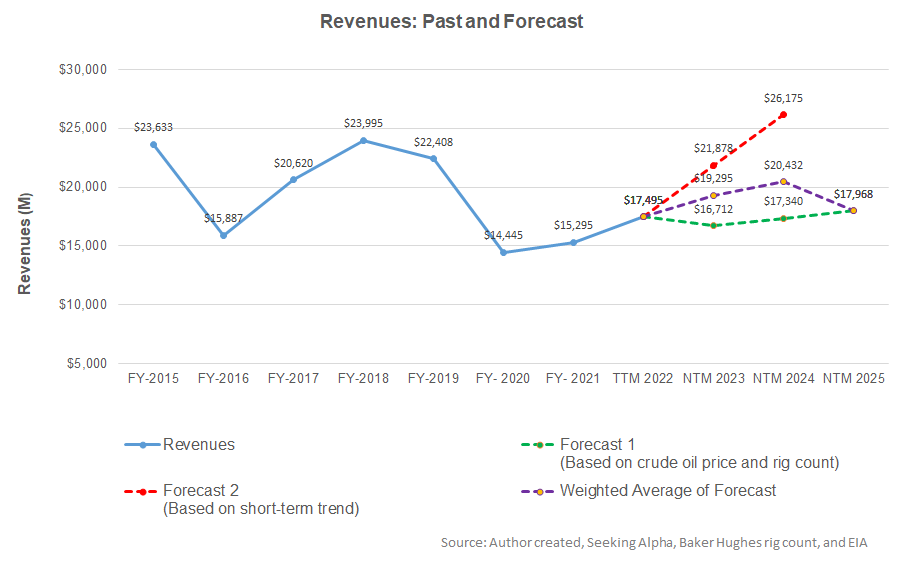

- The regression model suggests an increase in revenues in the next two years.

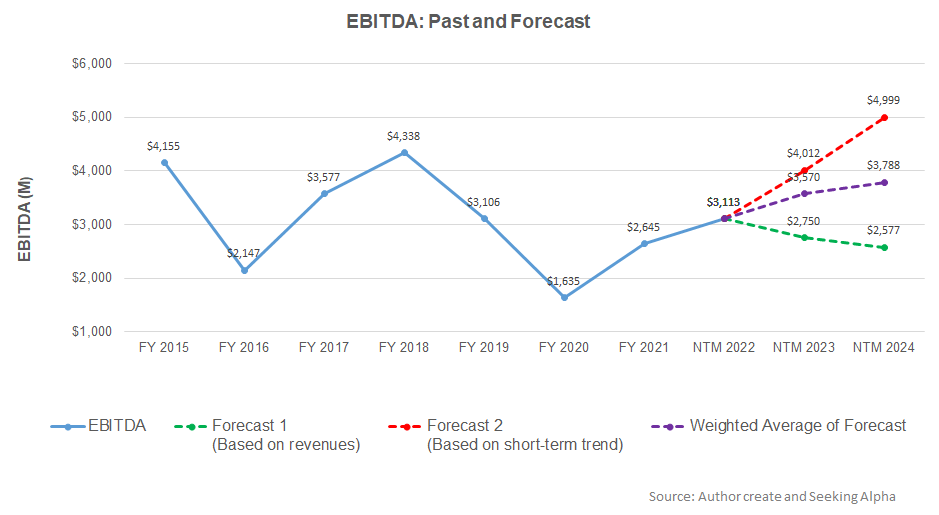

- EBITDA can increase sharply in NTM 2023 but will slow down after that

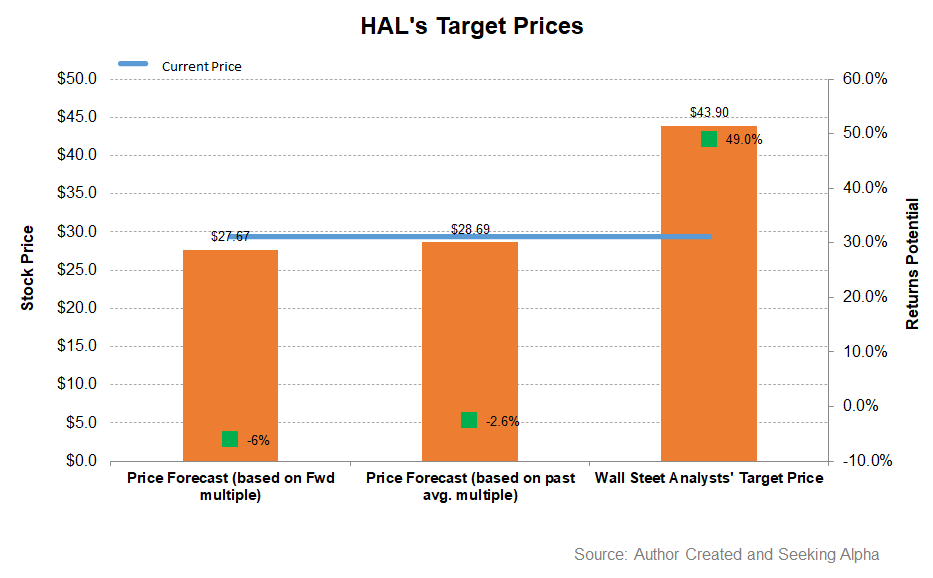

- The stock is reasonably valued at the current level

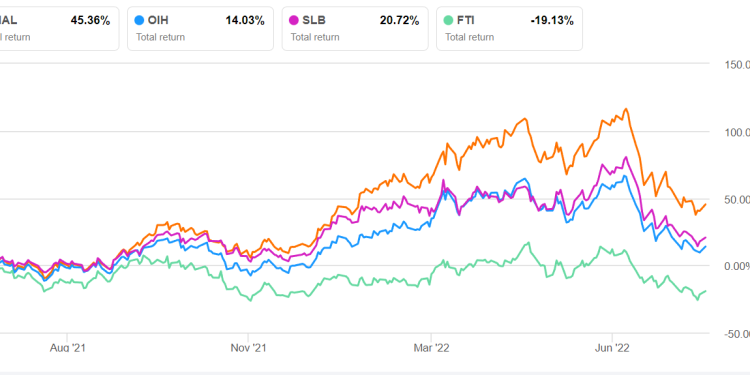

Part 1 of this article discussed Halliburton’s (HAL) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the crude oil price, global rig count, and HAL’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase in the next two years. However, the model suggests that it may fall in NTM 2025.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to increase sharply in the next 12 months (NTM 2023). The growth rate can decelerate in NTM 2024.

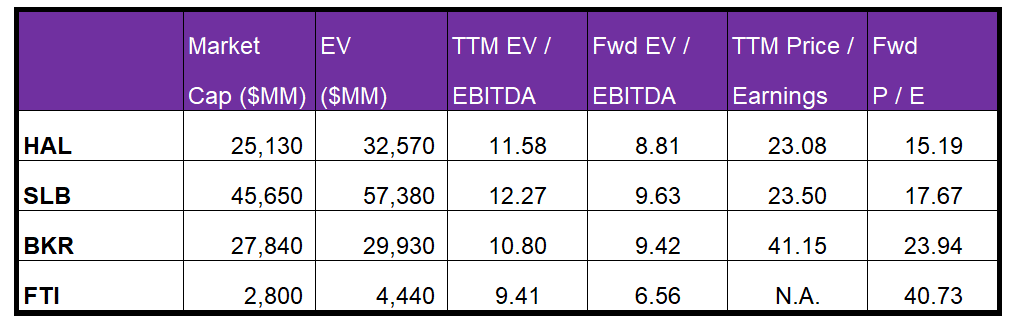

Target Price And Relative Valuation

Returns potential using HAL’s forward EV/EBITDA multiple (8.8x) is lower (6% downside) compared to returns potential using the past average multiple (3% downside). The Wall Street analysts have considerably higher return expectations (49% upside).

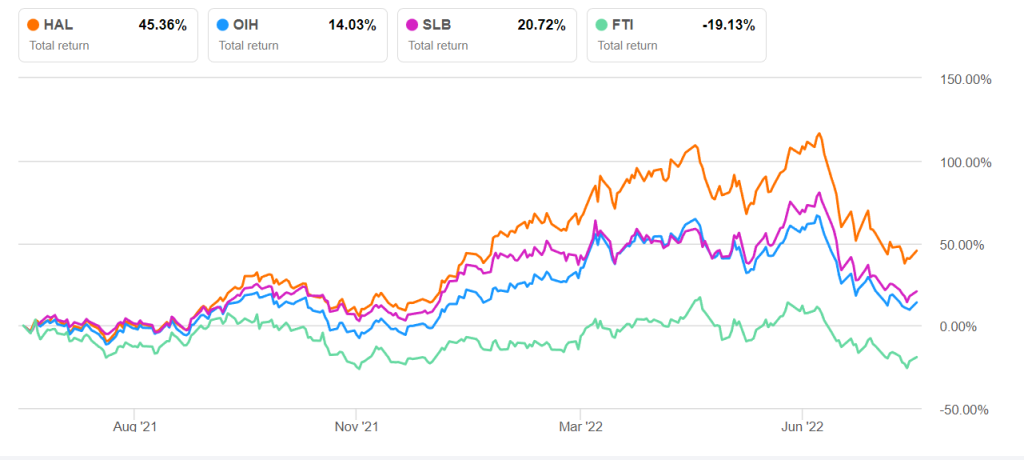

Halliburton’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is slightly steeper than peers because sell-side analysts expect HAL’s EBITDA to increase more sharply than its peers in the next four quarters. This typically results in a marginally higher EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple (11.6x) is higher than its peers’ (SLB, BKR, and FTI) average of 10.8x. So, the stock is reasonably valued versus its peers at this level.

What’s The Take On HAL?

After Q2, Halliburton’s management is convinced that its North America operation is “sold out” while the international market is in multi-year energy upcycle. In the international market, it is at the cusp of a multi-year energy upcycle. Because of its solid presence in the well construction and completion product service lines, the company can reap the short-term pricing benefits in the Middle East and Latin America. Since the pandemic-led downturn, the company has significantly lowered operating costs and capital intensity, which expanded the operating margin.

Although deleveraging remains one of HAL’s top priorities, a negative free cash flow in the early half of 2022 questions the ability. True, its debt-to-equity does not add to the worries. But, it might want to improve efficient working capital management to steady cash flow. The stock is reasonably valued versus its peers at this level. Given the current uncertainty on the supply side, investors might want to hold the stock for medium to long-term gains.