I hope everyone had a great July 4th weekend spending time with family and friends! Next week I am going to go deeper into the jobs report and walk through how jobs can keep rising even as a recession begins. For now- we kept this report energy focused with more macro data next week.

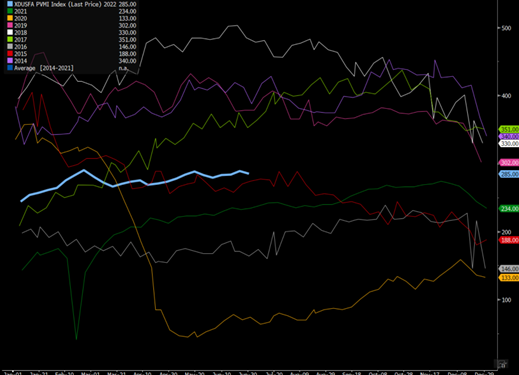

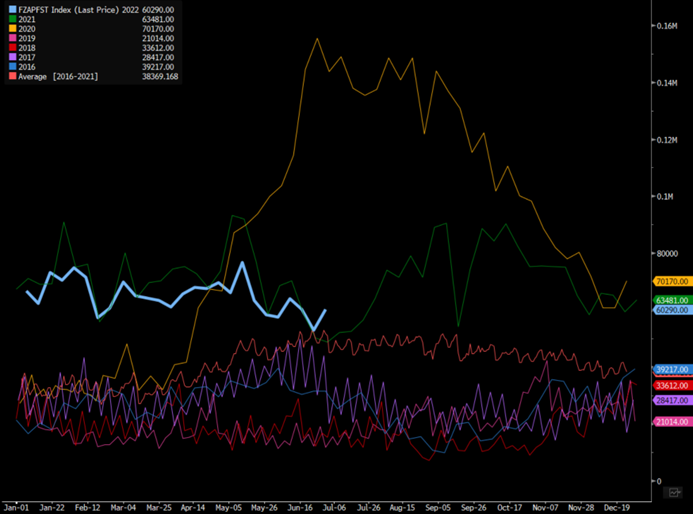

Activity in the U.S. remains on pace to see a bounce back from the holiday slowdown. We will see additional activity in the core areas of the Western Gulf, Bakken, and Anadarko as the Permian remains stable. We had a small dip in activity driven by the 4th, but it is usually short lived with a quick snap back. This is also when the smaller basins start to increase activity by 1 or 2 spreads. The smaller basins bring back some work is going to be the driver over the next few weeks and enable us to hit 300 active completions crews. The below chart helps to demonstrate the small drop that normally happens in the first week of July, but also the quick snap back in what drops off. We will get a slow grind higher to about 300, but we won’t see much movement past that sticking point. As Freeport comes back online, we expect to see activity increase around the natural gas basins again. They are still seeing a lot of activity given local demand, current export capacity, and domestic storage conditions. This is supporting prices above $6 and when Freeport comes back online- we expect another increase in prices. Weather can always shift the dynamics- but based on current data- it points to another increase in natural gas pricing.

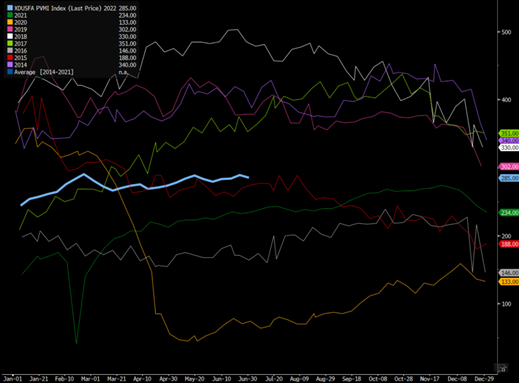

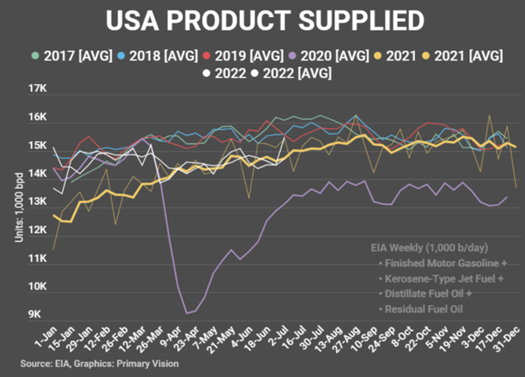

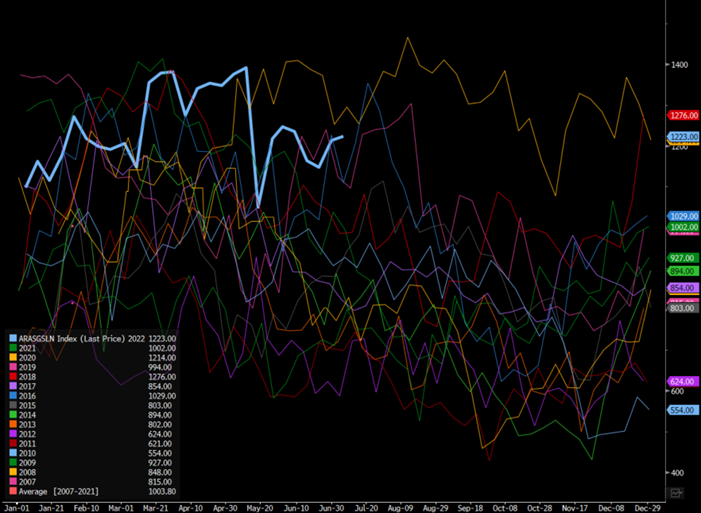

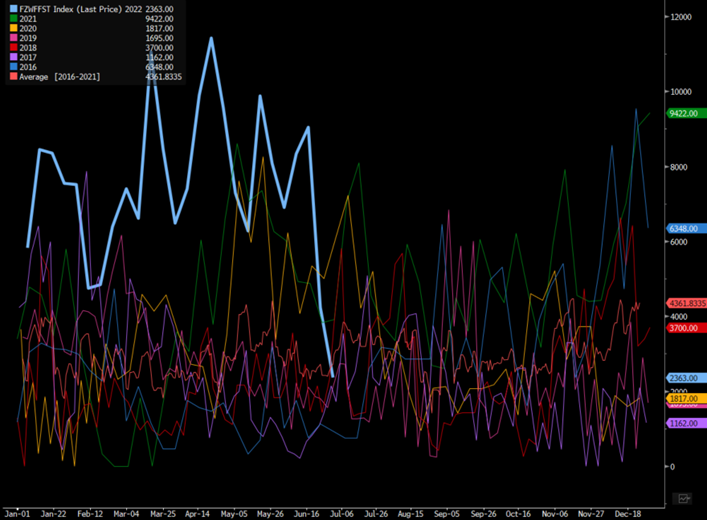

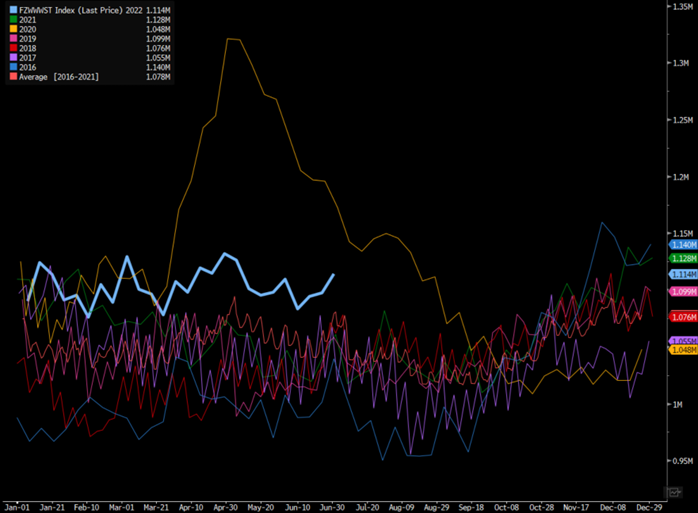

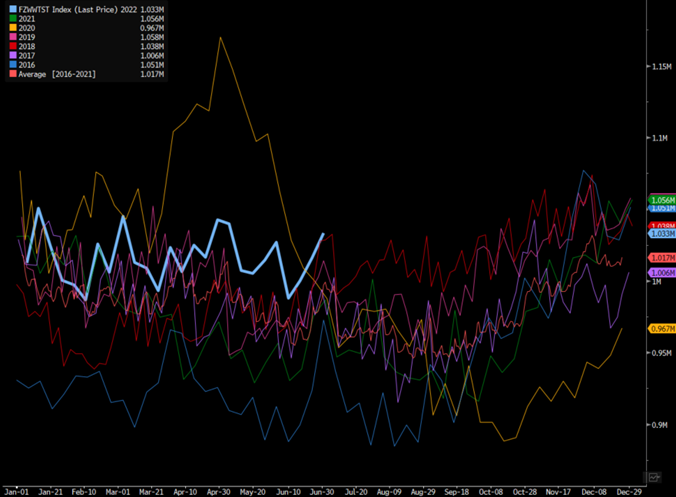

The U.S. had a spike in gasoline, diesel, and jet fuel demand as we normally do for 4th of July weekend, but it was still below what is deemed “normal.” You can see the “spike” is still there but falls below even the 2021 increase. We expect demand to drop back to about 14.9M-15M on average as gasoline demand moves to about 9.1M-9.3M barrels per day and diesel moving back to about 3.9m-4m and jet fuel 1.45-1.55M barrels a day. This will keep us at a steady pace, but still falling well below 2016-2019 demand numbers and even trending just below the 2021 averages.

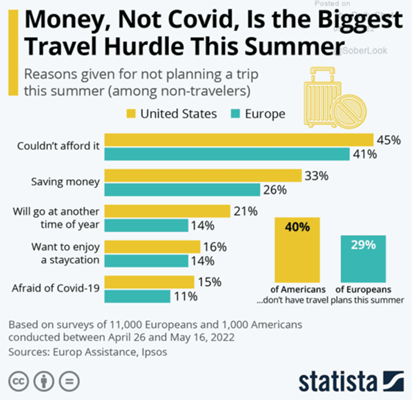

Price continues to be a huge driver with a growing number of people saying they can’t afford the current gasoline prices or are looking to save money. The cost of gasoline is hitting people in the U.S. and Europe, which will leave more gasoline in storage and keep demand muted. We aren’t going to see a collapse in demand, but rather a muted bump in summer demand.

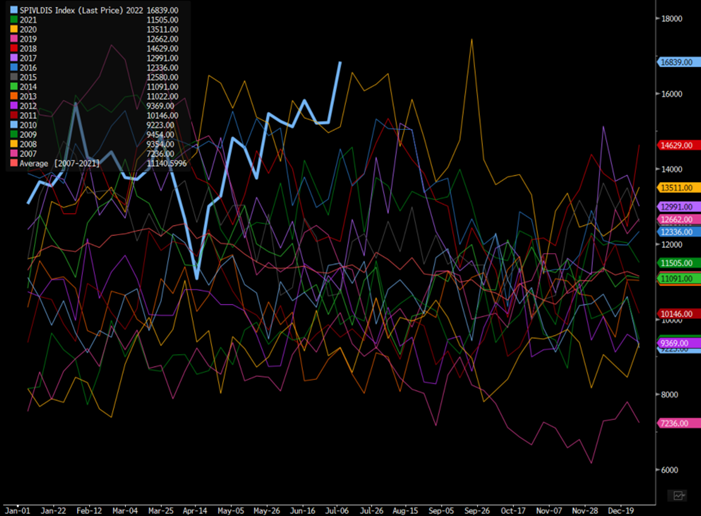

The distillate cracks are supporting refinery runs, but also throwing off a ton of gasoline that is resulting in record amounts of gasoline storage around the world. The U.S. is going to see flat storage, which will be counter seasonal and put us in an elevated spot as we approach the end of the summer.

European Gasoline Storage

Singapore Gasoline Storage

The diesel/ middle distillate picture remains vastly different with global shortfalls that will keep refiners running in the near term and targeting the heavier cut.

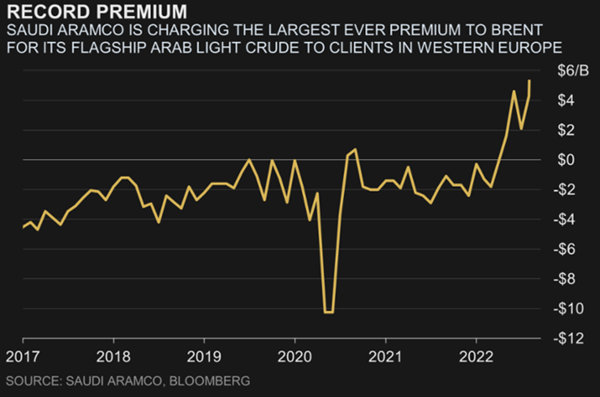

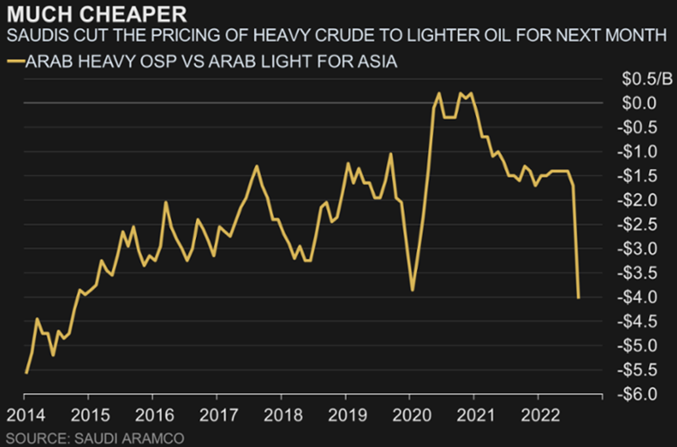

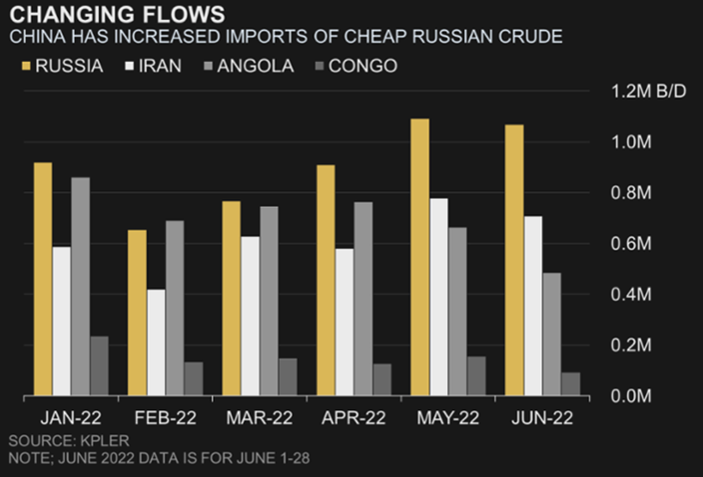

The physical market remains bifurcated, and the recent OSPs from Saudi Arabia confirm that backdrop. Heavy and medium crudes remain at a fairly distinct discount- especially into Europe and the Mediterranean. They also remain cheap (versus light) into the U.S. and Asia. Asia (China and India) have been big buyers of Russian crude, which has displaced Middle East and West African flows.

“Saudi Arabia is offering some of its crude at steep discounts to its flagship grade as flows of cheap Russian oil spark intense competition. The kingdom set the pricing of its Arab Heavy and Arab Medium grades at the largest discount to Arab Light since 2014 for August-loading cargoes to Asia, according to data compiled by Bloomberg. China and India are typically the major buyers of the discounted varieties, but they’ve increased purchases of Russian oil following the invasion of Ukraine earlier this year.

Saudi Arabia is not the only OPEC producer coming under pressure from Asia’s thirst for cheap Russian crude. Iran has been forced to slash the cost of its already discounted oil to compete for customers in China, while Venezuela is offering its crude at a record discount. Iraq has also been affected.

Saudi Arabia also offered similar discounts to customers in Europe and the US, although most buyers of the heavier grades are in Asia because their refineries are typically better equipped to process the sludgy and dense varieties. Grades such as Arab Heavy and Arab Medium tend to yield more, less profitable fuel oil, which is used in shipping and power stations. That’s made them less attractive, with refiners seeking oil that yields more gasoline and diesel, which are in higher demand. Profits from turning crude into fuel oil have tumbled in Asia and are near the lowest level since 2019, according to Bloomberg Fair Value data. That’s likely to have contributed to deeper discounts for the heavier grades.”

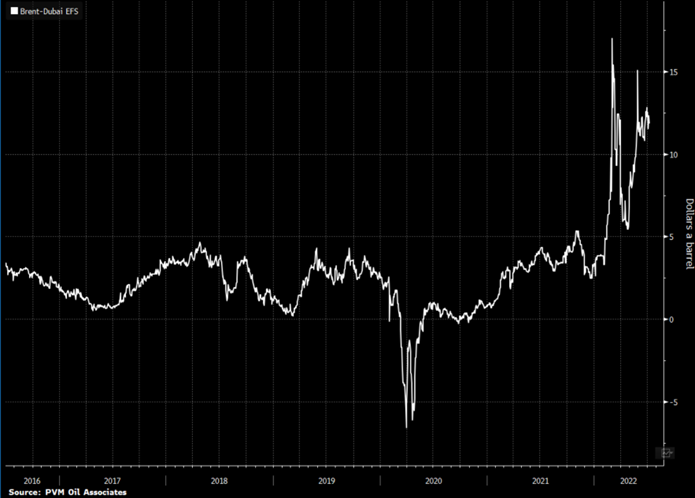

The support for the spike in Arab light crude is the wide differential between Brent and Dubai/Oman. The spread currently sits at $11.85, while Saudi Arabia is charging the following about Dubai: Arab super light to Asia at $11.35/ Extra Light $10.65/ Light $9.30. So even with the big spike in OSP- it is competitive against Brent. This can change quickly- and did the last time KSA spiked pricing- but given summer demand and elevated time spreads there is a bit more staying power this time around.

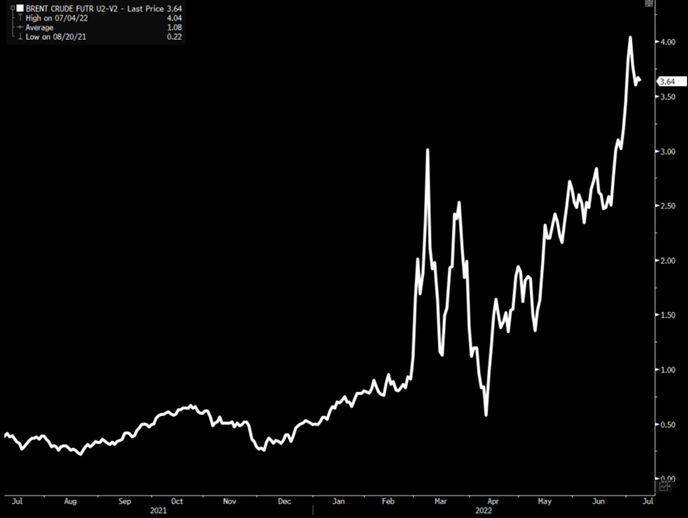

The below spread helps to show what kind of staying power the current backwardation has, which remains strong. We don’t see that pivoting in the near term, but you can see from the severity of the moves things can turn on a dime. All indications point to stability at these levels, which will keep the spread between Dubai/Brent wide.

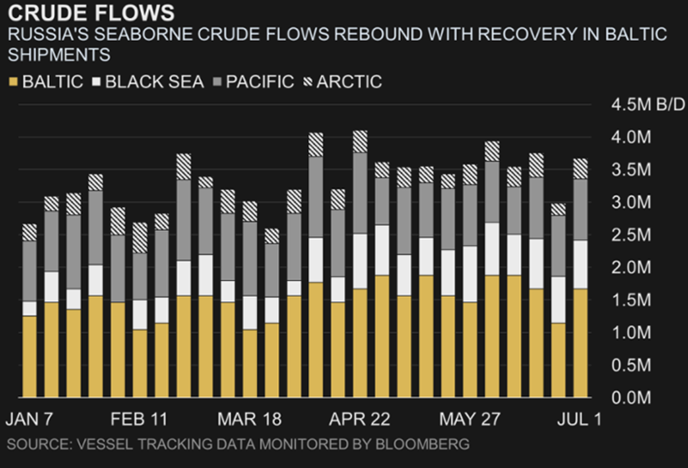

Russia crude flows are staying strong into Asia with a rebound in flows hitting the water.

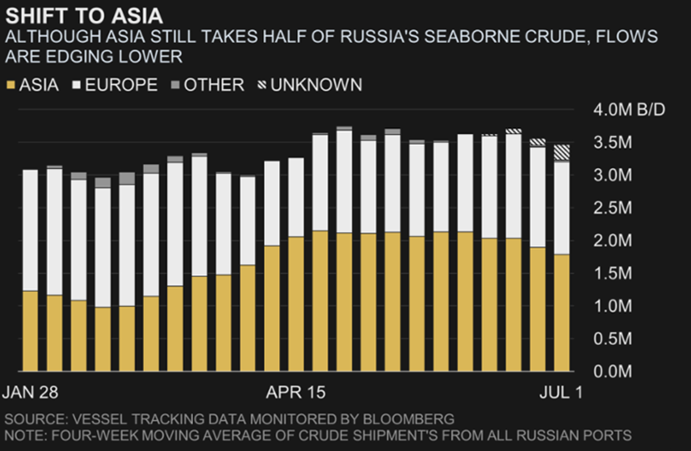

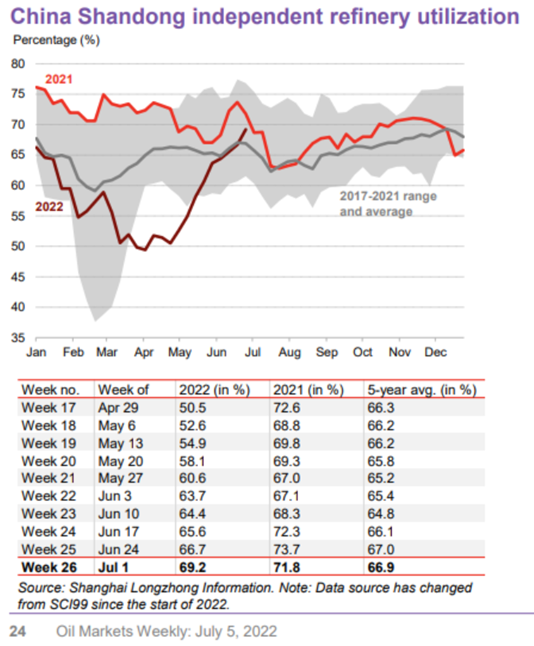

We have seen some purchases from China slow as floating storage increases again, and they face more bottlenecks at the refiner. Run rates are well off pace at the mega facilities and state-owned refiners while the Teapots (Shandong refiners) are hitting on all cylinders. The concerns around refining have keep the government cautious on the amount of refined product exports. “China issued its latest batch of fuel export quota for the year, but total allowances are still around 40% less than the same point in 2021. Some 5 million tons of diesel, gasoline and jet fuel quotas were awarded, according to refinery executives who received preliminary notices from the Ministry of Commerce and a note from local consultant OilChem. India’s exports of gasoline and diesel are expected to slow in the coming months after the nation implemented a windfall tax and shipping cap to ensure sufficient domestic supply, according to FGE. The consultant revised down its export forecast for gasoline by 50,000 barrels a day for the remainder of the year, and trimmed its estimate for diesel by 90,000 barrels a day.” We expect China to increase their allotments in another round of quotas because product storage is filling up quickly and the global market is short diesel/distillate. The arb is wide open, and it gets even better when you factor in using Russian crude trade at a $40-$50 discount. So you are buying crude at $60-70 but selling product based on spot Brent prices. A VERY healthy premium for China. The shift in taxes will cut the amount of product India has been exported, but won’t stop all of it given the global prices.

Even with the slowdown in Chinese flows, most of it is still coming from Russia as China cuts purchases from Iran and West Africa. The below chart also supports why Iran has been forced to cut their price in order to compete into China.

We have also seen an increase in Asian floating storage as the timing delays start to pile up with the slowdown at refiners. As more cargoes show up even as tanker activity slows, we expect floating storage to shift higher. There is a long transit time between some Russian and Chinese ports, which will keep levels elevated.

West Africa has benefited from a bit more aggressive pricing as well as disruptions from Libya and CPC. European buyers have rushed to buy from Nigeria and Angola, so even as Asian buying slows further- we are getting a sizeable pick-up in purchases from Europe. This has helped to bring floating storage back to normal levels.

Europe has been increasing their imports of Middle East diesel as KSA and Kuwait increase refiner runs and help fill the void that is left by India cutting exports and European storage sitting at such reduced levels. We are also seeing a sizeable increase in U.S. imports of Middle East Crude:

Shipments of Middle East crude and condensates this month to US buyers are set to reach the strongest level since May 2020, according to emailed note from industry consultant Vortexa.

- US refiners have sought crudes with greater vacuum gas oil (VGO) yields to replace sanctioned Russian VGO in order to fully use FCC units, says Houston-based senior oil market analyst Rohit Rathod

- Medium sour crudes from Middle East suppliers, especially Saudi Arabia and Iraq are suitable for US refineries including Motiva’s 600k b/d Port Arthur refinery and Valero’s plants

The U.S. is going to increase imports of the heavier crudes while we have more exports into Asia and Europe as prices support additional movement from the U.S. This just keeps us at our current levels of 3.4-3.5M barrels a day.

Europe is facing a bunch of headwinds from Libya only exporting 600k-700k barrels a day (for now) and the CPC issues. There are also rumors swirling that Libya is going to cut natural gas flows to Italy by 25%, which be another blow to Europe.

Here is a summary of the CPC debacle:

A crucial export route for Kazakh oil continued operations as the operator of the shipping terminal appealed a Russian court order for it to temporarily shut down. The regional court in Krasnodar, Russia plans to consider the Caspian Pipeline Consortium’s appeal on July 11, the company said in a statement. CPC is challenging a lower court’s order to halt all terminal operations for 30 days due to alleged violations of an oil-spill prevention plan. Exports of Kazakh crude via the CPC pipeline system are proceeding normally, the nation’s energy ministry said in an emailed statement. European oil traders are closely following CPC loadings, concerned that the shutdown, if it goes ahead, would further squeeze regional crude supplies. Shipments to Europe have fallen in recent months as a result of shrinking flows from Libya, the North Sea, West Africa and elsewhere. The CPC terminal is located on Russia’s Black Sea coast, but is the key export route for crude from Kazakhstan. It had been expected to load 1.24 million barrels a day in July, up from 1.08 million a day last month, according to a plan seen by Bloomberg.

The court in the Russian city of Novorossiysk on Tuesday ordered the CPC terminal to stop all operations for 30 days due to alleged violations of a spill-prevention plan. A statement from the CPC operator made on the same day didn’t specify when the shutdown period would begin.

The facility on Wednesday asked the court to delay the order, saying the halt “could result in irreversible consequences for its operations.” There was no new information on this request on the court’s website as of Thursday afternoon local time.

Kazakhstan is one of the Kremlin’s few remaining international allies, after a slew of other countries ostracized Russia following its invasion of Ukraine. Kazakh President Kassym-Jomart Tokayev on Thursday held a meeting on logistics, saying the nation needs to diversify its export routes and strengthen its trade fleet. Tokayev has also ordered an increase in shipment capacity for Kazakhstan’s oil pipelines toward China.

Kazakhstan has been pivoting further towards the West with another blow to Russia: “Kazakhstan withdraws from the CIS agreement on the Interstate Monetary Committee.” The CPC back and forth is a way to put additional pressure on the Kazak government.

Kazakhstan withdraws from the 1995 Commonwealth of Independent States Agreement on the Interstate Monetary Committee.

This is stated in the decree of the President of Kazakhstan Kasym-Zhomart Tokayev, ZONAkz reports.

The Interstate Currency Committee was created for cooperation between post-Soviet countries in the currency, payment and credit sphere, as well as for the improvement (convergence) of the currency legislation of the countries that are parties to the agreement. It was assumed that it would promote the development of economic cooperation and ensure the mutual convertibility of national currencies.

Here is a breakdown of the timeline[1]

The document on withdrawal from the agreement has already entered into force.

- On June 17, the President of Kazakhstan Tokayev stated at the St. Petersburg International Economic Forum, where Putin was also present, that his country will not recognize the “DPR” and “LPR”. Later, Tokayev announced that he plans to increase oil supplies to Europe.

- After that, “trouble” began in the countryʼs oil industry. The Primorye District Court of Novorossiysk closed an important terminal for the export of oil from Kazakhstan to Europe for 30 days.

- On July 6, an explosion took place at the Kazakh Tengiz field there was an explosion at the largest Tengiz oil field in Kazakhstan. What does Russia have to do with it?, killing two people and injuring three others.

- On the same day, it became known that Kazakhstan is considering a ban on the import of goods to Russia and BelarusKazakhstan is considering banning the transportation of sanctioned goods to Russia and Belarus that have been sanctioned by the European Union, Great Britain and the United States. The Ministry of Finance of the country has published an order for public discussion, which will last until July 22.

- On July 7, Reuters wrote that Kasym-Zhomart Tokayev instructed the government to diversify oil supply routes to Europe bypassing Russia

Russia is quickly losing support and friends, which is why they are increasing pressure on Kazak exports and cutting more natural gas flows to Europe. Libya cut of natural gas flows wouldn’t be a coincidence.

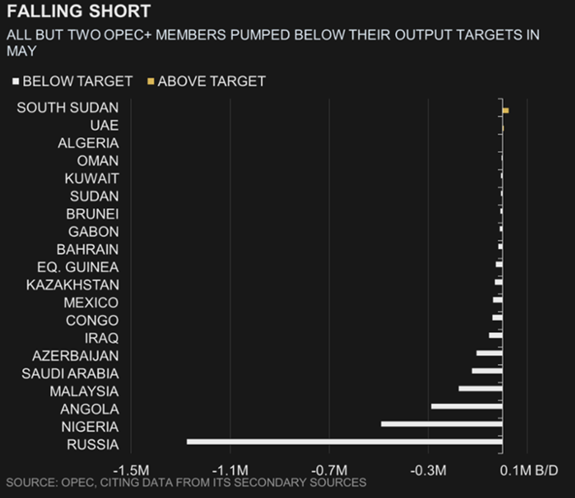

OPEC+ production has fallen driven by West Africa and Russia- which isn’t surprising given the lack of demand for WAF crudes. Russia is seeing the drop driven by falling piped crude as exports spike.

Even as some flows slow- we have a record amount of crude on the water and in transit as more Russian crude hits the water.

Crude Oil on the Water

Crude Oil in Transit

As more WAF crude heads to Europe and Russia oil to Asia- we are going to see that stay at a record setting pace. We believe this holds through the end of the year and sets a new seasonal record.

[1] https://babel.ua/en/news/81161-kazakhstan-withdraws-from-the-cis-agreement-on-the-interstate-monetary-committee