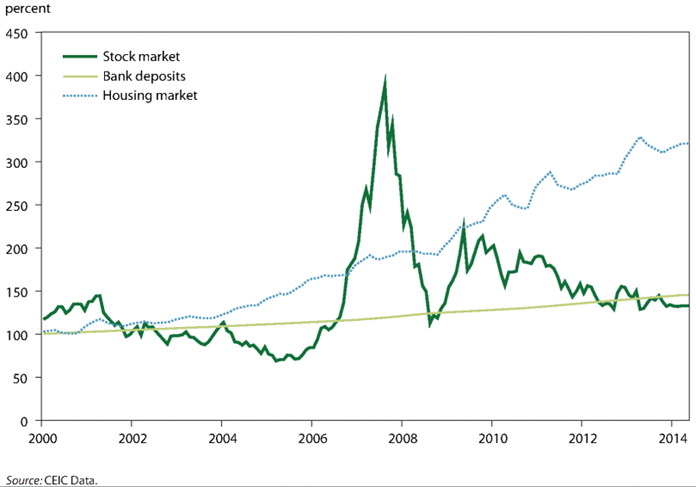

The Chinese data only strengthens the guidance we have provided regarding the consumer and general economic headwinds. The issues are only becoming more prolific, and this is being confirmed by official data coming from the CCP. There have been studies done that show any Chinese data (good or bad) is overstated by 3%-5%, which has proven true time and time again. There are now videos coming out of China showing unfinished (abandoned) towers being completely demoed. As with everything coming out of China, there is a mixture of truth in everything we see while some of it can be sensationalized. But, the fact remains there is a pressure in China that isn’t going away, instead it’s just getting much worse as the problems compound. The CCP recognized the importance of creating a strong domestic market and has tried to develop it over the last decade. The problem they have faced is a cultural one that supports more saving vs spending while putting a large part of wealth into real estate. On average, the Chinese consumer has 67%-70% of their wealth tied up in it while the U.S. averages about 27%. Between savings and illiquid investments, the domestic market has never materialized the way the CCP envisioned. They tried to “prime” it with more policy support across the dual circulation strategy and doubled down with common prosperity. The government continues to provide subsidizes across the board to keep inflation low and limit price increases.

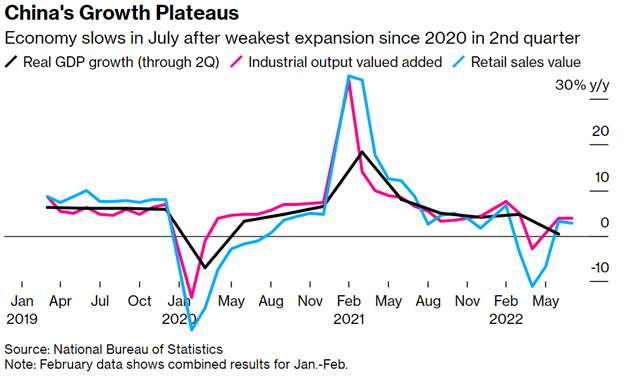

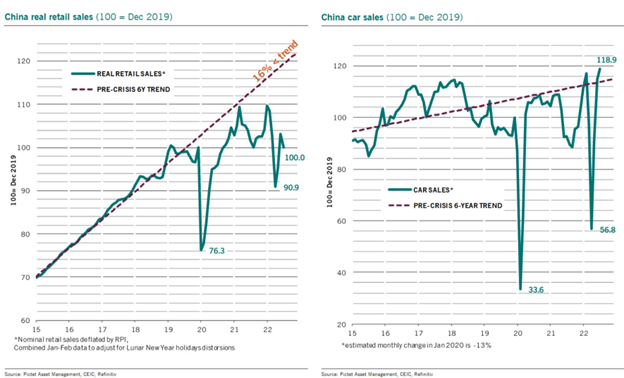

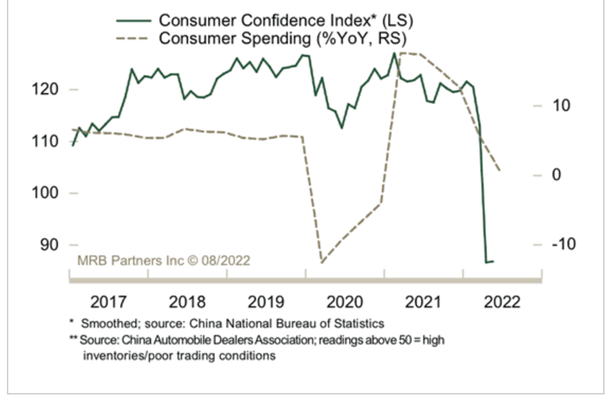

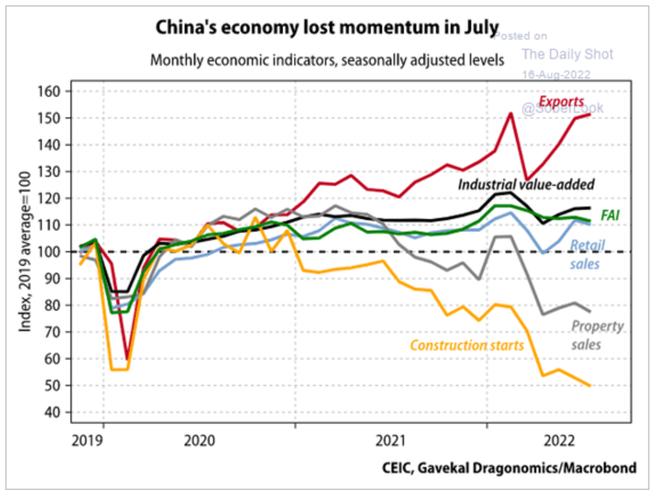

Instead, everything is trending in the wrong direction. The below chart looks at the last few years and how spending remains lackluster, but it misses I think the broader issue. The recent data had a benefit of steep car subsidizes to drum up additional sales, but even with the support things fell flat.

It also misses how much spending has shaken off the trend, and how the problems emerged well before COVID. It lines up almost perfectly to the shifts in employment when both service and industrial hiring was shown to slow in PMI and local readings. Real retail sales contracted to a level 13% below trend despite a further rise of car sales to record highs

So while the below listing of data against estimates, it’s important to remember how the trend is breaking down. The economic problems started slowly, and have progressively gotten worse.

“July’s economic data is very alarming,” said Raymond Yeung, Greater China economist at Australia & New Zealand Banking Group Ltd. “Authorities need to deliver a full-fledged support from property to Covid policy in order to arrest further economic decline.”

The headlines:

- Retail sales rose 2.7% y/y in July, down from a 3.1% y/y increase in June.

- Fixed asset investment rose 3.5% y/y in July, compared with 5.8% y/y growth in June.

- Value-added output at industrial firms rose 3.8% y/y in July, versus a 3.9% y/y increase in June.

Our take in one word: Dire.

The data missed expectations across the board:

- Analysts had forecast a 4.6% y/y increase in industrial value-added output last month.

- Retail sales had been expected to increase by 5.0% y/y.

- Year-to-date FAI growth of 5.7% y/y, missed expectations of a 6.2% y/y expansion.

At the heart of the weak numbers were the twin problems of China’s real estate slowdown and zero-COVID policy.

Households still show no sign of opening their wallets and increasing spending.

- Service sector activity was particularly bad, with catering sales falling 1.5% y/y in July.

The real estate sector also took another turn for the worse last month:

- Investment fell by 12.1% y/y, compared with a 9.6% y/y fall in June.

- Home sales worsened from a 23.1% y/y drop in June to a 28.6% y/y fall last month.

Weaker real estate activity dragged down the industrial sector:

- Floor space under construction in the real estate sector plummeted 45.2% y/y in July.

- Production of steel and cement were down 6.4% and 7.0% y/y, respectively.

In the face of this, stimulus measures are simply not cutting through.

The dire econ numbers were despite an increase in government spending:

- Infrastructure FAI rose 11.5% y/y in July.

- Capex at SOEs increased 11.8% y/y.

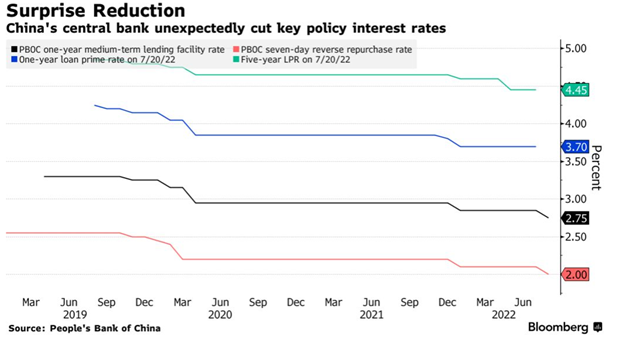

Get smart: In the face of the awful econ and lending data for July, officials are already looking to loosen policy. On Monday, the PBoC announced a 10 bps cut to its medium-term lending facility.

Get smarter: Things are now so bad that its hard to see how conservative 10bp rate cuts are going to cut the mustard.

The last statement above from Trivium highlights the cut by the PBoC, and while reducing rates can help with cost- it will do nothing to accelerate borrowing. Rates have been in a quantitative easing cycle since well before COVID, and the law of diminishing returns have caught up to Chinese policy makers.

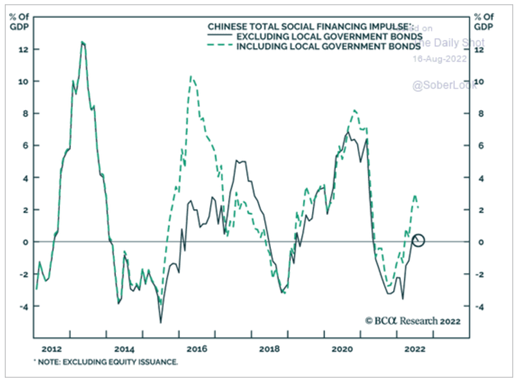

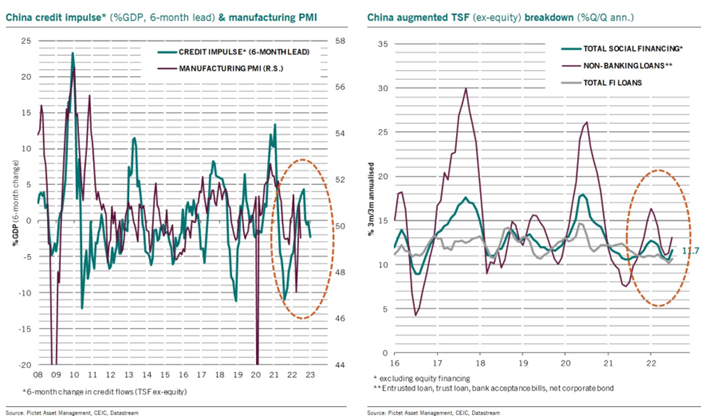

Aggregate financing has rolled over below 2020 levels on the back of slowing adoption even as the “cost” of borrowing stays supportive.

When we scratch just below the surface, you can see how the support has been created by government bonds mostly going to SOE’s. We broke it down several weeks ago, but this is just more proof that the private sector remains in contraction when it comes to credit impulses.

If we layer in the most recent credit data, China’s impulses are back in negative territory despite the sequential rebound of total loans q/q. This supports our thesis that the private sector is avoiding any new debt while local governments keep trying to push more debt. The SOEs are being told to take more, but even with that mandated it is still VERY muted.

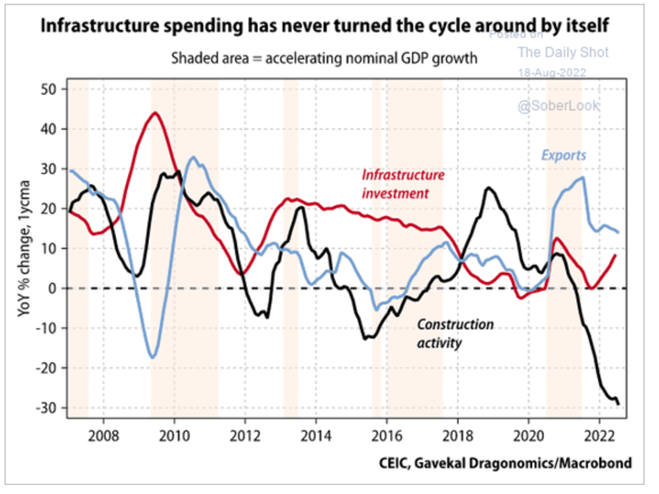

The below chart puts into perspective on the additional push across infrastructure investment, but it isn’t resulting in new construction. I believe this will turn into a similar situation as last year that was disclosed in the audit. The infrastructure investments through SPBs are overstated, and the money either sat idle or was used for things outside of its intended purpose. Infrastructure investment normally transitions into construction activity, but we are seeing a big shift in capacity given the economic headwinds China faces. China was able to “bail” out the market multiple times over the last 17 years with additional stimulus and by acting as the buyer of last resort. The capacity for stimulus is muted at best, which is being reflected by limited PBoC activity and driving impacts of the law of diminishing returns.

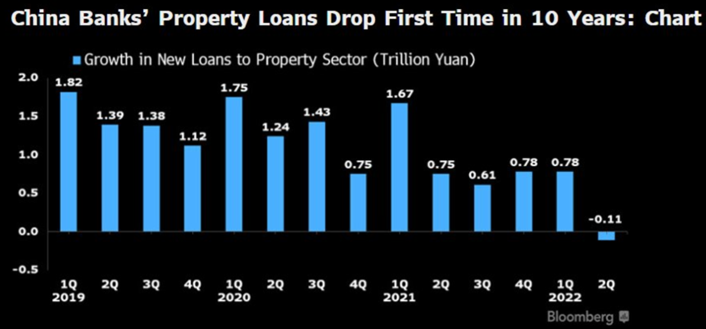

Another supporting data point regarding who is the lender is the China Banks’ Property Loans. China bank lending to the real estate sector dropped for the first time in 10 years and the decline is going to persist. The limitations impacting the Chinese economy is expanding, and the old adage of “just build stuff is failing.

The below quotes from Trivium just echo our points that expansion will be limited, and the where the additional stimulus is heading (infrastructure) is already fully tapped out. The problem right now with China remains that the economic troubles are expanding and broad based, but their solution is the same. This is why we talk so much about the law of diminishing returns, because they have reached a point where every new dollar has a negative impact and doesn’t stimulate.

The big headline: The economy grew 2.5% in the first six months of 2022 – the slowest rate since COVID first hit in 2020.

- Recent GDP data, whether Q1, Q2, or H1 – take your pick – looks pretty terrible.

- Most key growth drivers – the property sector, private investment, and consumption – are failing to fire, under strain from regulatory clampdowns and COVID controls.

- Exports, which have propped up growth in the past two years, are soon likely to join the list.

The writing’s on the wall: Recognizing the inevitable, in July, the politburo finally walked back China’s “around 5.5%” GDP target for the year – implicitly acknowledging what most have known for a while, that officials will struggle to come even close to the target.

The goal now: Keep the economy operating in a “reasonable range,” with the understanding that growth will continue to be sacrificed to keep COVID in check.

Question: How do policymakers intend to keep things “reasonable”?

Answer: Build stuff.

- As we type, government is shoveling a massive infrastructure stimulus package out the door to make up for weak-as-hell domestic demand.

- And there are plans to add to the stimulus load in H2.

We look down the barrel of this fiscal cannon more below, but for now, suffice to say it’s big – real big – and it’s probably going to get bigger.

But despite the size of the H2 stimulus, we argue there are significant barriers that will hamper its effectiveness.

- Sure, there’ll be a growth boost, but there are compelling reasons to think it will be smaller than one might expect, given the size of the cash pile.

In this deep dive, we look at Beijing’s stimulus, and why we think it won’t be all it’s cracked up to be.

The bolded commentary is the same playbook for a different and growing problem. We have consumer spending falling and being pulled lower based on how terrible consumer confidence is across the country. It’s important to reiterate that this is what has been publicly released, which just means it is likely much worse.

The momentum across all points of the economy is ebbing, and once you lose that upward trajectory it takes a more and more money. In the Law of Diminishing Returns, it’s described as every new incremental dollar provides less and less stimulus until every new dollar has a negative “util” or said a different way- detracts from the economy. Exports have been supported by provinces reopening and backlogs getting pushed into the market.

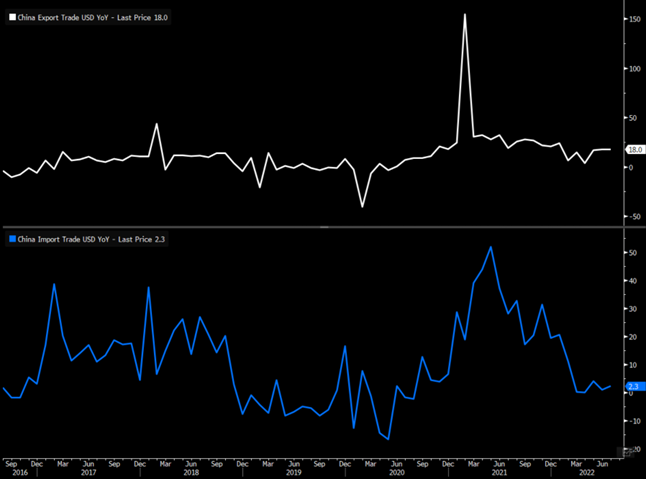

Exports have held flat and beaten estimates, but imports have fallen through a floor and have been coming in below estimates. For those that have been following us, we have discussed how imports are a leading indicator for exports and indicative of local demand. As imports drop, it will pull down export capacity over the next few months. One counter point to that is the fall in local demand because as consumers within China buy less companies will try to “dump” more into the international market. But the fact remains, imports is an important indicator for where the underlying economy is heading. As it weakens, it also spells additional trouble for Europe that relies significantly on China’s imports of their goods. With energy import costs exploding and exports dropping off, the current account balance for the European Union has flipped into a deficit with more pain ahead.

Exports were also supported by China “dumping” excess into the market, which is only growing as local spending declines and activity falls further.

China’s General Administration of Customs released monthly trade data for July on Sunday.

The headlines:

- Exports rose 18.0% y/y in dollar terms in July, up from 17.9% y/y growth in June.

- Imports increased by 2.3% y/y last month, versus 1.0% y/y growth in June.

- The trade surplus was USD 101 billion in July, compared with a surplus of USD 98 billion in June.

Deja-vu: Another month, another better-than-expected print for exports.

- Analysts have been calling the end of China’s export boom for the past year – but the sector continues to outperform.

- The consensus forecast was for a 14.1% y/y increase in exports last month.

Part of the reason for the continued strength in exports is that companies are still working through the backlog of orders that built up during COVID-19 lockdowns.

The seemingly unending export boom is also reflective of the problems with China’s post-lockdown economic bounce back:

- While production has recovered, domestic demand is still lackluster.

The still-weak levels of domestic consumption can be seen in the worse-than-anticipated import numbers:

- Analysts had expected inbound shipments to increase by 4% y/y in July.

Another worrying sign of the disconnect between overseas sales and domestic consumption is that China’s trade surplus hit a record high last month.

Strong domestic production plus weak domestic demand has led to firms dumping surplus products overseas:

- Steel exports, for example, jumped 41.2% y/y last month.

The bottom line: Strong exports are providing a much-needed boost to economic growth.

- But they are ultimately symptomatic of China’s problematic economic recovery, where production is rising faster than consumption.

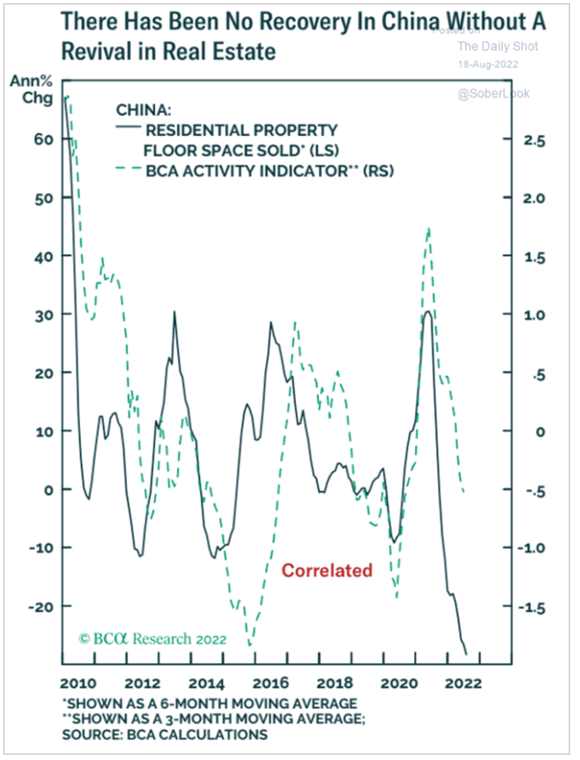

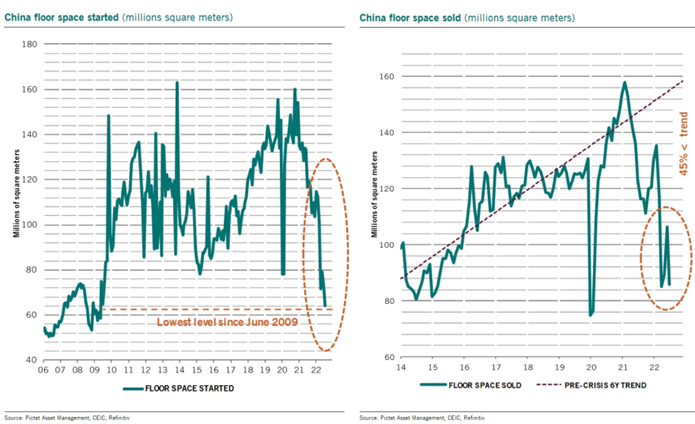

Chinese floor space sold is falling through a floor and is steeply negative, which will drag down the activity indicator even further. Exports have been able to provide some support for activity, but the trend remains lower as real estate drops further.

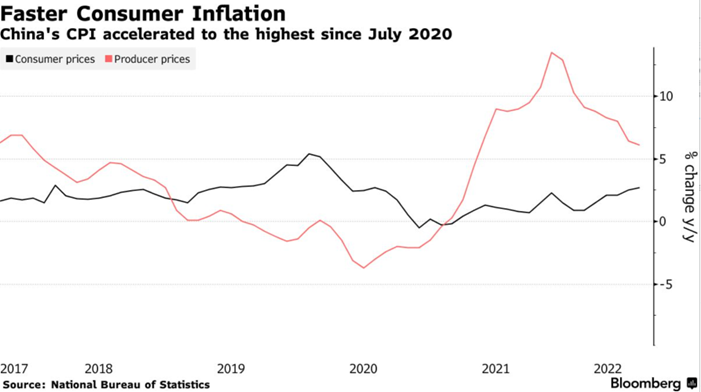

The government has tried many different ways to stimulate the economy, but as money goes out the door and the economy slows- the deficit grows. The food situation has turned dire with drought warnings springing up all along the Yangtze River. If you followed us back in 2020, we discussed and followed how the water levels were reaching 800-year highs, and now a mere 2 years later- the exact opposite is happening. Even as the CCP tries to manager inflation, it is still creeping higher. I know you can look at the chart below and think “well- it is so far well below the U.S. and global averages”, BUT in order to achieve it- the government has dumped billions into the market.

As Trivium highlights below, yes- they have maintained below normal inflation but it’s nothing to brag about. It’s something that has been very expensive and as the coffers run dry it will be difficult to maintain.

China’s stats bureau released the inflation data for July on Wednesday.

The headlines:

- The consumer price index (CPI) rose 2.7% y/y in July, up from 2.5% in June.

- The producer price index (PPI) increased 4.2% y/y in July, down from 6.1% y/y growth in June.

Consumer price growth may have hit a 24-month high, but the increase was very narrowly focused on food:

- Pork prices jumped 20.2% y/y last month.

With the government springing into action to bring down pork prices, this pace of growth is unlikely to persist.

On the other inflation front, things are looking more positive:

- Producer price growth fell to its lowest in 18 months in July.

Chinese officials like to trumpet that they have avoided the inflation problems plaguing the West through sensible economic policies.

- But that’s only half the story.

Weaker price growth in China is largely a function of poor domestic demand.

The consumer prices data shows that core CPI – which excludes food and energy costs – was just 0.8% y/y in July.

- That was down from 1.0% in June and the weakest since April 2021.

Producer price growth is also cooling off the back of weaker economic activity, as China’s commodities-intensive real estate sector remains in the doldrums.

Get smart: China may have avoided the inflation bedeviling other economies, but the reasons for that are nothing to brag about.

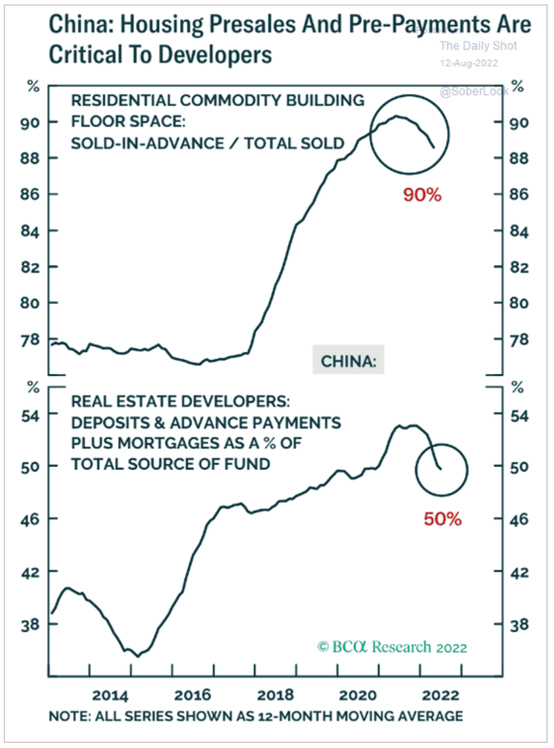

When we start shifting to the consumer now and the underlying issues, it’s important to remember the shifting population dynamics and unemployment problems permeating. But, the housing shift is still one of the biggest overhangs for consumer activity. “As investors piled on to the real estate, 70% of China’s household wealth is now tied to properties. The real estate craze was so high that buyers had to pay up to 30% of home value and start paying their mortgage even before the construction started. China’s Real Estate Market is considered the ‘most important sector’ in the world. The total value stands at $60 Trillion – More than the entire US Equity market and 2x our housing market. It’s unraveling now with S&P predicting 30% drop -> 1.5x worse than 2008 crash.” Housing and general infrastructure have been the driving force in Chinese growth since 2008, and it has been relentless with additional stimulus dumped in several times during periods of global slowdowns. This has maintained the pace of expansion but increased the underlying leverage ratios to (at even a conservative estimate) at north of 32x. To put that into context, when Lehman went bankrupt, their leverage was at 28x and within China the least levered entity is at 32x.

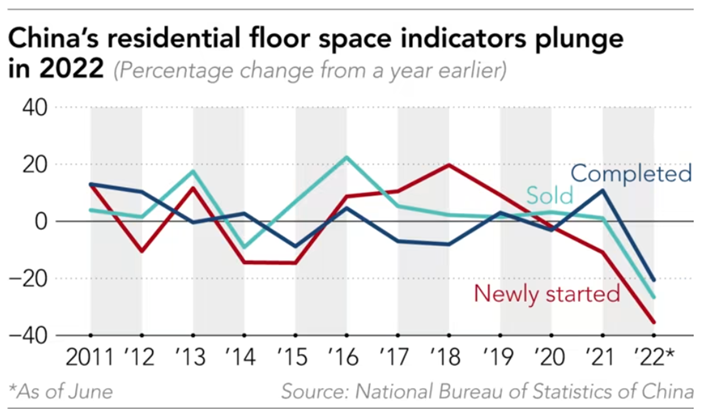

The sheer size of the Chinese market makes the slowdown a huge problem on a global level. Residential floor space indicators are collapsing and because of the sheer leverage- banks and corporations need this capacity to change hands. The way provincial governments finance themselves is by real estate sales, so as the floor space and general activity nose dives- it creates additional balance sheet problems.

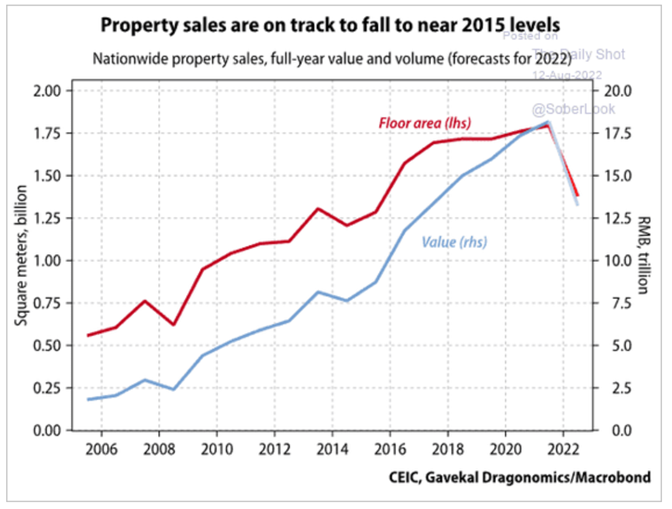

Another problem is the underlying value assigned to each asset because as write-downs and bad debt expenses rise, it makes the balance sheets that are already levered to the gills look even worse. It’s just interesting to see how long the problems have been percolating, but as they start to rollover the below chart puts into context how far things can still fall.

Property sales are just falling to 2015 levels but have been on an upward trajectory since 2008. There is still a lot of wind that can come out of these sales, and it will take the consumer/ local governments down with it.

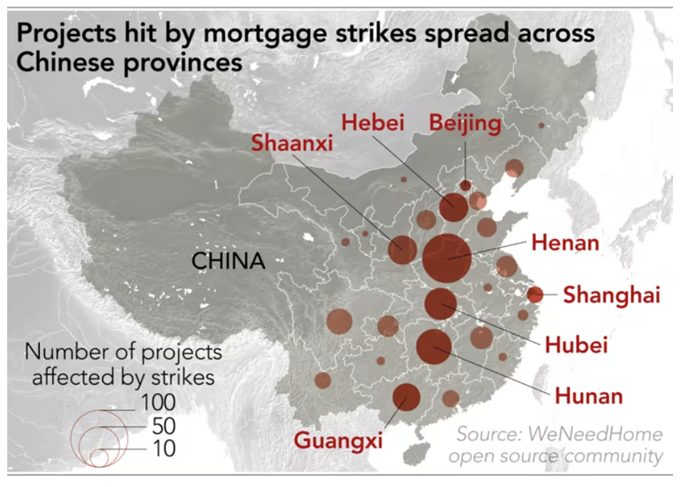

Mortgage strikes have been expanding, and while we will never get the full picture- what we know is already concerning.

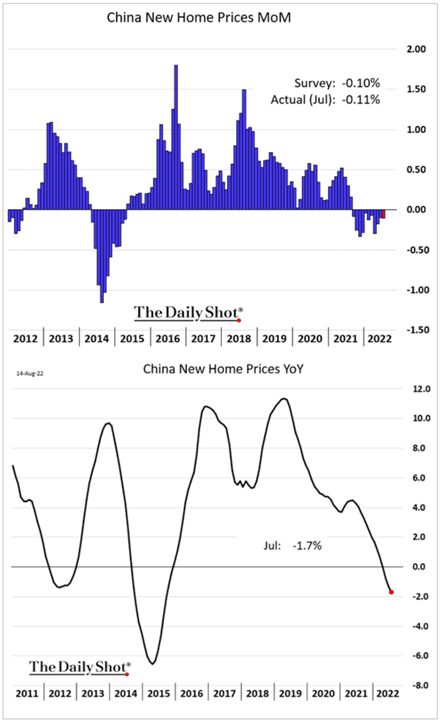

New home prices falling will only exacerbate the local banks that have to take write downs or increase bad debt expense stressing the leverage ratios.

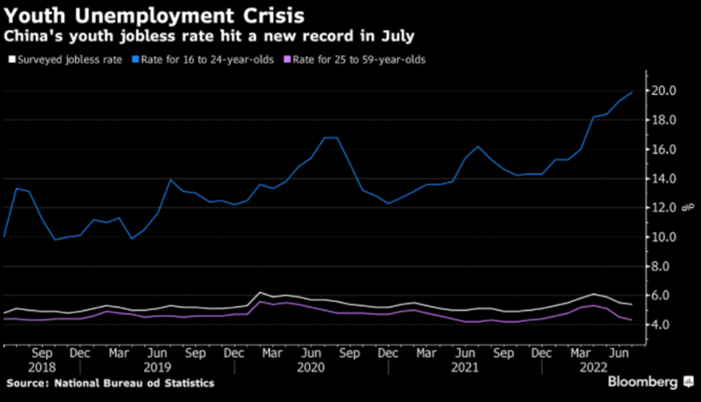

But back to the comment earlier regarding the shift in demographics and how the local population is changing. China is facing a huge problem as the populace ages, and the growth rate falls below 2.1 children per woman. The drop in youth unemployment is going to stress things further as young people can’t get jobs and create a foundation to start a family. The cost of raising a family has risen exponentially in many places and without a job it becomes even harder. China is introducing a bunch of different initiatives to increase the birth rate and address the demographic pivot. There are 26 agencies that have gotten together to create a path forward to address the population pivot- but I think the below data on unemployment is a much bigger problem hindering growth. The surveyed jobless rate for those aged 16-24 climbed to 19.9% last month from 19.3% in June, the NBS said Monday — a new record high – Bloomberg *It also compares to a rate of 5.4% registered for the entire nation, slightly better than June’s 5.5%.

I think it’s good to summarize everything and dispel some concerns around the pitch around China’s debt bubble. It comes as no surprise that China has dumped money into infrastructure spending with a large part of it funneled into ghost cities. We have known since about 2011 that China was heading down a path of destruction, but the PBoC and CCP were able to kick the can repeatedly along the way. As I gave a presentation back in 2011 and I said something along these lines: “We know that China is going to face consequences for their spending, but is it after 100 ghost cities or 1000 or 1M. It will eventually be their undoing, but timing it will take a lot of analysis and patience.” We have now reached the point where Law of Diminishing Returns come screaming home, and what appears to be a culmination of terrible things happening simultaneously. Companies are looking to “new shore” or “on-shore” to adjust the supply chain, and it should come as no surprise that firms are leaving China in the largest shift since globalization began. Apple just announced more products being built in Vietnam instead of China, and we will see this pattern continue.

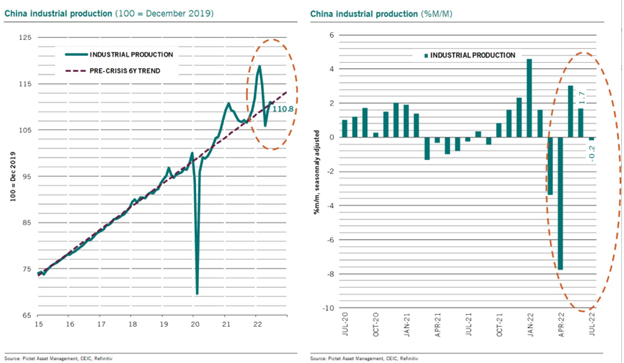

This pivot will weigh on China’s Industrial Production that has been treading water, but just started to pivot lower. We believe that this shift will only accelerate over the next few quarters.

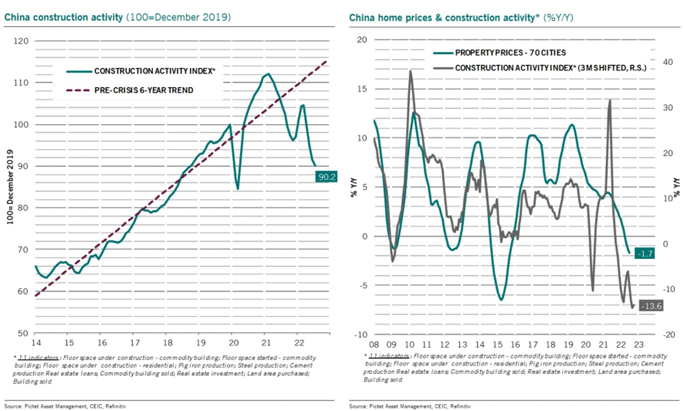

We already know that China’s main activity indicators for July were generally lower than expected and in contraction on a m/m basis. Real estate sector was once again a big disappointment as floor space started plunged to 13-year lows while residential demand fell back to cyclical lows.

Overall construction activity is down 13.6% y/y driving home prices lower (-1.7% y/y) and based on the trend- we don’t see this pivoting anytime soon.

The Chinese picture looks grim that can’t be saved by more stimulus and infrastructure spending. The invisible hand can be kept at bay for only so long before it comes back around to level the playing field.