- A tight balance between demand and supply can outweigh the typical seasonality effects in Q4.

- After adding six more frac fleets, Liberty’s frac fleet will remain unchanged in the near term.

- It announced the reinstatement of a quarterly cash dividend of $0.05 per share.

- In Q3, it announced a $250 million share repurchase program, which can boost its share price.

The Industry And Frac Fleet Reactivation

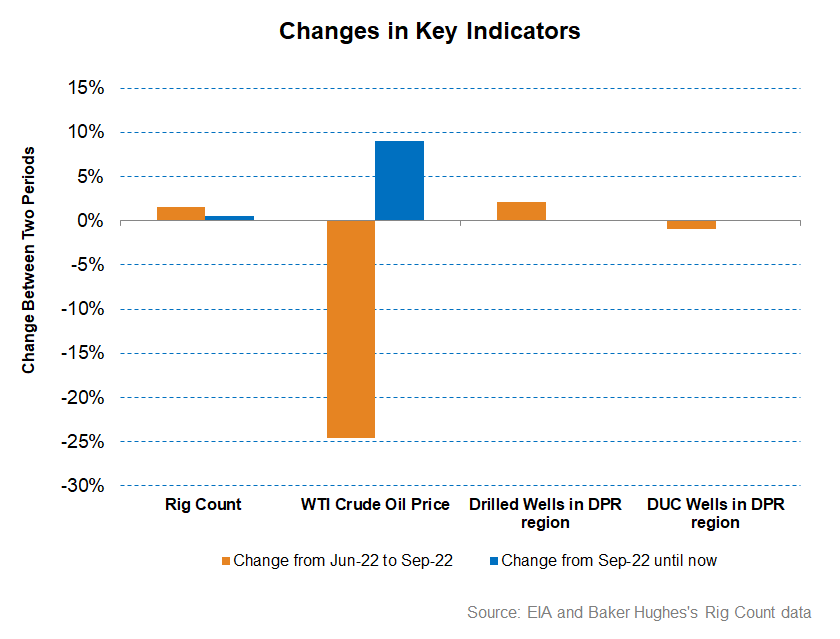

The crude oil price weakened in Q3 following concerns over the economic recession in the US and a global slowdown. Although it increased in Q4 until now, the price appears volatile. The US rig counts and drilled well have remained nearly unchanged since June. As discussed in my article on Baker Hughes (BKR), the long-term energy upcycle will benefit other international regions more than North America following years of underinvestment. The COVID lockdowns in China may persist longer than expected, thus crippling the supply chain. Energy supply, too, will remain tight following OPEC’s decision to curtail production. Additional sanctions on Russian seaborne crude can suck out supply even more. The global strategic petroleum reserves have decreased considerably over the past few years. So, energy prices will likely remain elevated near to medium term.

The fracking industry has persisted with disciplined capex with near full utilization of available capacity. Most frackers are building next-generation frac fleet capacity to offset legacy equipment before retiring. LBRT has recently deployed six reactivated frac fleets acquired through the OneStim acquisition from Schlumberger. This will take its frac count to the early 40s. It has exhausted its legacy equipment inventory and is not constructing any digiFrac electric fleets. It does not plan to add any more fleets in 2023 because the manpower or crews required to run them are challenging in the current environment. As we discussed in our previous article, it would not reactivate fracks at the spot price and will seek long-term relations with the customers.

Investment And Technology

The acquisition of SLB’s OneStim is a part of a long-term strategic decision for Liberty because of its high quality and dedicated customer base. LBRT, through its technology, scale, and vertical integration, has maintained a long-term relationship with its customers. It has also invested in developing new technologies. Typically, operators remain devoted to development programs even during a price pull-off.

The company’s recently introduced Sentinel logistics automation software would improve its logistics operations. Its recent investment in Natron Energy would enhance its digiFrac fleets’ capability through blue sodium-ion battery technology. The system would maximize the fleets’ uptime, optimize generator utilization, and lower emissions footprint. It is also partnering with Fervo to help advance geothermal resource development.

Q4 Outlook And Forecast

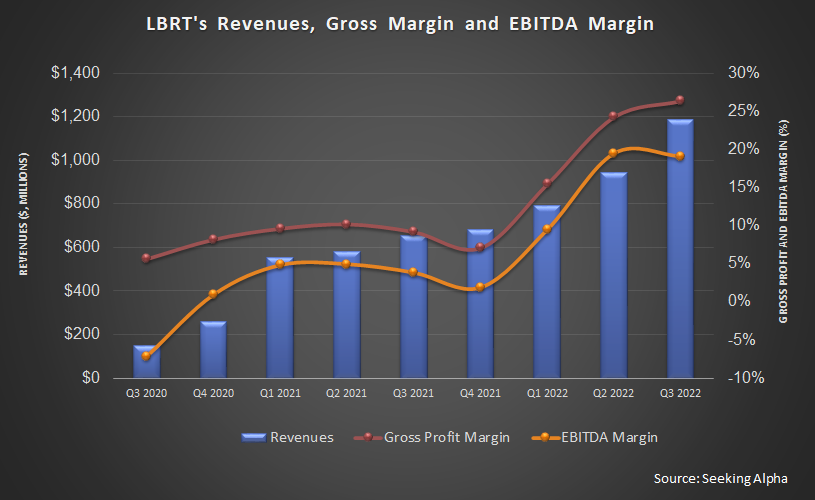

In Q4, LBRT’s management expects a flat sequential revenue growth (its quarter-over-quarter revenue growth was 27% in Q3). Contributions from crews deployed in Q3 can offset the typical adverse seasonality of Q4. Operating margin, too, can remain flat (EBITDA margin was 19% in Q3). The ongoing inflation in commodities, raw materials, and labor costs related to the supply chain problem can weigh on the margin in Q4.

However, the North American energy environment looks bright over the medium term because of a tight balance between demand and supply. Liberty’s management believes it is early in the cycle, and its investment would yield high returns over time.

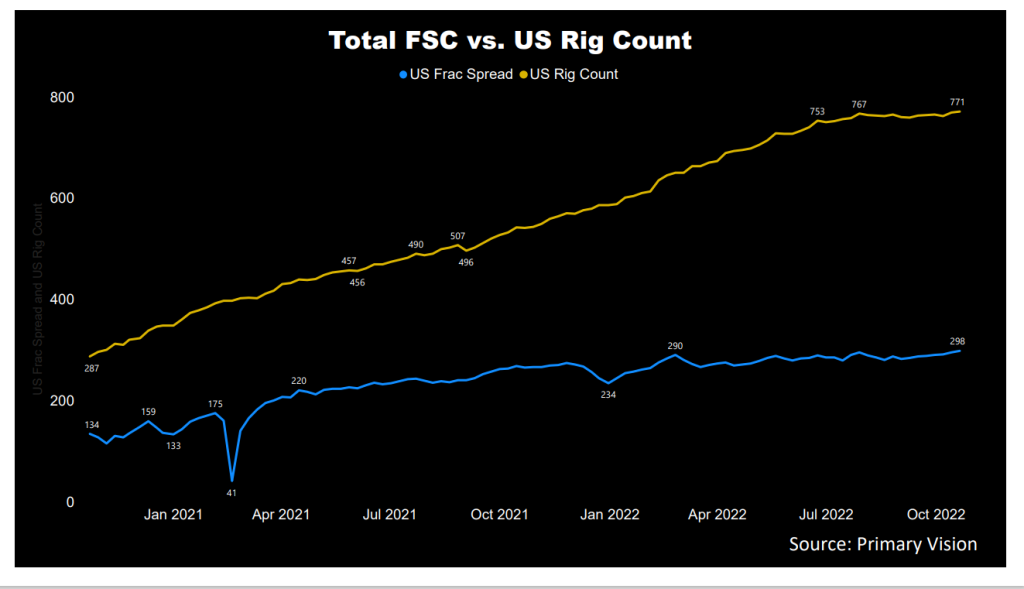

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 298 by the third week of October and has increased by 27% since the end of 2021. Over the past month, we saw ten frac fleet additions in the US. A rising frac count is positive for LBRT’s growth.

What Were LBRT’S Q3 Drivers?

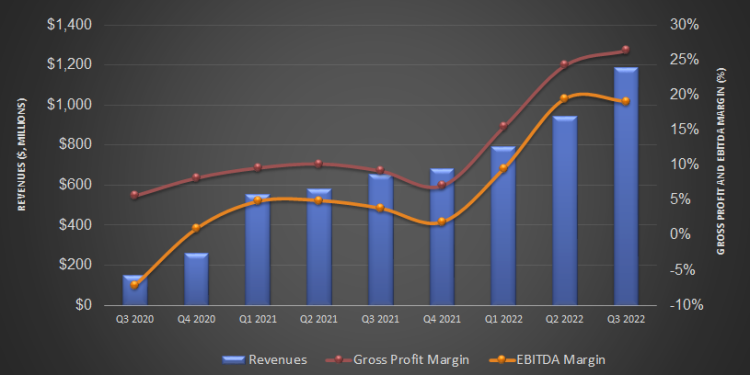

From Q2 to Q3, LBRT’s revenues increased by 26%, driven primarily by the reactivation of six additional fleets (acquired fleets from the OneStim transaction). The EBITDA growth was less pronounced in Q3 (23% up). Net earnings improved to $0.78 per share from $0.55 per share a quarter ago. The bottom line recovery is impressive because it recorded one-time charges ($29 million). In Q2, the company recorded a valuation allowance on a portion of deferred tax assets. However, a better result in the recent quarter allowed it to remeasure the TRA expense lines and resulted in the charges.

Cash Flows And Debt

LBRT’s cash flow from operations (or CFO) increased sharply (by 265%) in 9M 2022 compared to a year earlier, led by higher revenues. Capex, too, increased sharply (166% up), leading to negative but improved free cash flow (or FCF) in 9M 2022.

In FY2022, its plans to increase capex significantly remain nearly unchanged, except some of its Q4 capex may slip into Q1 2023. Significant supply chain delays can cause this. However, it can scale down its capex target based on economic conditions, customer demand, and returns expectations. The company’s debt-to-equity (0.18x) is lower than many of its peers in the fracking services industry.

In Q3, it announced a $250 million share repurchase program and repurchased $70 million during the quarter at an average of $14.9. Its current price is higher, however. In May, it announced a quarterly dividend of $0.05 per share after a gap of two years. This indicates the management’s confidence in its profit generation capability.

Learn about LBRT’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.