As I mentioned in my previous Monday Macro View, one of the biggest events of 2023 is the reopening of the 2nd largest economy of the world. Global markets are full of analysis and estimates regarding the prospects of this reopening and what will it mean for the world. Will the economic engine roar back to life (a V shaped recovery) or will it spark sporadically and gradually picking up speed? Both the scenarios mean different things for the global economy.

In case China’s economy is able to pull of a V shaped recovery we are looking at another rally in commodity prices. While the increase in demand of commodities might bode well in terms of a global recession but it might also be the reason that ushers it in – like a paradox. As China’s appetite for iron, copper, oil, zinc, soybeans etc will rise, so will the prices. Now we are living in a highly inflationary environment where a rise in prices will only make it worse. As such this will delay Fed’s or other central banks’ plan for a pivot/change in their monetary policy thereby tightening the noose of one of the most prolonged and serious contractionary global monetary policy. This will have consequences that almost everyone is aware of at this point: falling investments, rising cost of debt servicing, stronger dollar, etc.

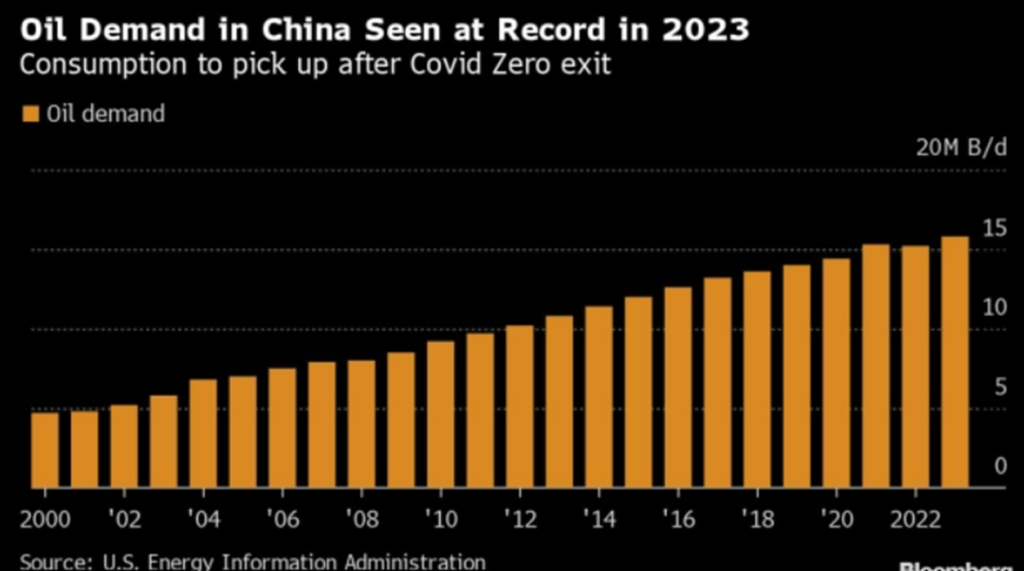

Goldman Sachs, for instance, say that China’s oil demand can add about $15 per barrel to current oil prices. Similarly, LNG prices can go up adversely effecting a hitherto manageable energy crisis in Europe due to relatively warm temperatures.

The following chart also shows the impact on oil markets:

However, the road will be bumpy. As the country reopens infection rate will go higher subsequently increasing the death toll. Already about 60,000 deaths are being reported in China daily. Infection rate is at 60 percent and traffice is down by 45 percent in Beijing. Overall the economy isn’t doing very good – property sales are down.

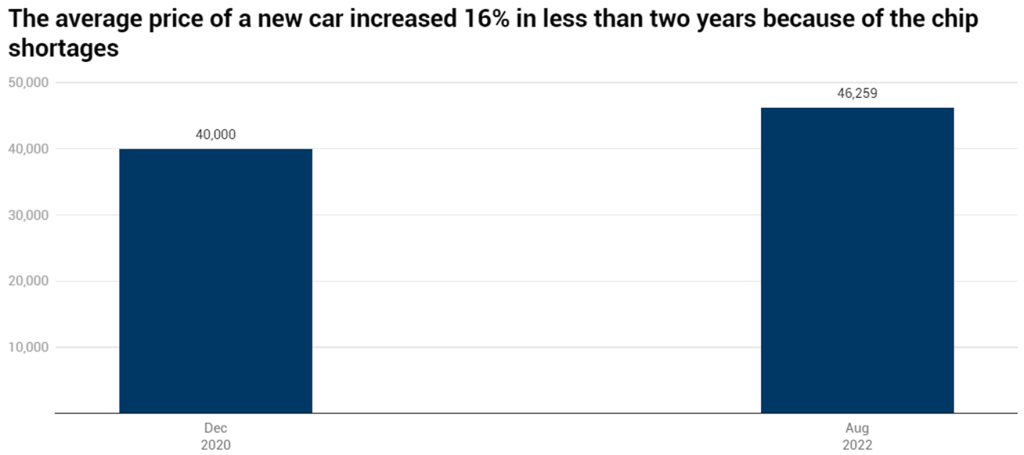

Adding fuel to fire is the chip war between U.S. and China and there is a chance that we might see a full blown redux of trade war in 2023. China’s aggressive stance regarding Taiwan or U.S. interference there can trigger such a development.

All in all, while the prospects of a recovery has already risen due to the grand opening of China, the same event has the capacity to take the world down the lane of recession faster than expected.

Stay tuned for more analysis!