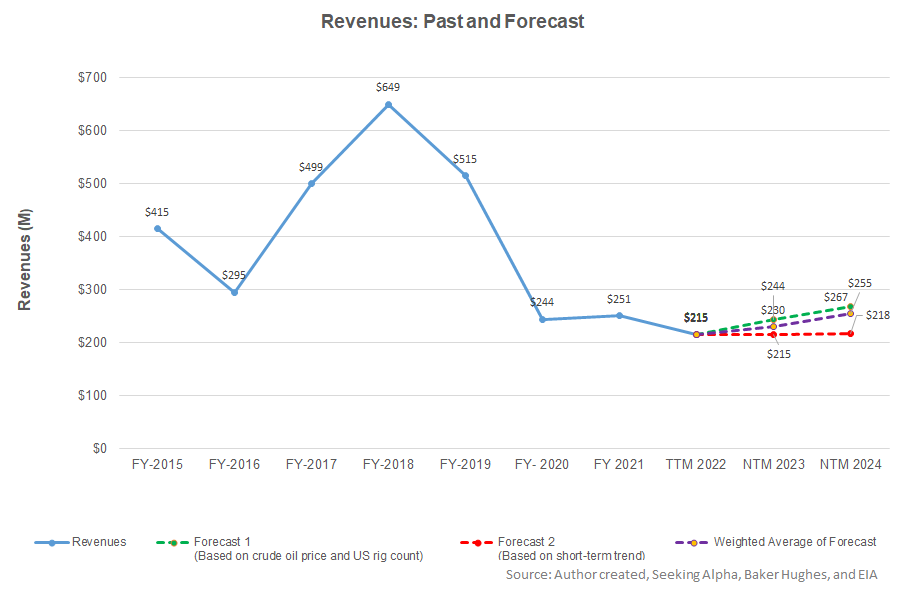

- Estimates suggest revenue growth in NTM 2023, and the growth rate can accelerate in NTM 2024 and NTM 2025

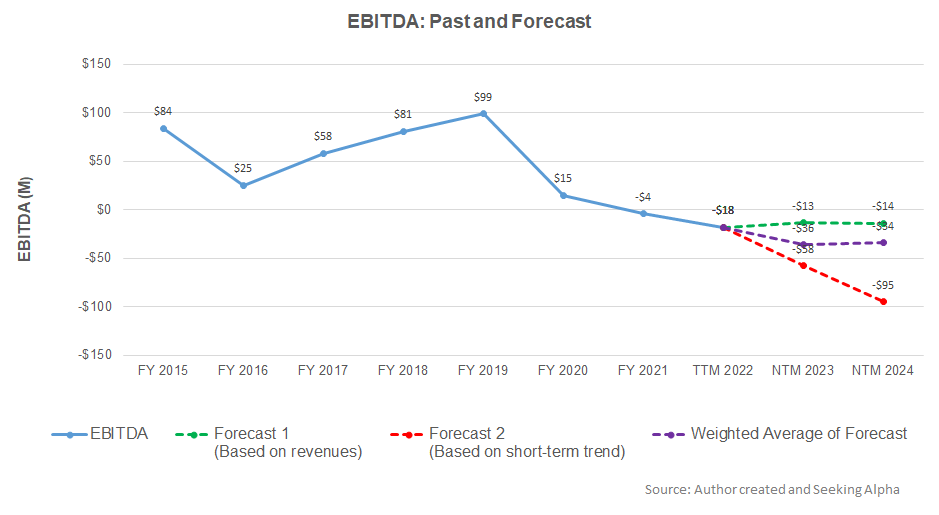

- EBITDA can stay in the red in the next two years

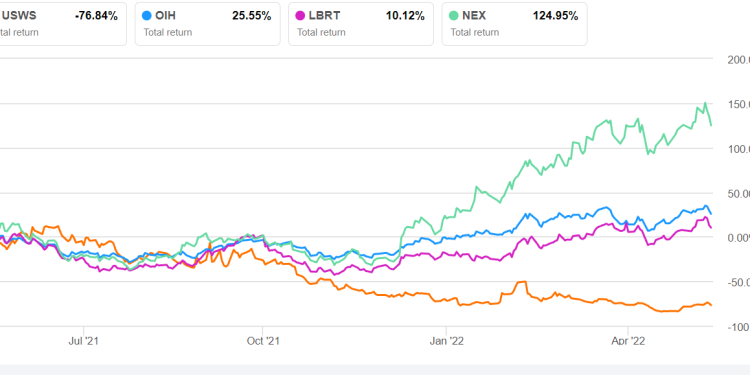

- The stock is relatively overvalued versus its peers at the current level

In Part 1 of this article, we discussed the U.S. Well Services’ (USWS) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and U.S. rig count) and USWS’s reported revenues for the past seven years and the previous eight-quarters, I expect its revenues to increase in the next 12 months (or NTM) in 2023. The growth rate can accelerate in NTM 2024 and NTM 2025.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to deteriorate in NTM 2023. While the EBITDA will remain negative in NTM 2024, it will improve compared to the previous year.

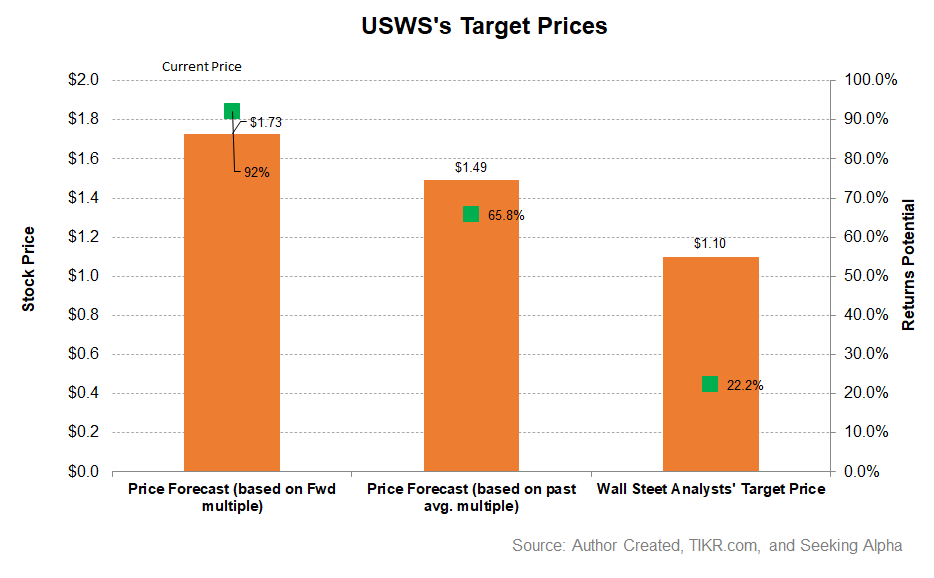

Target Price And Relative Valuation

Returns potential using the past average EV/Revenue multiple (1.26x) is lower (66% upside) compared to the forward EV/Revenue multiple (92% upside) but higher than the sell-side analysts’ expected returns (22% upside) from the stock.

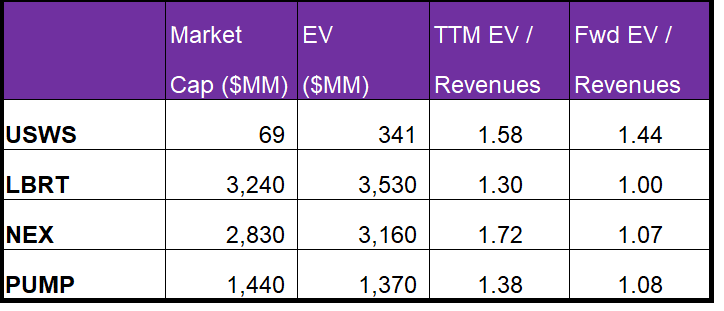

USWS’s forward EV-to-Revenue multiple cotraction versus the current EV/Revenue is less steep than the EV/Revenue multiple contractions for its peers. This typically results in a lower EV/Revenue multiple. The company’s EV/Revenue multiple (1.58x) is higher than its peers’ (LBRT, NEX, and PUMP) average of 1.47x. So, the stock is overvalued versus its peers at this level.

What’s The Call On USWS?

USWS’s medium-term outlook is promising as plans to roll out four Nyx Clean Fleets by the end of 2022. Over the past several months, the company signed several vital contracts. As the length of contracts extended, its revenue and gross profit contribution per fleet should improve, too. In today’s scenario, electric pumps are fetching higher revenue per fleet because of their cost advantages over diesel fuel pumps and lower carbon footprint.

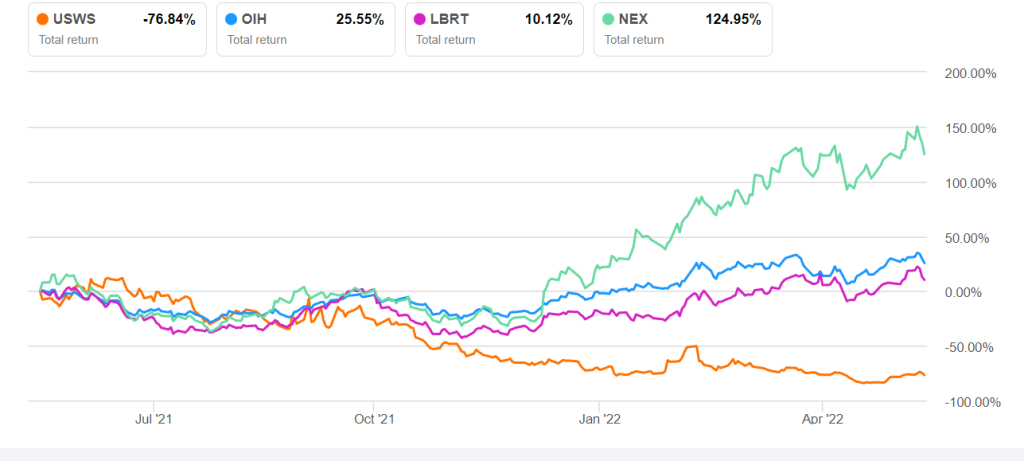

The stock is relatively overvalued at the current level. On the other hand, the cost inflation will affect its margin adversely in the near term. Plus, the negative shareholders’ equity signals significant financial risks, especially when combined with negative cash flows. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Given the overall risk level, I would suggest investors avoid the stock for now.