- Development activity and increased capex at the wellbore in onshore and offshore will pivot Halliburton’s international business in 2023.

- For the growing ESG-compliant fracking, HAL offers a combination of Zeus e-fleets, Optiv, and SmartFleet intelligent fracturing systems.

- However, operating margins in the Completion & Production and Drilling & Evaluation divisions can contract in Q1 2023.

- Despite that, the management increased dividends and re-initiated share repurchases to boost shareholder returns.

The Geographic Outlook

In our articles on SLB (SLB), we discussed how the management has a bullish outlook in the near-to-medium term, while Baker Hughes (BKR) considers the secular rise in natural gas and LNG to drive its growth. However, the global economic recession can hamper its growth trajectory.

Halliburton’s (HAL) management believes that increased requirements replace production and to cater to higher demand in the medium-term, multiple years of increased investment is necessary for the energy sector. These investments will drive demand for oilfield services. So, drives a longer duration cycle will drive demand for Halliburton’s services. In North America, it expects customer spending to grow by ~15% in 2023. So, higher capex coupled with tight equipment supply will keep HAL’s completion utilization high while pricing continues to improve across all product service lines. Given the current ESG initiatives, its Zeus e-fleets saw contracts added recently.

In the international markets, the Middle East and Latin America will lead to activity growing by the mid-teens. Development activity and increased well-bore spending will lead the charge onshore and offshore. With 53% coming from international operations in Q4, HAL should benefit from its leading positions in critical well-construction product lines. The recent 33% dividend hike and re-initiation of the share repurchase program reflect the management’s confidence in its business model industry outlook. Read more about HAL in our previous article here.

The Fracking Side Of The Story

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 258 by the third week of January and has remained nearly unchanged in the past year. In January, a few frac fleets were taken off the market. A falling frac count is negative for HAL’s growth. Along with Zeus eFleets, its automated fracturing platform, Optiv, reduces maintenance and extends component life. On top of that, its SmartFleet intelligent fracturing system provides customers with data about how their fractures permeate and the potential for frac hits to improve completion designs.

Short-Term Forecast

In Q1 2023, the management expects revenues in the Completion and Production division to remain flat versus Q4 2022, and margins can drop by 75 and 125 basis points. The Drilling and Evaluation division can see ” low-to-mid single digits” revenue growth, while margins can contract by 25-75 basis points in Q1. In both segments, the management’s margin outlook became much bearish compared to a quarter ago. Investors may note that year-end product sales would impact international sales adversely in Q1.

What Do The Industry Indicators Suggest?

According to the EIA, crude oil prices can decrease by ~18% in 2023 and may fall even further (6% down) due to the increased crude oil production inventory. The EIA expects non-OPEC crude oil production growth to curd the price in 2024.

According to the EIA’s Drilling Productivity Report, US shale oil production can increase by 2.8% on average by February 2023. The drilled wells went up by 42% in the past year, while the drilled-but-uncompleted (or DUC) wells have declined by 10%. The DUC backlog declined steadily over the past before registering a rise in December.

Analysing Division Performance

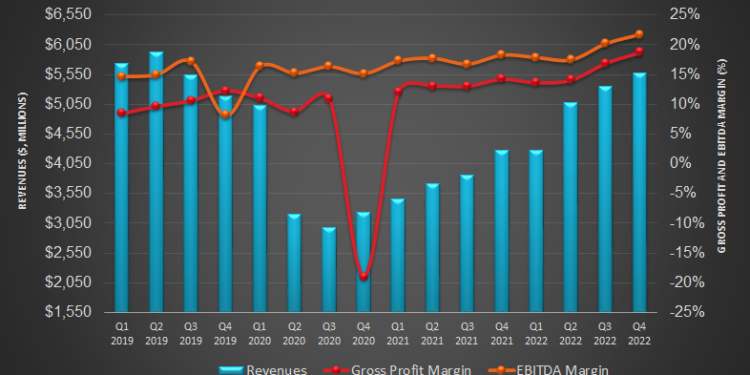

In Q4 2022, Halliburton’s Completion and Production division revenue increased by 1.5% compared to Q3 2022. The topline movement led to improved pricing, service efficiency, and a better activity mix in North America and other international geographies. As a result of this overall growth, its operating income margin also expanded by 210 basis points) in this segment. However, weather-related downtime partially mitigated the growth.

Quarter-over-quarter, HAL’s Drilling and Evaluation division revenue growth was 8.1% in Q4. During Q4, software sales and international activity increased. The operating income margin expanded by 150 basis points.

Dividend And Dividend Yield

Halliburton increased its quarterly dividend by 33% to $0.16 per share, translating to a 1.18% forward dividend yield. Schlumberger (SLB) also increased its dividend by 43%, which equals a forward dividend yield of 1.79%.

Free Cash Flow And Debt

HAL’s cash flow from operations (or CFO) increased by 17% in FY2022 compared to a year ago, led by higher revenues in the past year. Capex increased by 27% in FY2022. As a result, free cash flow growth was limited.

Halliburton resumed its share buyback program of $5 billion and repurchased shares for $250 million. It plans to return at least 50% of its FCF flow to shareholders through dividends and buybacks. HAL’s debt-to-equity is ~1.0x, much higher than its peers (Schlumberger, TecnipFMC, and Baker Hughes) (BKR).

Learn about HAL’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.