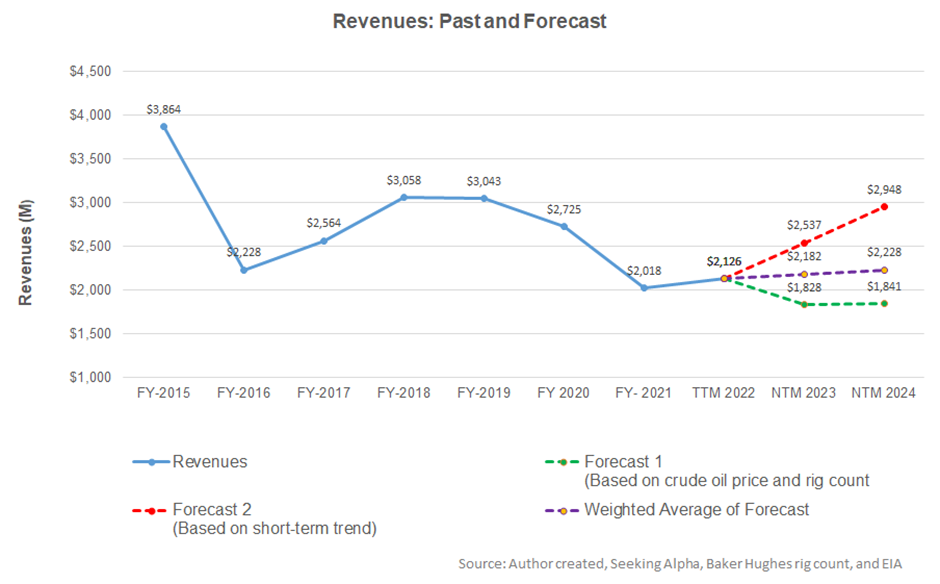

- The revenue estimates are stable in the next two years

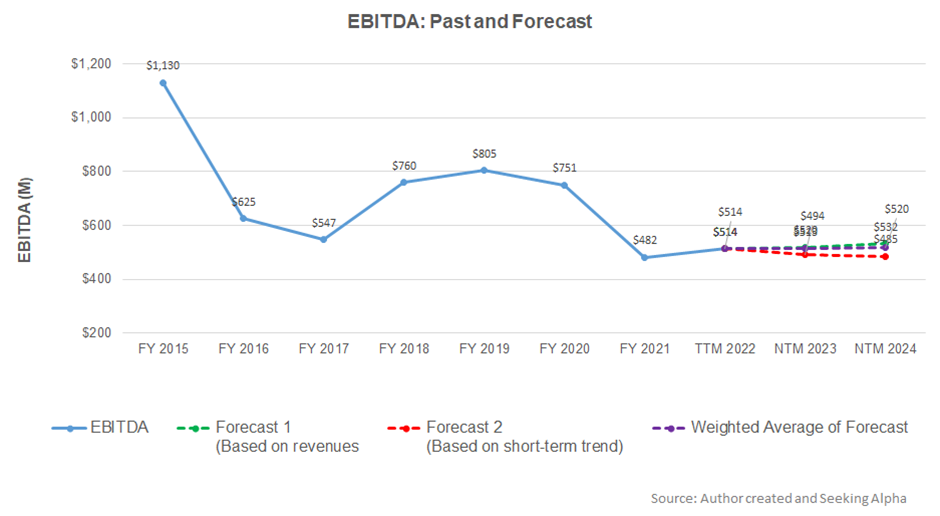

- EBITDA can remain unchanged in NTM 2023 and will remain steady in the following year

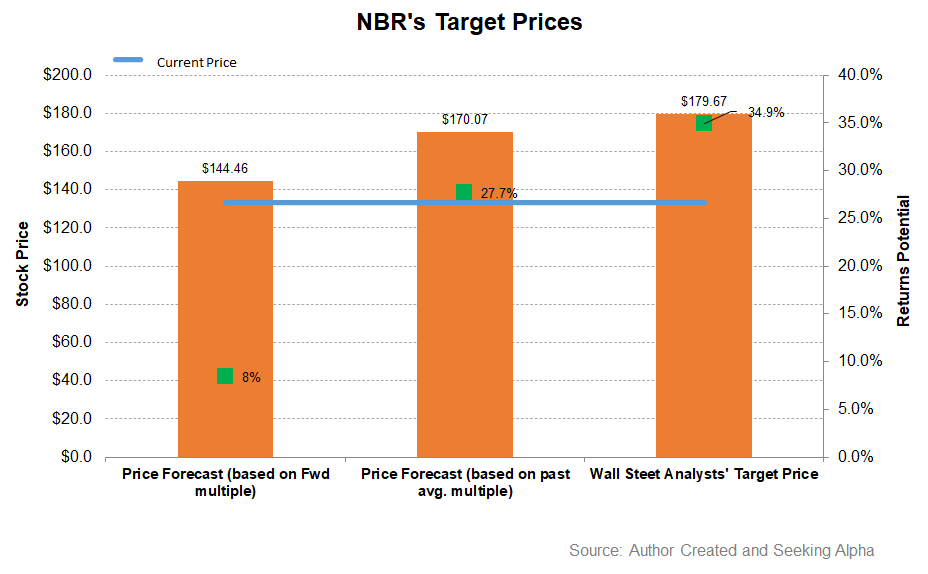

- The stock is reasonably valued versus its peers at the current level

In Part 1 of this article, we discussed Nabors Industries’ (NBR) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and NBR’s reported revenues for the past seven years and the previous four-quarters suggests that NBR’s revenues will remain steady in the next couple of years.

Based on the regression models and the average forecast revenues, the company’s EBITDA will remain unchanged in the next 12 months (or NTM 2022). In NTM 2023 also, the model suggests the company’s EBITDA will be steady.

Target Price And Relative Valuation

The stock’s returns potential using the past five-year average multiple (7.5x) is higher (28% upside) than the returns potential using the forward EV/EBITDA multiple (6.7x). In comparison, Wall Street’s sell-side analysts expect even higher returns (35% upside) from the stock.

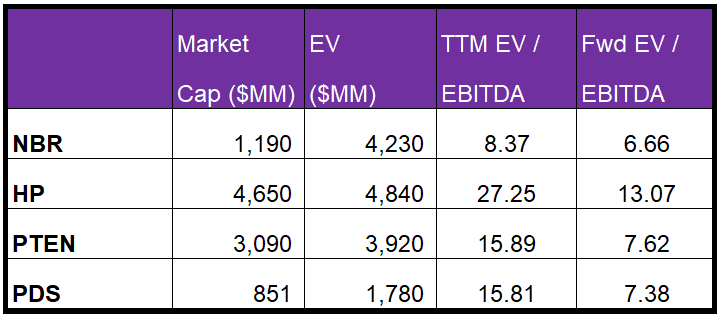

NBR’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is less steep than peers, which would typically result in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (8.4x) is lower than its peers’ (HP, PTEN, and PDS) average of 19.6x. So, the stock is reasonably valued versus its peers at this level.

What’s The Take On NBR?

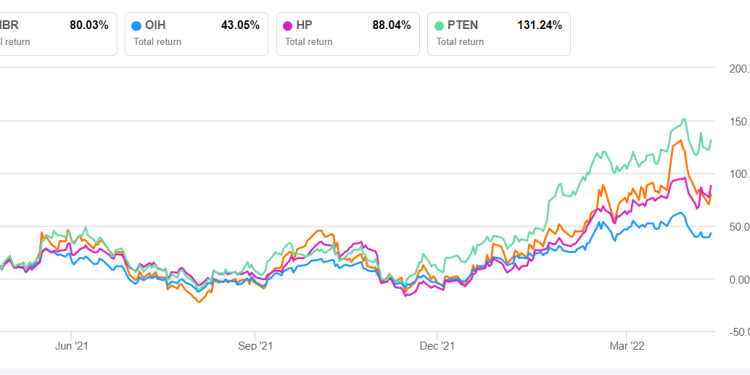

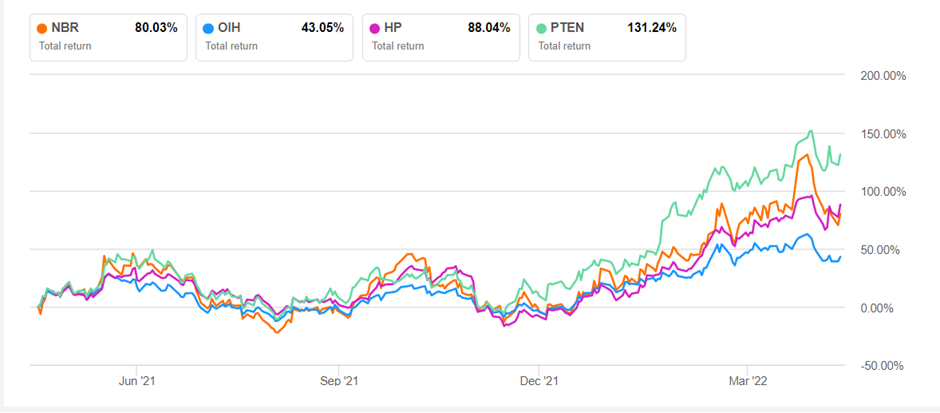

NBR’s strategic focuses rally around automation, digitalization, and robotization. The implementation of the smart suite across the rigs should help improve its margin further in 2022. Pricing and leading-edge rates are increasing in the US as shale production grows. The company has a joint venture in Saudi Arabia, which is expected to drive the company’s business and margin in the medium term. For long term sustainability, the company has struck agreements to market multiple fuel additives, which would reduce fuel consumption. As the positive factors strengthened, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, the pressures on the supply chain can disrupt the company’s internal manufacturing infrastructure and the lead time can stretch. So, NBR’s cash flows dwindled in Q1. Its balance sheet is highly leveraged, and it may need to reduce debt further to avoid issues in the future aggressively. Thankfully, the energy activities have moved up significantly in the past year, which has provided breathing space. Although the stock is reasonably valued versus its peers, investors with a longer horizon might consider staying put for a higher return.