As Mark couldn’t do last week’s EIA and ECON show, I am going to talk about few of the important developments both in global oil markets and world economy. First, the context: oil prices are still mainly bullish, the likelihood of a Russian oil ban by the EU and the former country halting its gas flow to different European countries (latest one being Finland). Global economy is still under pressure as net tightening cycles in major economies raises the chances of a recession. That is also increasing troubles for the emerging economies as food and energy prices continue to go up. There is also a looming supply shortage of distillate and diesel products.

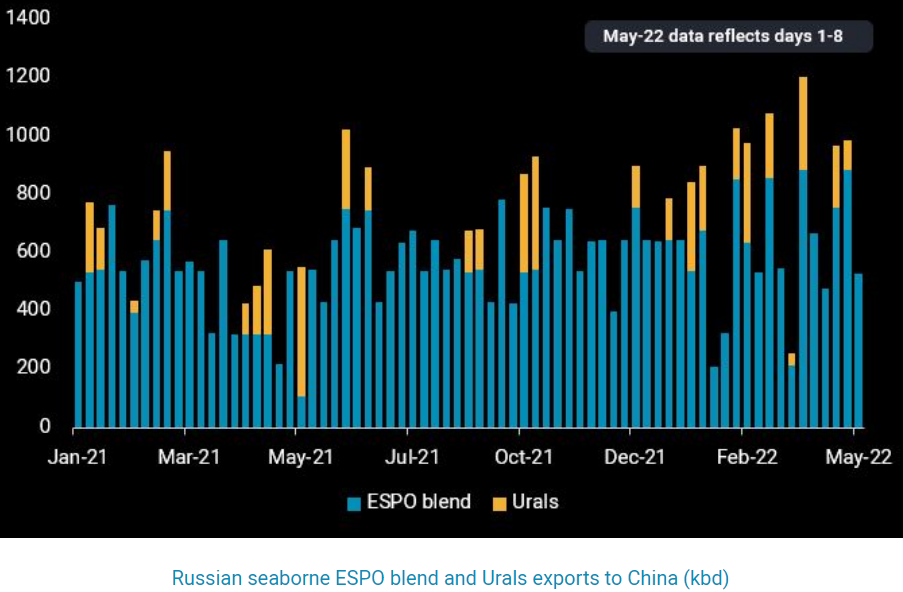

Let’s have a brief look at China and its oil demand. Recently Vortexa reported that Russian Ural loadings to China in April was 750,000 bpd which was 50 percent less than Q1.

However, recently there are reports that Chinese independents can’t resist the mouthwatering discounts on Russian crude and therefore have started to secretly buy more of it. As another analysis by Vortexa highlights, China’s buying of Russian oil will jump to 1.1 mbpd, 750,000 bpd higher than Q1 and 800,000 bpd above 2021. Unipec, Zhenhua and Livna are one of the top buyers. Independent refiners are getting a discount of $29/barrel which is very attractive for them given low margins and a relatively slow economic growth in the country. If we add 800,000 bpd separetely received by China through pipelines, it would bring the total imports to 2 mbpd that would amount to 15 percent of China’s crude imports.

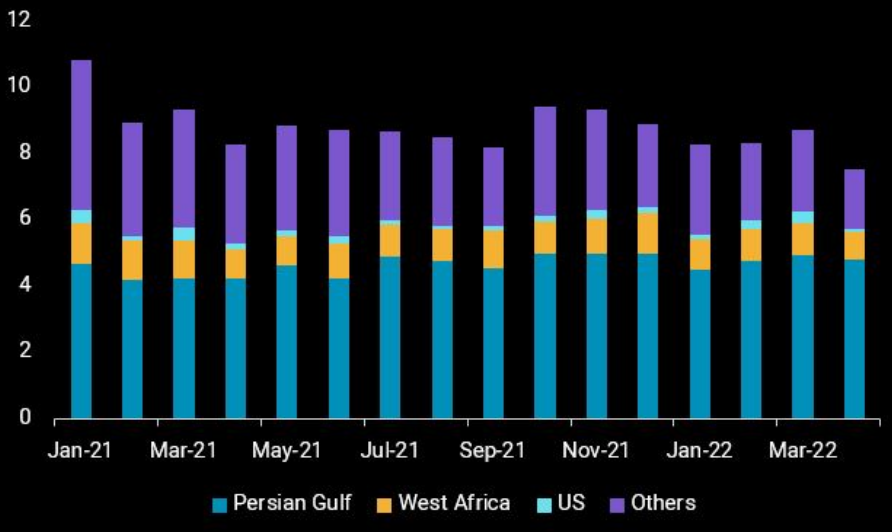

China is also ramping up its imports generally as indicated by the increase in crude being sent to inventories. China doesn’t release its figures for SPR, but Clyde Russell of Reuters have always done a brilliant job in calculating this figure by figuring out the difference between total availability of crude from imports and domestic output. As per these estimates, China added 2 mbpd to oil inventories in April this year which was 610,000 bpd more than March boosting its SPR. According to Refinitiv Chinese crude oil imports will increase to 10.53 mbpd in May from 10.47 mbpd in April.

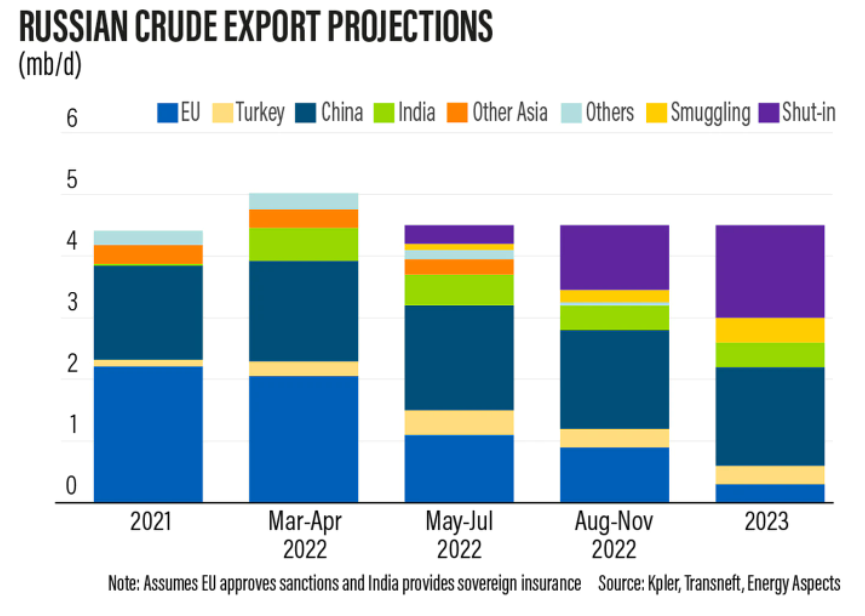

In terms of a looming supply crunch we are witnessing some serious shortages. Russian oil output is already down by 1 mbpd and the total amount of oil getting out of market due to a fall in production is 3 mbpd.

In Europe distillate stocks fell by 378 million barrels by the end of April, lowest since 2008 while in U.S. fuel inventories stood at 105 million barrels also the lowest since 2008. This is a telling sign of a period of slower growth in future as talks of a recession gain hold.

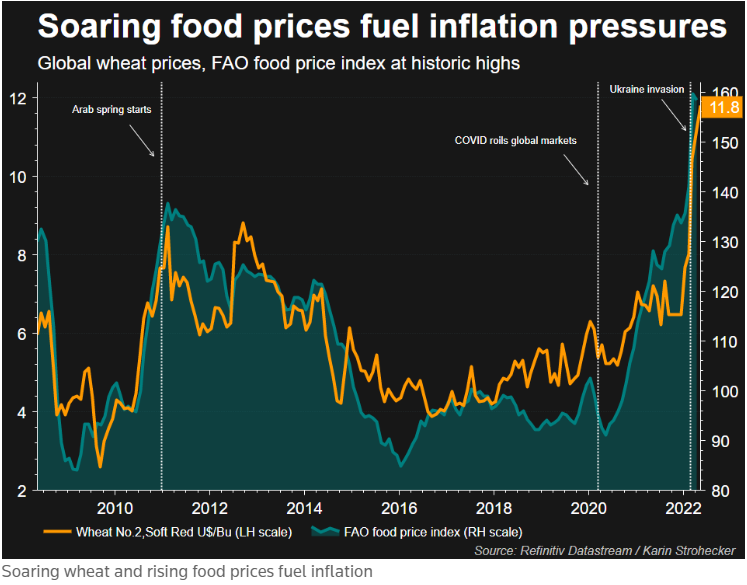

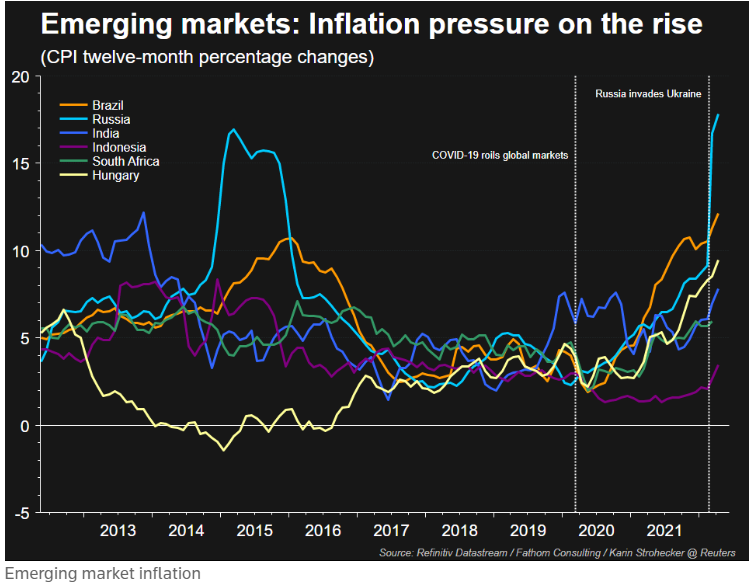

Shifting to Emerging Markets, food price inflation is a major concern. In low income countries food constitutes 40 percent of CPI and with global food prices touching 2 years high, the risks of impending social unrests also increases.

The rest of the story remains the same: emerging market debt is also very high, dollar is gaining strength which makes debt servicing more expensive. Rising energy prices further puts pressure on import bills of energy dependent countries and the overall effect of this is falling reserves that devalue the currency and the viscous cycle never ends.

The point of these weekly articles is only to highlight the global context. I cover these topics not to scare our readers but to give them a realistic overview of what’s going on here.

See you next week with some exciting new episodes of EIA and ECON!