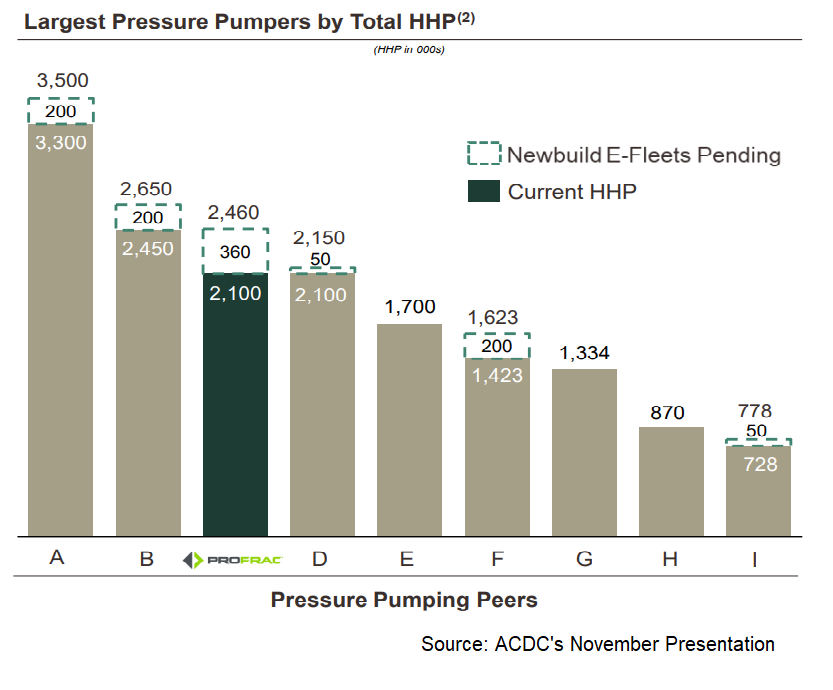

- With a strategic focus on ESG-compliant fracking, ProFrac, with four electric fracs under construction, will become the leading electric frac provider in the US.

- By the end of 2022, it will have 12 electric fleets – one of the largest in the industry.

- However, the lower average selling price for sand and higher material cost due to the supply chain issues dent a hole in its operating margin drive.

- Free cash flow turned positive despite a huge capex increase in 9M 2022.

USWS Acquisition And Fleet Size

In November, ProFrac Holding (ACDC) completed the acquisition of US Well Services (or USWS). It added seven active fleets from the acquisition and deployed its first electric fleet in Q4. It issued 12.9 million shares to fund the purchase and used ~$210 million of cash to retire $170 million in USWS debt. The company’s average active fleet count for Q3 2022 was 31, unchanged from Q2. Also, USWS will enhance ACDC’s ESG strategy by reducing fuel costs and minimizing the emissions footprint. It currently has four electric fleets under construction and ~$140 million in potential licensing fees.

As of November 2022, it had 39 active fleets, eight of which were electric. E-fleet fuel cost is typically less sensitive to changes in natural gas pricing than diesel fleet. In 2023, it aims to achieve $35 million in annual savings from reducing corporate expenditures, eliminating redundant costs, and consolidating facilities.

Earlier, in March 2022, ProFrac acquired FTSI, following which its active fleets went from 17 before to 31 after. In May, it acquired Flotek. Read more on the past acquisitions in our previous article here.

Key Indicators

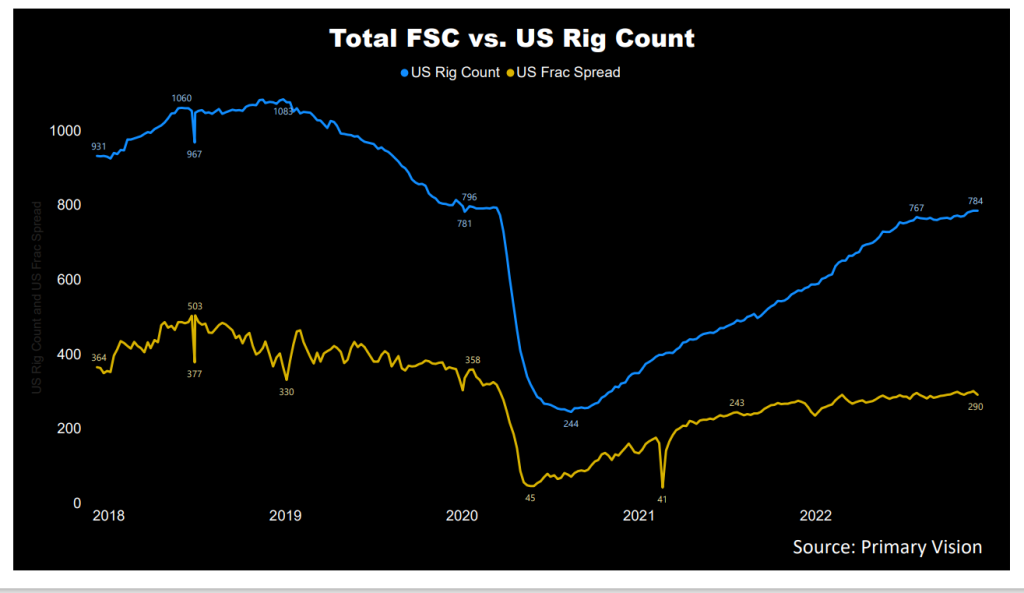

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 290 by the first week of December and has increased by 24% since the start of 2022. The tight supply and the upstream operators’ logical response to the energy price rise determine supply. The oilfield services industry looks to retire, replace the equipment, and implement vertical integration. As the equipment side gets squeezed, the OFS companies remain “sold out,” leading to higher prices and, therefore, higher returns.

Let us now look at ACDC’s critical strategic goals and actions. The company’s ESG initiatives will bear fruit as it upgrades the legacy fleets and introduces more electric fleets in the coming quarters. This will create a pricing appreciation scope and will help it increase bundling materials provided by the company. The vertical integration strategy would help capture customers’ completions budget because the company now provides a single provider for sand, chemicals, storage, and logistics.

As the company increased the fleet size, the integration enabled it to provide approximately 40% of the sand it pumped and 50% of the chemistry. The company’s fleet utilization in Q3 was also one of the highest recently after it took steps to reduce maintenance times, increase pump hours per day, and pump more days per fleet. We can expect the momentum to continue in Q4.

Electric Frac And Equipment Upgrading

ACDC’s management has doubled the rate of engine upgrades per month. With this, it expects to achieve $15 million in cost savings (annualized). Out of four, it expects to construct the first three electric fleets to cost ~$75 million. It also expects to deploy the second and third fleets in early 2023.

The USWS and FTSI acquisitions helped unbundle 30%-40% of its sand required for pumping. This should bring in more logistics efficiency and increase fleet profitability. In other developments, the Lamesa sand plant, constructed at $45 million, will likely be operational by December. It strategically located sand mines in West Texas, which minimized capex per fleet. Among its other cost-saving initiatives, it will reduce the number of fleets waiting for maintenance which should lower the high maintenance cost it had to bear in Q3.

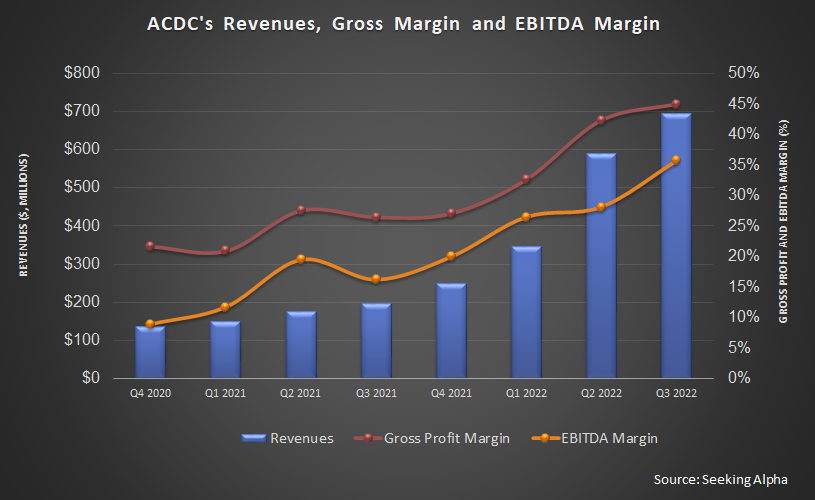

Analyzing Q3 Results

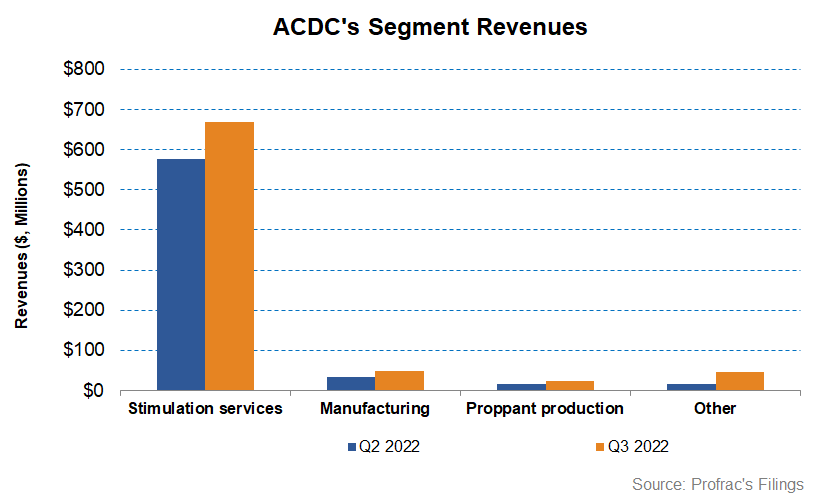

In Q3 2022, ProFrac’s Stimulation Services segment revenues increased by 16% compared to Q2 2022. The top line was boosted by improved pricing and utilization. The segment’s EBITDA margin expanded by 330 basis points in Q1 2022.

Quarter-over-quarter, ProFrac’s Manufacturing segment revenue increased by 40% in Q3 while the segment EBITDA margin contracted steeply (960 basis points). Higher cost of materials in the past year following the supply chain constraints led to the margin fall in Q3. Revenue growth in the Proppant Production segment was the highest (41% up) in Q3. However, the performance decline of its operating profit or EBITDA margin was also the steepest due to lower average selling price per ton and lower utilization of the sand mines following maintenance downtime.

FCF and Capex In FY2022

Following a sharp increase in revenues, ACDC’s free cash flow (or FCF) increased significantly in 9M 2022 compared to a year ago. Despite a steep rise in capex in the past year, an even sharper rise in cash flow from operations (or CFO) increased FCF. The management estimates capex will increase nearly 300% in FY2022 compared to FY2021 due to the construction of four electric-powered fleets and the upgrading of Tier II fleets to Tier IV dual fuel fleets.

Following the USWS acquisition, it expects to have $650 million in net debt and 155 million shares outstanding. This means its net debt will increase compared to the current net debt level. The company’s debt-to-equity was 0.63x as of September 30, 2022, which is higher than peers’ (LBRT, NEX, and HAL) average of 0.56x.

Learn about ACDC’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.