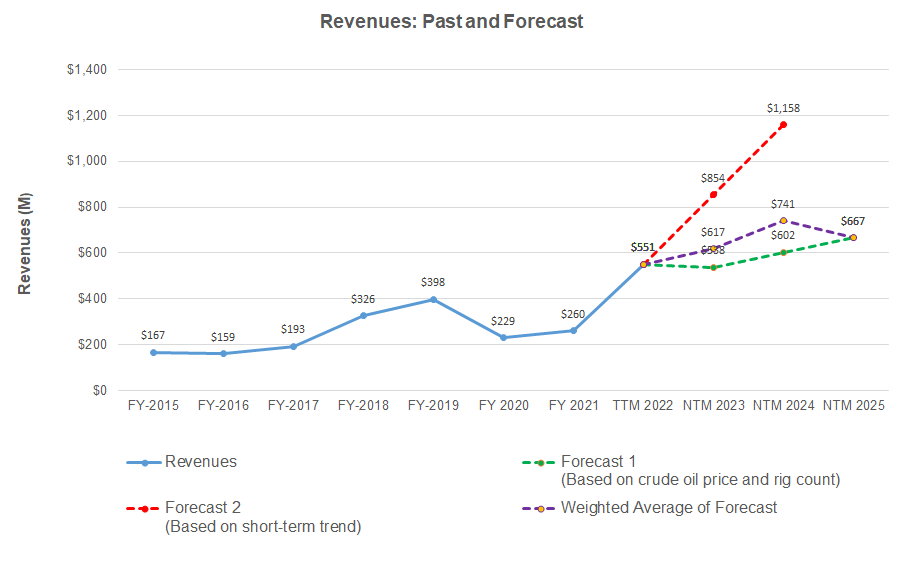

- The regression equation suggests steady revenue growth for BOOM in the next couple of years.

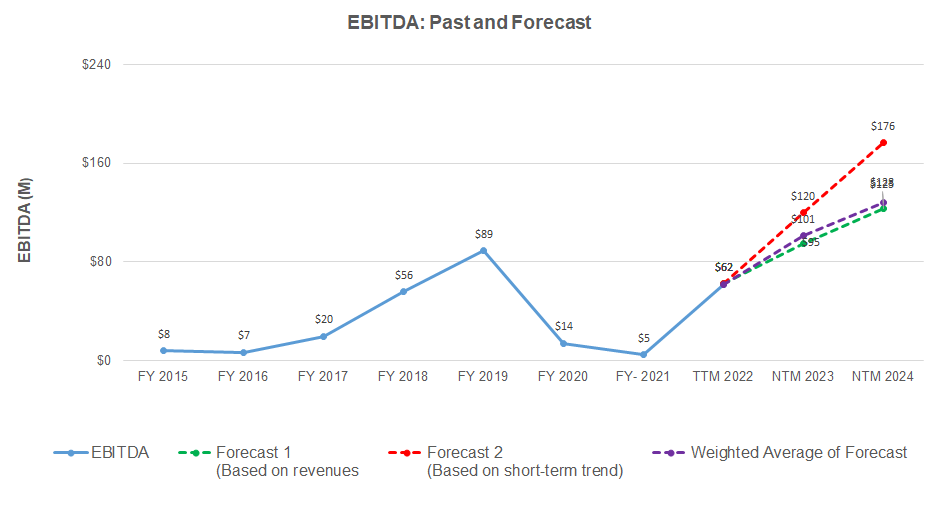

- EBITDA can increase sharply in NTM 2023 but decelerate in NTM 2024.

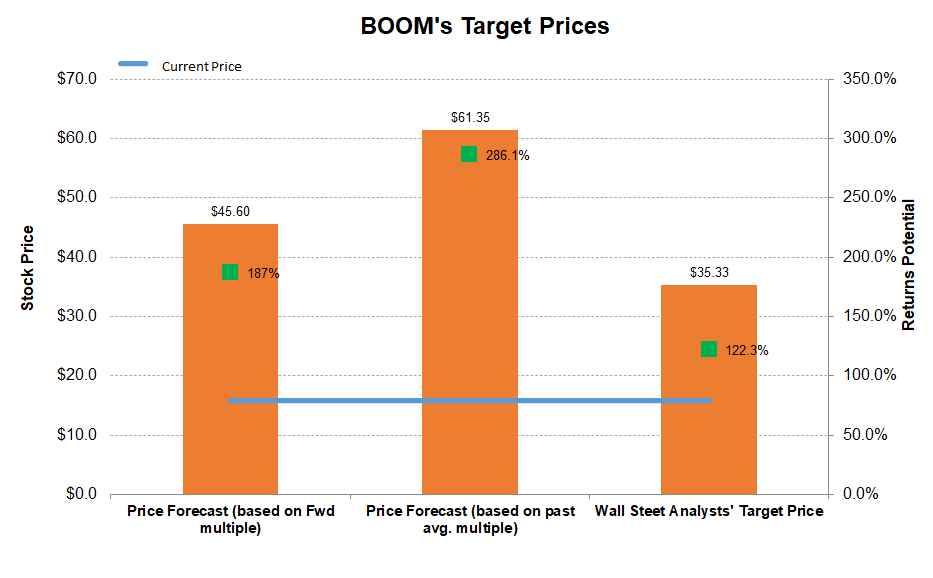

- On a relative basis, the stock is reasonably valued with a negative bias.

Part 1 of this article discussed DMC Global’s (BOOM) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation consisting of crude oil price, total rig count, and BOOM’s revenues for the past seven years and eight quarters, I expect revenues to increase by 12% in NTM 2023 and by 20% in NTM 2024.

The linear regression model using the forecast revenues suggests its EBITDA will increase by 63% in NTM 2023. The growth rate may decrease in NTM 2024 but will still be relatively healthy (27% up).

Relative Valuation And Target Price

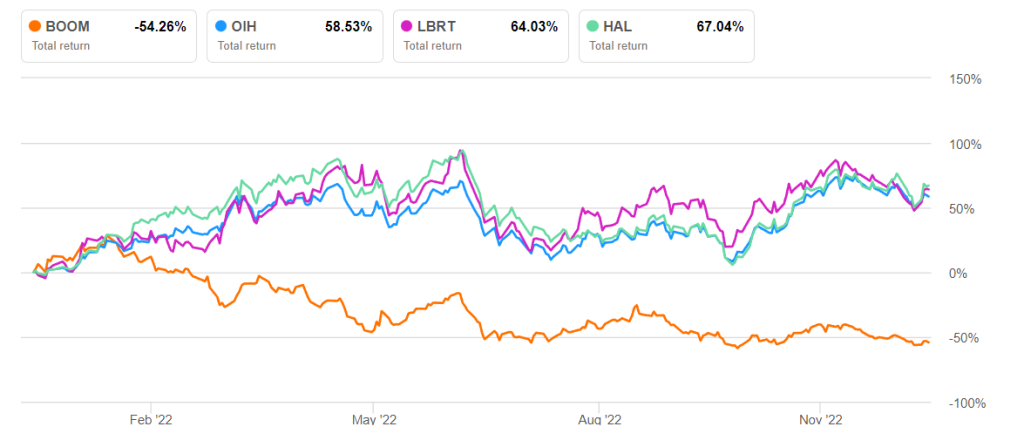

Returns potential using the past average multiple (286% upside) is higher than the returns potential using the forward EV/EBITDA multiple (9.4x) (187% upside). Wall Street analysts also expect steep returns (122% upside) from the stock.

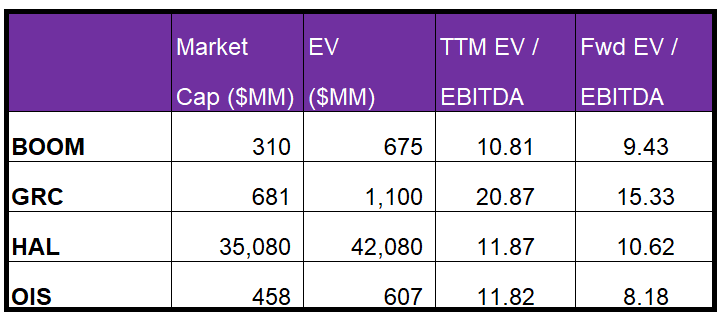

BOOM’s EV/EBITDA multiple (10.8x) is lower than peers’ (GRC, HAL, and OIS) average of 14.8x. This justifies the less steep forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA. So, the stock is reasonably valued at the current price.

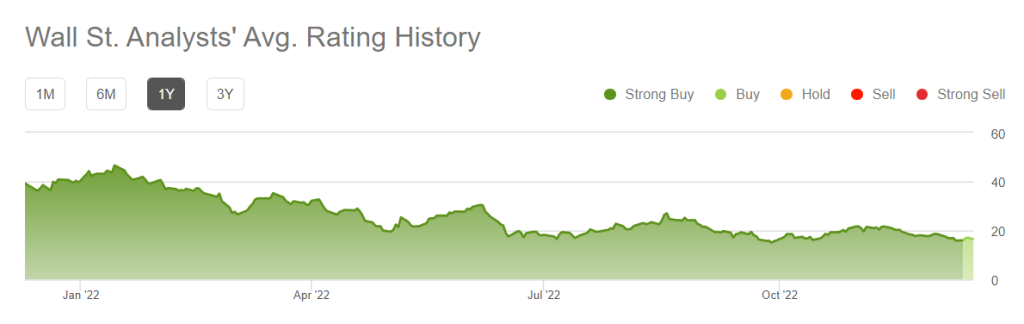

The sell-side analysts’ target price for BOOM is $35.3, which, at the current price, has a return potential of 122%. Out of four, three sell-side analysts rated BOOM a “buy” or a “strong buy,” one rated it a “hold,” and none a “sell” in the past 90 days.

What’s The Take On BOOM?

Although some energy industry indicators stayed strong in Q3, the crude oil price has remained volatile. BOOM’s strategy to implement higher pricing to mitigate the effect of inflation on raw materials/aluminum may take longer than originally anticipated. As a result, we do not expect its gross and operating margins to gain much traction in the short term. However, higher prices will knock out the cost push over the medium term, especially as the company’s sales mix improves. Demand for its products will likely remain high in the Western and Southwestern US territories.

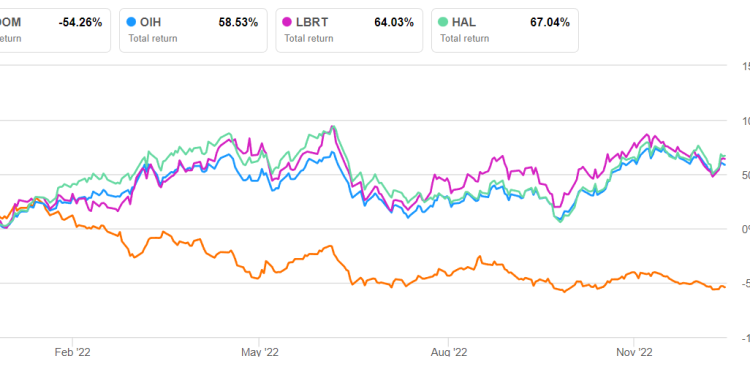

Nonetheless, many more upstream companies will prefer the DynaStage DS factory-assembled perforating systems. So, the DynaStage system sells at a premium over the competitive products. With uncertainty surrounding the economy and the pressure on margin due to the elevated cost level, the stock price significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Based on relative valuation, we think the stock has a slight negative bias at the current level.