- A weaker economy and supply chain issues can put a dent in Baker Hughes’s growth plans in 2022

- Loss of revenues from the Russian operations and low Turbomachinery & Process Solutions segment backlog can lower the topline growth.

- However, steady energy prices, a rise in major LNG projects, and increased contracting activity underline its natural gas business’s long-term prospects.

- BKR’s low leverage and share repurchase reflect the balance sheet strength

Market Outlook

BKR’s management sees future challenges inundating the energy market in 2023 and 2024, although the crude oil price has seemingly stabilized at a high level in 2022. A high inflation rate and the central bank’s hawkish policy can dent consumers’ purchasing power, crippling the demand side of the equation. The supply side remains more attractive. The supply chain challenges will stay with us for a few quarters more. However, underinvestment in drilling, undersupply of equipment, and labor shortages will pull the supply side in different directions. So, the outlook for oil prices remains volatile with a bullish flavor.

The natural gas market, however, is on a firmer footing. High prices, a rise in major LNG projects, and increased contracting activity underline the natural gas business’s long-term prospects. In 1H 2022, the long-term LNG offtake agreements in the U.S. totaled ~35 MTPA, significantly higher than the past seven-year average.

Strategic Realignment

As discussed in the previous article on Baker Hughes, it plans to expand into industrial energy. With that objective, it has recently created The Climate Technology Solutions Group (or CTS) and Industrial Asset Management Group (or IAM). In 1H 2022, it made tuck-in acquisitions and new energy investments in Mosaic, Net Power, and HIF Global. The inorganic route will provide opportunities in the energy transition and industrial areas. It now focuses on optimizing its operations and finding additional synergies between TPS (Turbomachinery & Process Solutions) and DS (Digital Solutions) on the one hand, and between (OFS Oilfield Services) and OFE (Oilfield Equipment), on the other.

The Natural Gas Market

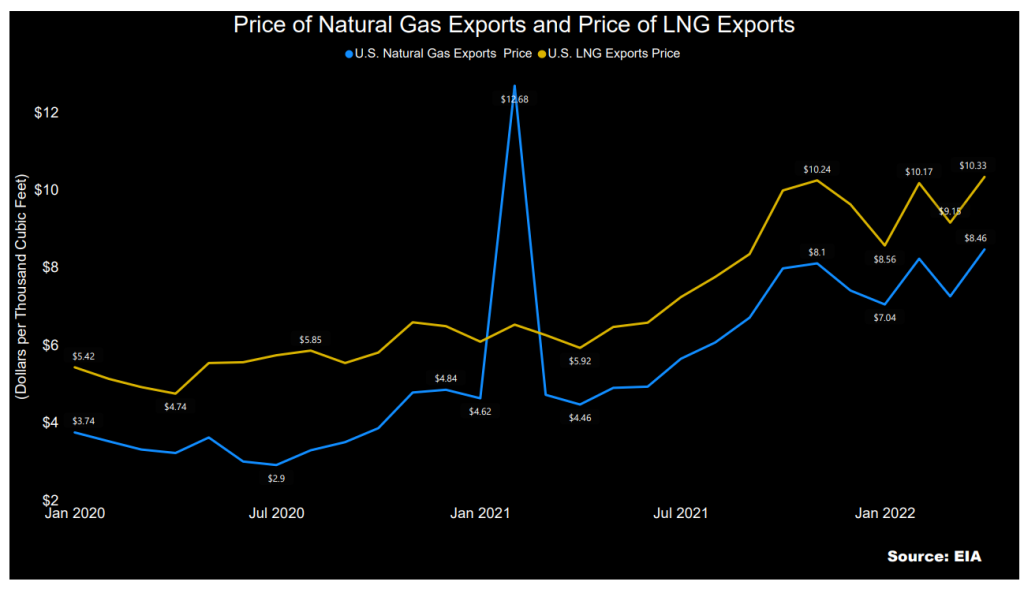

The natural gas export price increased by 90% in the past year until April 2022. During the same period, the LNG export price increased by 74%. The EIA expects natural gas production to increase by 3% in 2022 compared to 2021 and even more in 2023 (4% up to 2021). The natural gas spot prices can average $5.97/MMBtu in 2H 2022 and decline to $4.76/MMBtu in 2023. Amidst the geopolitical volatility arising from the Ukraine-Russia conflict, natural gas prices will derive strength from the ongoing constraints in the coal market and strong demand from the electric power sector in the summer.

The Russian Impact

At the end of Q2, BKR marked its OFS business in Russia as “held for sale” to ensure compliance with all sanctions. As volume and revenues from Russia declined by 51% in Q2, cost under absorption increased, adversely impacting the margin. In FY2022, the TPS segment will be affected the most. The segment revenue is estimated to be reduced by $400 million, although the impact on the margin will be low. The OFE segment also saw all equipment and service contracts suspended in Russia. So, it will be impacted by lower volume and cost under absorption over the next few quarters.

Oilfield Services: Outlook And Performance

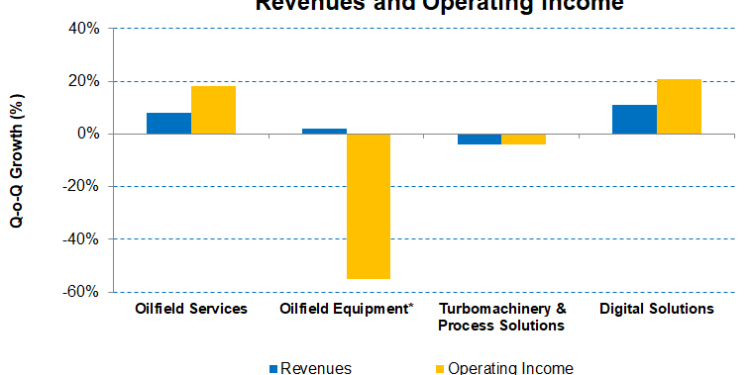

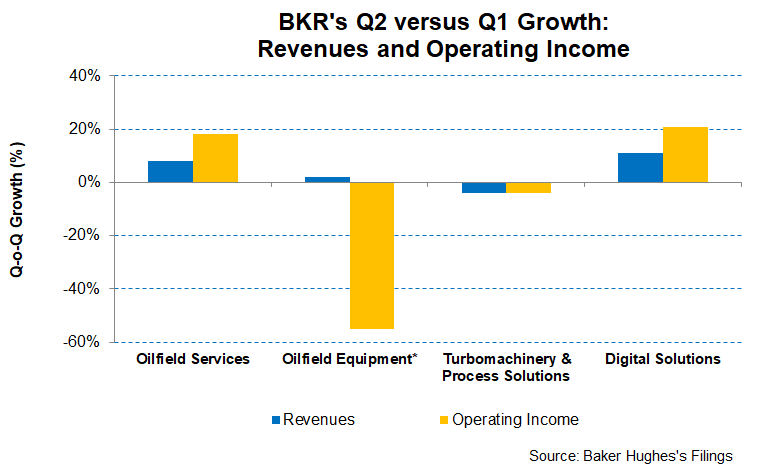

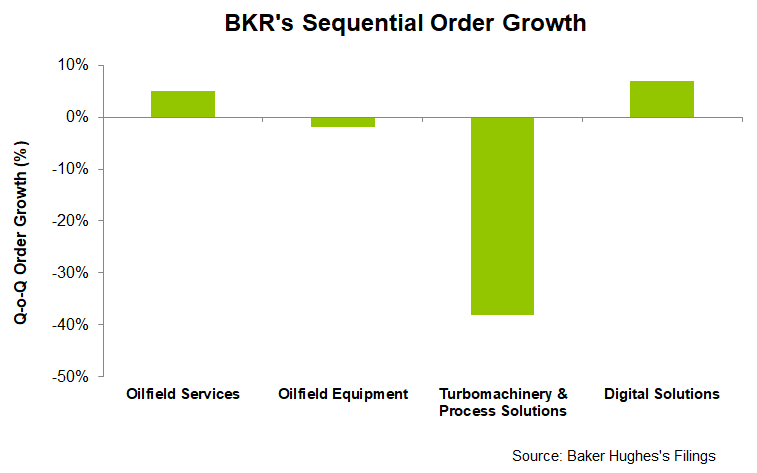

In Q2, revenues in this segment increased by 8% compared to a quarter ago, while the operating profit registered an 18% rise. In FY2022, the recovery in the energy activities in the international market can reach “mid-double digits.” So, BKR’s OFS segment can see topline grow by “mid-double digits,” while the operating margin can increase in Q3 and may inflate by 19%-20% in Q4.

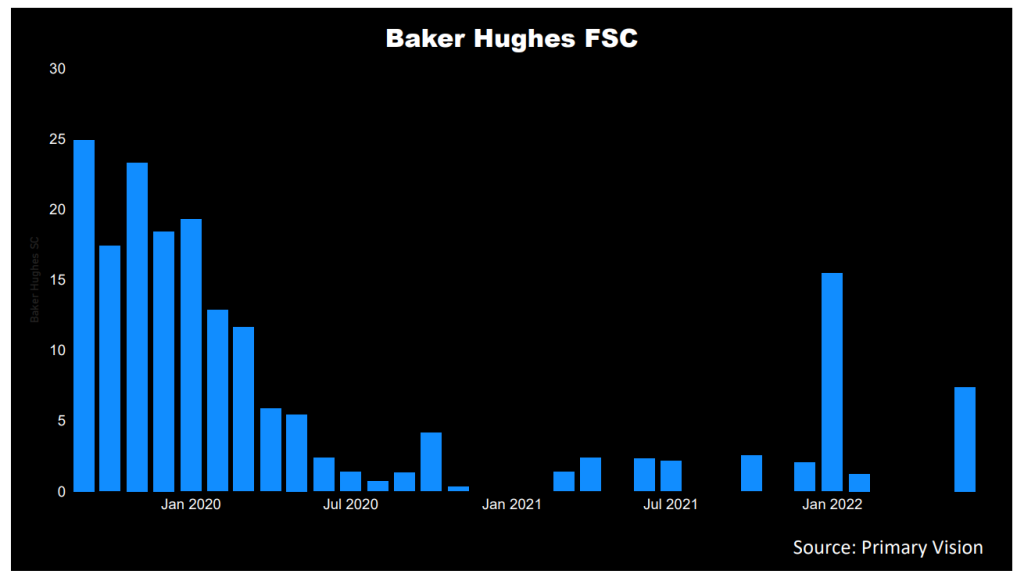

In Q3 2022, however, revenue can increase by a “mid-single digit” compared to Q2. The operating margin can increase by 50 to 100 basis points. In this context, investors might be interested in knowing the frac spread count changes – a key indicator for the oilfield services companies. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 279 by the second week of June and has increased by 19% since the start of 2022. BKR’s frac spread count in June increased substantially compared to a year ago. The rising count is a positive for BKR’s 2022 outlook.

The Oilfield Equipment Growth Drivers

BKR will depend on deepwater opportunities after securing several large contracts across the Americas (Brazil) and the Middle East. It plans more integration between OFE and OFS, driving more efficient cost management. The company primarily provides risers, flowlines, and jumpers to improve oil recovery and extend field life. The primary challenge in this segment is to arrest the margin decline. The operating income will remain below breakeven due to cost under absorption. The segment saw lost volume following the suspension of contracts related to Russia.

The segment revenue can increase by “low-single digits” in Q3, as expected by BKR’s management. In FY2022, a recovery in offshore activity and project awards can add to the orders by double-digit. However, the topline will suffer from the deconsolidation of SDS. As a result, the revenue can decline by “double digits,” while the operating margin will stay below breakeven.

In Q2, the segment revenues increased slightly (by 3%), although the operating income went several steps backward (55% down) during the quarter. In Q2, it booked over $600 million in flexibles orders – one of its highest, which indicates a potential topline improvement in the coming quarters.

Analysis: The Turbomachinery & Process Solutions (or TPS) Segment

Sequentially, in Q2, the segment revenues increased by 2%, while the operating income crashed by 55%. Lower volume in Subsea Production Systems and Surface Pressure Control Project primarily contributed to the operating income fall. Revenue loss due to the removal of Subsea Drilling Services business added to it. In Q2, it provided LNG trains to support the Stage 3 expansion project of Cheniere’s Corpus Christi Liquefaction facility. It also received a natural gas processing award in Saudi Arabia and another from Tellurian to provide compressor line technology and turbomachinery equipment.

Backed by increased project awards, revenue can increase by “mid-single digits,” year-over-year, in Q3. However, the sharp fall in order backlog in Q2 can thwart the revenue growth potential. The operating margin, however, will remain steady. In FY2022, the revenue growth to be roughly flat to up low-single digits.

The Digital Solutions Segment Outlook

The segment will continue to face challenges from electronic shortages and inflationary pressures. In Q2, it contracted with GE to sell its Nexus Controls product line. Baker Hughes will be the exclusive supplier of GE’s Mark control products.

In Q3, the company expects a “low-single-digit” sequential revenue growth with a marginal increase in operating margin. In FY2022, too, the topline and margin are expected to increase. Revenues in the Digital Solutions segment increased (11% up) due to increased volume, while operating income went up by 21% from Q1 to Q2. Orders in this segment increased by 7% sequentially.

Dividend

BKR’s annual dividend is $0.72 per share, amounting to a 2.55% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.63%) is lower than Baker Hughes’s.

Cash Flows And Debt

BKR’s cash flow from operations was $393 million in 1H 2022, a steep deterioration compared to a year ago (67% down). Although year-over-year revenues remained flat, a significant rise in working capital requirements led to the drop in CFO. As a result, free cash flow (or FCF) nearly vanished (95% down) in the past year. In Q3, the company expects FCF to improve, although free cash flow conversion from adjusted EBITDA may weaken slightly due to lower cash generation in Russia.

Baker Hughes’ debt-to-equity (0.44x) is significantly lower than the peers’ average, suggesting the balance sheet strength. During Q2, it repurchased shares worth $226 million at $34 each, on average, continuing with its previously announced program. The current stock price is lower (~$25 per share), suggesting the management has confidence in seeing a higher stock price.

Learn about BKR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.