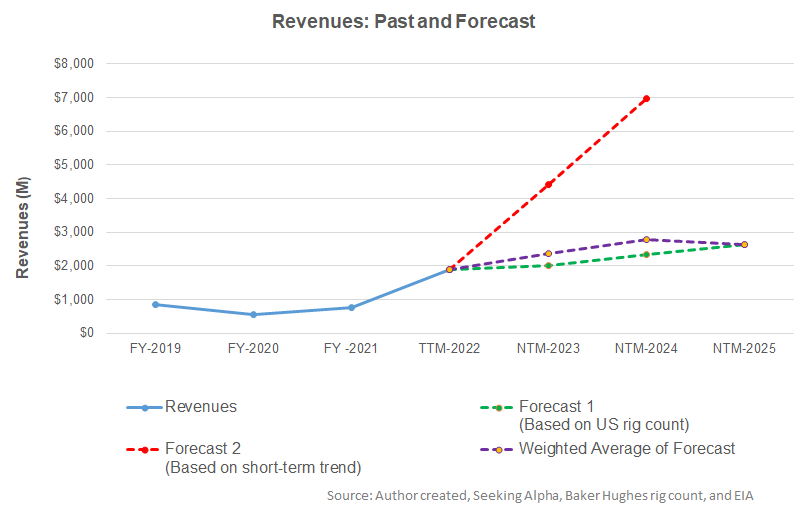

- Our regression model suggests that the revenue growth estimates are steady in the next two years.

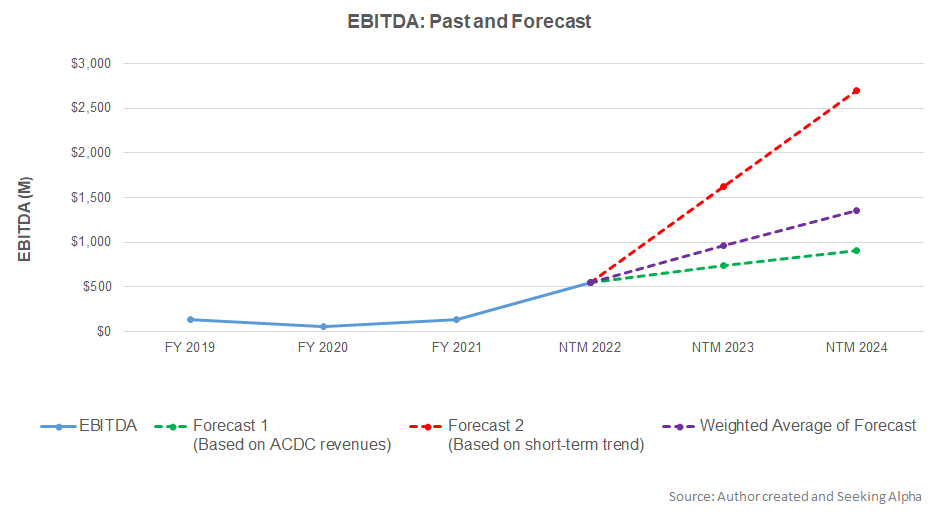

- EBITDA can increase sharply in NTM 2023 but decelerate in the following year.

- The stock is undervalued versus its peers at the current level.

Part 1 of this article discussed ProFrac’s (ACDC) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship between the US rig count and ACDC’s reported revenues for the past four years and the previous four quarters suggests that its revenues will increase by 27% in the next 12 months (or NTM 2023). In NTM 2024, it can grow further by 17% but may decline in NTM 2025.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase by 74% in the next 12 months (or NTM) in 2023. In NTM 2024, the model suggests the company’s EBITDA growth can increase by 40%.

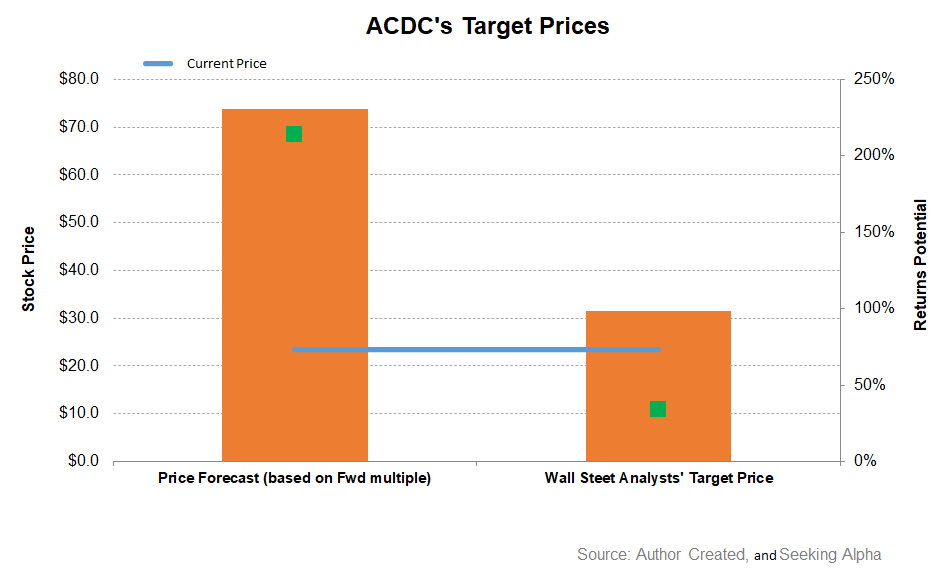

Target Price And Relative Valuation

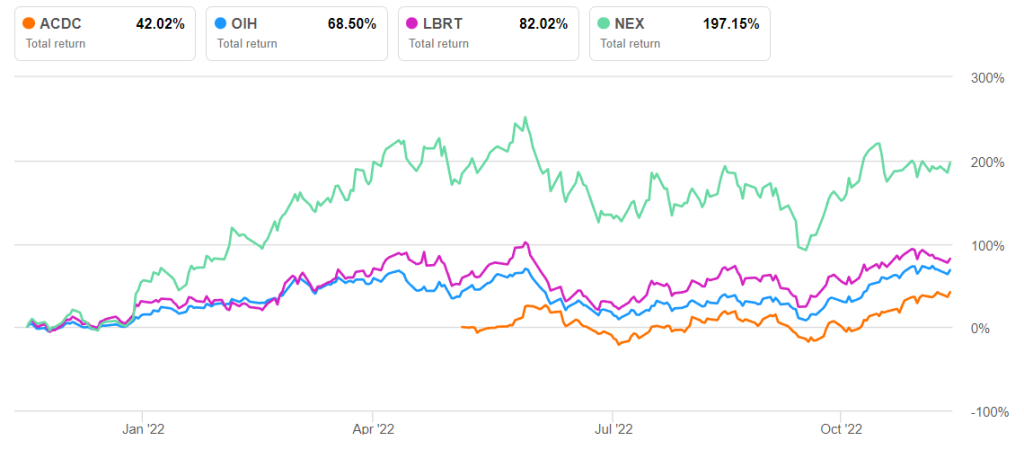

The stock’s return potential using the forward EV/Revenue multiple (1.5x) is steep (214% upside). In comparison, Wall Street’s sell-side analysts’ expected returns are more moderate (34% upside).

Relative Valuation And Analyst Rating

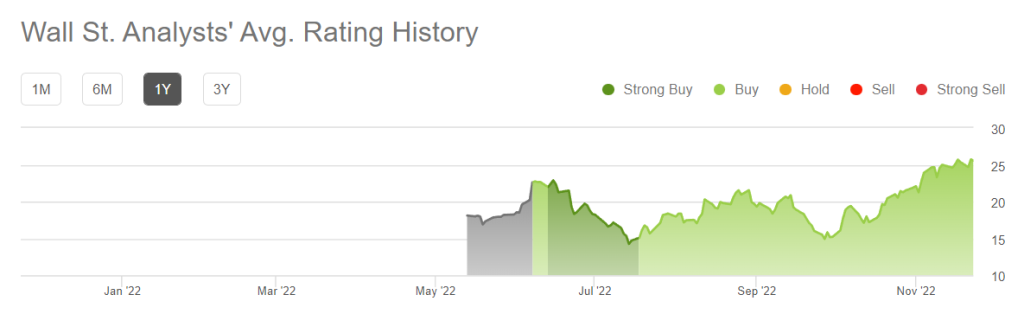

The sell-side analysts’ target price for ACDC is $31.5, which, at the current price, has a return potential of 34% at the current price. Out of the six sell-side analysts rating ACDC, five rates it a “buy” or a “strong buy,” while one rate it a “hold.”

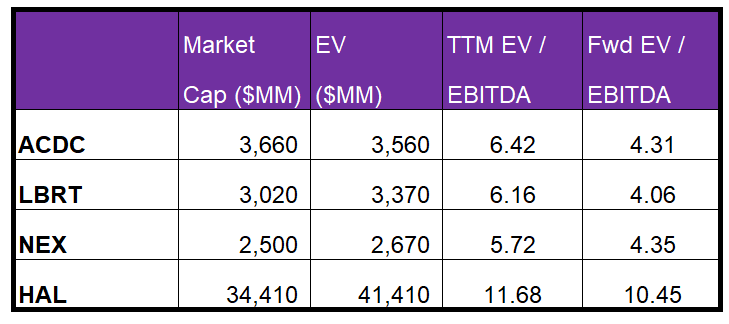

ACDC’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers because its EBITDA would rise more than its peers in the next four quarters. So, its EV/EBITDA should typically be higher than its peers. However, its EV/EBITDA (6.4x) is lower than its peers’ average (7.9x). So, I think the stock is undervalued versus its peers and has a positive bias at this price level.

What’s The Take On ACDC?

As the equipment side gets squeezed, the OFS companies remain “sold out,” leading to higher prices and, therefore, higher returns. ProFrac, under the current scenario, looks to vertically integrate with supply chain management, leading to fuel cost savings. It would help capture customers’ completions budget as a single provider for sand, chemicals, storage, and logistics. The Lamesa sand plant will likely be operational by December, which would be a step toward backward integration and will support its cost reduction initiatives. As the US fracking industry increasingly looks for fuel-efficient solutions, the Tier IV fracks and electric pumps will command the leading-edge day rates. It also expects to deploy three more electric fleets in early 2023.

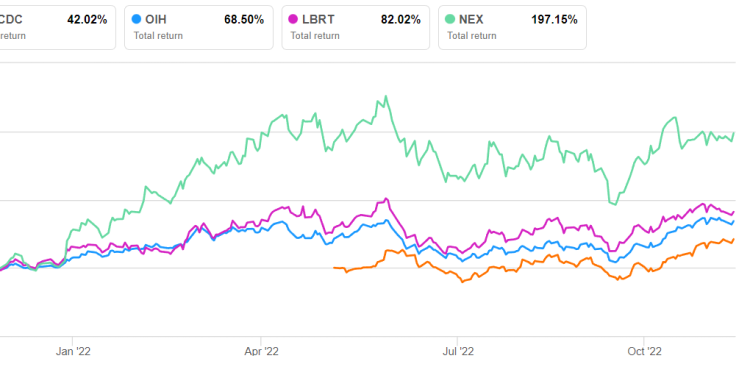

A couple of factors might have pulled ACDC’s stock price down more than it did for the VanEck Vectors Oil Services ETF (OIH) in the past year. These include the higher cost of materials, the lower average selling price per ton, and the lower utilization of the sand mines. Its cash flows improved significantly over the past year, which can absorb the pressure exerted by higher net debt expected to occur by the end of the year, at least partially. A relative undervaluation and a margin from a mix of fuel-efficient electric fracs should keep investors interested in buying the stock.