- Higher leading-edge pricing will induce fleet reactivation as operators expand capacity

- LBRT will deploy PropX’s PropConnect software, digiFrac pumps, and the Stim Commander software to increase efficiency and reduce costs

- However, the profitability of active frac fleets is still low due to high equipment attrition and labor shortages

- Despite negative cash flows, the company’s low leverage ensures financial safety

The Industry And Outlook

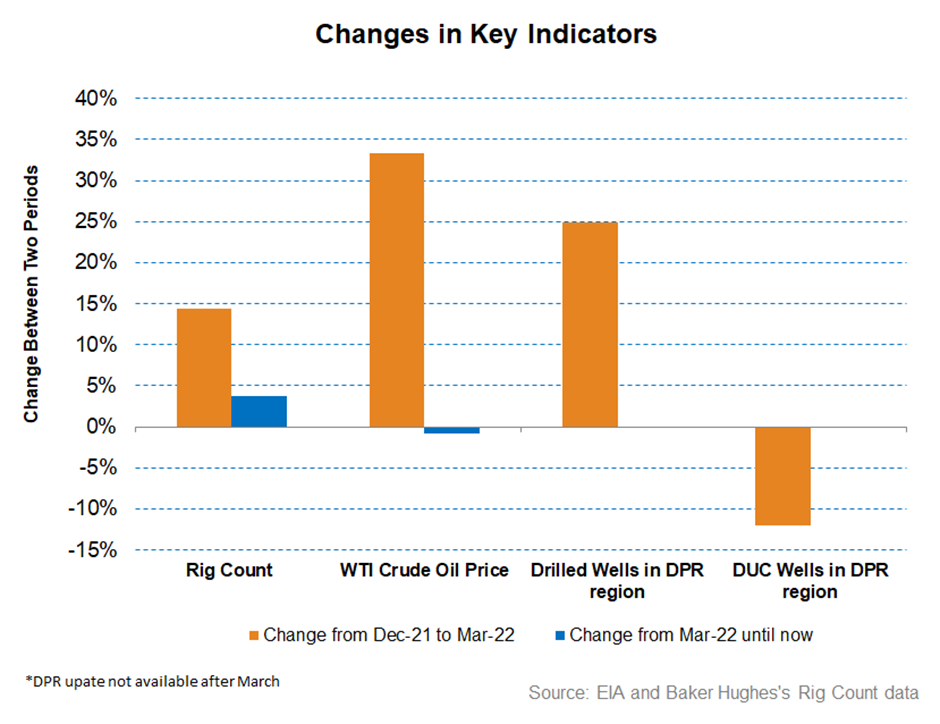

The crude oil price steadied in Q1 after it had soared following the Ukraine crisis. The US rig count, which increased rapidly in Q1 (14% up), has continued to move forward in Q2. The drilled well continued to strengthen in Q1 while the drilled-but-uncompleted (or DUC) inventory dipped even further (12% down). As I discussed in my previous articles on Halliburton (HAL), Schlumberger (SLB), and Baker Hughes (BKR), the energy upcycle has already begun in North America and other international regions following years of underinvestment. In the face of the global supply chain challenges, energy production in North America has been resilient because of the local supply of natural gas and its price advantages. Nonetheless, the profitability of active frac fleets is still frail due to high equipment attrition, labor shortages, and low investment in the past few years.

In 2022, LBRT expects to benefit from the increased pricing as the leading-edge pricing is about to reach a stage that can sustain fleet reactivation. Some of its partners may expand capacity as well. So, its revenues can increase by 10% in Q2 versus Q1, expects the management. As the activity level increases and net pricing gain is realized, its EBITDA should also rise in Q2. Improved margin will induce frac fleet reactivation from some of the long-term customers. However, the change in approach will show how the energy service companies mitigate the commodity price inflation through better completion design, integrated planning, and optimization of the frac calendar.

The Key Strategic Changes

I discussed the benefits of Liberty’s PropX acquisition and the acquisition of SLB’s OneStim in my previous article. Driving further on logistics synergies, LBRT will look to deploy PropX’s PropConnect software in West Texas to optimize the number of truck drivers. Because truck driver shortages are pervasive, the software can reduce operating costs. Similarly, assimilating Liberty’s frac fleet, which has differential technical specifications, sees higher the intensity of frac work in high-pressure pumps and uptime maximization, which also drives down costs.

LBRT owns full automation of the pumping equipment on the digital side, with intelligent rate and pressure control systems. The company plans to deploy digiFrac pumps soon. Recently, it has started rolling out the Stim Commander software and plans to complete the remainder over the coming quarters. We expect all those initiatives to reduce operating costs and solidify Liberty’s position in the frac market.

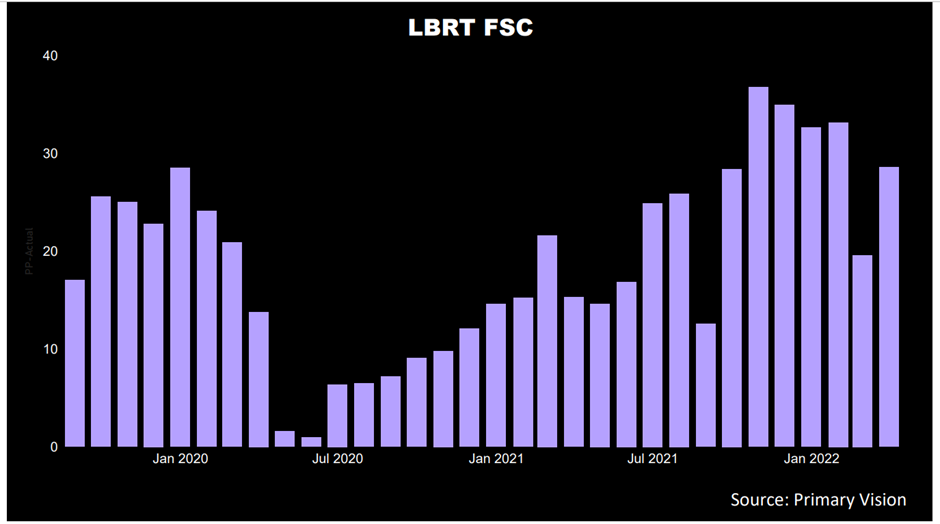

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 278 at the start of May and has gone up by 19% since the end of 2021. Liberty’s FSC, which dropped significantly during mid-2020, has recovered steadily since. Year-over-year, it nearly doubled until April. In Primary Vision, we expect to see the spread hold steady throughout the summer months, which is in line with the typical summer backdrop.

What Were LBRT’S Q1 Drivers?

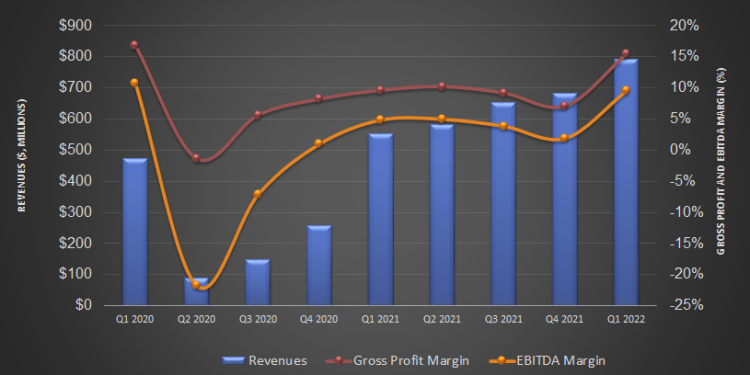

LBRT’s topline made tremendous progress in Q1. From Q4 2021 to Q1 2022, its revenues increased by 16%. Following contracts repricing and activity gains from the energy producers, net price increases led to revenue growth. The EBITDA growth was even more remarkable in Q1 (480% up) because sand and logistics bottlenecks could have dragged it down. In Q1, it expanded its service line to include the wireline operation while it acquired two sand mines in the Permian Basin. This, along with the benefits of the PropX acquisition, which will benefit wet sand handling and last-mile profit delivery solutions, is paying a rich dividend.

As a result of these strategic changes, the company achieved margin growth, lowered operating costs, and passed through inflationary costs. In the Permian Basin, the company is headed to make further inroads through a vertically integrated portfolio and its impacts on sand and logistics challenges. The improvements are also reflected in the company’s bottom line. In Q1, the company’s net loss lessened to $5.4 million from $34 million in Q4.

Cash Flows And Debt

LBRT’s cash flow from operations (or CFO) decreased by 47% in Q1 2022 compared to a year earlier. Higher working capital requirements led to the cash flow decline despite higher revenues. Capex increased even more sharply (262% up), leading to negative free cash flow (or FCF) in Q1 20222. In FY2022, it continues to invest in digiFrac pad generation systems and Tier IV DGB upgrades with sand handling technology. As of March 31, 2022, LBRT’s liquidity amounted to $255 million. The company’s debt-to-equity (0.17x) is significantly lower than many of its peers in the fracking services industry.

Learn about LBRT’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.