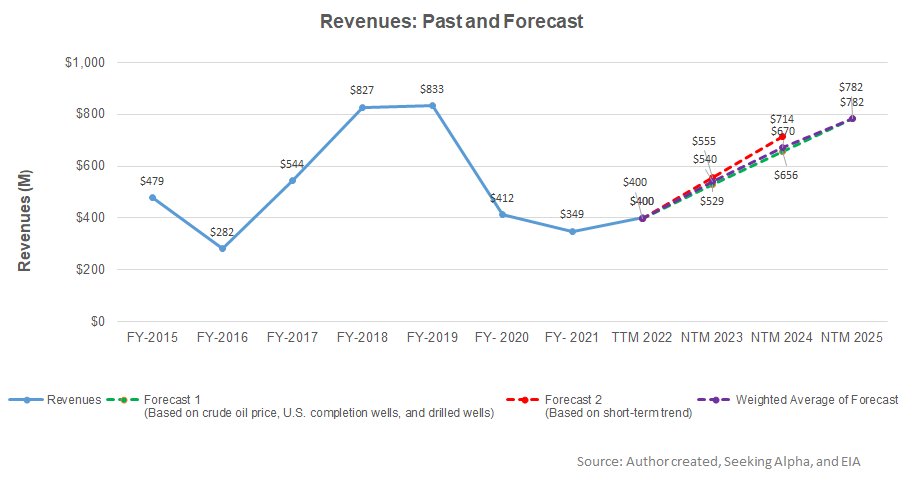

- Regression estimates suggest strong revenue growth in NTM 2023, but the rate can decelerate over the next couple of years

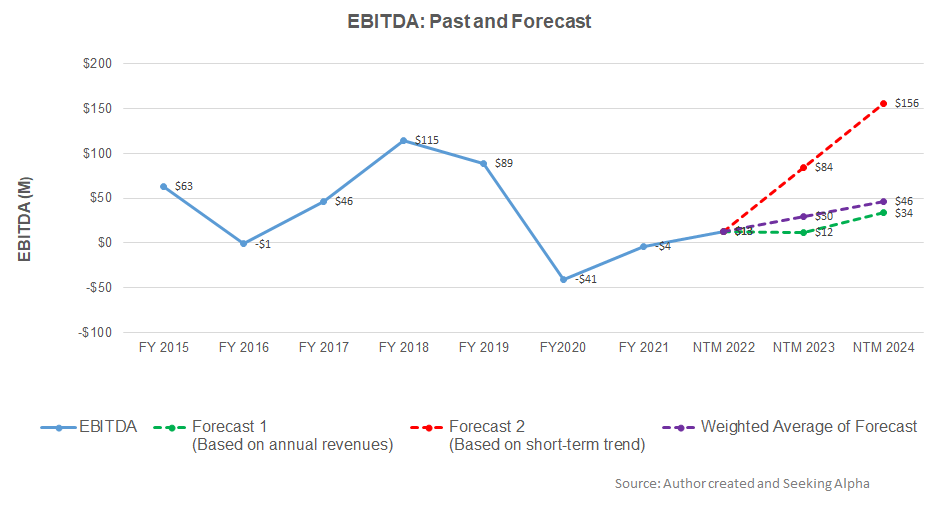

- The EBITDA growth rate is robust in NTM 2023 but may fall in NTM 2024

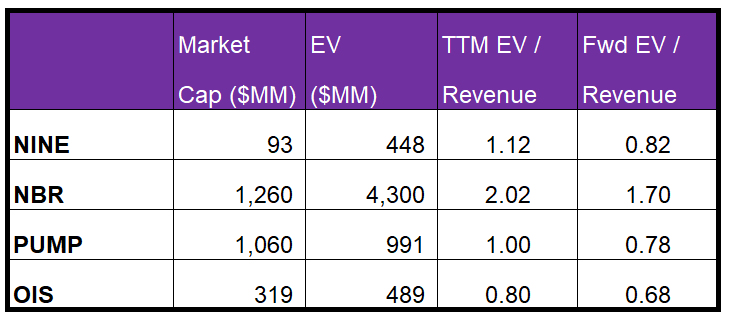

- The relative valuation suggests the stock is undervalued; the model also suggests a positive upside bias at this level

Part 1 of this article discussed the Nine Energy Service’s (NINE) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the crude oil price, US completion and drilled wells, and NINE’s reported revenues for the past seven years and the previous eight-quarters, I expect revenues to increase significantly in the next twelve months (or NTM) 2023. The growth rate can decelerate in NTM 2024 and NTM 2025.

Based on the regression model, I expect its EBITDA to improve sharply in NTM 2023 (but also because EBITDA was low in LTM 2022. The model suggests that profit growth will decelerate in NTM 2024.

Relative Valuation And Target Price

NINE’s forward EV-to-Revenue multiple contraction versus the adjusted trailing 12-month EV/EBITDA is steeper than its peers, typically resulting in a higher EV/Revenue multiple compared peers. The company’s EV/Revenue multiple (1.1x) is lower than its peers’ (NBR, PUMP, and OIS) average (1.2x). So, the stock is undervalued compared to its peers at this level.

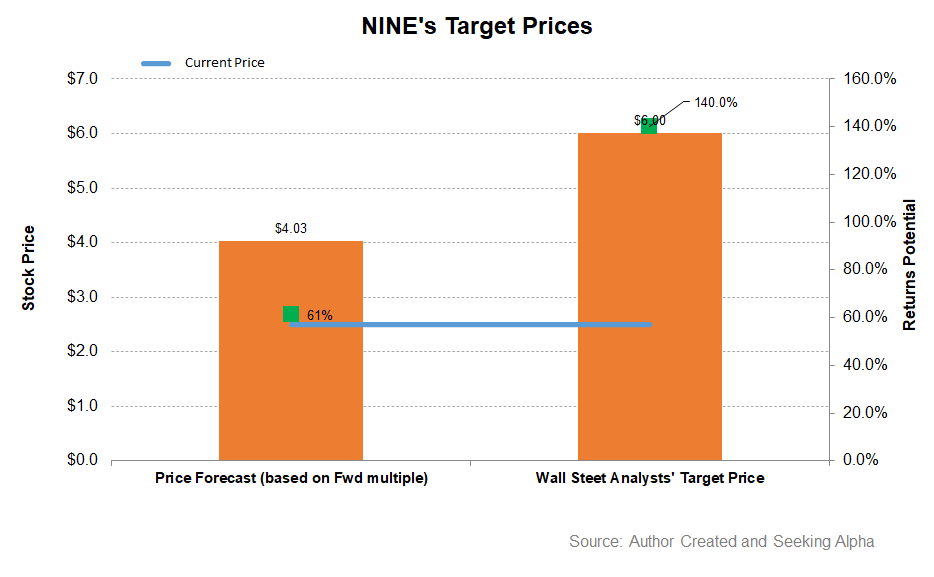

EV has been calculated using NINE’s EV/Revenue multiple. The returns potential using the forward EV/Revenue multiple (0.79x) is lower (61% upside) than sell-side analysts’ expected returns (~140% upside) from the stock.

What’s The Take On NINE?

In the short to medium term, NINE’s outlook is quite robust. As the natural gas price strengthens, the company’s focus on natural gas-heavy Basins like the Haynesville and Northeast have started paying rich dividends. On top of that, the company’s strategy of promoting the dissolvable plug also yields positive results because the technology is wrestling market share. Energy drillers’ ESG initiatives will encourage the adoption of dissolvable as operators look for cost-effective ways and reduce emissions.

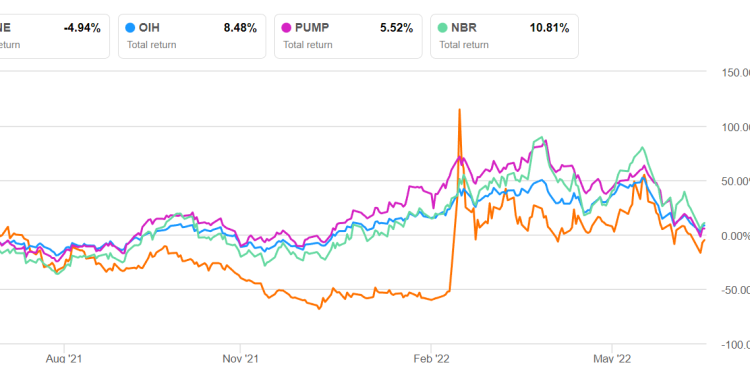

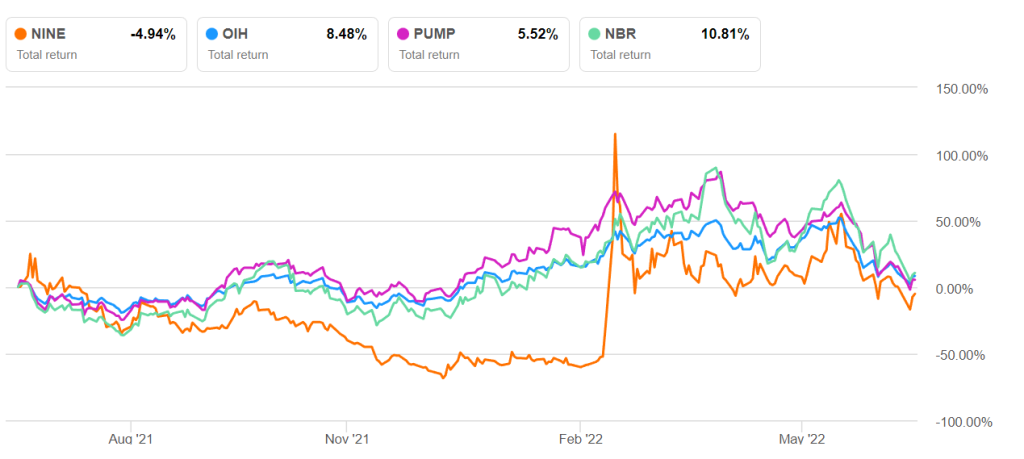

However, growing energy production will put more pressure on labor demand, which, coupled with the supply chain disruption, would lead to further wage and material inflation. Thus, the operating margin can take a hit in Q2. Investors should also stay cautious of the negative cash flows and shareholders’ equity. As a result of such concerns, the stock price underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, the recovery potential and the stock’s relative undervaluation should induce investors to hold on to the stock in the medium term.