Early next week I will send out another regarding Chinese data, USD strength, and Emerging Market issues. A lot of moving pieces that will be a big overhang for global growth. I talk about Europe and Chinese weakness below, but the China problems are vast and deep and require a separate report.

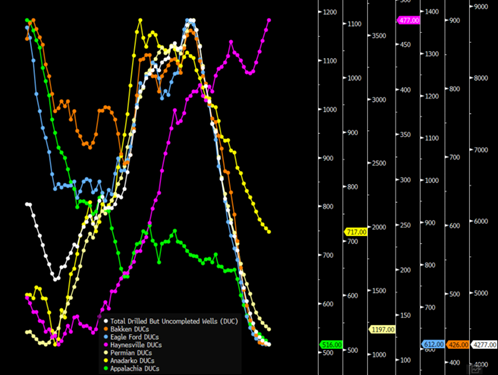

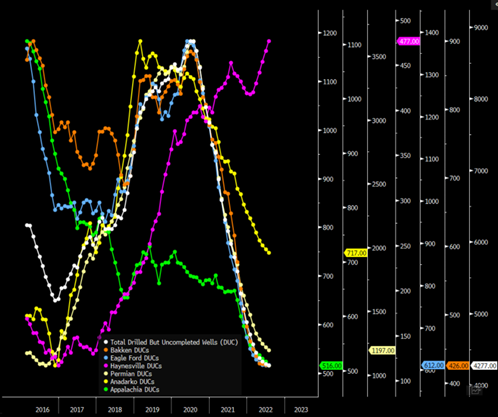

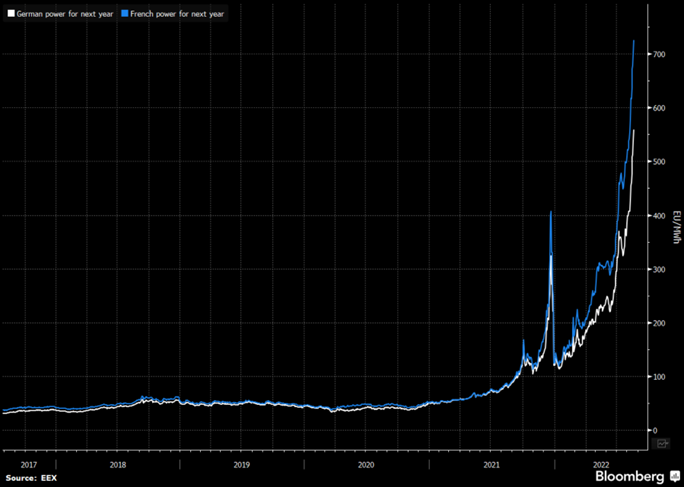

The decline in DUCs (drilled but uncompleted wells) has slowed down to a trickle with increases occurring in the Haynesville. According to our figures, we have some small increases (and not declines) in the Permian and Anadarko, but the drop record by the EIA is negligible. We believe that the EIA will start showing increases as completions remain range bound while rig activity stays elevated. Completion activity will remain strong in the Permian and Eagle Ford, but there is upward momentum we are seeing in the Anadarko and Haynesville. Natural gas and NGL prices remain robust with a lot of support behind local gas and LNG pricing. Natural gas prices in Europe keep printing new records as electricity continues to follow suit, which will maintain a very robust flow of LNG.

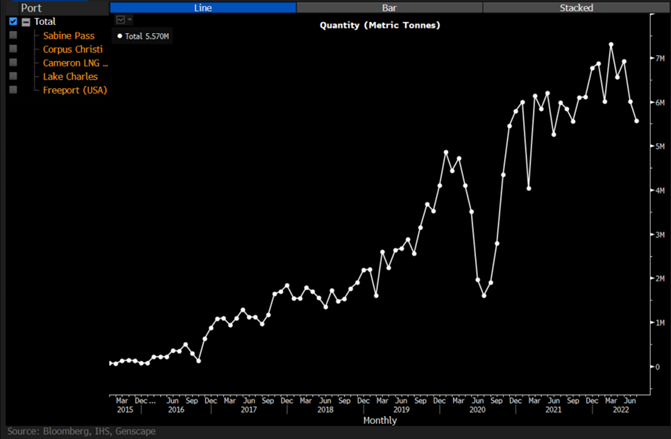

Exports of LNG from the U.S. have remained robust even with Freeport offline. Freeport has been given clearance to restart in October, which will keep the U.S. tight on the natural gas front.

Electricity prices in Europe have gone parabolic, which is crushing the European economy even further. The pain is happening heading into shoulder season, and right now- there is no relief in site as more countries roll out quotas to manage natural gas consumption. Rationing plans will only hit harder as we progress out of shoulder season and into winter. Diesel/distillate shortages remain world wide with natural gas at decade highs and electricity through the roof and no one has turned on their heat yet… this is going to be a very “interesting” winter.

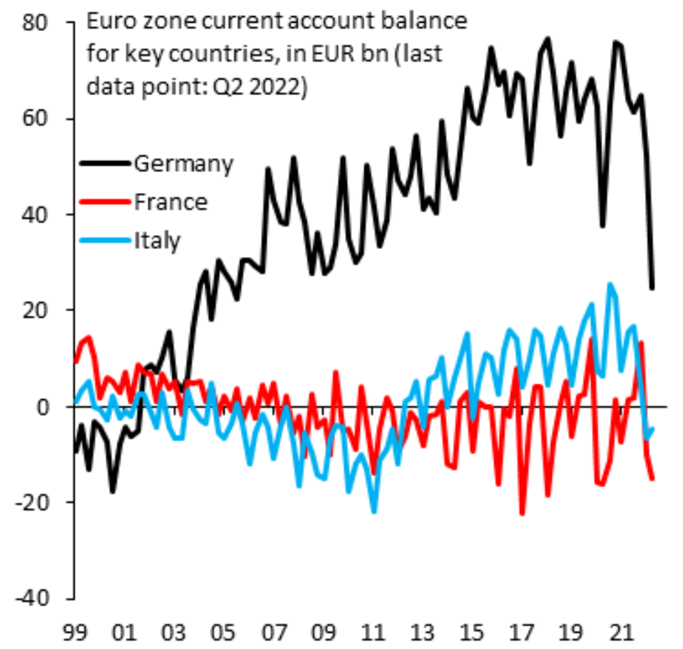

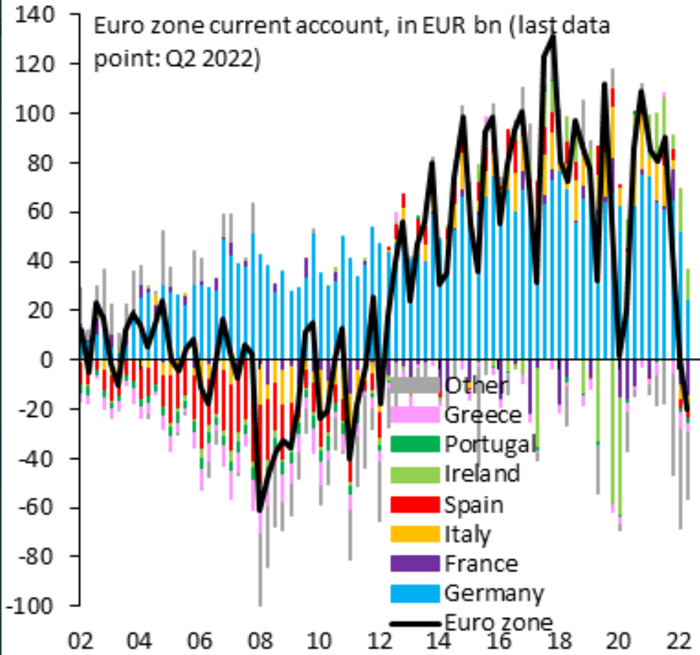

It is no surprise to see Eurozone current account balance drop like a rock with more pressure on the horizon. The Euro zone is in trouble. Italy ran current account surpluses ever since the debt crisis in 2011/2, because weak domestic demand and a big output gap cut import demand. That’s over. The sharp rise in energy prices has pushed Italy’s current account into deficit in 2022 (blue).

The total European Union has flipped into a deficit, and given the big drop in Chinese imports of EU goods and huge spike in energy imports- this sends Europe into a deep recession.

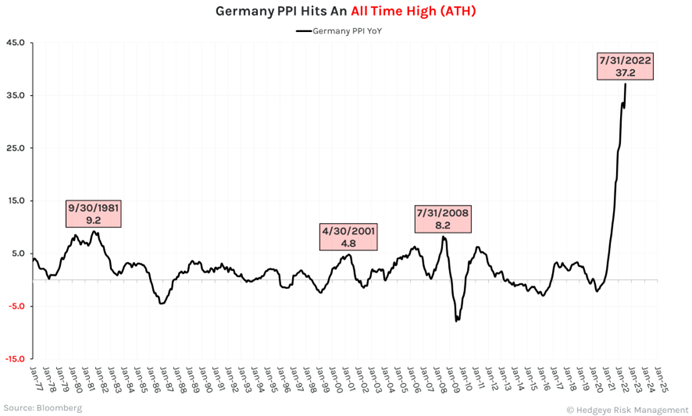

While Germany’s PPI accelerates to a fresh all time high of +37.2% YoY and up 5.3% MoM. Don’t expect CPI to come down any time soon, German Natural Gas is up +59% on the month and their CPI-PPI Divergence just hit a 6.6 Z Score.

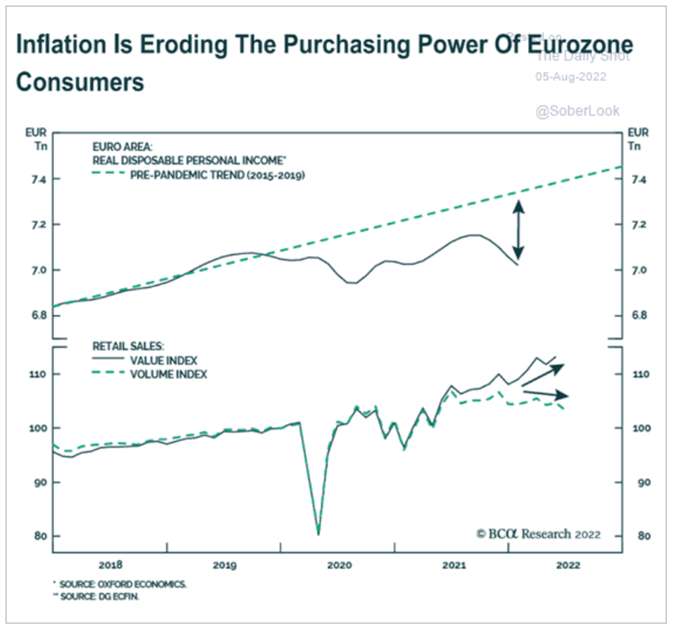

This has already destroyed the purchasing power of the European consumer, and these new data points will only make it that much worse. The below chart doesn’t even reflect the most recent run up in electricity, and the PPI numbers are leading indicators of a re-acceleration of CPI pain.

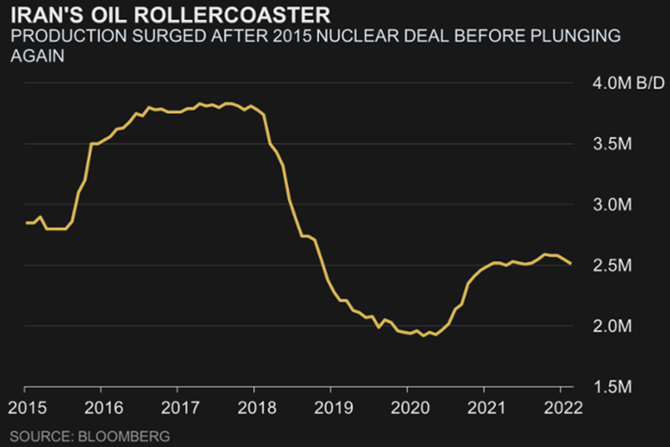

The Iran deal has re-entered the conversation with Europe showing support for a potential deal. In my view, the U.S. won’t participate in the agreement but won’t stand in the way of Europe. It will be something similar to what we had prior to 2015, which will allow some flow into the EU but provide complications when it comes from the transfer of equipment. It was always very convoluted on what could be sold into Iran from Europe without triggering a rebuke from the U.S. Due to the dire situation in Europe, I think the U.S. will be very “forgiving” regarding what the terms are and any potential violations of U.S. sanctions. It may tighten over time, but the concern heading into winter will limit any near-term actions. I don’t expect a big spike in actual production from Iran for several reasons.

- China has openly been buying Iranian barrels so the “reclassification” from Malaysian or Iraqi barrels has happened to a certain degree.

- If Europe makes a deal, we will see some additional exports from Iran and a drop from Iraq’s Basrah port

- Iran was able to maintain operation by getting equipment shipped in from Russia that was from the U.S. or Europe. As sanctions tightened, the availability of spare equipment that could filter down to Iran has fully stopped. This will create a bigger lag on production increases after a deal is signed and limit the production potential that can be reached.

We will see a quick increase of 250k-300k, but “new” production will only be about 100K as the different will just be shifted from other areas. Iran would settle out at about 3M by early next year but getting back to 3.7M will be very difficult by year end- let alone early next year.

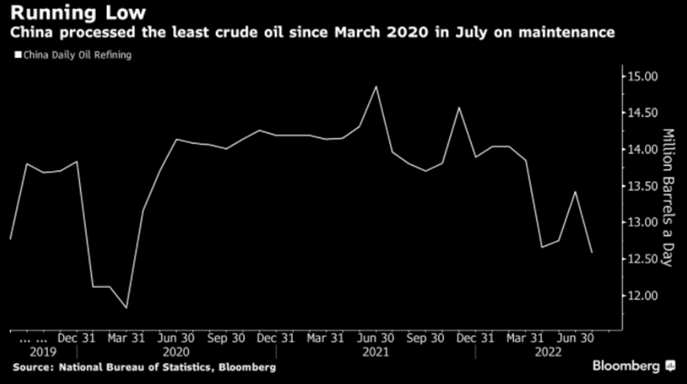

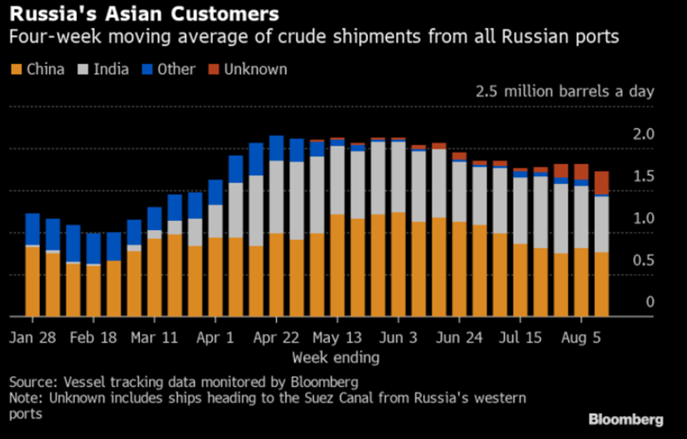

“The European Union views Iran’s response to a proposed blueprint for reviving the 2015 nuclear deal as constructive, according to an official familiar with the diplomatic efforts, and is consulting with the US on a “way ahead” for the protracted talks. The positive comments are the first sign that the Iranian position, formally submitted by Tehran to the EU on Monday night, might not further stall the negotiations. The official, who didn’t want to be named because of the sensitivity of the matter, said Iran’s response still required study and that other parties to the nuclear talks — which include the US, China and Russia — are assessing it.” On the other side, China continues to cut imports as they sit on a huge amount of crude in storage and lockdowns remain in place. The local economy as industrial data struggles and retail sales diminish significantly. We don’t see any near term inflection point driven by the poor economic situation within the country and rolling lockdowns.

“Oil demand in China, the largest importer, is under threat as the government presses on with strict anti-virus curbs and growth slows. Among warning signs, total oil-product demand may average about 14.1 million b/d this quarter, below the average of 15.7 million b/d in the same period last year, according to data and analytics firm Kpler. Separately, official figures show apparent crude consumption sank almost 10% in July as refineries handled the least oil on a daily basis that month since March 2020. China refined 53.21 million tons of crude in July, the least since April, the National Bureau of Statistics data showed. That’s equal to about 12.58 million barrels a day, 6% lower than June and the least since March 2020, according to Bloomberg calculations.”

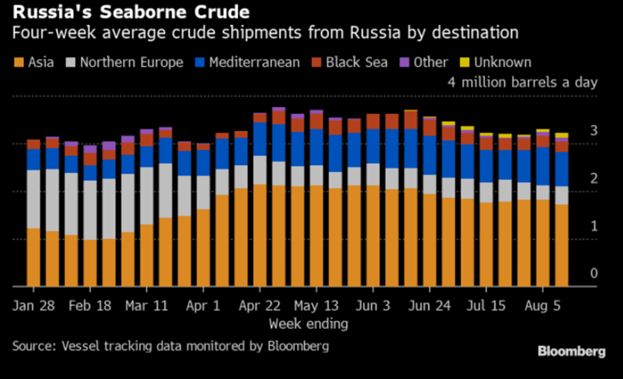

As China slows down purchasing, they are dropping Middle East flows to a trickle (essentially only term buying) while cutting West African flows even further. The below is just an example of the drop as the flows stabilize below the peak from the initial Ukrainian invasion. “Russia’s seaborne crude shipments have stabilized at a level about 500,000 barrels a day below the peak they reached after Moscow’s troops invaded Ukraine, and remain little changed from where they were before the attack. On this basis, seaborne exports edged lower in the week to Aug. 12, slipping to 3.24 million barrels a day from 3.32 million the previous week, according to vessel-tracking data monitored by Bloomberg. “

China has been the biggest driver of the dip while India has maintained most of its increased flow. We don’t see a pivot in Chinese buying in the near term, and it will leave more crude in the water.

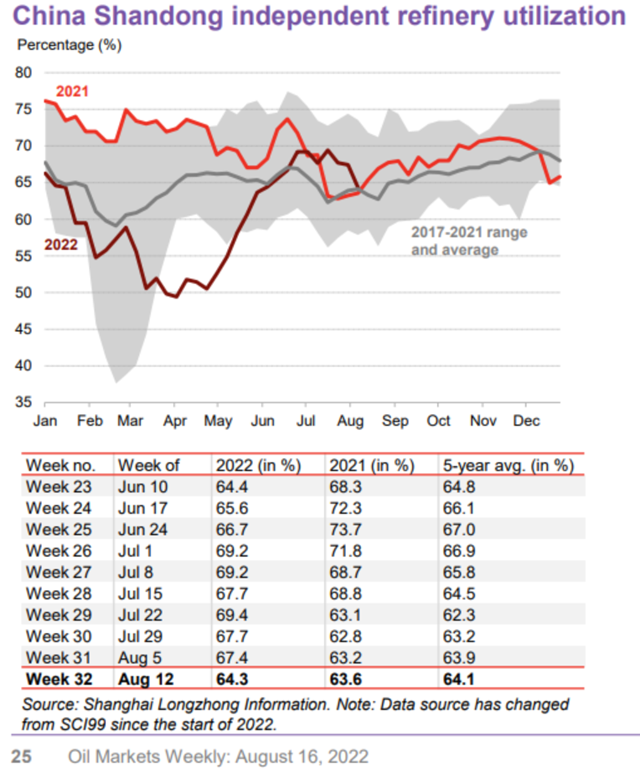

China’s Shandong refiners (teapots) were the only assets that saw a shift higher in utilization rates, but those have also come under pressure over the last few weeks. We believe that activity will hold around 64%, but unless we get some additional export quotas soon- we will get a drop back to about 60% activity. China is currently stuffed with both crude and product in storage, so we will need to see a shift in exports to keep utilization rates elevated. It would be great economically speaking because the diesel market remains robust around the world as storage is either at or near record lows.

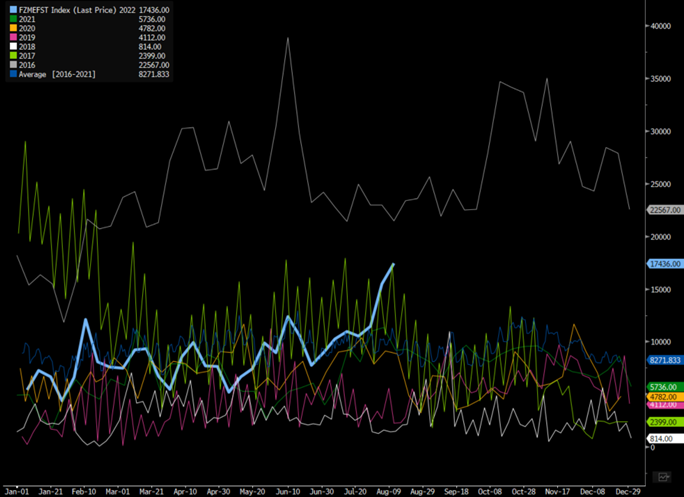

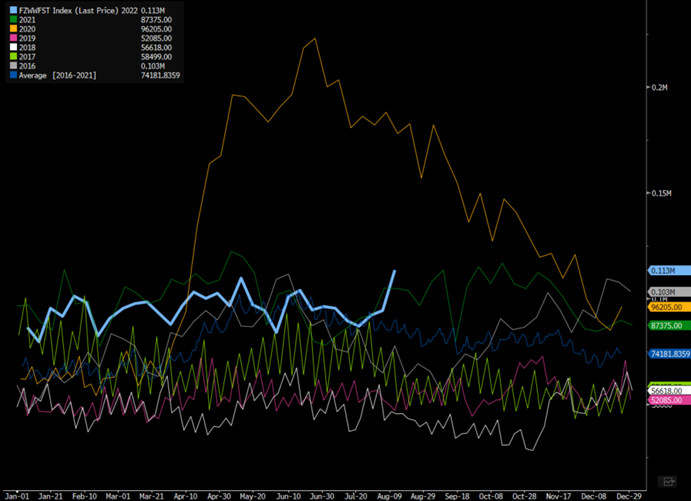

Saudi Arabia sent their OSPs (official selling price) to record levels across their portfolio resulting in a huge drop in purchases. As we called out previously, if KSA got aggressive on pricing- it would result in a floating storage spike that is now pushing to record levels. Given the price increase carries through the end of September, we expect to see more barrels get left in the water and will likely take out the 2016 highs unless some soft discounts are rolled out.

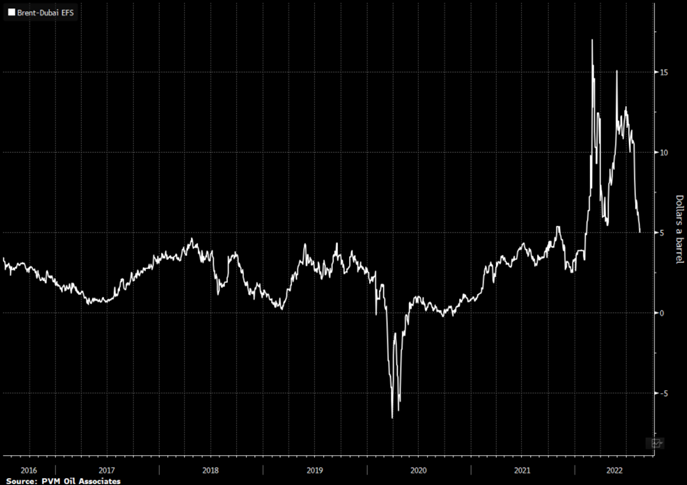

The increase is a mix of OSPs as well as China just not buying the same level of crude. The Brent vs Dubai spread has collapsed back to $5.22, which also makes Middle East crude very unattractive. Heading into Asia- KSA light is trading at $12 above Dubai while Brent is only $5. Even factoring in shipping and insurance, it is still much more profitable to purchase from the U.S., Europe, and West Africa. The U.S. flows have been supported with an average of about 3.7M barrels a day exported into the market between Europe and Asia. We don’t see that slowing down given the current economics and spreads sitting in the market. The arbitrage is supportive of flows as we have seen bigger price cuts rolling out in West Africa and Europe. Even with the price cuts, the spreads still support U.S. exports that will help pull down other prices in the market.

The slowdowns in purchasing have resulted in a bigger increase in floating storage that will continue to trend higher over the next few weeks. The data isn’t helped by seasonality as we are coming into a slow purchasing period with shoulder season.

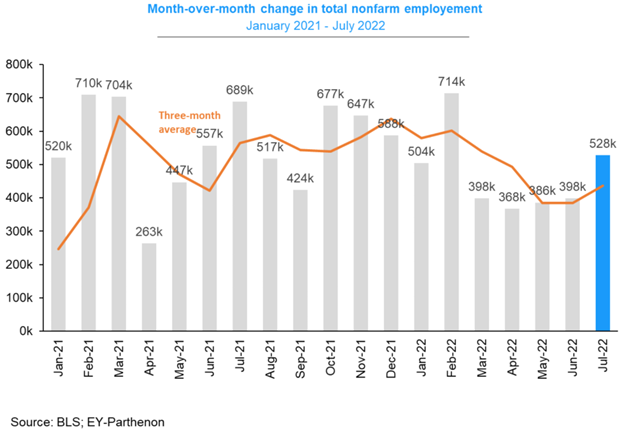

We have gotten a lot of questions around housing and the varying jobs report. I think it’s important to understand each of them, and why there is more pain ahead when we review the leading indicators. The Non-Farm Payroll came in with a strong number for July, but it normally has a big bounce in July given the hiring period. The change we saw in July was a big step up from estimates, but the devil is always in the details.

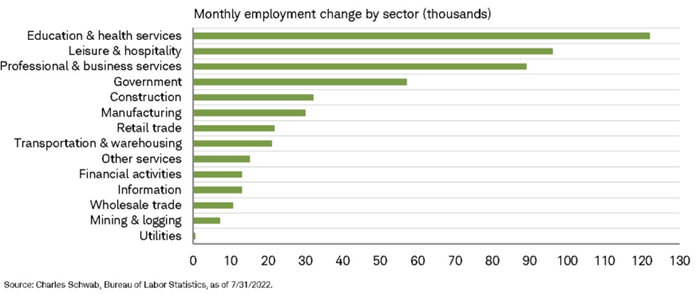

The biggest driver was the increase in education, which is normal for the hiring ahead of the school year. We will see some of that slowdown as we head into August/September while the rest tend to be lumpy as we get to the close of summer.

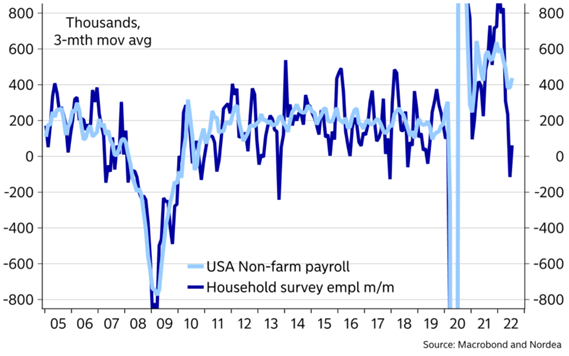

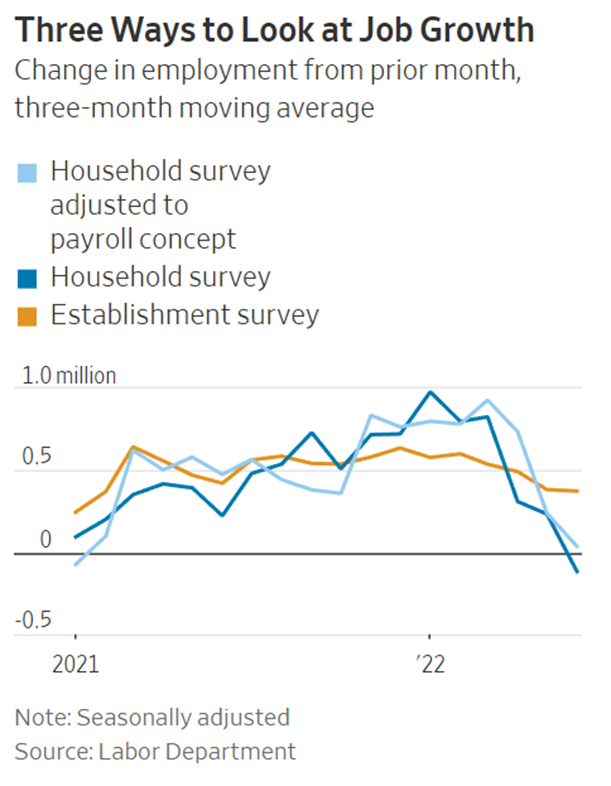

Typically, the NFP survey has a history of being unreliable at pivotal turning points. The revisions tend to be very large (in both directions) with the household survey tending to be more accurate but is a bit more volatile. The household survey is showing the trend has been clear with the last 3 months showing a clear downward trend with revisions likely.

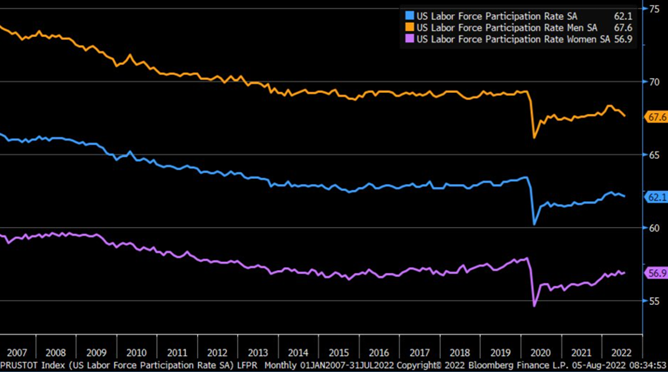

The household survey is also used to set the participation rate, which fell across the board. This is a much bigger issue as people still remain outside the workforce. The trend is problematic when we consider wages and the cost of employment. Even as jobs slow and cuts accelerate, wage costs will stay elevated keeping pressure on margins and businesses.

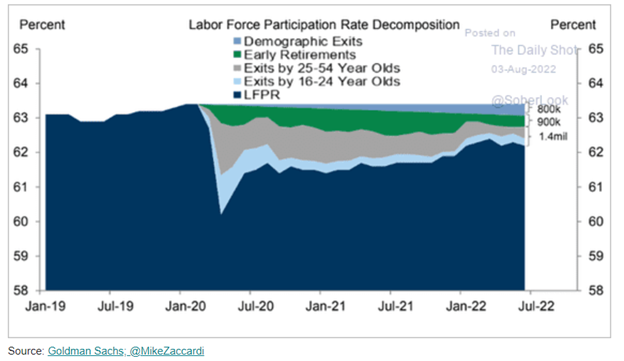

The participation rate is being driven by multiple variables, including early retirements, but we should have seen additional activity from the 16–54-year-old market. Instead, it remains well below the pre-covid normal with little to show a shift is in the works.

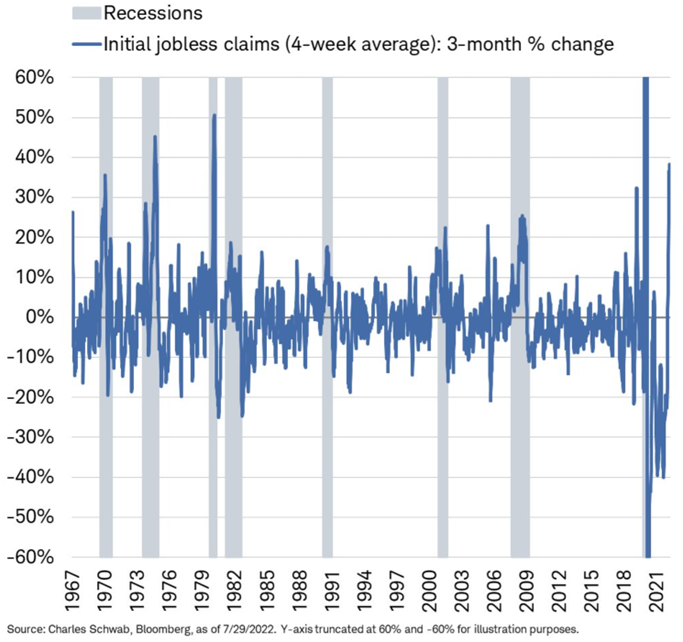

We are also getting a recent spike in jobless claims: Recent spike in 4w average of jobless claims has been consistent with prior recessions; in fact, 3m % change of late has exceeded peak spikes seen in GFC, 2001, 1990-91, and 1981-82 recessions.

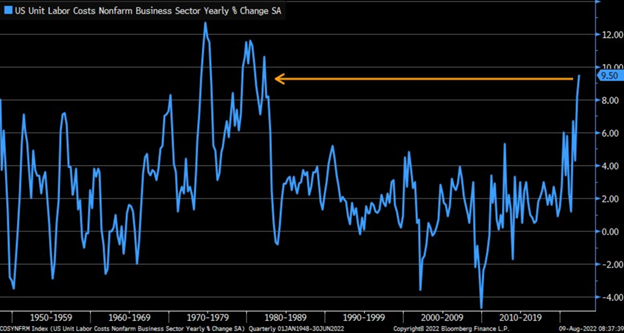

Even as Jobless claims grow- unit labor costs soared by 9.5% y/y in 2Q’22, which is the largest spike since early 1982.

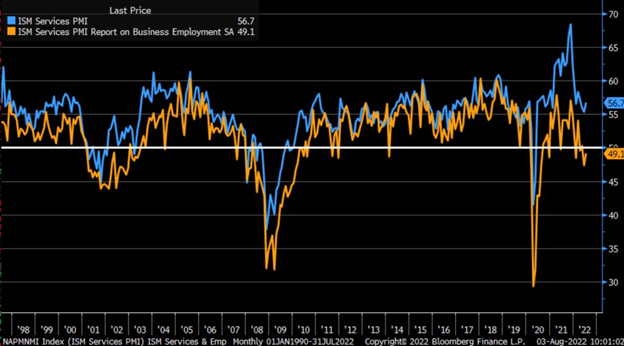

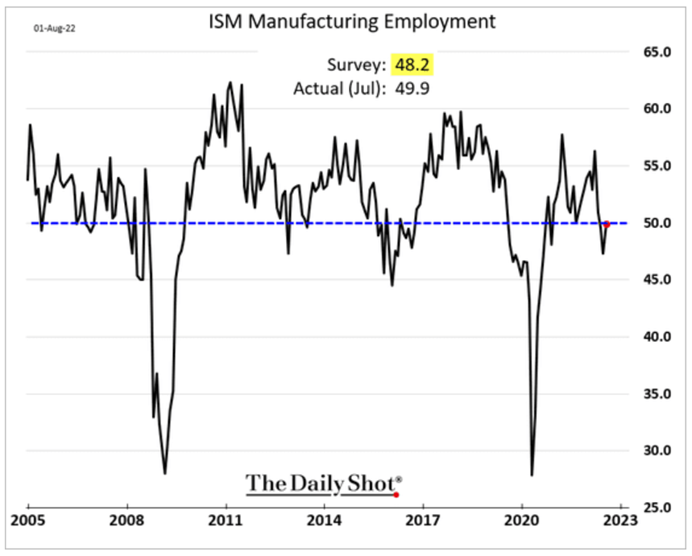

Here are some other readings on employment, which you can see is in contraction.

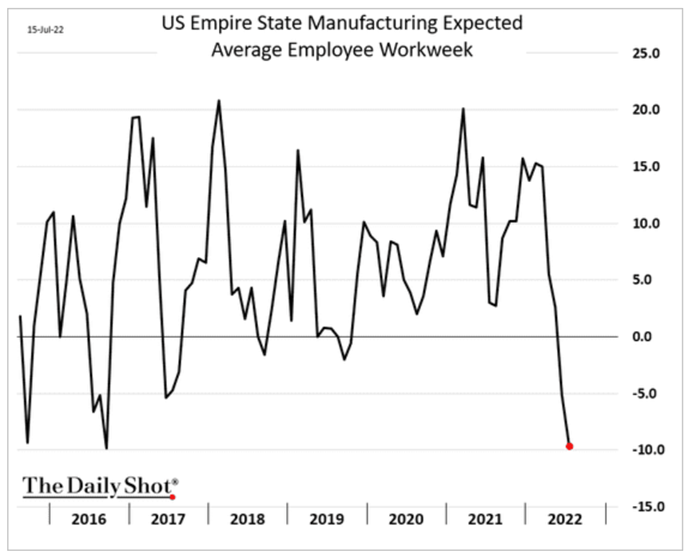

Every regional Fed data set shows a reduction in employment and a steep drop in the expected average employee workweek. A similar chart shows that the household survey has moved into contraction, and it’s just a matter of time for the “established” survey to reflect something similar.

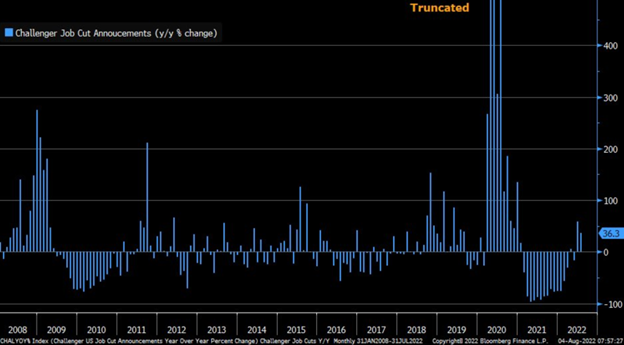

Another way to confirm the data is by looking at the Challenger Job cut announcements. This was the second consecutive month of y/y increase in job cuts, +36.3% vs. +58.8% in prior month. The auto sector has led this year with >25k cuts, 9.5k of which occurred in July; Tech sector is in 2nd place with YTD total of 9.3k. We have seen a big increase in layoffs across the tech sector with more recently announced.

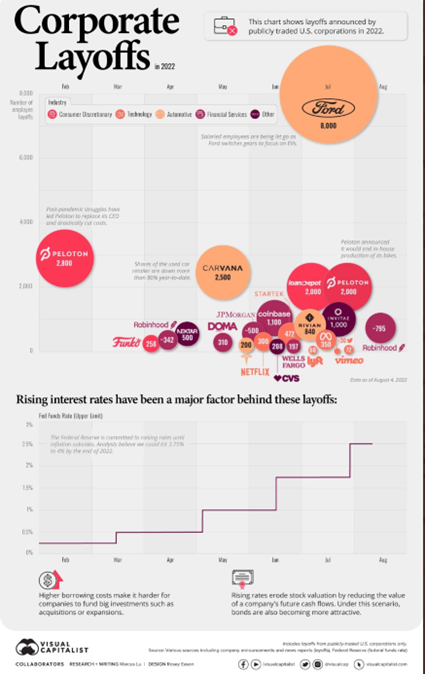

Below is just a recent list of corporate layoffs with more to come.

If we look at the regional fed data, household surveys, challenger job cuts, jobless claims, corporate announcements, S&P Global PMI data, and ISM data- we are on a clear slowdown path with layoffs and job freezes increasing across the board.

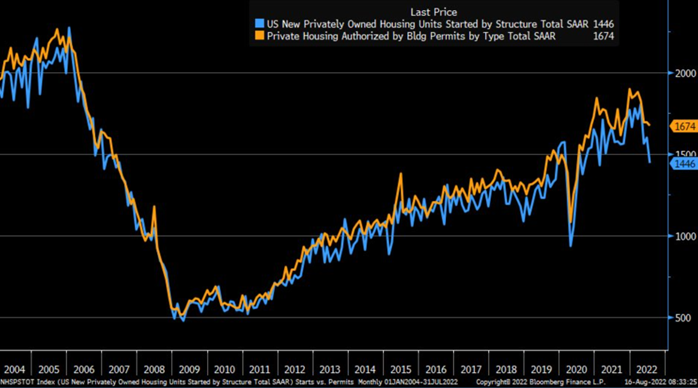

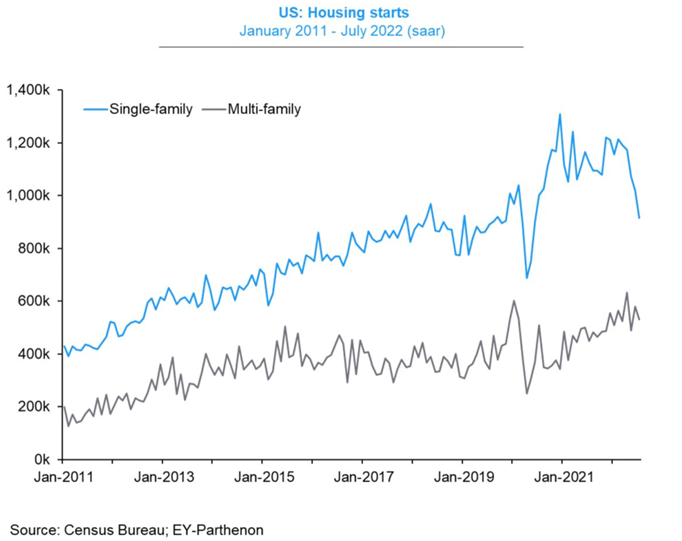

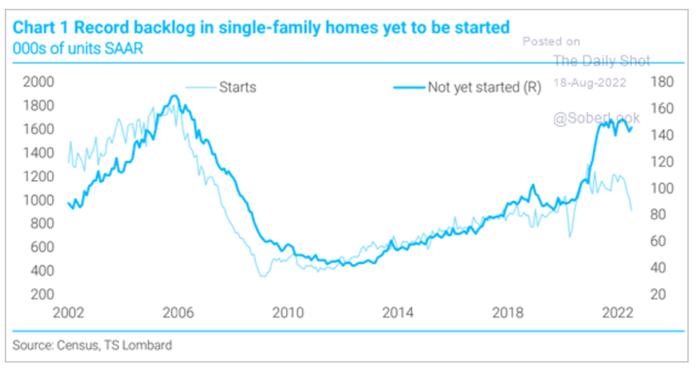

When we pivot to the housing sector, we have seen a very large pivot across the board that is only going to accelerate into next year. The real estate sector continues to struggle on multiple fronts as weakness creeps into each area of the industry. We can kick off with a huge miss in housing starts: July housing starts -9.6% vs. -2.1% est. & +2.4% in prior month (rev up from -2%) … building permits -1.3% vs. -3.3% est. & -0.6% in prior month. Even as housing starts slow, it isn’t even across all types of construction.

Single family starts were down 10% while multi-family starts were down 8.6%. The percentages look large, but they are uneven vs single and multi-family. We believe that the single-family data will continue to worsen because there remains a record amount of capacity under construction, but the multi-family front never saw the same type of explosive builds.

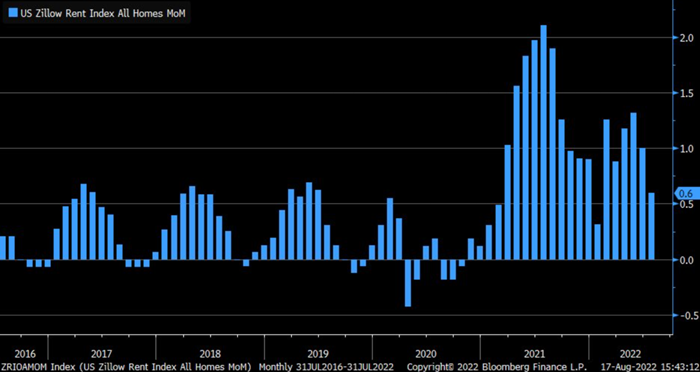

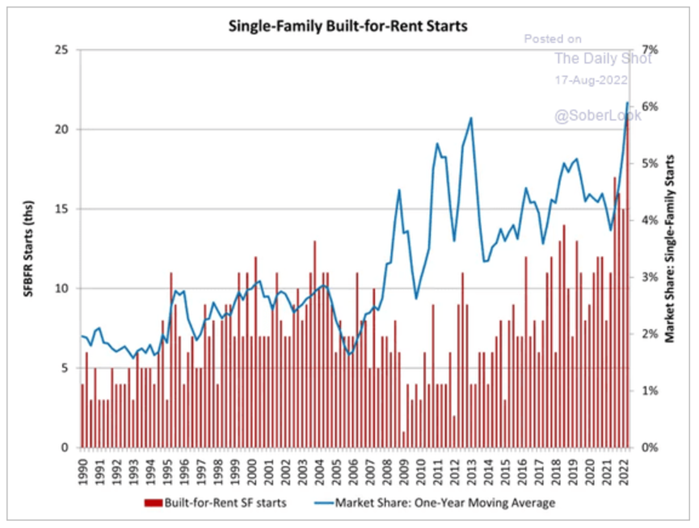

As rents remain elevated, there will be support for multiple units as well as the ability to spread costs across multiple units instead of a single family. We have already seen the “value” of flipping diminish signficnalty, which opens up more opportunity for additional building. Rent pressure starting to cool a bit per index tracked by Zillow, but m/m change remains quite firm relative to history. There will be more downside pressure, but we don’t see it as bad across the multi-units.

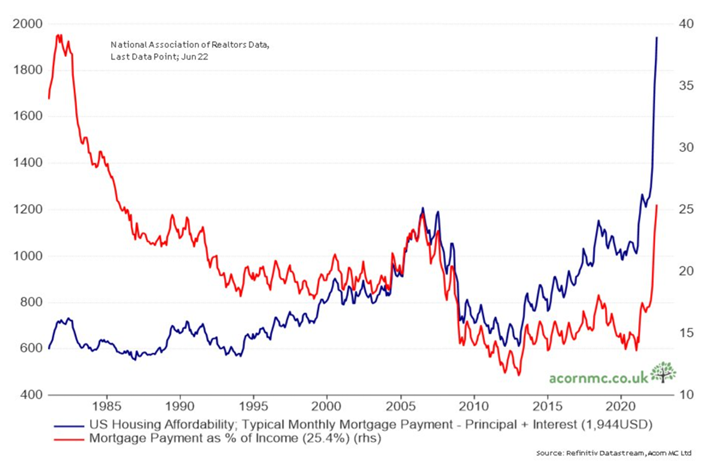

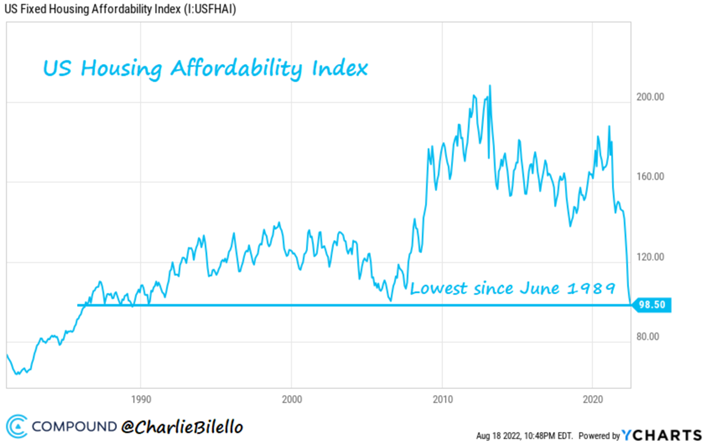

U.S affordability has hit a record with mortgage payments as a percent of income pushes back to the highs from 2006. As rates continue higher, the red line (% of income) will keep shifting higher and force prices down as they are typically inverse. Rates moving higher means that the cost of the mortgage will prohibit a continuous rise in housing prices because the monthly payment becomes increasingly problematic. In order to keep monthly payments low, a buyer will have to increase the down payment but with savings rates current trend- it’s unlikely anyone will have that cash laying around.

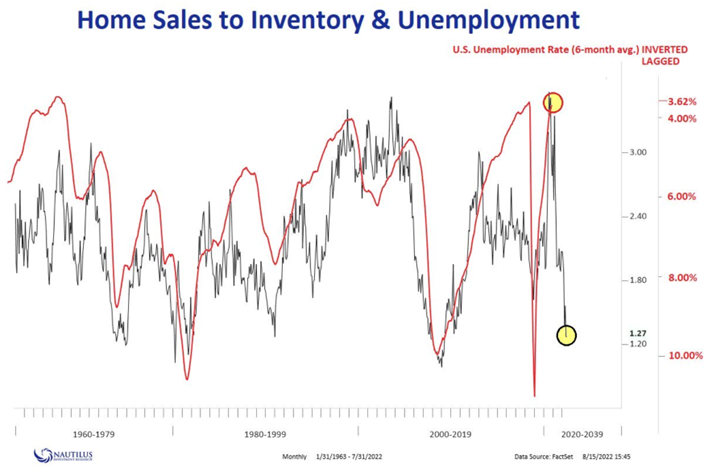

The above chart is a key reason why people have equated housing directly to the business cycle. If you take the unemployment rate (as we discussed above- we believe it will grow) and make it inverse to the home sales to inventory metric, you can see how quickly things can turn. We are an extreme that is preparing to correct quickly, and it will cause a much bigger slowdown across the U.S. The below chart is playing out in other areas of the world and will be a drag on the global economy- especially in China.

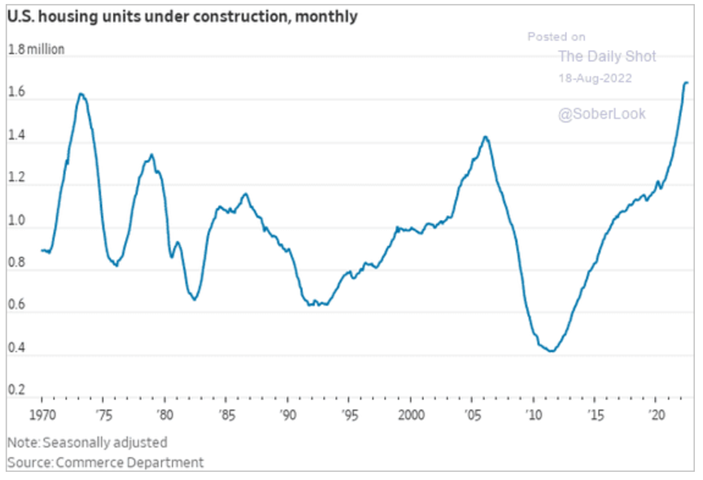

As we mentioned above, housing starts have collapsed BUT we have a record amount of housing units under construction. I am talking the most in U.S. history, and there is even more that haven’t even started yet. Some of these homes may never be started, but the ones currently under construction will need to be completed because normally there is a bank loan against it. A developer has two options: pre-sell the home or build on speculation that is normally bankrolled by financial institution.

These homes will either be sold OR the developer can try to wait for better pricing and rely on renting. It isn’t surprising to see more builders starting to turn to rental properties waiting for a turn around in housing. They are locked in at very elevated costs driven by labor, equipment, and material, which limits their options.

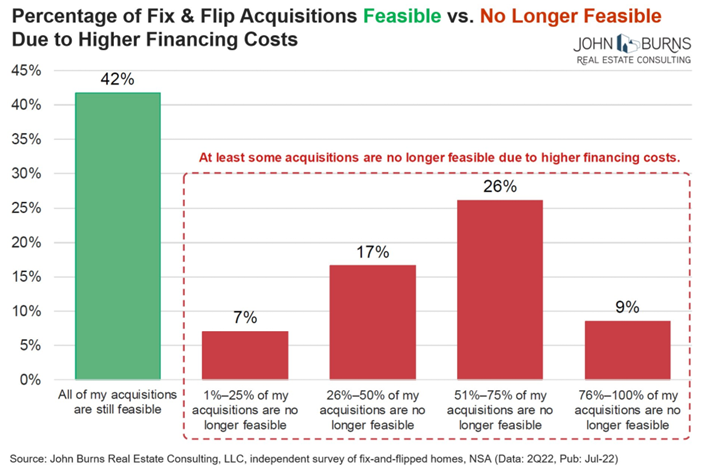

I think this chart does a great job of capturing what I mean by home flippers now underwater. The survey was run from July 11th-19th and between higher financing costs and underlying building expenses there ware more dead deals. As these deals are no longer feasible, it pushes people to become “longer term” holders and try to remain above water.

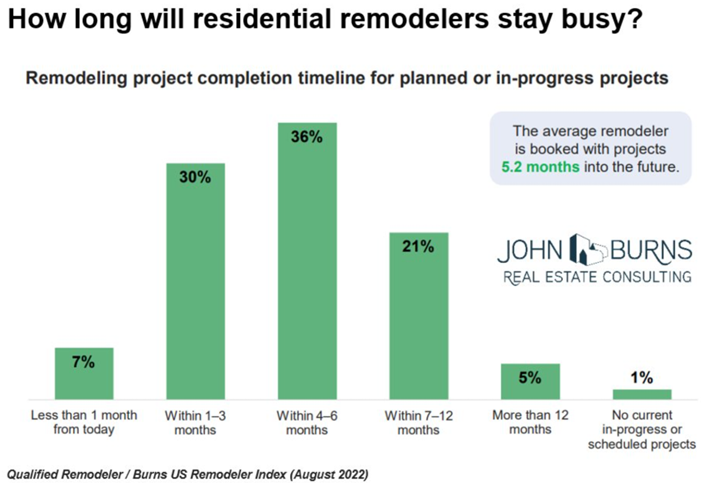

The remolding industry is also seeing a steep slowdown in new work: “Residential remodelers tell us they are sitting on an average project backlog of 5.2 months. And new project bookings have slowed to a trickle. On the bright side, this sets up relief on material pricing, labor availability, and product lead times for builders and remodelers.” I have discussed how there was a slew of work that happened in my neighborhood over the last few months, but there has also been a steep drop off. As I am consistently nosey, I was asking the guys what their backlog looked like (back in early June), and they said they were fully booked through late August/ early September but after that period there is a steep drop off. The data below has the average a bit longer carrying us into year-end, but also has a very steep drop off in general.

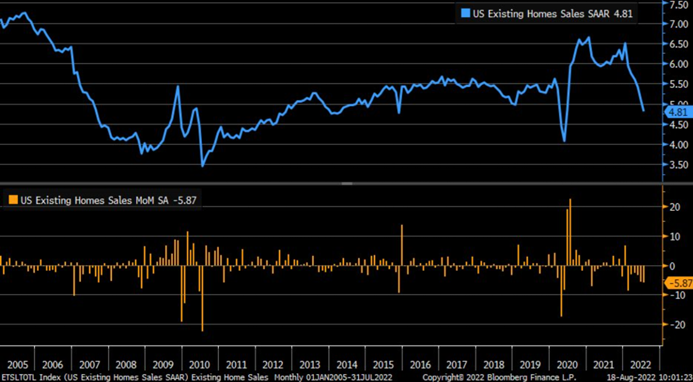

The issues don’t stop at new construction or new starts but expands into existing home sales. “Continued “yikes” for existing home sales, -5.9% in July vs. -4.9% est. & -5.5% in prior month; annualized level of sales at 4.81M is lowest since May 2020 … median selling price +10.8% y/y to $403,800 … first-time homebuyers accounted for 29% of transactions.” There has been a drop of home sales right back to the lows over the last decade, and given the current backdrop, we will keep moving closer to the levels seen (consistently) in ‘08/’09.

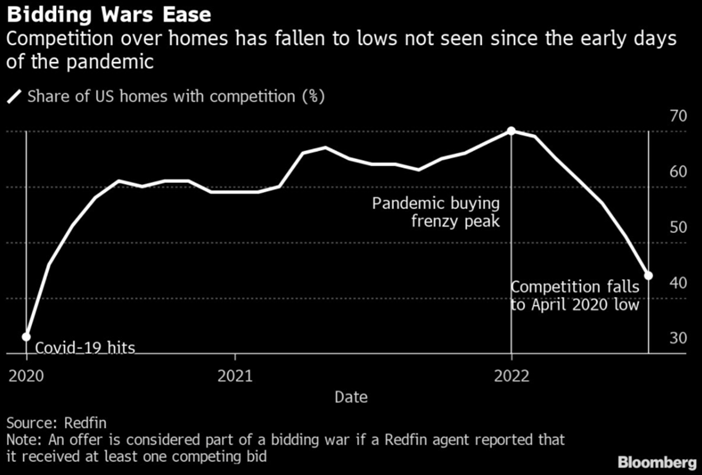

You might say: “What gives you the confidence we will see a drop to that level?” We just need to look at “bidding wars”, which is defined by Redfin as an agent receiving at least one competing bid.

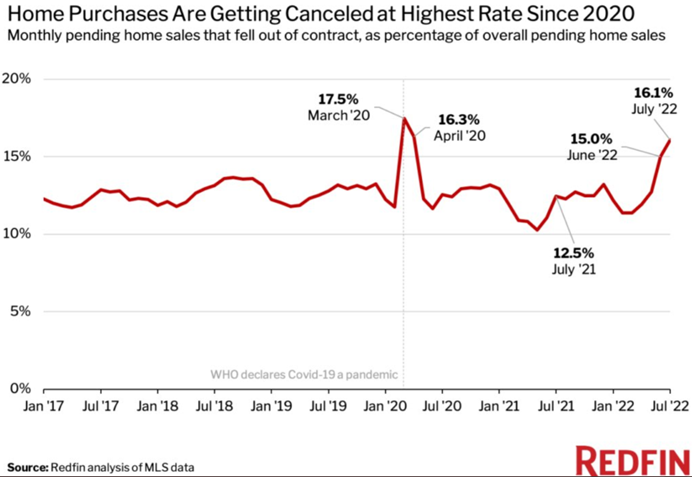

As more homes receive only one bid showing the decline, we are also seeing more canceled transactions as economics pivot and mortgages fall through. Banks are no longer waiving appraisals and requiring more proof of income hindering some transactions. Homebuyers are backing out … roughly 63,000 home purchase agreements fell through in July, which equals 16.1% of homes that went under contract that month: highest % since March/April 2020.

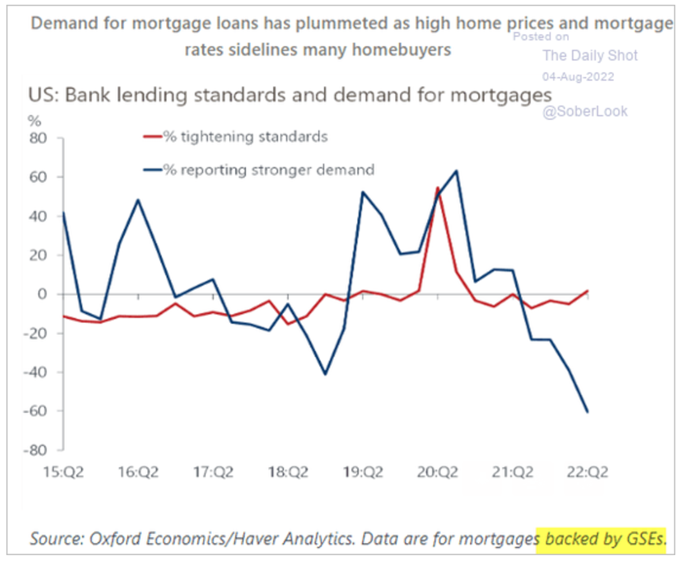

When we look at home purchases being canceled, we can also see the same information in bank lending standards and demand for mortgages. It isn’t surprising to see the bigger shift as banks try to protect their bad debt expense and reduce waivers/ increase borrowing requirements.

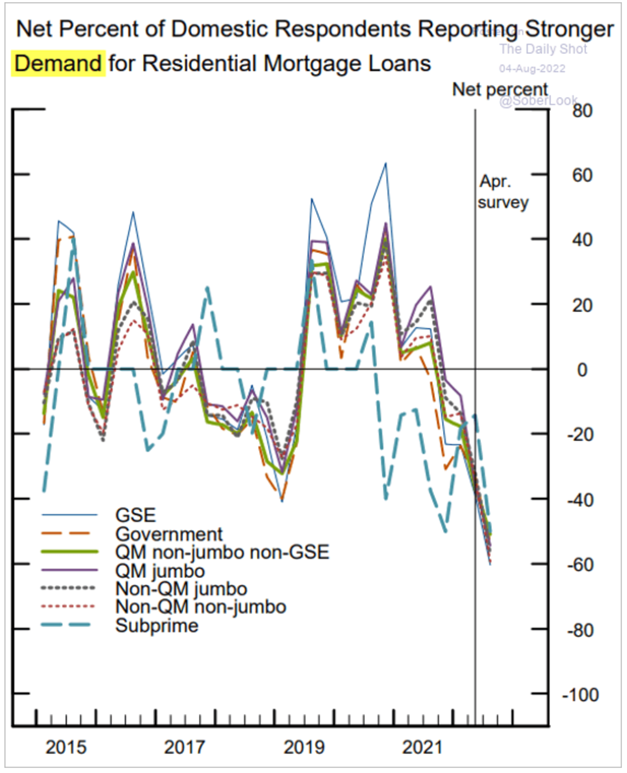

So it isn’t surprising to see a big drop in demean for residential mortgage loans.

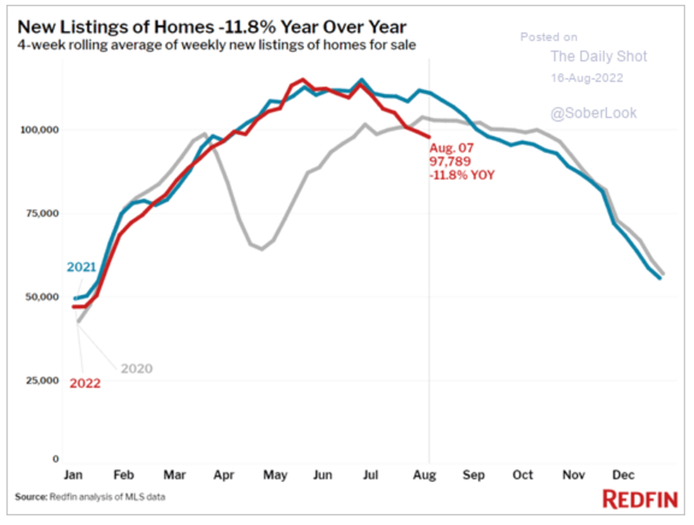

Another interesting twist in the saga is the drop in new home listings. Even as new listings drop, we are still seeing inventory grow because buyers are dropping off faster than sellers are coming to market.

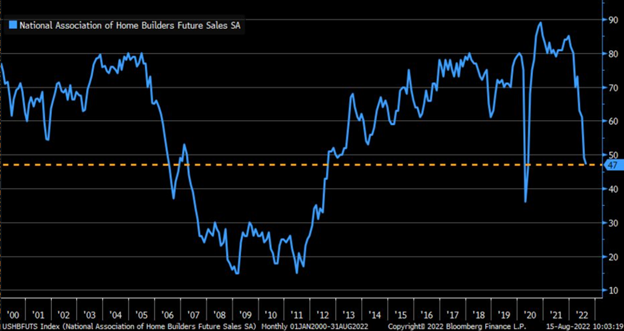

These views are being confirmed by the homebuilder’s market index that saw a broad drop in current market conditions and expectations going forward. Homebuilder sentiment still in freefall: August Housing Market Index fell to 49 vs. 54 est. & 55 in prior month; future sales, present sales, and prospective buyers traffic all fell. The sentiment declined for an eighth-straight month, marking the worst stretch since the housing market collapsed in 2007.

Future sales component within homebuilder confidence is approaching its pandemic low … at 47, index is consistent with where it was in mid-2006; a year ago, it was at 81.

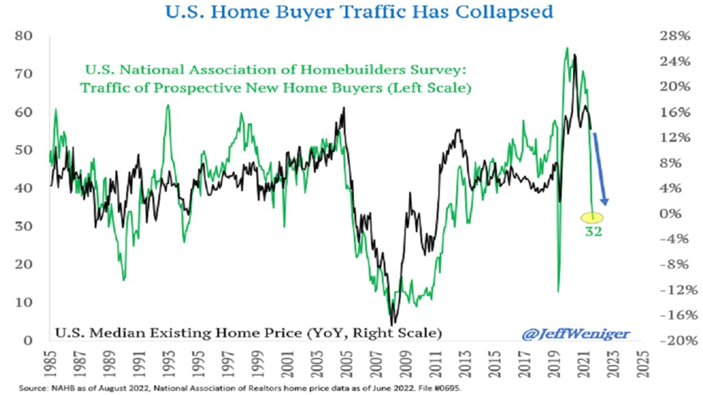

The biggest “surprise” to the market has been the pace of the slowdown, but this is right inline with our views and is a key reason why we see a much steeper slowdown/recession. The general traffic of prospective new home buyers is dropping through a floor and as rates continue higher and savings dwindle- we believe it will fall further over the coming few months.

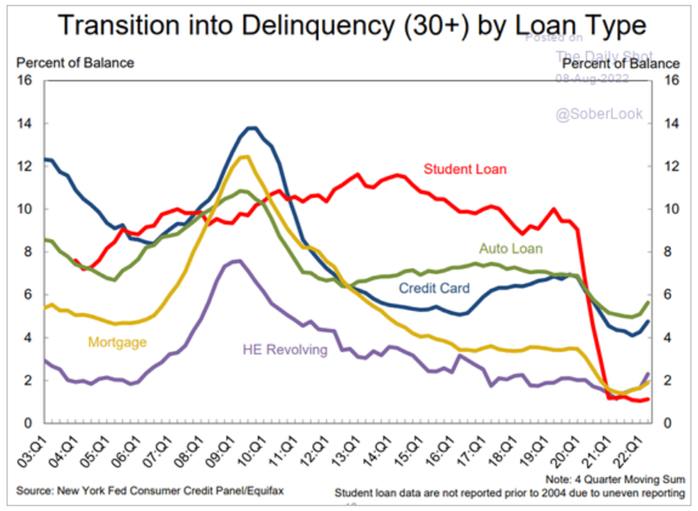

The pace of delinquencies has accelerated across auto and credit cards. Credit cards is a bigger concern because rates for borrowing have shifted higher, and U.S consumers have a record amount of debt on their cards. We have seen in previous downturns how quickly things can pivot, and those two are key bellwethers for the health of the consumer. When consumers come under stress, the first thing they stop paying are their car loans, and we have already heard from car companies highlighting the increase in delinquencies and repos. My biggest concern is the credit card data where we believe the most pain will become apparent driven by how high balances are at this point in time.

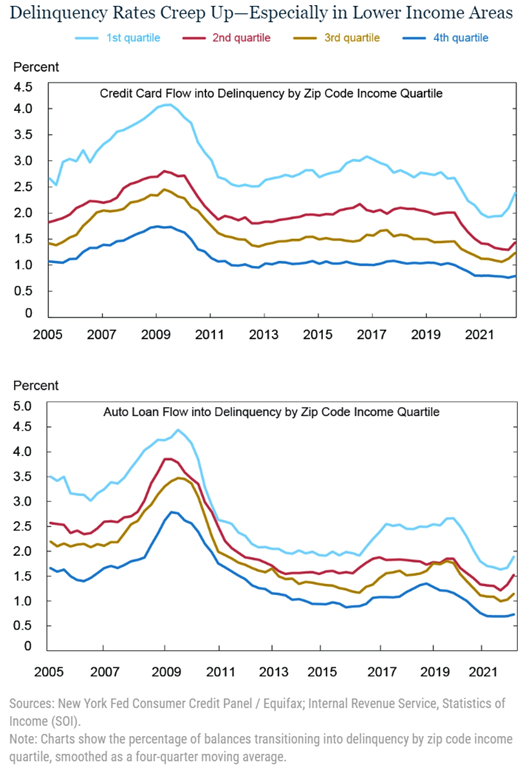

The below chart shows where the issues are accelerated, and it shouldn’t be surprising to see it at the lowest income bracket. These are the people that are trying to maintain lifestyles as prices go through the roof and savings have been exhausted. Because balances are back at records and rates are rising, we think this is the key leading index that begins the bigger crack in retail sales.

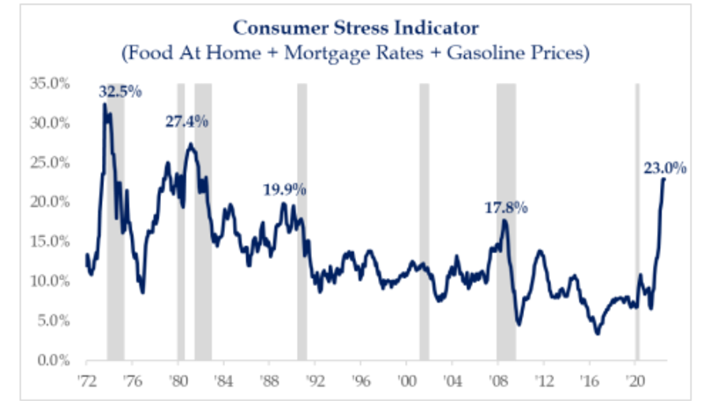

These consumers will also get hit again as we enter winter with heating oil (diesel), natural gas, and electricity prices are very elevated levels. The consumer stress indicator remains at 23% for the 2nd month despite mortgage rates and gasoline prices falling significantly from June. The CPI release yesterday showed that the food at home component is now growing at 13% which offset the decline in the other two components.

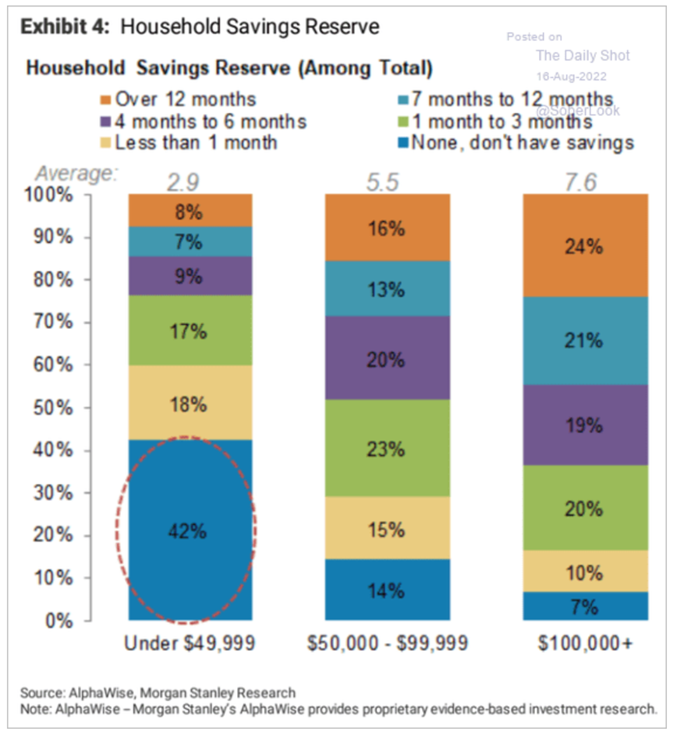

The savings cushion has all but evaporated for many with the lowest income brackets seeing the most pain. With inflation elevated and real wages negative, the cushion will keep falling at a fairly rapid pace and increase the struggle. We have already seen over 40% of people in surveys saying they are struggling to pay bills, and the data above supports that type of figure.

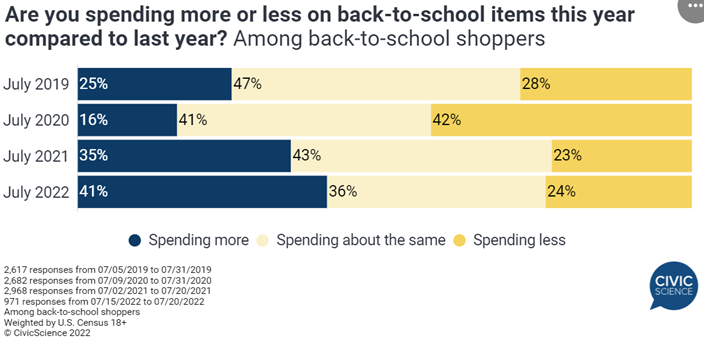

If we do another “gut check” with back-to-school shopping, we are seeing parents saying they are spending more vs last year.

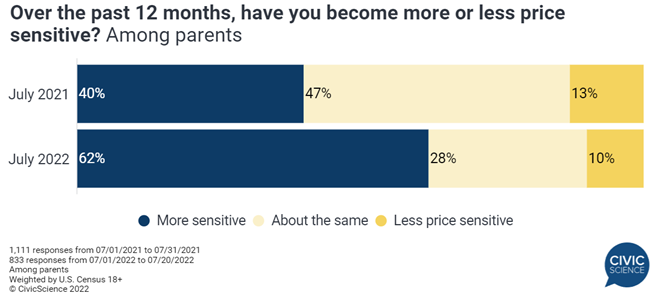

And while they are spending more- parents highlighted they are “more sensitive” to pricing, which isn’t a surprise.

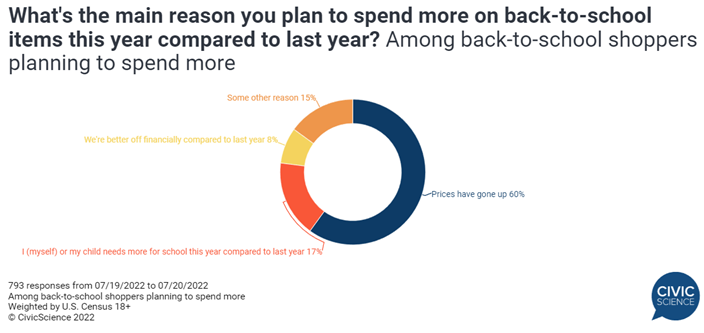

The icing on the cake is the fact that many of them are spending more purely because prices have gone up.

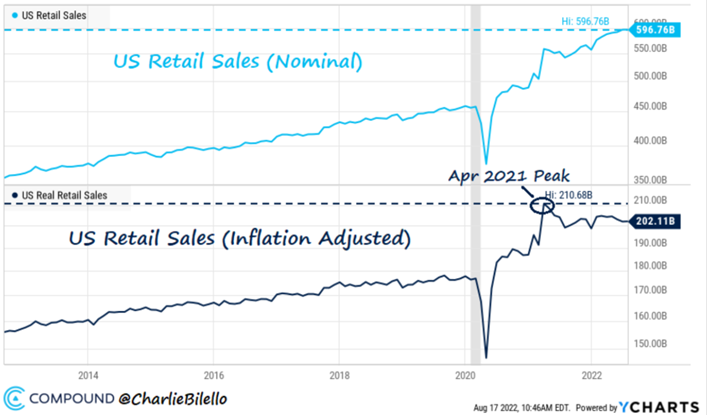

It shouldn’t be a surprise to see a shift in the “volume” of stuff people are purchasing. In nominal terms, US Retail Sales are still strong, hitting another all-time high in July, up 3.6% over the last 6 months. But after adjusting for inflation, the story changes. Real Retail Sales peaked in April 2021 & are down 1.1% over the last 6 months. While we still see retail sales “rising”, people are walking out with less stuff. But, you can see that things are still maintaining a steady level of purchasing, but I think as we move into Sept/Oct the pace of retail sales is really going to drop off. FedEx and Amazon have already said they will increase surcharges beginning in Sept (day after Labor Day) instead of the end of October for the “normal” Christmas price surge. Another important data point: Telling comments from Walmart on earnings call: *WALMART HAS CANCELED ‘BILLIONS OF DOLLARS’ IN ORDERS, CFO SAYS *WALMART CFO SEES NEW PRICE CUTS ON SOME GOODS TO PARE INVENTORY”

Walmart is the largest retailer in the world, and they are a very important signal when considering the “health” of the market.

Overall, retail sales have slowed from 13.7% y/y in January to 10.3% y/y in July. But, in inflation-adjusted terms, retail sales are up only 1.7% relative to last year. In other words, while consumers’ retail receipts are higher, they’re getting fewer items for their dollars.

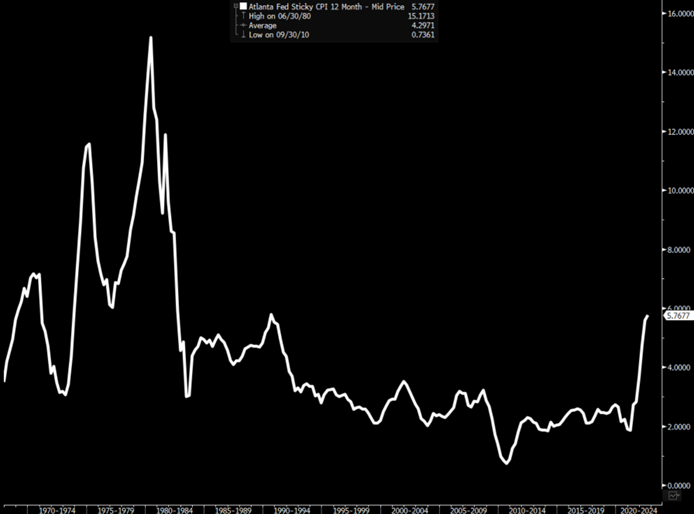

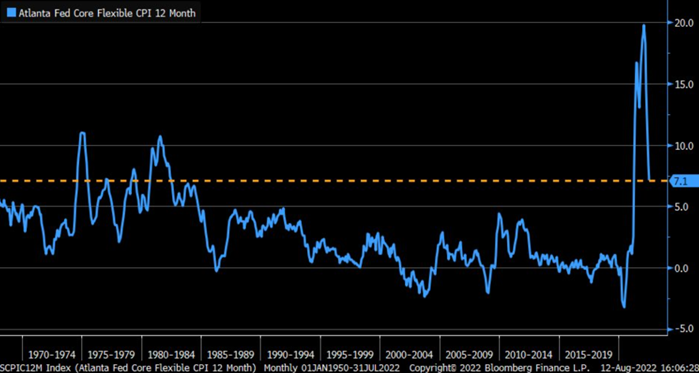

Even as flexible inflation falls off the highs, sticky inflation remains elevated with more pressure to the upside driven by housing and healthcare. As real estate slows, the CPI calculation didn’t keep pace so there is still more upside for pricing in the near term. But, the move in inflation is so broad based that even as real estate/ rent cools off many other of the inputs are heading higher. This will be supported by a renewed surge in many input costs- natural gas and electricity just being two of them.

Flexible inflation has pulled back with gasoline prices, but as gasoline pricing levels off and diesel remains elevated, we see this finding a near term floor. Even though flexible inflation has fallen significantly, you can see it is still near the peaks from the 70’s. We believe it finds a bit of a floor here, and it goes sideways as energy pricing flatlines and other parts of the energy basket move higher.

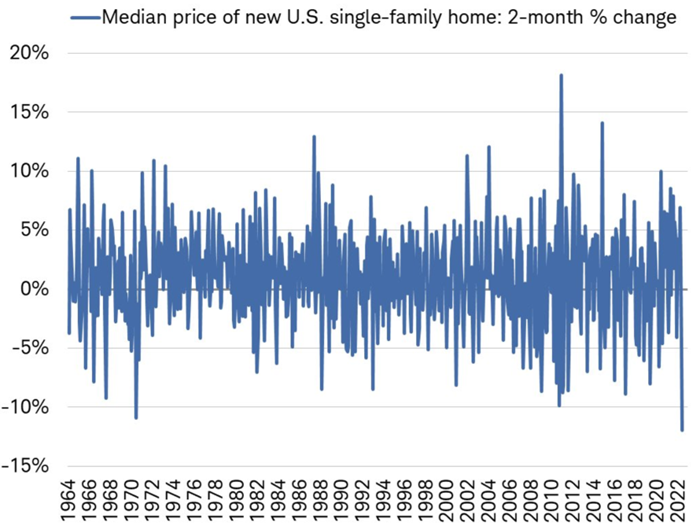

We are starting to see the crack in family home prices, but we still have a long way to go given how insane prices have gotten. This is why it’s important to put this kind of fall in perspective after such a “rocket ship” higher. “2-month change in median price of new single-family home has cratered to -11.9% (worst in history; even beyond housing crash during GFC)”

But the meteoric rise still remains intact with housing affordability at the lowest level since 1989.

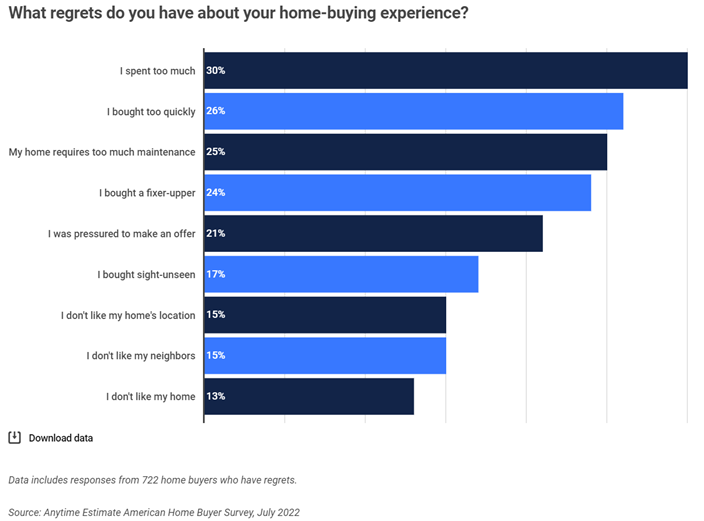

There is a lot of buyer’s remorse out there with 3 in 4 buyers regretting their home purchase. Some of this is “normal”, but it also gives an idea of how people paid up to get out of cities. I bring this up because it begs the question- “Who is the next incremental buyer?” People were able to lock-in great rates, but had to pay a crazy price to lock down the housing. They are now going to live with “golden handcuffs” with great mortgage rates but a purchase price that they won’t be able to recover. This will keep them “trapped” in the house or have to accept a write-down on a sale or pay down their mortgage faster. These are issues that will limit resale and cut inventory going forward, but it also keeps buyers at bay. We see a big drop in potential buyers going forward, which will keep pressure on pricing mixed with new construction coming to market and falling rates… fun times ahead!

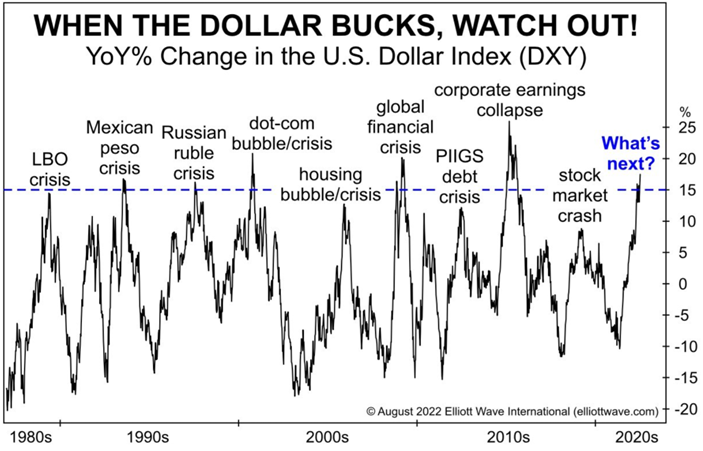

The dollar is now ramping up for a run to 115, which will be soul crushing for Emerging Markets. There is a significant amount of data showing the problems that are caused when the dollar goes parabolic. This time around- EMs are sitting on a huge amount of dollar denominated debt and are firmly in a tightening cycle. The rise in USD will put additional pressure on the market as interest expense gets more and more costly.

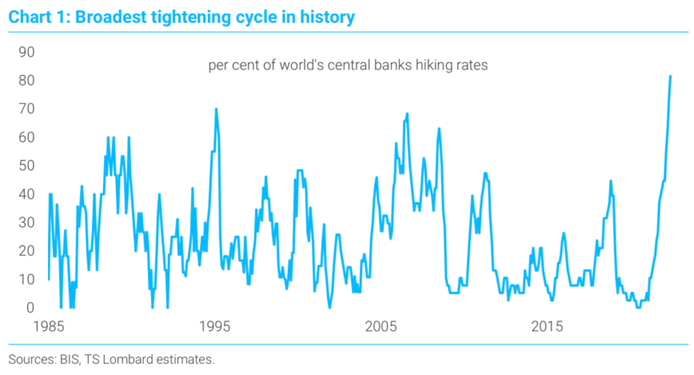

It isn’t surprising to see the “broadest tightening in history” after seeing the biggest cut in history. Inflationary pressure, rising rates, and USD strength is a recipe for disaster when we look at the EM world.