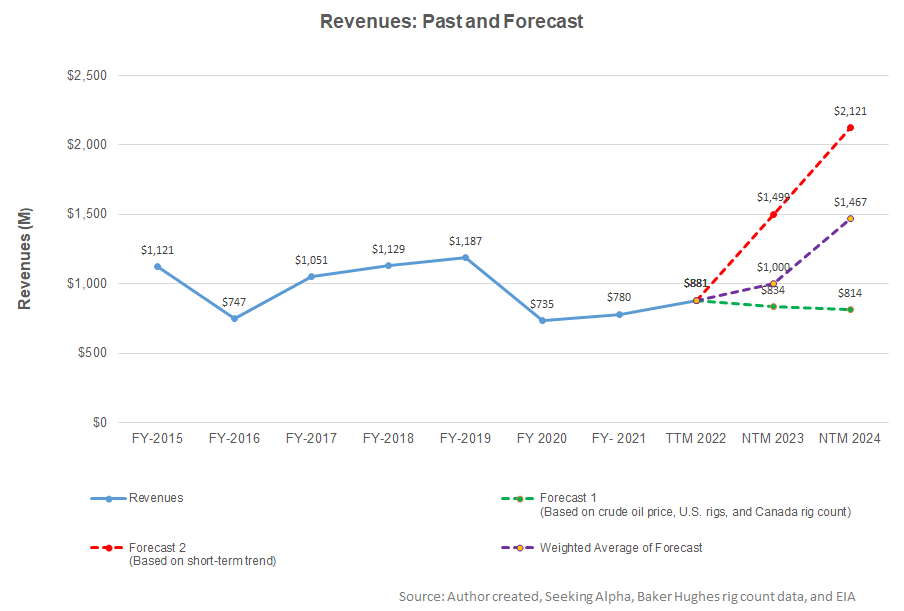

- Regression estimates suggest a decent revenue growth in NTM 2023, but the rate can accelerate over the next year

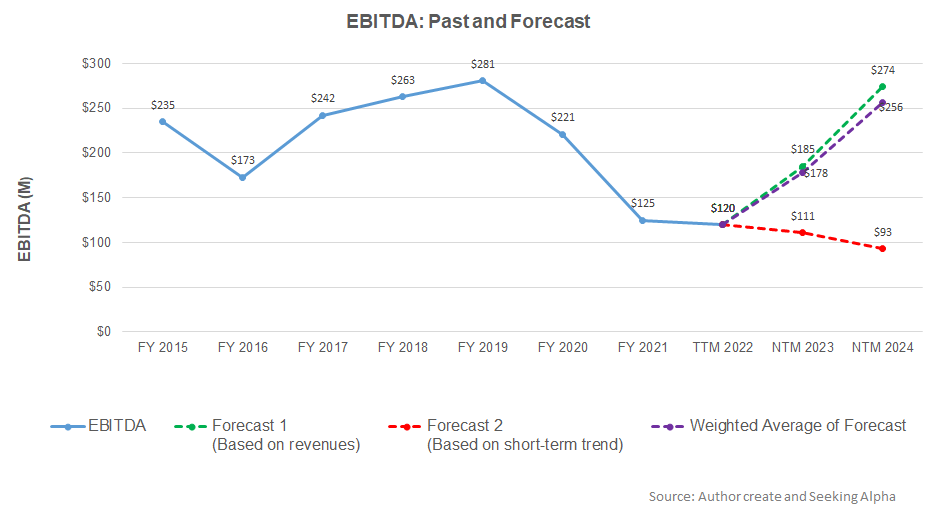

- The EBITDA growth rate is steady in NTM 2023 and NTM 2024

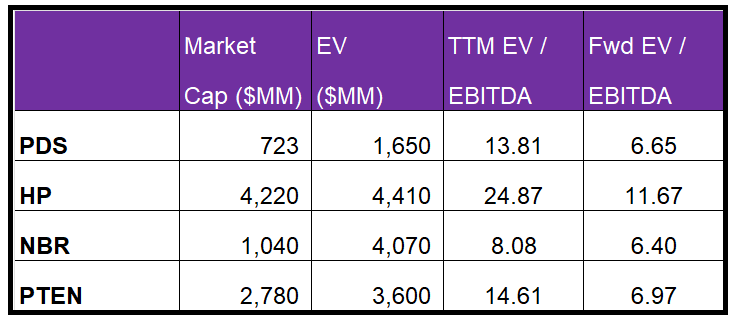

- The relative valuation suggests the stock is undervalued

Part 1 of this article discussed the Precision Drilling Corporation’s (PDS) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation on the relationship between the crude oil price, the US rig count, the Canadian rig count, and PDS’s reported revenues for the past seven years and the previous four quarters, I expect revenues to increase marginally in the next 12 months (or NTM 2023) and accelerate in NTM 2024.

The company’s EBITDA can improve steadily in the next two years based on a simple regression model using the average forecast revenues.

Relative Valuation

PDS’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to increase more sharply than its peers in the next four quarters. This would typically reflect a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (HP, NBR, and PTEN) average of 15.9x. So, the stock is relatively undervalued at the current level. The consensus target price is $125.1, which yields a 97% return at the current price. While the sell-side analysts are likely overestimating the potential returns, the stock may have an upward bias in the short term.

What’s The Take On PDS?

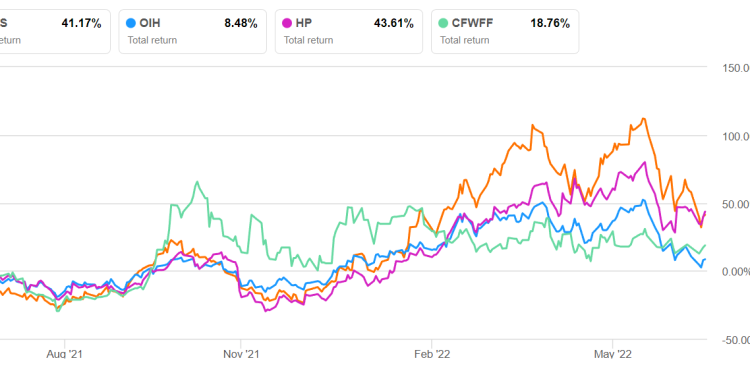

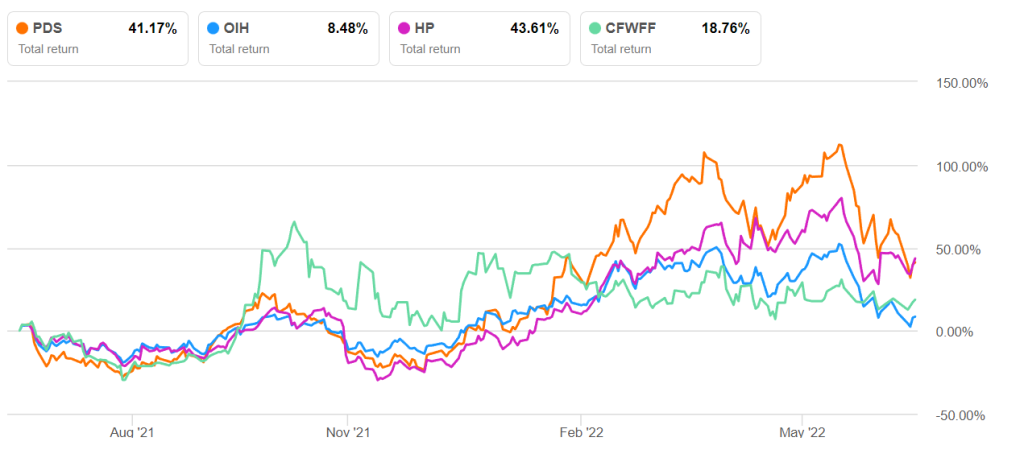

As customers’ demand for energy-efficient rigs rises, high-spec rig shortages become common. PDS’s ST-1500 rigs equipped with AlphaAutomation can command a premium in this environment. Not only are leading-edge rates trending up, but the company also gets to sign medium-term contracts at higher rates. Higher fixed cost absorption and commercialization of the AlphaAutomation system are expected to become significant drivers in the medium term. On top of that, it has recently introduced EverGreen environmental solutions – a battery storage system and the fuel & emissions monitoring app. As a result, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Much of the stock’s upside potential is tied to its ability to deleverage the balance sheet between 2022 and 2025. However, some headwinds prevail on account of customers’ resistance to implementing cost and price increase initiatives in Canada. In Q1, PDS’s free cash flows dipped. Hence, a cash flow paucity can put a question mark on the effort. Nonetheless, given the relative undervaluation, I expect returns from the stock to grow in the medium to long term.