I was busy in a family event this weekend so couldn’t do my write-up. However, here is a short piece on changing oil dynamics which are getting interesting everyday. Mark Rossano did a very interesting segment on this in the recent EIA show and I would highly recommend that you watch it. Here is the link:

As the date when European ban on Russian oil imports go into effect i.e. 5th December, many expect a supply shortage. This ties neatly with recent production cuts by OPEC+ that bifurcated the oil market analysts where one group believe that these cuts were in alignment with the global oil demand which is expected to fall as a recession looms while the other maintains that as China eases Covid-19 lockdowns and inflation peaks, we will see a rebound and supply will not be enough to meet the demand. I am in the former group.

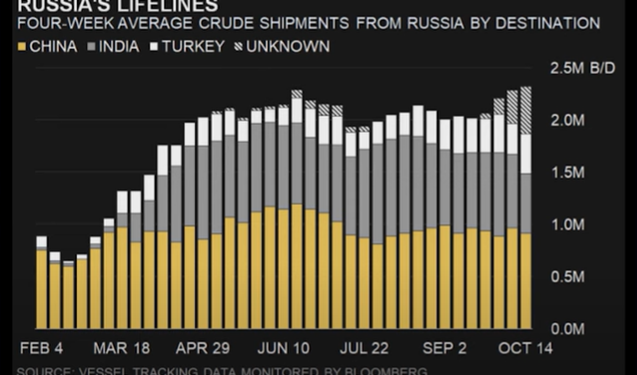

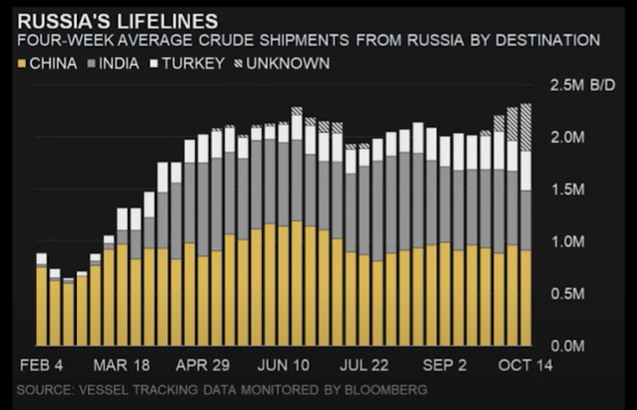

India, one of the largest buyer of Russian crude, has changed its stance as the aforesaid date comes near. Two largest buyers in India aren’t going to buy more Russian crude ahead of the deadline of 5th. But there is also another aspect where India has already bought a lot of it – as the graph below shows. In that case the question arises that if there is any more capacity to buy more? Floating storage in the area has gone up (as Mark says in his show), so have shipping rates. Apart from this, there has been a change in oil flows from Russia as well. Fows to China, India and Turkey have peaked at 2.2mbpd. Russia is trying to move more of its products to Asia as there will be more demand there.

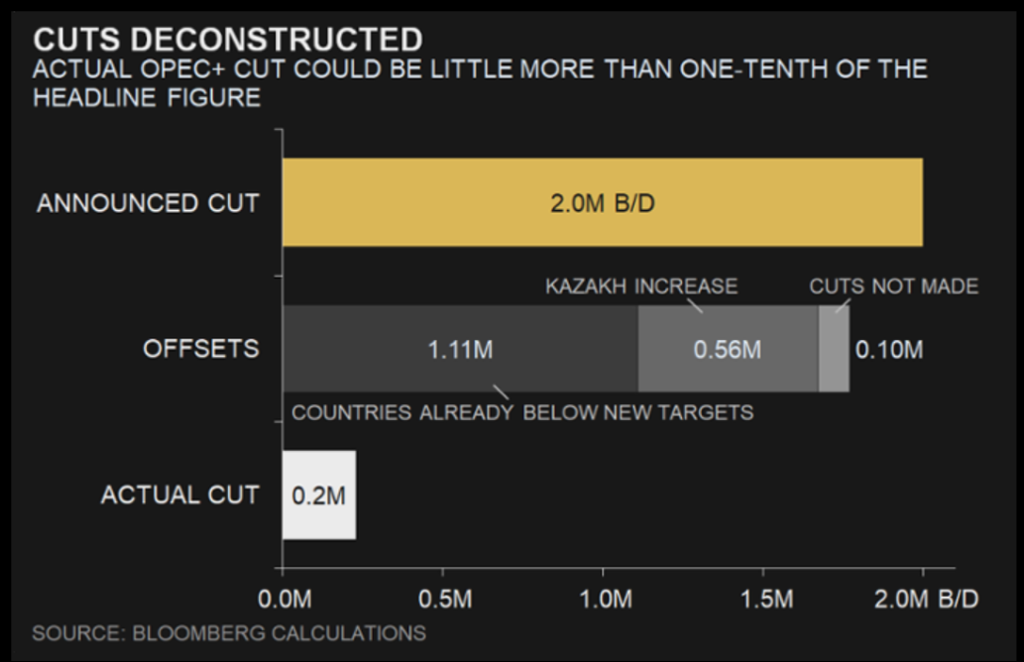

Another interesting dynamic is the OPEC+ cuts that I just mentioned. The chart below is very interesting and I’d like the reader to just have a look at it before proceeding to read. First of all, I agree with Mark in regards to the expectation that whether this target (of 2 mbpd) is going to be met or not. It isn’t. Iraq’s production has been more than their quota and so is that of the UAE. This amounts to roughly 800,000bpd of production cuts. If you include the Kazakistan’s increase (560K bpd) and the 0.10 mbpd of cuts that aren’t made, the actual production cuts amount to 200,000 bpd. This also includes factoring in rise in output from Libya. Another interesting point is that Iran isn’t part of the cuts and it remains to be seen if they increase or decrease their production. Oil workers strike is key in this regard.

Jumping back to the larger picture, the recessionary fears are still loud and getting solid. IMF says Germany and Italy will enter recession in 2023 while the former also faces another challenge of making through the winter without Russian gas. Industry in Europe is suffereing, especially dairy and bakery due to their energy intensive processes. For example, butter prices has surged 80 percent in in Europe per the European Commission data while milk powder registered an increase of 50 percent.

More on this in today’s Monday Macro View.

See you all next weekend!