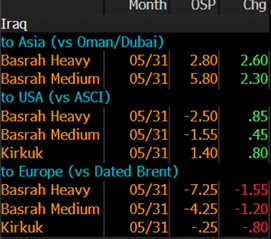

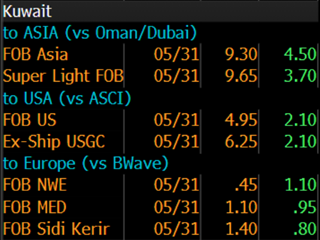

It has resulted in discounts to expand in WAF with more to come. Saudi Arabia raised OSPs in a big way for May- sending things to over $9 above Oman/Dubai for many of the grades to Asia. Iraq just came out with their OSP, and while they raised it by over $2 into Asia- it is still over $4 CHEAPER vs KSA pricing. Kuwait on the other hand followed KSA, but Iraq is now in a more competitive position to move cargoes into the water and compete more effectively. Iraq also cut OSPs for Europe and remains the most competitive into all three key regions: Asia, U.S., and Europe. Iraq is looking to capitalize as much as possible when it comes to getting their crude into the market and capture these elevated prices.

The spread between Dated Brent and Dubai/Oman has bounced a bit- which will support Iraq more than the other two as they are still WELL above the current spreads.

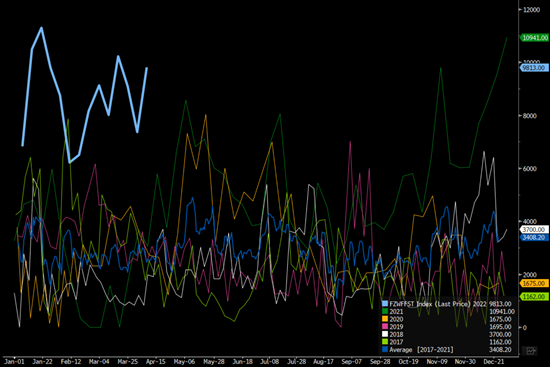

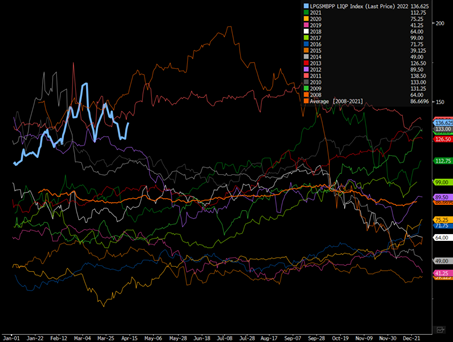

As KSA also raised LPG prices (Propane and Butane) to 2014 levels, it has pulled way more U.S. LPC into the market, and we expect that to continue. Even at these elevated Mt. Belvieu prices, we have seen exports not only remain elevated but accelerate as they are still cheaper vs KSA pricing.

- OPEC Shifts on Production and Demand

I know a lot of people like to point to OPEC production and say this is “proof” that there is limited spare capacity in the market. But, if you can barely sell even a fraction of your marketed crude- why would you increase production? The market is upside down and sideways, and Russia dumping crude into the market isn’t going to improve anything at this point. We have a record amount of crude on the water (once you take away 2020), and between the amount of volume in transit and in floating storage- that number isn’t going to decline any time soon. Instead, it will actually move higher. So if there is a record amount of crude on the water- why would exporting nations look to gun production? They are benefiting from elevated spreads and political turmoil- so why ruin the party when investors want to push the paper markets around.

Just as an example, Angola normally sells over half their crude to China/India, but in the current flows you can see the inherent slowdowns. The pressure on Angolan sales will only increase as China struggles under lockdowns, economic pressure, and options to purchase deeply discounted crude from other nations.

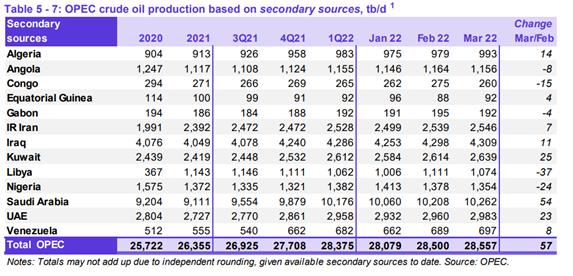

Therefore, I am not surprised that we have crude production only growing by 57k barrels a day. WAF is grossly over compliant but based on floating storage and current sales- they won’t be looking to close that gap anytime soon.

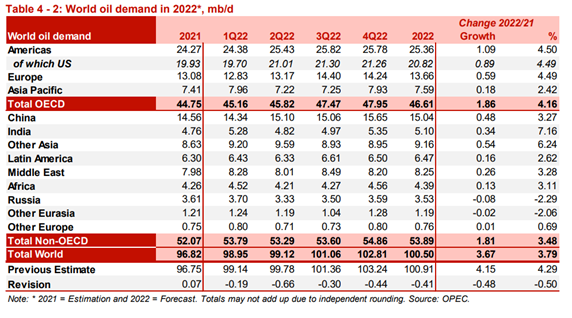

We also have OPEC starting to take down their crude demand estimates. When we look at the U.S. alone, we have seen additional drops in driving and distillate consumption- while flying remains off the 2019 “normal” pace. The issues are broad when we start factoring inflation into the mix- especially in Emerging Markets and Europe. We had Lagarde say that Europe is already in a recession, and for those that read these reports and watch our YouTube videos- that is of NO SURPRISE! I am just glad she finally caught up with the rest of us.

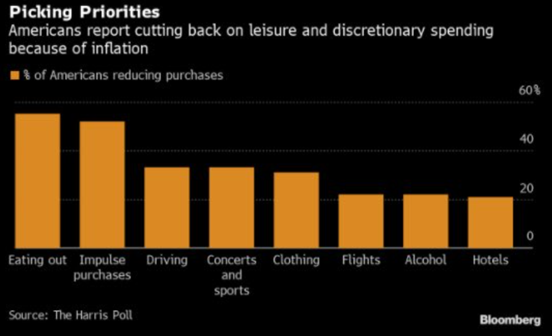

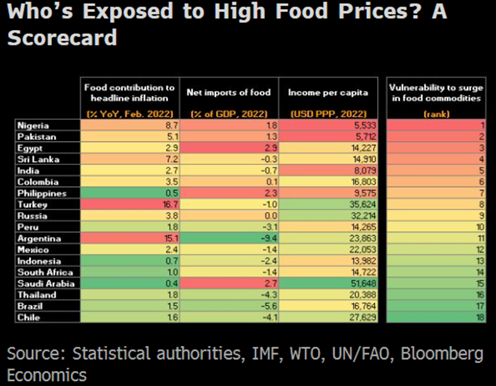

- More Downside for Crude Demand

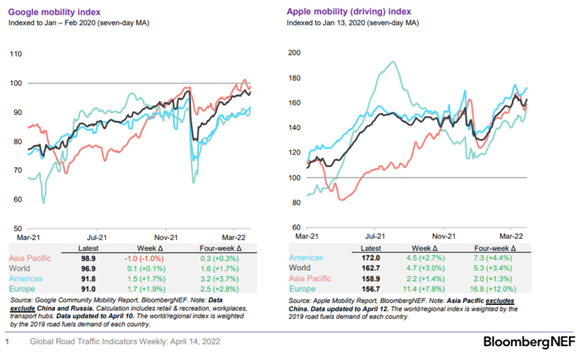

There remains more downside pressure on the demand front as driving slows and food issues take center stage. Just another example, Nigerian inflation quickened in March to its highest in five months on rising food prices, fuel shortages and supply shocks caused by the war in Ukraine. Consumer prices rose 15.9% from a year earlier, compared with 15.7% in February, according to data released by the National Bureau of Statistics on its website. India and China are the big Emerging Markets to watch as more pressure mounts on the underlying markets. But first, lets look at the developed world and what the driving data looks like at the moment. We should be seeing a pick-up in driving as we head into the spring months and Easter/Spring Break driving. Instead, we are still well off the normal pace, and it is unlikely we get close to the “normal” driving setting. We should be seeing a big “pop” in driving but instead we are seeing very muted increases that remain well off “historical” norms as prices remain crushing. More and more surveys are coming out showing consumers adjusting spending patterns and many of the top ones are around less activity and underlying travel. This will keep activity well below the “normal” range with Emerging Markets under the most pressure as governments will have to “choose” between food or fuel subsidies because the costs of both are devastating.

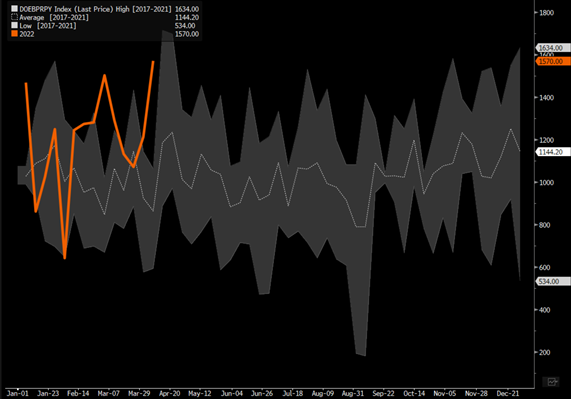

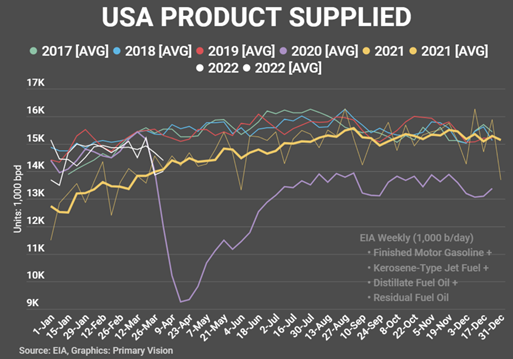

The U.S. remains well off the normal pace for this time of year- we will get some increases this week for Easter, Passover, and Spring Break. But- it will be important to see how the trend continues or if it is a fleeting moment where people are still struggling to manager their bills.

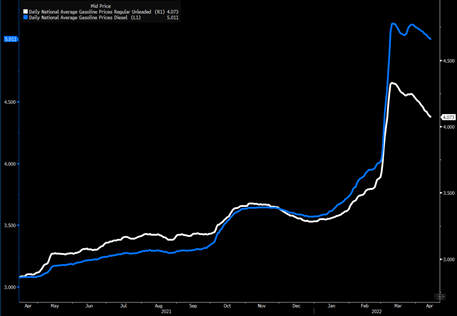

Gasoline and diesel prices have now flatlined and will start to shift higher as crude prices have bounced and driving season approaches. We are also getting into summer grade needs, which is more expensive to make vs winter grade. This will all shift prices back up and keep a lid on normalizing demand. We have said multiple times that people see gasoline prices 1st hand, but it is really diesel prices that impact EVERYTHING we buy and drive-up prices on all goods. There is also a global diesel shortage that is supporting prices and keeping prices elevated around the world.

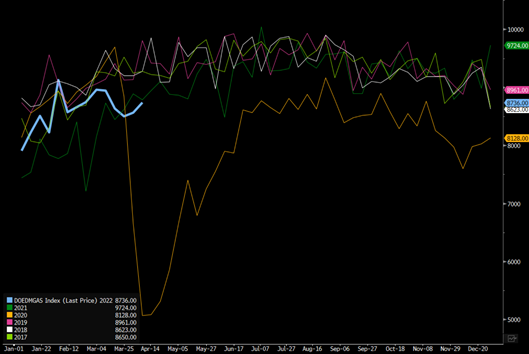

These gasoline prices are also leading to current gasoline demand running below 2021 levels. You can see from all years except 2020 that Easter/Spring Break resulted in a bounce of demand- the key will be how it levels off post the increase.

The most recent survey showed that 84% of Americans plan to cut back on spending as a result of higher prices. Many of them are tied directly to driving/travel activity that will limit the underlying demand in the U.S., and put more downside pressure on the global oil demand metrics.

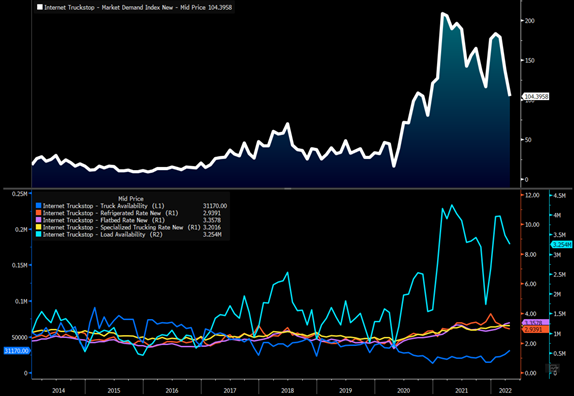

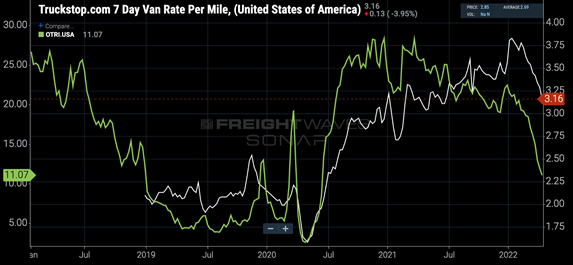

The cost of logistics from the perspective of labor/diesel is also falling through a floor. The demand for trucking is falling as prices rise and inventories grow allowing companies the flexibility to “skip” or “reject” the current tenders in the market. As we come out of heating season (heating oil/diesel) and we see a slowdown in trucking, diesel/distillate storage should pick back up and keep a lid on prices rising back to the highs. There is too much upside pressure to allow them to dip, but the counterbalance of the demand side will keep diesel prices from the highs.

Tender rejections continue to show weakness. As long as rejections continue to fall, it is unlikely that spot rates will firm up.

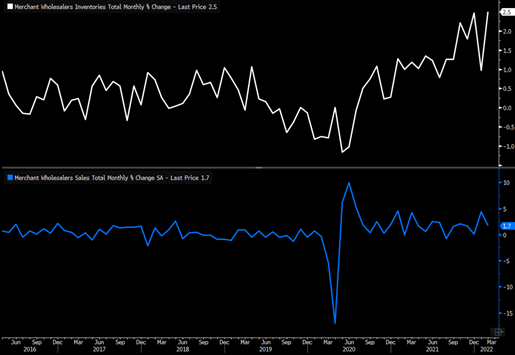

The ability for companies to reject tenders comes as inventories build, which is a mixture of the supply chain catching up a bit (but it is getting worse again) as well as retail sales slowing. We are getting all of that!

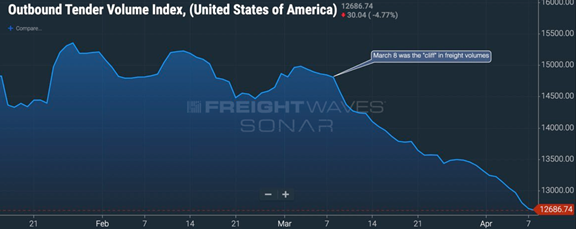

This a chart of freight demand for the US contract truckload market. March 8 was the “cliff” in freight demand. Its unlike anything we’ve seen before. Rapid deterioration in national freight demand. Spring is usually one of the best times.

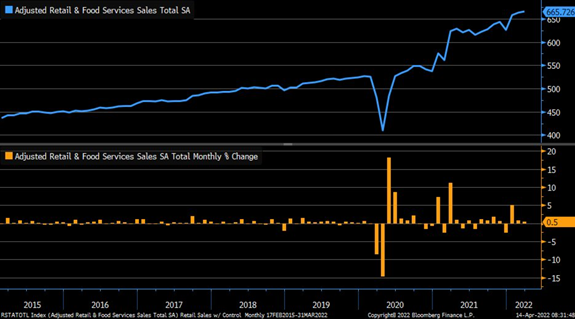

March retail sales +0.5% vs. +0.6% est. & +0.8% in prior month (rev up from +0.3%); ex-auto sales +1.1% vs. +1% est. & +0.6%) in prior month (rev up from +0.2%); control group -0.1% vs. +0.1% est. & -0.9% in prior month (rev up from -1.2%). Core sales were negative again as the consumer keeps slowing down their underlying purchases, which is leaving more goods in inventory. As companies build inventory, they are able to skip some of those shipments- especially at such elevated levels.

- China Economic Slowdown and Impacts to Demand

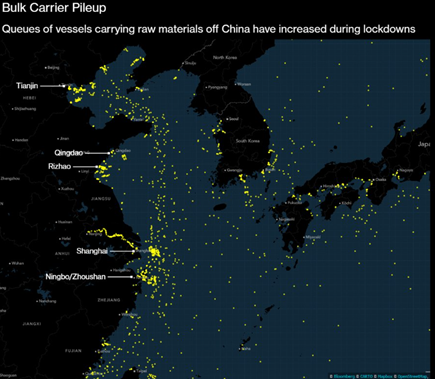

The bigger issue now is the supply chain slowing down again driven by global trade issues with a lot of it starting in China. Chinese bulk carrier pileup – Dotting the sea off Chinese ports are nearly 500 bulk cargo ships waiting to deliver resources from metal ore to grain into the country.

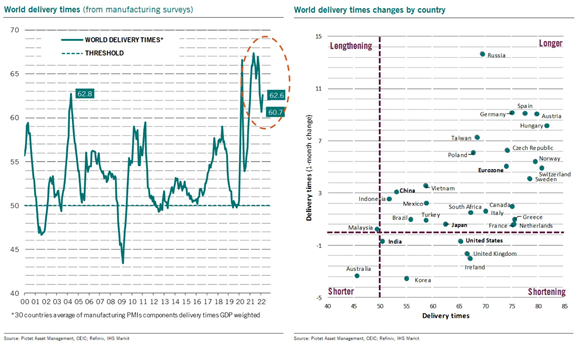

The lockdowns have created a huge backlog that is only building, and on a global level we are seeing delivery times getting worse again. The U.S. is still in “shortening”, but we expect that to shift higher as the new data comes out. The Eurozone and China will continue to deteriorate as their supply chain is hit hard- China from lockdowns and EZ from Russia/Ukraine and China. It is important to appreciate that even though things “improved” we are still talking about the worst situation over the last two decades even as things got a bit better… aka more pain ahead!

The CCP is demanding that provinces reduce roadblocks and allow for more “normal” travel even during the extensive lockdowns occurring in the country. The problem is the different messages governments are receiving from the central government. On one hand, leading party members in COVID areas risk their jobs (and lives) for allowing COVID to spread, but they are also told to remove roadblocks and allow the passage of goods. One results in a “slap on the wrist” and the other your job… so even though they are demanding the highways reopen- we expect that to be very slow. This will result in sluggish traffic and keep refiners and underlying crude demand muted.

The collateral damage from China’s “zero-COVID” policy is mounting.

In particular: Crucial logistics and supply chains have been disrupted because of ongoing containment measures.

The latest: Over the weekend, stories of widespread road closures along China’s eastern coast went viral.

- According to reporting by logistics companies, access points to inter-provincial highways were shut off in at least 10 coastal provinces.

You’ll have to take our word for it: By Monday morning, almost all reporting of the road blocks on social media platform WeChat had been deleted.

There is clearly something going on (MoT):

- On Saturday, the Ministry of Transport revealed that it held a meeting Thursday to address logistics problems.

At the meeting, officials pledged to:

- Prohibit local governments from setting up COVID-19 testing sites on highways or in service stations

- Ban local governments from closing service centers along highways

- Establish a nationally recognized COVID-19 travel pass, especially for logistics professionals and truck drivers

- Abolish unauthorized travel restrictions

Vice Premier Sun Chunlan has also called out the problem:

- In Shanghai on Saturday, Sun urged local officials to “break through transportation and distribution blockages as soon as possible” (Shanghai NHC).

Get smart: Local governments – trying to prevent another Shanghai-style COVID outbreak in their jurisdictions – are behind the widespread road closures.

Get smarter: Road closures and other COVID containment measures have already caused major economic disruptions.

- The central government is trying to ameliorate the problem, but containing COVID remains the number one priority. That means some level of disruption will persist until this outbreak is under control.

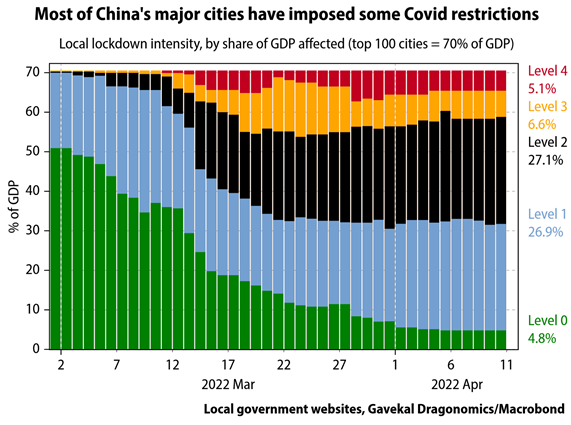

The bottom line: Downside risks to the economy are mounting. Because of these “unclear” directives, there is more downside coming into the market right now. COVID continues to spread even as China attempts to lockdown regions aggressively. Gavekal’s bottom-up analysis of China’s top 100 cities by GDP finds that all but 13 have imposed some form of quarantine restriction, and the intensity is increasing. We classified these cities from no restrictions (level 0) to full lockdown (level 4).

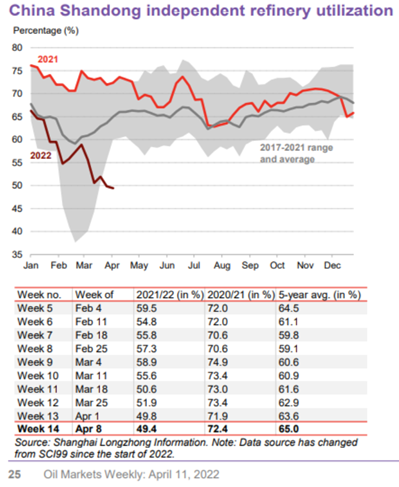

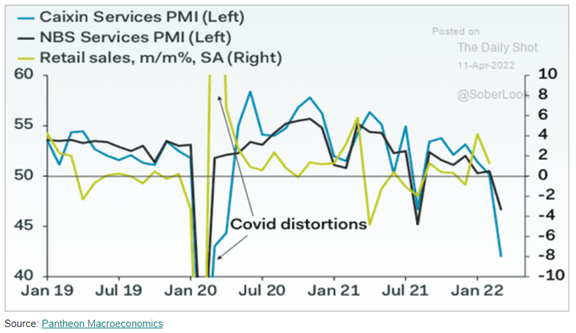

Even as these provinces/cities reopen, it will be in phases because they government will be concerned about flare-ups and cases rising again as things spread. It is another key reason why Chinese Teapot refiners are setting new record lows on refinery runs. We expect to see an increase in gasoline/diesel exports over the coming months to help balance storage while also capturing a healthy global diesel premium. But, the slowdowns in China has also resulted in a hinderance on new crude purchases- leaving more crude in the water- especially in West Africa.

The biggest roadblock for logistics is… roadblocks

Logistics in China is grinding to a halt because of COVID lockdowns.

On Tuesday, 21st Century Biz gave some stats showing just how bad things are.

Road traffic between Shanghai, Jiangsu, and Zhejiang, i.e. most of the Yangtze River Delta (YRD) economic belt, has dropped to a crawl so far in April, according to information passed to the paper from a logistics industry association seminar (21st Century Biz):

- 14%-31% of highway toll gates were shut.

- Highway traffic dropped by 40%-80%.

That spells trouble for the YRD, which accounts for 20% to 25% of China’s GDP, and the broader economy. A 2020 research report showed (EEO via The Paper):

- Freight volume through the YRD accounted for 23% of the national total in 2019.

- 73% of YRD freight goes by road.

Industrial supplies are bearing the brunt of local roadblocks while priority is given to daily essentials for residents:

- Trucks carrying food and medical supplies get first dibs on permits to pass through highway checks.

Epidemic controls have also created a shortage of drivers, and some companies, especially exporters trying to get their goods to port, are switching to inland waterways and rail transport where possible.

Get smart: Local lockdowns are causing chaos for businesses and recent orders from the central government to clear blockages asap won’t provide relief anytime soon.

Bottom line: Logistics will only start to normalize when the Shanghai lockdown is fully lifted – so expect supply chain snarlups to continue for some time yet.

As China faces a growing economic problem at home, citizens are getting fed up with the broad lockdowns as food and other supplies are in short supply. This has led to more protests and some violent interactions with police. The longer this persists- the broader the problems will get. The government is trying to get in front of it by increasing support for businesses with a HUGE focus as you will see on food and all things agriculture. The issues aren’t going to go away quickly, and the big focus remains on food and ensure there is enough available as we come into the spring planting season.

Central government policies to ease burdens on struggling businesses have come thick and fast in recent months.

Local officials need to ensure they’re actually rolling these policies out – and fast.

That was Premier Li Keqiang’s main message to officials on his Jiangxi inspection tour Tuesday.

Specifically, Li said (Gov.cn):

- “[We must] accelerate the implementation of policies that have been set to bail out enterprises.”

Li also stressed the importance of macro stability, and his site visits highlighted his particular concerns about:

- Agricultural input prices

- Employment

- Businesses’ vitality

Li assured rice farmers that, if necessary, more ag subsidies would come:

- “If the price of agricultural materials is still high when the autumn grain is planted this year, the state will take new measures to subsidize agricultural materials.”

At an e-commerce business park, he encouraged entrepreneurship training to help more people start businesses and find jobs:

- “We should stimulate market vitality… promote mass entrepreneurship… and allow new business forms and new models to emerge one after another.”

He also stopped in at a new-energy vehicle plant to reaffirm government support for small, medium and micro enterprises:

- “The progress of tax rebates should be further accelerated, so that enterprises can get real money as soon as possible.”

Get smart: Li wants to make sure officials are using all available policy tools to juice economic growth – and support businesses and jobs.

Get smarter: Even with broader stimulus, a 5.5% growth target seems out of reach.

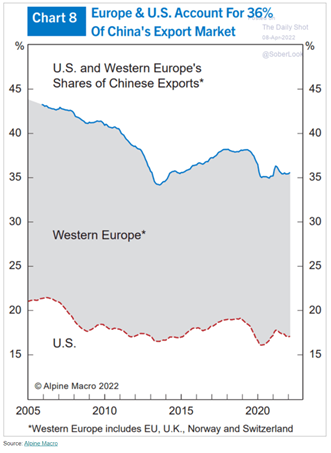

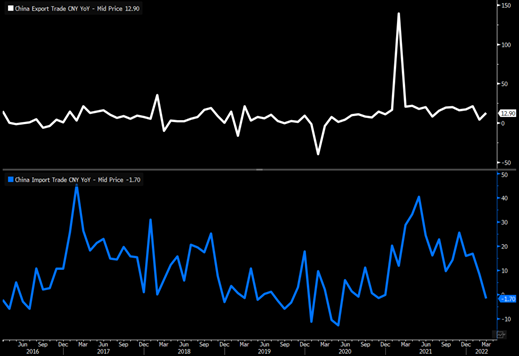

We have been highlighting since they announced this growth target as it being unattainable without some crazy CCP math magic and that only gets harder as we progress through the year. Last year- the only thing that provided support for a slowing economy. Now- China has seen their imports drop like a rock (well beyond expectations) as exports also missed expectations. Some of this can be blamed on the lockdowns, but the broader issue remains slowing internal demand and struggling trade partners (IE- U.S. and Europe).

China’s General Administration of Customs released trade data for March on Wednesday.

The headlines:

- Exports rose 14.7% y/y in dollar terms in March, down from 16.3% y/y growth in the combined January-February period.

- Imports fell by 0.1% y/y last month, down from 15.5% y/y growth in the first two months of the year.

- The trade surplus was USD 47.3 billion in March, compared with a surplus of USD 115.95 billion in January-February.

The collapse in imports is a real shocker.

- The consensus forecast was for an 8% y/y expansion in March.

What gives?

Given the lag between Chinese companies placing import orders and the goods arriving, last month’s collapse in inbound shipments is more likely to be down to port disruptions, rather than weaker demand because of COVID-19 lockdowns.

- Lower demand for imported goods because of production disruptions will show up in the imports data in coming months, however.

The slowdown in exports, meanwhile, mainly reflects the softening in overseas demand.

- Since May 2021, the new export orders subindex of the NBS Manufacturing PMI has been in contractionary territory.

- Export growth is on a downward trend due to last year’s high base and the shift in overseas household spending towards services as countries drop COVID-19 restrictions.

Things are only going to get worse: Going forward, export shipments will also be hit by production stoppages due to COVID-19 lockdowns.

Adjusting for high inflation, China’s trade picture in March was even more dire.

- Import growth will have been well into negative territory in March in real terms, with exports broadly flat y/y.

Get smart: Lockdown-related production stoppages will be temporary.

- But with both the global and domestic economy weakening, the extent to which import and exports will recover once these disruptions end is unclear.

The government has turned to- you guessed it- Special Purpose Bonds (SPBs) once again! When in doubt, turn back to the tried-and-true dumping ground for liquidity. The following is from Trivium, but I think it is funny how the Chinese government tosses in the caveat of- make sure it is a “good” project. After YEARS of dumping money into the market through SPBs- all of the good projects or at least ones that could cover interest AND principal are long gone. Many companies/individuals would be more than happy to take the cash- but deploying actual solutions that generate a return has been fleeting since 2018. Many of the SPBs that are put into the market are earning a multiplier of .87 or for every $1 invested earning $.87- and that has been declining for YEARS.

Special-purpose bonds (SPBs) are all the rage in Beijing – and central government officials want local governments to use them sooner rather than later.

ICYDK: Local governments use SPBs mainly to fund infrastructure and other major public projects.

- At the March National People’s Congress, Premier Li Keqiang announced a RMB 3.65 trillion SPB quota for 2022 – unchanged from 2021.

On Tuesday, during a visit to a water conservation project in Jiangxi, Li exhorted officials to (Gov.cn):

- “Speed up the issuance of special-purpose bonds, increase credit support, and streamline project approvals.”

At a Tuesday presser, Vice Minister of Finance Xu Hongcai echoed Li’s message, saying the MoF would (China Internet Information Center):

- “Act to guide local governments to issue and use special-purpose bonds as soon as possible.”

But when it comes to SPBs, officials want both quantity and quality.

Xu laid out some specific rules of thumb for SPB distribution, including:

- Limit issuance in areas with high debt risk

- Focus on funding major projects that have clear social and economic benefits, and avoid “pepper sprinkling” (i.e. don’t spread the cash across too many disparate projects).

In particular, Xu wants SPB cash to flow to:

- Water conservation

- Information infrastructure

- Agriculture modernization

- Grain storage logistics

Get smart: As headwinds to China’s economy mount, Beijing’s urgency to get project funding out the door grows.

- The faster SPBs are issued, the faster projects break ground and the faster employment opportunities materialize.

Get smarter: With Beijing pushing to get money out the door fast, some of that money is going to end up funding unproductive projects. That will undermine growth in the years to come.

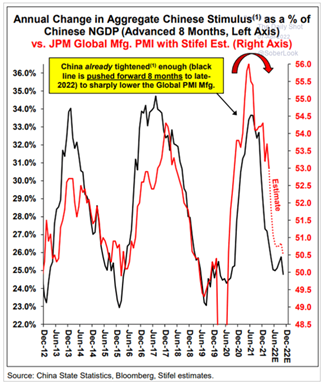

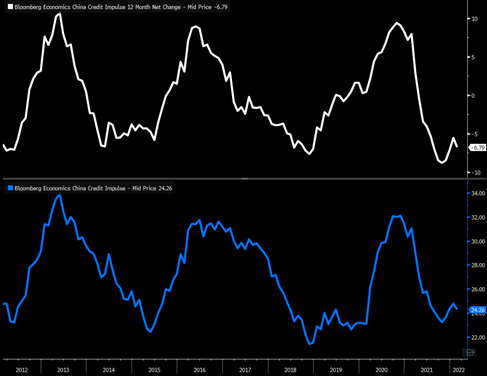

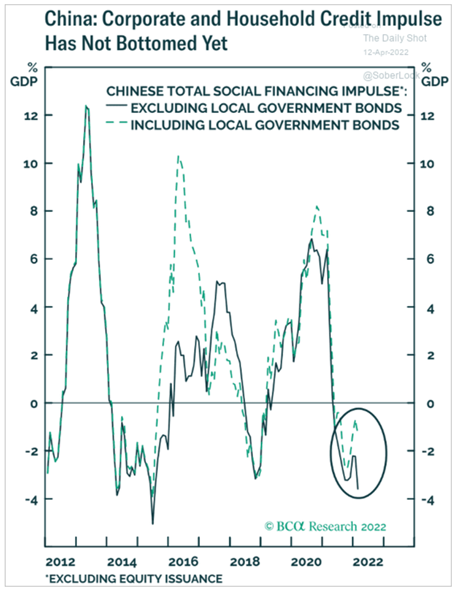

The focus of the investments remains on water, food, and food storage- so you get the gist of the underlying problems. The main focus for the PBoC remains trying to bridge the liquidity gap while not flooding the market with new money. It is why we still see declines in credit impulses.

The PBoC kept rates flat (our base case expectation), which was not something the market was expecting. The view was that there was going to be more support given to the market, but in our opinion, then PBoC wants to manage credit impulses at the current levels. Instead, the PBoC adjusted the reserve requirements at banks. “The 25 basis point reduction in banks’ reserve requirement ratio in theory allows them to inject more than Rmb500bn ($78bn) in new loans into the economy. Analysts are skeptical that such measures, even if coupled with rate cuts, will be enough.” Banks remain unwilling to lend to the market even as rates are better than what the government will give you- opening up an arbitrage opportunity. But on all levels of the market- there is a broad unwillingness to invest into the market.

This is also creating more problems for companies and employment- which all leads down to retail sales. We have been beating the drum on the issues with employment for some time, and now the Chinese government is getting more aggressive on the demand front. The below chart puts into perspective the issues in the market, and the pressure that will pull retail sales much lower. We already so a big drop in imports, which is a bellwether for exports as well as internal demand. Both are worsening and is a bigger concern now for the PBoC.

Beijing is getting jittery about unemployment.

On Wednesday, we had Premier Li Keqiang pledging to expand unemployment insurance benefits and increase financial support for companies who retain staff. On Thursday, it was Vice Premier Hu Chunhua’s turn.

- He held a symposium on jobs, calling for “all-out efforts to stabilize and expand employment.”

Participants included:

- Academic experts

- Business leaders

- Representatives from employment service agencies

Some context: As far as we can tell, this is only the second time in a decade a symposium of this nature has been held.

- Premier Li Keqiang chaired a similar one in 2016 – so this is by no means a regular part of the political calendar.

IKYDK: The top leadership uses events like this to gather input on issues of concern, and to push for alignment around government or Party priorities.

Hu reminded attendees that maintaining stable employment is critical to delivering on broader economic stability goals, describing the current situation as “complex and severe.”

He called on all sides to pull their weight (People’s Daily):

- “Relevant departments…should solve the difficulties faced by enterprises in a timely manner.”

- “Employment agencies should…continuously improve the quality and level of employment services.”

- “Companies play the main role…and must actively fulfill their social responsibilities and strive to stabilize and expand employment.“

Get smart: With economic headwinds mounting, Beijing is scrambling for solutions to stop unemployment from spiraling, threatening social stability.

Get smarter: Expect large, state-owned companies to patriotically ramp up hiring in coming months – and potentially some large private firms, as well.

Get real smart: Employment stability is hot-button issue. The Party may have no option but to open the stimulus floodgates if the situation gets truly dire in the runup to autumn’s all-important Party congress.

While the government is FINALLY looking more aggressive at employment- it will take time to implement any new policies and by that point the damage will be done. Employment has been TERRIBLE since BEFORE COVID and this is just making things much much worse. We don’t see any near-term solutions to adjust the drop in economic prowess. The government keeps getting more aggressive on employment and inflation as things worsen in the region.

In the latest signal, on Thursday, Premier Li Keqiang presided over a symposium of economic experts and business leaders to check in with top advisors.

- This comes ahead of the Politburo’s April meeting, which will discuss economic policy.

Top of Li’s mind: Jobs and inflation.

The solution: Li issued a laundry list of measures to “stabilize employment and prices” (Xinhua).

For employment, agencies should:

- Bring in support measures for companies to retain staff

- Improve employment services for college graduates

- Support entrepreneurship

Erm. Okaaaaay. That’s all pretty nebulous.

So what about prices? Agencies should:

- Ensure the supply of agricultural products and stabilize prices

- Support more coal-fired power production to guarantee energy supply

- Support the logistics industry and maintain supply chain stability

These are not exactly new concerns:

- Premier Li unveiled a similar set of macro measures at Wednesday’s State Council executive meeting.

- Premier Li visited the agriculture ministry two weeks ago to discuss food prices.

- Vice Premier Hu Chunhua held a special symposium on stabilizing employment on Thursday.

Li also gave a shout-out to consumption.

- In particular, he said agencies should investigate how they can support folks who are facing difficulties repaying loans due to the pandemic.

Get smart: The government is concerned about the right problems. But it’s unclear that they have solutions.

Get smarter: The ambitious 5.5% growth target for this year looks increasingly unattainable.

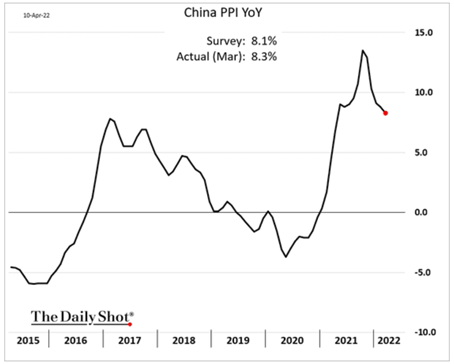

The PBoC/CCP keep protecting against inflation- the PPI remains elevated and increases the cost of government intervention. The supply chain issues will push the PPI back up, and even after several prints of cooling- it still remains at the highest levels in over a decade.

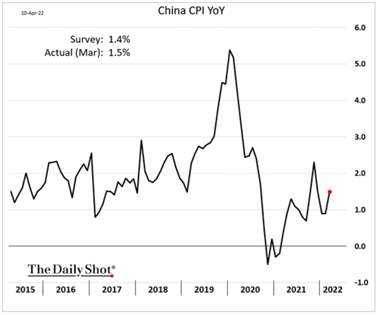

Core CPI remains elevated while total CPI bounced again- and the government (as shown above) is doing everything it can to step in front of inflation and keep the impacts limited.

But- none of this is free and resulting in weakening foreign reserves, which will only get worse as trade struggles and internal costs rise. The CCP is still looking to cut tax revenue and issue varying rebates, which will diminish the coffers further.

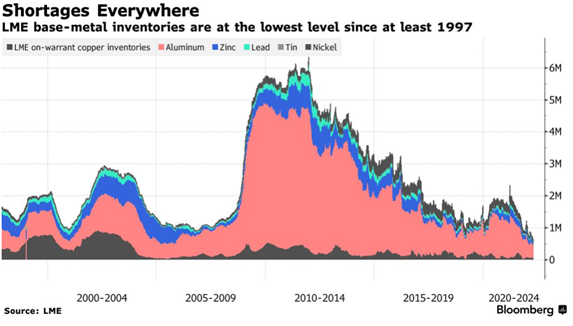

A final note on China is the drop in imports and the underlying commodity prices- the counter point to it is the shortage in LME storage. We are seeing inventories at the lowest levels since 1997, and with political risk in key producing areas: Russia, Chile, Myanmar to name a few- it is unlikely it changes in the near term.

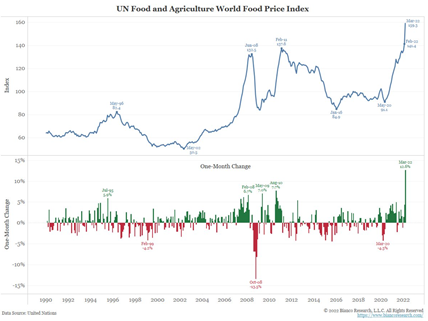

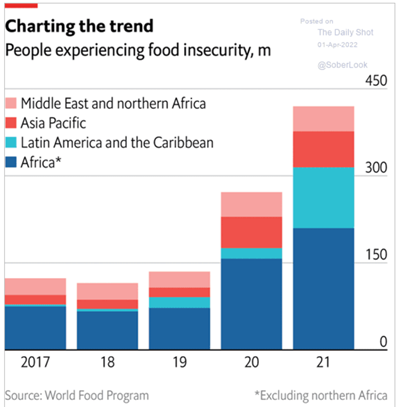

- Global Inflation and Food Prices Pressing Higher

Food remains front as prices push higher again and put more stress on countries balance sheets. There is more pain to come as crop yields remain under pressure. The last month has seen the biggest month/month increase with more pressure to come. The rate of change will slow, but the underlying increase will be in the same direction- higher. We have already seen protests and food riots, and we are still at the very beginning of the pain. There still remains food and fuel subsidies, and as country by country (especially Ems) drop them- the protests and riots will increase in intensity.

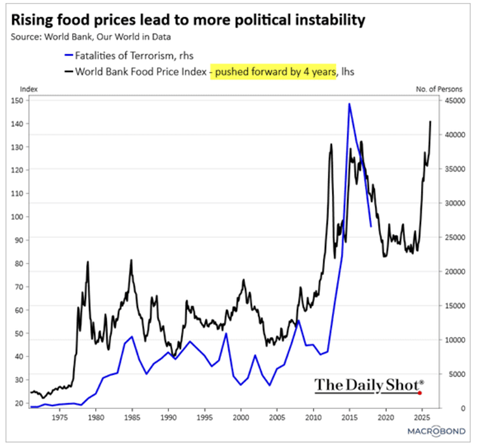

It isn’t surprising to know that as food prices roof so does military activity!

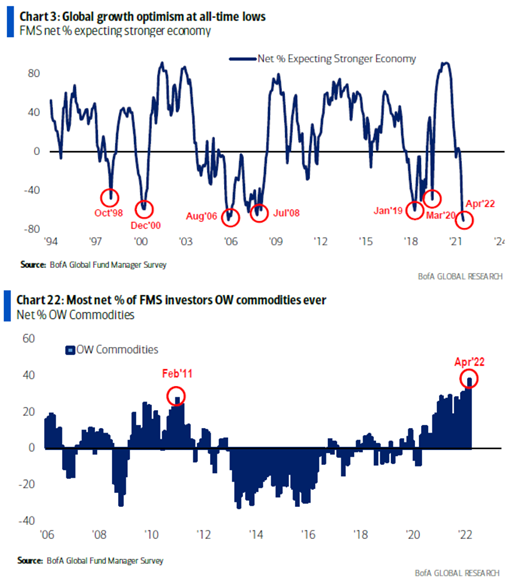

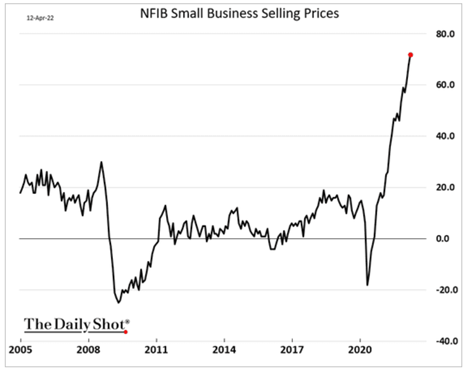

The global shifts in the market will give way to stagflation as optimism wanes and more pressure comes into the market. We are not sitting in a good period as pressure mounts on a global level. Central banks are raising rates, and the U.S. is moving firmly into quantitative tightening.

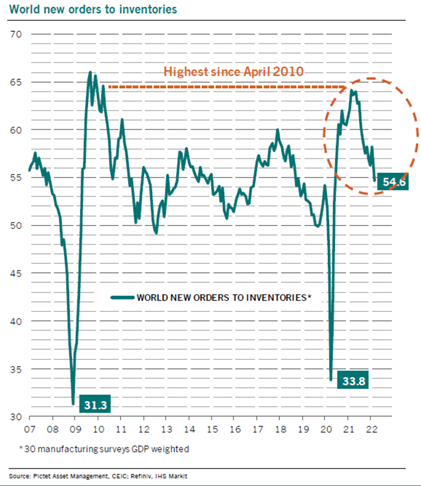

Orders have continued to slow, which again leads back to the slowdown in global trade and the pressure that remains in the system.

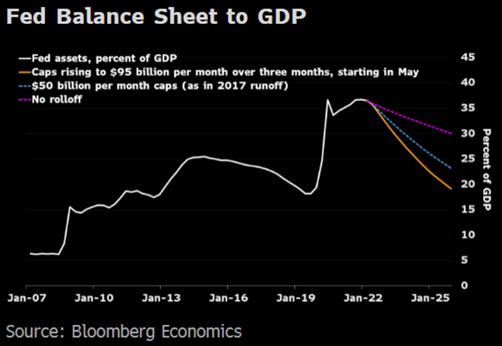

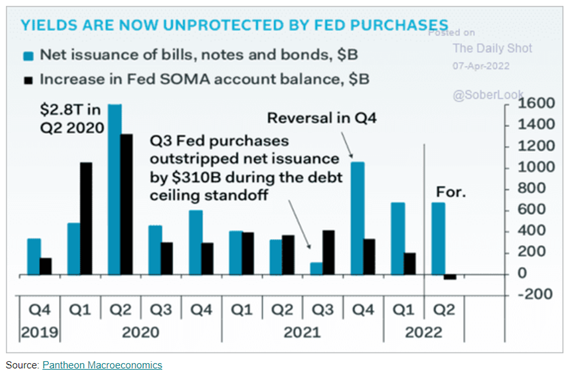

The pace of Fed tightening will have to accelerate if they are going to hit their target of the balance sheet going from 37% of GDP to 23% of GDP by 2024. They gave some guidance around a “cap” of $95B a month, but when you look at the 2017 runoff of $50B you can see they don’t hit their target until well into 2025. We expect them to be a bit more aggressive on the tightening front.

As the Fed goes from a net buyer to a net seller- it will put even more pressure on yields. There have been several quarters where they were bigger buyers vs what the treasury was issuing. This will take away the biggest buyer of TSYs while also putting additional selling pressure into the market.

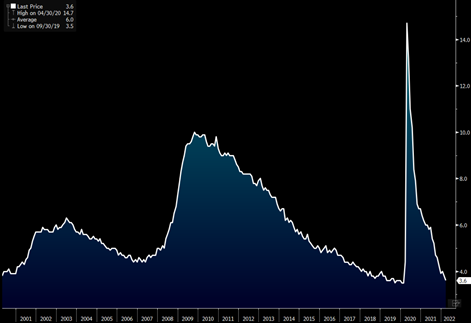

We talked about it last year when we wrote about the Fed being killed by yield (we were right!), but we are also seeing the end to the bond bull market. Since the early ‘80s, bonds have been in a perpetual down movement that is now rapidly coming to and end as the world fights mounting inflation.

Global inflation numbers just came out- and to no one’s surprise- they surged again. You are probably wondering… when does this end? How does this end? Is there a way to make money on this insane price moves? I keep getting the question of when will we see peak inflation, which is a very difficult item to pin down given how fluid the situation is but I will try.

Wages typically rise during the March-June period as hiring accelerates and people quit their jobs following bonuses and companies with fresh budgets. The push higher in wages will also be supported by a very tight jobs market and a surge in living expenses as inflation continues to outpace the move higher in earnings. The move higher in CPI is just pushing that figure lower: Average weekly earnings on an inflation-adjusted pace are declining by the most in data going back to 2006, highlighting how far wages are lagging consumer price increases.”

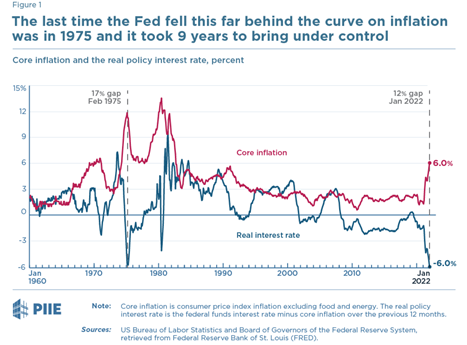

When we evaluate employment, you have to compare it against “natural unemployment.” There will always be people quitting or company layoffs, and the current level we should be at is 4.3% while we sit at 3.6%. The Fed has a dual mandate: full employment and inflation. We are currently well below full employment and the Fed inflation target is “about 2%” while we just printed 8.6% with some more pain to the upside.

The fact we are so far away from their targets opens up the ability for accelerating rate hikes to bring things back into alignment. The issue becomes- how fast will they raise rates? The short answer is- quickly because they are so far behind monetary policy.

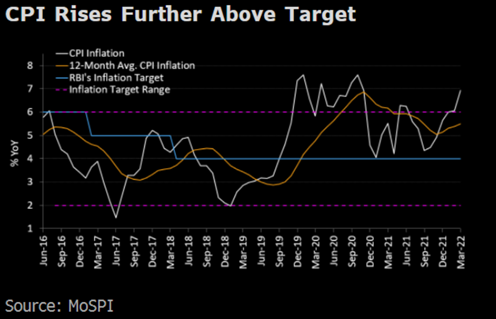

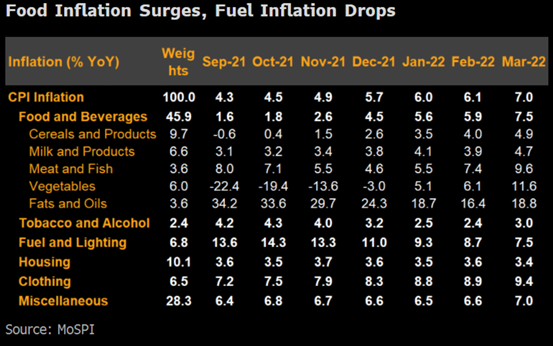

India saw their inflation top estimates (and right in line with ours) as it approached 7% hitting 6.95%.

The pressure remains to the upside as Ukraine-Russia creates a shortage of varying vegetable and fats/oils flow into India.

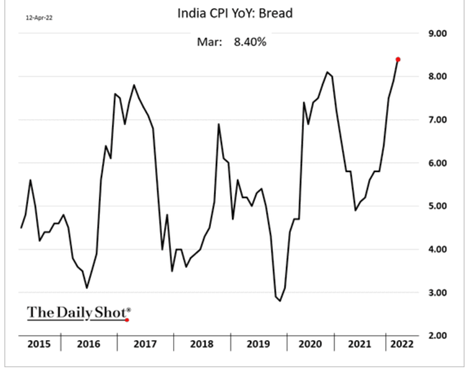

As we look forward, the most important things such as bread and other core items are shifting higher.

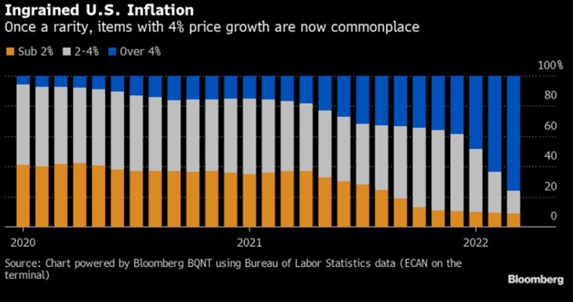

The U.S. is going to import all of these elevated prices, which is going to push our inflation numbers higher still. U.S. inflation didn’t just reach a fresh four-decades high of 8.5% in March, it also got wider. An analysis of diffusion indexes for consumer prices shows that 76% of the goods and services measured by the Bureau of Labor Statistics saw gains of at least 4% from a year earlier. That’s up from two-thirds in February, and less than 5% at the end of 2019, before the pandemic. Last month, only 2% of items in the index saw a decline in prices, including smartphones and TVs. When we turn abroad, looking at global PPIs and our import prices- the pace may slow but the direction remains higher.

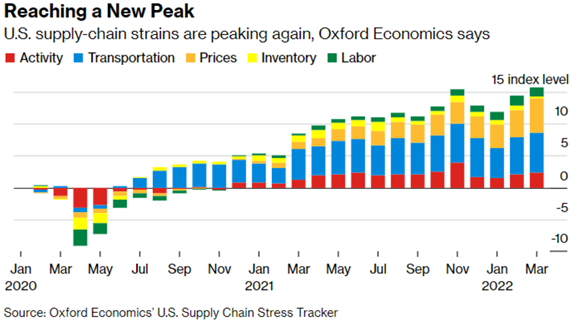

As the supply chain worsen again and more cost is passed through- we will see a lot of staying power in not only flexible inflation but also sticky inflation.

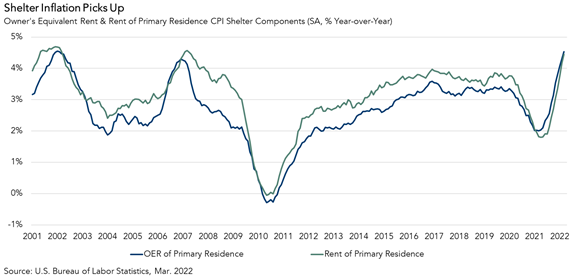

The shelter index rose 5.0% YoY in March, its largest YoY increase since 1991. Even if YoY house price growth slows over the coming months, shelter inflation will continue to increase for some time, as shelter inflation lags observed rental & house price increases by ~1 year.

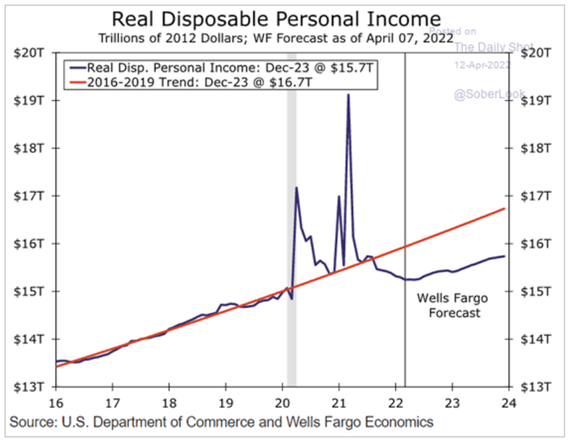

As inflation worsens, so does disposable income and the ability for people to spend money. We expect the pressure to mount and while wages will push higher- it won’t be enough to get anywhere close to closing the gap. Average weekly earnings on an inflation-adjusted pace are declining by the most in data going back to 2006, highlighting how far wages are lagging behind consumer price increases.

This is all a global problem with a lot of shared pain as prices continue to rise around the world!