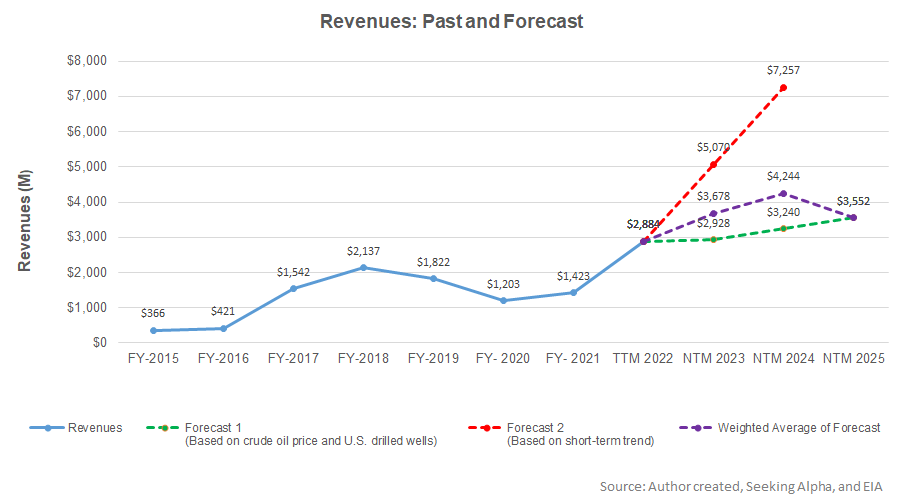

- Our regression estimate suggests NEX’s revenues will go higher in NTM 2023 but may decelerate in NTM 2024.

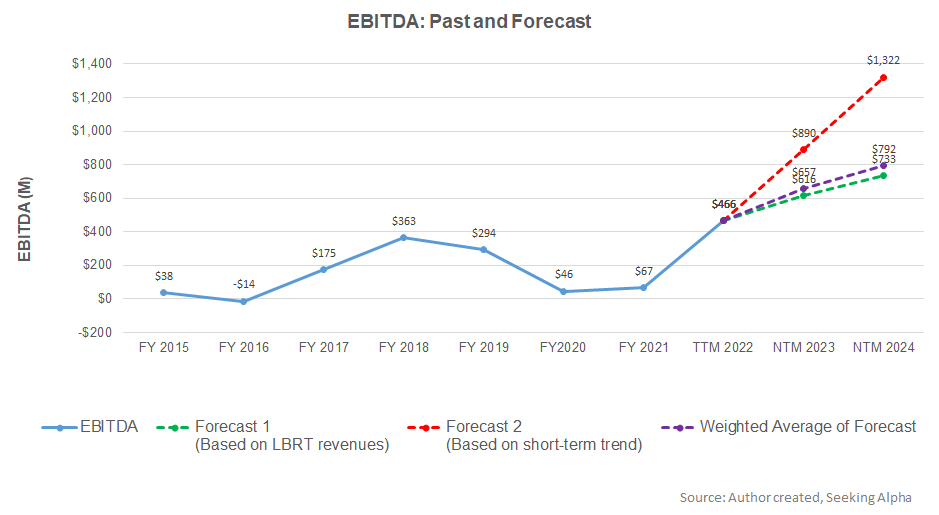

- EBITDA, too, can increase steeply in NTM 2023 before decelerating in NTM 2024.

- The stock is reasonable versus its peers at the current level.

Part 1 of this article discussed NexTier Oilfield Solutions’ (NEX) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the key industry indicators (crude oil price and drilled rigs) and NEX’s reported revenues, as well as its past four-quarter revenues, I expect its revenues to increase by 28% over the next 12 months (or NTM 2023). The topline growth can moderate to 15% in NTM 2024.

Based on the regression model using the average forecast revenues, I expect the company’s EBITDA to increase by 41% in NTM 2023 and 21% in NTM 2024.

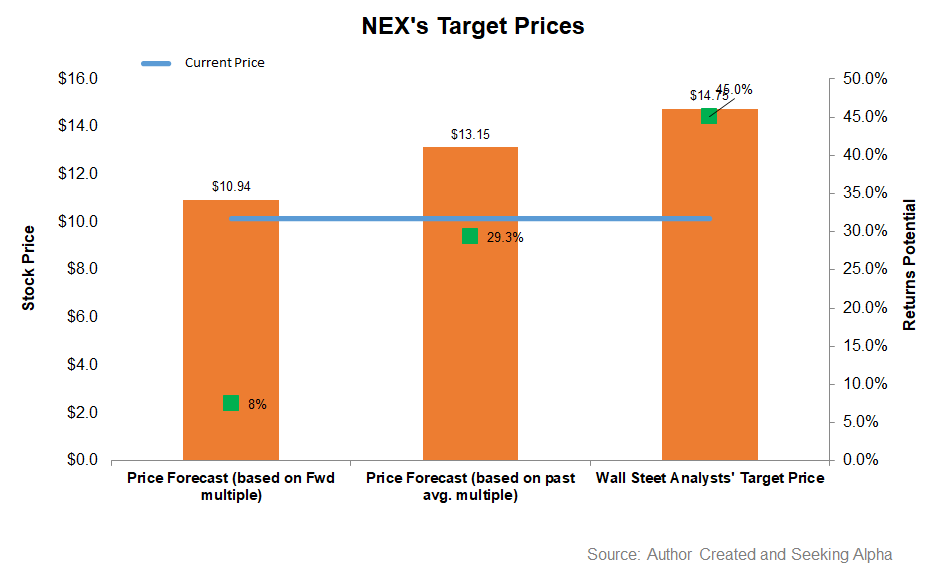

Target Price And Relative Valuation

EV has been calculated using the forward and past five-year average multiple. Returns potential (8% upside) using the forward EV/EBITDA multiple (4.4x) is lower than Wall Street’s sell-side analyst expectations (45% upside) and the past average EV/EBITDA multiple (29% upside) from the stock.

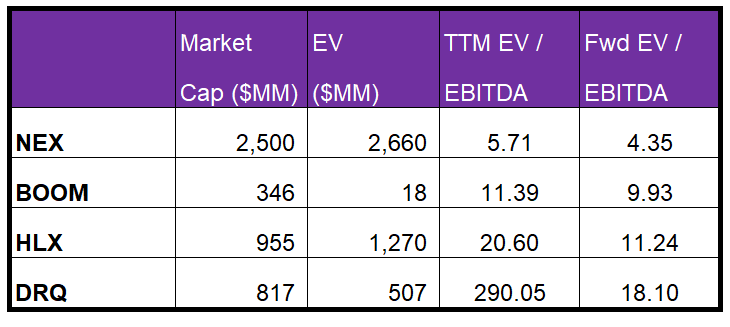

NEX’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers, which typically reflects a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple (5.7x) is much lower than its peers’ (BOOM, HLX, and DRQ) average. The current multiple is also lower than its five-year average (24.7x). So, relative valuation-wise, the stock is reasonably valued at the current level with a positive bias.

Analyst Rating And Target Price

According to data provided by Seeking Alpha, seven sell-side analysts rated NEX a “buy” in the past 90 days (including “Strong Buy”), while three of the analysts rated it a “hold.” None of the analysts rated it a “sell.” The consensus target price is $17.75, suggesting a 45% upside at the current price.

What’s The Take On NEX?

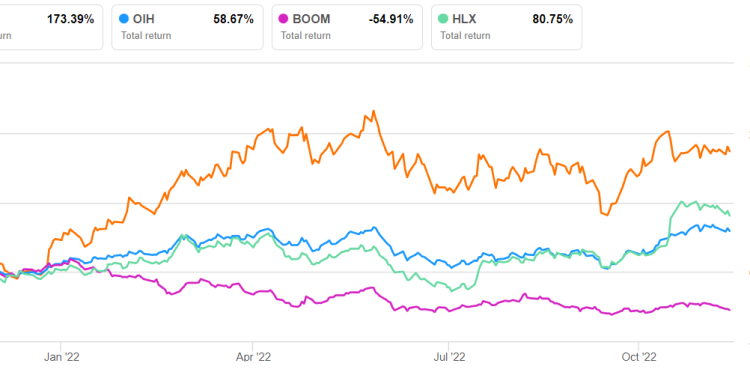

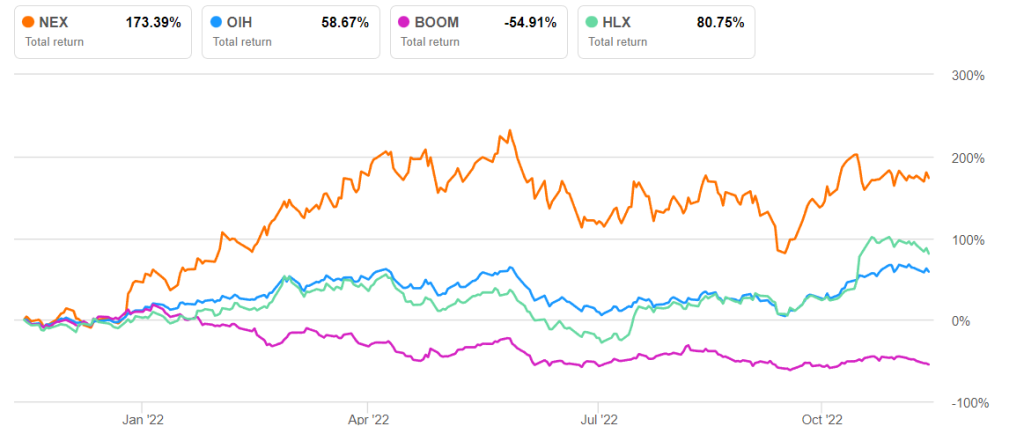

By late 2022, NEX believes it will benefit from a multi-year upcycle. In the short-term, energy supply restrictions would favor a crude oil price rise. The company will look to preserve its market share in natural gas-powered equipment fleets. Its fleets remained “sold out” by September. It plans to expand the wellsite integration platform, enhance the last-mile logistics platform, and upgrade ancillary frac equipment. The advantages are reflected in the steep rise in cash flows in 9M compared to the previous year. So the stock significantly outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

NEX does not plan to deploy any additional horsepower in the near term. Its topline will likely stagnate as seasonal energy market slowness hits the industry. Operating profit, however, will go unchecked as the cost control efforts materialize. Also, positive free cash flow generation can reduce net leverage and achieve zero net debt by 2023. The stock is reasonably valued relative to its peers at this level. Investors might want to hold the stock for an upside in the medium term.