- Following the DGB conversions, ProPetro can begin 2023 with six Tier 4 DGB fleets, which can increase to at least seven by mid-2023.

- Its Silvertip acquisition re-establishes PUMP’s position as the leading completions-focused oilfield service company.

- Recently, it executed orders for two electric frac fleets for an E&P operator.

- PUMP has zero debt and robust liquidity, but free cash flow turning negative in 9M 2022 would be a concern.

The Industry Outlook

ProPetro Holding’s (PUMP) management expects steady to flat activity in the energy industry in 2022 and into 1H 2023. Despite crude oil prices’ recovery in the past year, supply and demand factors pull back the growth potential, including supply chain constraints, a tight labor market, and potential global recession. So, E&P companies have given preference to service providers with high-grade equipment or pressure pumping companies that upgrade to natural gas burning equipment like electric and Tier 4 DGB. Naturally, the pricing and margin advantage is higher for the companies adopting these strategies aggressively.

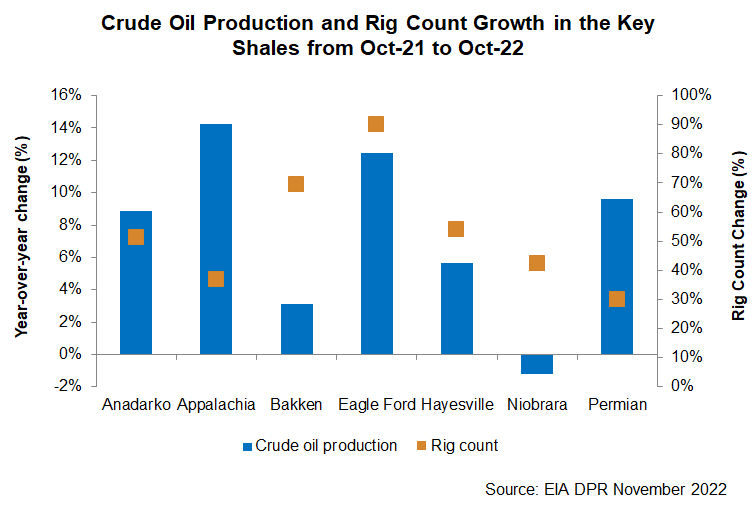

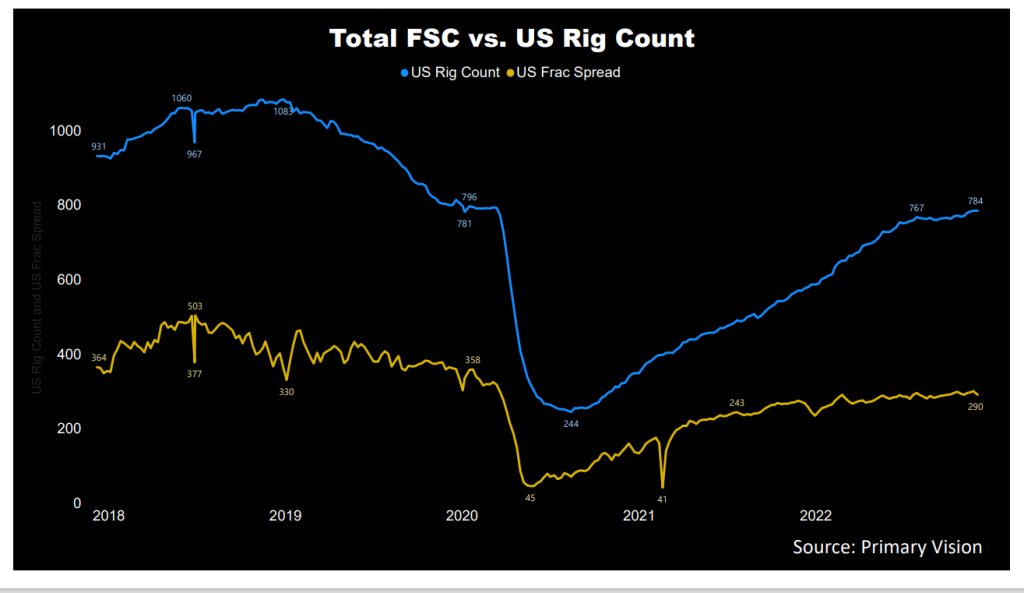

According to the EIA’s estimates, crude oil production will likely increase by 2.7% in the seven key shales in December 2022 compared to the current output. Crude oil production increased by 8% in the key unconventional shales in the past year. The Permian production increased by 10% during this period, while the rig count went up by 30%. Investors may note that much of PUMP’s assets in operations are Permian-centric, and it wants to participate further in the electrification of pumps (e-fracs) in this region. According to Primary Vision, the frac spread count has increased by 24% to 290 compared to the start of the year. The higher frac count can improve PUMP’s topline in Q4 2022.

Investigating The Critical Strategies

PUMP, on its part, optimizes its operations to boost free cash flows as its transitions to next-generation equipment in a capital-light manner. Such programs are cost-effective, extend the life of equipment, and reduce downtime. The company will continue to deploy Tier 4 DGB (dynamic gas blending) conversions and can begin 2023 with six Tier 4 DGB fleets and approximately seven in operation by mid-2023.

In Q3, it executed orders for two electric frac fleets and is likely to deliver them in Q3 2023. It is also in contract negotiations with two E&P operators to utilize these electric fleets in 2023. Demand for electric-powered solutions is under a multiyear-long upcycle, and these contracts may begin the electrification of hydraulic fracturing operations in the Permian – the most critical US basin.

Acquisition And Portfolio Rebalancing

In November 2022, PUMP acquired Silvertip, which provides wireline perforating and pump-down services. The transaction had an implied value of $150 million. The acquisition re-establishes PUMP’s position as the leading completions-focused oilfield service company. Silvertip brings in complementary, dedicated pump-down assets with substantial cross-selling opportunities, allowing ProPetro to offer a more integrated and diverse service. The acquisition is expected to be accretive on adjusted EBITDA multiple, free cash flow per share, and earnings per share.

The management expects the acquisition to increase 2023 adjusted EBITDA by approximately $65 million to $75 million. The adjusted EBITDA into free cash flow conversion would double to 80% from 40%. The company’s strategic focus is not limited to acquisition but involves divesting the non-core business. In September, it sold the coiled business to STEP Energy Services. As a result, it got rid of frac plug mill-out, wellbore clean-out, tubing-conveyed perforating, and nitrogen pumping services. The asset rationalization would serve PUMP’s sustainable long-term growth, margin expansion, and cash flow generation goals.

The Value Drivers In Q3

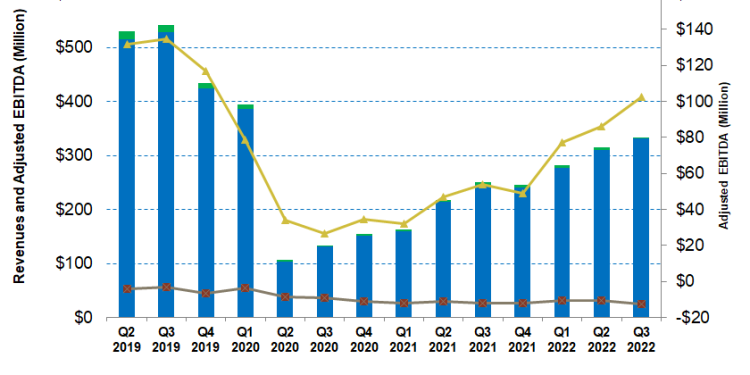

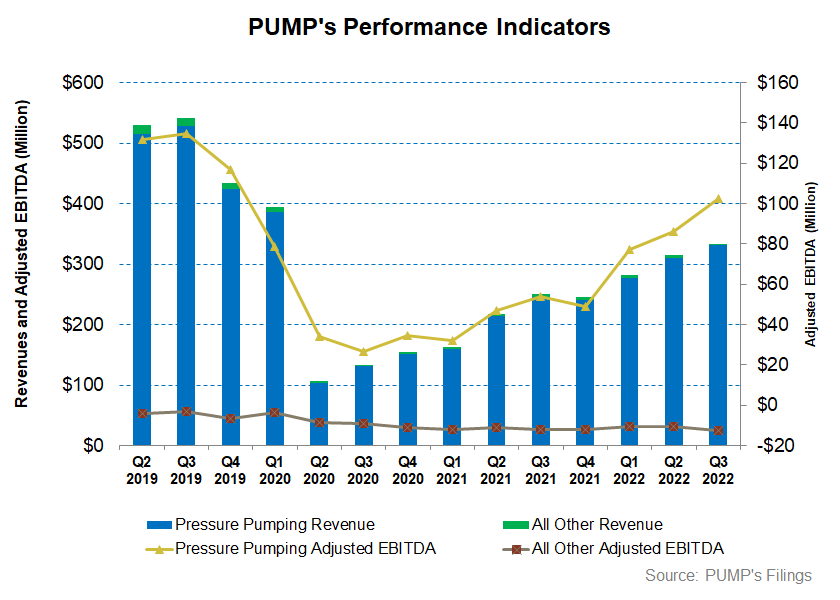

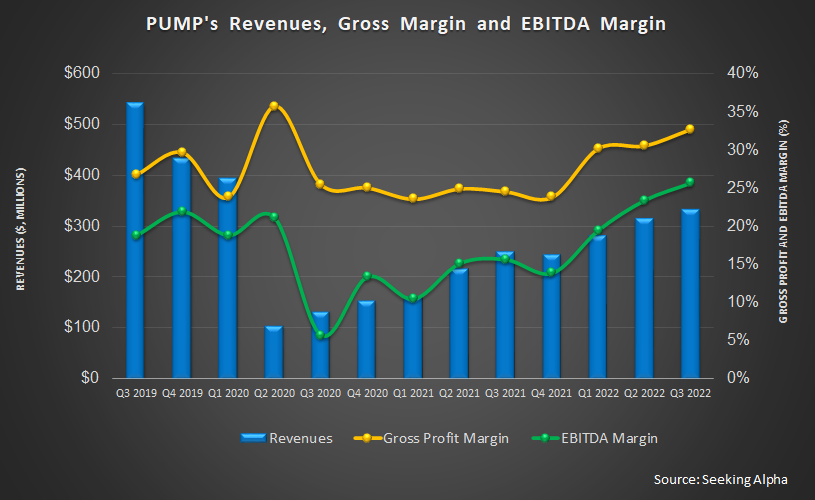

PUMP’s quarter-over-quarter revenue growth was 5.7% in Q3, primarily due to pricing gains, better cementing performance, and a favorable job mix. Its effective fleet utilization of 14.8 in Q3 was unchanged from Q2 and aligned with the prior guidance.

The adjusted EBITDA margin expanded by 230 basis points in Q3 compared to Q2 due to pricing gains and continued fleet repositioning. As a result of the positive changes in the bottom line, its net income turned positive to $0.10 per share in Q3 compared to a $0.32 loss per share in Q2. Investors may note that in Q2, it recorded a $57 million impairment charge after evaluating the DuraStim equipment.

Balance Sheet and Cash Flow Analysis

In 9M 2022, PUMP’s cash flow from operations (or CFO) increased by 60% compared to a year ago, primarily led by the revenue increase. Despite that, its free cash flow (or FCF) turned sharply negative in 9M 2022 because of a significant capex rise. In FY2022, the company’s capex is projected to increase by At least 126% versus FY2021 following its decision to transition to more natural gas burning and electric offerings. In FY2023, however, capex is expected to fall. So, in FY2023, lower capex and higher operating profit would result in a higher free cash flow.

PUMP’s total liquidity as of September 30 was $163 million (including cash and available capacity under an asset-based credit facility). As of that date, it had no debt. This makes it significantly safer than some of its overly leveraged peers (PTEN, LBRT, and NBR).