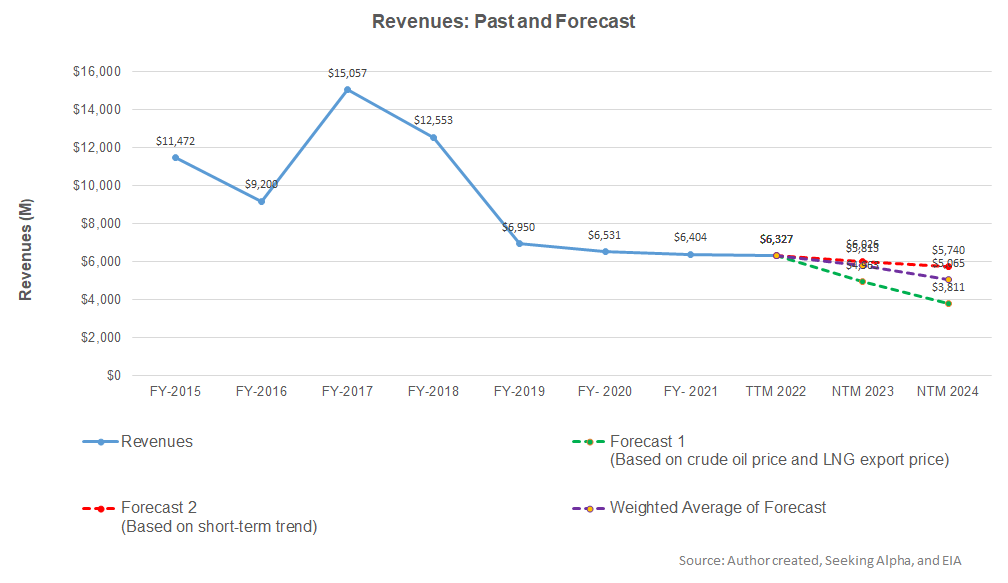

- Estimates suggest a revenue fall in NTM 2023, while the rate of decline can accelerate in NTM 2024

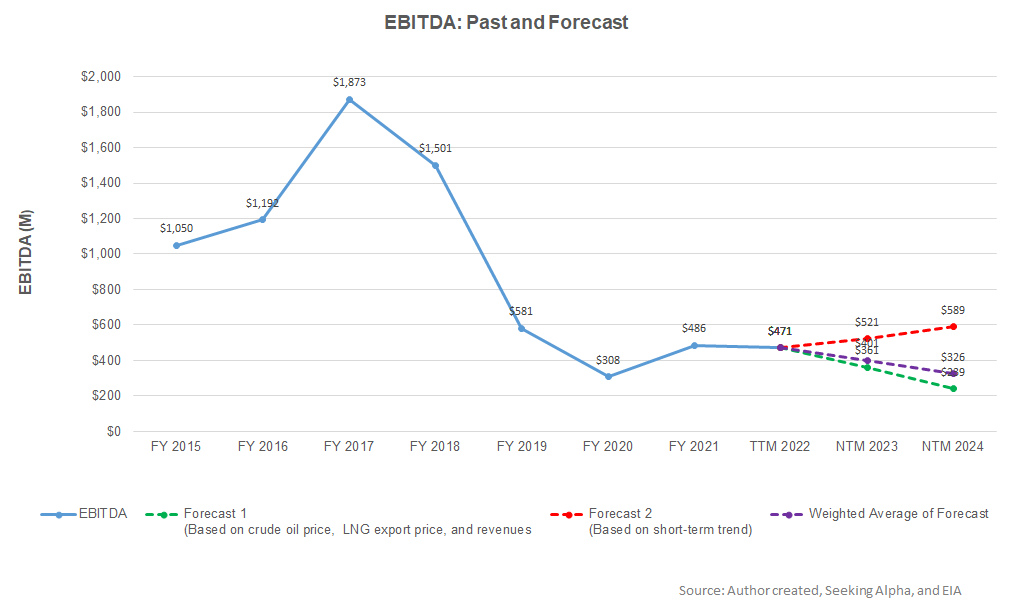

- EBITDA, too, can fall in NTM 2023 and NTM 2024

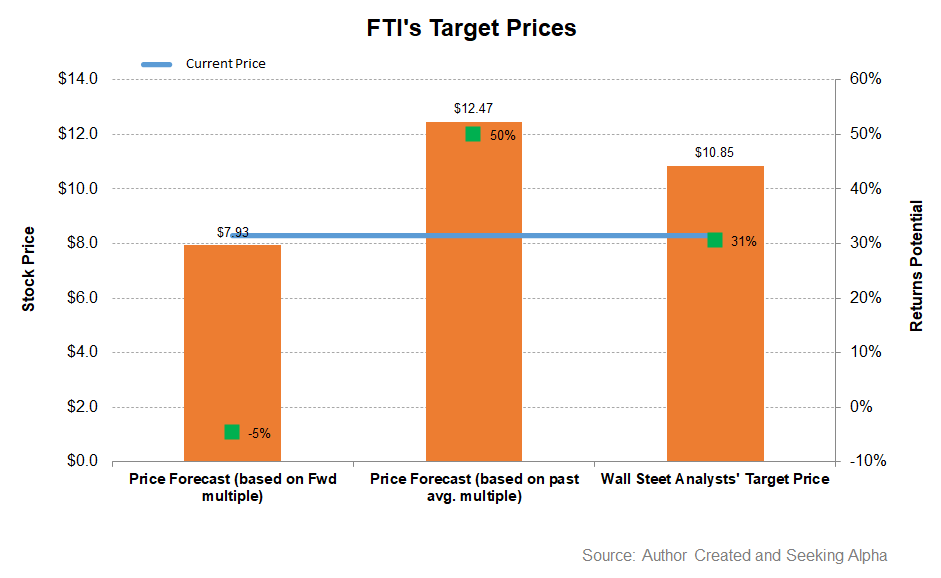

- The stock is relatively undervalued; the model suggests it can have an upside at the current level

Part 1 of this article discussed TechnipFMC’s (FTI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and LNG export price) and FTI’s reported revenues for the past seven years and the previous four quarters, its revenue is expected to decrease steadily in the next 12 months (or NTM) in 2023. The decline rate can accelerate (i.e., revenues can fall further) in NTM 2024.

Based on the same regression models and the forecast revenues, the company’s EBITDA will likely decrease in the next two years.

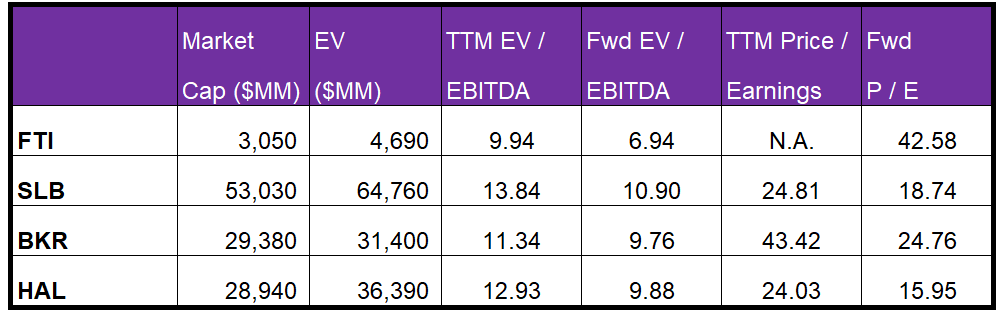

What Does The Relative Valuation Tell Us?

FTI’s forward EV-to-EBITDA multiple contraction versus the adjusted EV/EBITDA is steeper because its EBITDA is expected to rise more sharply than its peers in the next year. This should typically result in a higher EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple (9.9x) is lower than its peers’ (SLB, BKR, and HAL) average of 12.7x. The stock is relatively undervalued at this level compared to its peers.

Analyst Target Price And Rating

Returns potential using the past average EV/EBITDA multiple (5.1x) is higher (49% upside) compared to the returns potential using the forward EV/EBITDA multiple (7% returns) and the sell-side analysts’ expected returns (31% upside) from the stock.

According to data provided by Seeking Alpha, 16 analysts rated FTI a “buy” in May (including “Strong Buy”), while eight recommended a “hold.” None of the sell-side analysts rated it a “sell.” The consensus target price is $10.9, which yields ~31% returns at the current price.

What’s The Take On FTI?

The US LNG export price has increased steeply over the past year as supply tightens amidst the geopolitical situation in Europe after the Russian invasion. The expanding LNG market allows the subsea inbound order growth to grow by 30% in 2022. The subsea market offers more than $20 billion in opportunities across Brazil, Guyana, and West Africa. On the Subsea 2.0 product platform, its CTO model would deliver a competitive offering. It also reduced inventory from the balance sheet and eight-month lead time. The share of inbound orders coming from smaller unannounced project awards has increased, thus broadening the revenue base.

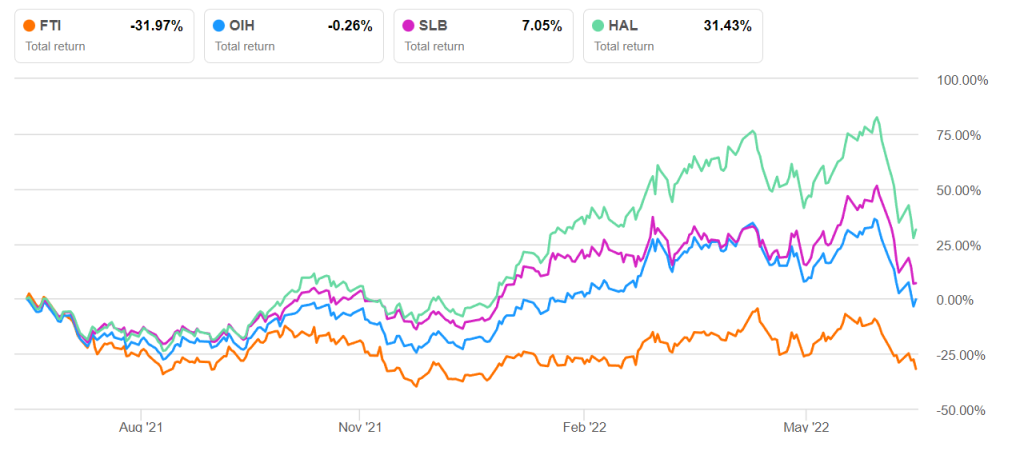

However, the LNG export price decreased as the natural gas consumption, and deliveries to LNG export terminals in some regions in the US fell in May. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Over the long term, the company focuses on building a robust renewable energy portfolio through offshore renewables and green hydrogen. Despite negative cash flows in Q1, robust liquidity will cushion against any cash flow pressure. The company also has margin headwinds following its transition to the new manufacturing facility in Saudi Arabia. Given the relative undervaluation compared to its peers, I expect returns from the stock price to strengthen.