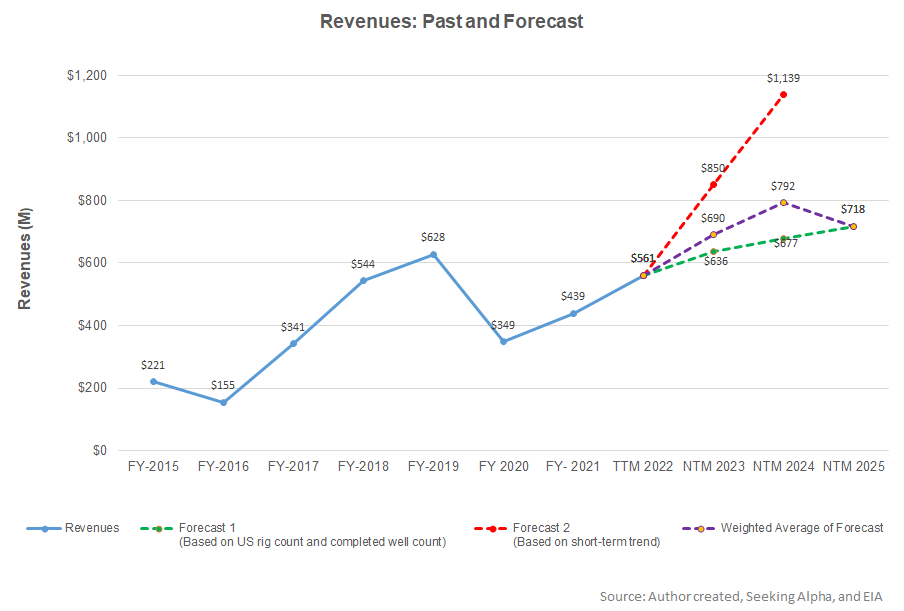

- The regression equation suggests a sharp revenue growth for Cactus in NTM 2023

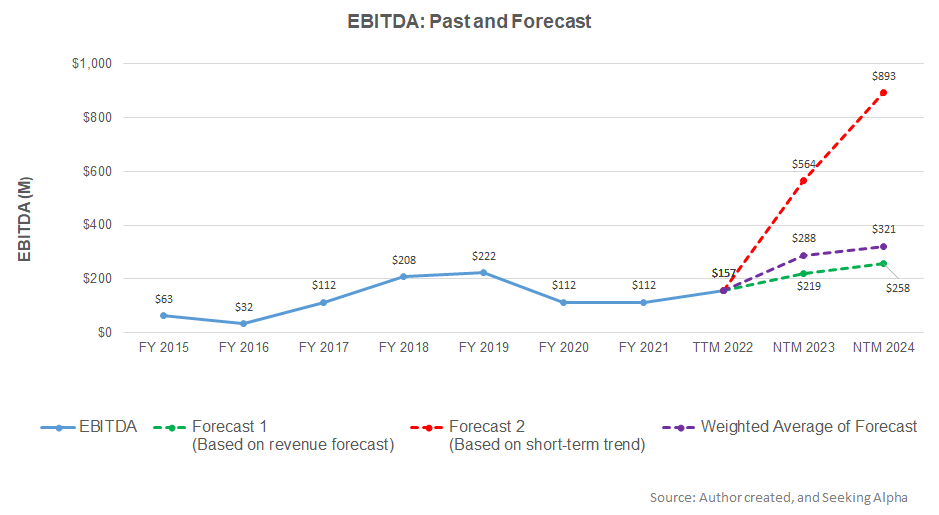

- EBITDA can increase sharply in NTM 2023 but decelerate in NTM 2024

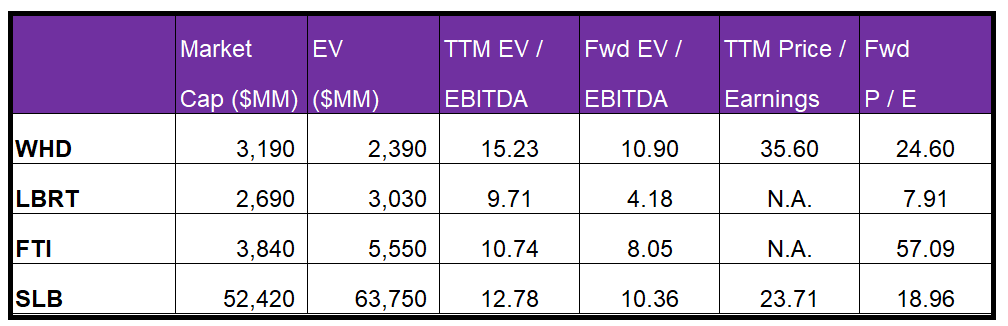

- On a relative basis, the stock is overvalued

Part 1 of this article discussed Cactus, Inc.’s (WHD) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the key industry indicators (US rig count and completed well count) and WHD’s reported revenues for the past seven years and the previous four quarters, I expect revenues to increase sharply in the next 12 months (or NTM 2023). The growth rate can decelerate in NTM 2024 and decline in NTM 2025.

Based on the regression model, I expect the company’s EBITDA to double in NTM 2023 nearly. The growth rate can decelerate significantly in NTM 2024.

Target Price And Relative Valuation

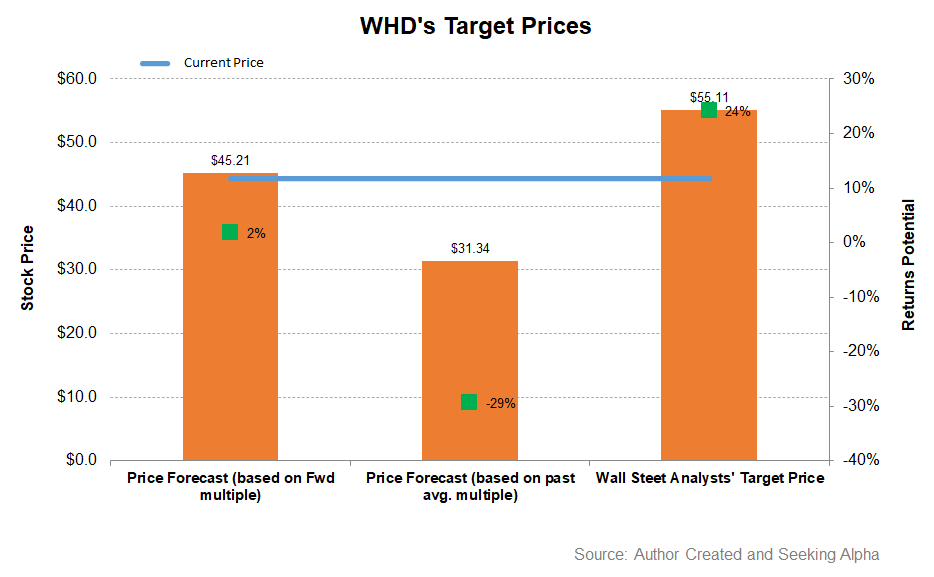

EV has been calculated using the forward multiple and the past average multiple. Returns potential (2% upside) using the forward EV/EBITDA multiple (10.9x) is higher than EV using the past average (29% negative returns). However, Wall Street’s sell-side analysts have much higher expectations (24% upside) from the stock.

WHD’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than its peers, which indicates a lower EBITDA than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (15.2x) is much higher than its peers’ (LBRT, FTI, and SLB) average (11.1x). So, the stock is overvalued compared to its peers at this level.

What’s The Take On WHD?

Higher product sales and measures to control inflationary costs improved WHD’s revenues and margin impressively in Q2 2022. In some international regions, raw material and component costs show improvement. In the near to medium term, the company’s target market is expected to expand as additions to the public and large private customers accelerate.

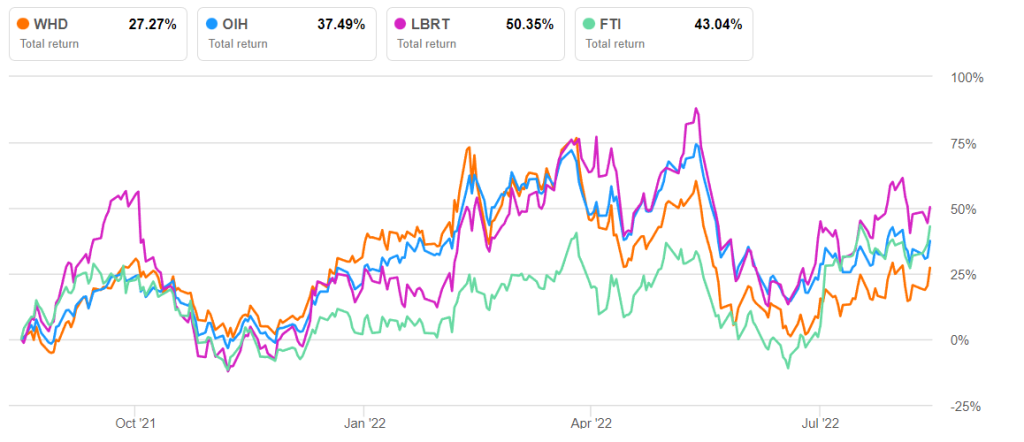

However, Low rental prices following the energy market depression in 2020 and stiff competition in a fragmented industry would mitigate the revenue growth. A higher capex can drag the FCF in 2022, which is already strained because of higher working capital requirements. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Given the stretch in relative valuation, the stock may not produce attractive returns in the short term. Investors should keep it on the radar because its medium-term drivers are sufficiently strong.