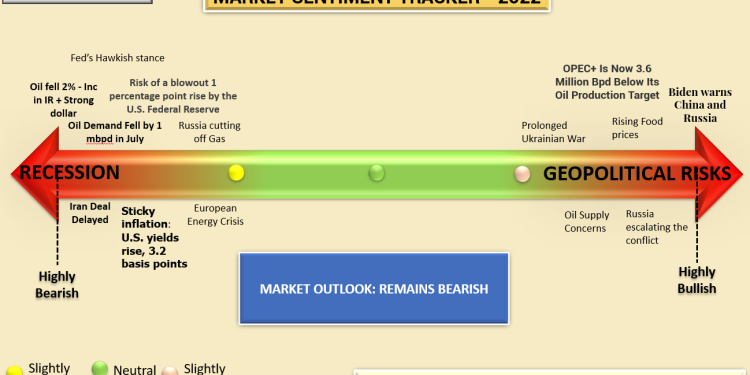

From the past two Monday Macro View episodes, I have been mentioning that how and why the outlook of the market remains bearish. In the first one, it was confused, still deciding on some factors. In the second week, the markets took a downturn and prices started to fall mainly because of – guess what – “recessionary fears” (which is a continuous part of my Market Sentiment Tracker 2022).

One of the most significant and bearish news was the hike in interest rate by the Fed.

Albeit expected, markets still reacted. After the interest rates were increased by another 75 basis points, stock markets reacted: the Dow plunged by 522 points while the Nasdaq and S&P 500 lost 1.79 percent and 1.71 percent respectively.

Oil prices also took a dive by losing almost 5 percent due to a rising dollar that has touched its 20 years high. Brent was down 4.8 percent while WTI fell 5.7 percent – both are 6 and 7 percent down for the week. A stronger dollar makes commodities like oil expensive for other countries to buy, reducing demand and therefore prices. Oil demand has finally started to take a hit as IEA recently estimated that it will fall by 100,000bpd in 2022. The Oil Market Report by IEA also mentions that supply has continued to increase for the third straight month (and this is despite OPEC+ not being able to meet their production quotas, falling 3.53 mbpd short). Supply is expected to increase by 50,000 bpd and 40,000 bpd. The slowdown in oil demand was attributed to covid lockdowns in China and stalling growth in developed countries as they fight inflationary pressures. One of the factors that might change this balance is an expected fall in Russian oil production which can be 1.9 mbpd lower in February 2023 versus last year.

These developments has cast a shadow of doubt on strong oil demand projections by OPEC and earlier IEA.

Finally, the housing market is also giving red flags. U.S. mortgage rates hit 6.7 percent, a level not seen since 2008, and more than double as compared to last year. Eddie Gomez on LinkedIn did a very insightful post on this where he highlighted that around 38 percent of homes in August in the U.S. were sold below their listed price while the pruchase of luxury homes have sunk 28 percent – “the most on record”.

All in all, the red flags are getting frequent and increasing in intensity. I believe that a recession or a great slowdown is due. Rumors of a coup in China – if turned out to be true – can cause a huge sell-off in the global markets.

Catch me tomorrow on Monday Macro View where we will discuss this in detail. Mark is back as well so look forward for a deluge of insights this Wednesday, Thursday and Friday.

Happy Sunday!