- FTI’s Subsea order backlog can increase to $9 billion by Q1 2024 from $7 billion in FY2022.

- Its Subsea EBITDA margin can extend to 15%, or even higher, by 2025.

- On top of the key project awards in Q3, it has recently received an award for ExxonMobil Gas in Guyana.

- Although cash flows turned negative, it has announced a new $400 million share buyback program and would initiate a dividend in 2H 2023.

The Inbound Order And Margin

FTI’s management has grown in confidence over its outlook on offshore energy. In recent times, offshore energy projects have seen costs decline while the time to produce oil has come down. Its management believes that in FY2022, its subsea orders will be up by 40% compared to a year ago. Currently, its order backlog book is approaching $7 billion. Over the next five quarters (i.e., by Q1 2024), it will inflate to $9 billion. Over the medium-to-long term, the issue of energy security would accelerate the development of both traditional and alternative energy sources.

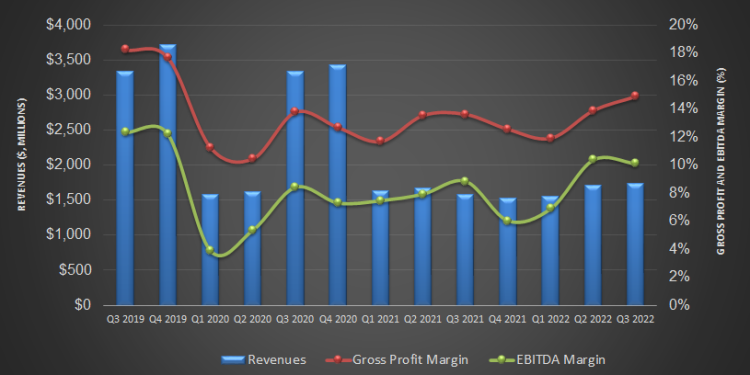

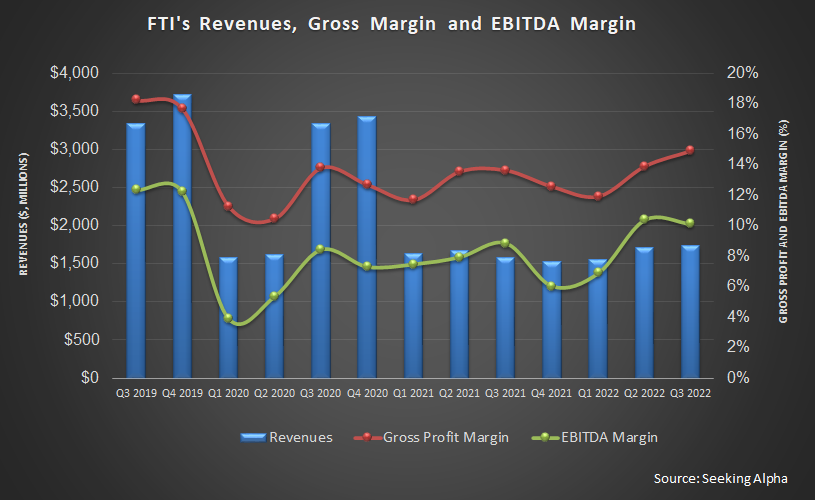

Since 2021, FTI has concentrated on the iEPCI (integrated engineering, procurement, construction, and installation) projects, primarily in the Subsea segment. On the Subsea 2.0 product platform, the configure-to-order (or CTO model) would deliver a competitive offering. Read more about FTI’s strategies in our previous article. Approximately 71% of the company’s total inbound orders ($1.6 billion) were from the Subsea segment in Q3 2022. The company recently witnessed an acceleration in inbound orders, reflecting increased topline growth. This, in turn, will expand its operating margin. So, the company expects its Subsea EBITDA margin can extend from the current 10.5%-level to the targeted 15%, or even higher, by 2025.

FY2022 and FY2023 Outlook And Forecast

FTI’s FY2022 guidance remained essentially unchanged in Q3 from the previous guidance. Overall, it expects to generate an EBITDA of $650 million-$670 million in FY2022, which would be 14% higher than in FY2021. FY2023 can reach $825 million, or up by another 25%. It expects to convert ~35% of EBITDA to free cash flow.

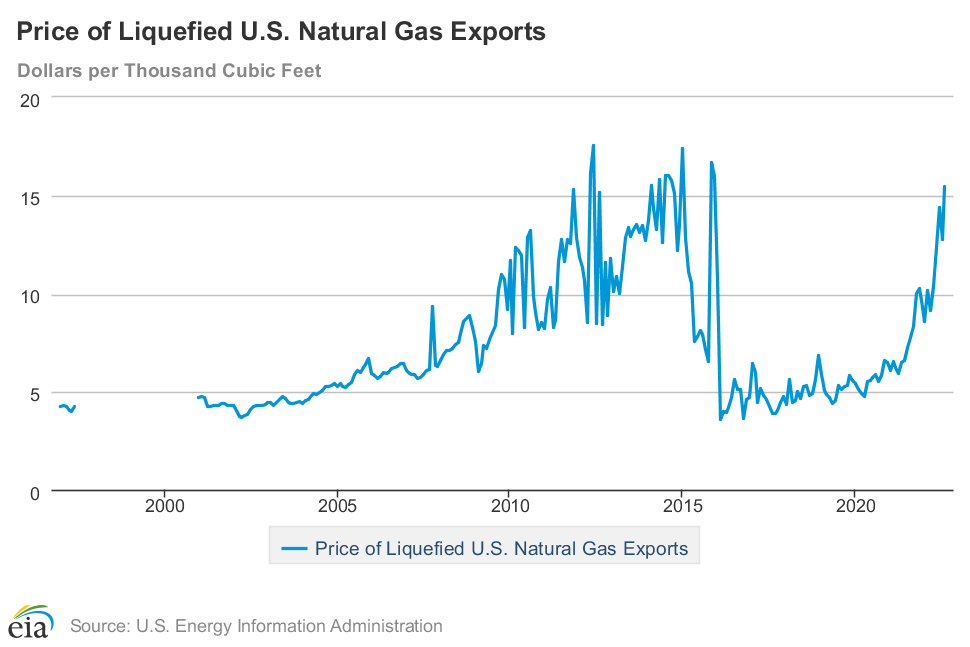

LNG Price Has Improved

The US LNG export price in the past year increased by ~76% until July 2022, although it was lower than the previous month. According to EIA, the US monthly storage inventories have remained below the five-year average. However, according to its estimates, the US dry natural gas production in September increased and contributed to September’s natural gas stock builds. The liquefied natural gas (or LNG) exports fell below the past average as many liquefaction terminals other than the off-line Freeport terminal operated near full capacity.

Key Project Update

In Q3, inbound in Surface Technologies was $449 million, representing a book-to-bill of 1.4x. This reflects an increase as orders from Aramco accelerated. However, a significant portion of this backlog will result in revenue in 2023 and beyond. Among the key projects, it received during Q3 were installing umbilicals and flexible pipe in Total Energy’s project in offshore Brazil and a contract from Shell for prominently pipe-in-pipe technology for the new Jackdaw platform feature. It received an award for ExxonMobil Gas in Guyana for future inbound orders, which awaits FID and government approvals. The project involves shifting a part of its power generation to cleaner natural gas.

Subsea Segment: Performance

FTI’s Subsea segment revenue remained unchanged in Q3 2022 compared to Q1. The segment operating income increased by 8% following a rise in installation activity. The crude oil price curve has also flattened as the demand side wobbles around the globe. A sedate drilling and production activity can affect oilfield services companies adversely.

Surface Technologies Segment: Analyzing Recent Performance

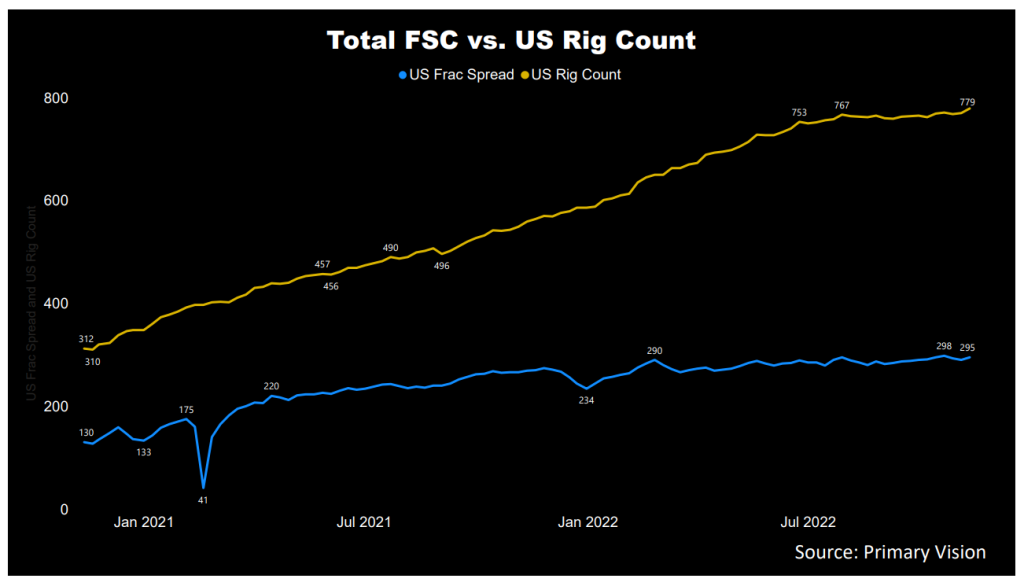

Quarter-over-quarter, FTI’s Surface Technologies segment increased by 5% in Q3 2022, due primarily to increased activities in the Middle East. Operating income recovered sharply, by 90%, during this period as Saudi Arabia’s volume ramped up. The US frac spread count has increased by 26% in 2022, although the pace decelerated in Q4, as estimated by Primary Vision.

Cash Flows and Balance Sheet

FTI’s cash flow from operations (or CFO) deteriorated sharply and turned negative in 9M 2022 compared to a year ago. The adverse effect of the differences in project milestones, vendor payments, and fluctuations in derivative assets and liabilities led to a steep fall in CFO. So, free cash flow also turned significantly negative in 9M 2022 versus a year ago. However, revenues remained nearly unchanged in this period.

FTI’s debt-to-equity ratio (0.43x) is lower than its peers’ (SLB, BKR, HAL) average of 0.75x. As of September 30, 2022, its liquidity (cash plus investments plus availability of borrowings under the revolving credit facility) was $1.5 billion. So, despite having the bulk of debt on the balance sheet, robust liquidity will partially cover the financial risks. Also, in July, it announced a new $400 million share buyback program. Plus, it has reaffirmed its commitment to initiate a dividend in 2H 2023, which reflects the management’s confidence in its positive outlook.

Learn about FTI’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.