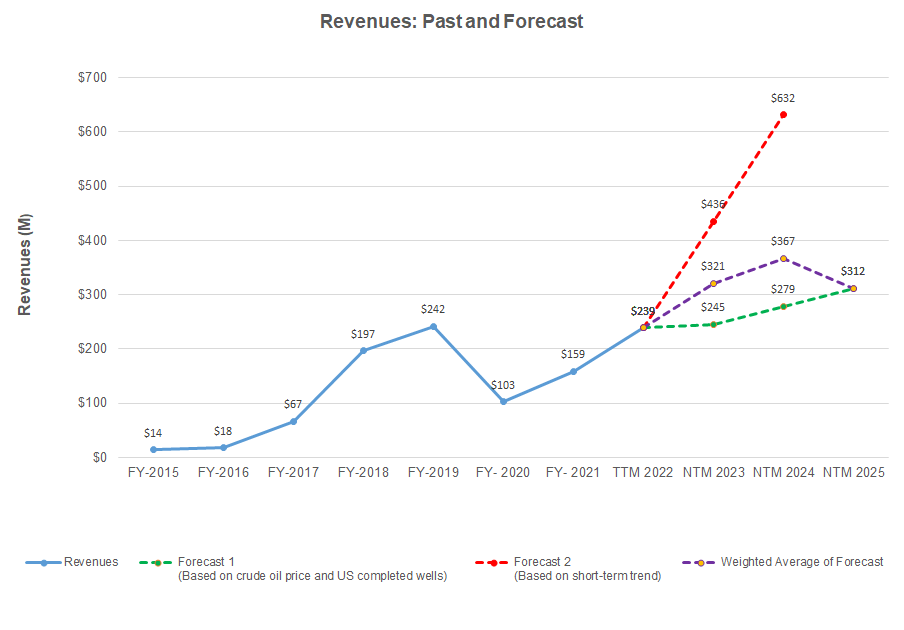

- Our regression estimate suggests strong revenue growth in NTM 2023 and NTM 2024

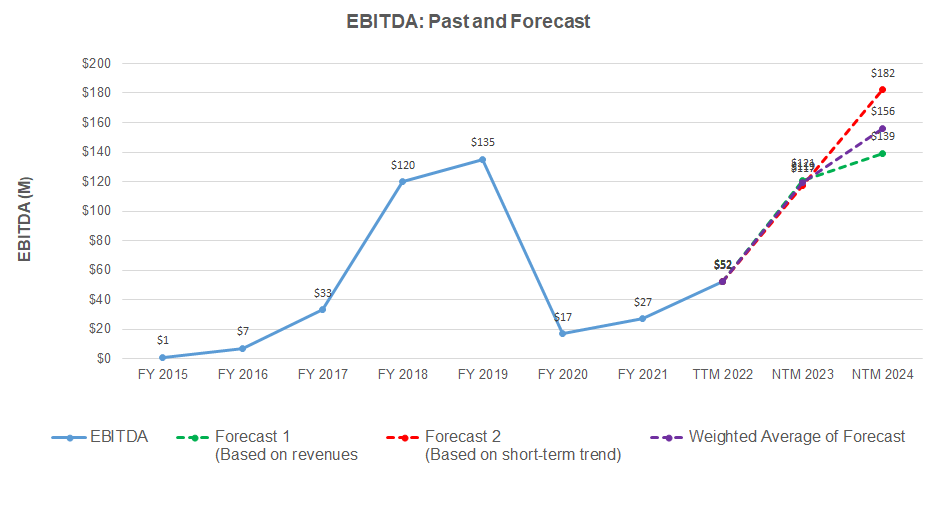

- According to the model, the EBITDA growth rate is high in NTM 2023, but growth may decelerate in NTM 2024

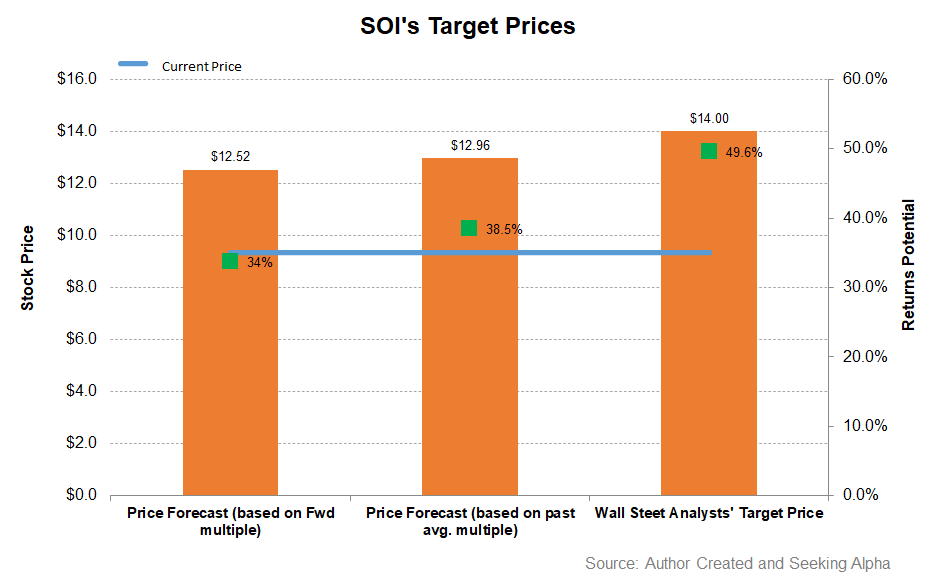

- The relative valuation suggests the stock is reasonably valued at this level

Part 1 of this article discussed Solaris Oilfield Infrastructure’s (SOI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between crude oil price, US completed well count, and SOI’s reported revenues for the past seven years and the previous four quarters, we expect revenues to increase by 35% in the next twelve months (or NTM) 2023 and further 14% in NTM 2024. However, the model suggests revenues can decline in NTM 2025.

Based on a simple regression model using the average forecast revenues, we expect the company’s EBITDA to more than double in NTM 2023. The model suggests the EBITDA growth rate can decelerate in NTM 2024.

Target Price And Relative Valuation

Returns potential using the past average multiple (11.3x) is higher (38% upside) than the forward multiple (4.8x) (34% upside). The sell-side analysts expect even higher returns (50% upside).

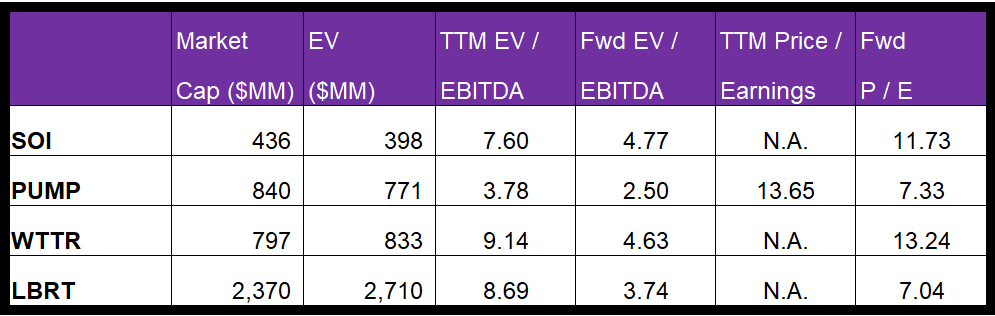

SOI’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than its peers, typically resulting in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (7.6x) is lower than its peers’ (PUMP, WTTR, and LBRT) average of 7.2x. So, the stock is reasonably valued at the current level.

What’s The Take On SOI?

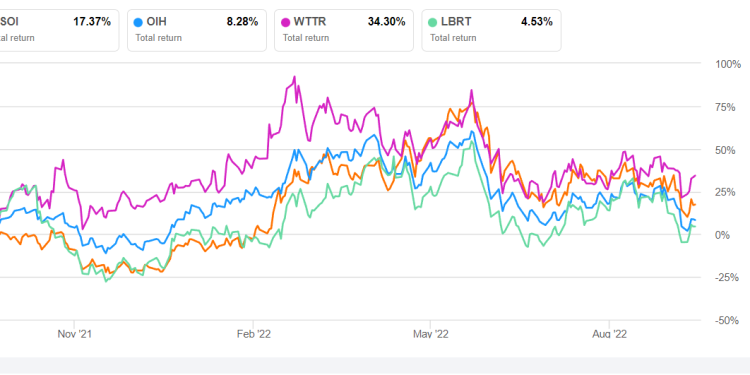

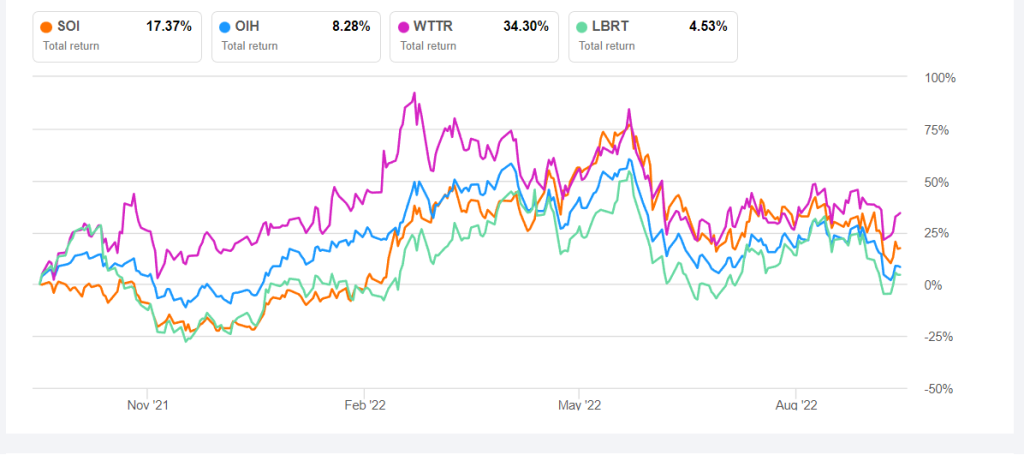

In Q3, Solaris’s number of fully utilized systems can increase by 10% to 15%, reflecting sustained demand for its services in the fracking market. The company’s technological innovations, including an integrated all-electric blender technology – AutoBlend, can see SOI capturing the market share faster than many of its peers in 2023, when more electric fracs will be introduced. Similarly, its top fill, last mile services, and fluid silos in under-penetrated markets can yield 2x-3x returns over investment. So, its stock price outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The average number of fleets in the top fill systems can grow significantly in Q3. So, improved system cost absorption leads to a higher margin. Investments in new products have increased capex, leading to negative free cash flows in 1H 2022. Nonetheless, a zero-debt balance sheet puts it at an advantage over its peers. In the medium-to-long term, investors might like to “buy” the stock in expectation of steady returns.