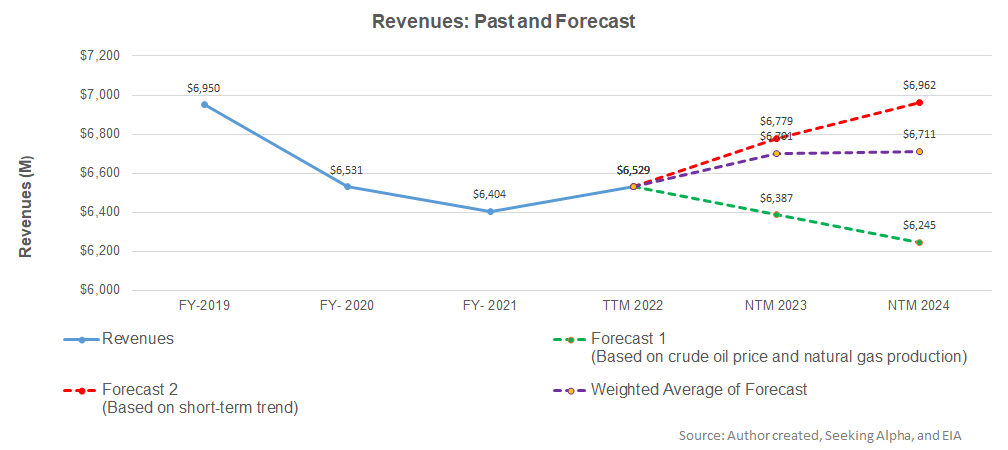

- Our linear model suggests revenue stagnation in the next two years.

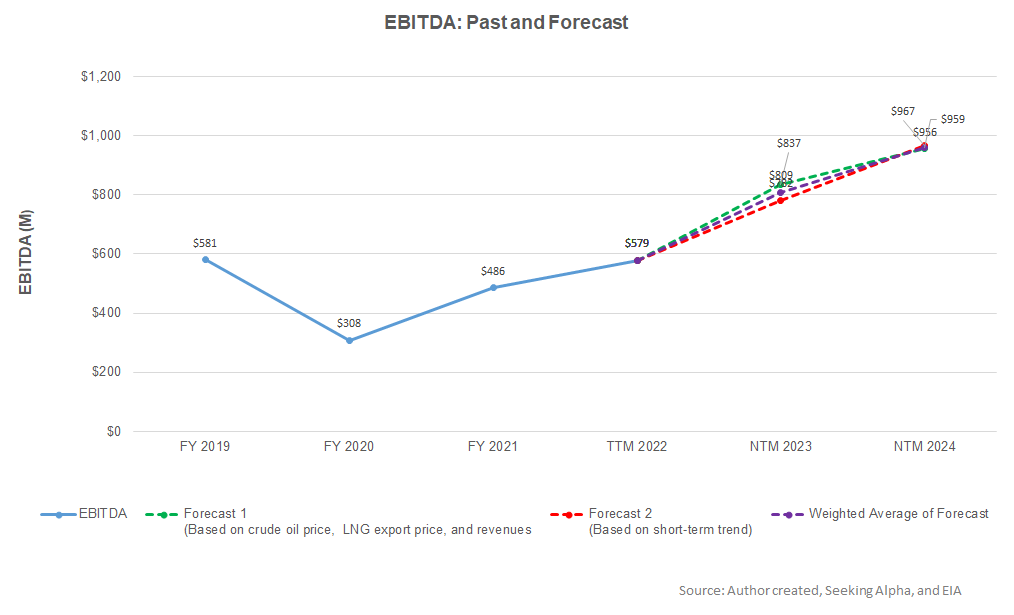

- FTI’s EBITDA can rise sharply in NTM 2023 and decelerate in NTM 2024.

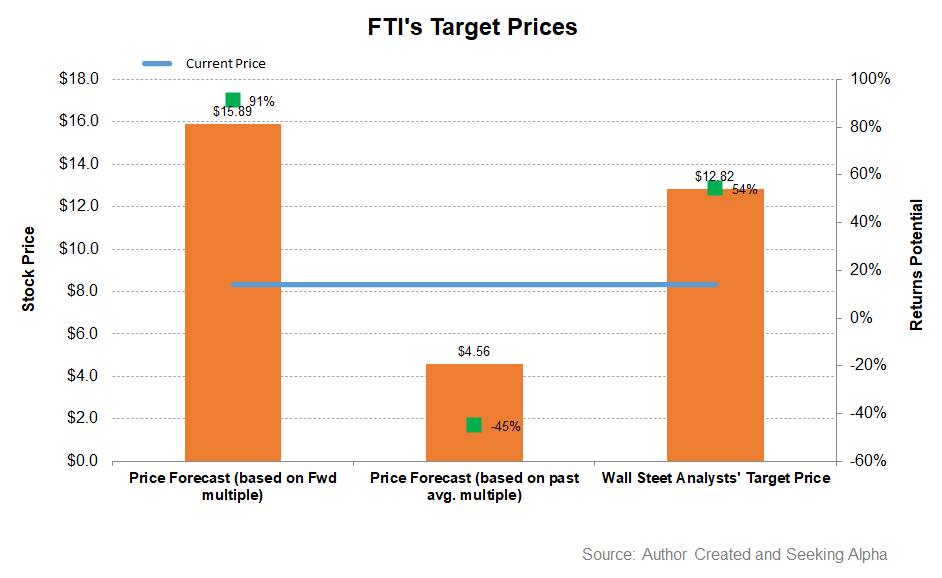

- The stock is relatively undervalued at the current level.

Part 1 of this article discussed TechnipFMC’s (FTI) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and natural gas production) and FTI’s reported revenues for the past seven years and the previous four quarters, its revenue is expected to increase marginally in the next 12 months (or NTM) in 2023. The growth rate may plateau in NTM, while revenues can fall in NTM 2025.

FTI’s forward EV-to-EBITDA multiple contraction versus the adjusted EV/EBITDA is steeper than its peers because its EBITDA is expected to rise more sharply than its peers in the next year. This should typically result in a higher EV/EBITDA multiple than peers. However, the company’s EV/EBITDA multiple (12.1x) is lower than its peers’ (SLB, BKR, and HAL) average of 13x. So, the stock is relatively undervalued at this level compared to its peers.

Analyst Target Price And Rating

Returns potential using the past average EV/EBITDA multiple (5.6x) is sharply lower (45% downside) compared to the returns potential using the forward EV/EBITDA multiple (91% upside) and the sell-side analysts’ expected returns (54% upside) from the stock.

According to data provided by Seeking Alpha, 20 analysts rated FTI a “buy” in the past 90 days (including “Strong Buy”), while four recommended a “hold.” None of the sell-side analysts rated it a “sell.” The consensus target price is $12.8, which yields ~8% returns at the current price.

What’s The Take On FTI?

FTI’s subsea inbound order backlog book is approaching $7 billion. Over the next five quarters (i.e., by Q1 2024), it will inflate to $9 billion. Recently, it received projects for umbilicals and flexible pipe installation in Total Energy’s offshore Brazil project and another for Shell. Pending FID, it has also received an award for ExxonMobil Gas in Guyana. Although the topline may remain flat, the company’s EBITDA may gallop over the next two years. A higher operating profit margin can also help improve the free cash flow generation.

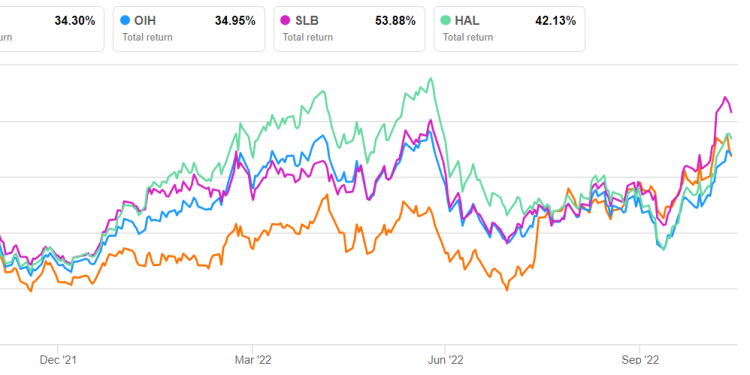

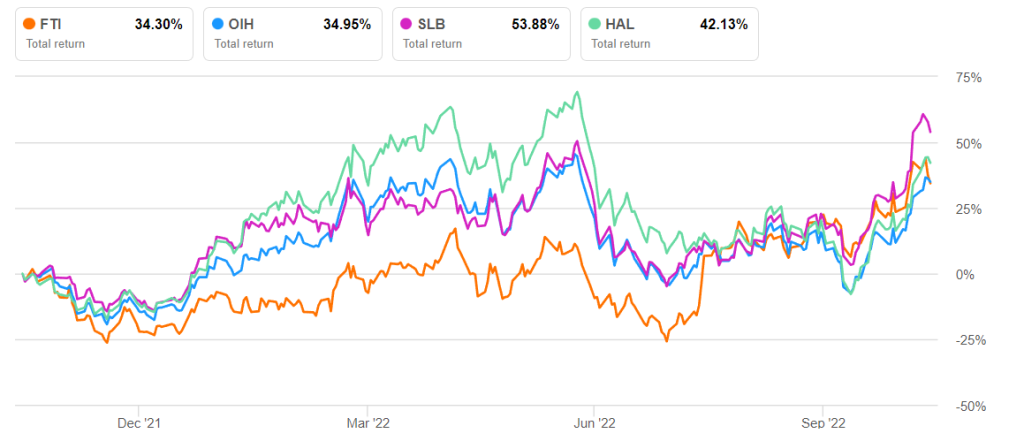

FTI’s cash flow from operations (or CFO) deteriorated sharply and turned negative in 9M 2022 compared to a year ago. The adverse effect of differences in project milestones, vendor payments, and derivative assets and liabilities fluctuations. Despite negative cash flows, robust liquidity will cushion against any cash flow pressure. As a result of various counter-balancing forces, the stock performed in line with the VanEck Vectors Oil Services ETF (OIH) in the past year. Given the relative undervaluation compared to its peers, we expect returns from the stock price to strengthen in the medium term.