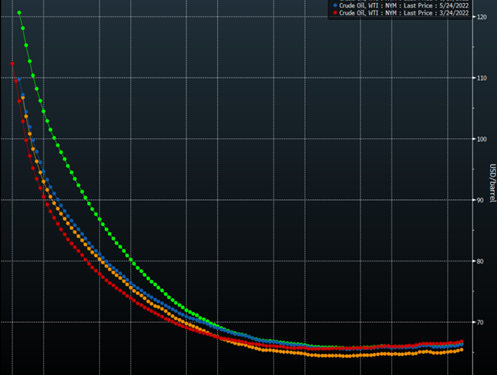

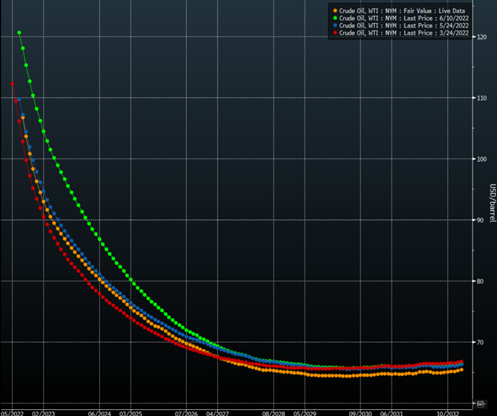

Crude prices have had a sizeable drop over the last week as the front of the curve moved lower and the belly of it softened. The long-term trend is still holding around $65 that will support the sanctioning of additional projects in the global market. Even at the reduced price, we are still in steep backwardation that will keep activity in the U.S. moving at a steady clip. We don’t see a pivot in our activity predictions as the front of the curve normalizes a bit vs the previous extremes. As I outlined in a piece I did for Anas Alhajji. I think crude prices remain range bound (as outlined in answer 3) as the market prices in a global recession (that we do a deep dive on in the later pages). Demand will remain muted with physical pricing showing some slowdowns in price premiums. BUT- they are still trading at premiums just softening premiums that helped push down the front month. We have already done a deep dive on the comments coming from the White House, and why those ideas won’t solve the problems we face. China imports remain muted after taking in a huge swatch of crude that is still in storage. We expect to see a step up in flows, but as some of these Russian vessels “go dark”- they will attempt to hide their end destinations. We know the cargoes will end up in China/India- so it won’t be a surprise at all.

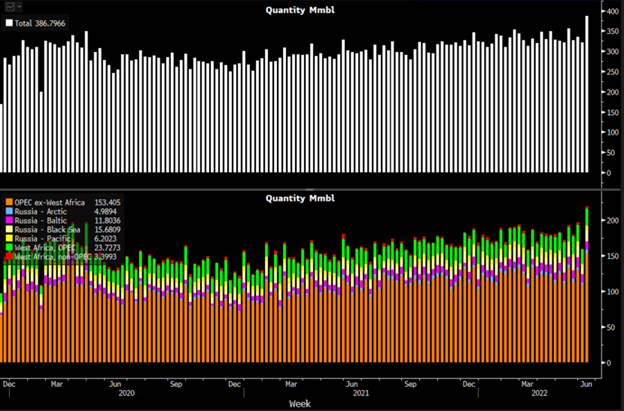

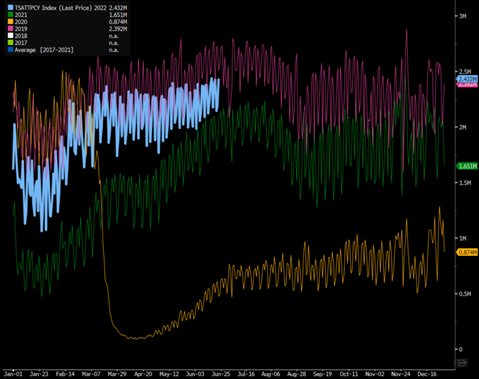

The below chart helps to put into perspective just how much Russian crude is flowing into the market. OPEC in general has seen a step up in flows with a large part flowing into Europe and the U.S. as Russia flows to Asia.

1-As Russia’s foreign minister Sergei Lavrov visits Saudi Arabia before OPEC+ monthly meeting, do you expect any changes to OPEC+ plan on Thursday? In your view, are there any oil-related significance to his visit?

Regarding end of year Russia wants to maintain their presence in the agreement and find a long-term path forward to be a part of OPEC. Russia was coming from a point of strength and was able to dictate terms on production schedule that were favorable to their portfolios. Their position on the global stage has weakened, and I think this was the first in a long serious of negotiations to maintain their status within the organization. Russia is also struggling with equipment and labor shortages driven by sanctions, and I am sure this was a big part of the conversation. Inventory of parts is dwindling, and they need to find ways to circumvent sanctions to keep operations stable.

2-In your view, how will OPEC+ look like after the current production deal ends toward the end of the year when they go back to pre-COVID-19 production levels while EU sanctions on Russian oil imports kick in immediately after that? In other words, what changes are expected in January 2023 and thereafter?

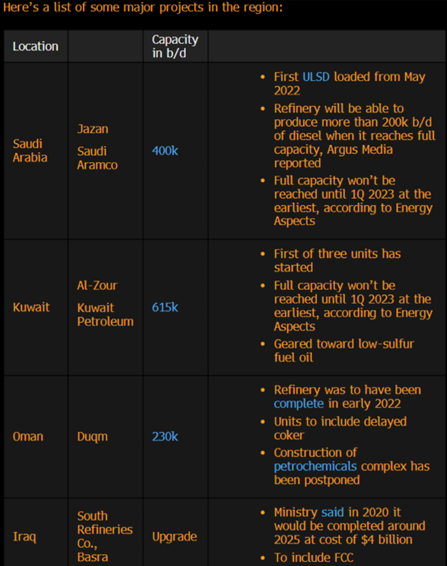

I believe that Russia will remain within the OPEC organization, but we will see their role be diminished. The Middle East nations will produce closer to their quota, but I expect a bigger jump in refined product exports as new facilities come online. There is a record amount of crude on the water (outside of 2020) driven by an increase in miles per ton and elevated floating storage around the world. Production in West Africa remains hindered as Asia purchases cheap crude from Iran, Venezuela, and Russia leaving WAF cargoes floating offshore at record levels. Nigeria, Angola, and Congo are not incentivized to produce at allotted levels given the difficulty they are having to clear even reduced loading schedules. Until we see these cargoes moved into the market, I expect West African nations to produce well below their quotas while Saudi Arabia and Kuwait export more product into the Atlantic Basin. Production will remain elevated out of the Middle East countries, but West Africa will continue to disappoint as Russia takes market share driven by steep discounts.

3-Where do see oil prices heading in the second half of 2022?

I think we see prices range bound at this point with the higher end hitting about $118 WTI with the downside at about $112. The global gasoline glut is growing with near record or at record levels around the world, which will weigh on the crude slate refiners run. The middle distillate shortfall will keep refiners active since the crack can carry a weak gasoline (light distillate) cut, but it will push refiners to run a heavier slate to maximize middle of the stack output and limit gasoline production. As these dynamics hit in July/August, it will put more pressure on crude pricing and shift it down to its previous range of $102-$108. I would say the second half of ’22 averages something around $103/$104.

4-Does OPEC+ decision today single additional increases in September to compensate for the decrease in Russian oil exports?

Yes, I think the Middle East nations will increase exports to supplement some of the lost Russian exports into the European and U.S. markets. Kuwait has also accelerated the completion of the Al-Zour refinery to capture the healthy spread in the Atlantic Basin refined product market as Russian diesel is displaced by sanctions. West Africa still has a large amount of floating storage they could sell into the NW Europe and U.S. markets, but they have been hesitant to be more competitive on spreads. As Asia purchases even more discounted Russian cargoes, Middle East and WAF crude will see an increase in exports into Europe and the U.S.

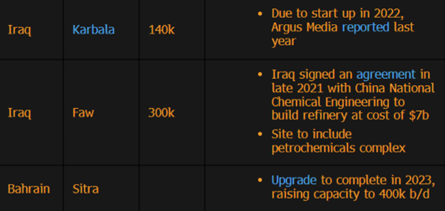

The below is a list of refiners that will be coming on this year helping to close some of the gap for middle distillates. Refiners in the Middle East will process 8.8 million barrels a day of crude in 2023, according to estimates from the International Energy Agency. That’s about 1 million barrels a day above 2019 levels, which would roughly compensate for the amount that Europe will lose over the period.

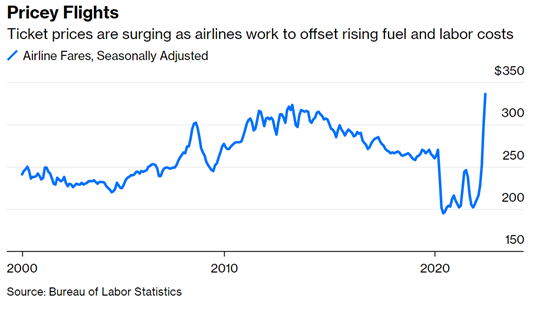

The issue on refined product demand continues to point to more downward pressure as prices stay elevated and the consumer feels the pain. Not only is it TERRIBLE to fly right now- but it is costing the most going back through 2000 to do so.

It is a key reason we expect passenger counts to remain below 2019 numbers, which has so far remained the case.

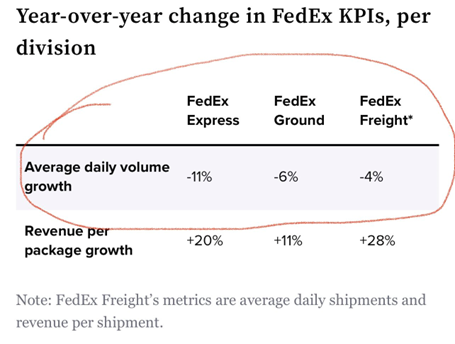

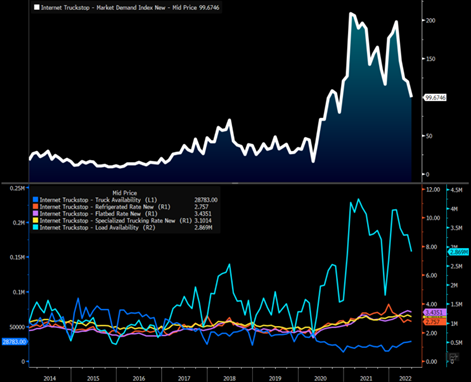

Diesel demand continues to trend well off the 2021 highs, and we see more downward pressure as inventories spike across the supply chain. Prices remain prohibitive keeping demand capped.

Demand is still “above” normal but no where near those 2021 levels- as the economy slows further we expect more downside pressure to these figures.

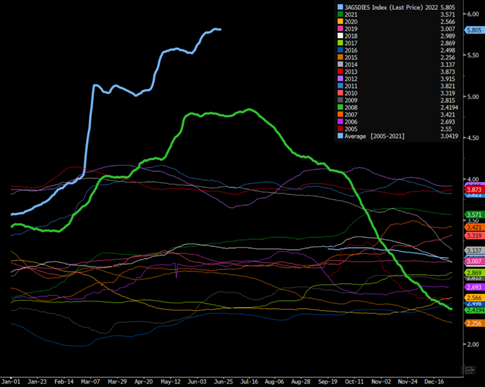

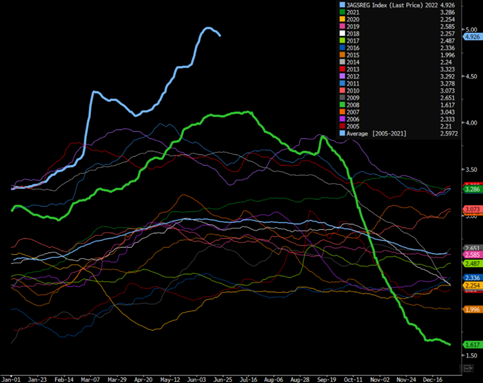

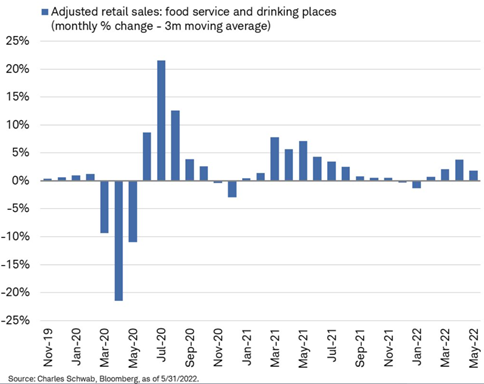

The data continues to support our view that gasoline demand will sit between 9.1M-9.3M barrels a day as prices remain elevated and consumers adjust to the elevated prices. Restaurant/bar data is showing a slowing trend, which normally increases in the summer months as consumers reduce spending habits. We have more on that specific piece below. It is just important to consider the current price of gasoline and diesel- especially against 2008 numbers. There are some key differences between the two- and it is refining capacity and the availability of heavy crudes. We believe that gasoline storage will build and prices will fall “faster”, but there is a structural issue when it comes to diesel and the available crudes to make the distillate cut. As demand slows, it will put pressure on diesel prices, but it won’t have the same impact as in 2008 as supply remains constrained even as demand slows. Global trade is slowing and trucking pressure grows- but we are starting at an aggressively low storage level around the world which limits supply. There is a lot of support for diesel prices at about $3.40 even if demand swoons similar to 2008.

Diesel Prices 2022 vs 2008

Average US Gasoline Retail Prices

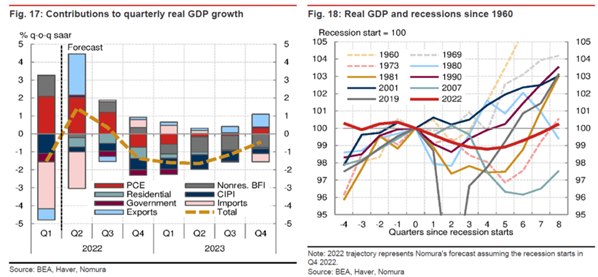

We have our first major bank predicting a 2022 recession! In terms of annual changes, Nomura lowered its real GDP growth forecast in 2022 to 1.8% yo-y (-0.3% Q4/Q4), down from 2.5% (1.4% Q4/Q4). In 2023, we expect real GDP to decline 1.0% y-o-y (-1.2% Q4/Q4), down from +1.3% (+0.6% Q4/Q4).

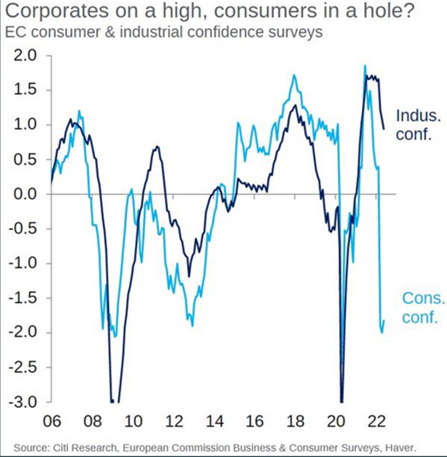

Europe is in a MUCH worse spot than the U.S., but the expectations haven’t adjusted enough for some analysts. The market is just catching up to the issues that the U.S. is facing, but things in Europe are even worse than they are here.

Some estimates are finally being adjusted, but there is still more to go as analysts and wall street in general adjust growth profiles. We have covered extensively how things are slowing, and why things are getting worse as trade slows and the consumer stops spending. In an early discussion, I covered the drop in manufacturing and utilization but not until the consumer really stops (retail sales just went negative) does the pain really start to set in. I think the retail sales mixed with central banks still raising rates that is going to shake people out of their stupor.

The shift in the consumer is being reflected in the inventory to sales ratio pivot:

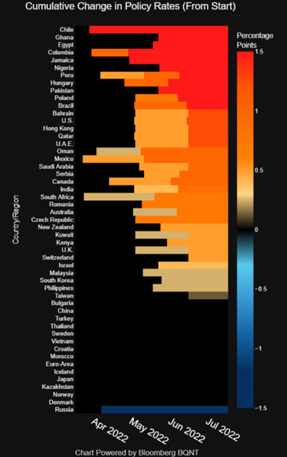

Just to put into perspective the amount of rate hikes over the last few days:

What I find the most shocking piece of this information- people are the “most bearish” since the Great Financial Crisis- but yet still positioned massively bullish as retail STILL “Buys the Dip!”

According to the latest EPFR data, investors plowed a whopping $16.6bn to stocks, all of it passive of course, with $32.3BN to ETFs offset by $15.7bn from mutual funds, bringing the YTD ETF inflows to $328BN vs $117BN in long-only outflows. “Despite the large market correction, flows into equity funds (ETFs and mutual funds) have been robust (cumulative $210bn year to date or 1.2% of AUM)” – DB

We now have consumer sentiment at the lowest level on decades, rates rising around the world, housing nosediving, retail sale slowing, layoffs accelerating, and inflation giving way to stagflation… So Buy the Dip?

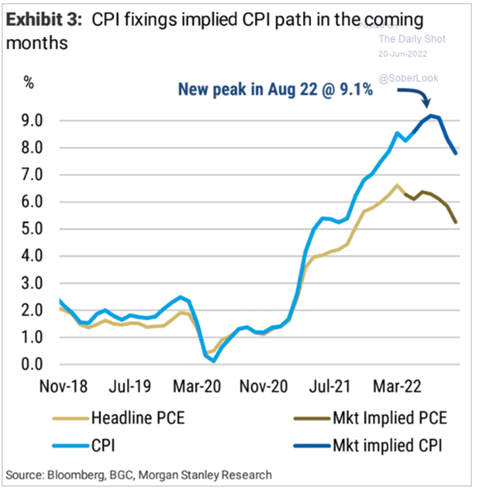

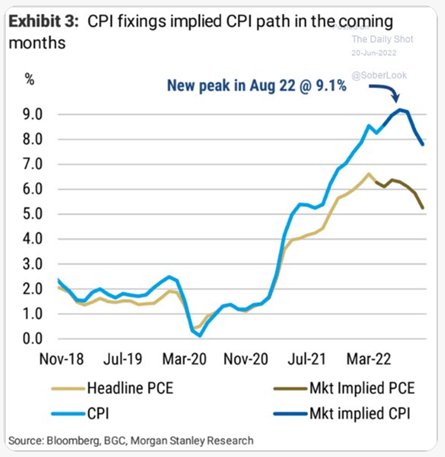

The market is starting to wake up to the likelihood of U.S. CPI hitting over 9% by the end of the summer. It holds with our view that the “rate of change” slows, but the upward trajectory still holds firm to the upside. Housing and other “sticky” components will be the driving force behind the push higher on pricing pressures. The international prices keep moving higher, which will keep our import prices elevated. The strong dollar will help insulate us a bit, but the pricing pressure will remain keeping us pinned near the highs.

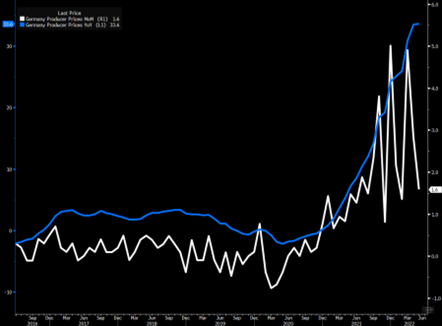

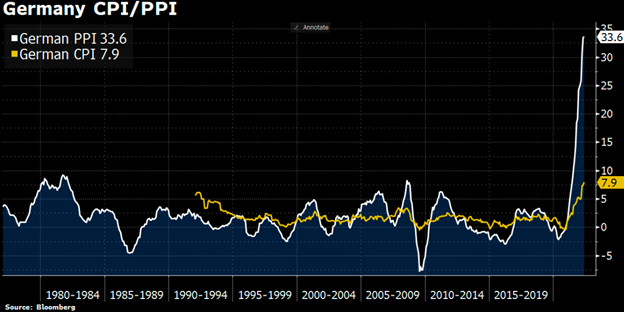

For example, inflation pressure keeps rising in Germany. German PPI jumped by 33.6% in May YoY, the highest increase ever since the start of the statistic in 1949 driven by electricity prices rising by 90.4% year over year and fertilizers/ nitrogen compounds (+110.9 %). The input prices (Produce Price Index) still remain at record levels, which is a leading indictor for local inflation and a rise in export prices. These are prices that U.S. will be importing across all things including cars and steel.

It also signals way more pain for Europe’s largest economy. When you look at the difference between PPI and CPI- things are just starting on the local level.

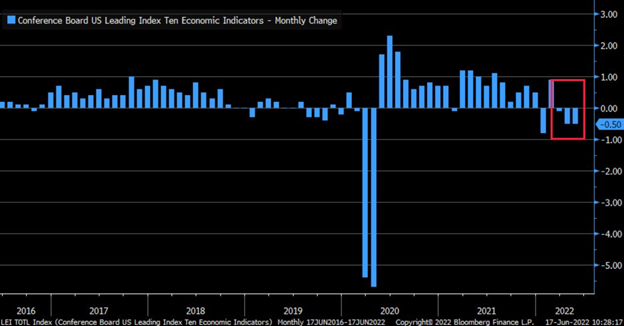

The U.S. leading indicators are starting to show softer data for May, and we believe this clearly followed through into June- especially when you consider retail sales (even when not adjusted for inflation) was negative. There is still enough growth in Q2 to eek out a small positive GDP print- but it leads to a bigger issue for Q3 and Q4.

The trend accelerated to the downside and is now sitting at the lows.

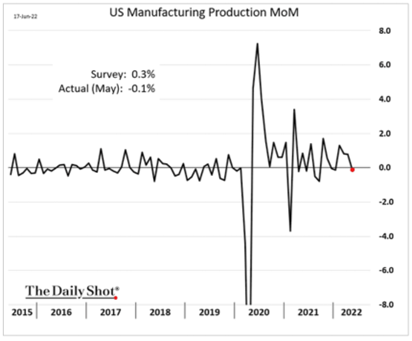

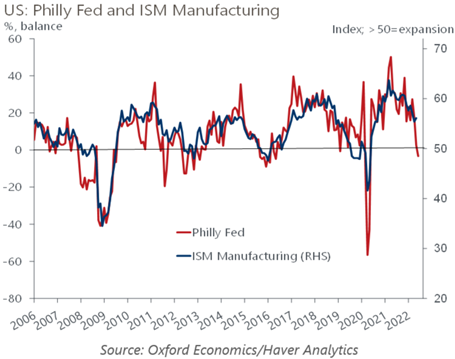

U.S. manufacturing is also starting to show some cracks with the first negative print of 2022. We expect to see this accelerate in June given the build up in inventory and slowing retail consumer.

The first “crack” is usually when manufacturing capacity utilization peaks and starts to roll over. It is still early, but we have a signal that must be tracked over the next few months. The new orders we discussed in previous writings from Fed leading data are all negative. This is why we think U.S. manufacturing and capacity is heading down.

This chart does a great job of showing what is going to drive that lower:

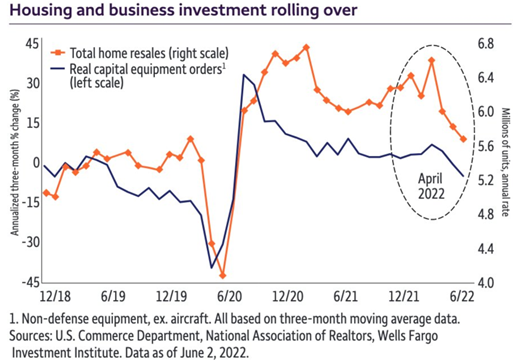

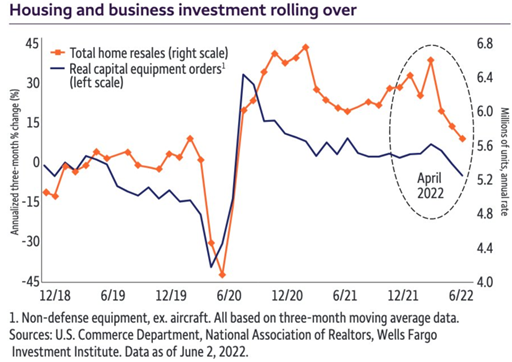

The follow through is going to be with the housing and business investment dropping and will pull down 2H’22 estimates. Housing and business investment in the US are tumbling as the economy continues to weaken in to an all but inevitable recession because housing represents 15-18% of GDP, this is a meaningful econometric to watch closely, with existing home sales numbers posting tomorrow.

When we factor all these leading indicators together, we see a broader drop in the US data that will move into contraction over the next 2-3 months.

The markets have been moving violently, but not making all that much progress in either direction. It may feel like you have aged a lifetime, but we have just been running in place for the last week or so.

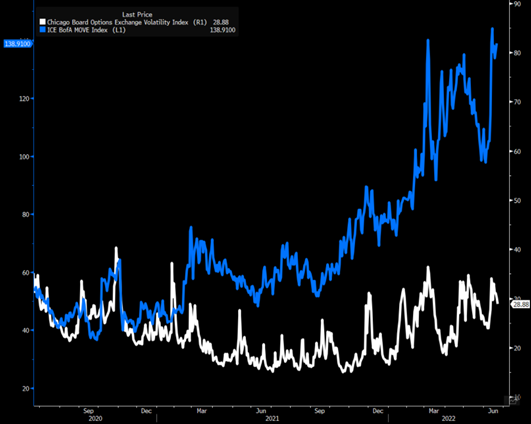

These moves are sending the VIX back towards 30, but the MOVE index (a measure of bond volatility) has spiked right back to the highs. The bond market continues to send flashing warning signs that the equity market is slowly waking up too. The VIX (measuring equity volatility) has started to creep back above 30 and holding close to this pivotal position.

We expect volatility to keep growing as recession fears grow following another round of weak data- especially some key leading indicators. The message from US factories is pretty clear that activity is turning lower. Demand is slowing down (new orders), helping delivery times normalize and taking upward pressure off prices. There are competing factors when we are talking about prices, and the data continues to support range bound movements that will “slow” the rate of change higher and pivot further into stagflation. The US economy had enough juice to show growth in Q2, but things are shifting hard as the Fed has limited choices as they step up the tightening campaign.

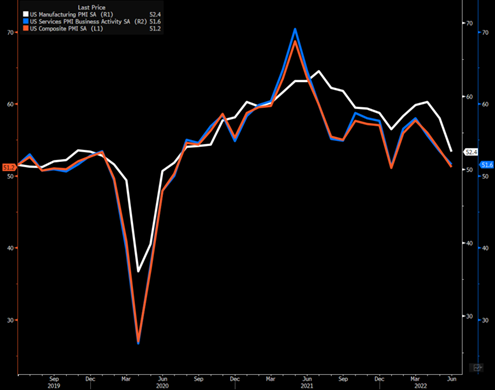

The U.S. flash PMI data came in well below estimates and show a continuation of the slowing activity we have discussed previously. For Composite Index: -First contraction in new orders since July 2020 -New export orders contracted at steepest pace since June 2020 -Pace of input price inflation slowest in 5 months -Slowest employment gains since February -Business confidence lowest since September 2020. The data came in as follows: U.S. Mfg PMI (preliminary read) dropped in June to 52.4 vs. 56 est. & 57 in prior month; Services PMI fell to 51.6 vs. 53.3 est. & 53.4 in prior month; Composite PMI (shown in chart) fell to 51.2 vs. 52.9 est. & 53.6 in prior month.

The chart helps to show the rapid roll-over in activity that has more pressure to the downside.

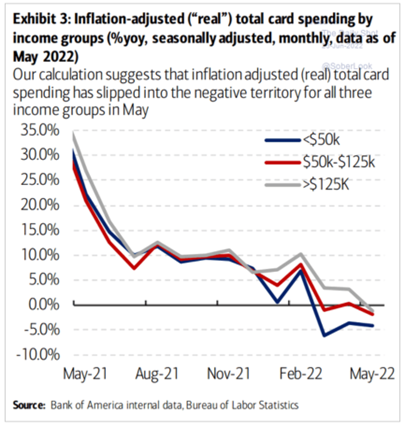

The consumer is the largest driver of U.S. GDP growth, so it is important to account for their financial health and spending activity. Spending has been moving in the wrong direction with “real” spending well below normal and heading lower. It is always important to make the distinction between “value” and “volume” because people can be spending more (value) but getting less stuff (volume) due to the price increases.

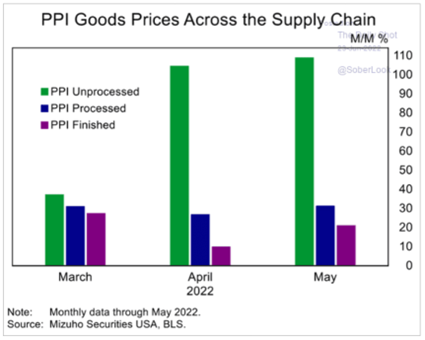

The leading indicators on inflation point to more pricing pressure- you can see the “pace” is slowing and supports more stagflation and not another huge surge in CPI. It points to more pressure ahead.

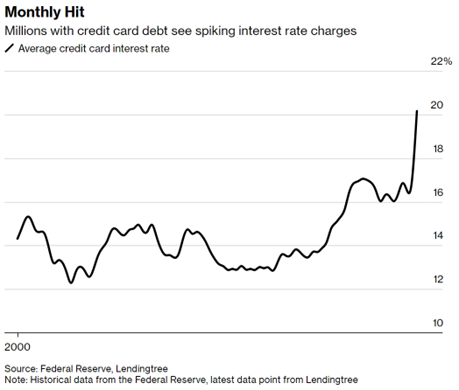

The problems get even worse when you consider how credit card interest rates have seen a huge spike over the last few months. We have already talked about how many U.S. consumers are using credit debt at a RECORD level again- this is just going to squeeze them even harder.

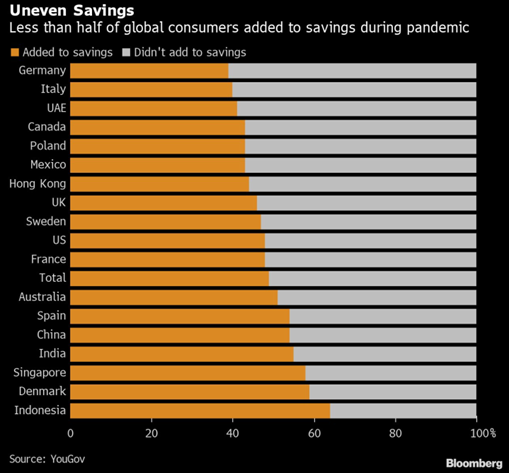

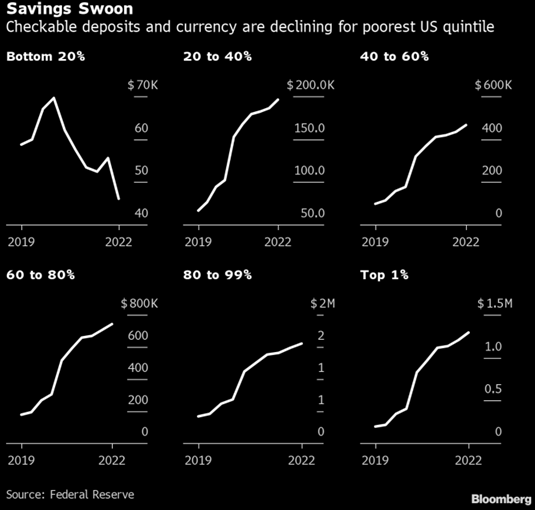

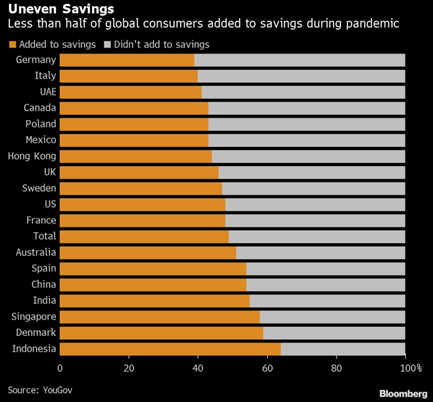

There has been a lot of comments around the savings rates of global consumers, but it is massively lopsided. New data from YouGov conducted by Bloomberg shows fewer than half of Americans set aside rainy-day cushion during pandemic. We know what remains is concentrated among oldest/wealthy. In short, the people who need the savings the most- don’t have it available to them.

This helps put it into perspective as the bottom 20% experiences a steep drop with limited options to address the shortfall. We have already seen savings rates slow to 2011 levels as a percentage of disposable income (discussed in earlier reports), which is driving down the figures for the higher quintiles.

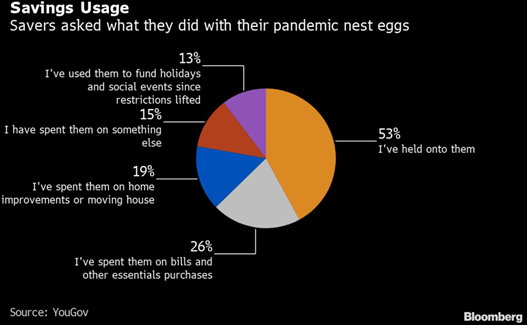

Nearly half of the people who have saved started to pull money out of their “pandemic nest eggs.” As costs remain elevated- it is only going to keep pulling the figures lower and impact people’s spending and living standards. My wife went to the store earlier today and dropped this gem: “Remember when $100 was a lot of money? Now I get a few things at Walmart and it’s over $100!” When I talk to friends, clients, strangers on twitter/ YouTube- the comment is always the same. They are blown away at the speed and the prices they are paying for everything. All of the people also comment- the raises they received have failed to even REMOTELY match the shift higher in prices. If you are expecting it to stay the same or even get worse- is a person likely to spend more or less?

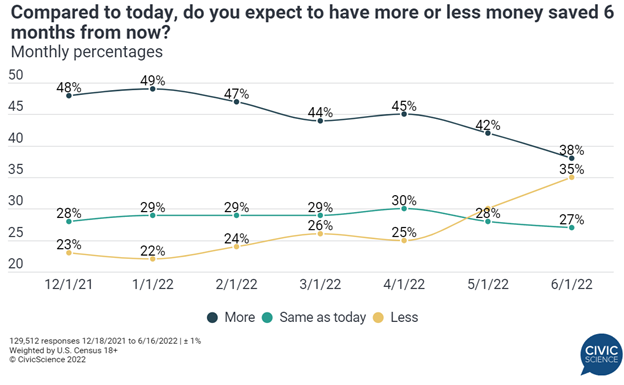

As people project forward, they are expecting their financial situation to shift drastically and not for the better.

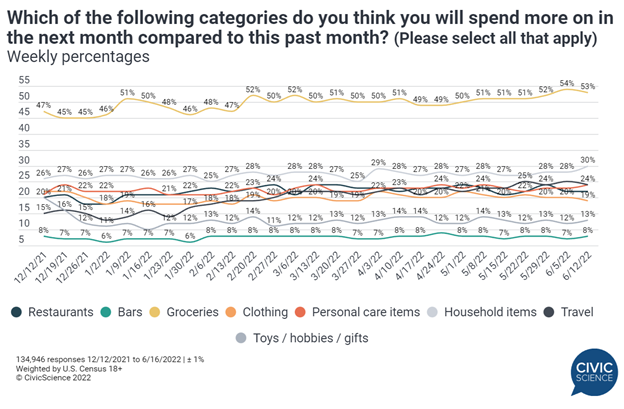

The pivot is being felt across the board, and one of the biggest impacts remains groceries.

The shift in spending can also be seen in the inventory to sales ratio at “Other General Merchandise Retailers.”

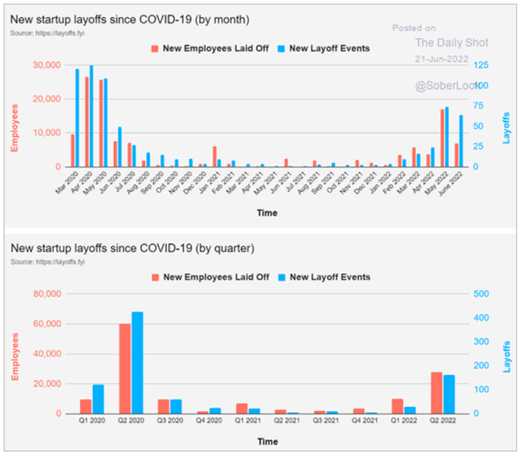

It is near impossible to “predict” when the consumer will officially pivot because many people have different levers to pull. They can leverage their personal finances, use credit cards, home equity lines, or maintain spending out of savings. I try to track all of these factors to pinpoint potential “pain points” that will cause a bigger shift in the market. Another shoe to drop is the shift in employment as companies tighten their belts. In our previous report, we discussed the companies that rolled out hiring freezes or started with some layoffs. It isn’t surprising to see things picking up again as pressure mounts.

The shift lower in employment will loosen up the jobs market and help cool wage pressure. But as wages stagnate or start to move lower, we still have living costs getting driven higher. This will only put more downward pressure on economic growth- especially the “C” in the GDP calculation.

It is important to understand how GDP is calculated: C (consumer) + I (investment) + G (government) + (X-M) exports – imports will get you to GDP. We have already discussed at length how the government subsidies and support are expiring as transfers keep falling, and how the consumer pressure will push things down again on consumption.

The next step is to look at housing and business investment, which is following the same path. As companies look to reduce spending, CAPEX cuts will expand. This is what the data showed from regional Fed outlets as well as the small business indexes (NFIB). Housing and business investment in the US are tumbling as the economy continues to weaken in to an all but inevitable recession. Because housing represents 15-18% of GDP, this is a meaningful econometric to watch closely as all of the data rolls over already showing negative growth.

On the trade side, the U.S. is a net importer, but our trade balance can fluctuate significantly. U.S. current account deficit widened in 1Q22 to $291.4 billion vs. $275 billion est. & $224.8 billion in prior quarter … goods deficit widened to $342.2 billion while services surplus narrowed to $58.5 billion. We had a big shift down, which will pull our GDP lower as it weighs on the way its calculated.

Some of the biggest growth points over the last few months and something that normally strengthens into the summer is food services and bars. A move back down for restaurant retail sales (on 3m average basis), which breaks up trend established heading into summer. The pressure points are widespread and create a negative backdrop as we head into Q3.

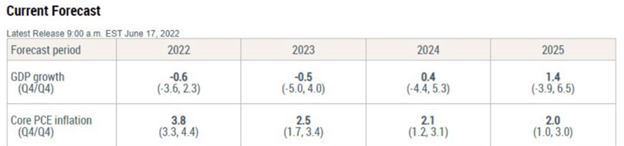

All of these reasons are why we aren’t surprised by the New York Fed model. The New York Fed models now point to negative real GDP growth in the US for both 2022 & 2023. Chances of soft landing sitting at only 10%. In other words: their base case is a long-lasting recession.

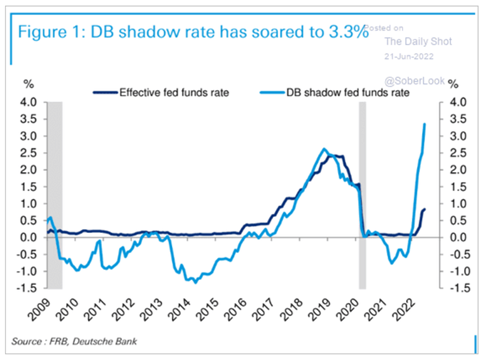

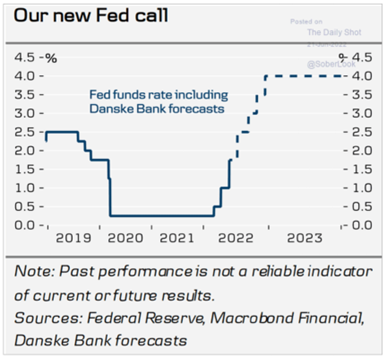

The pressure on pricing is going to keep the Fed raising rates, which will tighten financial conditions and limit the amount of capital available to businesses and individuals. The neutral rate or natural rate is estimated to be at around 3.3%-3.5% for the Fed Funds Rate. Powell has started making comments that he could see a “prolonged” period above this level to bring the market back into balance. This puts the Danske estimate right on point at about 4%, which would quickly cool some of the growth estimates.

Inflation is running so hot in the “sticky” category with rents and home prices still hitting records while the CPI component for housing still sits at 4.5%. This will keep driving CPI higher even as things balance out in other areas, which is why it is very likely that inflation keeps moving higher into August. I disagree with the view that we have a failure rapid pivot lower- instead I think we have more staying power in this elevated level.

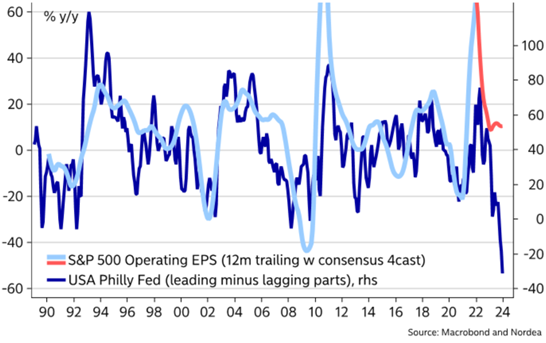

An important leading indicator- The Philly Fed- has turned negative and when you overlay it with the current pricing of the S&P 500- you can see how it will pull us lower. This is another proving point that Q3 is going to be a very difficult backdrop.

How deep the slowdown goes in Q3 will depend on the consumer, and based on all the metrics- we are in a position to surprise to the downside.

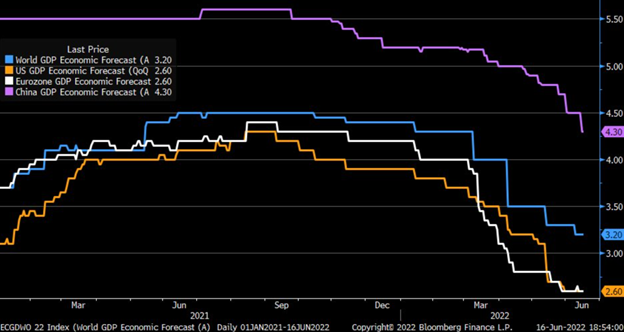

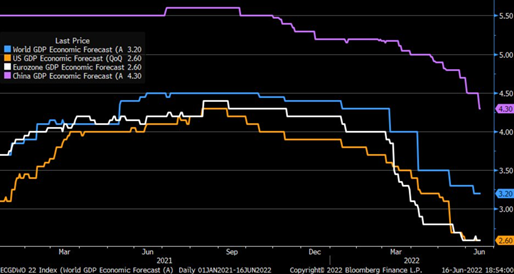

The global estimates for GDP growth have shifted down again, but given the recent data- there is still more downside to be recognized. There was (finally) a sizeable drop to global GDP, but some of the recent “NowCasts” on China GDP is at 0% and the U.S./Europe also printing closer to 0%. While, the data below still has some relative growth remaining in the year, which will lead to another shift down in estimates. We have been ahead of the curve for some time- calling out how these estimates were ludicrous and would quickly adjust as the “Current” data reflected everything we saw coming.

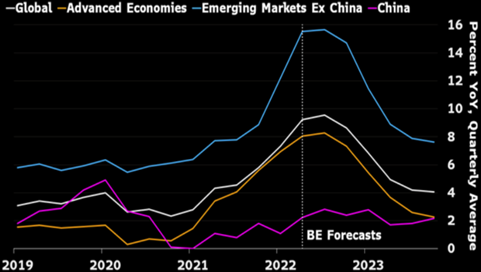

Inflation remains a big driver on a global basis, and we expect to see these levels persist well into 2023. As central banks attempt to contain inflation, they will keep pushing rates higher. This will inherently drive rates higher around the world and make it more expensive for governments, companies, and consumers to borrow. This will result in additional slowdowns as financial conditions tighten and money is pulled from the banking system. It will also make lenders more prudent with their cash and investments, which will be a long term benefit of a tightening cycle.

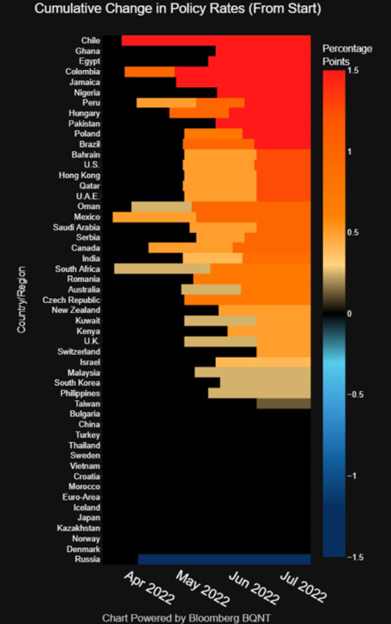

When we look at cumulative policy rate changes over the last 90 days, you can see just how aggressive some central banks have gotten. It isn’t a surprise to see Emerging Markets at the top of the list as they try to get in front of inflation.

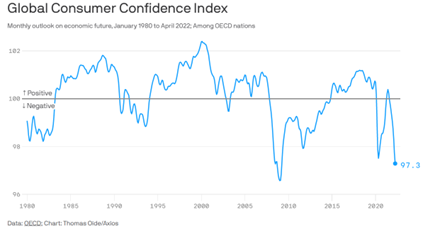

The shift in rates, inflation, and global activity is pushing the global consumer confidence index to a new recent low. We are still above the levels achieved in the financial crisis, but we are below the COVID-19 low. This is pointing to more pressure on the consumers’ willingness to actual spend- especially as global excess savings are drawn down.

The below chart (referenced in a different section as well) shows how much savings were built up in different countries. In some of these areas, the savings have already been drawn down and in others (such as China and Japan) it is being kept in the bank out of growing concerns. The Chinese consumer has been levered to the gills, and they are now saving more and reducing their debt consumption. This is to help adjust their own personal leverage, but also due to uncertainty around future lockdowns and growing layoffs. There is a big concern in China regarding wages and jobs keeping consumers cautious and keep those savings elevated.

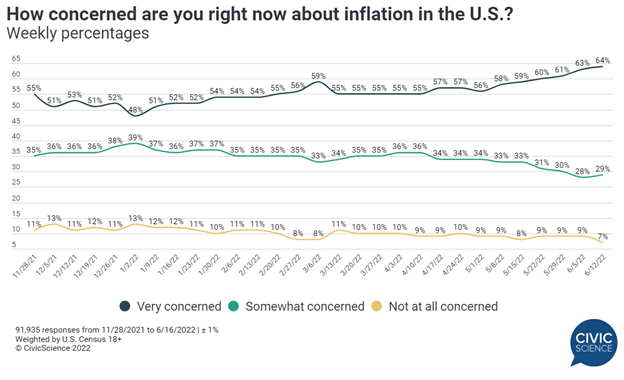

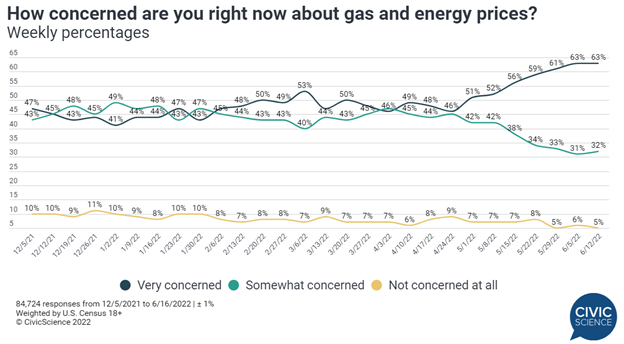

The U.S. is no different- especially as fear of inflation and energy prices remains at near term highs.

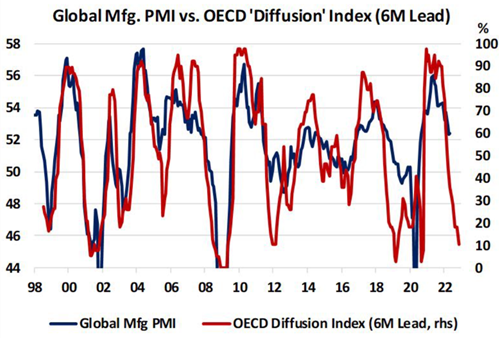

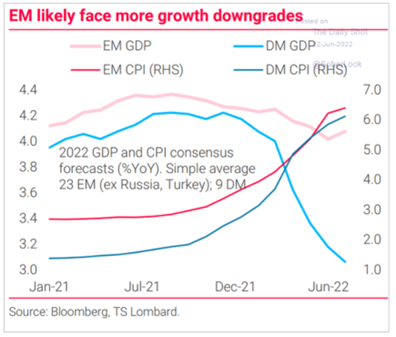

As developed markets slow, it has a knock-on effect that spreads through the supply chain hitting the emerging markets hard. But, it takes time… it isn’t something where the developed world’s stops buying and instantly the supply chain reacts. There is a lag in what happens in the DM and how it spreads to the EM world. The OECD data is showing a steep drop, but it is normally a leading indictor that will “pull” global manufacturing down with it. This will hit the Emerging Market on a lag.

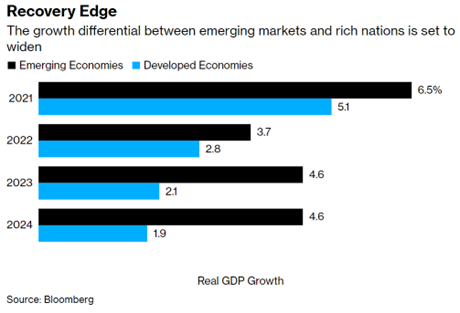

This is a very well-known aspect, which is why I always laugh when you see Emerging Market estimates “outpace” the developed world by such a wide margin. As the market “adjusts” estimates, it will force more liquidation in the EM world and put more downward pressure on their local economy and currency.

The downgrades will also gain speed as world trade volumes keep moving lower as new orders, new export orders, and other leading indicators have already gone negative or into contraction. As inventories build, it will cause even less orders and backlog which will push this down even further.

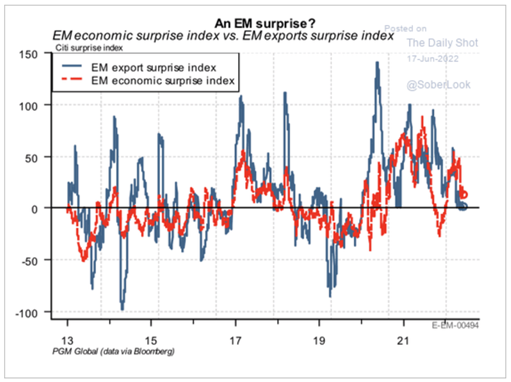

It isn’t a surprise to see more economic data out of Emerging Markets surprising to the downside as the supply chain slowdown starts to bite. We expect more pressure to the downside until the market “adjusts” some of their growth projections.

Even as Emerging Markets struggle, some very important central banks are making broad blunders. We have picked on the Fed enough, now we will breakdown the ECB and the BoJ.

The ECB has introduced an “anti-fragmentation” tool to purchase and protect rates for the periphery countries. But, shouldn’t the market penalize countries with elevated leverage? Plus- what investor would purchase low yielding debt that doesn’t properly reflect the excess risk?

Questions for the new ECB anti-fragmentation tool 1. Let’s say Italy goes into another political crisis like in 2018 and the spread on 10-year BTPs over Bunds rises. Will that be considered fragmentation of monetary policy transmission or a justified rise in the risk premium? The real 10-year US Treasury yield is still very low, so it will have to rise further to tighten US financial conditions. Italian spreads are “high-beta,” i.e. if global real rates rise, Italy’s spread will widen out given Italy’s high debt. Is this fragmentation? What if R* isn’t low anymore, given rising geopolitical risk, debt rises due to COVID and supply disruptions? Isn’t it natural for markets to punish countries with big debt overhangs if R* is up and an incentive for these countries to bring debt down? Is this fragmentation?

Milton Friedman gave many examples about how the failure of the euro would come about, and one of the main arguments was about having a unified currency but not debt structure. Each country can issue their own debt with relative impunity, but what about the FX adjustment? For example, if the German deutschmark strengthened vs the Italian lire- it would adjust the way businesses and tourists operate. As the Italian economy weakened, it would also push down their currency and open up an opportunity to attract more tourism and business as people take advantage of a weak lire. With one currency- there is no opportunity for Italy to attract “increased” businesses as their local economy struggles. Instead, they will just issue more and more debt to “stimulate” the economy and because the currency is linked- there is little damage to the broad Euro. But what happens if everyone does the same thing… which led to the European Financial Crisis.

Now the ECB is in the midst of a recession and rates are ALREADY at -.5%. Inflation is at over 8% with PPI north of 33% and rising. The ECB is now forced to raise rates, but they are going to do it so slowly- that it will exacerbate an already terrible situation and by “protecting” the periphery drive away natural buyers. This is why the market is betting against the ECB and believe they will be forced to make a bigger increase.

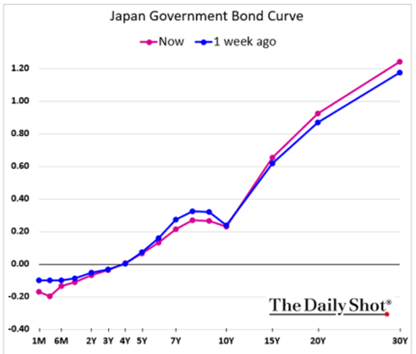

The BoJ (Bank of Japan) ushered in quantitate easing as a “solution” to the Asian Currency crisis of 1998. They stepped in to stabilize the Yen and support the yield curve to bring things back under control. When they first started, I asked the question: “How do they exit?” My professor laughed and said: “They don’t- at the rate they are operating it will either create a huge spike in interest rates or a sovereign default. They would rather default vs lose control of rates.” I thought he was being a bit sensational, but as we sit in 2022 and the BoJ is still at it… he was right. The BoJ is sticking with its yield control policy, which is becoming a headache for the central bank. Can you tell which point on the curve the BoJ is trying to pin down? The market wants to take yields higher as inflation rises, and this policy looks increasingly shaky.

The BoJ is fighting the market at the 10yr to try to keep rates low, and in order to do that- the BoJ buys the 10yr and gives people Yen. This results in the currency depreciating rapidly as they dump Yen into the market. After 24 years of QE, they now have a Yen-USD exchange rate the same as 1998, no economic growth in 20+ years, a wage issue, a demographic problem, and now rates want to rip higher. Inflation is picking up aggressively in Japan and the market wants to price that in, while the BoJ fights tooth and nail.

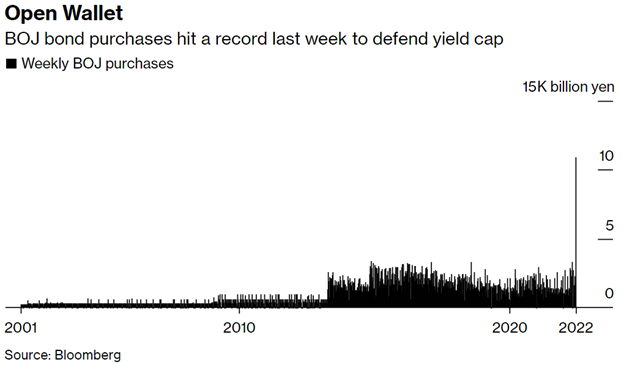

The below chart puts into perspective just how much money the BoJ is issuing to protect rates. It is creating a big problem because now the market smells blood in the water and will keep pressing the banks resolve until they finally relent. Once they step back, it will create a massive shift higher in the yield curve- especially in the belly.

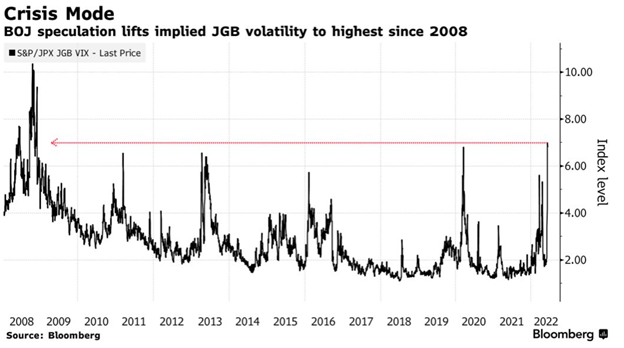

The fight in the bond market is creating a big shift higher in volatility, which is getting harder and harder for the BoJ to control.

This is already reverberating throughout Asian currencies and markets as fear grows around a shift higher in rates. The U.S. 10yr TSY typically sets the floor for global debt, but as the dollar strengthens (holding above 104) it puts more pressure on the Yen and other currencies in the area. It will also impact import-exports that have already come under pressure with slowing global trade.

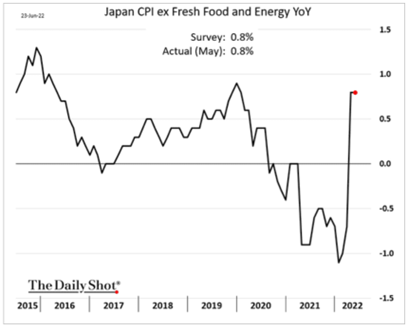

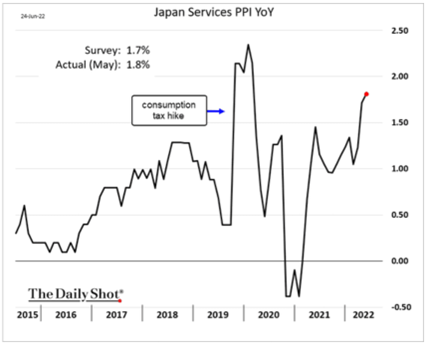

These key pressure points in Japan are happening at the same time as PPI and CPI have pivoted higher in Japan with more pressure to the upside on the producer price index.

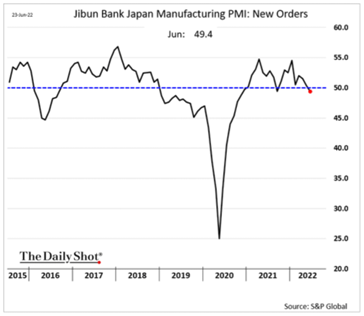

The next level of pain is coming as “new orders” dip once again- a key leading indicator for exports and local demand.

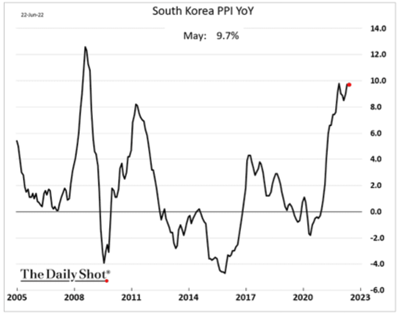

Japan isn’t the only one that is seeing the pressure on PPI as South Korea experiences another push higher in factory gate costs. We believe these costs will remain pinned to the highs (which we import into the US!)

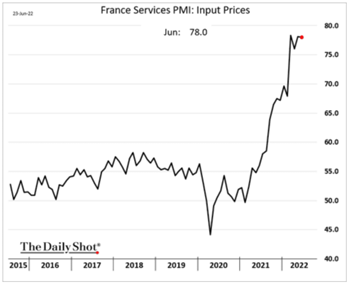

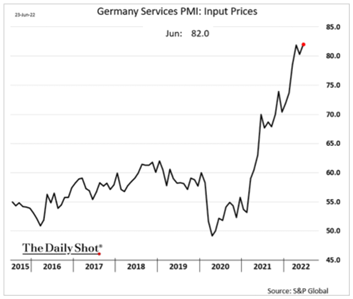

Europe is seeing a lot of similar pressure that is hitting hard once again across key regions- Germany and France. The input prices pushing higher again and pinning to the highs is a leading indicator that CPI is going to get pulled higher. It will also lead to higher export prices being passed on to their trade partners within the EU and abroad.

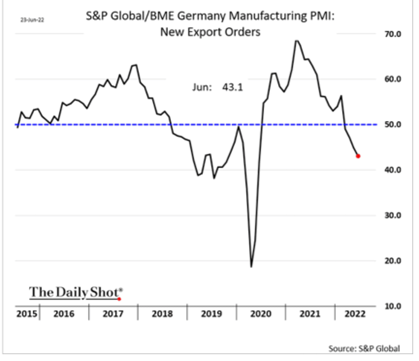

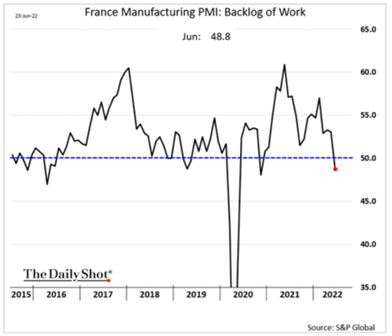

When we look at other important leading indicators, you can see a big dip in demand and export orders.

All of these important leading indicators have fallen into contraction but haven’t had a “small” dip. Many of them are well below 50, which is showing the speed of contraction and the problems this is going to cause going forward.

Europe is clearly already in a recession with more pain on the horizon!