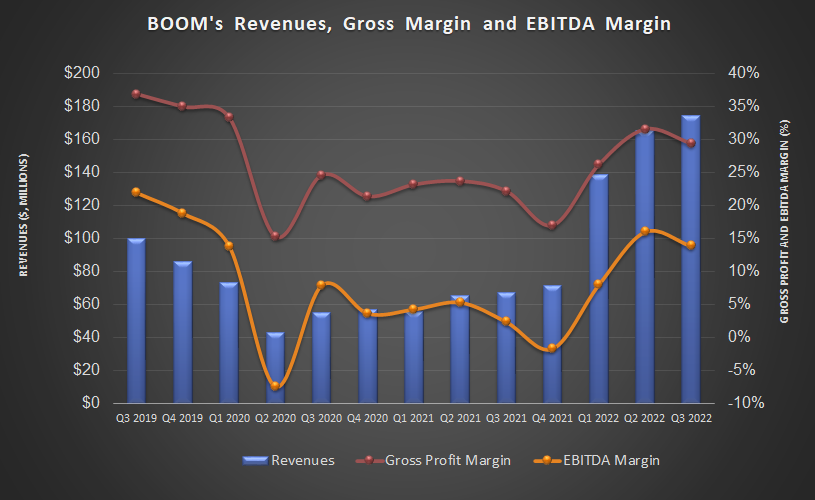

- Despite various rounds of price hikes since late 2021, DMC Global’s gross and operating margins dipped in Q3 due to high inventory costs.

- However, operating costs can be lower in the medium term as the share of large customers increases in the sales mix.

- The company’s DynaStage DS factory-assembled perforating systems see steady sales.

- Its balance sheet is robust due to the low leverage ratio, while cash flows improved in 9M 2022.

The Arcadia Acquisition And Other Strengths

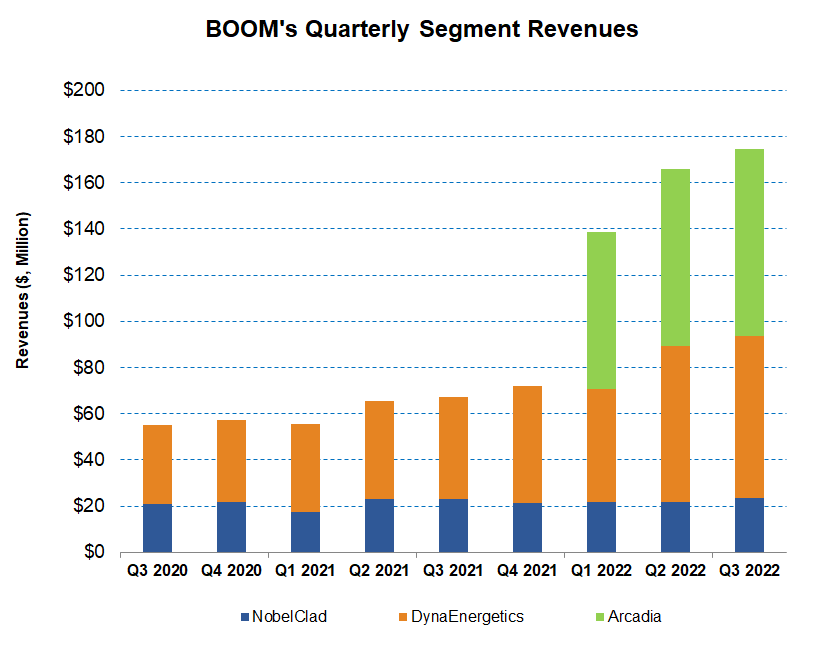

In December 2021, DMC Global (BOOM) acquired 60% ownership in Arcadia, a leading US supplier of architectural building products, for $469.6 million. Through the acquisition, DMC added the capability for high-end homes using Arcadia’s engineering-built products for commercial buildings and residential real estate. During Q3, it implemented a selling price hike in this new segment. However, it did not offset the increase in aluminum price, which is Arcadia’s primary input. So, Arcadia’s gross margin reduced to 30% in Q3 from 34% in Q3. It also serves the high-end residential market, where order growth is strong.

Let us now discuss BOOM’s perforating product suite. BOOM’s management assesses that the assembled and hand-wired components will fall out of favor, and many more upstream companies will prefer the DynaStage DS factory-assembled perforating systems. DS products are expected to reduce the customers’ inventory, supply chain resources, and working capital investments.

The company’s integrated perforating gun systems sales came under pressure because the margin pressure prompted some users to opt for the cheaper assembled products. According to the company’s estimates, although the DynaStage system sells at a premium over the competitive products, its cost premium in lowering the cost of completions on a well can run as high as 7x-10x. So, its strategy of focusing on value should help regain market share in the medium-to-long term.

Pricing And Margin Strategy

In 2021 and early 2022, BOOM had various price hikes in the DynaEnergetics segment. During 1, demand for DynaEnergetics products increased significantly and will likely remain so during the rest of 2022. In 2H 2022, the company is considering slow-moving inventory. Its gross margin can still improve in a strengthening market, but based on a lower price point than anticipated. The underlying gross profit of the existing sales is stronger. Its strategy is to adopt a business practice where the best customers are offered the best prices. Because the share of larger customers is increasing, we can expect the gross margin to benefit in the medium term. Eventually, pricing will accelerate in 1H 2023.

The company’s inventory cost will remain high in Q4 and Q1 2023 because of high-priced aluminum stock. Later, its gross margins will return to normalized levels (30%-mark) when the cost falls. The primary contributors include hotels, educational facilities, and casinos. The company’s new service centers in Dallas and Houston will serve the additional growth.

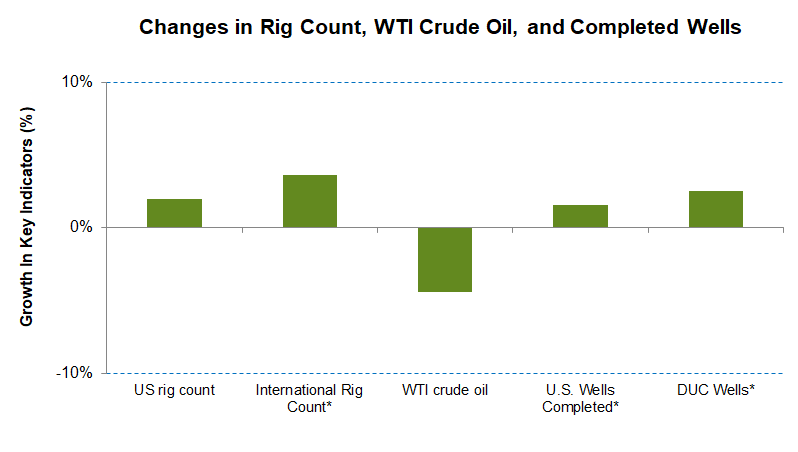

The Industry Indicators

Most of the energy indicators have remained steady in Q4, except for the crude oil price, which stayed weak following the COVID surge in China and the global economic health. From Q2 to Q3, the crude oil price declined by 25%. The US rig count went up by 1.6% during this period. The international rig count saw net additions. However, the completed well count growth in the key US shales was unchanged in this period.

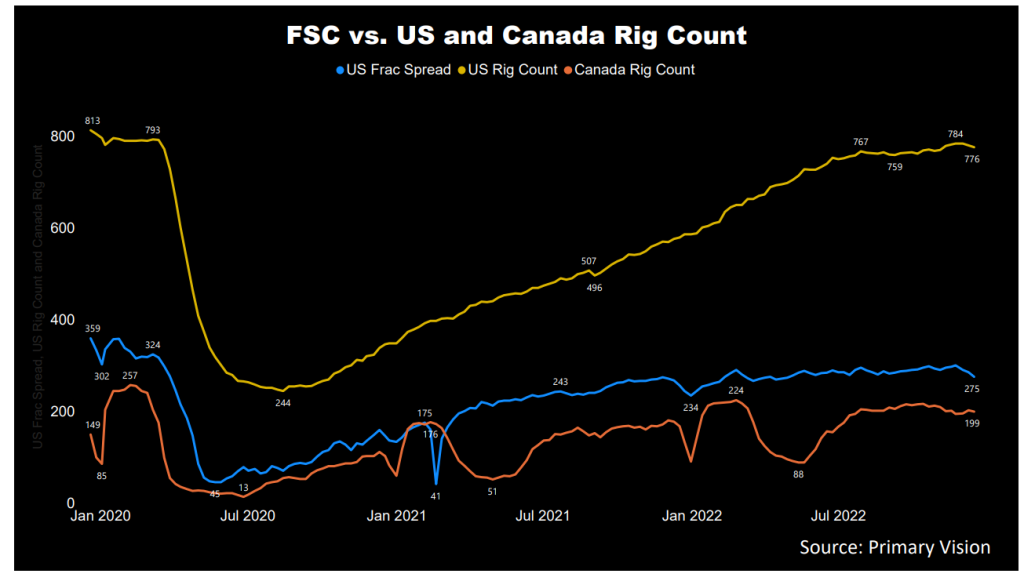

According to Primary Vision, the frac spread count has increased by ~18% to 275 compared to the start of the year. The higher frac count can improve BOOM’s topline in Q4 2022.

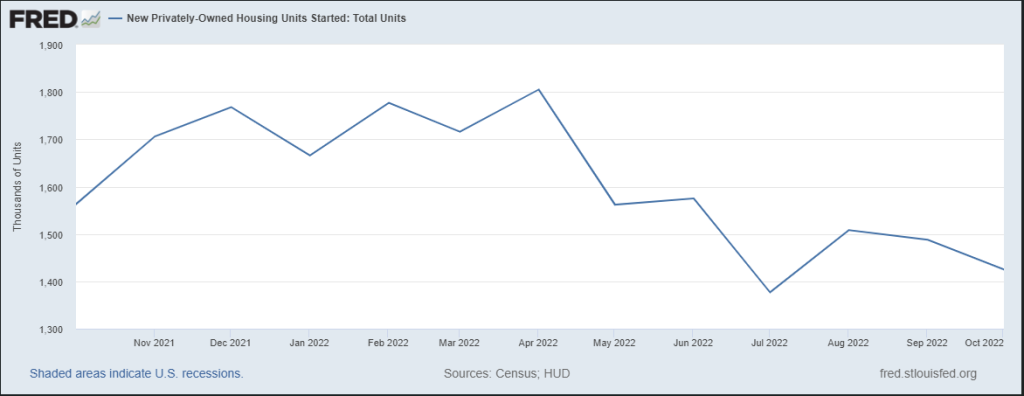

According to the FRED economic data, the new privately-owned housing units declined significantly since January 2022 (14% down). As the recession fear looms on the corner, rising interest rates affect the higher end of the residential market less than the other segments. So, a countercyclical industry can help steady the ship for DMC Global.

Q4 2022 Guidance

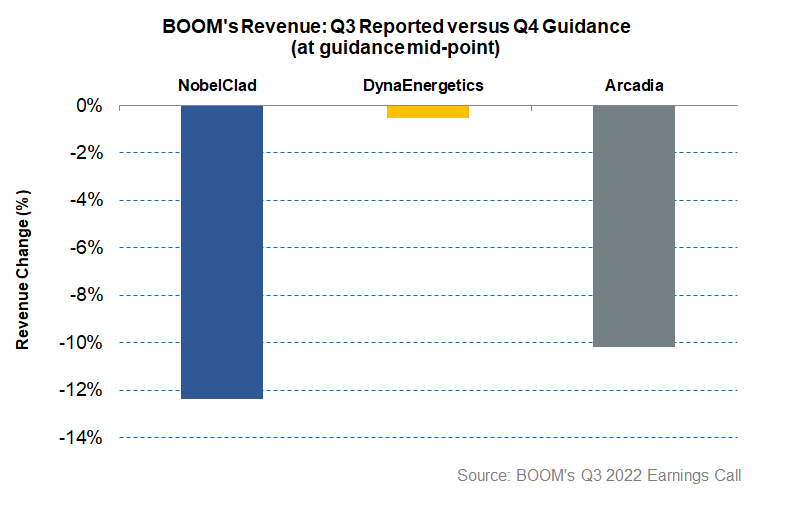

DMC Global expects the top line to decrease by 7% in Q4. Revenues in the Arcadia segment can go down by 10% (at the guidance midpoint), reflecting the impact of seasonality. DynaEnergetics segment revenues are expected to hold steady (1% projected fall). The management expects the NobelClad segment’s topline to decline by 12% in Q4. Company-wide, the gross margin can decrease by 100 basis points due to the unfavorable project mix at NobelClad and the impact of higher-priced aluminum inventory at Arcadia.

How Did The Segments Perform In Q3?

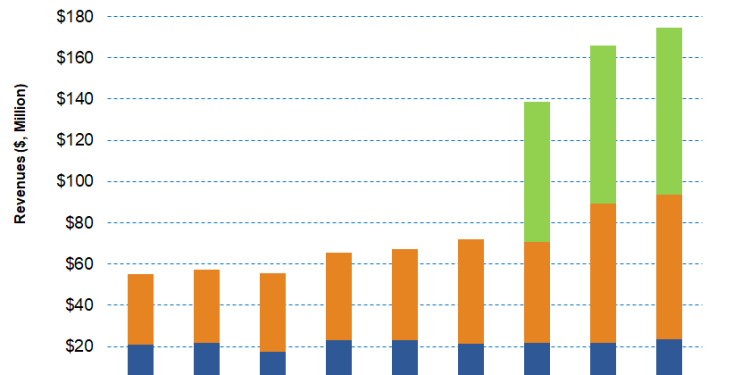

Relatively steady activity in the global well-completion industry and robust performance of DynaEnergetics DS perforating systems led to DynaEnergetics segment revenue increasing by 7% in Q3 2022 compared to Q2. The Arcadia segment revenues increased by 6% in Q3 due to higher selling prices in response to a sharp increase in aluminum costs. Because some of the backlogs sold out already baked in the higher cost, it affected the margin adversely. So, Arcadia’s gross margin reduced to 30% in Q3 from 34% in Q2. In NobelClad, revenues increased by 7% quarter-over-quarter in Q3.

Cash Flows And Balance Sheet

In 9M 2022, BOOM’s cash flow from operations (or CFO) turned positive compared to a negative CFO a year ago, led by significantly higher revenues during this period. However, higher inventory levels and lead times for several essential raw materials partially offset the CFO’s growth. Free cash flow also turned positive in 9M 2022.

BOOM had total debt of $138 million as of September 30, 2022. Its leverage (debt-to-equity) of 0.38x is much lower than many of its peers, and its liquidity (cash plus available credit facility) was $68 million. So, the financial risks are limited despite the Arcadia acquisition.