- FTI’s Subsea 2.0 model helps address the future technology needs, leading to improvements in contractual arrangements

- In subsea, order opportunities totaling more than $20 billion remain across Brazil, Guyana, and West Africa

- The share of inbound orders coming from smaller unannounced project awards increased in Q1

- Cash flows turned deep into the negative territory following the adverse effect of timing differences on project milestones and vendor payments

The Subsea And LNG Market Activity Rises

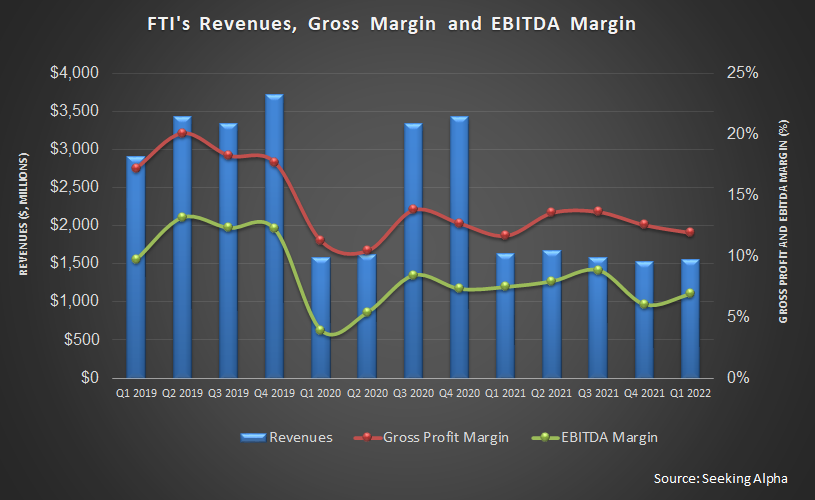

Since 2021, FTI has concentrated on the iEPCI (integrated engineering, procurement, construction, and installation) projects, primarily in the Subsea segment. Approximately 87% of the company’s total inbound orders ($2.3 billion) were from the Subsea segment in Q1 2022. The expanding LNG market would allow the subsea inbound order growth to grow by 30% in 2022. The management expects iEPCI, direct awards, and Subsea services to account for 75% of its inbound orders. In May, it received an EPCI award from Equinor for the manufacture and installation of flowlines and the installation of umbilicals and subsea structures on the Norwegian Continental Shelf.

On the Subsea 2.0 product platform, the configure to order (or CTO model) would deliver a competitive offering. The model eliminates design engineering, utilizes pre-approved suppliers and standard configurations, and leverages configurable assemblies. The CTO model enabled FTI to reduce inventory from the balance sheet and reduce lead time by eight months. The company estimates that these advantages can result in a 25% reduction in cost and a 50% reduction in product delivery time.

As I discussed in my previous article, FTI’s significant investment in renewable energy is transitioning to alternative energy. The company plans to build new initiatives on offshore wind, wave and title energy, hydrogen, and greenhouse gas removal. Its management expects to realize $1 billion inbound orders in offshore wind, wave and title energy, hydrogen, and greenhouse gas removal by 2025.

FY2022 Outlook And Forecast

FTI’s FY2022 guidance remained unchanged in Q1 from the previous guidance (as in Q4 2021). The Subsea market outlook is robust, with opportunities totaling more than $20 billion across Brazil, Guyana, and West Africa. There is a growing demand for feed gas used in LNG facilities, most of which are supplied by Subsea wells. FTI can meet the demand for increased activity in major basins from Africa to Asia-Pacific.

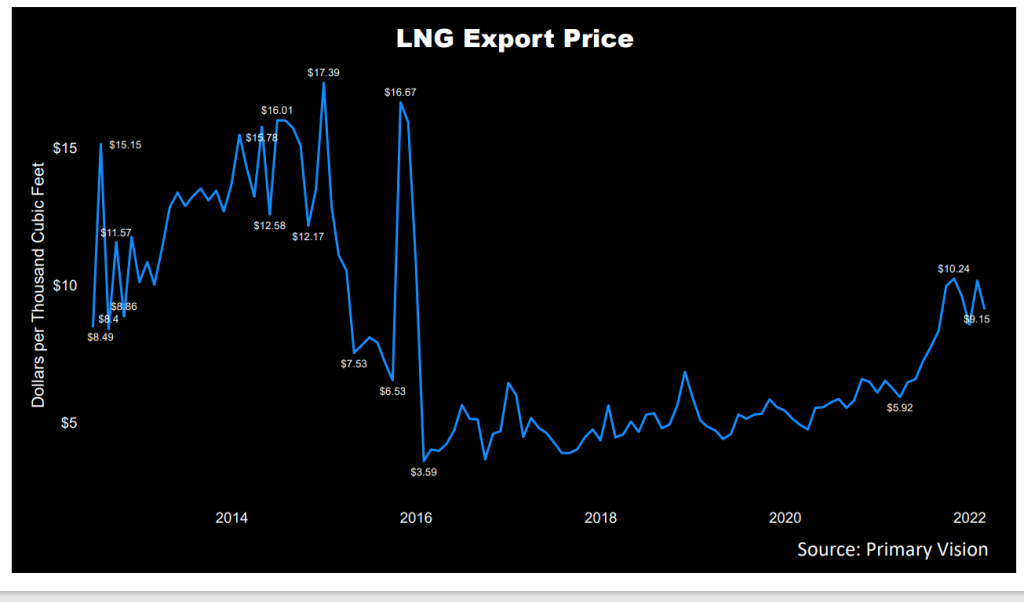

LNG Price Weakened In May

In the past year, the US LNG export price increased by ~46% until March 2022, although it was lower than the previous month. According to EIA, the natural gas consumption in the Gulf Coast and Southeast fell by 1% in the last week of May. Similarly, the deliveries to LNG export terminals in South Texas and South Louisiana fell during the week. Overall, US LNG exports decreased by one vessel in the last week of May from the previous week.

Key Projects And Technip Energies Sale Update

FTI announced two key projects in Q1 – the Petrobrasis Buzios 6 greenfield development and Wintershall as Maria revitalization iEPCI project. The company will help lower operators’ carbon footprint. During the quarter, ~40% of the inbound order came from smaller unannounced project awards, including projects for more than 30 operators. Also, in April, it completed the sale of Technip Energies for $1.2 billion.

Subsea Segment: Performance And Outlook

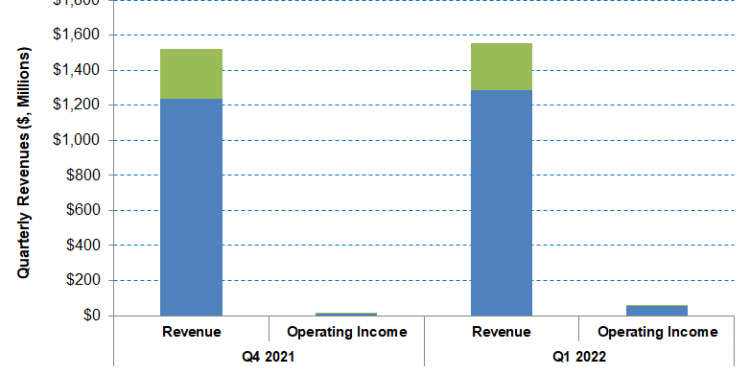

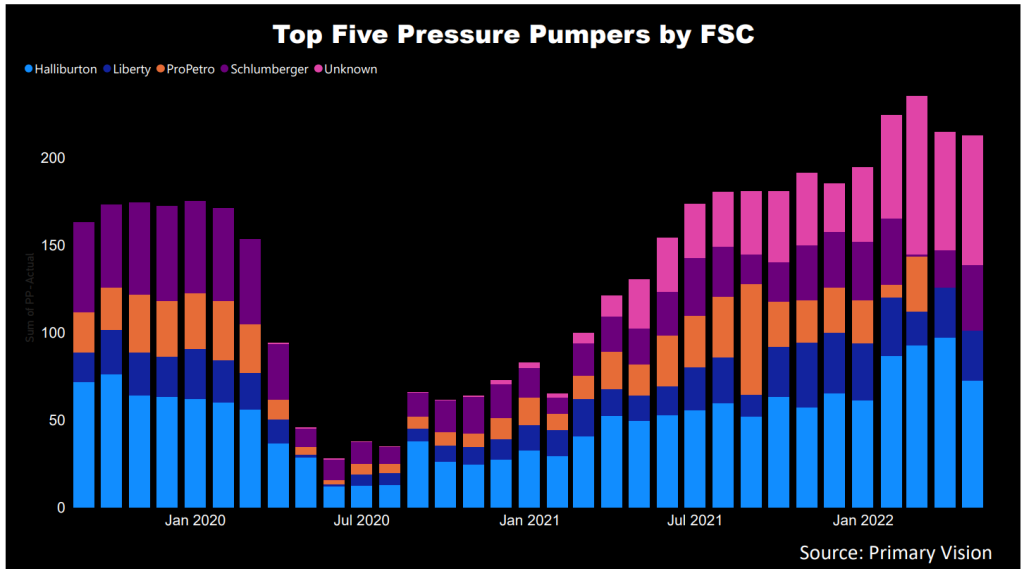

FTI’s Subsea segment revenue increased by 4.3% in Q1 2022 compared to Q4 2021. The segment operating income increased sharply during this period. Higher project activity in Australia, North America, and Asia led to revenue and operating income growth in Q1. The US rig count has increased by 21% in 2022, continuing with the momentum gathered in Q4 2021. The crude oil price curve has steeped, rising by 51% in 2022. As estimated by Primary Vision, the frac spread count has mirrored the rig count’s growth.

Surface Technologies Segment: Analyzing Recent Performance

Quarter-over-quarter, FTI’s Surface Technologies segment declined by 7% in Q1 2022. Inbound orders in the segment decreased by 73% compared to a quarter ago. Operating income fell sharply, by 58%, during this period. Lower international activity resulting from its transition to the new manufacturing facility in Saudi Arabia contributed to the income fall. However, an improving pricing environment in North America partially offset the adverse effects in Q1.

Cash Flows and Balance Sheet

FTI’s cash flow from operations (or CFO) deteriorated sharply and turned negative in Q1 2022 compared to a year ago. Although the revenue decrease was modest in this period, the adverse effect of the timing differences on project milestones and vendor payments led to the steep fall in CFO. So, free cash flow also turned significantly negative in Q1 2022 versus a year ago.

FTI’s debt-to-equity ratio (0.57x) is lower than its peers’ (SLB, BKR, HAL) average of 0.84x. It expects to reduce gross debt by up to $400 million in Q2. As of March 31, 2022, its liquidity (cash plus investments plus availability of borrowings under the revolving credit facility) was $2.2 billion. So, despite having the bulk of debt on the balance sheet, it has sufficient liquidity to cover the financial risks.

Learn about FTI’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.