- SLB’s premier drivers remain capacity expansion projects in the Middle East and offshore activities.

- The company’s North American operation will also benefit from increased activity and higher pricing.

- In Q4, debt retirement and a sale of its investment in the Arabian Drilling Company helped accelerate the balance sheet deleveraging.

- A 43% dividend hike reflects the management’s confidence in its 2023 outlook.

Summing The Growth Prospect

Our previous SLB (SLB) article reiterated the up-cycle in the international markets and the short-cycle activity in North America would remain robust. After Q4, SLB re-emphasized its view that short-term spending in key US land basins and drilling activity in North America would become the most significant beneficiaries. Offshore, a strong spending uplift would highlight the US Gulf of Mexico production. Over the medium term, the US crude oil market is expected to remain resilient over the medium term because of tight demand-supply conditions. The management expects the Middle East and Latin America geographies to display a robust growth prospect in the international market. Flowing upstream investments, capacity expansion projects, and new development projects offshore should drive growth in these regions.

Along with the traditional line of energy services, SLB has invested handsomely in the clean energy and digital business. The company has diversified its new energy business into carbon solutions, hydrogen, geothermal and geo-energy, critical minerals, and stationary energy storage. The company has mainly focused on digital technology advancement in the cloud and AI. Recent partnerships in CCS (carbon capture) and operators’ low-carbon initiatives should benefit SLB.

The Medium-Term Outlook And Contracts

SLB has been pushing to deploy its fit-for-basin strategy, technology access, and transition technology that have fueled growth and margin expansion in nearly all divisions. It has also registered growth through the inorganic route, including the acquisition of Gyrodata and the recently announced joint venture with Aker Solutions for subsea. In FY2023, the management expects to achieve 15% revenue growth compared to FY2021. The adjusted EBITDA would grow by mid-20 percent, driven by margin expansion in international and offshore businesses.

As I already discussed, the Middle East, offshore Latin America, and Africa would benefit the most from the current upturn in energy market spending. Among the key contracts inked in Q4 was a $1.4 billion integrated drilling fluids services award from ADNOC, an offshore contract in Malaysia, an offshore award in Angola, and a $400 million five-year contract in India. Also, North America would not fall behind, with a 20% growth expected from increased activity and higher pricing. On top of that, increased technology adoption and enhanced operating leverage would result in a higher operating margin that would translate into a much higher free cash flow in FY2023.

Frac Spread Count

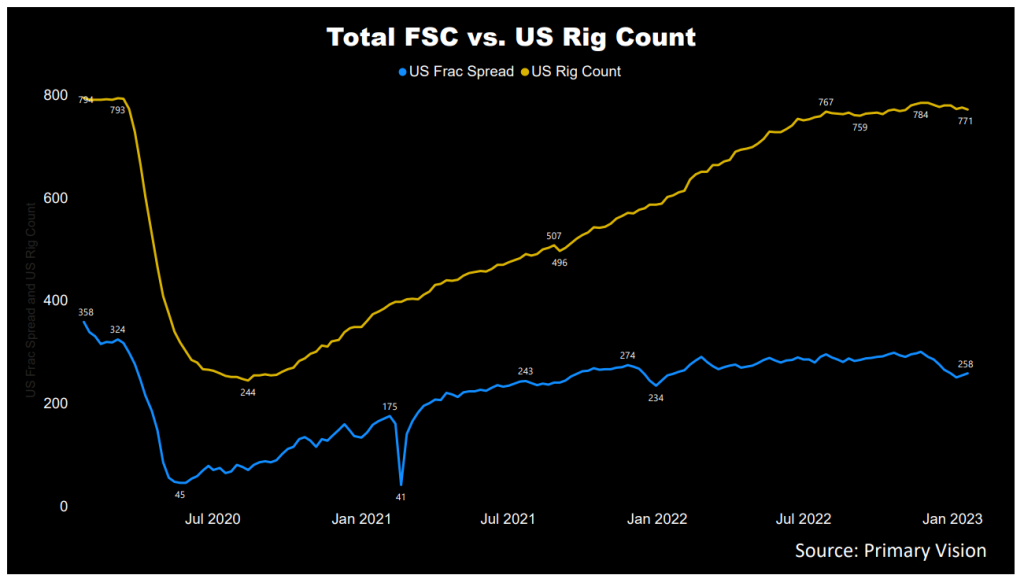

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 258 by the third week of January and has increased by 28% in the past year. A rising frac count is positive for SLB’s growth. In January, we saw eight frac fleet additions in the US. In 2022, SLB sold a majority stake in its Permian frac sand business to Liberty Oilfield Services (LBRT). Please read our analysis on LBRT here.

Other Industry Indicators

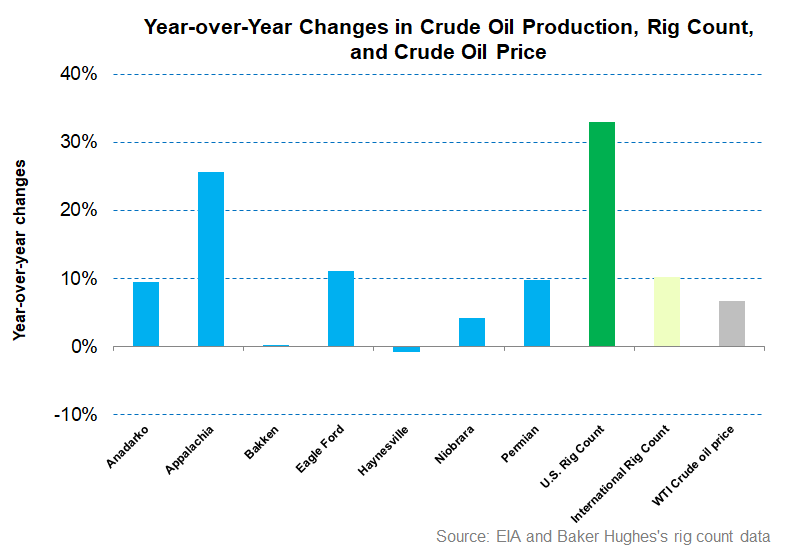

In the past year until December 2022, the key US unconventional Basins, on average, saw an 8.5% rise in tight oil production. However, the US rig count recovery (33% up) significantly outperformed the production growth. According to EIA’s latest estimates, crude oil production in the key shale basins will increase by ~3% in the next two months. Global crude oil production can increase by 3% in 2024. According to the EIA, crude oil prices can decrease by ~18% in 2023 compared to 2022. By 2023 and can fall further in 2024 due to the higher inventory and production growth.

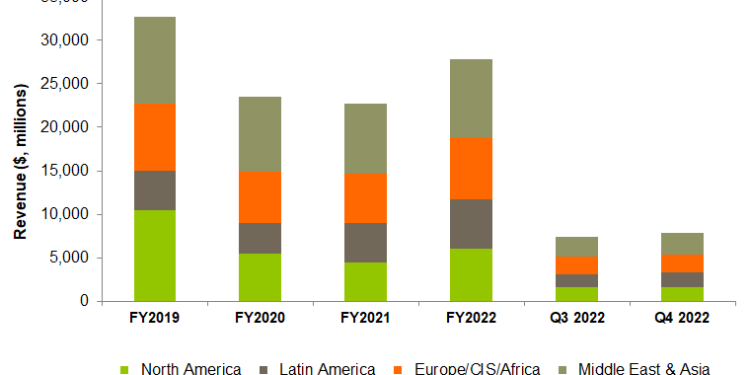

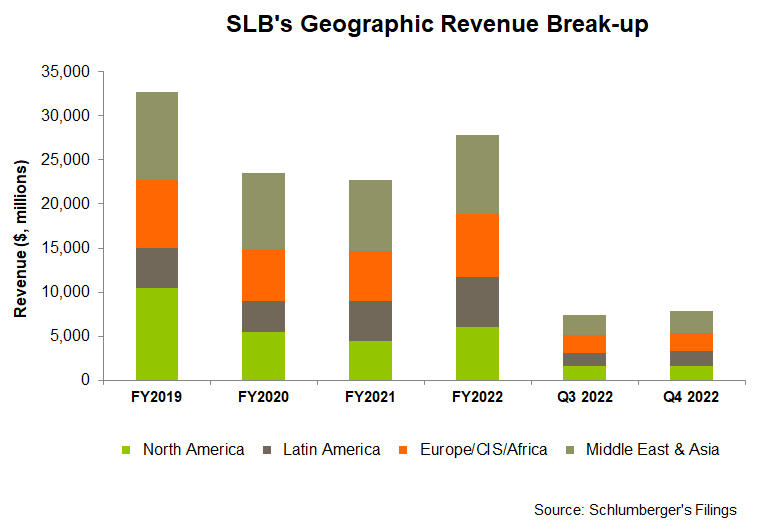

SLB’s growth momentum in Q4 and FY2022 was essentially a result of its balanced approach. From FY2021 to FY2022, its revenue share from the Middle East operations deflated by 300 basis points. The North American area grew (200 basis points up year-over-year). Latin America saw a modest sequential recovery (21% up), followed by Europe/CIS/Africa. In North America, the company’s fit-for-basin approach, greater market access, and higher pricing in the drilling market made the difference in Q4 and FY2022.

The Key Segment Drivers In Q4

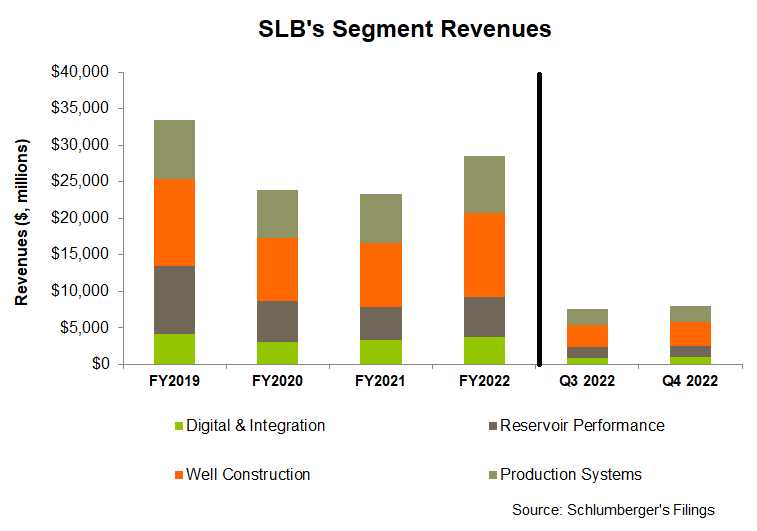

In Q4 2022, SLB’s Digital & Integration revenue segment revenues increased the most among its segments (12% up compared to Q3) because of higher exploration data license sales and higher digital sales in the international markets. The segment operating income, too, pared up by 25% – quite a turnaround from Q3’s performance.

Quarter-over-quarter, SLB’s Well Construction segment revenue increased by 5% in Q4 due to improved pricing and solid activity from new projects, particularly in Saudi Arabia and Qatar, and drilling activity in Brazil and Mexico. The operating income growth, however, was limited in Q4. Revenue growth in the Reservoir Performance segment was impressive (7% up) in Q4, following activity gains in the Middle East and the adoption of new technology in various offshore sites in Scandanavia, Angola, and the Ivory Coast. The Production Systems segment registered the lowest revenue growth in Q4, following relatively muted valves and subsea production systems sales.

FCF and Capex

In FY2022, SLB’s free cash flow (or FCF) declined by 20% compared to FY2021. Lower cash flow from operations (or CFO) and higher capex reduced FCF. Although revenues increased in this period, a higher inventory balance due to increased product backlog and lower accounts receivable collections caused the CFO to decline. The management estimates the cash flows to improve in FY2023. In FY2023, it expects capital investments to be ~$2.55 billion, or 11% higher than in FY2022.

In December, the company repurchased $804 million of its long-term debt. A partial sale of SLB’s investment in the Arabian Drilling Company, which resulted in receiving net proceeds of $223 million, expedited the balance sheet deleverage process in Q4. The company’s debt-to-equity is 0.68x, which marked a successive improvement over the previous two quarters. However, it is higher than the peers’ (HAL, BKR, and FTI) average of 0.64x. Also, its net debt-to-EBITDA was 1.4x as of December 31, 2022.

Dividend And Dividend Yield

SLB increased its annual dividend for FY2023 by 43% to $1.00 per share, with a 1.22% forward dividend yield. In comparison, Halliburton (HAL) pays a yearly dividend of $0.48, which amounts to a forward dividend yield of 1.19%.

Learn about SLB’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.