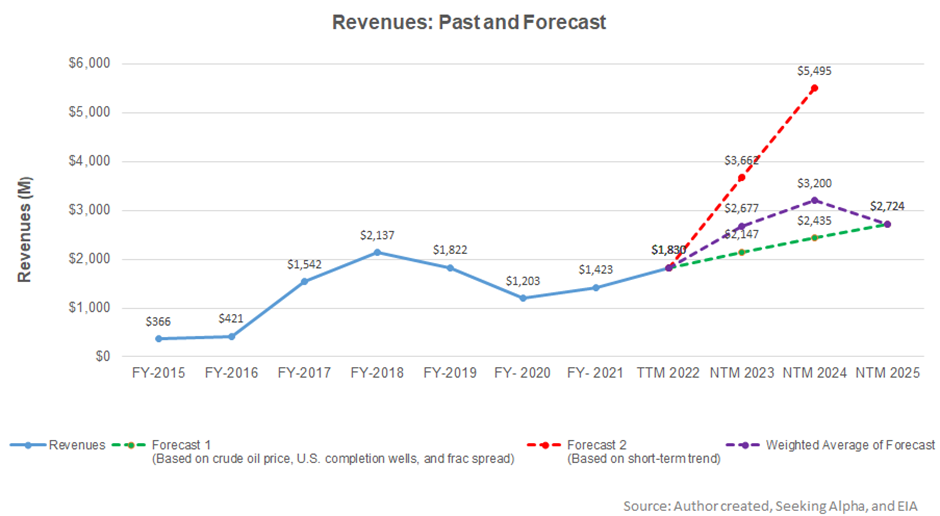

- The revenue estimate is much higher in the next year and stable afterward

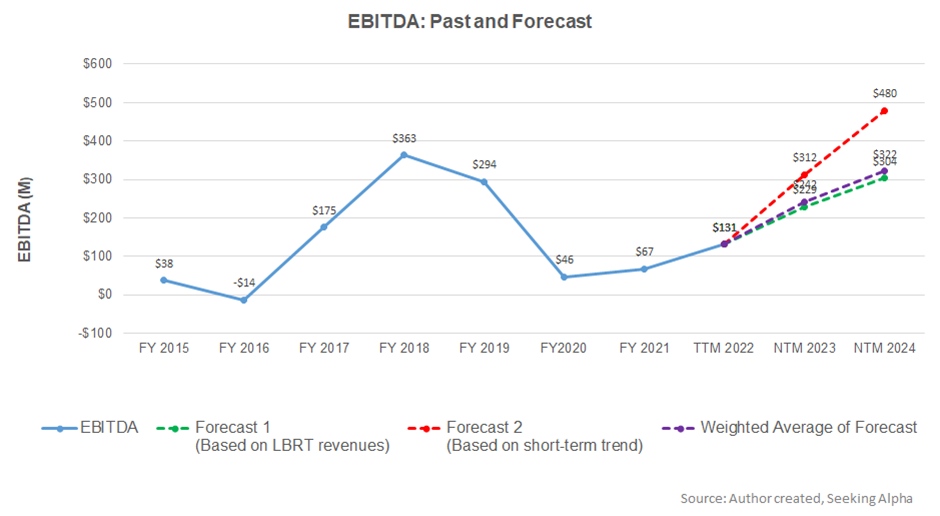

- EBITDA can increase sharply in NTM 2023 but will decelerate in the following year

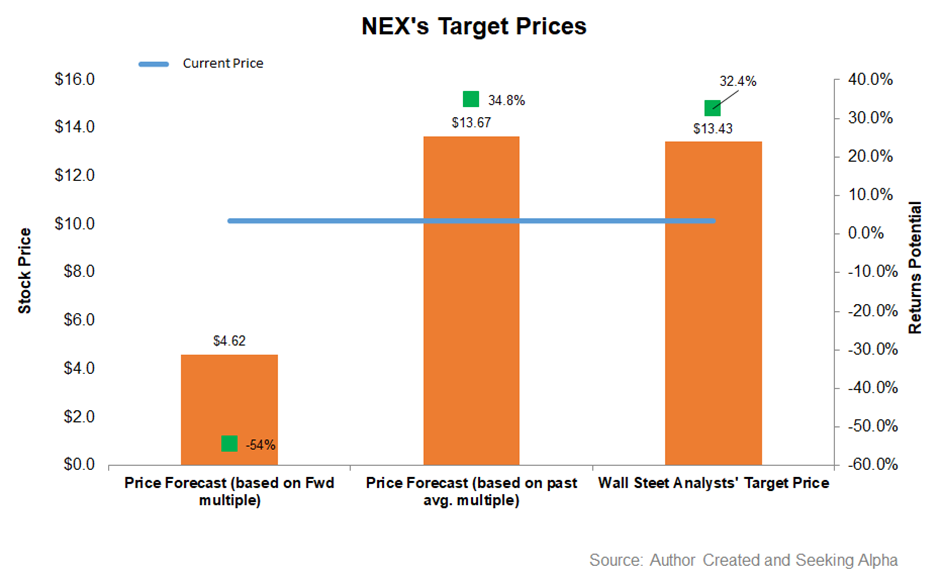

- The stock is undervalued versus its peers at the current level

In Part 1 of this article, we discussed NexTier Oilfield Solutions’ (NEX) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the key industry indicators and NEX’s reported revenues, I expect revenues to increase sharply, particularly in the next 12-months (or NTM 2023). The topline growth can moderate in the NTM 2024.

Based on the regression model using the average forecast revenues, I expect the company’s EBITDA to increase steeply in NTM 2023. It will continue to grow at a more normalized rate in NTM 2024.

Target Price And Relative Valuation

EV has been calculated using the forward and past five-year average multiple. Returns potential (54% downside) using the forward EV/EBITDA multiple (5.9x) is significantly lower than Wall Street’s sell-side analyst expectations (32% upside) and the past EV/EBITDA average (35% upside) from the stock.

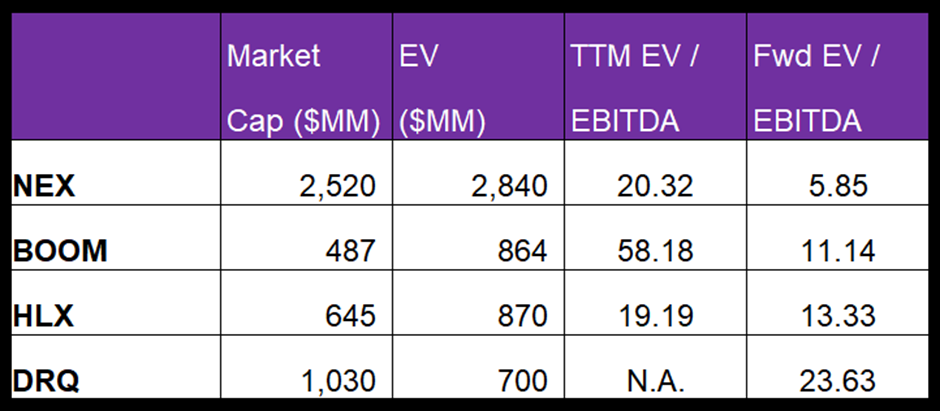

NEX’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is steeper than its peers, which typically reflects a higher EV/EBITDA multiple than the peers. The stock’s EV/EBITDA multiple (20.3x) is much lower than its peers’ (BOOM, HLX, and DRQ) average of 38.7x. So, relative valuation-wise, the stock is undervalued at the current level.

What’s The Take On NEX?

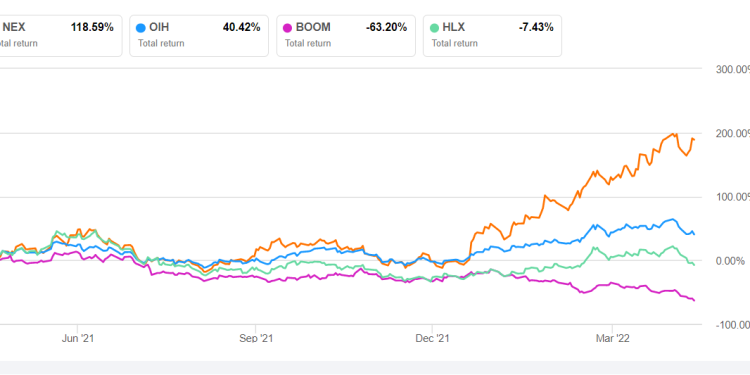

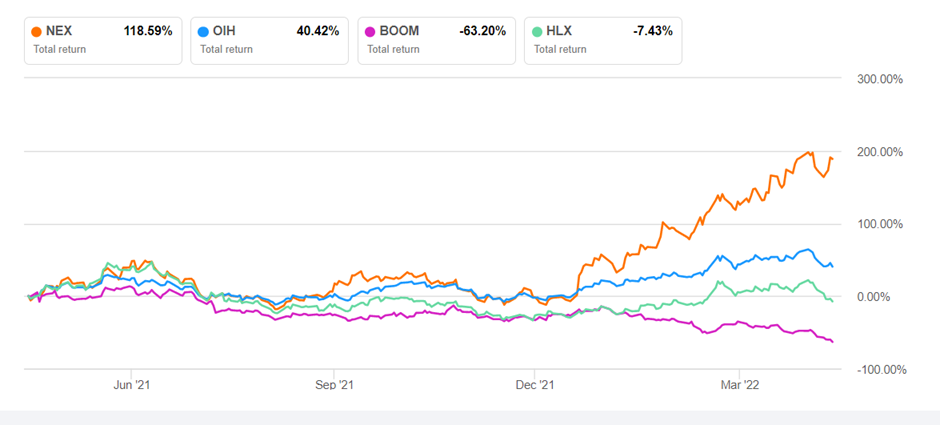

In 2022, the pricing recovery for well-completion services and the frac fleet utilization are accelerating, given the demand-supply balance. Newbuilds with Tier IV capability and electric frac spreads will also replace or enhance the legacy diesel-powered engines, resulting in $10 million in lower fuel costs per year on each fleet. The natural gas-powered fleets also command a pricing premium over conventional diesel-powered frac equipment in an undersupplied market. The fuel cost of NEX’s Tier 4 dual fuel fleets has increased much less than the conventional diesel fleet. So, fielding more of such models can see operating margin expansion in the coming quarters. So the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Although the pricing level remains below the pre-pandemic level, we expect the recovery to accelerate in 2022, notwithstanding the commodity price inflationary costs and their adverse impact in the short term. The cash flow improvement is also a positive given the company’s leveraged balance sheet. The stock is undervalued relative to its peers at this level, encouraging investors to buy it for an upside in the medium term.