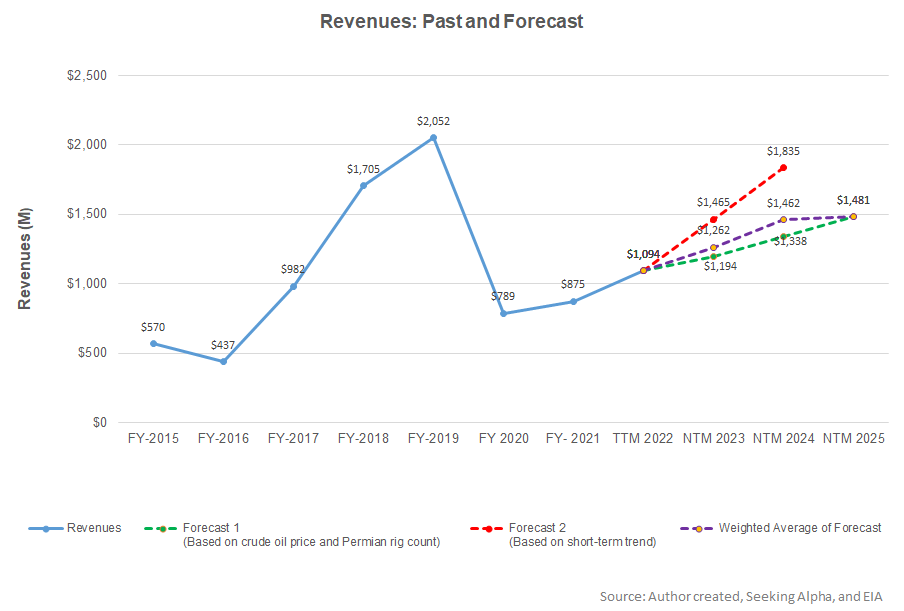

- The regression equation suggests a steady revenue growth for PUMP in the next couple of years

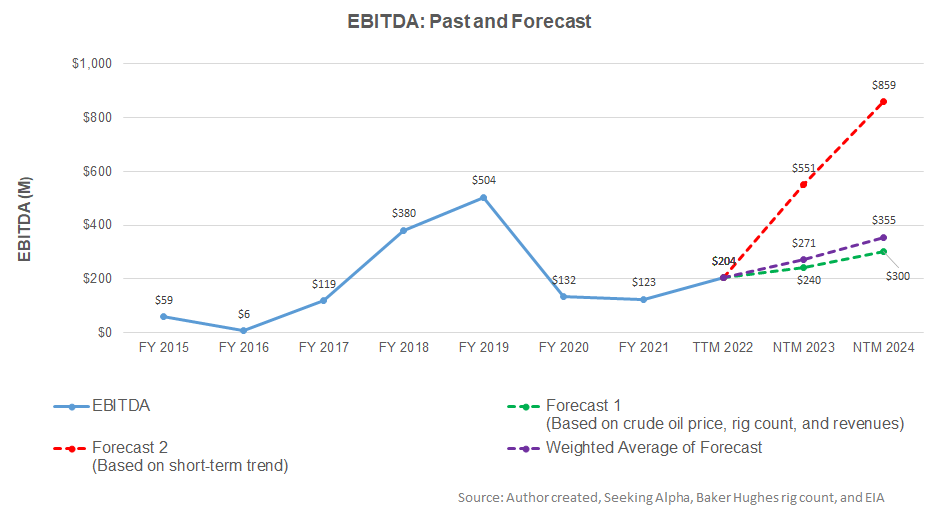

- EBITDA can increase sharply in NTM 2023 and NTM 2024

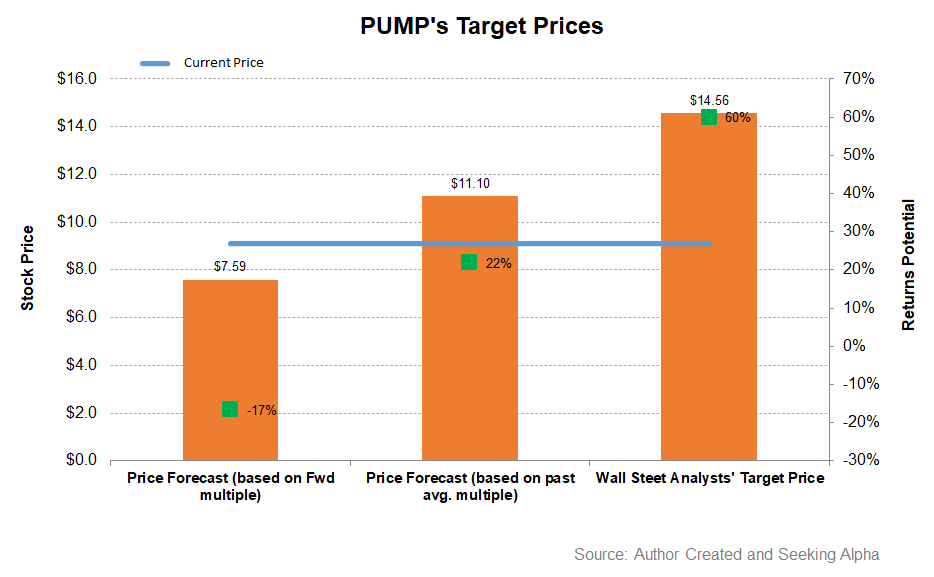

- On a relative basis, the stock is reasonably valued, with a positive bias

Part 1 of this article discussed ProPetro Holding’s (PUMP) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the key industry indicators (crude oil price and Permian rig count) and PUMP’s reported revenues for the past seven and four quarters, I expect revenues to increase steadily in the next two years. The growth rate can plateau in NTM 2025.

Based on the regression model, I expect the company’s EBITDA to increase significantly in the next 12 months (or NTM 2023) and NTM 2024.

Target Price And Relative Valuation

We have calculated the EV using the forward multiple and the past average multiple. Returns potential (17% downside) using the forward EV/EBITDA multiple (2.7x) is lower than the past average (22% returns potential) and Wall Street’s sell-side analyst expectations (60% upside) from the stock.

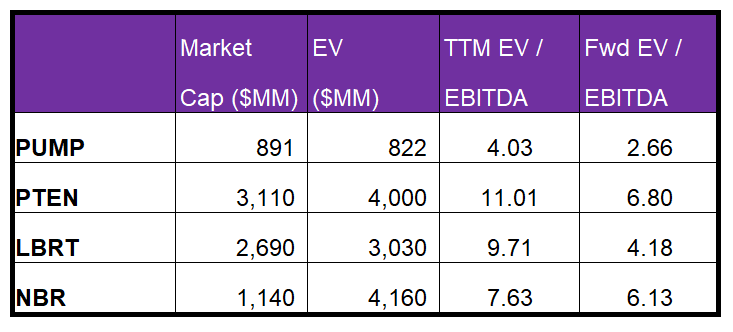

PUMP’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than its peers, which indicates a lower EBITDA than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (4.0x) is much lower than its peers’ (PTEN, LBRT, and NBR) average (9.5x). So, the stock is reasonably valued, with a positive bias, compared to its peers at this level.

What’s The Take On PUMP?

The global crude oil market is structurally undersupplied, which draws investment in the Permian Basin. PUMP, predominantly Permian-centric, focuses on converting its legacy Tier II pressure pumping fleets to ESG-compliant fleets and upgrading them to Tier IV capacity. It plans to deploy four to five fleets by the end of 2022, while by early 2023, the number may reach six Tier 4 DGB fleets. Recently, it executed a lease agreement for two electric frac fleets with expected delivery in Q3 2023. Higher demand, stable utilization, and increased prices for pressure-pumping equipment should produce a healthy return in the coming quarters. So, the company’s operating margin has improved steadily over the past few quarters and will reach the pre-pandemic level by mid-2022.

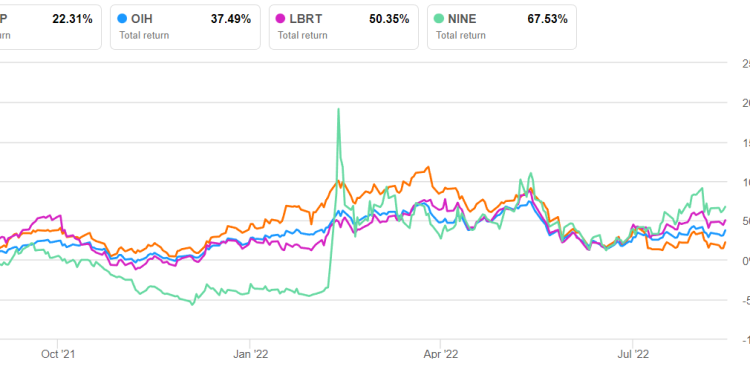

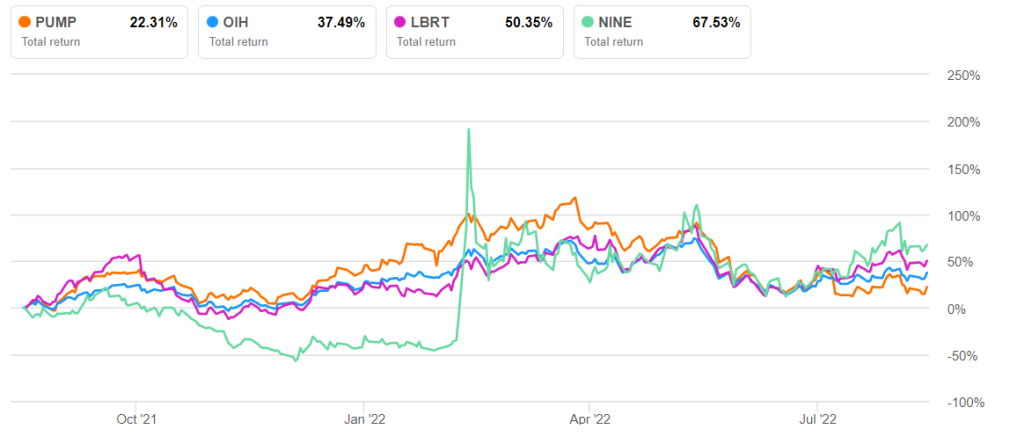

However, the failure to commercialize the DuraStim hydraulic fracturing assets in time cost it dearly in 2022. Also, equipment supply tightness and inflationary impacts on the supply chain can offset some of the gains in the near term. A higher capex will drag the FCF in 2022, which is already strained because of higher working capital requirements. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. However, it has sufficient catalysts to warrant a hold in the medium term.