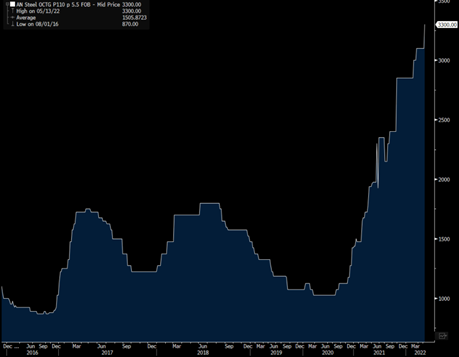

Rigs moved higher again with another 9 being added- especially in key areas throughout Oklahoma. We expect to see more growth in the Mid-Con as well as in Louisiana. The U.S. completions market is continuing to grind higher, and we remain on target to hit about 290 spreads by the end of May. Labor and equipment prices keep heading higher, which will be an overhang on “how fast” we see spreads get added back into the market. It will be difficult to see a big spike, but rather a measured increase over the next 6-8 weeks. OCTG pipe just went up AGAIN, and we don’t see this moving lower anytime soon.

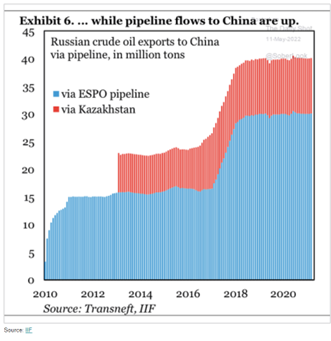

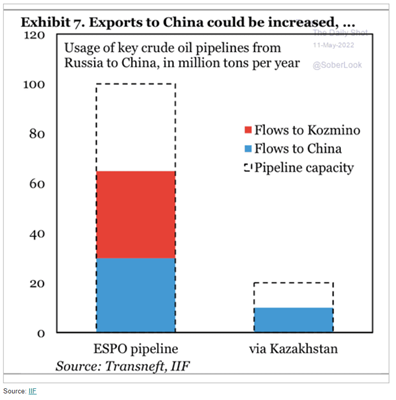

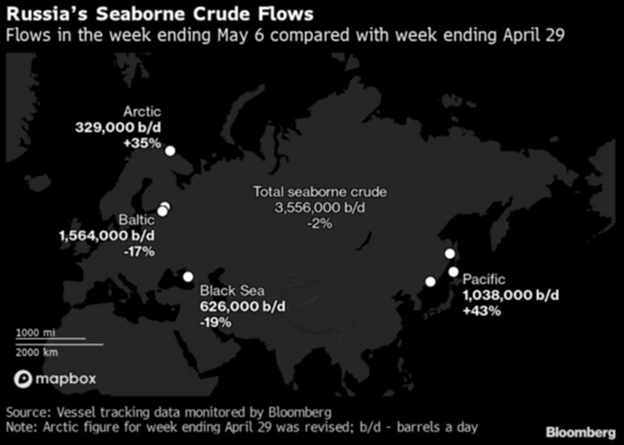

Another key piece is: why focus so much on OPEC+ compliance? They can’t sell massively reduced quotas- so why would you increase your production? Angola and Nigeria alone are 200% compliant and STILL can’t sell their full slate of scheduled exports. We had Angola slashing prices to move cargoes in the loading month… why would they produce at their allotted amount if they cant sell current volumes? We have a record amount of crude on the water and in transit and a huge backlog in China with more resales happening from their coast. Plus China is taking more ESPO as Russia shifts volumes from the Baltic to increase it on pipelines- so WAF is going to see renewed pressured on their slate. You also had Middle East floating storage spike because they put OSPs well over $9 so countries/companies took bare minimum term and left the rest in the market. There remains some spare capacity on the pipelines that can carry some additional capacity from Russia into the Pacific.

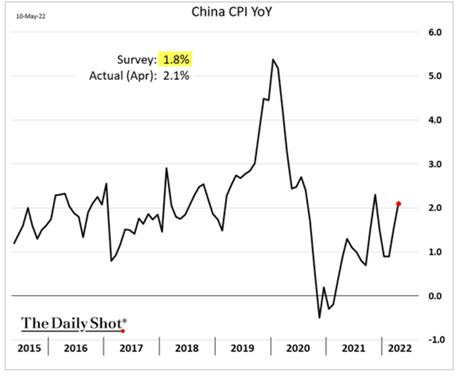

Russia pushes as much as possible into the market it pushes down the demand for WAF further. We have already seen WAF left in the market (Congo and Angola) as China/India increased purchases of Iran/VZ cargoes and underlying demand remained a bit soft. Ship and insurance are a huge issue but given the massive spike in India inflation and “surprise” spike in China inflation- the U.S. cant afford to push their prices up further. We will allow them to run as much Russian crude as they can get their hands on in the near future.

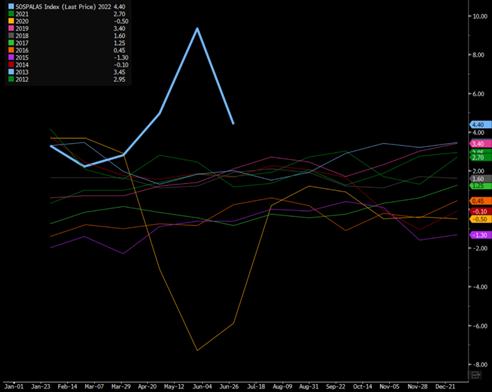

We have seen a drop in Middle East OSPs- which are still at a record- but at least closer to market value when comparing Brent vs Oman/Dubai. This puts the spread between $4.50-$5 above Oman/Dubai, which is much closer to Brent.

This was driven by term buyers minimizing allocations and leaving more in storage as we can see below:

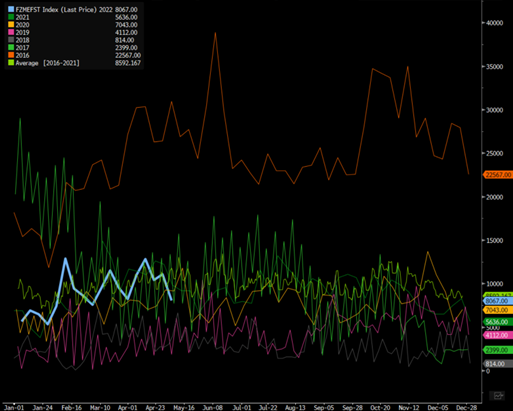

These shifts in the market are putting a record amount of crude on the water, and we don’t see that shifting as miles per ton keep increasing.

We are also seeing a wide divergence in pricing for “quality of crudes” with heavier crudes or crudes with a higher distillate cut trading at a richer premium due to the spread between gasoline and diesel. Refiners are trying to increase their distillate production as much as possible while trying to limit gasoline.

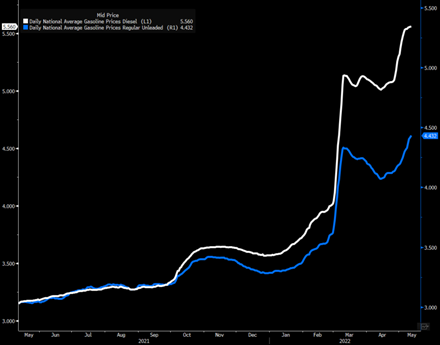

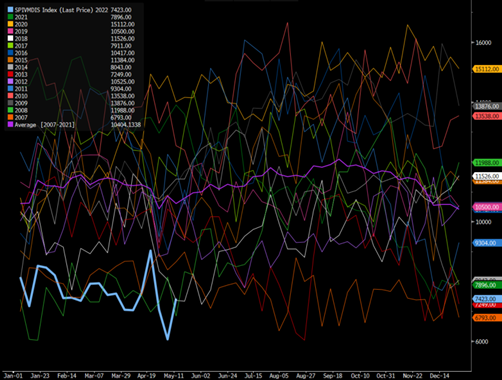

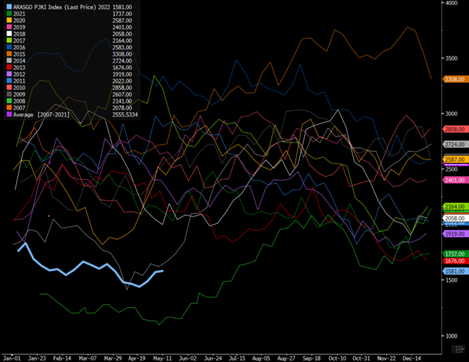

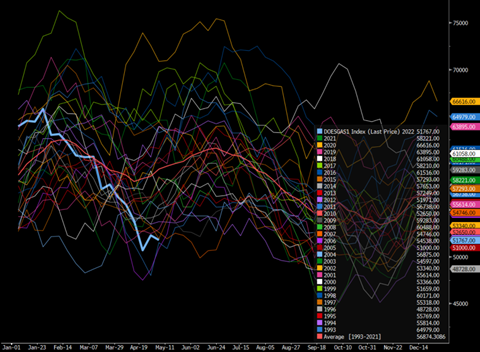

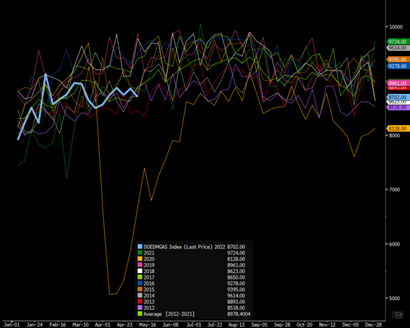

Diesel remains front and center in many people’s minds as the East Coast faces a growing shortage. We have had a re-acceleration of pricing in the U.S.- reaching new all-time highs. We expect to see diesel prices pushing past $5.60 but next week as the global tightness persists.

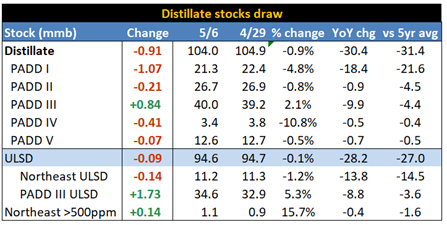

Global storage levels for middle distillate remains at or near record low levels helping to support prices at these levels. Singapore remains at the lowest level we have seen since 2018 and before that 2008. Indian diesel demand increased last month, and we don’t see that dipping in the near term keeping the Asian markets fairly tight. India also increased their exports of diesel/gasoil into the European markets, which will keep the “East of Suez” region tight and support elevated refiner crack spreads. The diesel market is carrying refiner margins right now because gasoline stocks are building globally- which poses a bigger problem as we get into June/July- especially if we get a weaker summer driving season (our base case).

Europe is no different with near record lows- the only time it was lower was 2008. The arb opened up to send diesel from the U.S. Gulf Coast (PADD3) to Europe from the middle of March to the end of April. The arbitrage is now closed, and we will see more getting moved from the Gulf of Mexico (PADD 3) to the East Coast (PADD 1).

The U.S. has a sizeable shortfall- but it isn’t equal across all regions. The lion share of the shortfall is in PADD 1, which is being caused by several issues:

- The drop in refiners available on the East Coast- The last being the Philadelphia Energy Solutions refiner that blew up in June 21st, 2019.

- Cargoes were flowing from PADD 3 to Europe based on the arbitrage

- Homes in New England and the tri-state area use ultra-low sulfur diesel instead of heating oil

- Ban on Russian imports – a large part of it was diesel into PADD1

PADD1 is at a RECORD low on the distillate front with fears of rolling shortages when it comes to diesel availability.

The Colonial Pipeline Co.’s main distillates line (Line 2) saw demand rise to meet capacity, which was indicated when they froze nominations earlier this week. The first batch of disty will reach Linden, New Jersey, in early June, the latest pipeline schedule shows. Faster relief will come by ship with over 2M barrels of diesel expected to offload in New York starting Thursday through June 6, according to estimates from oil analytics firm Vortexa. These include ships from South Korea, Europe, Saudi Arabia and the United Arab Emirates. Among them is a Greek-origin vessel that was diverted to New York from its original destination in Spain earlier this week, Vortexa data show.

Diesel resupply from the pipeline has only recently turned profitable, even though the East Coast has been short on fuel for months. That’s because of the backwardation in the market — where forward prices have traded at a steep discount to prompt deliveries — making exports a more lucrative option. Shipping fuel on the pipeline — which takes weeks to reach its destination — risked losing money. The backwardation in the diesel market has eased this month, making the pipeline arbitrage viable again.

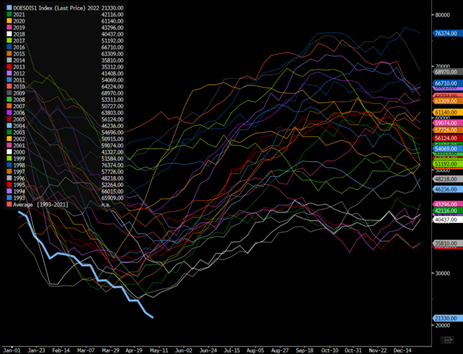

The below chart of PADD 3 shows that there is enough product available to flow to PADD 1.

The Gulf of Mexico has been shipping product to Europe, but as the arb closed- they have turned back to shipping by pipeline or purchasing product from abroad. The spike in exports happening in late March/ Early April but will slow down back to the average as more product gets put on Line 2.

We expect to see distillate exports to drop back to the 5-year average but given the dynamics in the global market- remain elevated.

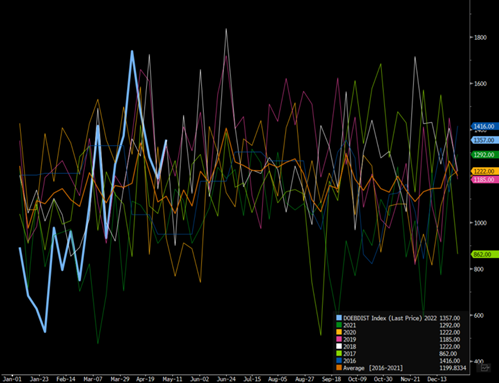

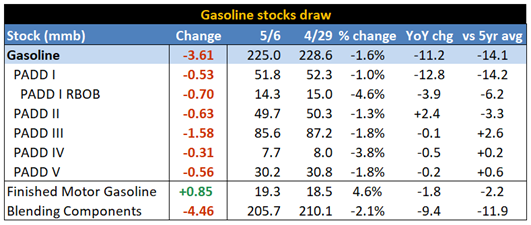

Gasoline is a bit different given the storage backdrop- Europe is at a record/ Singapore is near record/ U.S is normal (except in PADD1). PADD 1 is the driver of the low storage levels for gasoline with the rest of the U.S. sitting at normal levels.

PADD1 gasoline storage sits at 1997/ 2006/ 2011 levels while things are well above normal in PADD3.

PADD3 gasoline levels sit at 2021 levels with only 2020 being a higher year. The point will be to get product from GoM to PADD1, but we expect to see a bigger shift in gasoline from Europe into the East Coast.

When we turn to Europe- gasoline is at a record level, and the refiners will have to manage the storage systems here and PADD1 has more than enough room.

Light distillates in the Middle East and Singapore are also showing large builds that will persist. Now that Ramadan is over- the demand is going to be reduced over the next few weeks that will keep Singapore elevated.

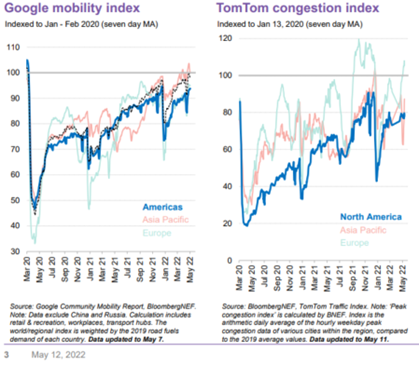

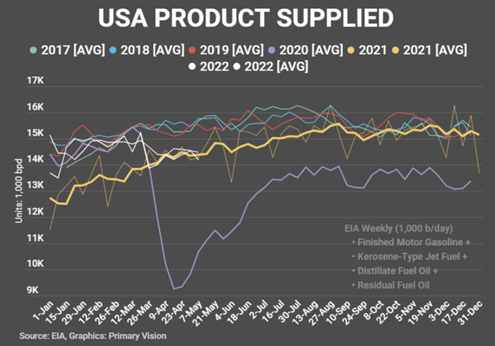

The problem is- when you make diesel you inherently create gasoline on about a 1 to 2 ratio. We are already seeing headwinds for driving and gasoline demand throughout the summer season. The U.S. driving demand is sitting at levels not seen since 2014, and we don’t expect to see a big step up given gasoline prices at the moment.

We expect to see demand “flat-line” around these levels in the near term with more headwinds coming as emerging markets cut subsidizes.

Given the price spikes globally (especially in the U.S.)- we expect refined product demand to stay under pressure. We have seen mobility fuels fall below 2021 levels and given underlying pricing and a slowdown in supply chains- demand will remain here.

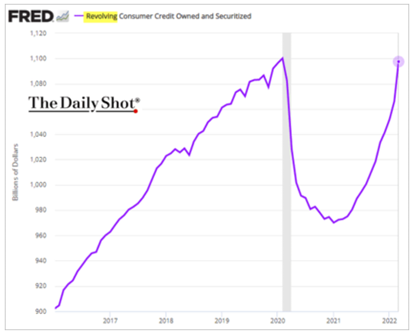

As living costs keep rising, it is important to keep track of wages, but more importantly, how fast the consumer is adding back credit. We saw a huge drop in consumer credit over the last two years as people used government transfers to pay down debt and increase consumption of goods. The U.S. is now seeing a HUGE reversal of this trend with a RECORD amount of debt being added over the last two months. Revolving consumer credit is now right back to where it was pre-COVID with a record month-over-month addition in credit.

I am sure you have read the articles and headlines talking about how much consumers have in savings or that wages are rising at a record level. But the truth of the matter is- the average U.S. consumer (aka 80% of Americans) are struggling to manage the rising costs. The savings number you see is grossly skewed by the amount of money the top 10% have squirreled away into their accounts. 54% of additional savings is attributed to the top 1% and if you include the other 9% of the top quartile- you now accounted for 83% of increased savings. Well… what about the other 90% of people that live in America? The massive spike in credit gives you the indications of how they are managing the rise in prices… by putting more of it on their credit cards.

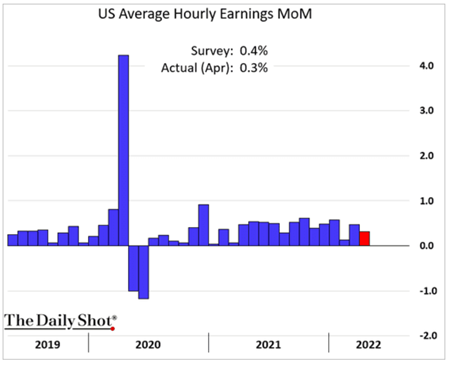

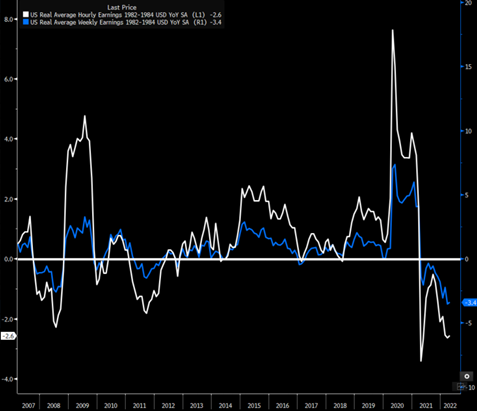

The big spike in credit is also happening when U.S. Average Hourly Earnings MoM are missing estimates and continue to not keep pace with inflation. There was a much slower than expected wage gain, which also leads to another problem… are companies starting to hit a resistance point of raising wages? Are they concerned about additional cost and the ability to recover it?

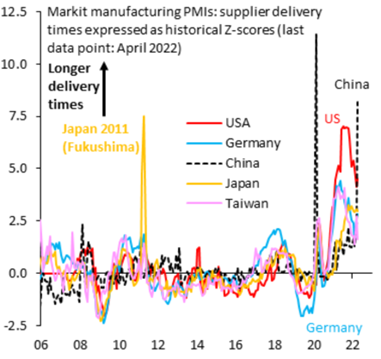

Companies are getting more concerned about the Chinese lockdowns, which are creating shipping delays that rival 2020. It is worth considering that the Chinese lockdowns in 2020 are STILL being felt today and it has been over two years from the initial zero tolerance COVID policy. This is going to create another supply side inflationary situation that will cause prices to rise again even as demand wanes. As companies face rising logistics costs again, they are looking to limit the amount of wage cost because firms won’t be able to pass through logistic AND wage cost… they will be lucky if they can pass through even one side of that equation.

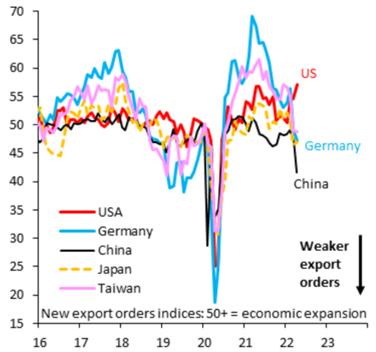

The two biggest exporting economies in the world are seeing their new export orders in the manufacturing PMIs drop sharply. It highlights the deteriorating global demand as we move closer toward a global recession. We have seen a sharp drop in demand when looking at global shipping as the pace of exports has waned and inventories have recovered a bit in most countries. This is a mixture of slowing retail sales as well as a small catch-up in the supply chain, which has just gotten much worse (again.)

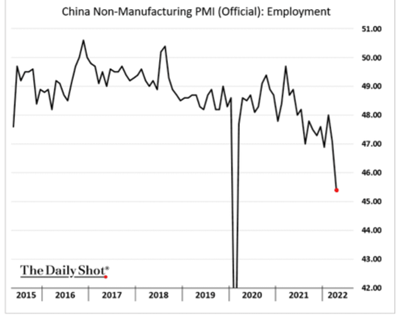

The last concerning piece when we look at China and the “health” of their local consumer is the employment situation. It isn’t surprising to see a big contraction in employment during a broad based lockdown in China, but the problem is the contraction that has been happening since pre-COVID. Employment has been contracting since 2017, which is a broader issue when we consider that retail sales have also been falling in the system time frame. As hiring has contracted, it has created a bigger problem when looking at job availability and a way to generate more local consumption.

It is difficult to generate sustainable spending when companies are not hiring and actual contracting their employment base. This just helps drive home that the issues facing China were there before COVID, and they don’t have the ability to stimulate the way the market expects. China isn’t saving the global market this time around, and that is a tough reality for many to handle.

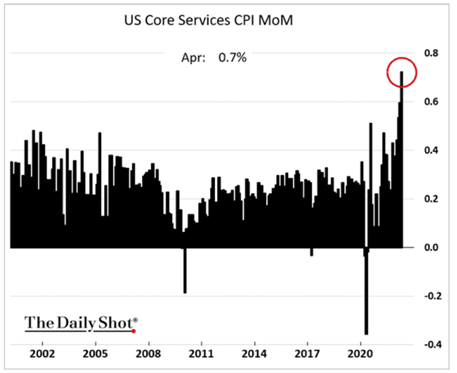

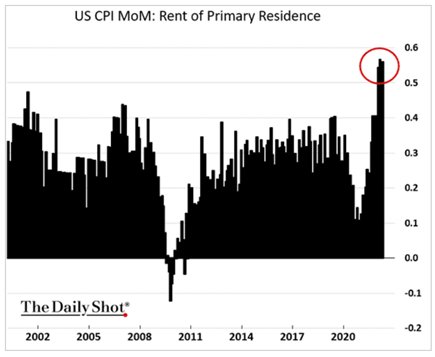

Inflation remains rampant around the world with more pressure coming throughout the supply chain. U.S. core services CPI surged again with more pressure coming from rent of primary residence.

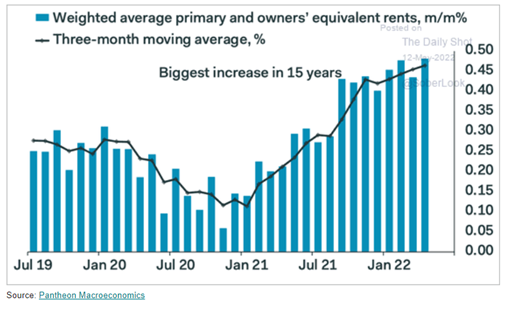

The shift in primary and owner equivalent rents saw the biggest surge in 15 years, but there is more to come when you look at the lag between the CPI value and the current breakdown.

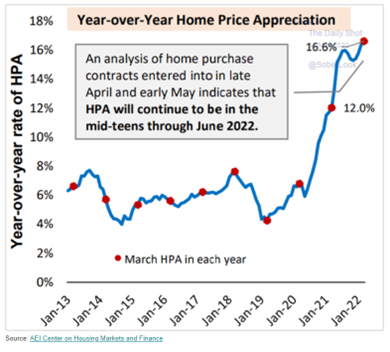

The y/y price appreciation remains well into the upper teens and will stay there throughout Q2 and most likely Q3 of this year.

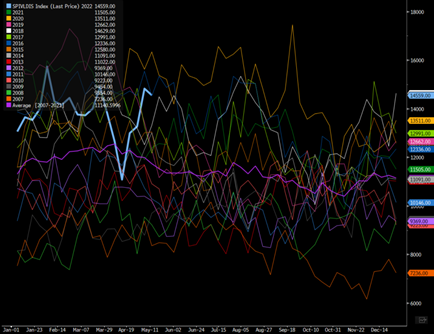

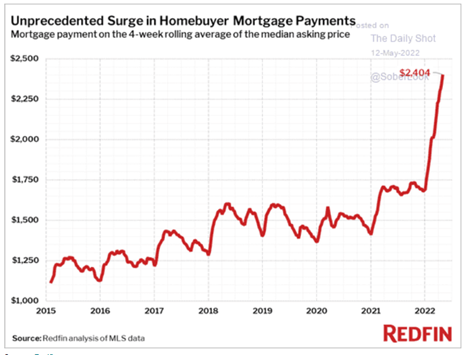

But the shift in mortgage rates has caused mortgage payments to have an unprecedented run higher.

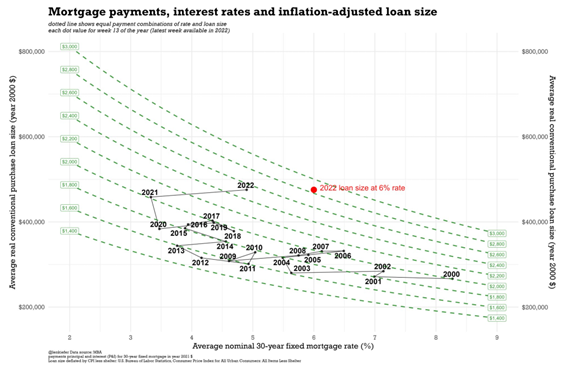

When we put that mortgage payment scale into perspective over the last 22 years- you get an idea on whey this is such a huge jump. It hits hard when you look at the value of homes as people will struggle to manage those payments, which has caused buyers to purchase smaller square footage.

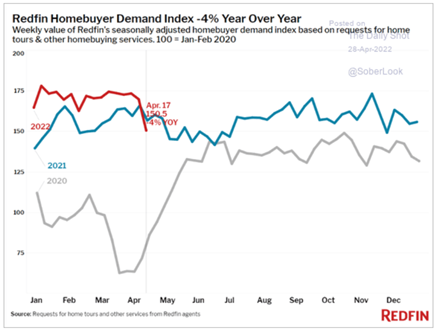

The housing market has just started to slowdown from all-time highs, but we expect that to accelerate as rates move higher.

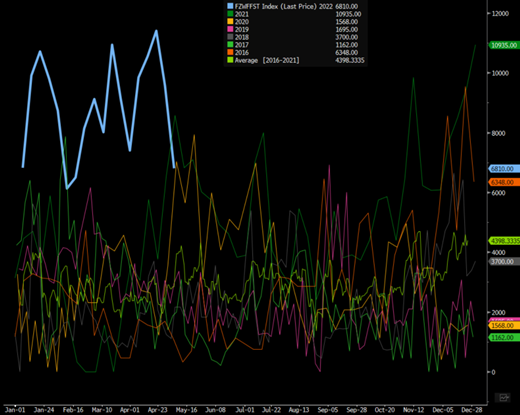

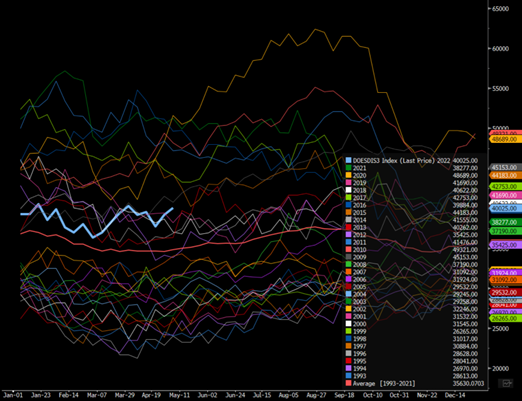

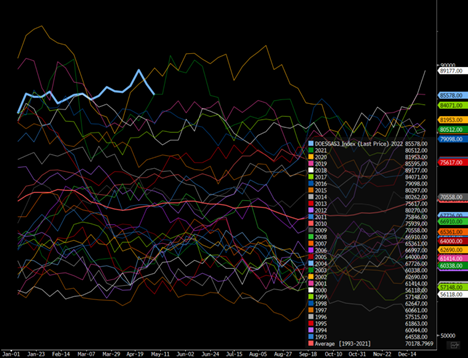

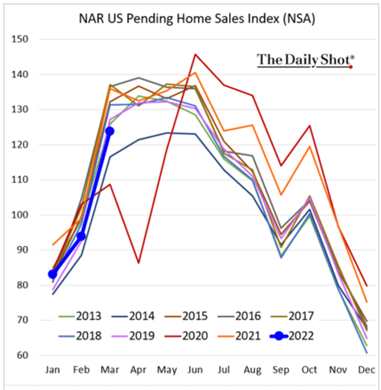

The leading indicators on the US Pending Home Sales Index has started to show the cracks as we look at it compared to other years. We had the “normal” seasonal jump, but you can see the rate of change was slower with the top being well of typical flows.

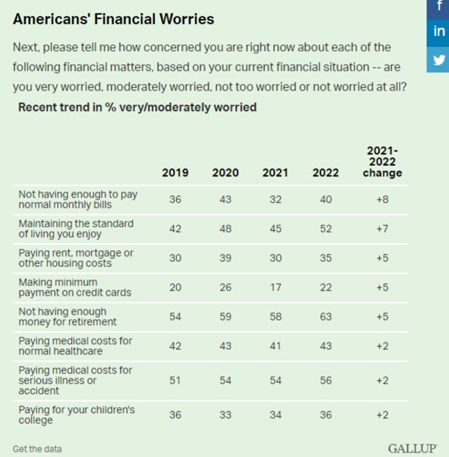

Given the pain in the market, it isn’t surprising to see Americans worried about their financial conditions. The pressure is mounting on consumers as they have turned back to credit cards and other borrowing to maintain their current living conditions. But, when we look at the ability to “maintain the standard of living” 52% of people are worried they won’t be able to keep it.

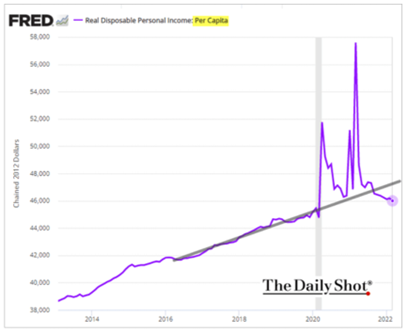

When we look at the shift in real disposable income, they are probably right that the issues will only keep getting worse. The consumer has less buying power, and given the current shifts in the market around supply chains and diesel- it will only get worse.

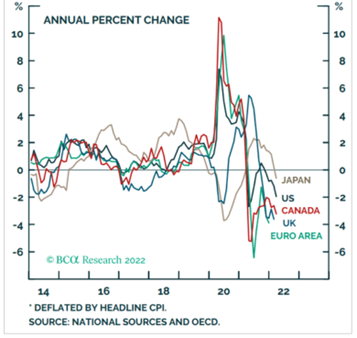

Here is an updated real wages chart based on the newest data on CPI and wages. Real wages keep falling around the world, and when you account for inflation- it gets even worse.

Inflation spiked again in Canada/ EU/ UK driving down disposable income. The buying power of consumers is now well below 0 and is in negative territory that is between -.5% to -4% and falling. We expect things in Europe to get even worse vs the rest of the world.

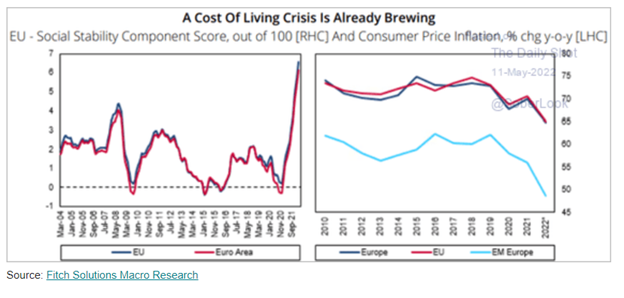

The cost-of-living crisis is far worse in Europe… and the pain is only growing.

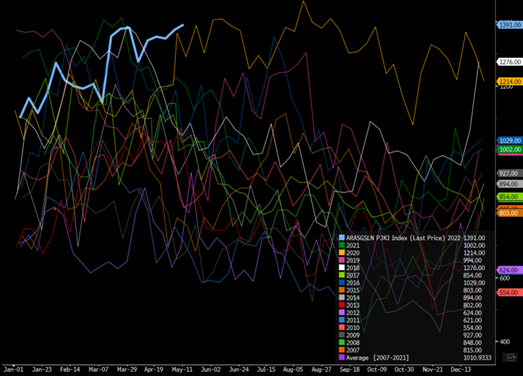

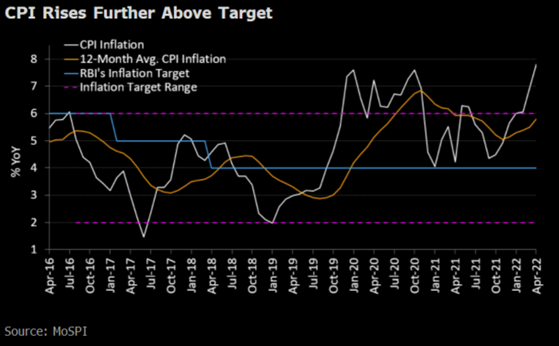

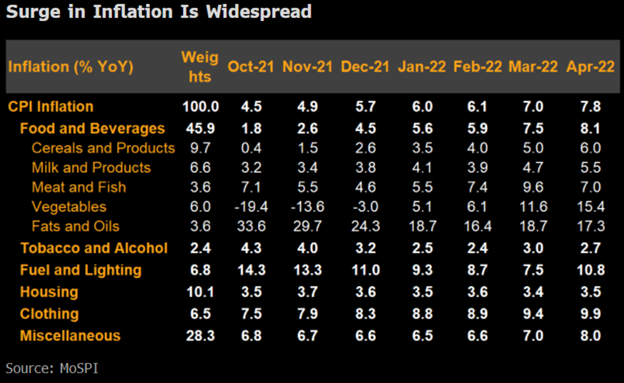

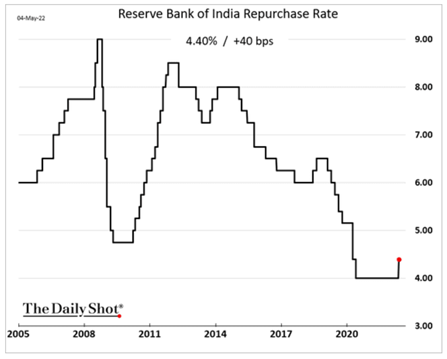

When we turn to India, inflation is becoming an even bigger issue as the cost of living keeps shifting higher- with more pressure to the upside. India’s inflation soared further above the Reserve Bank of India’s target range in April, driven by a broad-based increase in the cost of food, fuel and core goods and services. The reading is likely to elicit another steep rate rise by the RBI at its June review after a surprise hike in an out-of-turn decision on May 4. By the end of the third quarter, the central bank will almost certainly have failed on its mandate to keep average inflation below 6% for three consecutive quarters. Inflation increased to 7.79% year on year in April from 6.95% in March — marking a fourth month above the 6% ceiling of the central bank’s target range. The reading beat our forecast of 7.3% and the median consensus estimate of 7.4%.

When we look at the breakdown of the inflation data, you can see it was broad based with a lot of momentum behind it. My expectation was to see inflation at around 7%, but instead it surged higher with a lot of staying power above the 7% figure.

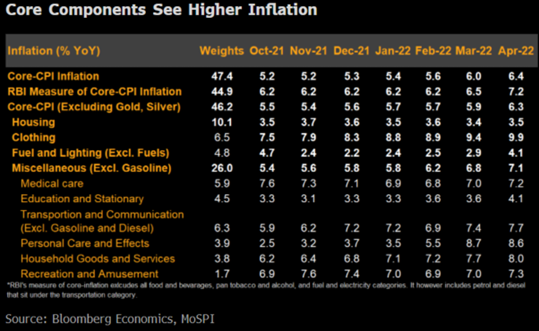

It isn’t surprising to see such a big increase in food and fuel prices given the rise in pricing around the world. We see crude prices as being range bound, but the shortage in diesel continues driving up global costs. But even when you exclude food and fuel to get “core inflation”: it advanced to 6.4% in April from 6% in March.

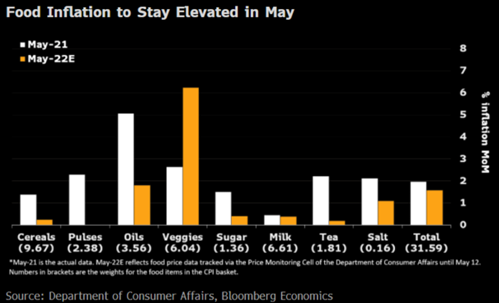

The estimates for food pricing this month is so far topping estimates and will keep pressure on the inflation data. We will get a small pull back- but there is more than enough to keep it well above 7% and force the RBI to take action again.

The demand for refined product in India rose showing some additional activity across the local economy:

India’s oil-product consumption in April rose 12% y/y, up the most since April 2021, to 18.6 million tons, according to provisional data published by the oil ministry’s Petroleum Planning & Analysis Cell.

- Gasoline consumption was at 2.8 million tons, +17% y/y, up the most since April 2021

- Diesel consumption was at 7.2 million tons, +7.9% y/y, up the most since August

- Naphtha consumption was at 1.06 million tons, -14% y/y, down the most since January 2021

- LPG consumption +2.4% y/y to 2.16 million tons

- Petcoke consumption +18% y/y to 1.17 million tons

The shortage in diesel on a global level is keeping prices elevated, and it is making the problem worse within India. Because there is a lot of sticking power to Indian inflation, we expect another increase in local rates. This will put more pressure on interest rates, and increase the cost of borrowing for the government and local businesses. The government is still running a deficit, and between the USD spiking/ US 10 year/ local rates… the price of borrowing is going to hit hard.

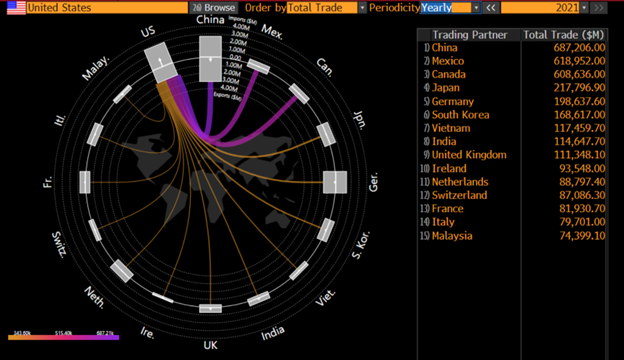

As inflation hits hard- it is important to look at where the U.S. imports a large amount of goods. China is number 1 and India is number 8 and as their costs rise- the companies look to pass through the increases through pricing. The U.S. will continue to import inflation from around the world keeping our living expenses elevated. We don’t see a big drop in U.S. inflation, and for anyone that has been to the store… you have only seen things move in one direction.

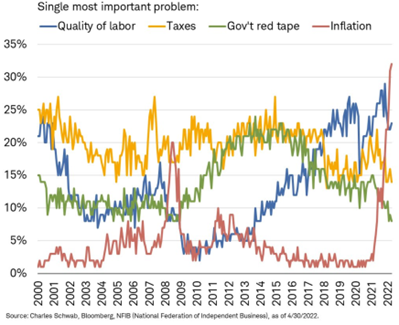

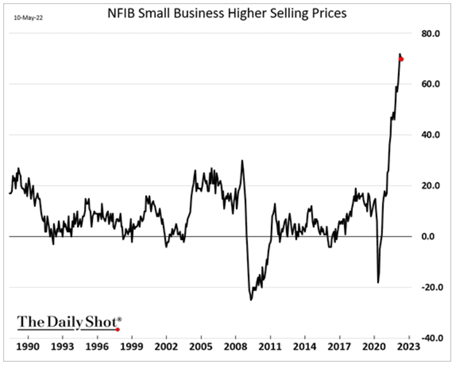

Small businesses are viewing the future with an eye of caution as their outlook on general business conditions reaches a new all-time lows.

The fear that businesses have is based on inflation and fears around pricing. You just need to look at the logistical nightmare that lays before us (again!) to know that prices are going up across their supply chain as they have to increase wages to fill jobs. Even though labor isn’t a “top” problem, you can see that “Quality of Labor” is still a huge concern. A new employee needs to be trained, and if they are coming in without any real previous skills for the role they have- the delays will be even longer before they reach peak efficiency in that job function.

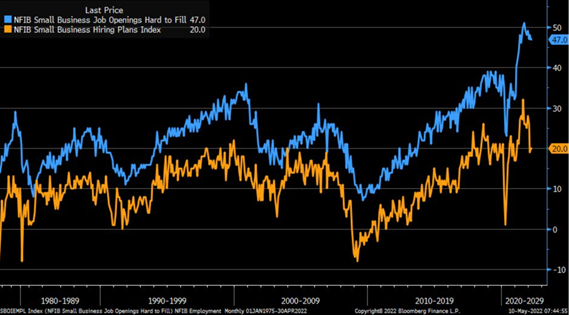

The jobs hard to fill have pulled back a bit, but you can see they are still near all time highs. But, the pace of hiring is expected to slowdown as either jobs are filled, positions are put on hold due to cost, or the function is eliminated. Hiring plans still remain elevated, but we expect to see them slow further as wage costs continue to rise.

Small businesses are still trying to pass through as much of the cost as possible, but we are seeing the pace of selling prices slow.

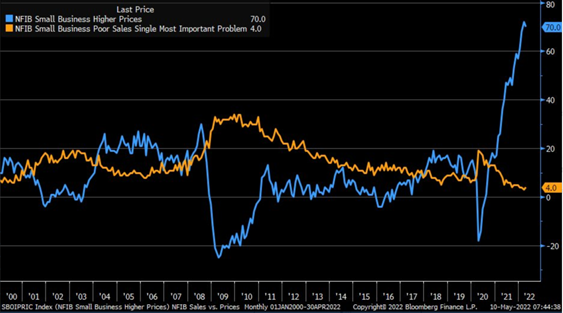

When we layer higher prices with businesses reporting that poor sales are the single important problem- there is starting to be a pivot. It is still a VERY small shift, but this comparison is going to be a very important over the next few months. As businesses get more concerned around sales, it will be a leading indicator for retail sales, and an early warning sign for the “Consumer” portion of U.S. GDP.

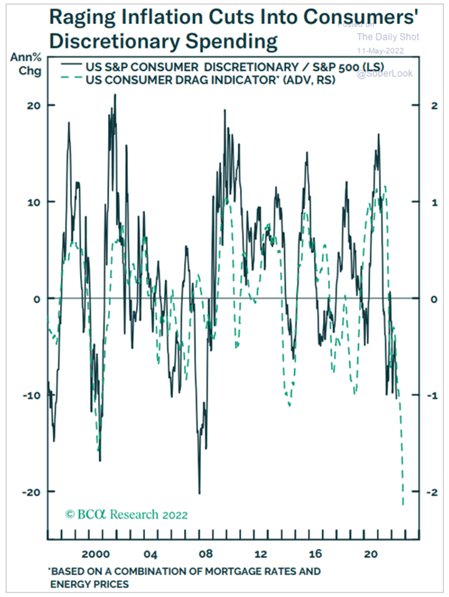

There are already warning signs from the public consumer discretionary companies as the drag is cropping up in earnings commentary. If we look at the historical connection between discretionary spending and S&P Consumer Discretionary companies- we are already seeing pressure to the downside.

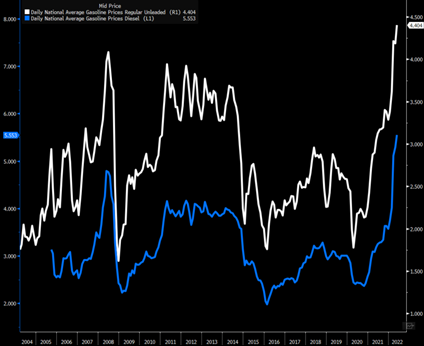

The consumer and businesses alike are getting hit on all fronts- especially when you look at how gasoline/diesel prices have had a strong move off the recent pause/small dip in April. Each price is sitting at record levels, but diesel is the one that has a fundamental problem given shortages in global storage. We expect to see diesel prices remain well above average because the “type” of crude needed to increase the distillate cut remains in short supply. It would be great to have that Keystone Pipeline right about now!

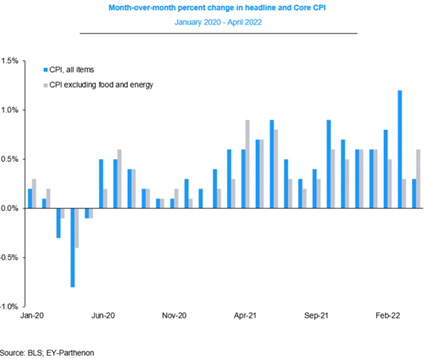

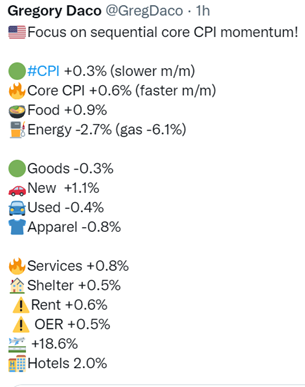

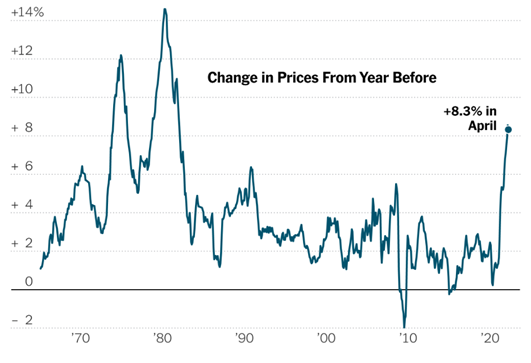

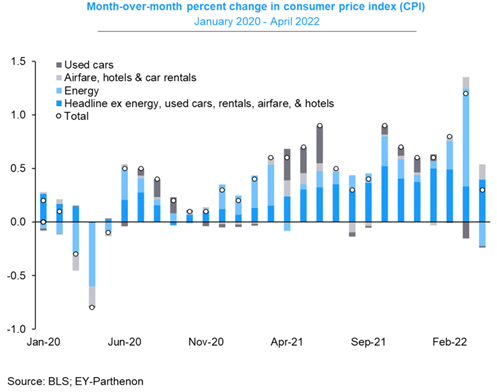

Inflation topped estimates core CPI accelerates M/M, which is a much bigger concern as we look ahead. We have been discussing that topline inflation was going to have tougher comps, so the rate of change was going to “cool” but the underlying price to consumer was still going to grind higher. The small business data reinforces what we have been saying as price increases are slowing- but still heading higher.

I think this is a great info graphic because the things that hit people the hardest have pivoted higher. It is also important to know that energy prices dropped in the month of April, but has pivoted HARD higher- breaking to brand new all time highs. We have been talking for over a year now that OER (Owners Equivalent Rent) has a lot of catching up to do and it will be the driving force behind Core CPI. OER is the largest component of the core calculation (over 40% weighted average), and based on rents/mortgages it still has another 18% of price increases to absorb over the next few quarters.

The numbers show a slowdown in the rate of change of inflation, which just means that CPI M/M rose .3% vs last months 2.5%. But, the expectation was for CPI to only rise by .2% but instead came in slightly hotter at .3%- and that includes a huge drop in gasoline prices. We expect to see inflation reaccelerate in May as more pressure comes from the energy and OER part of the equation.

The pressure on pricing is only made worse by REAL average earnings growth still firmly negative. The average worker is still seeing their wages not keep pace with inflation, which just confirms everything we have seen from savings and credit data. Consumers are putting less into savings, and have increased their use of credit back to Pre-Covid levels.

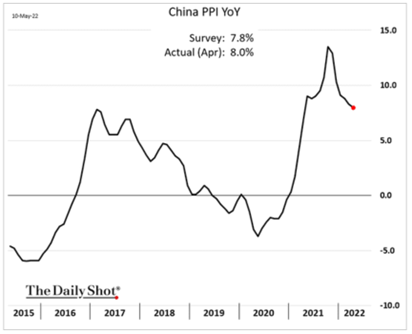

The leading indicators within the U.S. and internationally point to more pricing pressure on companies and the underlying consumer. The most recent data out of China only confirm the problems that we face, and the fact it will keep inflation (prices) pinned to the highs throughout the summer months. The Producer Price Index (PPI) was supposed to weaken further in China, but instead surprised to the upside. Given the lockdowns and logistical nightmare within China, we expect to see more pressure higher- which will be passed on in higher costs to their customers. The largest customer of Chinese products is the U.S. consumer, which will keep our prices elevated as companies attempt to push through more increases or at least hold firm on recent raises.

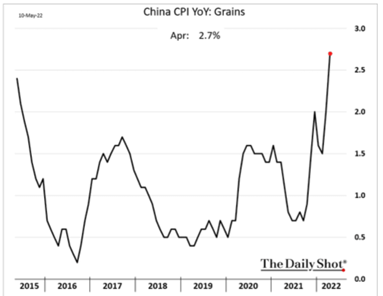

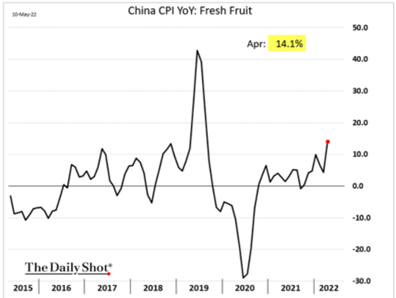

China also reported a “surprise” increase in local CPI with a large part of it driven by food pricing. So now we have China that is reporting another slowdown in employment, weakening new orders, and a spike in food prices. Given where global food prices are right now and how much China relies on the international market for their food- we don’t see these pressures being reduced any time soon.

The local pressure on the Chinese consumer will put a further dent in spending and underlying retail sales. The two largest economies in the world are facing pressure that is only made worse by China’s zero COVID policy. All of this culminates in the U.S. consumer facing a mountain of headwinds even if the market tries to “spin” the topline number to be a positive backdrop. The topline number is still an increase of 8.3% y/y with more price increases in May sending us higher.

In May, we will see a continuation in wage pressure keeping prices for goods and services elevated as energy shifts to be positive again.

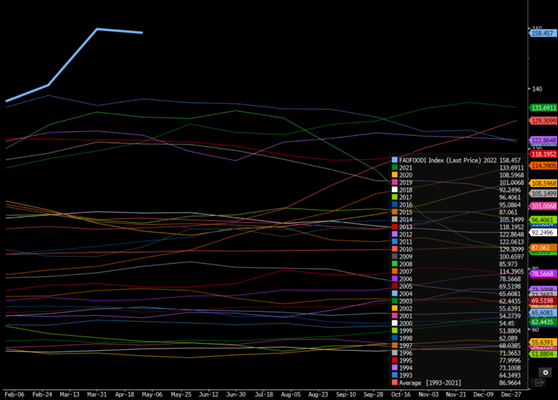

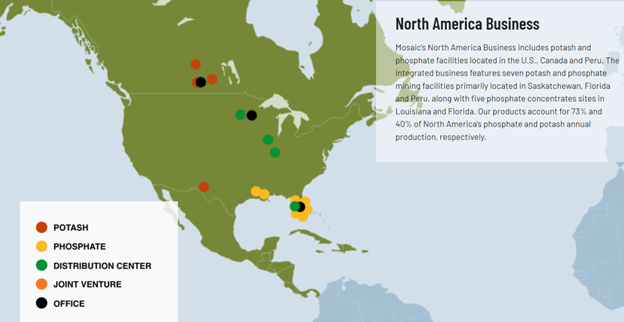

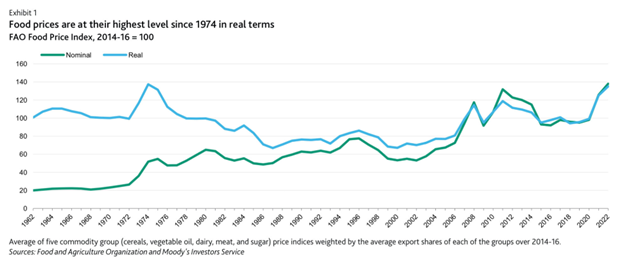

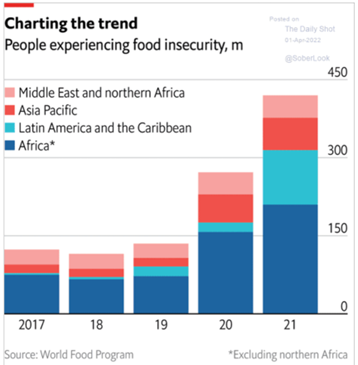

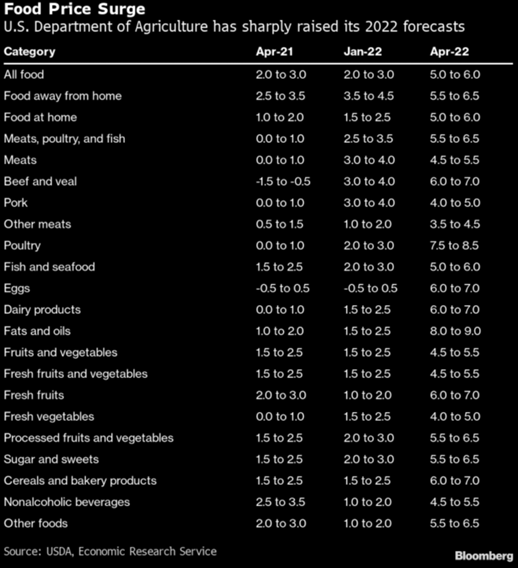

The world is facing a global food shortage that rivals the 1930’s and the “Dust Bowl.” “Even before COVID-19 reduced incomes and disrupted supply chains, chronic and acute hunger were on the rise due to various factors, including conflict, socio-economic conditions, natural hazards, climate change and pests. The impact of the war in Ukraine adds risk to global food security, with food prices likely to remain high for the foreseeable future and expected to push millions of additional people into acute food insecurity.”[1] The Agricultural Price Index is up 41% compared to Jan 2021, and countries need to find ways to purchase food and increase current yield. Food prices have officially taken out the previous high from 2011 with more pressure coming as the planting in Ukraine is non-existent and Russia withholds exports. The rate of change has slowed, but it hasn’t stopped us from hitting new highs- with more to come. Diesel and fertilizer prices are still moving higher, which are all key input prices. Fertilizer is an energy intensive process, and as prices (such as natural gas and diesel) explode higher- facilities have to either pass on the cost or cut utilization rates. In Europe, fertilizer production has been curtailed due to the huge spike in pricing as well as to preserve natural gas due to Russian sanctions. The U.S. is still one of the cheapest places to due business and local companies such as Mosaic are in a position to capitalize on their advantaged position.

UN Food and Agriculture World Food Price Index

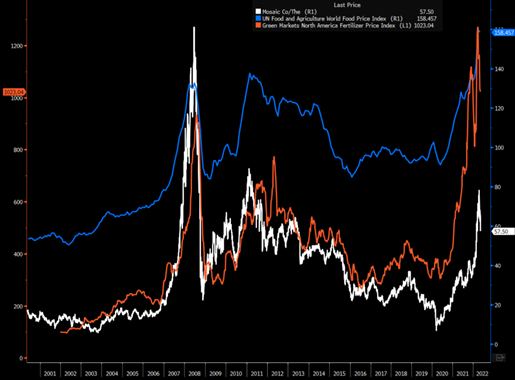

In comparison to previous shocks, the Mosaic (MOS) stock price has underperformed the recent increase in prices. The market in general is very different today vs previous spikes as weather patterns shift increasing drought in some areas and severing flooding in others. This drives up the price of food and incentivizes farmers to due whatever is possible to increase yield- IE put down more fertilizer. The only problem is- the fertilizer market is facing additional supply issues! Ukraine-Russia removes almost 37% of potash from the global market, and the CEO of K+S has stated that even if Russia leaves Ukraine today- it would take 2-3 years before getting volumes back to pre-invasion levels. We are facing a prolonged shortage and a demand for driving up yield to offset droughts and other pressure points. Mosaic is in a prime spot to capture pricing, which will be returned to shareholders over 2022.

Mosaic Stock Price vs UN Food Price vs North America Fertilizer Prices

From the Mosaic earnings call, “Given the direction of our business, we anticipate generating significant earnings and free cash flow in 2022. Returning capital to shareholders remains a key part of our strategy. We continue to expect returning up to 75% of our free cash flow to shareholders through a combination of share repurchases and dividends. Including the $463 million returned in the first quarter of 2022. We completed the $400 million accelerated share repurchase program announced last quarter. And continue to repurchase shares through our existing authorization. As a reminder, last quarter our Board also approved a new $1 billion authorization.” Mosaic operates in North and South America, providing a certain amount of geopolitical stability enabling them to increase total production to about 25M tons of finished product by the end of 2023. They have taken the initiative to expand production in key areas at only a step up of about $100M in new project costs, which is a clear double digit return even if fertilizer prices fall.

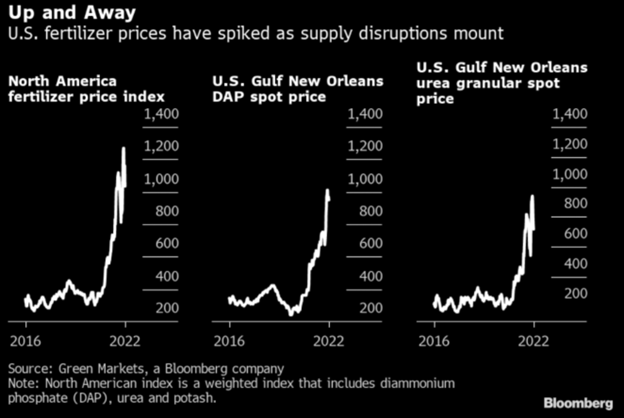

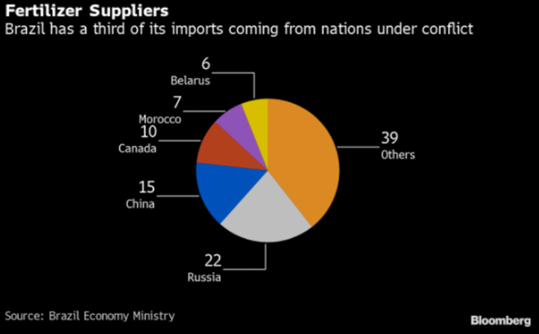

Fertilizer prices around the world remain at near record levels providing a strong revenue backdrop heading into peak application season. There is concern around the world about the availability of fertilizer, which is causing some countries to horde and others to source product ahead of schedule. This is pulling forward tightness and providing support for pricing well into 2023. Brazil is running significantly short fertilizer as more cargoes are trapped in Russia without a way to get it to market.

Mosaic’s strategic position in the Americas means they are the viable and well-placed option for farmers looking to replace Russian volumes and grow yield.

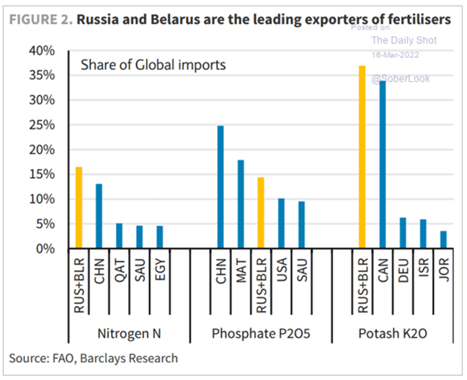

“Over the coming months, a major challenge will be access to fertilizers which may impact food production across many crops in different regions. Fertilizer prices surged in March, up nearly 20% since January 2022 and almost three times higher compared to a year ago. Russia and Belarus are major fertilizer exporters, accounting for 38% of potassic fertilizers, 17% of compound fertilizers, and 15% of nitrogenous fertilizers.”[2]

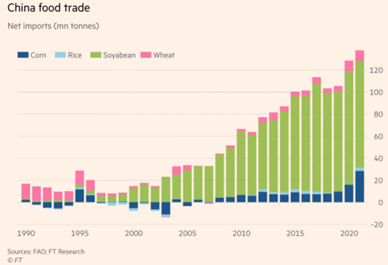

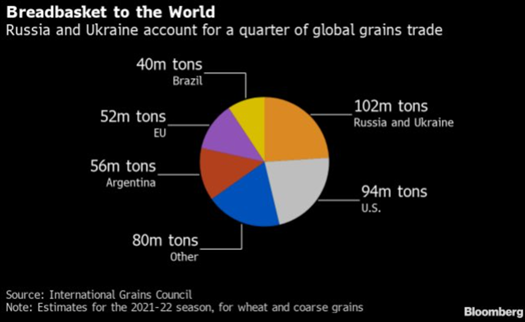

Grains is just the first in a long step of processes before it reaches you at the restaurant or is purchased at the grocery store. Each part of the supply chain has their own costs and margins to manage with a large part also being driven by labor shortfalls and logistical strain. The U.S. has the ability to feed itself, but the broad market is short and getting “Shorter” as many growing regions are seeing drought and yields falling. All the while- the global population is growing with Chinese demand surging to record levels. China is world’s largest agricultural importer … last year, it imported record 28 million metric tons of Ukrainian corn, more than double previous year’s 11 million; war now exacerbates risk for food inflation and disruption. This is another key reason we have seen China open its markets to Russian wheat and other grains to help offset the loss of LatAm and Ukraine.

Another key piece that makes the food situation worse is the growing shortfall of fertilizer as well as the rising price. Russia and Belarus account for a huge percent of the world’s available fertilizers, and they won’t be exporting anything in the near future. So not only are we short food in the world- but we also don’t have the fertilizer available to try to increase yield. But- we are also facing a mother nature that is not cooperating with broad droughts and floods also cutting this year’s yield that is already short and building on weak harvests since the end of ’19.

It is unlikely the U.S. and other areas will be able to make up for the losses in fertilizer production or in food, given the droughts in LatAm and input costs- fertilizers/ seed/ diesel among other things. This will keep crop prices elevated especially as China absorbs more cargoes and other countries are left scrambling.

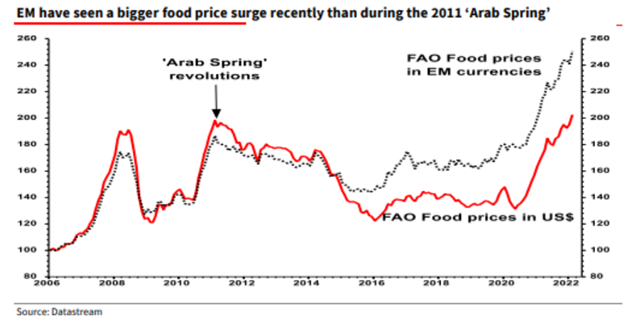

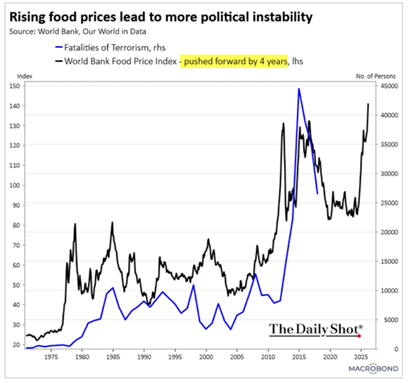

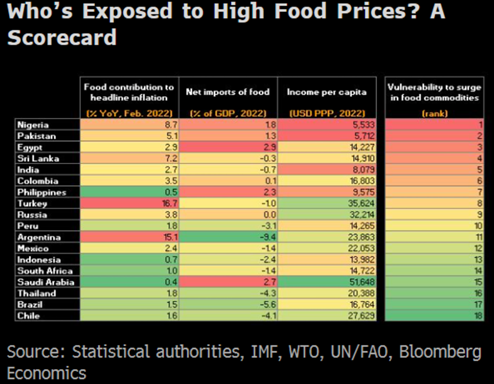

Emerging markets have already seen a bigger food price surge vs what they experienced during the Arab Spring or the Peasant Uprising. This will put more pressure on governments to try to maintain some semblance of normalcy through subsidies. The World Bank has been issuing near-term loans and grants to help countries to pay farmers, finance fertilizer and food purchases, and other investments to increase yield.

When we break this down into “real terms” when evaluating food prices- we are right back to levels not seen since 1974.

Food prices are going to be pinned to the highs as fertilizer prices surge to a new record. Everything from diesel to fertilizer are hitting new records that will keep farmer costs sky high that have to be passed on to the consumer. As we have said in the past, Food shortages don’t happen suddenly- it takes time to work through storage and state reserves. It started out slow in the end of ’19 but accelerated in ’20-’21 with droughts/floods/pests/logistics… Ukraine-Russia is just the topper to a situation that started several years ago. The issues have been compounding since the end of 2019, and now we are in a terrible position with ANOTHER projected terrible year of crops BEFORE we even consider the impacts of Russia-Ukraine.

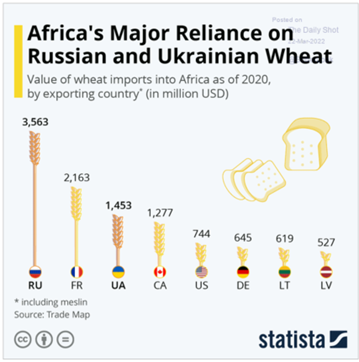

We have already highlighted what the war means for emerging markets, but here is just another reminder for what it means for Africa.

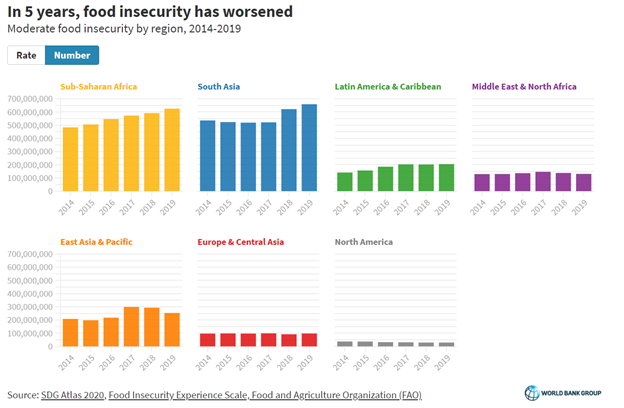

Basic needs are the crux of survival, and economic expansion can’t begin until people not only have enough to live, but excess that can be stored or sold to allow for growth. For example, if you are worried about your next meal, will you focus on growing a garden / foraging for food, or sitting at a library to study to become a doctor, engineer, writer, or another skilled job? Food insecurity has become a big problem around the world, with Africa and Asia seeing a steady rise in basic needs not being met. The below chart is from 2019, so when we factor in prices that are now back to 2014 highs, the pain is just getting worse. 2014 was when global food insecurity really started, and now that prices have pushed back to decade highs—alongside a global pandemic impacting salaries and subsidies—the pain is just beginning. It is important to note that even without COVID19, the world was already facing several “Biblical”-sized locust swarms, droughts, floods, swine and avian flu, army worm infestations, among other disruptions that were causing yield drops. COVID19 was the cherry on top that has made a bad situation much worse—limiting the movement of migrant workers, delaying plantings, harvests, and bottlenecks at ports. We have seen an increase in acres planted, but weather hasn’t been cooperative, delaying key planting across places like Latin America. These adjustments take seasons, and with China absorbing massive amounts of grains in the market and dealing with a new round of swine flu driving up prices, poor countries will be left paying up for goods to feed their people. Nationalism will also become a bigger issue as countries withhold exports, managing volumes and pricing, to make sure their citizens have enough to eat. We saw evidence of this at the outset of the pandemic, and restrictions still remain in place with export quotas and rising tariffs.

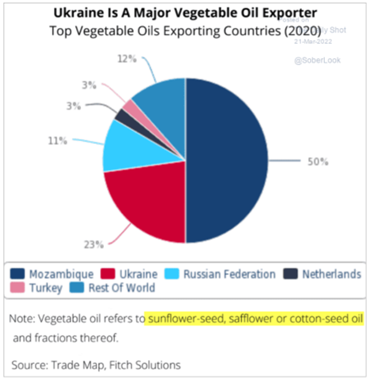

But- another key area of concern is the “vegetable oil” market, which is DOMINATED by Ukraine-Russia. They are about 34% of the global market, and this is another key point of inflationary pressure- especially in India. The below is another example of why India/China will remain neutral with Russia because they can’t risk losing Russian commodities.

Russia is also a key provider of military equipment to a wide range of countries with India relying significantly on them for equipment and training. After China attacked India in Ladahk, Russia was quick (and the first country) to support India and accelerated the delivery of key equipment including the S-400 and other military equipment. India relies on Russia extensively, and we believe they will remain very neutral in the current conflict. India also has to walk a fine line because they are also part of the QUAD along with the U.S., Australia, and Japan. So they can’t go “too far” towards the Russia camp, but instead remain neutral and purchase cheap crude from the country and maintain a steady flow of food and military equipment.

Peru is a perfect example of what happens when food subsidizes are lifted and people can no longer feed themselves. There have been rampant riots and looting food stores as people struggle to deal with the shifts in the global food shortages. The food situation is hitting everyone hard, and China is no different with the world’s largest population.

The issues keep compounding as China continues to pulldown as much fertilizer, seed, and crops to keep their silos full. By them being so aggressive in the market, they are driving up prices and reducing volumes available for other countries around the world. They are very aware of the dangers from food shortages that the below chart helps drive home:

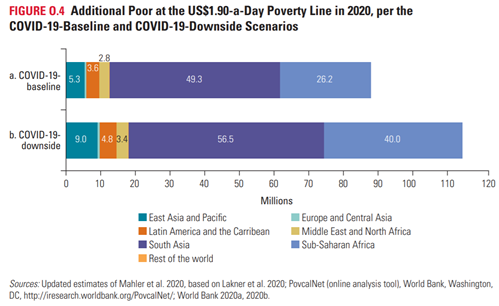

The CCP will do everything in its power to limit pressure out home no matter the cost. Even countries, such as Nigeria, that are sellers of crude are big buyers of refined products. The surge in pricing is also hitting their budget, and will directly impact their ability to purchase food. “The so-called Petroleum Motor Spirit subsidy is expected to cost 4 trillion naira ($9.6 billion) this year, compared with a previously projected 443 billion naira, President Muhammadu Buhari said in an April 6 letter to lawmakers seen by Bloomberg. Higher prices hurt Africa’s biggest oil producer because the state energy company swaps unrefined crude for imported gasoline, which it sells on at an increasingly steep loss to keep the pump price at 162.5 naira a liter ($.39). Budget revenue will also be hit by “significantly” lower crude output because of “massive theft” by criminals who tap into oil pipelines, Buhari said. The national police force also requires additional funding to “boost their morale as they grapple with heightened security challenges in the country,” the president said.” These are just a few examples of a global problem, but you can see that Nigeria hits the top of the list with India coming in very high… again more issues. The rise in inflation and inherent costs—alongside falling wages—has only intensified the extremes of poverty, with more people being added to the “$1.90 a Day Poverty Line” continuously throughout COVID19. The longer people reside below these levels, the more anger builds up against their situation, and blame gets passed around. We have already seen food riots and general uprisings in Africa (most recently Nigeria), the Middle East (Iran), and Asia (Myanmar), and we aren’t even fully out of the pandemic. Pain, despair, and anger has been bubbling beneath the surface for years, and now the match has been lit.

The World Bank has seen the global poverty figures declining steadily over the last several years. Since 2019, the trajectory started to shift and COVID19 sent us on a completely different path higher due to lack of earnings potential. Now, with the U.S. 10-Year Treasury Bill shifting higher, the cost of borrowing has risen, limiting the underlying stimulus a government can provide through subsidies and economic incentives. We are already seeing fuel costs rise globally with little ability for governments to protect or limit the rise. This will only exacerbate underlying issues across food availability and basic needs. Sadly, the below chart illustrating global poverty is not painting the full picture. Their criteria for classifying “poor” does not include levels seen in Developed Countries—who are having their own issues with food security and populations falling well below the poverty line designated by the country. The U.S. is no exception to the pressure, as weekly jobless claims throughout the pandemic have outpaced the worst day of the financial crisis (665k jobless claims in March 2009). We have the benefit of borrowing, but as the U.S. taps the debt market at a greater rate and inflation fears rise, so do our interest rates. As our rates go up (10-year is typically the global “risk free” benchmark), countries are finding it harder (and more expensive) to access the markets. This is why I believe we will see those “Number of Poor” values continue to shift higher and reach the “downside” case—especially in Africa and Asia. In the United States and Europe, the extremes of destitution are vastly different, but that is not to say that people aren’t reaching the same levels of despair and “hopelessness” as other people in poverty around the world.

The below chart helps drive home where the issues are the most prolific, and it also indicates that these issues were starting to creep higher in 2019. This is NOT just because of COVID or the Russia Invasion- but it is a compounding problem that takes years to develop and years to fix.

Brazil sources a large amount of their fertilizer needs from Russia making these statements concerning: Russia is urging the country’s fertilizer producers to halt exports in a move that could send soaring global fertilizer prices even higher. Russia’s Ministry of Industry and Trade recommended domestic fertilizer producers cut volumes to farmers due to delivery issues with foreign logistics companies, according to a Friday statement. The country, which has been facing increasing international sanctions since invading Ukraine, is a major low-cost exporter of every type of crop nutrient. This would also hit Europe hard because they provide a significant amount of product to the rest of the continent as well.

Russia can’t supply (or doesn’t want to?) farmers in Europe and elsewhere with contracted volumes of fertilizers because a number of foreign logistics companies are sabotaging deliveries, Russia’s Industry and Trade Ministry said Friday in a statement.

- Given the circumstances, the ministry recommends a halt to fertilizer exports

- Russian farmers will receive volumes of fertilizers they need

The uncertainty around new sanctions has also put buyers on the sidelines until there is more clarity, which hits all commodities originating from Russia. Russia trades a signficant amount with Europe with mainly raw materials and energy flowing into the EU whole the EU sends finished products back to Russia. The U.S. exposure is smaller, but still significant in the areas we import- IE oil and diesel.

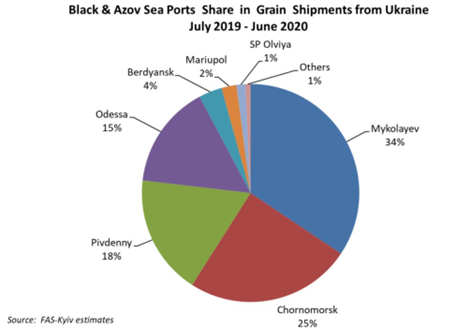

The food impact will be a huge issue given most Ukraine ports are under siege/attack and won’t see any new exports. Ukraine is typically planting this years crops, which is highly unlikely to happen even if Putin pulls all of his troops out of the country. This will leave the whole world short grains- not just this year- but also next year. We have already had droughts in Brazil/Argentina causing those estimates to fall again.

Russia and Ukraine make up the largest amount of global grains in the world. By losing one if not both, will put the world on a very scary path of broad shortfalls and another big driver of inflation in the market.

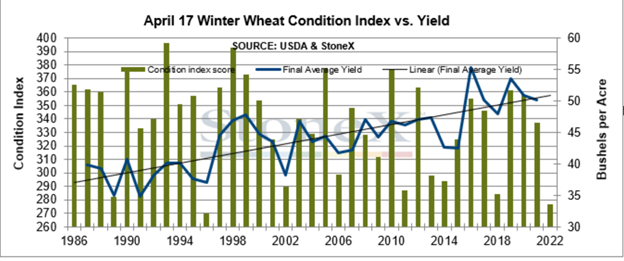

Even though the U.S. can feed itself, it faces a struggling situation with drought conditions limiting yield and cutting the amount of volume available for export. A Texas farmer Allen Meissner: “The 2011 drought was one for the ages,” said Meissner, who this year has 1,000 acres of wheat and 5,000 acres of corn on the line. “We aren’t there yet but it sure is trending in that same direction.” Fear that extreme drought in Kansas, Texas and the surrounding region will severely shrink U.S. yields this year is driving up grain prices and adding to fears of worsening global food inflation and shortages. In Kansas, the biggest U.S. grower of hard red winter wheat, farmers are grappling with what some say is the driest season they’ve ever witnessed. The bulk of southwest Kansas has gone almost 300 days without an inch of precipitation, according to the Kansas Wheat Commission. This is driving up price expectations across the U.S.

These price increases are happening as global stocks continue to drop around the world and silos run dry. Many countries are out of inventory and are relying on shipments to keep their population fed. Governments have increased the subsidizes on fertilizers to enable farmers to increase their purchase of the products and cover the cost in an attempt to protect yield. The problem is- these shortages don’t happen all at once. They build and grow over time- as we saw this slow moving train wreck beginnging in late 2019. In 2020, we had broad issues, but there was still reserves and food in storage that could be relied on, but as 2021 proved to be another tough year- the issues became pronounced. Now in 2022- things only look worse and more dire. For example, only 22% of U.S. corn was planted by Sunday May 8th, the slowest pace for the date since 2013 and well behind the 50% average.

Every crop is facing a unique problem and the farmers are desperate… more fertilizer application is the only near term solution.

[1] https://www.worldbank.org/en/topic/agriculture/brief/food-security-update

[2] https://www.worldbank.org/en/topic/agriculture/brief/food-security-update