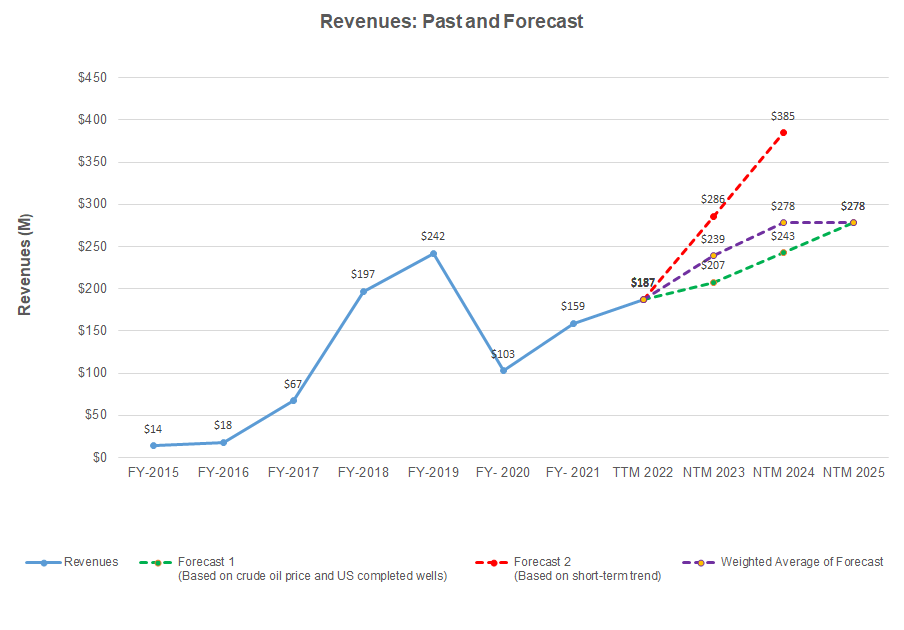

- Regression estimates suggest strong revenue growth in NTM 2023, but the rate can decelerate over the next couple of years

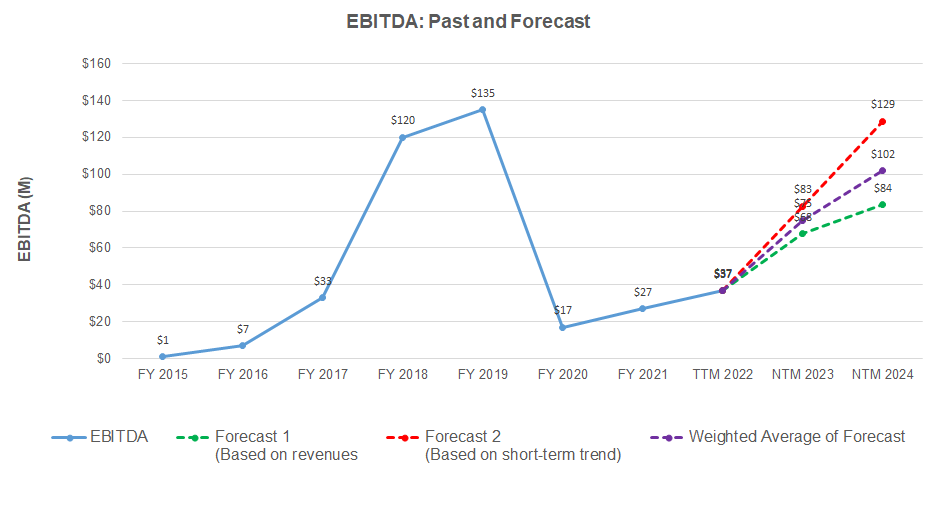

- The EBITDA growth rate is robust in NTM 2023 but may fall in NTM 2024

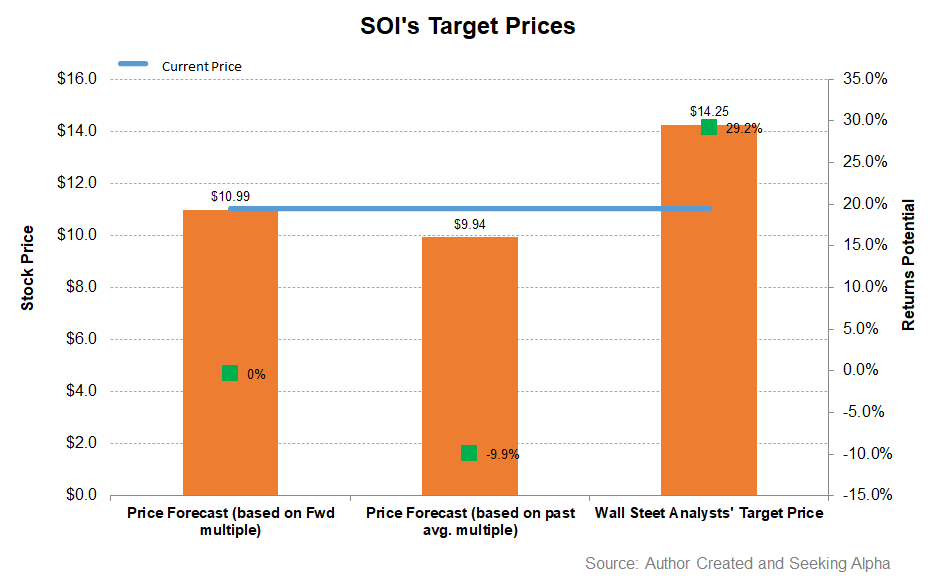

- The relative valuation suggests the stock is reasonably valued; the model also suggests a mild downside bias at this level

Part 1 of this article discussed Solaris Oilfield Infrastructure’s (SOI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between crude oil price, US completed well count, and SOI’s reported revenues for the past seven years and the previous four-quarters, I expect revenues to increase sharply in the next twelve months (or NTM) 2023. The recovery will decelerate in NTM 2024 and flatter in NTM 2025.

Based on a simple regression model using the average forecast revenues, I expect the company’s EBITDA to double in NTM 2023. The model suggests it can continue to rise at a decelerated rate in NTM 2024.

Target Price And Relative Valuation

Returns potential using the past average multiple (11.4x) is lower (10% downside) than the forward multiple (0% upside). The sell-side analysts expect higher returns (29% upside).

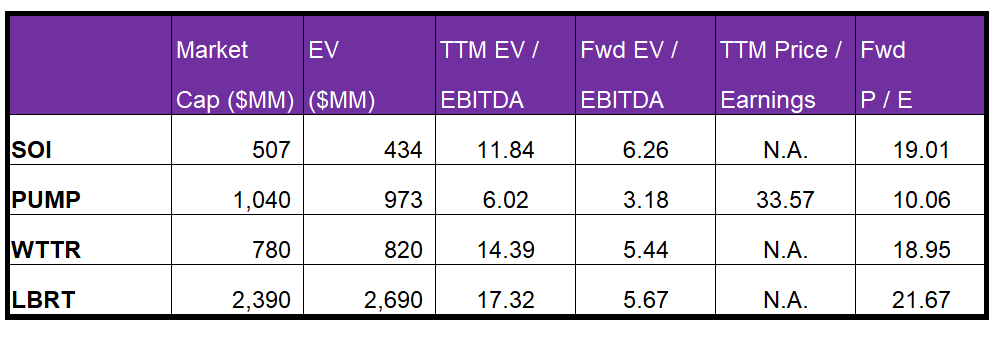

SOI’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is less steep than its peers, typically resulting in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (11.8x) is lower than its peers’ (PUMP, WTTR, and LBRT) average of 12.6x. So, the stock is reasonably valued at the current level.

What’s The Take On SOI?

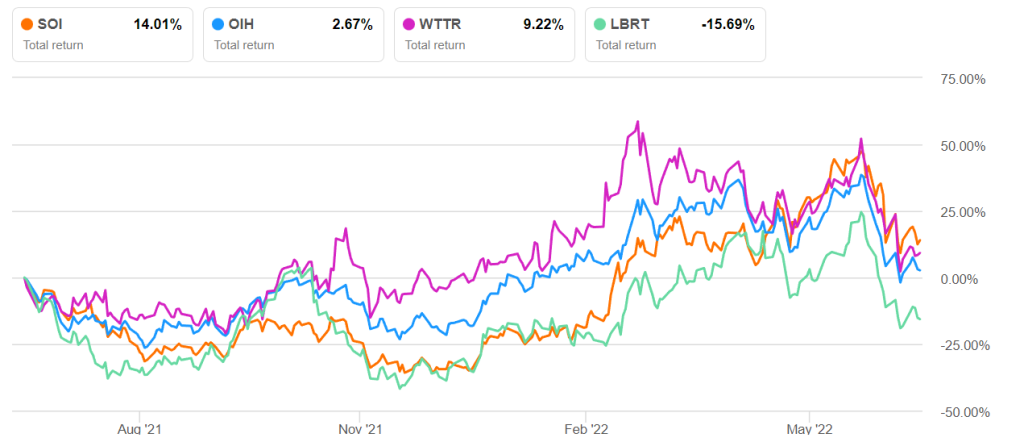

While Solaris changed its stance by late 2021, concentrating on profit maximization, the positive effects are on display in 2022, reflecting increased volume and profit per frac crew under its last-mile model. Demand for its top fill solution and 9- and 12-pack configurations exceed supply, leading to profit maximization. On top of higher volume and cost absorption, the margin benefits from the price hikes initiated in 2H 2021. These advantages tipped the stock price to outperform the VanEck Vectors Oil Services ETF (OIH) in the past year.

With additional investment in top fill and AutoBlend technology, SOI’s capex is likely to outmatch cash flows. This can be worrying, especially when its free cash flows turned negative in Q1. Nonetheless, a zero-debt balance sheet and robust liquidity will act as a buffer against a cash crunch. In the medium-to-long term, investors would like to buy in expectation of steady returns.