- Patterson-UTI Energy plans to add six more drilling rigs in Q3

- Average revenue and pricing in contract drilling and pressure pumping are likely to improve due to the tight demand-supply balance

- It is finalizing contracts for additional rigs for upgrading, which can be activated in 2023

- The company revised up capex guidance while free cash flow deteriorated further in 1H 2022; so, despite better profitability, cash flows remain a concern

Rig Upgrade And Premium Pricing

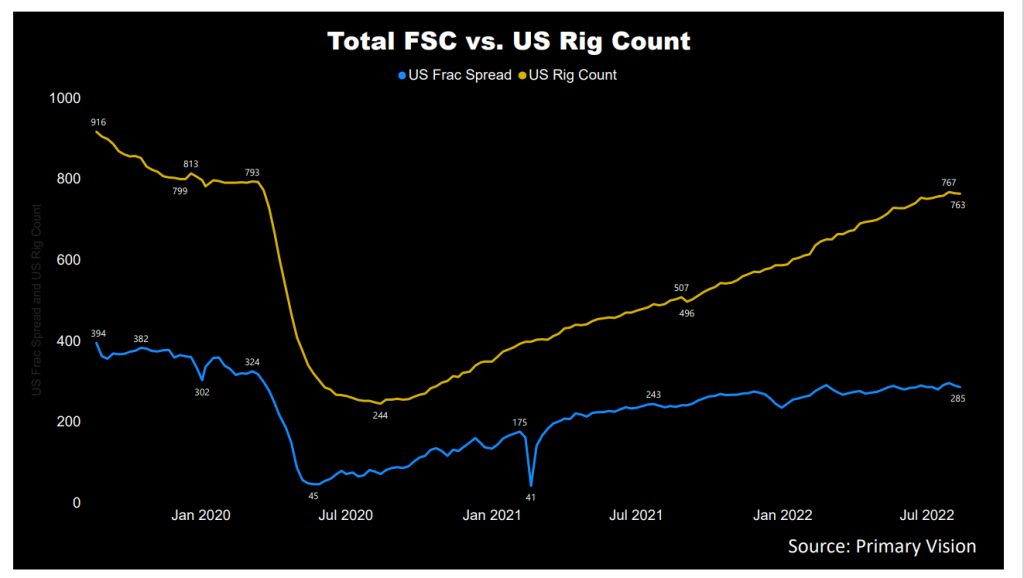

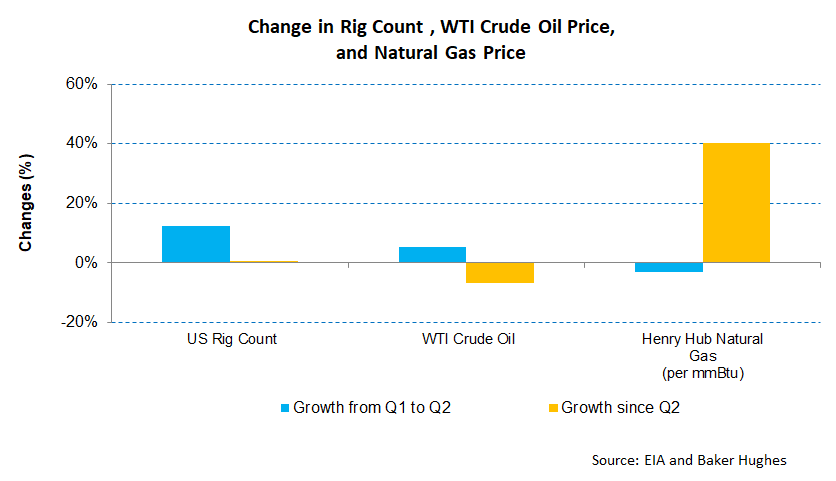

The US rig count has gone up by 31% in 2022, while the crude oil price has risen by 30% in 2022. As estimated by Primary Vision, the frac spread count has underperformed rig count’s growth. Our latest take is, “There are currently 285 spreads operating in the US, and we think 300 completion crews will be active by the first week of August.” As the US drilling and completions markets recovered, the demand for equipment and services soared.

So, PTEN’s management expects further improvements in pricing and activity, resulting in adjusted EBITDA exceeding $600 million in FY2022. Also, long lead items for rigs returning to work and input cost inflation would lead to 134% higher capex for the year compared to FY2021. Reiterating Halliburton’s (HAL) And Schlumberger’s (SLB) views, PTEN views the current energy industry’s multi-year upcycle as a positive and expects the US onshore industry to increase to 2023. So, it plans to increase its rig count in 2023.

Although 2022 may see some constraints on rig supply, the following year should see a step-up in activity. The company’s contract drilling, pressure pumping, and directional drilling services should benefit from the upturn. It will also push day rates and contract terms for its Tier 1 super spec rigs. Demand remains high for dual fuel spreads because of its ability to reduce fuel consumption and emission, allowing the company to grow its revenues and margins.

What Are The Indicators Signaling?

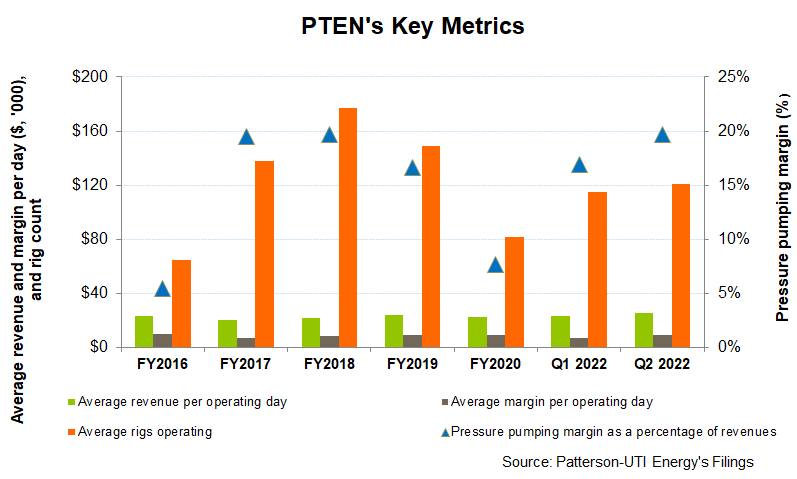

Currently, PTEN expects to operate 71 rigs under term contract in Q3, while for Q4 2023, it has 46 rigs under a term contract. It expects its average rig count to grow to 127 in Q3 from 121 in Q2. The average rig margin per day is expected to increase by $600. The base leading-edge day rates for Tier 1 rigs are low-to-mid $30,000, estimated by PTEN’s management. Including ancillary equipment, it may go up to mid-to-upper $30,000. As we discussed in our previous article, its operating margin has been recovering due to rig upgrades over the past few quarters.

PTEN is in the process of finalizing contracts for additional rigs for upgrading and being activated in 2023. The management estimates that upgrading the rigs will not be expensive because they already have a modern design. They are also expected to have term contracts, reducing the need for steep upfront expenses.

Pressure Pumping Outlook

PTEN reactivated its 12th frac spread in Q2. Plus, it reactivated Tier 4 dual fuel spread. So, seven of its spreads are now utilizing dual fuel. Since it is not planning to add any more spreads to the tally, it will focus on maximizing the profitability of the existing spreads.

Contract Drilling Segment: Analyzing Outlook And Performance

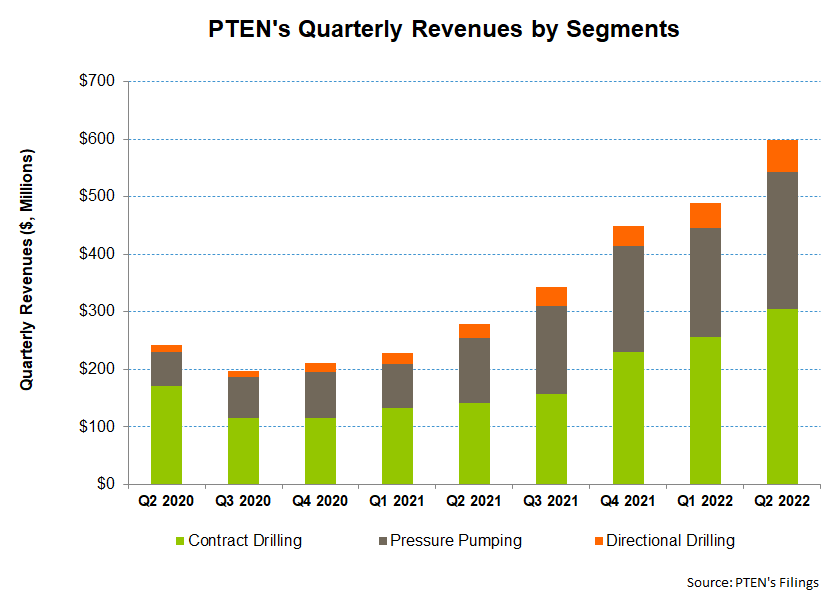

In Q2 2022, PTEN’s average revenue per operating day increased (12% up) quarter-over-quarter. Operating costs increased much less, leading to a 31% rise in the average margin. By June, the company’s term contracts provided $440 million of future day rate drilling revenue, which was a 10% rise compared to Q1. As revenue per rig rises in Q3, the average adjusted rig margin per day can increase by 11% versus Q2.

Pressure pumping revenues, which increased sequentially by 26% in Q2, can decelerate to a 5% revenue growth in Q1. The segment gross profit, which increased by 46% in Q2, can inflate further by 11% in Q3. Revenues from the Directional Drilling segment can remain flat in Q3.

Dividend

PTEN pays an annual dividend of $0.16 per share. Its forward dividend yield is 0.97%. Helmerich & Payne’s (HP) dividend yield (2.16%) is higher.

Capex And Debt

In 1H 2022, PTEN’s cash flow from operations (or CFO) increased by 92% compared to 1H 2021, led by 112% higher revenues. However, capex rose tremendously in the past year, offsetting all the gains. As a result, free cash flow (or FCF) steeped further into the negative territory in 1H 2022. It also increased its FY2022 capex guidance to $390 million from the $350 million set earlier.

The company had $595 million in liquidity (cash & equivalents plus revolving credit facility available) as of June 30, 2022. Its debt-to-equity (0.56x) is lower than its peers’ (NBR, HP, and LBRT) average of 0.72x. With abundant liquidity, we do not anticipate near-term financial risks.

Learn about PTEN’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.