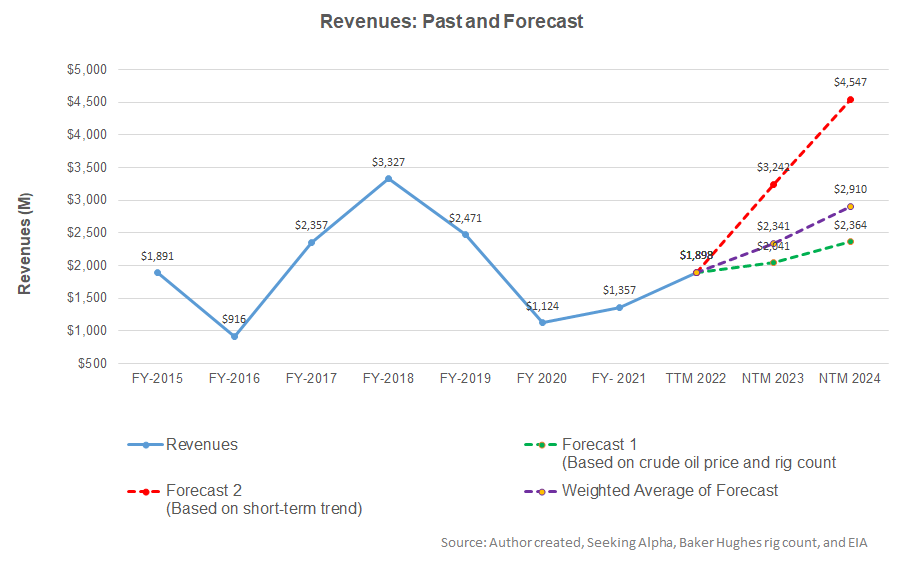

- The revenue growth estimates are steady in the next two years

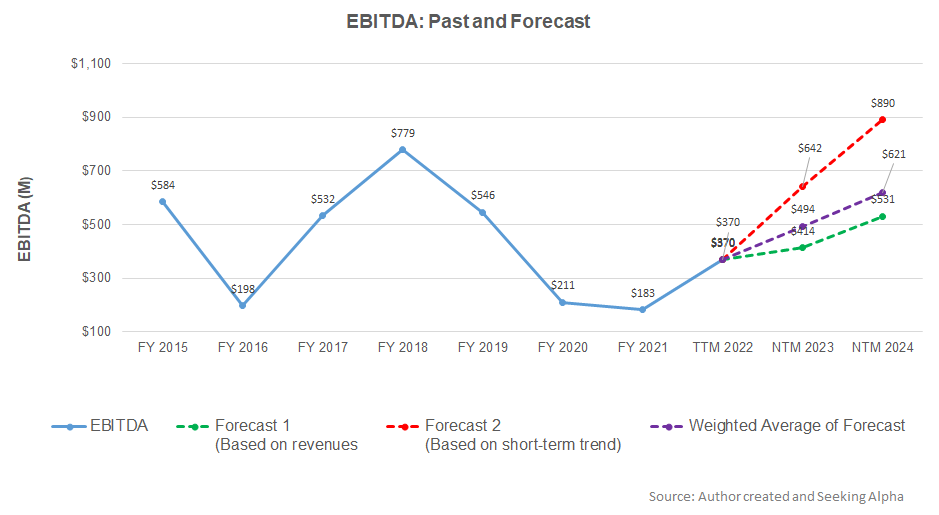

- EBITDA can increase sharply in NTM 2023 but can decelerate in the following year

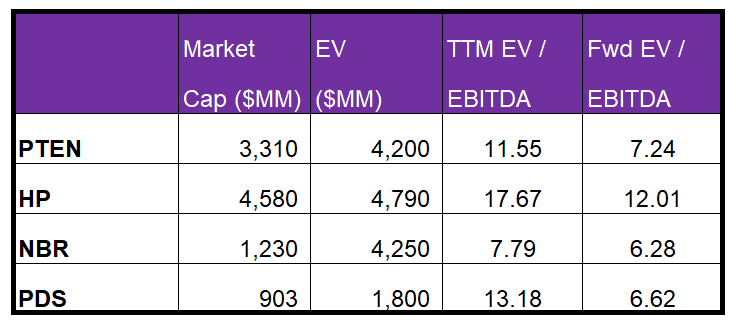

- The stock is reasonably valued versus its peers at the current level

Part 1 of this article discussed Patterson-UTI Energy’s (PTEN) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and PTEN’s reported revenues for the past seven years and the previous four-quarters suggests that its revenues will increase steadily over the next couple of years.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase sharply in the next 12 months (or NTM) in 2023. In NTM 2024, the model suggests the company’s EBITDA growth can decelerate.

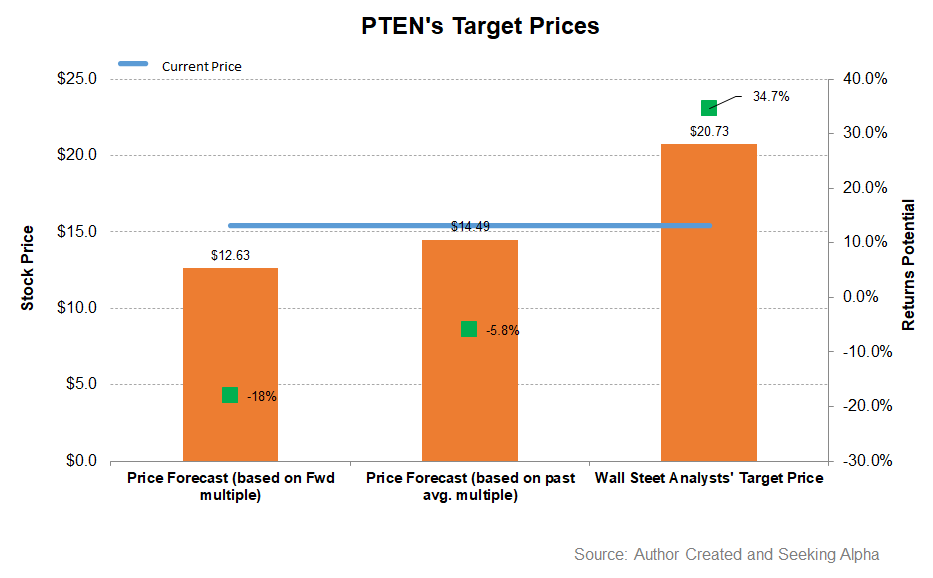

Target Price And Relative Valuation

The stock’s return potential using the past five-year average EV/EBITDA multiple (9.4x) is higher (6% downside) than the return potential using the forward multiple (18% downside). Wall Street’s sell-side analysts’ expected returns (25% upside) are much higher.

Patterson-UTI’s current EV/EBITDA multiple is 11.6x. The stock’s past five-year average EV/EBITDA multiple was 9.4x. So, it is currently trading at a premium to its past average.

PTEN’s EV/EBITDA multiple is similar to its peers’ (NBR, HP, and LBRT) average. Because PTEN’s forward EV/EBITDA multiple contraction is in line with its peers, it typically reflects in a similar EV/EBITDA multiple compared to its. So, the stock is reasonably valued at the current level.

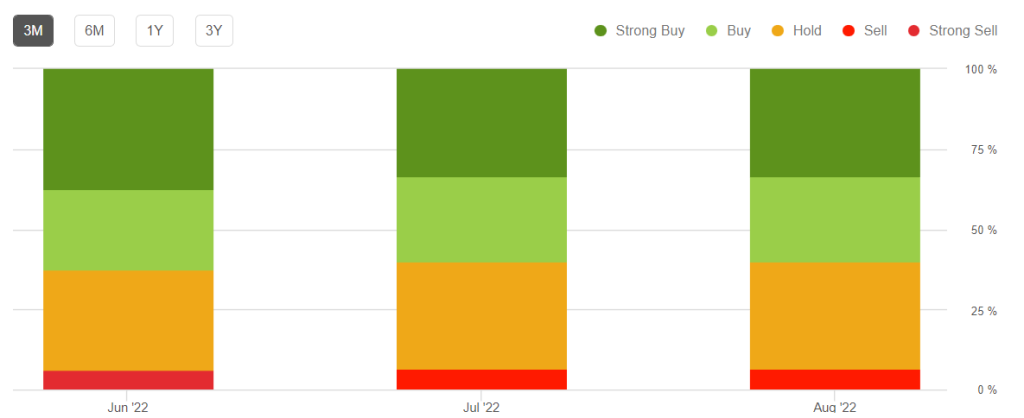

Analyst Rating And Target Price

According to data provided by Seeking Alpha, nine sell-side analysts rated PTEN a “buy” in August (including “Strong Buy”), while five of the analysts rated it a “hold.” Only one analyst rated it a “sell.” The consensus target price is $20.7, suggesting a 35% upside at the current price.

What’s The Take On PTEN?

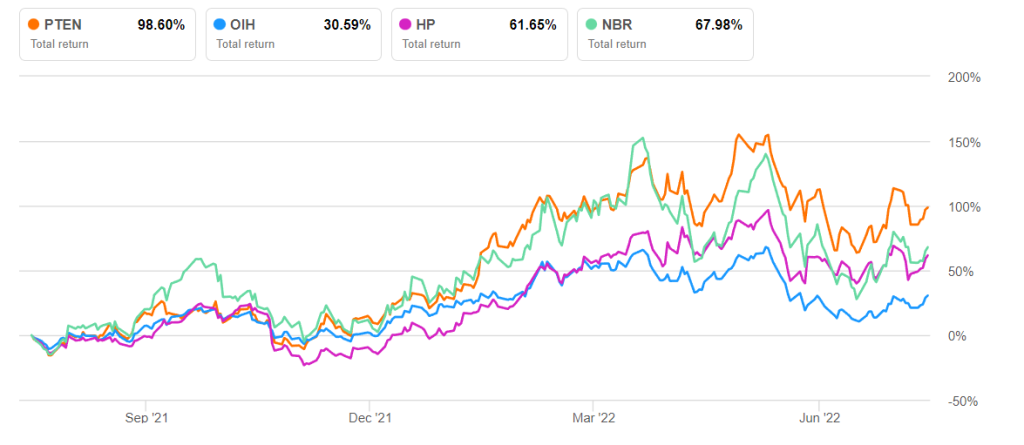

PTEN will continue to add a few more rigs in 2022 because its management believes that the energy industry is going through a multi-year upcycle and expects the US onshore industry to increase by 2023. Increased fracking activity will push day rates and contract terms for its Tier 1 super spec rigs. The leading-edge day rates are improving. Because the additional rigs will have longer-term contracts, the upfront payment will not be expensive. The average revenue and margin increased significantly in Q1 while operating costs moved little. A robust margin prompted the stock to outperform the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, an increased capex driven by a higher activity level can lead to significant pressure on an already negative free cash flow. Nonetheless, the balance sheet is robust with sufficient liquidity. The stock is reasonably valued but with a negative bias at the current level. Investors might like to hold the stock with an expectation of moderate returns in the medium term.