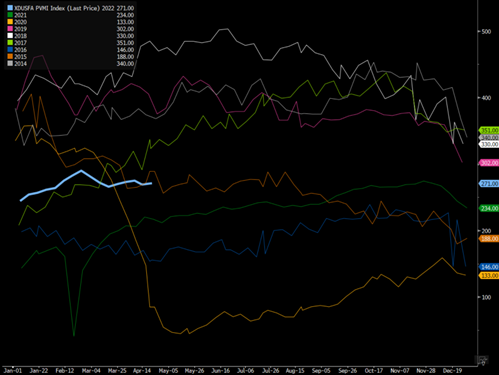

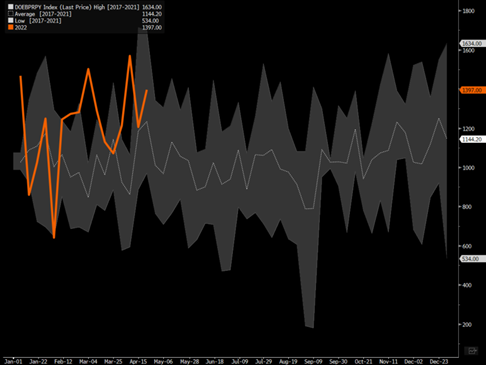

U.S. activity will continue its rise over the next few weeks as we move closer to about 280-285 spreads to kick off May. We expect to get much closer to 295 throughout May to hit the ground running into June. The biggest push is usually in the summer months as you can see in some of the charts below. Activity will be capped in the U.S. driven by a multitude of factors that we go through in detail below. There are many limiting factors within the energy supply chain, but also along the global economic backdrop which we discuss more below.

Through the first half of the year, we have seen completion activity follow a steady seasonal path but from a lower-level vs historical norm. The U.S. saw a strong rally bounce in activity in Q1, which cooled off a bit in March (similar to 2019 and 2018). We remained fairly flat for April, which has happened in the past depending on when the Holidays hit as well as Spring Break. Activity starts to pick back up as we head into the end of April and throughout May. We expect to see a similar bump in activity bringing us to between 290 and 300 spreads across the lower 48 states.

While the national spread count has been depressed versus other years, the Permian has been operating and full tilt and setting seasonal records in activity. Operations were steady to kick off the year, but as the price of every hydrocarbon started to rally so did the Permian. We have been either near or above seasonally adjusted highs as E&Ps look to capitalize on the strength in the market and demand in the international market. U.S. crude exports will stay between 3.2M-3.3M on a 4-week rolling average as countries look to replace either blend oil or replace Russian crude. The Permian’s sheer size and proximity to the coast makes it an ideal spot for a step up in activity.

Even though it has all these benefits, the energy sector (along with others) is facing a labor shortfall that isn’t easily overcome. Many previous employees have tired of the boom-and-bust cycle and have taken jobs in construction, trucking, or other areas that saw a significant bounce prior to the recovery in energy. This left the industry struggling to fill jobs and train new employees that are not familiar with the oil patch. The energy sector also went through a significant contraction with a lot of horsepower sent to the yard either cold or warm stacked. But either way- the equipment was sitting idle, and as companies looked to cut costs and keep some spreads operational- the horsepower in the yard became inventory. So as the energy market recovered, there were incomplete spreads that needed to be repaired or rebuilt due to being stripped or mother nature taking her toll. This came at a terrible time as the world continues to face a logistical nightmare with global shortages in everything from Gatorade to steel and everything in-between. As companies began looking to bring back equipment, suppliers said “get in line” and we are still waiting on horsepower to get redeployed into the market.

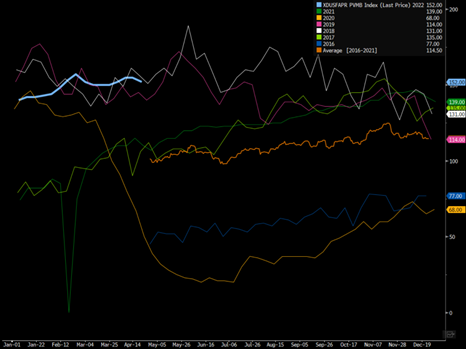

The steel issue is hitting many parts of the industry including pipe as well as pieces of equipment vital for effective and safe operation. Just as an example- North America Steel OCTG P110 Pipe 5.5″ Diameter Spot FOB- is at a record high with little chance that we see a decline in the near term. Pricing is going to keep activity bumping up against functional limitations leaving little time for the supply chain to “catch-up” with itself. Many companies that provide steel pipe for the oil industry also produce for other industries- especially construction. Even as the real estate market “slows”, there is still a huge backlog of houses and apartments being built that will compete directly with the energy markets. It will come to whomever is in the queue and once the pipe is created- it still needs to be threaded and delivered. This doesn’t even include the pipe needed to “tie-in” a well for production among many other needs to effectively bring a new asset to market.

Proppant and just general logistics remain a key limiting factor to how quickly completions can ramp up. There have been companies taking prices higher with U.S. Silica announcing a 25% increase in price starting May 15th. Industrial uses for sand (such as glass) have also risen, which puts more pressure on the industry. All of these factors limit how quickly a ramp in activity can be achieved, but it also limits how much available horsepower is in the market. We estimate the market to have about 325 spreads in the market, but not all of them can be deployed at this moment. There is enough demand and equipment coming that we can hit that number by the beginning of Q3’22, but that is the highest point we think is achievable this year. It is likely we fall just short and sit closer at about 315 as the industry moves into “prime” completion activity during the summer months.

There remains enough equipment and underlying DUCs to hit our target of 12.2M barrels a day exit rate. We outlined previously how we are sitting at about 11.87M barrels a day of production, and the EIA just “trued up” their number to be right at 11.9M barrels a day. The current pace on activity and our future expectations put us right inline for our current exit rate.

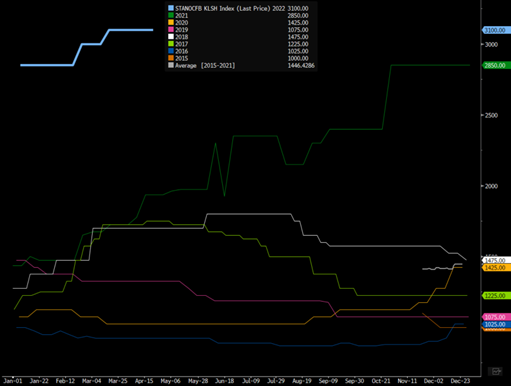

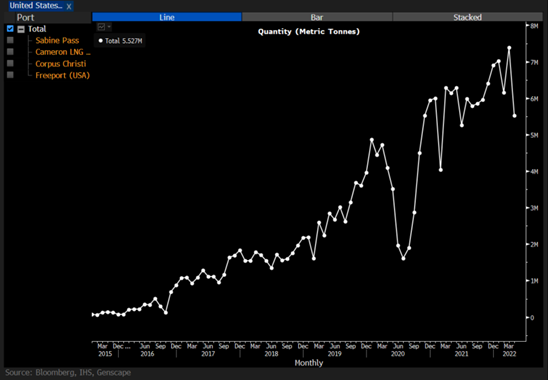

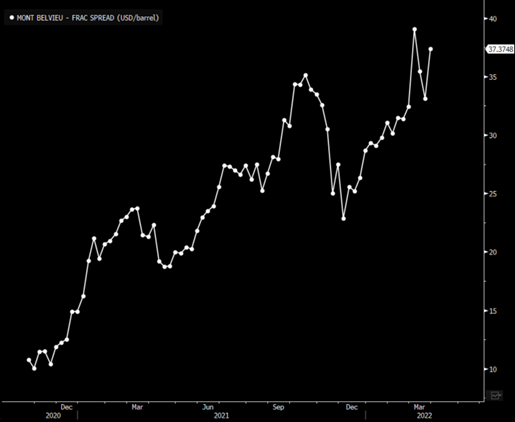

The U.S. is also exporting a record amount of natural gas liquids (NGLs) and natural gas by way of LNG as the market looks for solutions as the Ukraine-Russia war is ongoing. We have some “sub-par” equipment available as well as used pipe, which could be deployed in “easier” areas to frac such as Oklahoma (Anadarko and in areas Primary Vision defines as “other” in our data set). These areas are shallow and have a lot of natural factures, which aid in the process of drilling and completing with older equipment. When we look at refracs, they have been targeting the liquids and natural gas regions given a multitude of factors. There are a lot of things to consider with a refract from wellhead and casing conditions all the way down to EUR expectations and takeaway capacity. Refracs tend to yield a higher cut of liquids and natural gas because these molecules are more “mobile” when traversing from a high pressure (locked in the shale/sand) to the low pressure- fracture created by “frac’ing” the well. This is being accelerated by already targeting the Haynesville and Eagle Ford.

Natural gas in the U.S. is getting a huge bump by an increase in local demand as storage remains in a price supportive backdrop as LNG exports remain at or near a record. We will see exports stay between 6MTPA to 7.5MTPA with the only limitation being the capacity of the facilities. As new trains come online, we will see a steady increase in exports as the market is struggling to meet the growing demand as Europe shifts away from Russia.

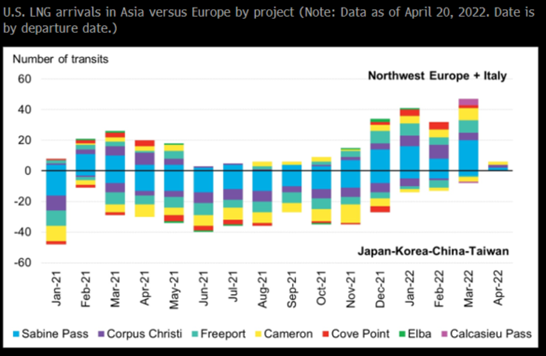

There has been a shift in where U.S. volume has been flowing with more of it pivoting into the European markets to replace Russian piped gas and LNG that flows from Yamal. Asia has been taking more volume from Qatar, Australia, and Russia to replace the normal flows that typically originate from the U.S. This is getting a big escalation as Russia will stop shipping natural gas supplies to Poland and Bulgaria starting April 27th if they don’t pay for it in Rubles. The European countries have stated that it would breach sanctions, and have so far refused to meet Putin’s demands:

From Bloomberg: “Moscow appears to be making good on a threat to halt gas supplies to countries that refuse President Vladimir Putin’s new demand to pay for the crucial fuel in rubles. Europe has said that doing so would breach sanctions and strengthen Russia’s hand. Poland has been particularly vociferous in its criticism of Russia and has refused to comply with the new terms.

Poland’s main gas supplier PGNiG said it’s been told that all flows will stop from Wednesday morning. Minutes earlier, Russian gas giant Gazprom PJSC issued a warning that Poland must pay up for its gas supplies — on Tuesday and in the Russian currency.

“I can confirm we’ve received such threats from Gazprom which are linked among other things to the means of payment,” Prime Minister Mateusz Morawiecki told reporters in Berlin. “Poland is sticking to the arrangements and maybe Russia will try to punish Poland” by cutting deliveries.”

The shift in Russian flows will only solidify the way the below chart looks as we progress through the end of the year.

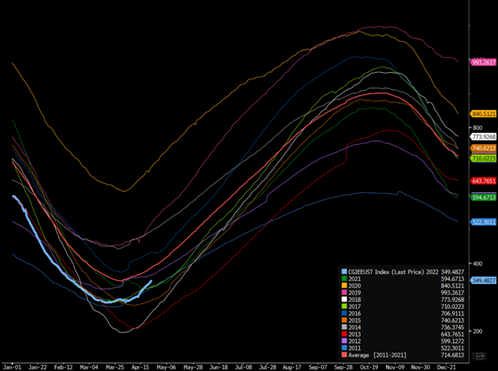

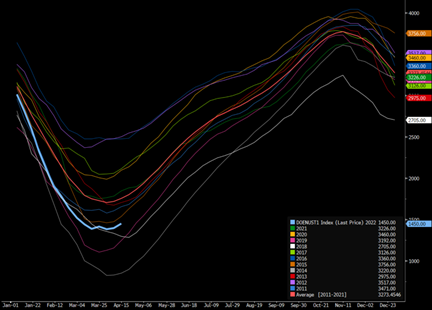

European natural gas storage has bounced at a slightly faster rate vs historic, but it still remains below the 11-year average. The concerns about “summer burn” and “winter demand” will keep Europe active in the floating market to ensure there is enough supplies during peak months.

During the same period in the U.S. we are still low in relation to the 11-year average and the rate of change has been muted. This just means that we haven’t seen a meaningful advancement to the average as demand stays strong and LNG demand absorbs a lot of capacity. This all leads to a strong backdrop for flow and supports new production through new completions or refracs.

The liquids market is also very robust as our export capacity has risen along with global demand for LPG and ethane. The demand in the U.S. and globally will be able to keep the NGL basket strong over the next few months- especially as Europe absorbs a lot of LNG. As LNG is pulled from Asia, we will see LPG/naphtha backfill some of the drop in LNG capacity.

The underlying flows and demand will keep the total basket well placed at the highs.

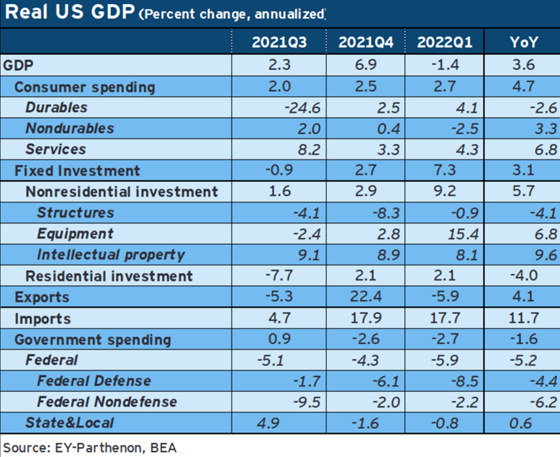

The U.S. GDP data came out this week and was much weaker vs estimates. Growth was negative at -1.4%, but there are a few caveats in the underlying data that is worth pointing out.

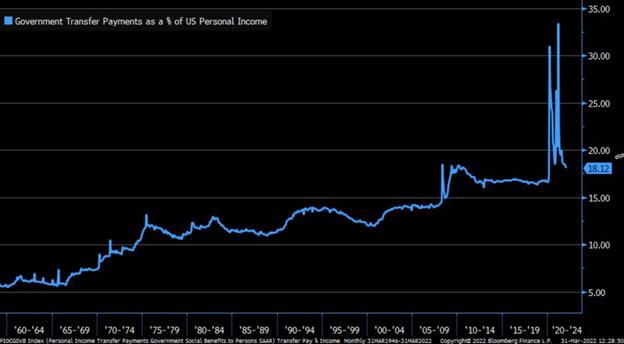

- The “Fiscal Drag” accelerated as spending declined further out of the federal government. There was a huge push of spending into the market throughout 2020-2021, but it has significantly dropped off and will continue to fall throughout 2022/2023.

- Imports shifted much higher as supply chains tried to “catch-up”, and we had a lumpy number that showed up in Q1.

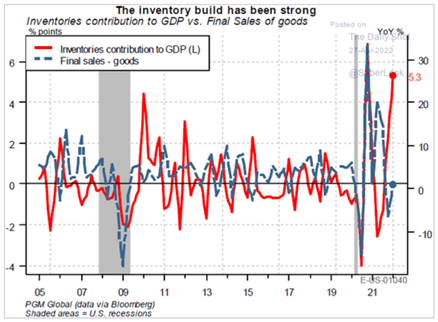

- Inventories were negative after seeing a huge build in Q4 that was a drag on the GDP data.

Government transfers (still above pre-pandemic levels) have been falling and will continue to decline as COVID benefits continue to fade. As inflation shifts higher, putting anymore fiscal stimulus into the market would only exacerbate the demand side of the equation and drive prices higher. Based on our previous writings, it is very clear that consumer and producer prices don’t need ANY help moving up.

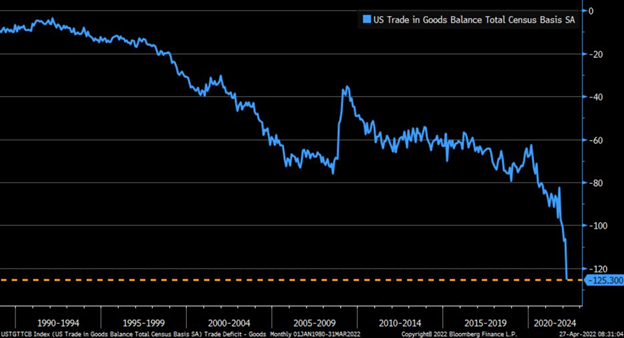

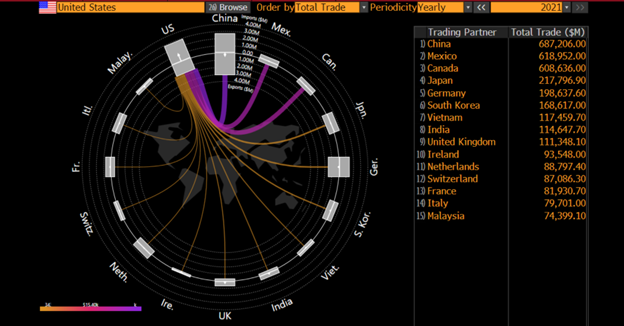

The U.S. is a net importer, which is something that will remain the case for years to come- even if we accelerate the “onshoring” of manufacturing. The U.S. trade deficit widened to a record in March to $125.3B with imports up 11.5%. If you have been to the store recently- you will have noticed that parts of the aisle is still bare or at least sparsely populated.

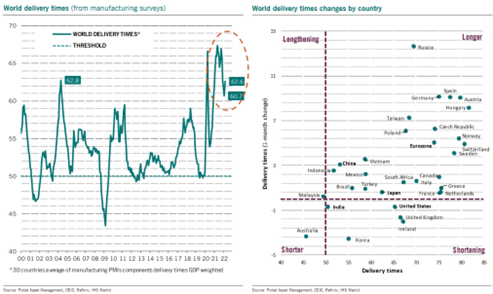

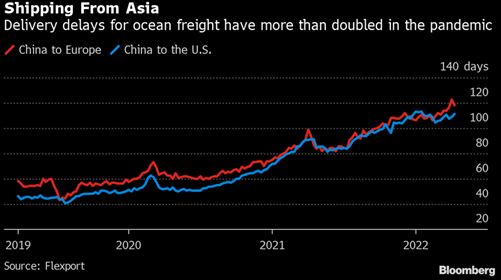

We had the supply chain “catch-up” a bit with delivery times getting a bit shorter throughout Q1. They were by no means “back to normal”, but the U.S. was one of the few countries that actually saw an improvement. This increased our imports as ships were finally offloaded and moved throughout the system.

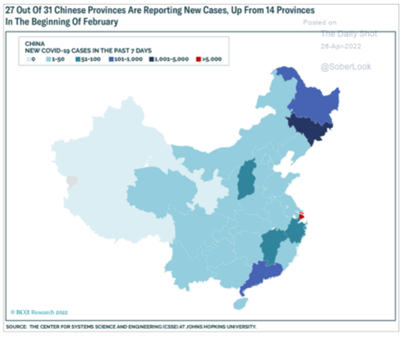

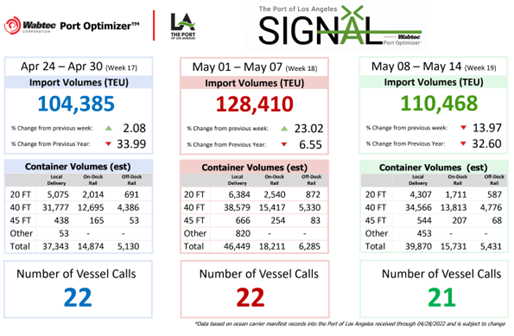

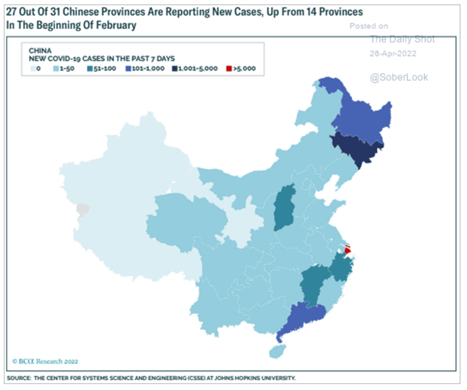

The Chinese lockdowns are going to make things exponentially worse for us really kicking off in May and getting progressively worse throughout June and beyond. During the first lockdown, it was concentrated further inland and while this created problems- it didn’t impact things to the level we are seeing today. The whole coast is essentially in some form of lockdown that is limiting the number of ships that can enter and leave the ports. This is also creating chaos for manufacturers because they don’t believe the schedules and their ability to guarantee a spot on an incoming ship. The result is a lot of unknowns on delivery schedules and corporate planning.

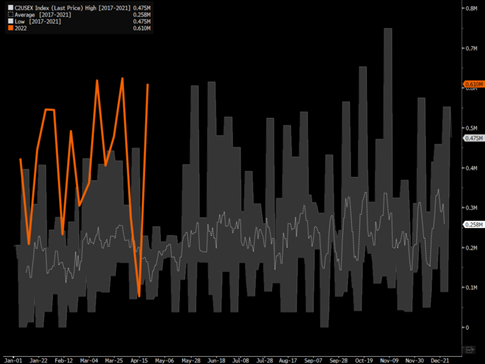

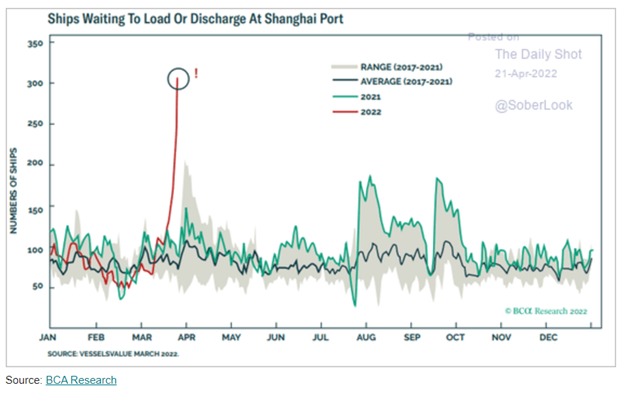

The below chart just puts in perspective HOW bad this is in relations to 2020. The spike at around 200 number of ships was 2020 and we are currently at over 300 and rapidly climbing higher.

China is our largest trade partner, so the huge backlog is going to cause supplier deliveries to get much worse, inventories to get drawn down, and imports to fall over the next few months.

We are already seeing them get much worse in the near term- and due to the uncertainty (as mentioned above)- the delays will only grow well above the recent record.

From a GDP perspective- this will create an artificial “bump” in the GDP figures because our imports will drop given the logistical nightmare that lays before us.

Inventories have also been rising because retail sales (consumer spending) have been slowing down as prices shift higher. The consumer is very fickle making it difficult to pinpoint exactly when they will say “enough is enough”, but we are at the point where people are cutting back on non-essentials. US inventories are elevated when compared to final goods sales, which represent a leading indicator of slowing production going forward and lower GDP growth.

This isn’t just a U.S. issue as the same is playing out in key markets developed markets around the world. It is all pointing to the global consumer heading in the wrong direction with the U.S. already negative and by far the largest around the world. As the U.S. consumer spending slows, this reverberates all the way down the supply chain causing a broad shift in all markets- especially Emerging Markets.

A large part of the reduction in spending is driven by the large drop in disposable income. Many countries are already deeply negative and falling further. The below chart is indicating that prices are far outpacing wage increases, which is cutting into the disposable income available to be spend on goods and services.

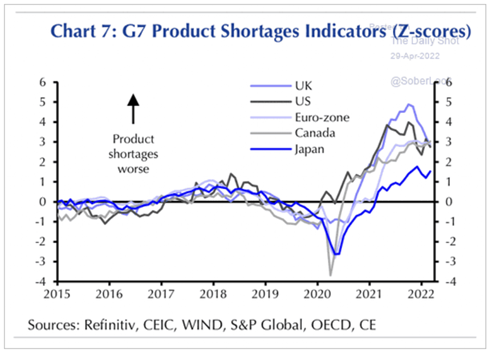

Product shortages remain a huge problem and base on all the current and leading indicators they are getting worse again. The Chinese lockdowns are creating more problems in the supply chain, but they have only just started to show up on our cost (again).

Due to sailing time and other logistical factors, there was already a backlog of ships at U.S. ports and heading over to the U.S. coast. It takes time for the Chinese lockdowns to “show-up” on our coast… But the issues are just starting to arrive now.

The problems caused by China’s lockdowns are now starting to hit our shore, and it will only get progressively worse as we move through the end of May. June is where we will see start to see the major impacts, which will lead to even bigger supply chain issues.

Nothing has improved out of China given the recent ship tracking data, which is going to cause a lot of renewed supply issues throughout the summer months. This is going to be a tailwind on prices (again) supporting additional price increases sending PPI (Producer Price Index) and CPI (Consumer Price Index) higher again.

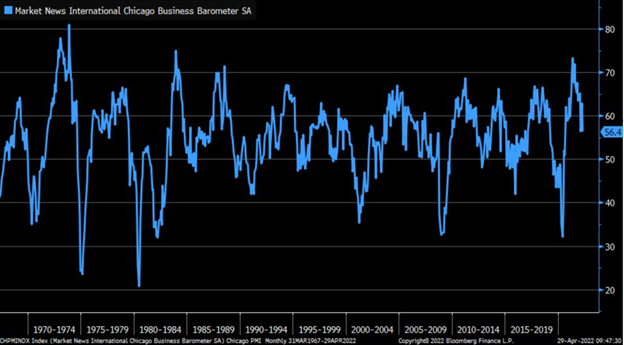

As we have discussed- the leading indicators from the regional Fed branches and other agencies are showing a marked slowdown in activity BEFORE the issues with China even hit us in a meaningful way. We had another miss on some of the data expectations: Chicago PMI fell in April to 56.4 vs. 62 est. & 62.9 in prior month; prices paid rose at faster pace; new orders, inventories, and supplier deliveries rose at slower pace; employment fell at faster pace (and is contracting). We have employment contracting and new orders slowing while prices paid (leading indicator for inflation) reached a new record.

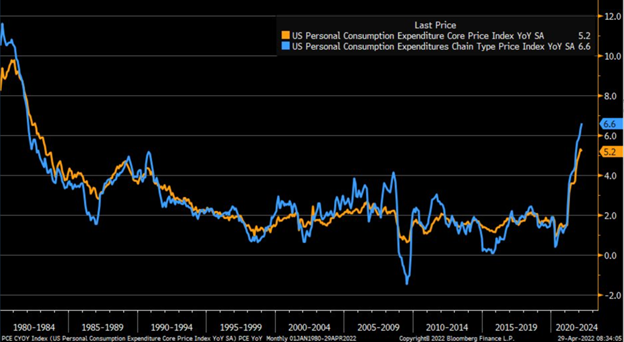

All of these issues are going to push the PCE inflation data to new extremes over the next few months. Based on the data we have seen, the pause here will be temporary as the pressure pushes us over 7% over the next month or two. The supply issues and prices paid data supports another push higher over the next 2-3 months at least.

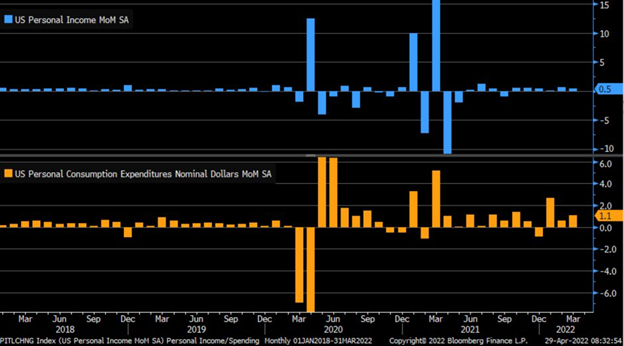

On the positive side- we did get a bit of a bump in personal income and personal spending, which is a positive. Even when we adjust spending for inflation, we were able to see a small bump- but the same can’t be said for personal income.

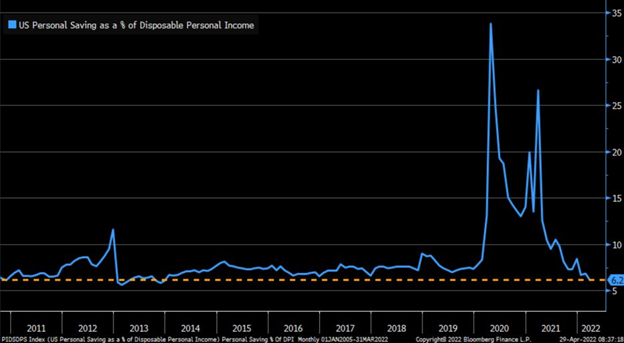

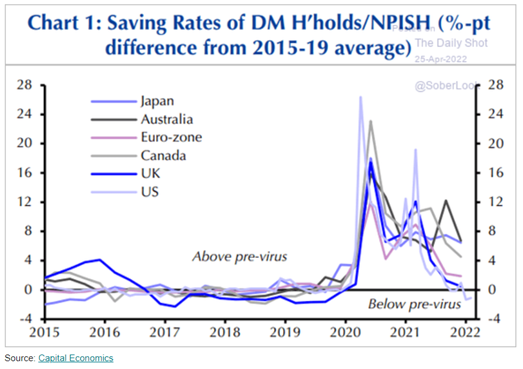

The issues on personal income are showing up in the savings rate, which has fallen again to the lowest level since 2013.

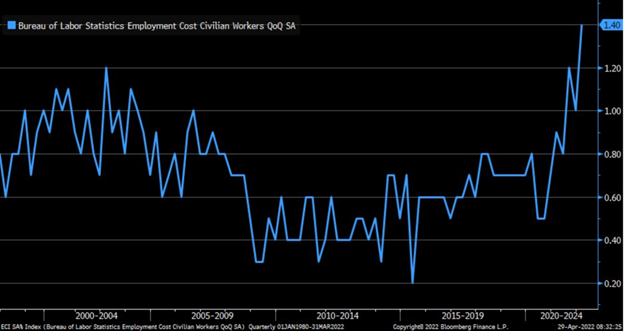

We have been harping on the employment cost index since last year because we believed it was going to be a huge tailwind for prices moving higher. Typically, March-June are the best times to get a job as companies have fresh budgets and bonuses have been fully paid out. Even though wages haven’t kept up with inflation- they have still risen over the last 18 months- so why not take advantage and switch jobs. The tightness in the job market means that companies have to be competitive and offer higher wages, but they will also try to recover that cost by raising the price of their good or service. The below chart puts into perspective- just how much that cost has increased over the last few quarters.

These factors and underlying pressure are causing consumers to question their financial situation. “Annual Economy and Personal Finance poll from Gallup shows 46% of U.S. adults rate their financial situation as “excellent” or “good,” lowest since 2015 … 16% say their situation is “poor,” highest since 2016”. As we project forward, there is very little to make people “feel better” about their current and future situation. The apprehension is real, and it is a global fear.

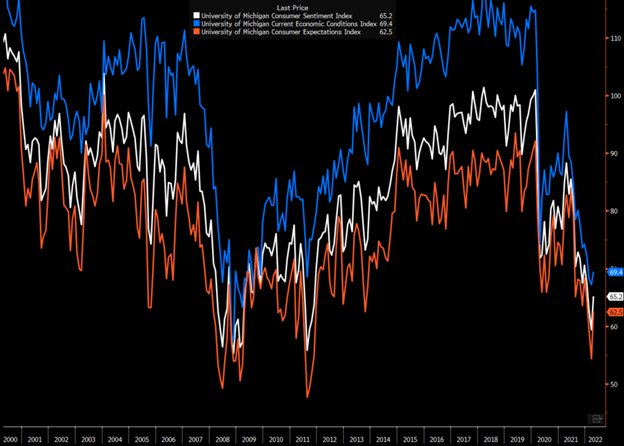

When we look at the University of Michigan data, there remains significant concern in the market- even more than what we saw during peak COVID fear. We are sitting at levels not seen since the Great Financial Recession and the European Financial Crisis.

The data points to more uncertainty and volatility ahead. The consumer is always a fickle beast, but the indicators are all pointing to a slow/weaker consumer that is going to face another rise in living costs. We continually highlight- this isn’t just a U.S. issue but a global problem… it will just hit differently in some areas. The U.S. consumer is still “slightly” expanding while Europe is firmly in a recessionary backdrop. The Chinese consumer is already firmly in contraction, and it is getting worse as more people are locked in their apartments (quite literally). The rest of Asia still has some protection originating from government subsidies, but the costs are becoming harder to tolerate with some of them already being removed or reduced. We are witnessing a slow moving train wreck, and the question becomes- when does the pain accelerate.

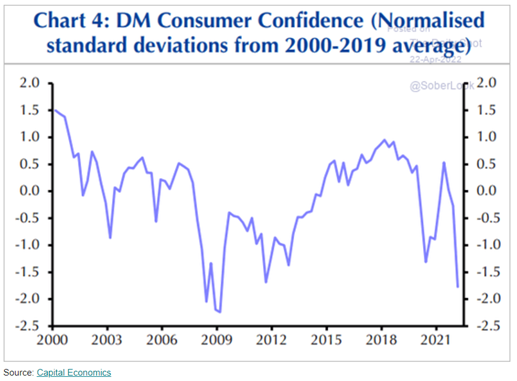

The U.S. consumer makes up about 70%-75% of the GDP number, so when you consider a slowdown in the purchasing power of the average American- we have a lot of downside ahead. It is showing up in the data as well for “Developed Market Consumer Confidence” that is falling very quickly. There is a lot of unknowns- fear in the market which will cause consumers to close their wallets and companies to limit investments (the I in the GDP calculation).

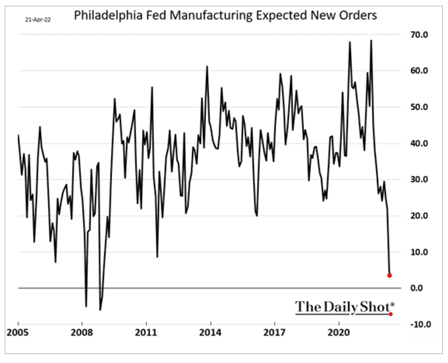

Corporations are already signaling a broader slowdown as “expected new orders” and “expected growth rate of new orders” have moved steeply negative. This is usually a great indicator for the future because many of these businesses have their fingers on the pulse of the global market.

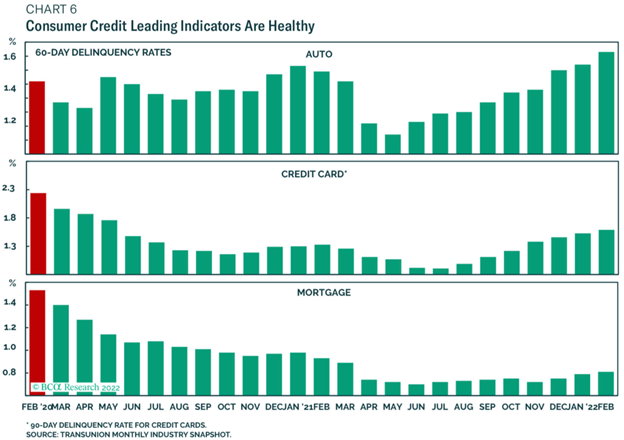

A small benefit from all the government heading to consumers is the amount of credit card debt that was paid off- and now rapidly being put back on. The U.S. added a RECORD amount of new credit and revolving debt this past month- which is shocking even for us. But, it also strengthens the point that the consumer is relying more on credit and savings to maintain their current lifestyle. The below chart shows that credit card debt is still below pre-COVID levels- especially when you factor in the huge expansion of credit in March (not shown in the chart below.) A leading indicator for consumer stress is auto delinquency rates- which is actually ABOVE pre-COVID levels. For some reason, U.S. consumers are quick to not pay their auto loans, and we are seeing that happen in a big way so far this year. Many consumers refinanced their mortgages, so that is one saving grace in the near-term profile of the consumer.

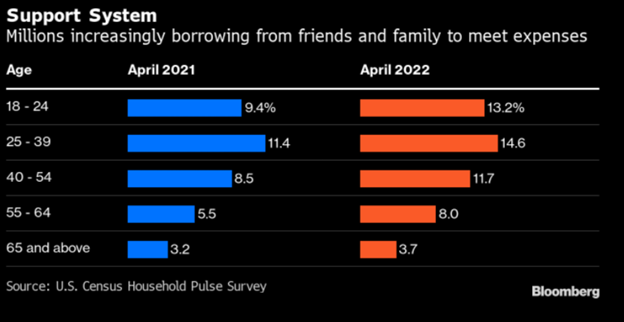

There has also been a big jump in people borrowing from family and friends. “Some 25.6 million people — more than 10% of all adults — relied on loans from those close to them to meet spending needs, according to the Census Bureau’s latest Household Pulse survey of finances, which covered the period from March 30 to April 11. That figure was up from 19.1 million a year earlier, when the question was first asked.”

We are also seeing savings rate drop off quickly and is now well below 2011 levels- which is a big concern when we look at the health of the consumer.

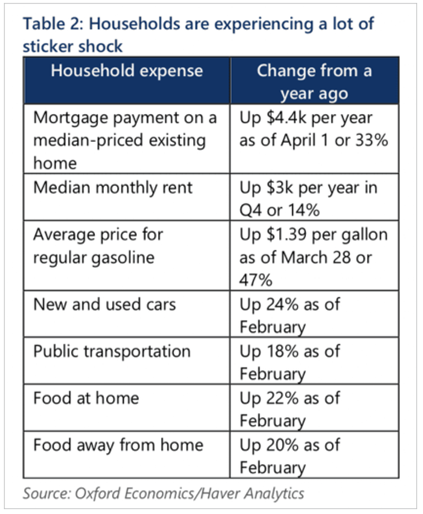

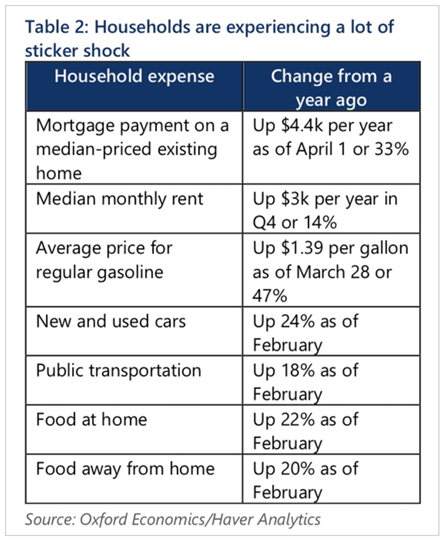

Here are just a few snapshots on how much pain the consumer is seeing right now, and we have “official” estimates moving even higher on the food front- so we are far from over when we look at food at home and food away from home metrics.

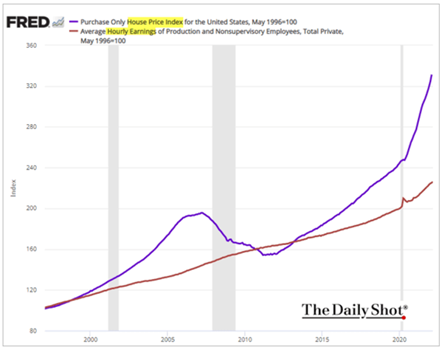

These huge pressure points are also leading to a big slowdown in the housing market with cracks not only forming- but widening. When we consider the huge surge in purchase price with only a small increase in earnings- it isn’t surprising to see people avoid or delay buying a home. We have seen a decline in the square footage purchased, but now we are seeing a big drop off in outright buying now that mortgage rates surged higher.

So housing prices have exploded higher…. Wages have risen slightly in comparison… while mortgage rates surged… seems like a recipe for an expanding housing market?

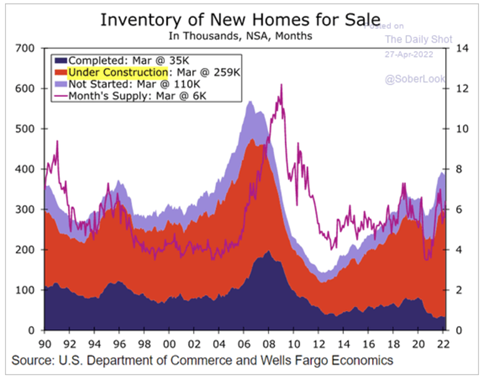

There remains a big backlog of houses that are waiting to be built or still under construction. The market is shifting quickly, and some are going to be sitting on very expensive inventory given where material and labor costs have gone over the last 2 years.

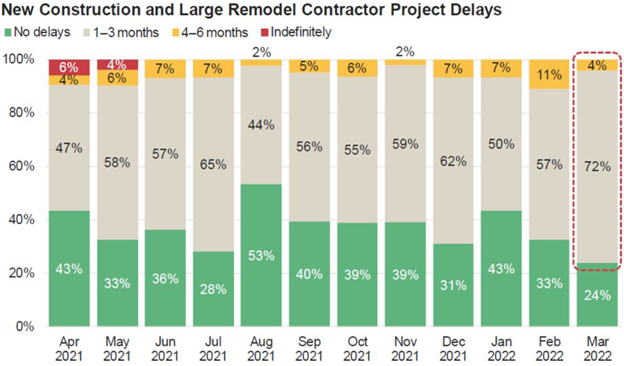

Above 76% of builders and remodelers reporting delays of 1 month or more, which is much worse vs Jan/Feb and consistent with what we are seeing as the supply chain steadily worsens again.

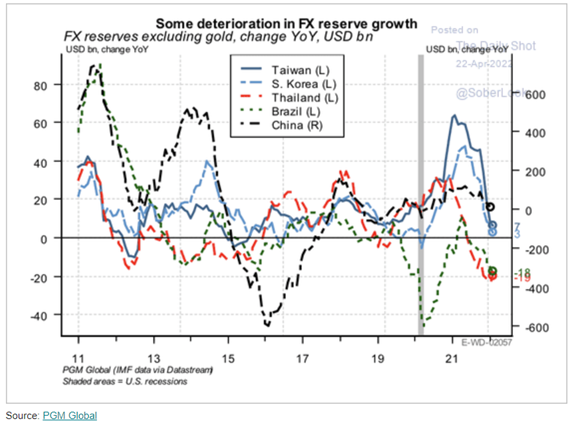

All of this puts the U.S. in a very precarious place as we move forward as well as emerging markets. We have seen the U.S. 10-year spike higher, which is what sets the rate for many of the developing/emerging market world. As the rates shoot up, it creates a knock-on effect as countries won’t be able to borrow, trade slows, and inflation fears mount internally.

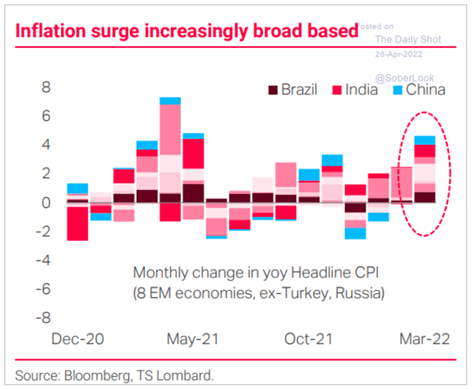

Emerging markets have been fighting inflation for several quarters (and losing) while they exhaust foreign reserves to manage their local currencies.

The international community has been spending USD and buying their local currency to try to maintain their “peg to the dollar” as well as control inflation. This is resulting in a big drop in foreign reserves that can only be replaced in one of two ways:

- Through a positive trade balance because about 85% of global trade is transacted in USD. This is a natural way to bring in extra USD.

- The other is to go into the market (or Fed window) to purchase USD.

As the U.S. consumer slows down further, the emerging market issues will only get worse as trade slows down further. The U.S. is the largest consumer in the world, and as we see a marked shift in spending patterns as well as rising rates…. Things are going to unhinge quickly as the potential for a recession shifts much higher.

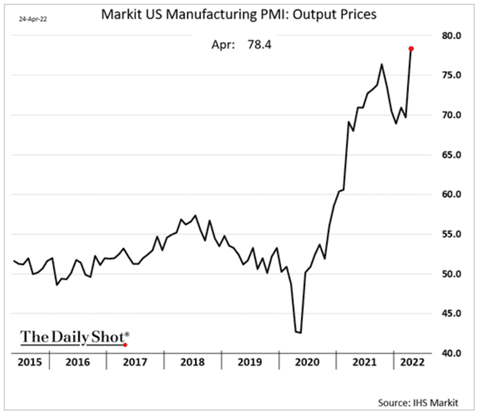

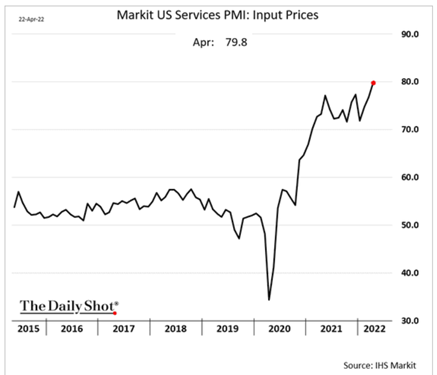

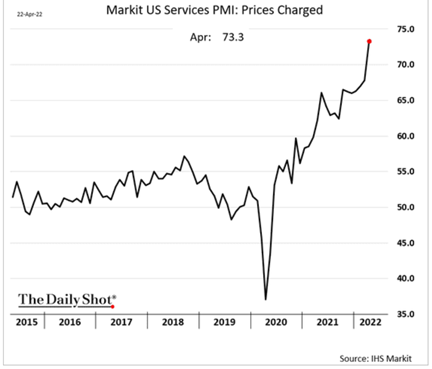

As new data emerges, we are getting a glimpse of the renewed push in cost pressure that will keep passing through the supply chain. The output prices surging to new records helps to identify what we can expect as consumers and where companies will attempt to push their prices. It is easy to point to something and say price gouging, but it is way more complicated and nuanced. My wife just told me one of our “normal” shopping trips that was still below $100 is now gone… just as the Dollar Store is going to need a name change to the $1.25 store.

It is important to recognize that input prices have lagged prices charged to the consumer. There is only so much that can be passed through as well as a natural lag between the two- but companies will try to adjust quickly wherever possible.

The natural pressure is still higher for all things- especially services. It has already seen a huge surge up… but there is more to come- especially as the “official” housing and rent data SEVERLY lags what the average American sees! This is why the OER (owners equivalent rent) is still heading higher and will be a driving force for sticky inflation.

Housing Prices + 19% Rent +17% CPI for housing (OER) +4.5%

I am sure everyone has seen the comments about how “everyone is flush with cash!” There is a ton of money in savings to support spending! The problem is- this is wrong. Yes- on the aggregate- there is more money in savings accounts BUT it is skewed to the top 10% of Americans- with the MOST being at the top 1%. So what does that mean for the rest of us? How is the average American going to survive as prices explode- the short answer is- using more from your paycheck for your day to day and putting less in savings.

This is not just a U.S. thing- which is now at 2011 rates- but a global slowdown in savings rates. We are facing a world with rising prices, and it is dwindling the amount people can squirrel away for a rainy day. This leads to a long-term slowdown in investments, housing, and just general consumption. Just based on leading indicators… we don’t see this getting any better in the near term.

Over the last few days, we have discussed the issues with inflation and prices going higher. The biggest knock-on effect is the inability for people to spend as wages lag the rise in living costs. I am sure everyone has seen headlines of salaries/wages going higher, but the news always leaves out HOW much higher they have gone vs living costs!

This chart answers that question- not high enough! We are seeing spending power of the U.S. consumer dropping quickly, and companies are hesitant to increase salaries because that is a cost to them that they will need to recover. If their costs are already up because of raw materials, logistics, diesel… anything you can think of really… how do you increase wages further?

As the chart shows, this is not just a U.S. issue but a global problem- especially for OECD nations. When you have the wealthiest countries in the world unable to spend, it all has knock-on effects and will put more pressure down the supply chain.

Demand and underlying retail sales have already slowed considerably, and as more cost gets pushed through the system- we will see demand slow. The U.S. consumer drives about 75% of the U.S. GDP figure- GDP= C + I + G + (X-Y) or said differently Consumption + Investment + Government + Exports-Imports. Well- the consumer is getting hit HARD, businesses are seeing their margins hit and are very uncertain about the future… so what investment? The Government blasted trillions into the market through fiscal stimulus and central banks (all now reversing) all the while global trade slows. So where is growth going to come from?

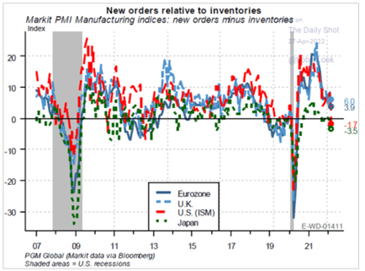

We are seeing a lot of ongoing pressure at the manufacturer level with expected orders dropping and the rate of new orders dropping.

Your cost of doing business is going higher… you are concerned about sales and orders… but you are going to pay people more money and invest in your business? No- you will slow expenses and try to limit protect cash. The slow burning logistical nightmare continues in China and that hasn’t even started to hit us yet.

China keeps locking down more provinces as the backlog of ships at the coast grow exponentially. This is going to create more pressure (again) on the supply side as shortfalls expand. Companies have been able to build up some inventory as supply chains normalized a bit (off the highs but still far above historical norms) and sales have slowed.

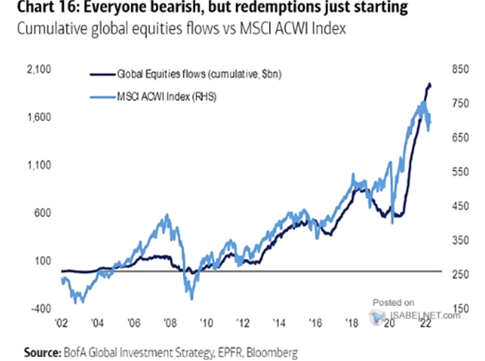

In the face of all these pressure points, investors have been very slow to shift weightings in the market. The market has been so conditioned to “buy the dip” with a “fear of missing out” that it takes time for people to adjust their behaviors. As the data worsens- I expect to see redemptions accelerate.

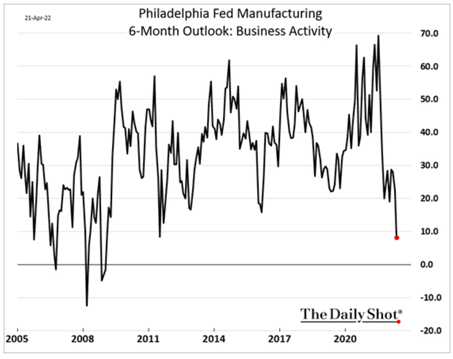

Leading indicators are the best way to see how the U.S. is progressing and where we are going. There are many different data points we review, but the Philly Fed offers up a good summary of what is happening in the U.S. Each regional Federal Reserve Office puts out data on their location.

The summary data point missed estimates, and came in at 17.6 instead of the expected 21.4. It is still in expansion, but the pressure to the downside is mounting driven by inflationary pressures and softening expectations. As companies become more concerned about the future- they will quickly adjust their spending, investment, and hiring to ensure there is enough cash reserves to make through the “lean periods.”

There are two key leading indicators that we look at- “Prices Paid” and “Business Activity.”

Prices paid is best defined as costs to the company. How much did you spend on raw materials? Are the prices rising or falling? What did it cost for electricity, labor, other factory gate prices? When a company is setting their price for consumers, they look at what the cost was to make or assemble the product- figure out their margin- and you get what the price will be on the shelf. This is a LEADING indictor for CPI (Consumer Price Index) and helps define where inflation will be over the coming few months. It is breaking out higher to a NEW record… just as we get renewed supply chain issues and broad logistical nightmares created by trucking and China lockdowns. Companies will try to pass through as much of this new cost as possible- until the consumer rejects the price increases. A consumer can either reduce total quantities due to price, find a replacement product, or just not buy anything in general. As this occurs- companies are forced to reduce their “margin” and keep prices reduced hoping to at least cover costs. This is when the pain really bleeds into the economy… and we are getting there.

Confirmation in that view comes in the future outlook from businesses… what do they expect their activity to be? You won’t be surprised to know- they are expecting a lot of pain ahead and will be hiring and constructing their inventory and general business operations along that line.

The last one that helps dictate hiring and what needs to be purchased for inventory are- “new orders.” They are getting absolutely crushed as consumers and businesses pull back on spending and ordering.

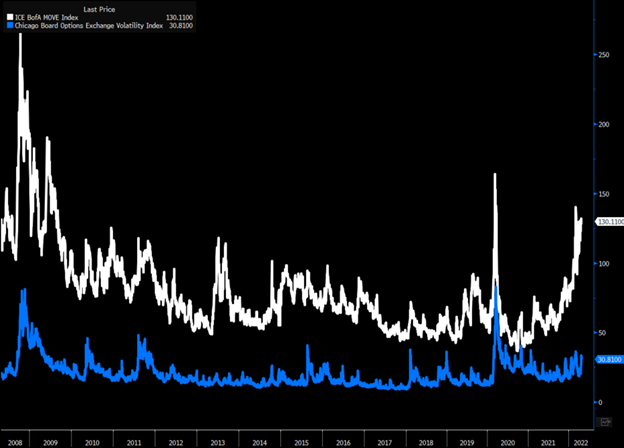

Sor far- we are still above zero and in expansionary territory- but it is clear that we are moving in the wrong direction with more pressure ahead! The market volatility will remain a staple as global uncertainty is a fixture regarding food, war, central bank tightening… you name it- it is probably happening at this point. Bond volatility has reached levels not seen since 2020 and before that we have to go back to 2009. The federal reserve has been laser focused on “controlling” bond volatility because as this picks up it creates a hesitancy for banks to lend and companies to borrow. Bond volatility is also a good leading indictor for equity gyrations, but right now- the equity market is heeding the warning. Instead, the equity market is just moving sideways at an elevated rate, but we haven’t seen any real panic selling. There hasn’t been a big increase in put buying (downside protection), redemptions, or just a general reduction in risk taking.

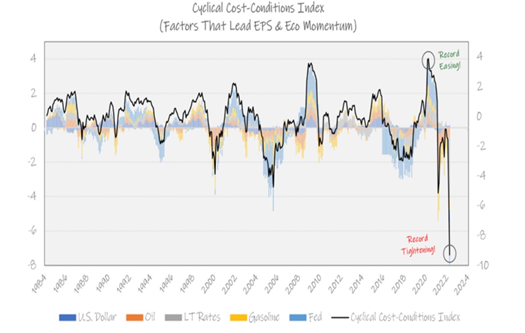

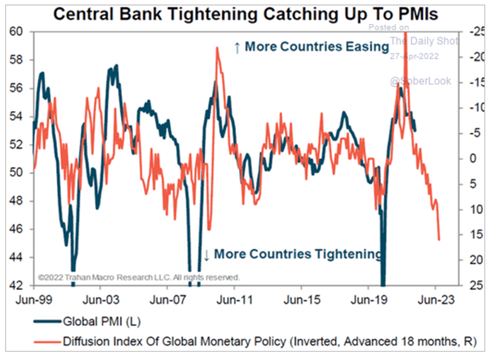

Another key point in this char- is how long the bond volatility has been elevated- it wasn’t just a “shock and fade” but a very sticky move higher. This is what happens when you have a world going from record easing to record tightening in the matter of several quarters. The below chart shows just how much of a record is being set for the tightening side of the central bank equation. We have seen close to this level of easing (2008), but we have NEVER seen this magnitude of tightening.

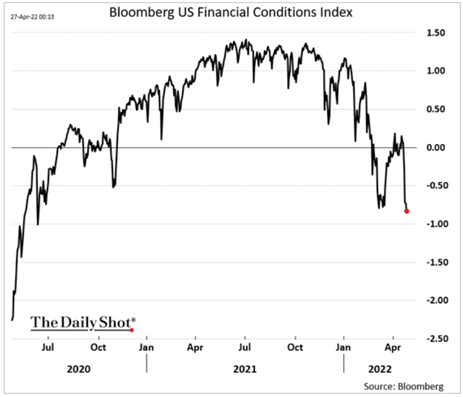

The uncertainty is forcing banks to tighten financial conditions and limit the amount they lend into the market. Banks want to make sure they are protected as yields explode higher and trends are breaking down in the fixed income world. We are in an unprecedented world with global food shortages, inflation elevated and rising, and geopolitical instability at the highest level since the 60’s/70’s.

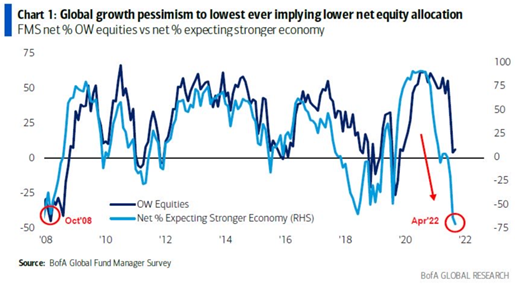

Investors and fund managers agree- this is the worst global growth expectations at the lowest EVER. But- this same group has been slow to go underweight equities, but the adjustments are happening albeit slowly.

But when we zoom out further- redemptions are JUST BEGINNING! The market has started to roll over a bit, but there has still been money flowing into equities.

The Fed has created an environment of FOMO (Fear of Missing Out) and BTD (Buy the Dip) mentality that it takes time to change people’s behavior. We are in a global tightening scenario with slowing growth, but yet investors are still buying equities. If you didn’t buy stocks during the Fed Easing- you were “fighting the Fed” so what is it considered now? A potential reason we could still be seeing such a large allocation to equities is money flows. There is still a huge amount of liquidity in the market. The Federal Reserve has been clear on their intentions on raising rates, but they have only raised .25% and haven’t started to sell their balance sheet yet. They are expected to start selling down some of their MBS (mortgage backed securities) and treasuries starting in May and accelerating in June at a rate not to exceed $90B a month.

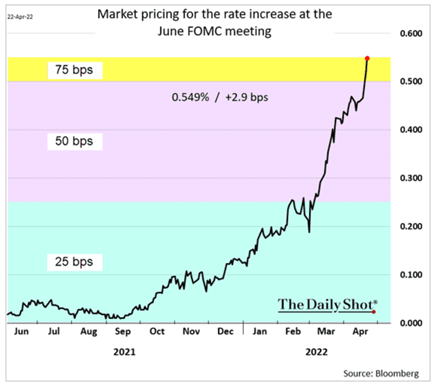

It is worth noting that bond volatility has exploded, and yields have ripped higher, yet the Fed hasn’t even started raising rates in earnest. So what happens when they do? The market is expecting a big spike in the Fed Funds Rate approaching .75%- but equities have barely budged.

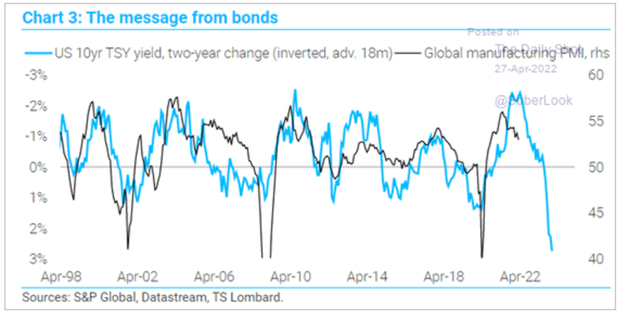

Monetary tightening is happening around the world at varying rates- and the U.S. is one of the last (the very last is reserved for the EU and Turkey). As central banks tighten, there is a very close relationship with PMI (Producer Manager’s Index), which is a key present and leading indicator.

So in summary- the world is slowing, rates are rising, fear is mounting, geopolitical instability rising, and food shortages rival the 30’s dust bowl… the question is…. How big is your equity exposure?

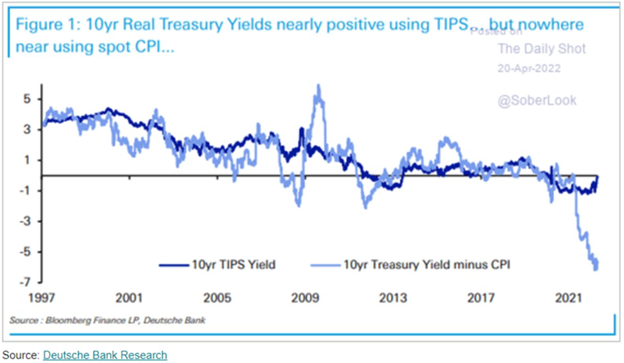

I know everyone is hearing a lot about inflation and what action the Fed will take to counter the rampant rise in pricing. The fixed income market (bonds) is the best place to get an idea about the volatility ahead and what potential pain the global market will face. I think this is a very important chart when we consider… where will the 10-year treasury bond go? How much higher will yields trend over the next few months?

There are two ways to consider “Break-evens” for bonds.

- To look at their TIPS (Treasury Inflation Protected Security) equivalent. This is a yield that is supposed to cover principal, interest, and inflation.

- Looking at current 10-year yield and factoring in current CPI (inflation).

The massive surge in inflation helps to show just how far the 10-year needs to go for a person to just break-even. If a person buys a 10-year bond- they will LOSE money over that time period because it won’t cover the loss in the dollars buying power (value).

We believe that as the market prices in more rate hikes from the Federal Reserve, and they begin the process of reducing their balance sheet- yields will keep heading higher.

The U.S. is in the early innings on the death of the bond bull market- and there will be a ton of Emerging Markets left bloodied in its wake.