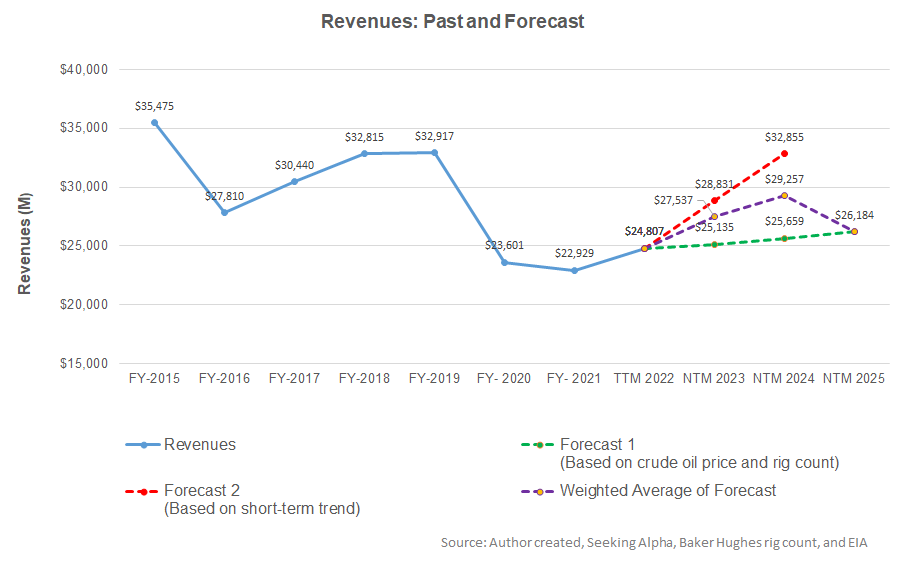

- The regression model suggests that Schlumberger’s revenue estimate is upward trending in the next couple of years but may slow down.

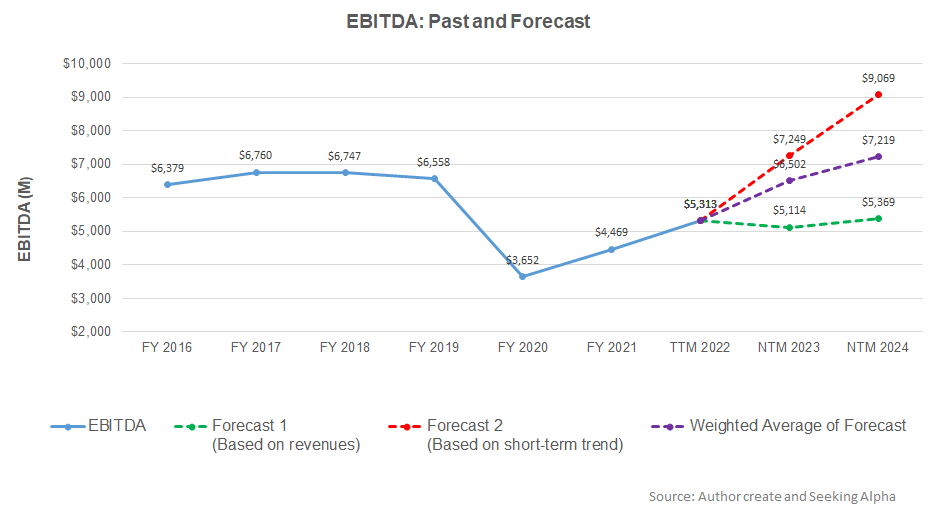

- EBITDA will also increase in the next couple of years.

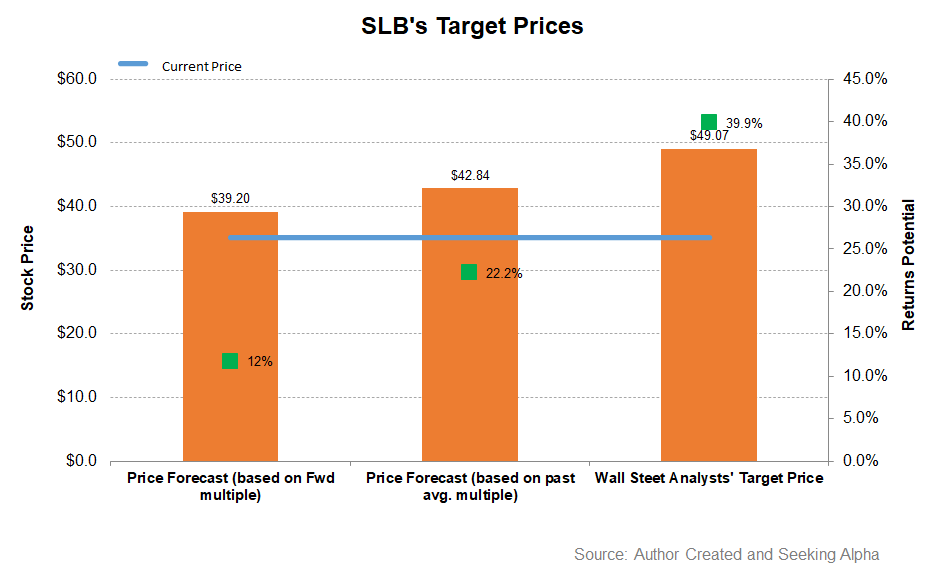

- The stock is relatively overvalued at the current level.

Part 1 of this article discussed Schlumberger’s (SLB) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

A regression equation-based model on the relationship among the crude oil price, global rig count, and SLB’s reported revenues for the past seven years and the previous eight-quarters suggests revenues to increase in the next two years. However, revenues can decline in NTM (next 12 months) 2025.

The EBITDA can decline sharply. Based on the average forecast revenues, the model suggests the company’s EBITDA will increase in the next two years.

Target Price And Relative Valuation

Returns potential using SLB’s forward EV/EBITDA multiple (9.9x) is lower (12% upside) than the returns potential using the past average multiple (22% upside). The Wall Street analysts have higher return expectations (40% upside).

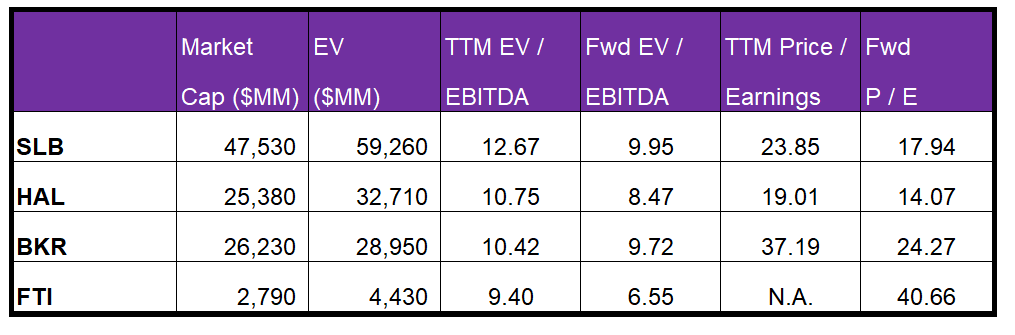

SLB’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is in line with the peers because the company’s EBITDA is expected to increase nearly as much as its peers in the next four quarters. This would typically reflect a similar EV/EBITDA multiple compared to the peers. The company’s EV/EBITDA multiple is higher than the peers’ (HAL, BKR, and FTI) average of 10.2x. So, I think the stock is overvalued at the current price.

What’s The Take On SLB?

Schlumberger’s management believes in the energy activity momentum supported by energy security, higher breakeven price, and long-term oil and gas production capacity growth. The international activities go up-cycle and will support revenue growth and margin expansion. In 2H 2022, steady growth in production systems will benefit its Digital & Integration segment. It has also upped the revenue growth from “mid-single-digits” earlier to “high teens” in its revised forecast for 2H 2022.

Despite all the positive factors mentioned above, a global economic slowdown concern and the Ukraine war can disrupt the energy sector’s growth path, at least in the short run. SLB’s free cash flows continued to fall in 1H 2022. Because working capital requirements can increase in 2022 due to higher inventory balance, FCF may deteriorate further during the year. At the current level, the stock is overvalued compared to its peers. Nonetheless, SLB’s balance sheet strength and the current momentum leave a positive bias over an extended period.