The global sentiment continues to be roiled by recessionary fears, uncertainty and volatility. As such the markets swon one direction or the other depending upon the headlines coming in that day. That is the equation at least until the end of 2023. In this article I am going to talk about three things: recession, the underlying risks and oil supply.

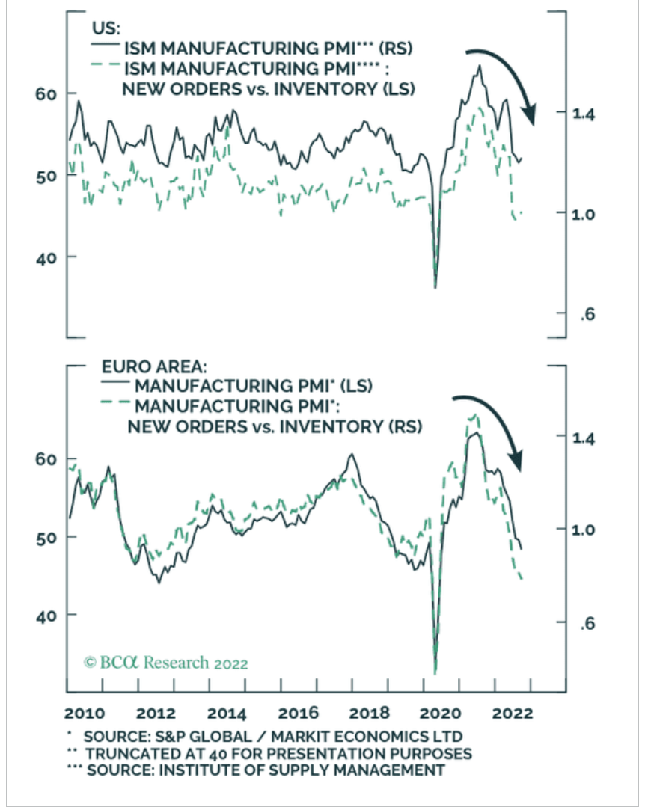

The global economic indicators continue to show red flags. As the chart below shows, the global growth indicators continue to plunge. One thing that is interesting is when people are highlighting how things are getting better. Now that is relative. Things might look better when you compare them to its recent peak! However, when you take average or compare it with a year ago, many indexes are still at highly elevated levels. Gasoline prices have decreased from its peak but are still 60 percent higher to the time when Biden took over the presidency.

The same is true for the U.S.

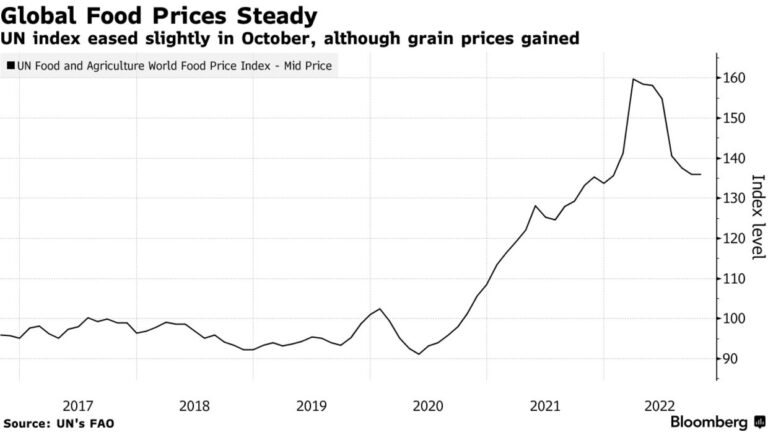

Food prices are down and stable which is somewhat of a good news. But as the chart below shows, they are quite elevated when you compare them to 2020.

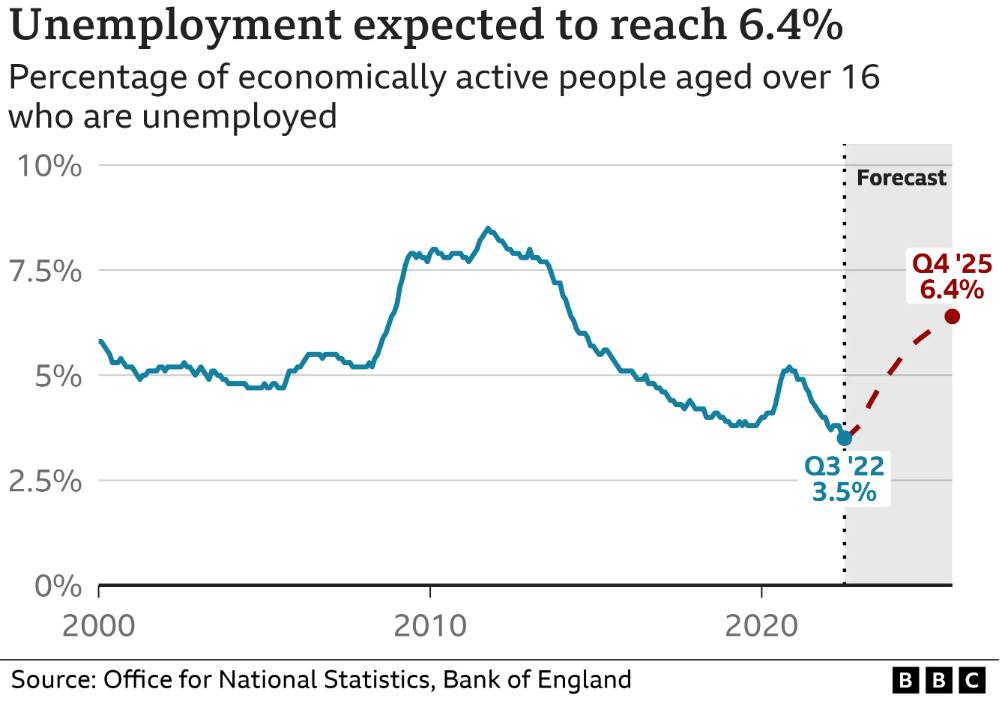

UK is expected to be in one of the “longest recession ever”. BoE has raised interest rates to levels not seen in the last 33 years. The interest rates in the UK now stands at 3 percent – a jumpy from 2.25 percent. The unemployment is expected to reach 6.4 percent. Similar concerns are being voiced in the U.S. where unemployment recently touched 3.7 percent. There is no way inflation can be tamed without inducing one of the worst recessions ever.

One of the people who successfully predicted global recession, recently wrote in The Guardian about the “megathreats” in the world right now. Per the article, and it is correct, private and public debt levels have reached record high levels (most of it was accumulated during a very low interest rate regime across the world). This is creating issues especially for the developing countries where costs of debt servicing has reached decades high. I continue to provide evidence in these weekly research articles that a recession is afoot so that our readers can benefit from it and be careful in their business decisions. It is a wise idea that we all keep some savings in our accounts for the rainy days – the clouds are already on the horizon.

Coming to the oil supply side, the debate is still on. However, if you consider the above mentioned developments it is not difficult to see that oil demand will remain stable. As per Vortexa, there has been an increased production in Atlantic Basin. U. S., Guyana, Brazil, Algeria and Libya has exported 7.6mbod of crude in October up from 7.1mbpd in September. Comp to covid lows in June’20, 3 mbpd have been added. U.S. production has already touched pre pandemic levels and the recent windfall profits might hint for another bout of increased production.

These were some of the points of ponder for this week. Mark Rossano did a brilliant job in the ECON show this week. Specially this episode on Fed was really interesting

Do check out our other shows as well.

See you all tomorrow at Monday Macro View!