- NexTier Oilfield’s frac fleets remain “sold out;” however, seasonality can reduce the topline, while the operating profit margin can hold steady in Q4 2022.

- It focuses on expanding the wellsite integration platform, enhancing the last mile logistics platform, and upgrading ancillary frac equipment.

- NEX has initiated a $250 million share buyback program through 2023.

- Positive free cash flow generation can reduce net leverage and achieve zero net debt by 2023

Industry Outlook And Company Strategy

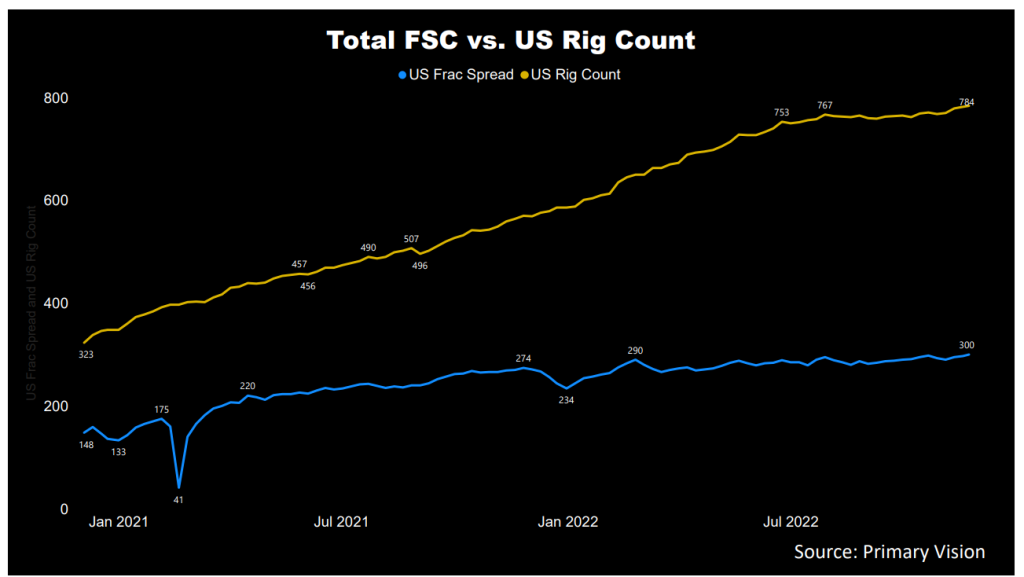

In the Q3 earnings call, NexTier Oilfield’s (NEX) management demonstrated conviction in positive multiyear US onshore well completion fundamentals. This was in tune with other industry leaders’ views, such as Schlumberger (SLB) and Halliburton (HAL). However, two factors can play a spoilsport in the near term: (a) supply tightness in fracking and (b) volatility in near-term oil demand owing to macro pressures. Despite that, the management expects relatively favorable US frac supply-demand dynamics in 2023.

In this environment, NEX has stressed the importance of enhancing its commercial terms, such as minimum pump hours and securing multiple integrated services. In September, NEX and National Fuel Gas Company announced the deployment of a fully integrated electric fracturing fleet in Q1 2023. Its natural gas-powered equipment carries a premium due to the fuel cost advantage. Because of the market dynamics tightness, it has shored up its finances. The company has robust liquidity ($620 million). It plans to return at least $250 million to shareholders between now and 2023-end as it exceeded its free cash flow generation target. The management also believes it can prop up the stock’s valuation through the shareholder return program.

One of the critical aspects of its balance sheet strengthening effort is to set a clear path to net debt zero. It intends to achieve this in 2023. Operationally, it aims to remain a top-tier US land completion services company in the long term. To keep its existing frac fleet deployed, it targets a capEx range of 8% to 9% of revenue through the current upcycle, allowing it to fund the transition to natural gas-powered and electric equipment. As a part of the strategy, earlier, it deployed the legacy Tier 4 dual-fuel fleet and upgraded the Tier 4 dual-fuel fleet through the Alamo operations in Q1 2022, as I discussed in my previous article.

Q4 2022 Forecast And Projects

NEX’s management thinks that US onshore frac market will remain “sold out” in Q4. The pricing improvement, which it witnessed in Q2 and Q3, will continue going into 2023. However, investors might want to keep in mind that despite higher utilization, the company’s realized net pricing is still 10% to 15% below the pre-COVID level. So, with equipment supply remaining tight in the near term, the pricing concessions made in the prior quarters might be fully reversed, leading to higher profitability.

However, the adverse effects of seasonality, including the holidays, can slow down the Q4 revenue growth. So, the management expects Q4 revenues to decline by 2%-4% in Q4 compared to Q3. Profitability and cash flow, however, can improve in Q4.

NEX’s projects will divert toward expanding the wellsite integration platform, including the next phase of the Power Solutions business, enhancing the last mile logistics platform, and upgrading ancillary frac equipment. In August, it agreed to acquire the sand hauling, wellsite storage, and last-mile logistics businesses of Continental Intermodal Group LP.

The Industry Drivers

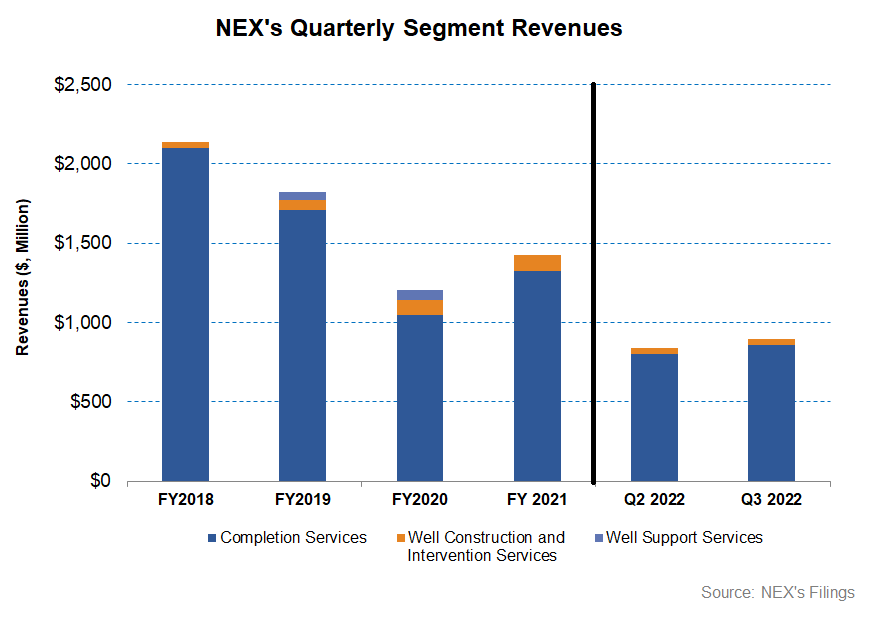

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 300 by the third week of November and has gone up by 28% since the start of 2022. In the past year, the drilled wells increased by 48% until October 2022, according to the EIA’s latest Drilling Productivity Report. In contrast, the drilled but uncompleted wells (or DUC) declined by 17% during the same period. The West Texas Intermediate (WTI crude oil) price has become volatile in recent months as the demand side wobbles while the supply side remains restricted.

Analyzing The Q3 Drivers

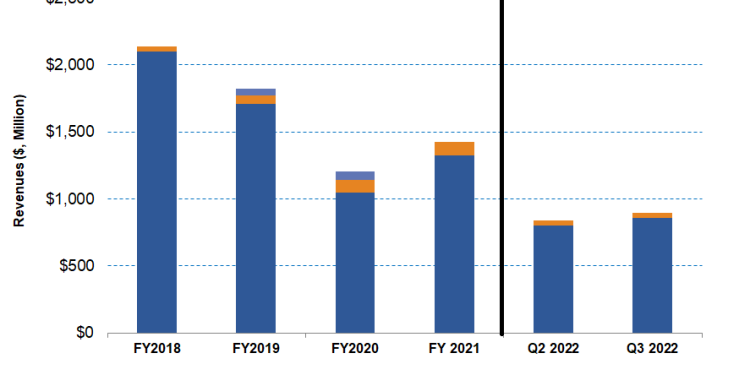

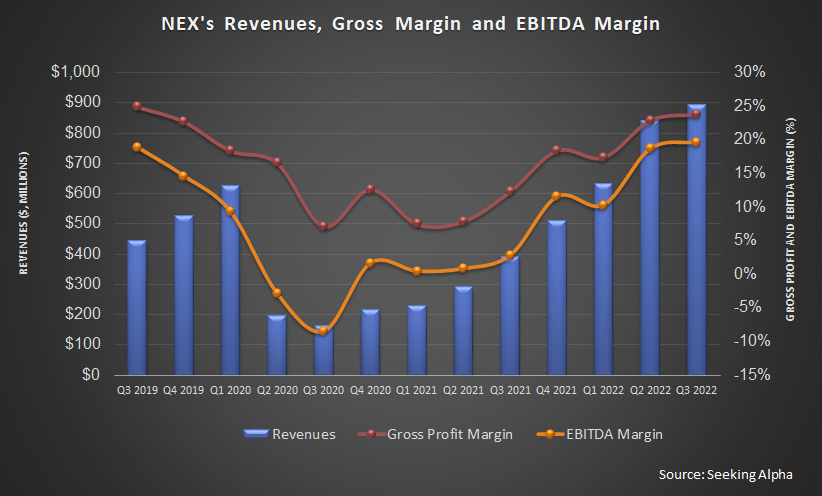

In Q3 2022, NEX’s revenues increased by ~6% compared to Q2 2022. Although it did not secure additional horsepower in Q3, it secured replacement pumps and deployed them for use in Q4. One of NEX’s frac spreads caught fire during the quarter, stymied the revenue growth in Q3.

Sequentially, revenues increased by 7% in the Completions Services segment in Q3, while the adjusted gross profit expanded by nearly 400 basis points. The adjusted EBITDA margin expanded by 100 basis points from Q2 to Q3. Revenues and gross profit in the Well Construction & Intervention Services segment, on the other hand, decreased by 9%. The sale of the Coil Tubing assets caused a decrease in revenue and profitability.

Cash Flows And Shareholders’ Returns

In 9M 2022, NexTier Oilfield’s cash flow from operations (or CFO) turned significantly positive ($310 million) compared to a negative CFO a year ago. Steeply higher revenues and a lower cost structure led to the CFO’s rise. Free cash flow also turned strongly positive in the past year. However, working capital is still draining cash because of the increased activity level.

NEX’s 2023 capex budget is $350 million, which is 89% higher than a year ago. It estimates that returning approximately half of its expected annual FCF to investors improves the investment thesis. It plans to use its free cash flow to support investment decisions through higher shareholder returns. It has initiated a $250 million share buyback program through 2023.

The company plans to use the positive free cash flow generation to reduce net leverage and achieve zero net debt by 2023 and in M&A activities. The company’s liquidity totaled $622 million as of September 30, 2022. Its debt-to-equity ratio (0.46x) declined compared to a quarter earlier.

Learn about NEX’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.