- Because the oilfield equipment market is in tight supply, Halliburton’s North American operation is “sold out” while the international market is in multi-year energy upcycle

- Since the pandemic-led downturn, it has significantly lowered operating costs and reduced capital intensity.

- Its well construction and completion product service lines will see demand increasing.

- However, cash flows did not grow in 1H 2022, which can be a concern given its deleveraging objective.

Explaining The Strategies

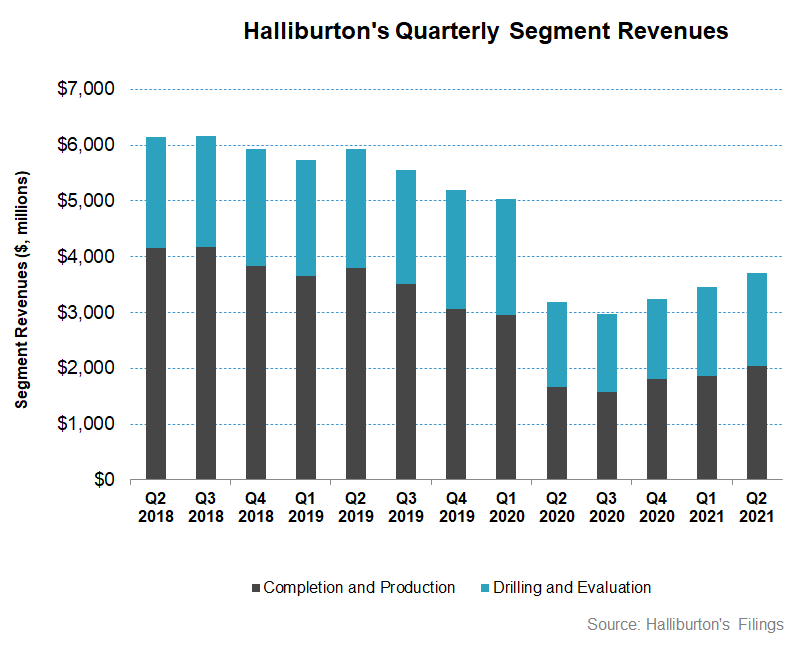

Halliburton’s Completion & Production and Drilling & Evaluation segments witnessed impressive margin expansion in Q1, reflecting its initial strategic realignment efforts. During the pandemic-led downturn, it re-aligned the chemical supply chain to strategic locations for its international customers and emphasized the localized workforce. This improved its cost competitiveness. Plus, it invested in drilling technology during this period. So, when the drilling and completion fluids business entered the current upcycle, it stood to benefit. To get a perspective, investors may note that since the downturn in 2020, it has lowered operating costs by $1 billion. It also reduced capital intensity by lowering the capex target to 5% to 6% of revenue compared to 10% to 11% earlier. It has also strengthened its balance sheet by retiring debt. Read more on HAL’s strategies in our previous article.

These strategic readjustments align with Halliburton’s views of a believed multi-year energy upcycle. The energy supply remains tight, OPEC spare capacity is low, and the Ukraine-Russia conflict threatens supply smoothening. Economic expansion and population growth will drive demand in the medium-to-long term, although the short term looks bumpy due to the current uncertainty and policy changes.

In this environment, the oilfield services market has kept its supply tight. Many operators have held the investment scope narrow and focused on developing the known resources, resulting in drilling more wellbores. So, operators spending more on services will benefit Halliburton in the short-to-medium term.

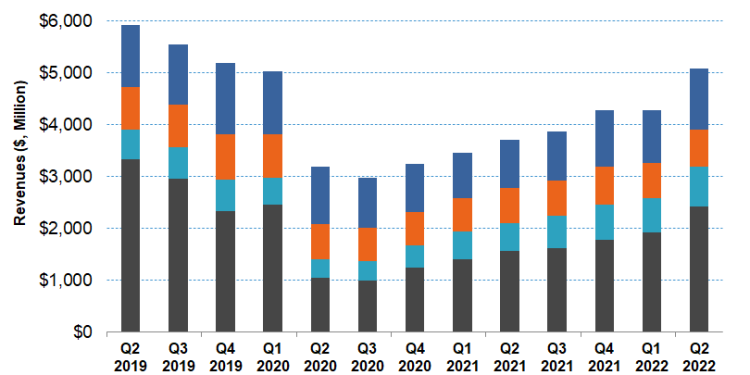

The North American vs. International Market Outlook

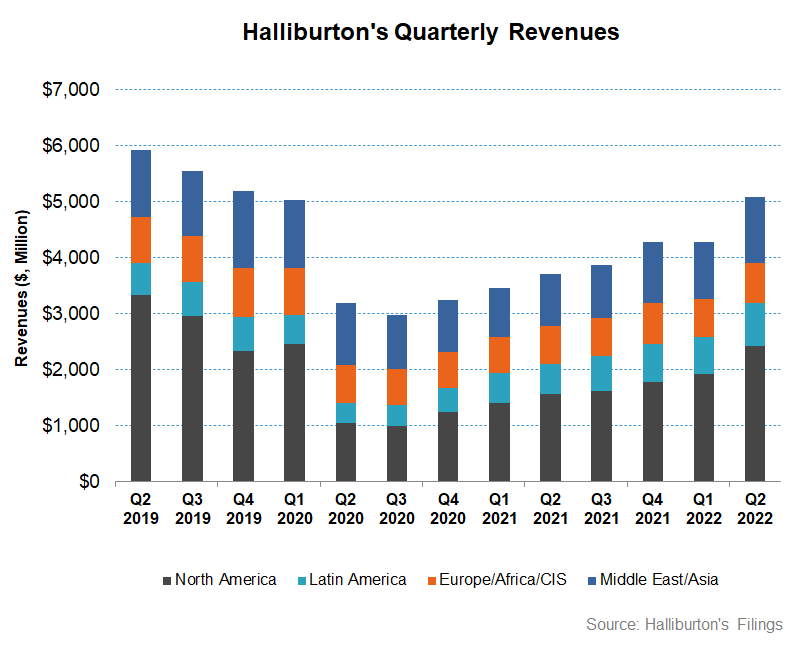

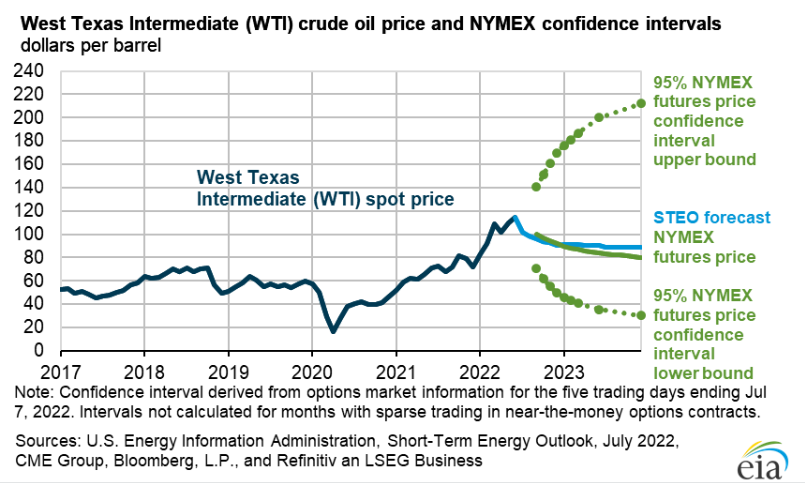

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 279 by mid-July and has gone up by 19% in 2022. Halliburton’s FSC has now increased by 18% compared to a year ago. As frac activity steadily increased in Q2, Halliburton remains “sold out,” which is possibly the highlight of its Q2 earnings call. Because of the OFS companies’ supply discipline, long lead times for new fleets, and supply chain bottlenecks, HAL expects their drilling and completion services demand to remain high in North America.

The management estimates that North American upstream capex growth will surpass 35% in 2022 compared to a year ago. However, OFS equipment supply will remain tight in 2023 as well. To lower costs in North America, the company has adopted a “one design approach,” which helps minimize the supply chain challenges for spares and equipment. Its internal chemical manufacturing capabilities in the US and Saudi Arabia have diversified supply and control input prices better than earlier during the supply chain crisis. This can also offset the continuing global labor issues.

In international markets, HAL has been looking to diversify its supply sources as a policy to counter the energy security issues under the current geopolitical uncertainty. However, the solution will be long-term because many countries are not currently equipped to handle energy independence. The Middle East and Latin America energy markets will grow in 2022. In these markets, HAL has a portfolio of well construction and completion product service lines, which should reap the advantages of a multi-year upcycle. New project announcements have been made in Australia and West Africa. Based on the trend, it is safe to expect activity acceleration in 2023 and beyond.

Segment Forecast

In Q3, the management expects revenues in the Completion and Production division to grow by “mid-single digits” and margins to improve by 75-125 basis points. The Drilling and Evaluation division can see “low to middle single digits” revenue growth, while margins remain flat in Q3.

What Do The Industry Indicators Suggest?

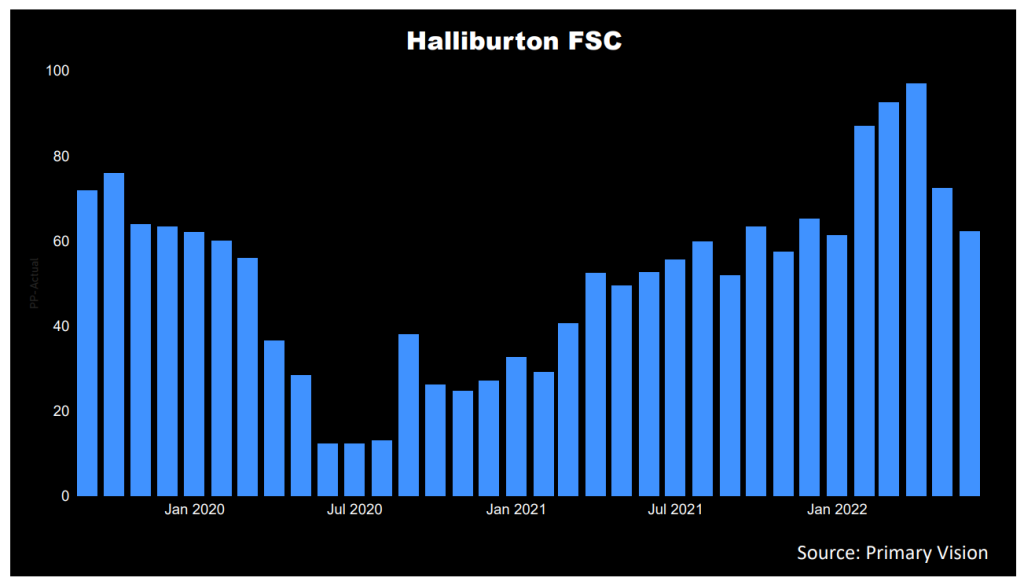

According to the EIA, crude oil prices can increase by ~6% in 2022 compared to the current level. By 2023, however, it can decline by more than 9%. The geopolitical situation in Ukraine and the global economic slowdown can lead to this demand destruction. However, the situation remains volatile, and how the Russian oil supply responds in the face of the sanctions and OPEC’s production decision will decide the pricing course. The EIA expects OPEC crude oil production will rise by 2.4 million barrels per day in 2022, but the production growth will decelerate in 2023.

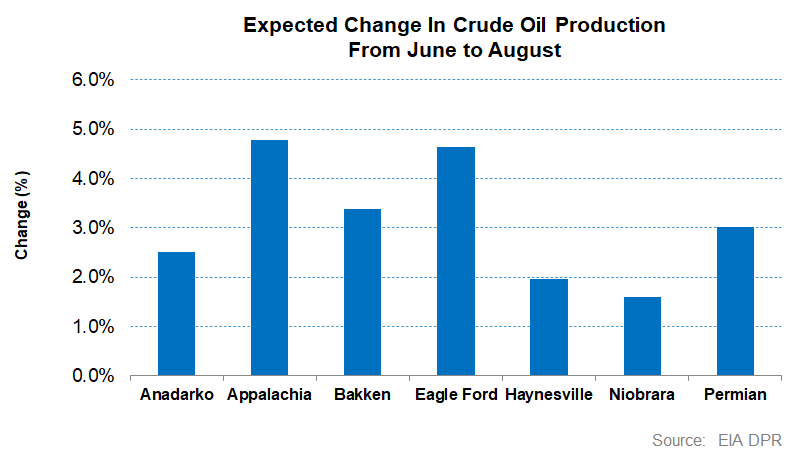

According to the EIA’s Drilling Productivity Report, US shale oil production can increase by 3.1% on average by August 2022. The drilled wells went up by 69% in the past year, while the drilled but uncompleted (or DUC) wells have declined by 31%. The continuous fall in the DUC backlog over the past several months points to reasonably steady energy production growth.

Analysing Division Performance

In Q2 2022, Halliburton’s Completion and Production division revenue increased by ~24% compared to Q1 2022. Higher completion tool sales, pressure pumping services, artificial lift activity in North America, and improved cementing activity in the Eastern Hemisphere led to the topline movement. Asa result of this overall growth, its operating income margin also expanded tremendously (450 basis points) in this segment. However, Latin America saw a drop in artificial lift activity, while lower stimulation activity in Oman kept a tab on growth.

Quarter-over-quarter, HAL’s Drilling and Evaluation division revenue growth was 12% in Q2. Increased fluid services and wireline activity, project management activity, and drilling services in some regions resulted in the topline growth. However, the operating income margin expansion was limited due to lower software sales and decreased drilling services in Brazil.

Dividend And Dividend Yield

Halliburton pays an annual dividend of $0.48 per share, translating to a 1.66% forward dividend yield. Schlumberger (SLB) pays a yearly dividend of $0.70, which equals a forward dividend yield of 2.11%.

Free Cash Flow And Debt

HAL’s cash flow from operations (or CFO) decreased by 47% in 1H 2022 compared to a year ago. Although revenue increased in the past year, investment in working capital led to a cash flow decrease. On top of that, the capex increased (32% up). As a result, free cash flow turned negative in 1H 2022 versus a positive FCF a year ago. The management expects to generate strong FCF in 2H 2022, which means cash flows are expected to be back-end loaded.

HAL’s debt-to-equity is 1.19x, which is marginally lower than Schlumberger’s (SLB) (0.96x) but higher than TecnipFMC’s (FTI) (0.57x) and Baker Hughes’s (BKR) (0.41x). Halliburton has been strengthening its balance sheet and has retired $1.8 billion of debt since 2020. However, a weakened cash flow will not be easy to maintain dividends and reduce debt.

Learn about HAL’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.