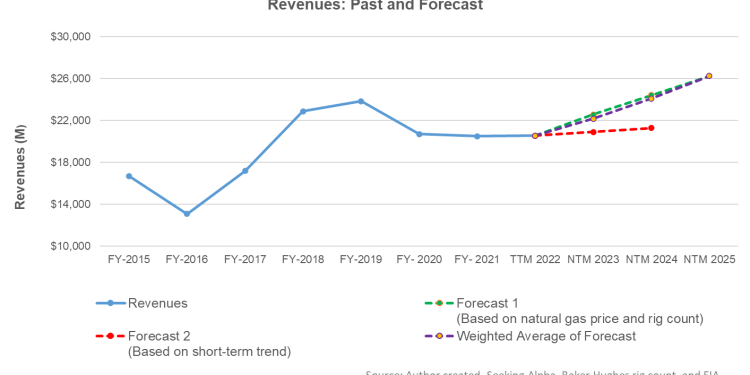

- Revenue estimates suggest a steady trend in the next three years

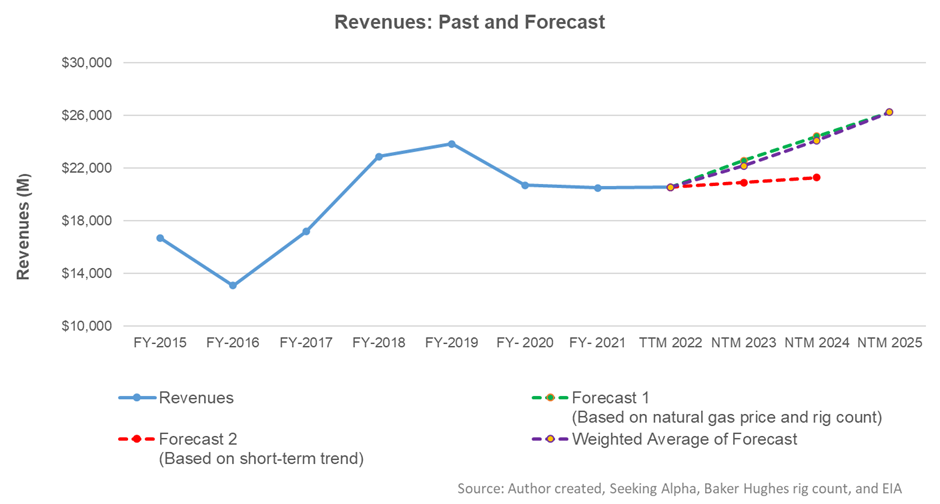

- EBITDA will also improve but at a more moderate rate in the next two years

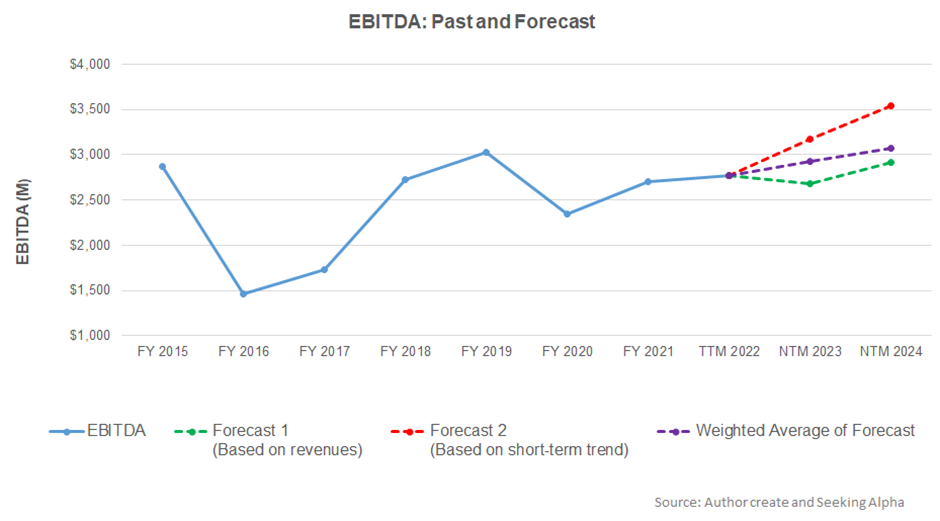

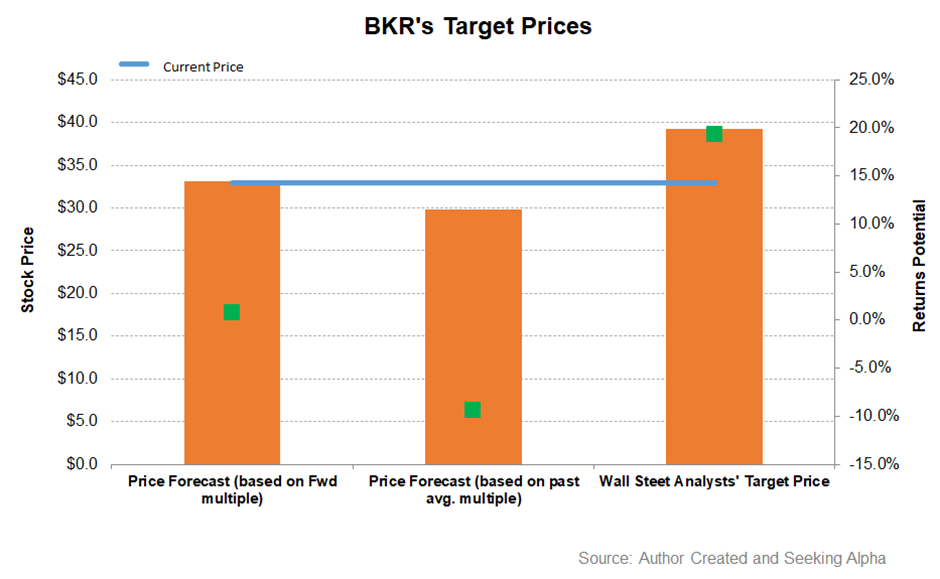

- The stock is marginally overvalued valued at the current level

In Part 1 of this article, we discussed Baker Hughes’s (BKR) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the natural gas price, global rig count, and BKR’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase steadily (8.5%, on average) in the next three years.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to increase moderately in the next three years (5%, on average).

Target Price And Relative Valuation

Returns potential using BKR’s forward EV/EBITDA multiple (11.9x) is higher (1% upside) than the returns potential using the past average multiple (9% downside). The Wall Street analysts have higher return expectations (19% upside).

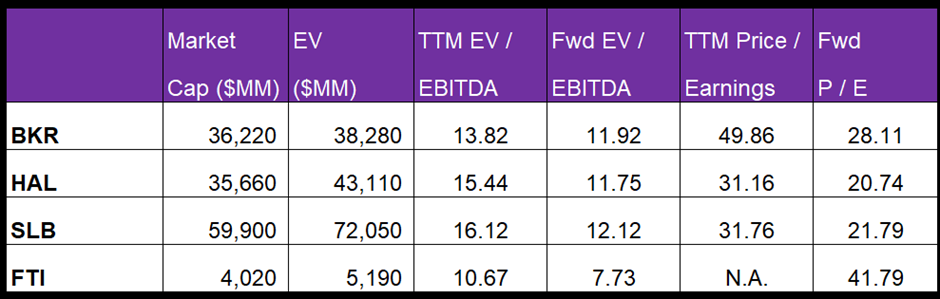

Baker Hughes is currently trading at an EV-to-adjusted EBITDA multiple of 13.8x, according to Seeking Alpha. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 11.9x. The current multiple is in line with its past five-year average EV/EBITDA multiple of 11.7x.

BKR’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This would typically result in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is in line with its peers (HAL, SLB, and FTI). So, the stock is marginally overvalued versus its peers.

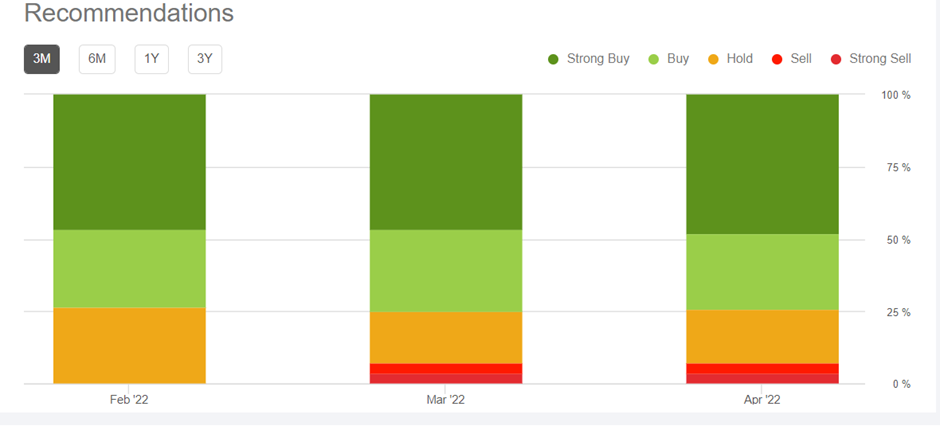

Analyst Rating

According to data provided by Seeking Alpha, 20 sell-side analysts rated BKR a “Buy” or “Strong Buy” in April, while five of them rated it a “Hold.” Only two of the sell-side analysts rated a “Sell.” The consensus target price is $39.3, which yields 19% returns at the current price.

What’s The Take On BKR?

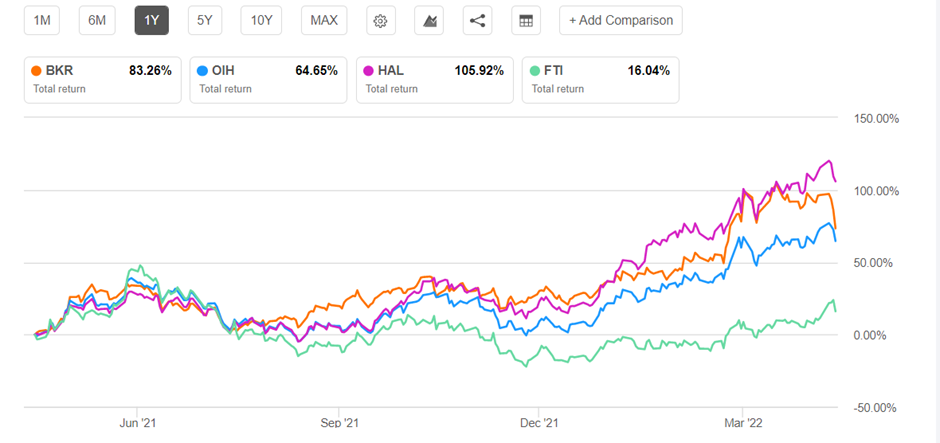

The LNG market is Baker Hughes’s primary driver and will remain so in the medium term, given its tremendous growth opportunity and natural gas price rise. The global LNG capacity may exceed 800 MTPA by 2030 compared to the global installed base of 460 MTPA. The rising alternative energy market looks into carbon capturing, hydrogen, emissions management, and clean and integrated power solutions. In the short term, Southeast Asia, Latin America, and the Middle East will lead the market growth. All of the company’s operating segments will register topline growth in 2022 and 2023. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, a challenging supply chain and inflationary environment in the commodity market will mitigate the operating margin expansion. Although BKR has robust liquidity, the cash flow deterioration can impede expansive capital market activities. Also, its relative valuation level is stretched. Nonetheless, investors can hold the stock for steady returns because of a current and long-term growing market.