- Nabors’ US rig count can increase moderately in Q3

- While the US rig count continues its upward momentum, the company’s leading-edge day rates can exceed the industry average

- In renewable energy and carbon footprint reduction, the company has made substantial investments in Q2

- NBR’s leveraged balance sheet is a concern for the investors, although it targets to generate significantly positive FCF in 2022

The Drilling Outlook

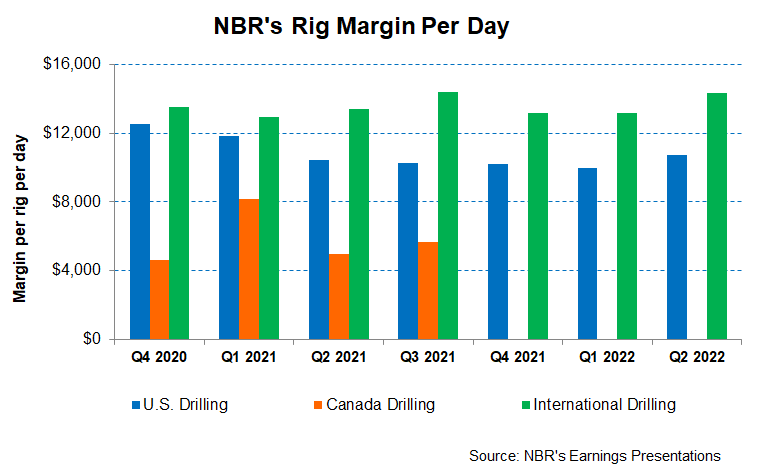

Nabors Industries (NBR) U.S. Drilling topline recovered handsomely in Q2 2022 as the US onshore drilling rig count increased by 31% year-to-date. As utilization increased, NBR’s average daily margins in the US onshore increased by more than $1,000, while daily margins in this segment improved by nearly $1,200 in Q2. Overall, the company’s pricing increased by more than $2,500 sequentially (11% higher). According to a survey conducted by the company, most of its customers plan to increase activity, leading to accelerated rig additions by Q4 2022.

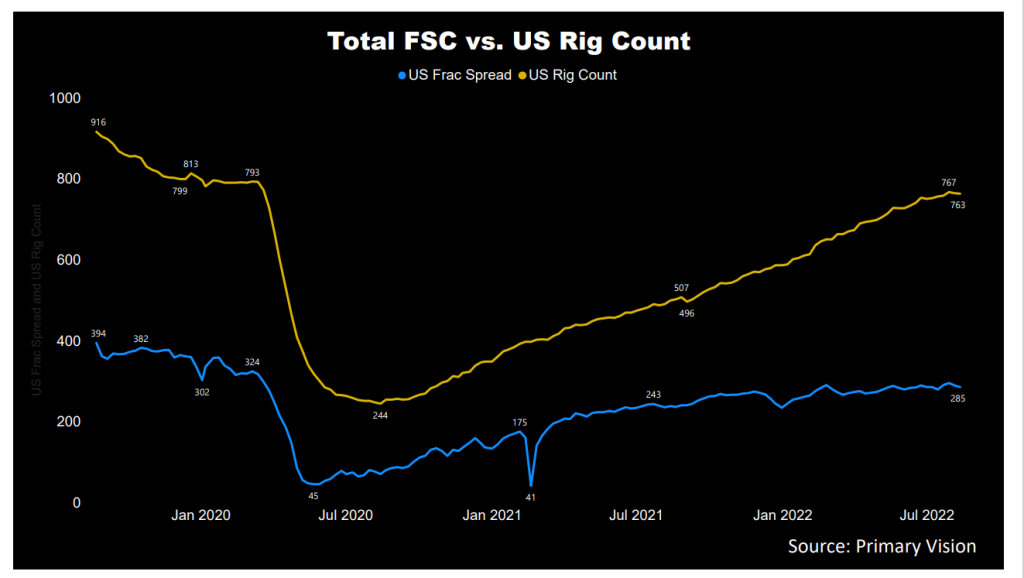

The company’s leading-edge day rates are now approaching the mid-$30,000. The company has over 40 M550s (1,000-horsepower AC rigs) which could be upgraded to super spec. Because the cost to upgrade these rigs would likely total $30 million, it will require a term contract with day rates into the high ’30s. However, investors should remember that the costs to activate high-spec rigs will also grow, putting upward pressure on dayrates and margins. This can eventually take a toll on rig demand. The US rig count has gone up by 31% in 2022, while the crude oil price has risen by 30% in 2022. As estimated by Primary Vision, the frac spread count has underperformed rig count’s growth.

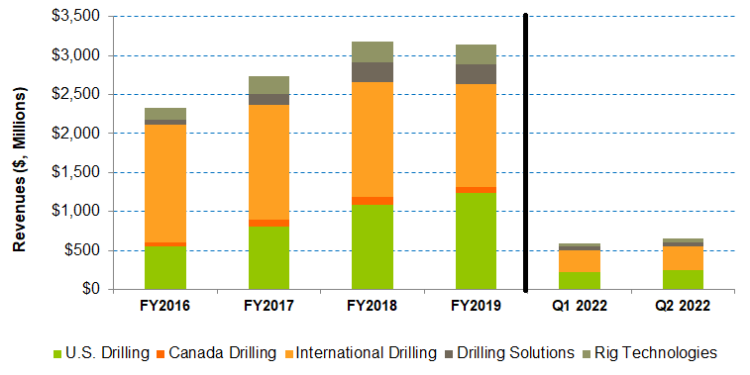

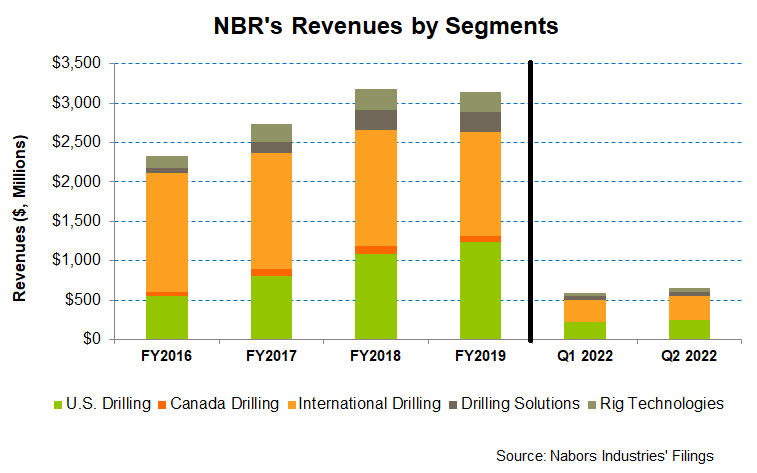

International business’s share in Nabors came down to 46% in Q2 2022, after rising steadily in 2021. The company has a joint venture (SANAD), which deployed an enhanced M1200 series rig in Q2. SANAD’s first new build rig in Saudi Arabia was commissioned during Q2. It plans to add one new build per quarter, contributing an annual adjusted EBITDA of ~$10 million. The JV’s long-term plan is to build 50 units over ten years, translating into a massive addition to the margin.

The US And International Forecast

The management estimates the company’s US rig count to increase by three to four rigs in Q3 versus Q2. It projects the US onshore margin at $10,400 to $10,600 per day as it contracts rigs at higher pricing. Its most recent contracts averaged ~$33,000, higher than the industry average ($30,000). Here, utilization hit 81% for the higher-spec rigs in Q2.

Saudi Arabia can see a second new build to start in late Q3. However, the company does not expect the rig count to increase in international regions. Over the medium-to-long term, however, the higher capability rigs with higher pricing potential can present an opportunity for ten rigs. The daily margin, too, will likely remain unchanged in Q3. In Drilling Solutions, however, the Q3 EBITDA can increase by 12% compared to Q2.

Energy Transition And Technology

NBR has been investing in leading-edge companies in carbon footprint reduction initiatives. It made three investments in Q2. The companies deal in monitoring and measuring GHG, building sodium-based battery technology, and developing ultra-capacitor solutions. In the US onshore, it targets further improvement in the intensity of greenhouse gas emissions. With that aim, it invests in new technologies like carbon capture and hydrogen injection. I think these will bring additional revenue growth opportunities in the medium term.

NDS (Nabors Drilling Solutions – focuses on managed pressure drilling, casing running, and directional drilling automation) contributed much of the operating margin improvement over the past several quarters. Using automation, digitalization, and robotization, NBR’s Drilling Solutions saw adjusted EBITDA increasing sequentially by 14% in Q2. In drilling services, it has significantly stepped up the penetration of smart drill and saw strong growth in SmartSLIDE, SmartNAV, and re-cloud analytics.

Risk Factors

The two imminent risk factors for NBR are the US recession possibility and a resulting global energy demand fall. Although NBR’s survey does not support any demand contraction from the operators, one should keep a close tab. The supply side woes, on the other hand, have not abated. The US labor market remained tight, which can inflate the wage bills for the oilfield services companies. The supply chain costs are still high, as is the lead time for material procurement. In this regard, NBR’s internal manufacturing facilities reduce costs effectively and can differentiate it from many other service providers.

Outlook and Performance

Over the past few quarters, we have witnessed improved drilling activity, leading-edge day rates, and rig utilization. In Q2 2022, the company’s U.S. Drilling rig count increased by 7% on average compared to Q1 2022. As a result, quarter-over-quarter revenues from U.S. Drilling increased by 16%. We think the pricing will continue to inflate.

Capex And FCF

In 1H 2022, NBR’s cash flow from operations (or CFO) decreased by 24% compared to a year ago, despite the year-over-year revenue rise in the past year. Adverse changes in working capital resulted in a cash flow decrease. In 1H 2022, the company’s capex nearly doubled, resulting in free cash flow drying up in the past year. Although a higher EBITDA can benefit cash flows, its planned investment projects and inflationary pressures on rig spares and component is a drag on capex. So, it may have to cut back on the capex estimate for the year. The company is targeting a $100 million FCF in FY2022.

NBR’s liquidity is $744 million (cash & investment and borrowing capacity). Its debt-to-equity (or leverage) is much higher (4.3x) than many of its peers (HP, PTEN, and PDS). A higher FCF will allow it to reduce net debt during 2H 2022.

Learn about NBR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.