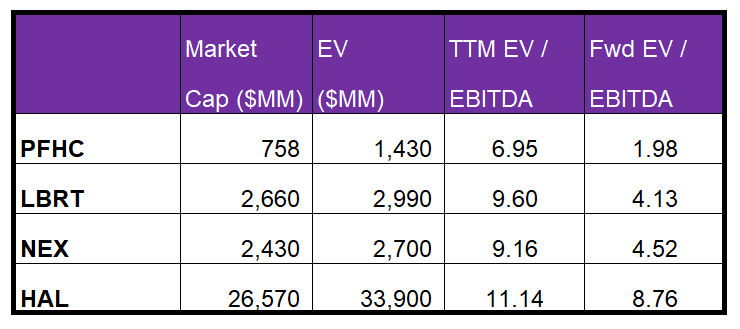

- ProFrac is undervalued relative to its peers at the current level

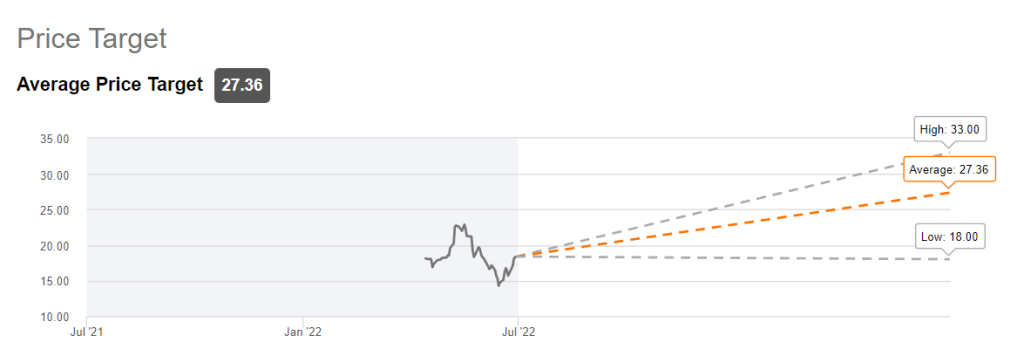

- According to Wall Street analysts, it has a returns potential of 49% at this level

- Most of the sell-side analysts rate it a “buy.”

Part 1 of this article discussed ProFrac’s (PFHC) outlook, performance, and financial condition. In this part, we will discuss more.

Relative Valuation And Target Price

The sell-side analysts’ target price for PFHC is $27.4, which, at the current price, has a returns potential of 49% at the current price. Out of the seven sell-side analysts rating PFHC, six rates it a “buy” or a “strong buy.”

PFHC’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers because its EBITDA would rise more than its peers in the next four quarters. So, its EV/EBITDA should typically be higher than its peers’ average. However, its EV/EBITDA (6.9x) is much lower than the peers’ average (10x). So, I think the stock is undervalued versus its peers and has a positive bias at this price level.

What’s The Take On PFHC?

In 2022, ProFrac stormed into the pressure pumping scene when it first acquired FTSI and later consolidated its dominance by acquiring USWS – one of the top guns in the market. The first acquisition allowed it to vertically integrate with supply chain management and standardized equipment, leading to fuel cost savings. Another inflection point for the company’s growth occurred in June when it acquired USWS. Not only will it take the company’s pressure pumping fleet count from 13 at the start of the year to 44 by the end of 2022, but it will also have the highest number of the electric frac fleet. As the US fracking industry increasingly looks for fuel-efficient solutions, the Tier IV fracks, and electric pumps will command the leading-edge day rates, maximizing the company’s operating margin in the medium term. The company’s purchase of the sand mines is another step toward backward integration and will support its cost reduction initiatives.

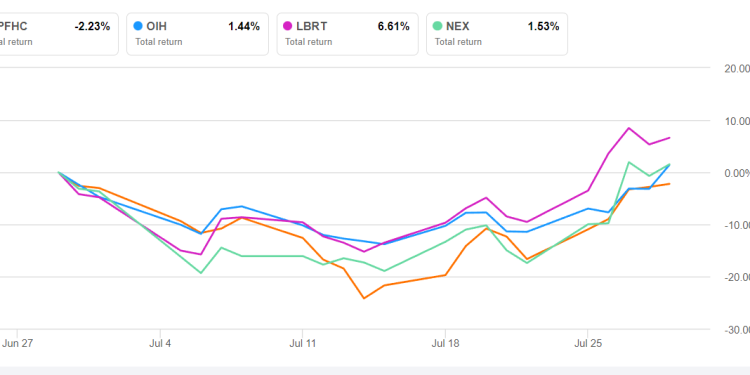

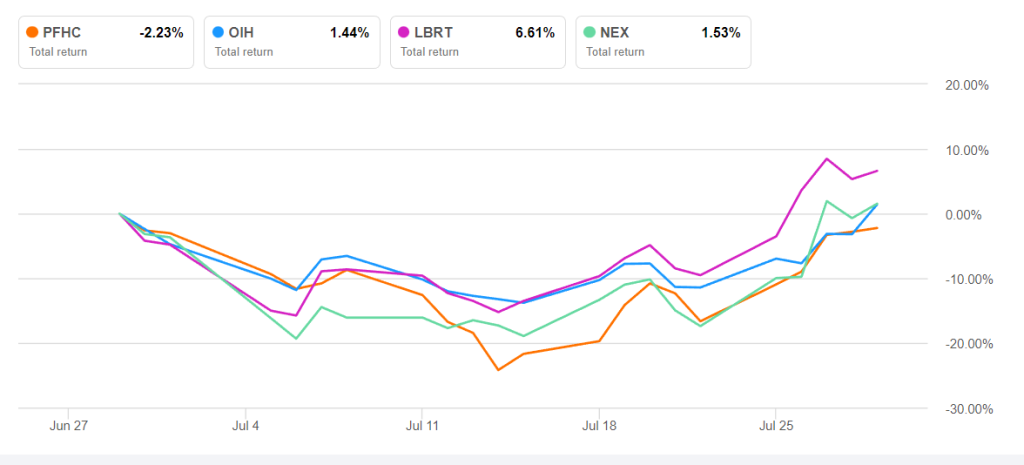

A couple of factors might have pulled PFHC’s stock price down more than it did for the VanEck Vectors Oil Services ETF (OIH) in the past month. The demand concern following the US economic downturn, free cash flow concerns, and the company’s overleveraged balance sheet. However, investors may have overreacted to the industry issues. The fracking industry is still in good shape with increased upstream capex, higher drilling activity, and a steady energy price projected for the year. An improved mix of fuel-efficient electric fracs can deliver the punch and improve returns rapidly in the coming quarters.