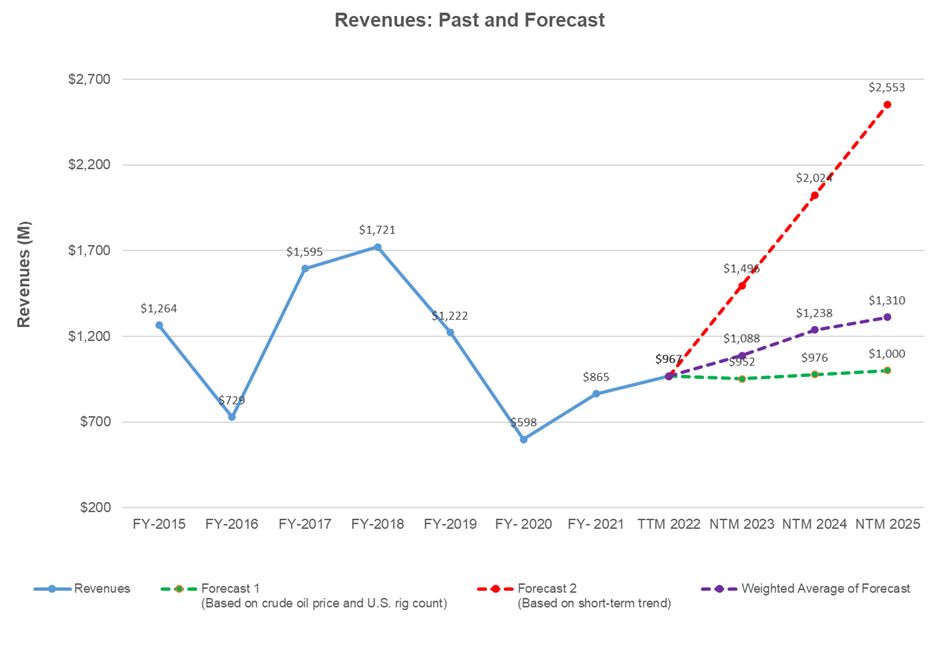

- The revenue growth estimate is steady for NTM 2023 and NTM 2024 but may slow down after that

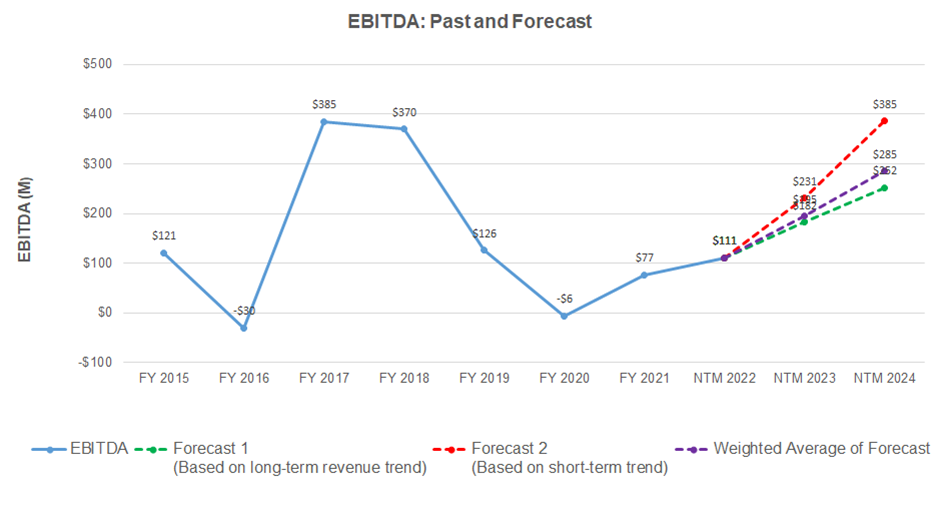

- EBITDA can increase sharply in the next couple of years

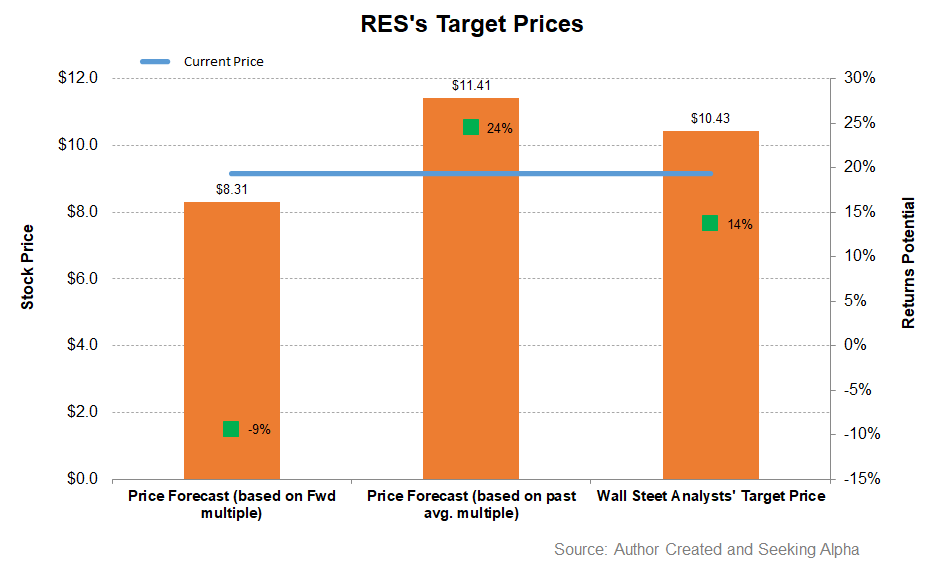

- The stock is mildly overvalued versus its peers at the current level

Part 1 of this article discussed RPC’s (RES) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation on the key energy indicators (crude oil price and the US rig count) and RES’s reported revenues for the past seven years and the previous four quarters, revenues can increase steadily in the next couple of years. It can, however, the growth rate can moderate in NTM 2025.

Based on the regression model and the forecast revenues, the company’s EBITDA can improve in sharply over the next couple of years. The recovery can decelerate in NTM 2025, per the model.

Target Price And Relative Valuation

Calculating the EV using RES’s forward EV/EBITDA multiple shows that the returns potential using the forward multiple (8.7x) is lower (9% downside) compared to the returns potential using the past average multiple (24% upside) and sell-side analysts’ estimates (14% upside) in the next year.

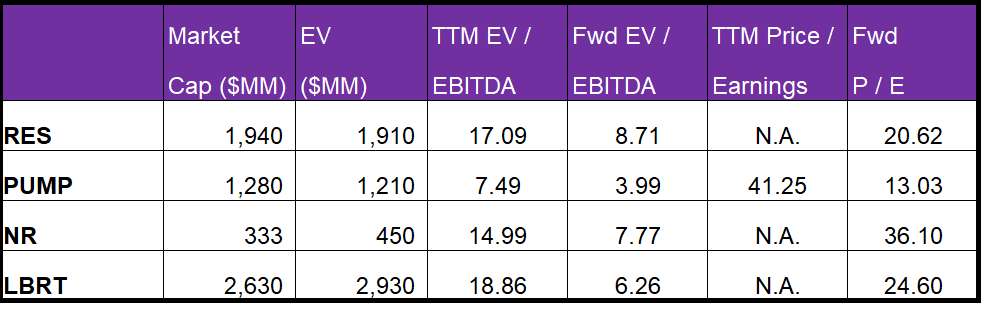

RES’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA suggests a similar EV/EBITDA multiple compared to the peers. However, the company’s EV/EBITDA multiple (17.1x) is higher than its peers’ (PUMP, NR, and LBRT) average of 13.8x. So, the stock is relatively overvalued versus its peers. Only one of the sell-side analysts recommended a “Buy” in April. Five of them recommended a “Hold,” while one recommended a “Sell.”

What’s The Take On RES?

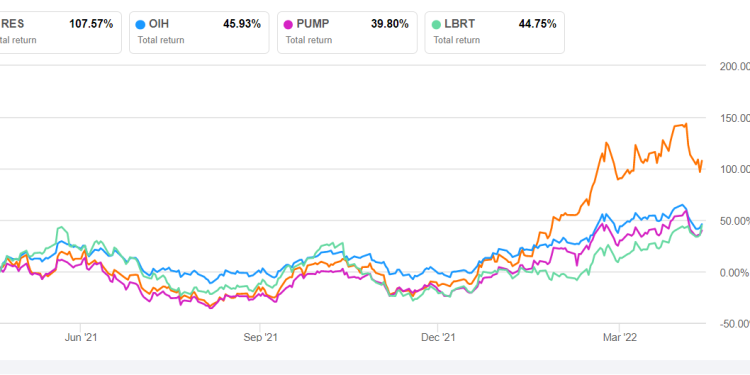

In 2022, the demand for its ESG-compliant drilling solution will go up in the market. So, RPC has started reactivating idle pressure pumping equipment as customer demand and market pricing recover. It will continue to operate eight horizontal pressure pumping fleets in the near term, although it is working on adding another fleet by Q3. The company has made some strategic changes to its pressure pumping service line because of the sand supply issues in the previous quarter, leading to lower costs and higher margin in the coming quarters. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

RES’s cash flows dropped significantly over the past year. This, along with a steep capex budget increase, can continue to weigh on free cash flow in 2022. The company has zero debt and a healthy liquidity base. Since the stock is relatively overvalued at this level, investors might want to wait more more opportune time to gain from a medium-term recovery.