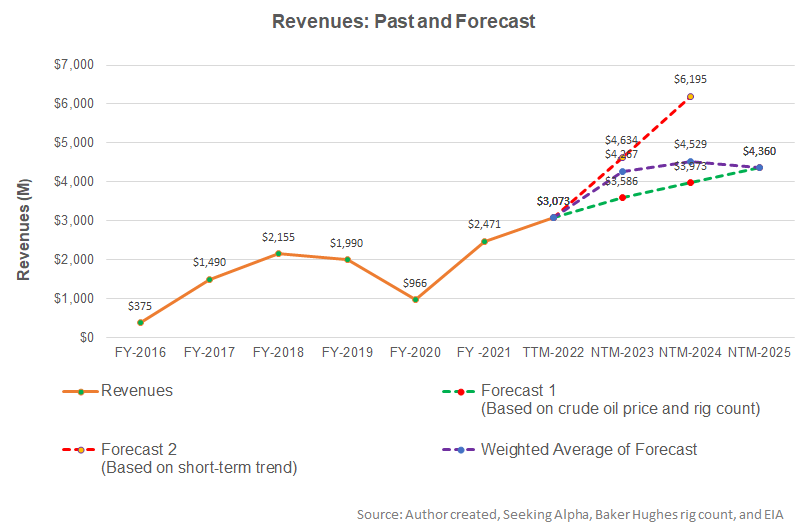

- The regression model suggests that Liberty’s revenues will rise rapidly in the next year but can decelerate afterward.

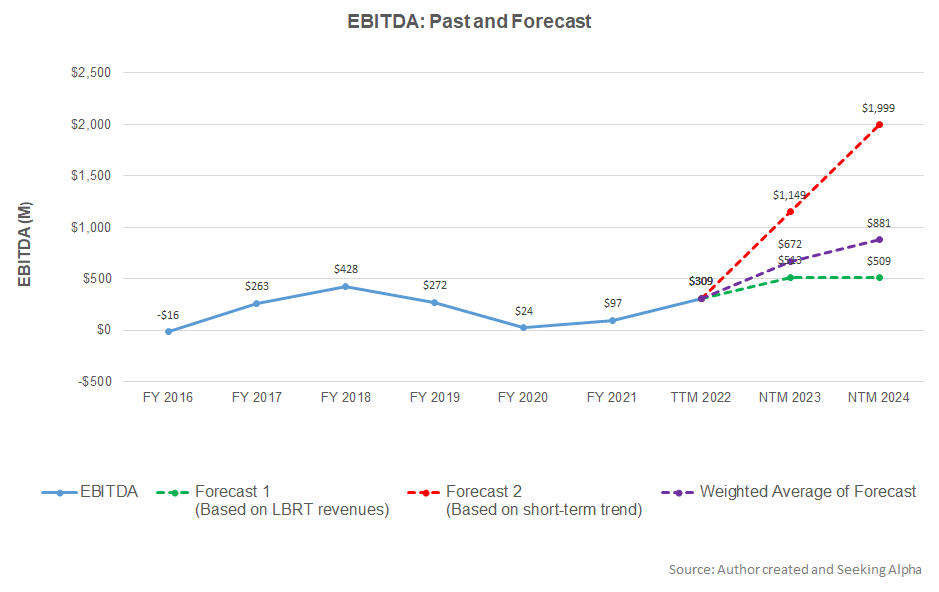

- EBITDA can increase sharply in NTM 2023 but will fall sharply after that

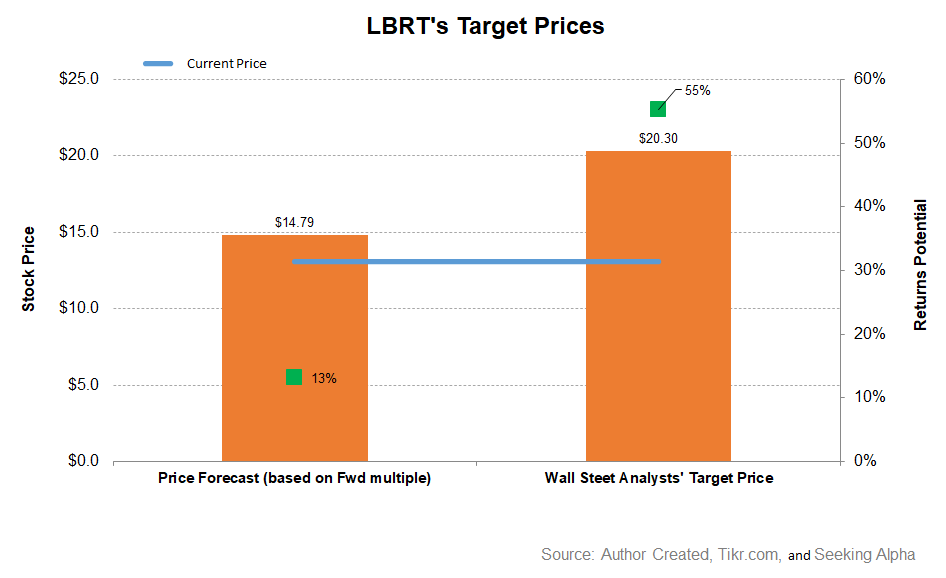

- The stock is relatively undervalued at the current level

In Part 1 of this article, we discussed Liberty Energy’s (LBRT) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation among the crude oil price and rig count, LBRT’s past seven-year revenues, its topline can increase sharply in the next 12 months (NTM 2023). The growth rate will decelerate in the following year and can decline in NTM 2025.

A regression model based on the forecast revenues suggests that the company’s EBITDA can increase sharply in NTM 2023. In NTM 2024, the model indicates that the EBITDA growth rate will fall.

Relative Valuation And Target Price

Here is an analysis of LBRT’s relative valuation using its forward EV/Revenue multiple. The returns potential (13% upside) using the forward EV/Revenue multiple (0.71x) is lower than sell-side analysts’ expected returns (55% upside) from the stock.

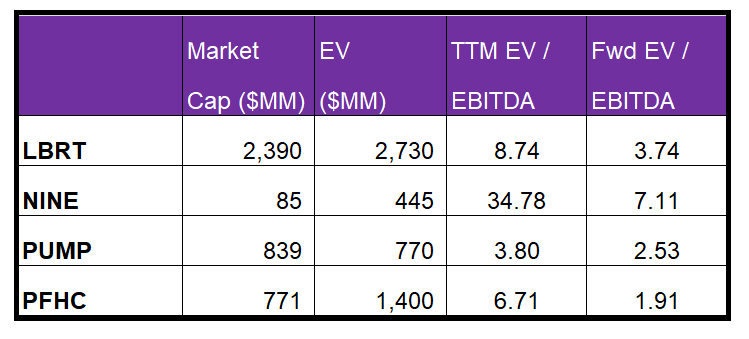

LBRT’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is in line with peers because its EBITDA would rise nearly as much as its peers in the next four quarters. Its EV/EBITDA is lower than its peers’ (NINE, PUMP, and PFHC) average (15.1). So, I think the stock is undervalued versus its peers (with an EV/EBITDA of 8.7x) at this price level.

What’s The Take On LBRT?

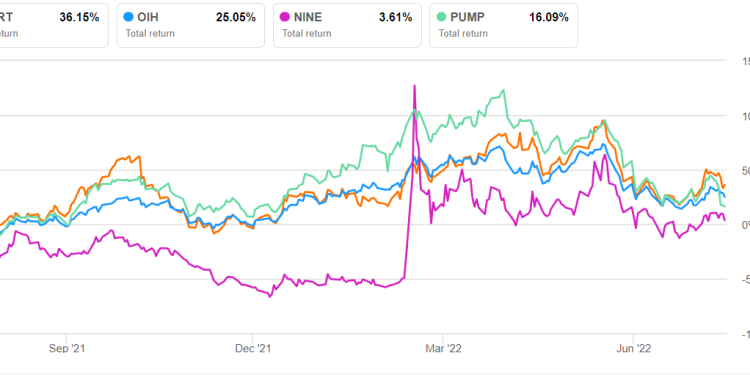

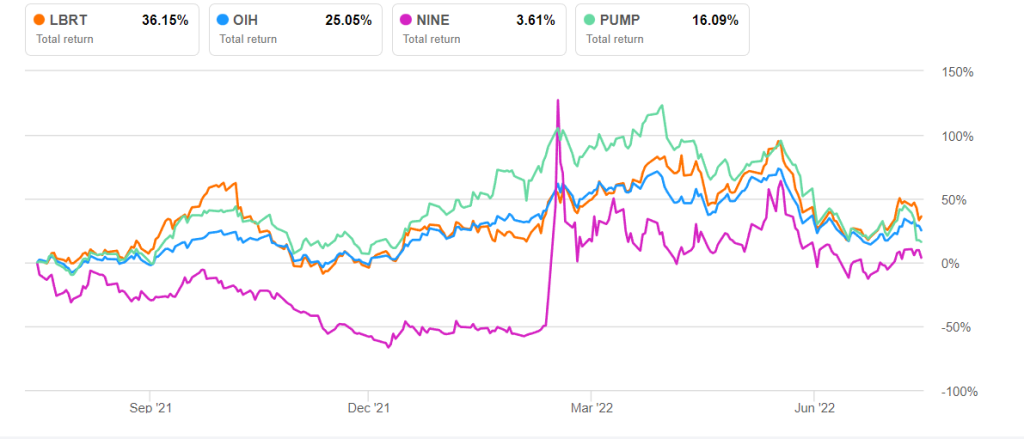

In a market where frac fleets and pressure pump supply remain tight, LBRT, with its suite of ESG-friendly frac fleets, will benefit from high demand due to its stringent emissions standards and fuel savings measures. Liberty can see frac prices improving as the share of ESG-friendly frac fleets rises as it invests heavily into digiFrac fleets and PropX sand handling. As pricing improves, its management indulges in a $250 million share buyback program in Q2, reflecting its confidence in its strength of balance sheet. So, LBRT’s stock price outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Free cash flow turned negative in Q1, raising investors’ concerns. There are few concerns over the demand side as the economy sets inti-inflationary measures which might mitigate energy demand partially. Also, heavy investment in new-age fleets can keep free cash flow low in 2022. Nonetheless, its low leverage (debt-to-equity) will protect it from any possible pressure on cash flows. The stock appears undervalued at the current level relative to its peers. Investors would do well to stay invested in this stock in the medium-to-long term.