The U.S. remains on pace to grow production to about 12.3M-12.4M barrels a day as completion activity stays on track. We are seeing a bit more activity coming into Texas, Oklahoma, and Louisiana. The small dip in production this past week was driven by Hurricane Ian shutting in some platforms in the Gulf of Mexico. There was about 250k barrels that came offline but will be fully operational by the weekend given how the storm tracked. It will result in a drop in demand across PADD 1 (East Coast) as Ian’s destruction was vast across Florida and is dumping a ton of rain all the way up the coast. This will push down gasoline/diesel demand in the short term but will quickly bounce after only a week or two.

The U.S. remains in a strong position in the natural gas industry especially after Nord Stream 1 and 2. The methane will exhaust itself by the weekend (Monday the latest) and allow cameras to get to the ruptures along the line. This appears to be sabotage based on the simultaneous leaks across both lines at the same time, and they “just so happened” to rupture outside of the Exclusive Economic Zones (EEZ). If the attack happened within the EEZ and not in international waters, it could be construed as an attack on a NATO nation that would trigger Article 5 or “Collective Defense.”

We can play game theory on why different countries would want to destroy these assets, but based on who had the “most to gain” would fall to the Russian side of the equation. It’s good to consider the multiple sides of the Russian equation:

- Russia outlined a plan to annex multiple areas of Ukraine

- Putin called up 300k reservists with another 1.1M behind it on a rolling basis (based on leaked information).

- It removes legal action that can be taken against Gazprom for not running natural gas because they can now claim Force Majeure. Gazprom initially took down line 1 to repair compression and claimed the electronic boards were shot and needed to be replaced. The compression repair was supposed to be three days, but as they came back it was shut down “indefinitely.”

- As the “indefinite” expanded, it would put more pressure on the legal side as contracted volumes were displaced- but this action would fall under force majeure.

There was also a planned vote over the last week of September regarding the annexation of the four provinces in Ukraine. Russia had already claimed Dontesk and Lugansk as “annexed”, so the new vote would encompass Kherson and Zaporizhzhia. The regions “passed” the decree, and just yesterday Russia approved the referendum and “officially” annexed the additional regions.

This opens up some “new” problems because it is now “recognized” Russian territory, which would open up the nuclear option per Putin’s commentary. He has been firm in his statements that an attack or attempt to move on “Russian Land or Affiliated Territory” opens up the use of the nuclear option. The move to annex this region expands the scope of where they could “politically” use nuclear capabilities. This doesn’t mean he will, but it opens up his options to be supported by the local legislation. In short, things are going to get worse with tensions being ratcheted up aggressively. This all comes on the back of additional success of the Ukrainian military across key supply lines. “Russian military leadership has likely failed to set information conditions for the potential defeat of Russian forces in Lyman despite increasingly concerned discourse among Russian military leadership regarding its potential envelopment by Ukrainian forces.” Ukraine has been able to make significant gains across all Eastern Fronts with Russia retreating quickly in Lugansk outside of Kharkiv. Ukraine has also made big strategic strives in Kherson by cutting off vital lines for the Russian military while resistance grows internally (behind enemy lines) which is why the support of the referendum is laughable as a “real” take on views on the ground. The U.S. and others have committed more money to the Ukrainian military as support remains strong. The destruction of Nord Stream also helps protect Putin in case anyone wants to replace him- the bargaining chip has been removed. This will force the Russians to continue to fight- at least that is what their intelligence community believes.

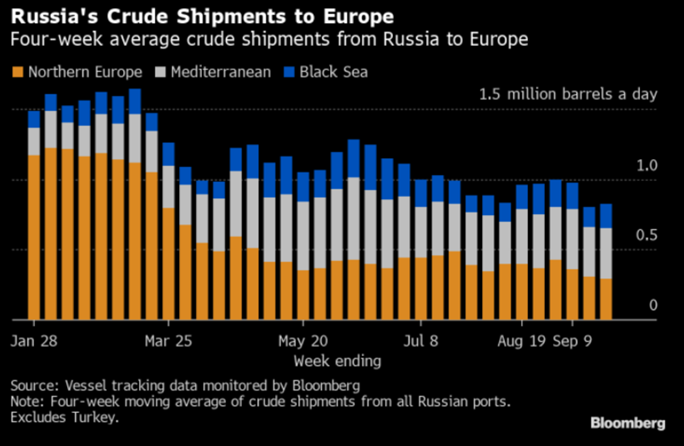

On a different note, the EU is struggling to pass the crude price cap, which is exactly what we expected. Even as the ability to pass it struggles, western Europe continues to reduce their purchases. “Observed flows of Urals crude from Russia’s three main western ports to Europe dropped to the lowest since the nation’s invasion of Ukraine. Poland expects that talks on oil supplies for the Schwedt refinery in eastern Germany will be completed this year”

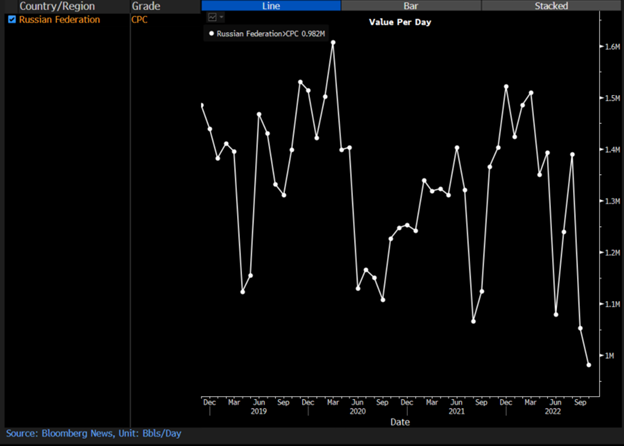

URALS TANKER TRACKER:

- A total of 2.26m tons of September-loading Urals were headed to Europe, down from 3.56m tons in August, according to ship-tracking data compiled by Bloomberg

- That represented about 28% of total Urals exports this month, compared with 38%-42% for April-August, 51% in March and 85% in February

- Asia will receive at least 3.2m tons of September-loading Urals, below the 3.6m tons seen in August

- Turkey will receive 1.42m tons of Urals for September loading, little changed from 1.4m tons in August

- In total, 8.12m tons, or 1.98m b/d, of Urals were loaded from the three ports in September, compared with 8.66m tons, or 2.05m b/d, in August

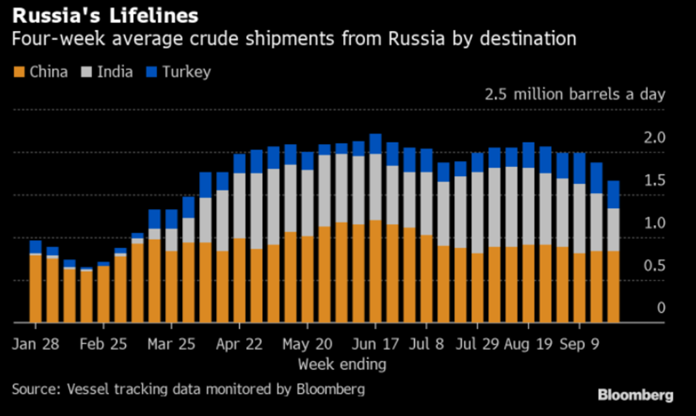

Total flows have slowed with India not buying as much as before, which is driven more by timing vs lack of interest. The miles per ton from Russian ports to India is extensive so India needs time to absorb the capacity. They also want to avoid expensive shipping, so it makes sense to see a bit of a slowdown in purchases in the near term. We expect to see these three countries (especially India and China) to buy between 1.5-1.8M barrels a day over the next few months.

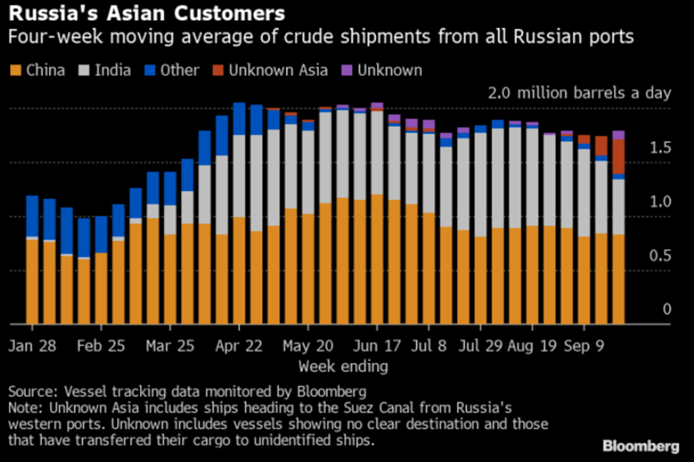

Because of the timing delay, we are seeing Russia “preemptively” send some cargoes into Asia under the “unknown” banner. This would help move some stranded cargoes in their region, clear up some onshore storage, and speed sales to customers in the region.

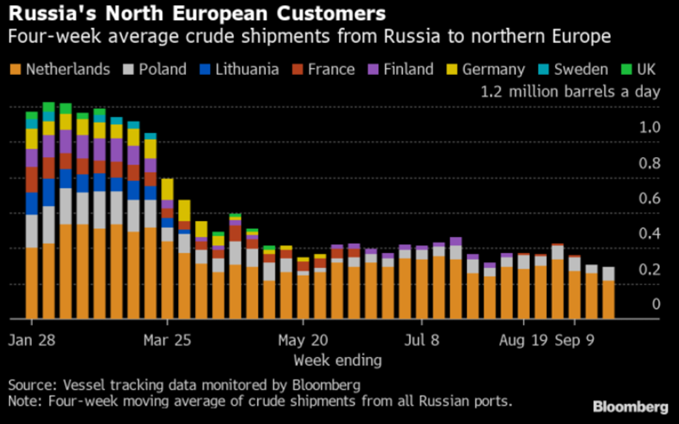

“Russia’s seaborne crude exports to Europe are being compressed, with the bloc’s sanctions only about two months away. Shipments in recent weeks have been little more than half pre-invasion levels and will come under increasing pressure as the import ban nears. Customers in northern Europe in particular have slashed their imports, which are now running below 300,000 barrels a day. That’s about a quarter of the volume that was traded into the region before Moscow sent its forces to Ukraine in late February, crimping the Kremlin’s revenues.”

The below puts into perspective the drop off into Northern Europe and why we will see some additional drop off.

The Netherlands and Poland remain the biggest buyers, but as CPC comes back online we will see Netherland purchases declining.

Kazakhstan’s Kashagan field will need at least three weeks to fully restore oil production, which will happen in conjunction with all CPC moorings being back in operational capacity by Oct. 15. This will help bump flows back up by about 400k barrels a day. So, between Libya back to 1.1M barrels a day of exports and Kazakhstan putting 400k barrels into the market- it will help offset some of the shortages created by Russian sanctions.

Even with the recovery of CPC and Libya, there is still enough demand in Europe to keep U.S. crude exports at about 3.7M barrels a day.

On a global basis, October loadings are still struggling to clear. Nigeria is the one with the biggest struggle as Angola has been able to move most of their cargoes. “Almost all of Angola’s crude cargoes for loading next month have found buyers, but about a third of Nigeria’s output for October is still looking for purchasers. Sonangol cut its offer prices for November-loading Dalia and Girassol.” Based on the Bloomberg data, even though Sonangol was able to clear November has slowed down and has resulted in prices cuts.

WAF OCTOBER SALES:

- Just one cargo of Angolan crude for October loading has yet to be bought out of 31 scheduled shipments, traders said

- That compares with 3-4 cargoes that were still lingering as of Sept. 23

- Republic of the Congo’s Djeno crude has only one outstanding shipment to be placed out of six scheduled

- That’s unchanged from a week ago

- About 10 consignments of Nigerian crude are still looking for a home from about 32 planned October cargoes

- Nigeria’s sales remain in the doldrums with ongoing reliability issues weighing on the sector, traders said

- Europe is seeing steady inflows of rival US and Libyan supplies, and a significant amount of French refining capacity is offline due to strike action, further eroding demand for the West African producer’s cargoes, the people said

- Differentials would be even weaker if it were not for the relative lack of Nigerian barrels stemming from the country’s recent output woes: traders

SONANGOL SPOT OFFER:

- 950k bbl of Dalia crude for Nov. 24-25 loading offered at Dated Brent +50c/bbl

- Compared with offer at +$1.20 on Sept. 21

- NOTE: BP offered a separate Dalia cargo for Nov. 16-17 loading at +50c/bbl on the spot market earlier this week

- Sonangol also offered 1m bbl of Girassol for Nov. 11-12 at Dated +$4.50

- Compared with +$6.50 on Sept. 21

It isn’t surprising to see the slowdown as the Middle East also struggles to clear their barrels. Floating storage remains well above average in the region, which will likely result in a cut to Official Selling Prices. There are rumors that OPEC will cut production by another 500k barrels a day. We expect to see some cuts but think it will be closer to 250k-300k barrels a day. To be clear, OPEC is CURRENTLY producing well below their target so an official cut would still not adjust the current production profile. West Africa is still well below their target as is other countries within OPEC. We are seeing some countries increasing loading schedule across Angola and the North Sea. Even with the increase in Angola flows, it is still well below a reduced OPEC target that could be decided next week.

The increase in North Sea has been driven by the following:

- Johan Sverdrup loadings will jump to 587k b/d in November; daily volume will be the highest since the field started production in late 2019

- November program consists of 13 cargoes of 600k bbl each, four of 700k bbl, one of 1m bbl, and three of 2m bbl

- Compares with 529k b/d for October

- November program consists of 13 cargoes of 600k bbl each, four of 700k bbl, one of 1m bbl, and three of 2m bbl

While the increase happened for Johan, we had a slug of deferrals out of October that will also support flows in November. Troll, Gullfaks, Aasgard, Statfjord cargoes for October deferred.

Flows for September heading to Asia remained supported by India for West Africa as China still remains a weak buyer.

SEPTEMBER WAF-ASIA EXPORTS:

- 48 cargoes of crude are due to load for Asia in September, equating to 1.48m b/d, according to Bloomberg estimates compiled from a survey of traders, loading programs and vessel-tracking data

- Dips from revised 1.53m b/d for August, comprising 51 shipments

- Refiners in China and India are the biggest buyers; other destinations include Indonesia

FLOWS TO CHINA:

- Shipments to China to decline to 735k b/d in September from revised 916k b/d in August

- 24 cargoes for China in September, down from revised 31 in August

- Buyers include Unipec, Sinochem, Cnooc and ChemChina

ANGOLA EXPORTS:

- Asia’s share of Angola’s exports to decrease to 62% in September from 73% in August; 12-month average rate is 75%

- Europe continued to pull elevated volumes of Angolan crude as the continent’s refiners seek alternatives to Urals before a ban on Russian imports takes effect on Dec. 5

- Other September destinations for Angola outside Asia include Brazil, Portugal’s Gap, France’s TotalEnergies, Italy’s Saras, Spain’s Cepsa and ExxonMobil in the Netherlands: survey

- Europe continued to pull elevated volumes of Angolan crude as the continent’s refiners seek alternatives to Urals before a ban on Russian imports takes effect on Dec. 5

EXPORTS TO INDIA, OTHERS:

- Shipments to India to soar to 509k b/d, highest since January, versus 220k b/d previously

- Indian Oil Corp. was the main buyer

- IOC purchased more Angolan crude in September than its typical monthly rate, including shipments of Hungo, Kissanje, Nemba and Plutonio, data from trader survey, vessel-tracking shows

- The refiner also bought Republic of the Congo’s Djeno variety and light Nigerian grades such as Agbami, Akpo

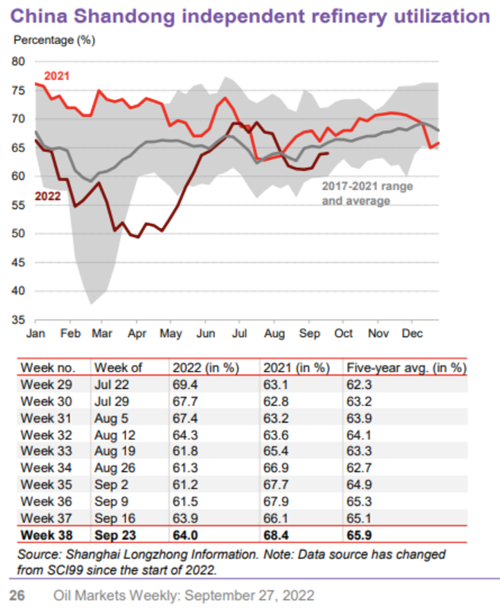

We don’t see China being a big buyer at the moment because they are still trying to clear out their glut in refined product storage. They should be able to balance the system fairly quickly given the sizeable increase in the export quota to about 1M barrels a day. This will help push more distillate and gasoline into the market, but drive down crack spreads in Asia (especially Singapore). We expect to see some economic run cuts to be rolled out in the region, which will put some additional pressure on refinery throughput and underlying crude demand. We will see Chinese teapot refiners bounce to about 68% utilization rates, but the bigger target has been to push the SOEs (state owned enterprises) and large privates from an operating rate of 75% back to about 85%.

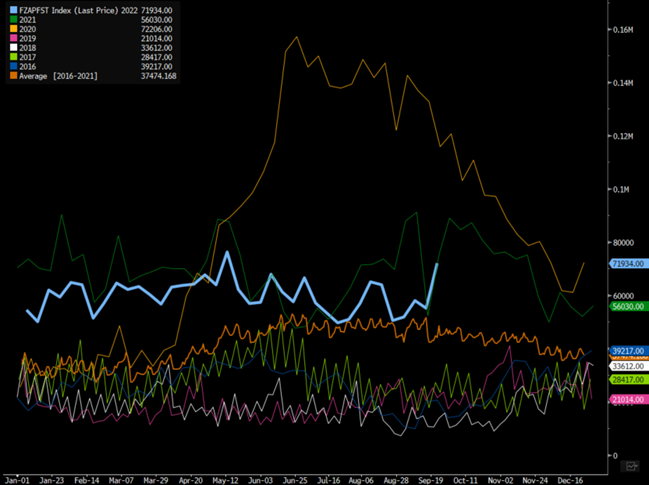

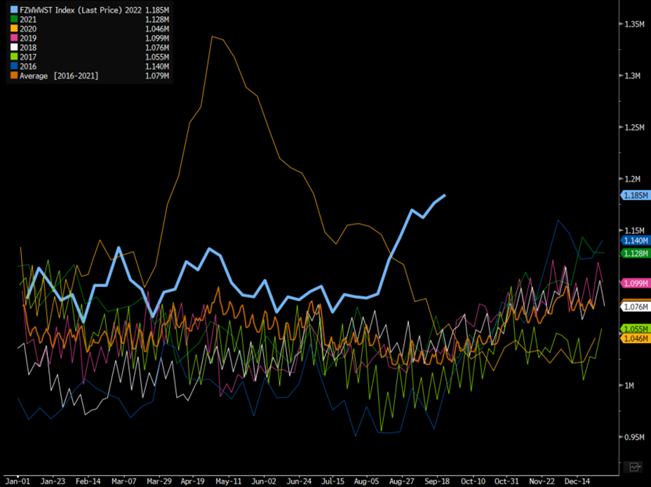

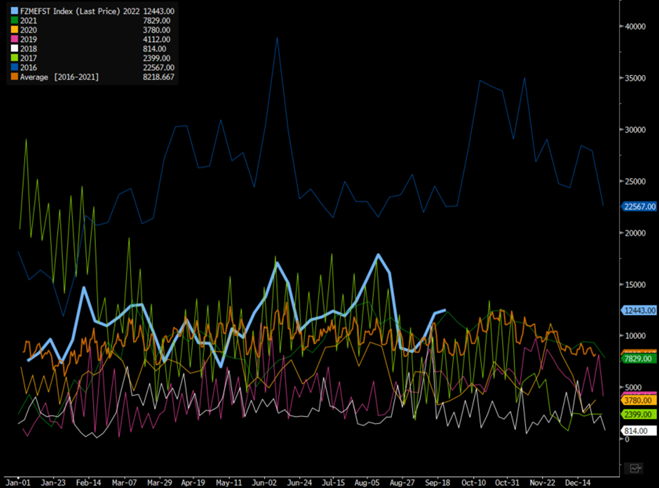

There is still a significant amount of floating storage in the market- with a lot of it driven by Asia. We expect Asian floating storage (chart below) to track closely with 2021 given the purchases that have been made by China. The cargoes are starting to show up, which is driving the need to push more product into the market.

Total crude on the water remains at a record- driven by the rise in floating storage while crude in transit sits at a record level.

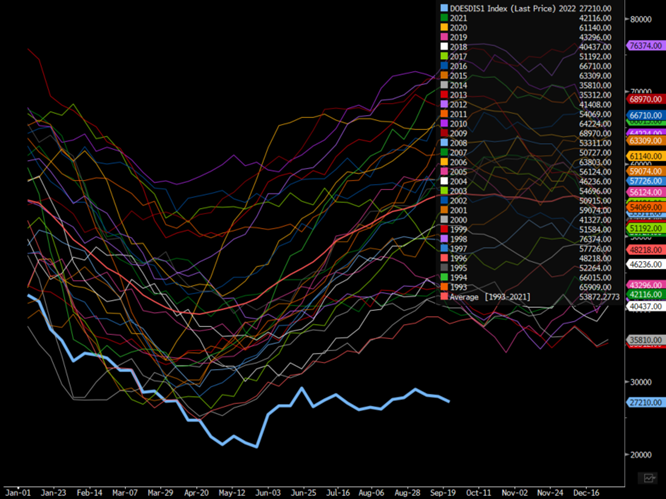

The pivots in crude products remain robust with distillate around the world remaining at near record lows while gasoline at record highs. Even with the storage situation, the disty crack has to carry the gasoline crack and with more Chinese product entering the market it will push down prices. They will still be elevated, but it will pivot the supply chains as Asian disty pushes into the Middle East, which will end up in the Atlantic Basin. As the U.S. increases exports of disty into Europe from PADD 3 (Gulf of Mexico), it will enable PADD 1 (East Coast) to import more and help bring in more desperately needed supply. Chart below on PADD 1 Disty.

The Middle East storage is the important one to watch as we head into OPEC decision and OSPs. The levels are tracking above 2021, and we see more builds coming over the next few weeks.

I want to provide a deep dive into the rates market and all the pieces that go into the current volatility. I will put something together and send it out separate from this set of insights. Have a great weekend!