Let’s talk about supply chains and food prices – which seems to be getting worse. Mark Rossano did a detailed segment on it and this article is inspired by that brilliant episode.

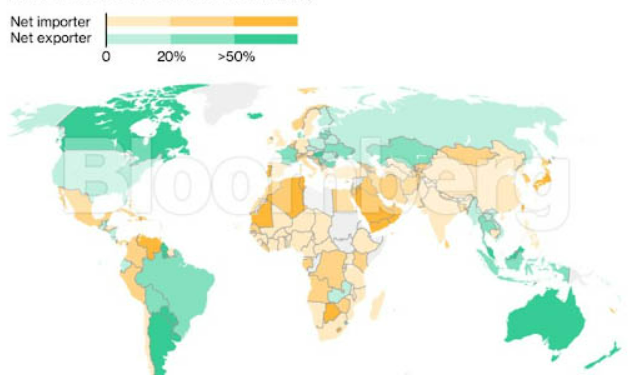

War in Ukraine continues to roil the global economy and this holds true especially for food prices. I am glad that at Primary Vision we have given sufficient time to this issue of food inflation as its consequences can seep into socio-political domain. This becomes a more relevant and pressing issue for developing countries such as Pakistan that are most vulnerable to rising food prices.

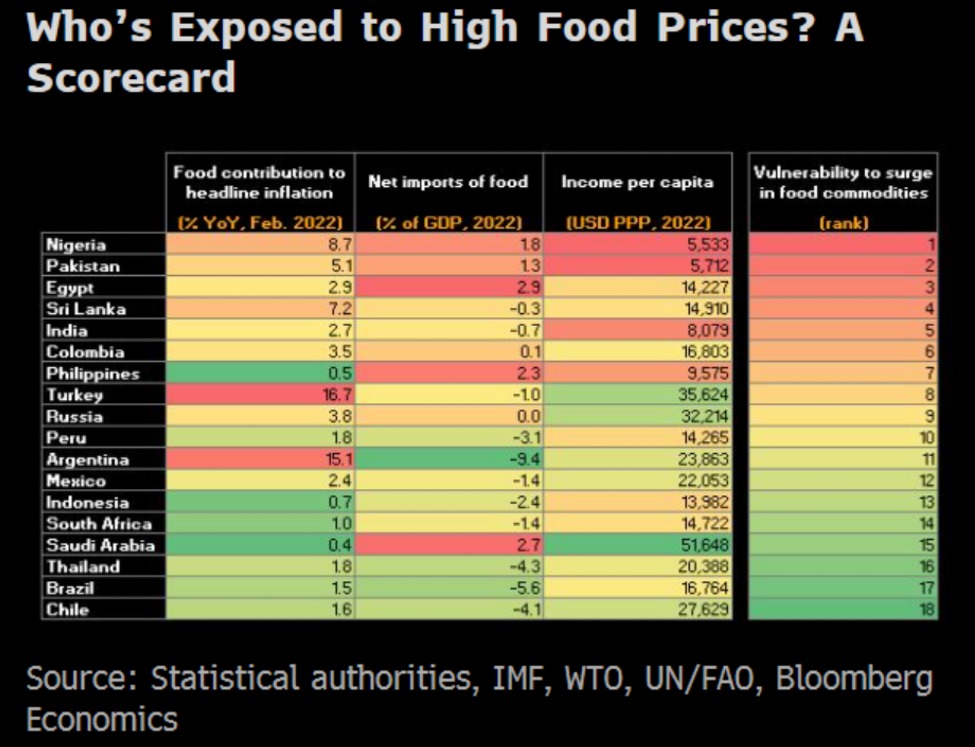

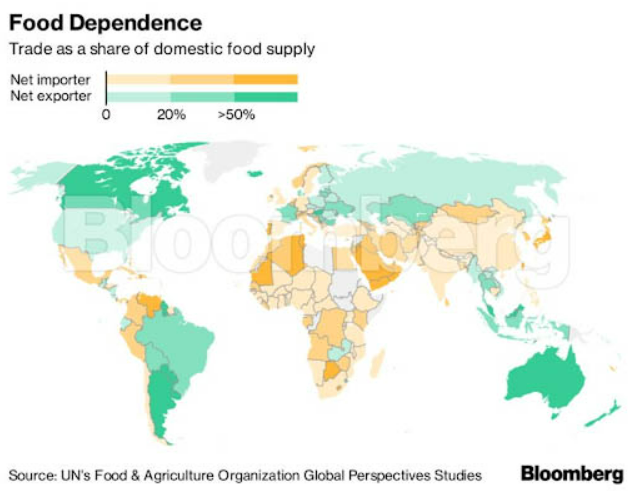

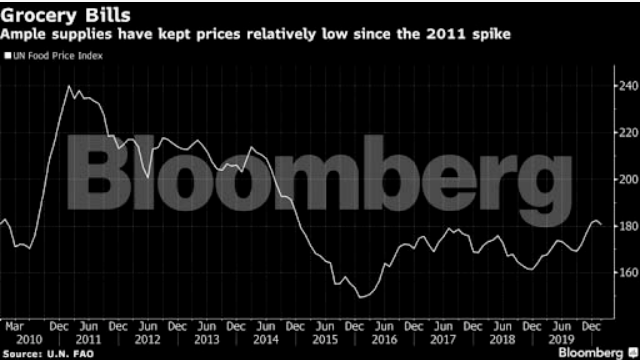

Why are food prices up? There are multiple factors. While rising temperatures, part of wider, disturbing and concerning trend of exacerbating climate crisis, is a major part of the problem there remains other issues. Food prices have been underpressure throughtout and post Covid. It was made worse by the closure of ports, absence of farmers tending to lands, missed sowing/harvesting seasons, unavailability of people at food processing units, lack of truck drivers (70 percent of food in the U.S. is transported through trucks), and overall clogged and inefficient supply chain issues. By the way, following is an interesting infographic on food.

If you have managed to scroll down this long inforgraphic let’s continue to discuss why are food prices rising and what lies ahead for food prices. Apart from supply chain problem, as mentioned above, natural events played its part too (however, these events are being caused by our unending pursuit for growth – topic for another time). For instance, Brazil which is the top soybean exporter encountered a sever drought in 2021. China suffered from a bad harvesting year as its wheat crop was “worst ever this year”. Countries have also started to hoarde staples. Number of countries imposing quotas or bans on food importas have recently increased by 25 percent in a matter of weeks – a total of 35 countries now have some sort of restrictions in place. Historical evidence suggests that such policy measures can elevate food prices sharply. Kazakhstan, biggest shipper of wheat flour has banned its exports while Serbia has halted the flow of sunflower oil.

World bank has estimated another 40 percent rise in wheat prices in 2022! This increase in food prices has also been the most significant factor contributing to the greates share of inflation in the U.S. since 1981.

On the other hand, the supply chains crisis is getting no respite. As it started to normalize, another wave of COVID19 in Shanghai, China introduced a new set of challenges as the country imposed serious restrictions on travel, mobility including a complete lockdown. A recent study by Royal Bank of Canada (RBC) that alomst one-fifth of global ships are stuck in various ports across the world. For instance, in China ships waiting at Port of Shanghai has increased 34 percent from last month and it is taking around 74 days more than a ship to travel from China to the U.S. (Note this also feeds into the inflation spiral) and in Europe ships from China are arriving 4 days late. Due to the war and issues at Black Sea (one of the most import area for food imports as well) insurance premiums have seen an increase in their premiums from 0.25 percent pre-invasion to 5 percent today. (Marine) Fuel prices at Singapore has increased by 66 percent on an YoY basis. The Time of Turnaround (ToT) at three of the largest European ports is quite high from their 5 year average.

One can relate this to the overall performance and development of global economy. AS always, just trying to highlight risks lest they become fat tail risks that can blow up either your analysis or portfolio.

Have a happy weekend!